|

市場調查報告書

商品編碼

1910921

馬來西亞宅配、速遞和小包裹(CEP) 市場:市場佔有率分析、行業趨勢和統計數據、成長預測 (2026-2031)Malaysia Courier, Express, And Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

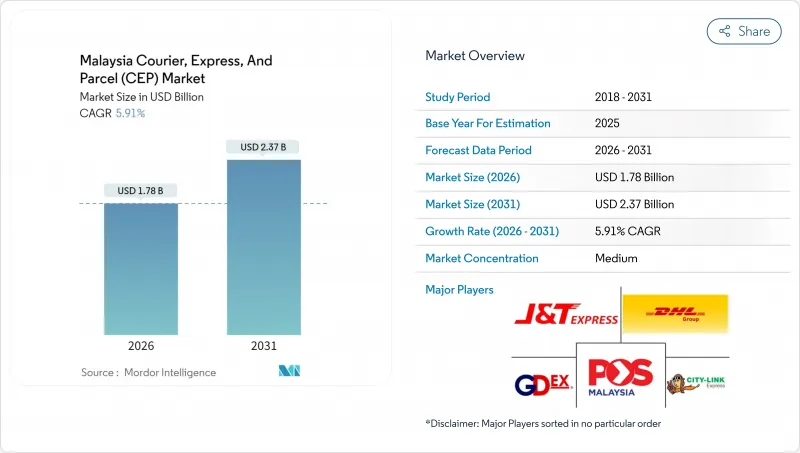

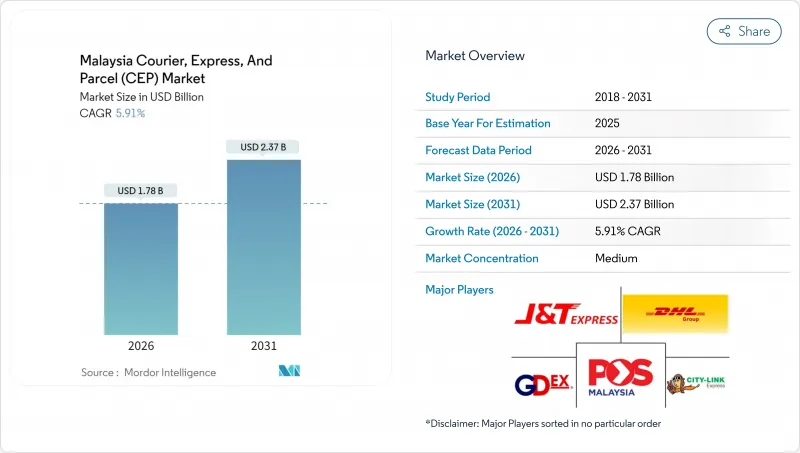

馬來西亞宅配、速遞和小包裹(CEP) 市場在 2025 年的價值為 16.8 億美元,預計到 2031 年將達到 23.7 億美元,高於 2026 年的 17.8 億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 5.91%。

小包裹量的強勁成長得益於電子商務的蓬勃發展、無現金支付的快速普及以及政府為簡化跨境海關程序而推出的各項計劃。為了提高遞送速度,營運商正在投資基於人工智慧的分揀系統、電動車以及與「暗店」(dark store)的合作。同時,他們也必須應對2024年補貼改革後柴油價格上漲56%的情況。儘管日益激烈的競爭迫使定價機制嚴格控制,以維持行業整體5%以下的營運利潤率,但規模經濟和技術應用正在幫助J&T Express等領先企業恢復盈利。該公司累計,2024年其區域淨利潤為1.1億美元。馬來西亞的宅配、速遞和小包裹(CEP)市場也受益於醫療物流需求的成長,其中藥品低溫運輸運輸的成長速度超過了其他垂直領域。從地理位置來看,由於接近性吉隆坡國際機場和巴生港,巴生谷仍然是小包裹配送中心,但東馬仍在努力解決基礎設施不足和多模態。

馬來西亞宅配、速遞與小包裹(CEP) 市場趨勢與洞察

電子商務的快速成長以及數位原生消費者日益成長的期望

預計到2030年,馬來西亞線上零售市場規模將達到239.3億美元,其中跨境訂單佔所有交易的40%,這將重塑公路規劃和小包裹結構。隨著網路普及率超過90%以及行動錢包的廣泛應用,貨到付款(COD)的使用率已增至約20%,迫使宅配業者改善其逆向物流收款流程。春節和齋戒月等季節性高峰期需要暫時擴容,迫使業者在吉隆坡附近設立臨時分類線。社群電商直播帶動了配送量的波動,降低了小包裹的平均價值,擠壓了利潤空間,因此需要提高網路密度並採用動態路線規劃。由此,馬來西亞的宅配、速遞和小包裹(CEP)市場越來越傾向於頻繁、輕量級的配送,這就需要可擴展的自動化系統。

政府支持的數位自由貿易區加速跨境履約

ePAM系統允許CIF價值500馬幣或以下的小包裹在飛機抵達前兩小時申報,從而實現近乎即時的清關。該系統已縮短了吉隆坡國際機場(KLIA)、檳城和古晉的貨物滯留時間。目前該系統已在七個機場投入使用,為擁有清關經驗的航空貨運合作夥伴和承運商提供了至關重要的優勢。東協快線鐵路在馬來西亞和重慶之間的查驗服務已實現了九天的運輸時間,凸顯了政府致力於建設區域物流基礎設施的決心。然而,由於500馬幣的閾值僅適用於空運貨物,海運和陸運仍然繁瑣且行政流程複雜,這延續了馬來西亞宅配、速遞和小包裹(CEP)市場以空運為中心的趨勢。多種運輸方式的業者正在遊說,以期獲得公平的競爭環境,從而進一步降低成本。

激烈的價格競爭導致營業利潤率降至5%或以下。

供應商多元化導致貨運價格下降,儘管自取消補貼以來柴油價格上漲了56%,但淨利率低於5%。大型業者利用自動化和燃油避險合約來應對價格波動,而小型業者的選擇較少,只能退出市場或進行整合。雖然SKDS 2.0紓困方案將部分涵蓋受影響車輛的柴油成本,但配額上限意味著許多業者必須承擔部分費用。旺季附加費只是暫時的緩解措施,因此,服務成本管理和收入管理對於馬來西亞的宅配、速遞和小包裹(CEP)市場至關重要。

細分市場分析

預計到2025年,電子商務訂單將佔小包裹需求的37.92%,而醫療保健領域由於嚴格的低溫運輸法規和醫療設備的廣泛使用,將在2026年至2031年間實現6.12%的最快複合年成長率。溫控貨車和符合GDP認證的倉庫帶來了高附加價值利潤。

金融服務、製造業和批發業維持可預測的B2B業務模式,並能有效緩解電子商務需求的季節性波動。對於承運商而言,涉足多元化垂直領域有助於穩定收入,並拓展其在馬來西亞宅配、速遞和小包裹(CEP)市場的服務範圍。

儘管預計2026年至2031年間國際貨運量將以6.11%的複合年成長率成長,但截至2025年,國內貨運量已佔馬來西亞宅配、速遞和小包裹(CEP)市場佔有率的64.42% 。跨境電子商務的進步、東協快速鐵路試點計畫以及數位自由貿易區的建立,正推動中小企業向海外目的地寄送小包裹的數量不斷成長,從而催生了對能夠處理清關的航空網路日益成長的需求。國內航線充分利用了巴生谷地區高度密集的城市化優勢,憑藉密集的航線網路和近乎零的投遞失敗率,確保了穩定的現金流。

透過電子旅客捷運系統 (ePAM) 縮短清關時間,以及泛亞細亞網路將運往中國的運輸時間縮短至九天,預計將推動馬來西亞國際物流宅配、速遞和小包裹(CEP) 市場的發展。然而,空運貨物馬幣的最低課稅門檻限制了多式聯運的發展,而公路和海運貨物仍需人工查驗,阻礙了端到端成本的降低。具備多式聯運仲介能力的貨運代理公司則能夠很好地利用這些缺口。

其他福利

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 人口統計數據

- 按經濟活動分類的GDP分配

- 按經濟活動分類的GDP成長

- 通貨膨脹

- 經濟表現及概覽

- 電子商務產業的趨勢

- 製造業趨勢

- 運輸和倉儲業的GDP

- 出口趨勢

- 進口趨勢

- 燃油價格

- 物流績效

- 基礎設施

- 法律規範

- 價值鍊和通路分析

- 市場促進因素

- 電子商務的快速成長以及數位原生消費者日益成長的期望

- 政府支持的數位自由貿易區(DFTZ)加速跨境履約

- 巴生谷地區即時配送「暗店」迅速擴張

- 利用人工智慧驅動的分類中心和路線規劃進行網路最佳化

- 透過最後一公里配送車輛的電氣化降低單位配送成本

- 東協經濟小包裹走廊提供3-5天送達服務,為中小企業擴大出口量開闢新機會

- 市場限制

- 激烈的價格競爭導致營業利潤率降至5%或以下。

- 由於東馬來西亞遍遠地區地址資料缺失,投遞工作試驗。

- 兩位數燃油額外費用波動

- 儘管實施了最低限度進口改革,低價值B2C進口商品仍面臨海關瓶頸。

- 市場創新

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 收件地址

- 國內的

- 國際的

- 配送速度

- 表達

- 非快遞

- 模型

- B2B

- B2C

- C2C

- 運輸重量

- 重型貨物

- 輕型貨物

- 中等重量貨物

- 交通工具

- 航空郵件

- 陸上

- 其他

- 終端用戶產業

- 電子商務

- 金融服務(BFSI)

- 衛生保健

- 製造業

- 一級產業

- 批發零售(線下)

- 其他

第6章 競爭情勢

- 市場集中度

- 關鍵策略舉措與競爭格局:市場集中/關鍵策略舉措/市場佔有率分析/公司簡介

- 市佔率分析

- 公司簡介

- City-Link Express

- DHL Group

- FedEx

- GDEX Group

- J& T Express

- Ninja Van

- POS Malaysia Bhd

- SF Express(KEX-SF)

- SkyNet Worldwide Express

- United Parcel Service(UPS)

第7章 市場機會與未來展望

The Malaysia courier, express, and parcel market was valued at USD 1.68 billion in 2025 and estimated to grow from USD 1.78 billion in 2026 to reach USD 2.37 billion by 2031, at a CAGR of 5.91% during the forecast period (2026-2031).

Solid parcel volume growth stems from expanding e-commerce, rapid adoption of cash-less payments, and government programs that simplify cross-border clearance. Operators are investing in AI-enabled sorting, electrified fleets, and dark-store partnerships to improve delivery speed while managing the 56% spike in diesel prices that followed subsidy reforms in 2024. Competitive intensity has forced pricing discipline below a 5% industry-wide operating margin, yet scale advantages and technology deployments are beginning to restore profitability for larger firms such as J&T Express, which reported USD 110 million in regional net profit for 2024. The Malaysia courier, express, and parcel market is additionally buoyed by healthcare logistics demand, with pharmaceutical cold-chain shipments outpacing other verticals. Geographically, Klang Valley remains the epicenter of parcel flows thanks to proximity to KLIA and Port Klang, whereas East Malaysia continues to wrestle with addressing gaps and multimodal constraints.

Malaysia Courier, Express, And Parcel (CEP) Market Trends and Insights

E-commerce Boom and Growing Digital-Native Consumer Expectations

Online retail is forecast to reach USD 23.93 billion by 2030, with cross-border orders forming 40% of all transactions, a mix that reshapes line-haul planning and parcel mix. Ninety-plus percent internet penetration and mobile wallets have increased cash-on-delivery uptake to roughly 20% of orders, compelling couriers to refine reverse-logistics cash collection workflows. Seasonal peaks during Lunar New Year and Ramadan force temporary capacity layering, nudging operators to install pop-up sorting lines near Kuala Lumpur. Social-commerce live-streaming adds volume volatility and squeezes margins because of lower average parcel value, prompting network densification and dynamic routing. As a result, the Malaysia courier, express, and parcel market is skewing toward frequent, low-weight shipments that demand scalable automation.

Government-Backed Digital Free Trade Zone Accelerating Cross-Border Fulfillment

The ePAM regime allows simplified declarations two hours before aircraft arrival for parcels under RM500 CIF, triggering near-instant release and trimming dwell time at KLIA, Penang, and Kuching. Seven airports are now live on the system, creating a decisive advantage for carriers with air-freight partnerships and customs brokerage depth. ASEAN Express rail pilots linking Malaysia to Chongqing promise 9-day transit, underscoring the administration's bid to anchor regional logistics. However, because the RM500 threshold applies only to air, sea freight and trucking remain administratively heavier, preserving an air-centric bias in the Malaysia courier, express, and parcel market. Operators with multimodal reach are lobbying for parity to unlock further cost savings.

Sub-5% Operating Margin Pressure from Intense Price Wars

A fragmented vendor field has triggered tariff undercutting that keeps net margins under the 5% threshold even as diesel prices jump 56% post-subsidy removal. Large-scale players exploit automation and contract fuel hedging to ride out volatility, whereas small firms lack leverage and are exiting or consolidating. The SKDS 2.0 relief card offsets some diesel cost for eligible fleets, but allocation ceilings leave many operators partially exposed. Peak-season surcharges provide fleeting relief, making cost-to-serve discipline and yield management crucial for the Malaysia courier, express, and parcel market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Expansion of Instant-Delivery Dark Stores in Klang Valley

- Network Optimization via AI-Driven Sorting Hubs and Route Planning

- Rural Addressing Gaps in East Malaysia Causing Delivery Retries

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

E-commerce orders made up 37.92% of 2025 parcel demand, but healthcare recorded the fastest 6.12% CAGR between 2026-2031 due to stricter cold-chain compliance and medical device proliferation. Temperature-controlled vans and GDP-certified warehouses lend premium margins.

Financial services, manufacturing, and wholesale trade sustain predictable B2B lanes that smooth seasonal e-commerce volatility. For carriers, diversified vertical exposure insulates revenue and reinforces service breadth in the Malaysia courier, express, and parcel market.

International consignments are climbing at a 6.11% CAGR between 2026-2031, even though domestic traffic held 64.42% of the Malaysia courier, express, and parcel market share in 2025. Cross-border e-commerce, ASEAN Express rail pilots, and the Digital Free Trade Zone elevate outbound SME parcels, sharpening demand for customs-compliant air connectivity. Domestic lanes capitalize on urban density in Klang Valley, where route density and near-zero failed-delivery rates secure stable cash flow.

The Malaysia courier, express, and parcel market size for cross-border flows is primed to widen as ePAM cuts clearance turnaround and the Pan-Asian Railway Network slashes transit to China to 9 days. Nonetheless, the RM500 air-only de-minimis cap restrains multimodal shift; road and sea consignments still wade through manual inspections, constricting end-to-end cost savings. Carriers with multimodal brokerage are best placed to arbitrage these gaps.

The Malaysia Courier, Express, and Parcel Market Report is Segmented by End User Industry (E-Commerce and More), Destination (Domestic and International), Speed of Delivery (Express and Non-Express), Shipment Weight (Heavy Weight Shipments and More), Mode of Transport (Air, Road, and Others), and Model (Business-To-Business, Business-To-Consumer, and Consumer-To-Consumer). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- City-Link Express

- DHL Group

- FedEx

- GDEX Group

- J&T Express

- Ninja Van

- POS Malaysia Bhd

- SF Express (KEX-SF)

- SkyNet Worldwide Express

- United Parcel Service (UPS)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Logistics Performance

- 4.12 Infrastructure

- 4.13 Regulatory Framework

- 4.14 Value Chain and Distribution Channel Analysis

- 4.15 Market Drivers

- 4.15.1 E-Commerce Boom and Growing Digital-Native Consumer Expectations

- 4.15.2 Government-Backed Digital Free Trade Zone (DFTZ) Accelerating Cross-Border Fulfilment

- 4.15.3 Rapid Expansion of Instant-Delivery "Dark Stores" in Klang Valley

- 4.15.4 Network Optimization via AI-Driven Sorting Hubs and Route Planning

- 4.15.5 Electrification of Last-mile Fleets Lowering Unit Delivery Cost

- 4.15.6 Cross-Border ASEAN 3-5-day Economy-Parcel Corridors Opening New SME Export Volumes

- 4.16 Market Restraints

- 4.16.1 Sub-5% Operating Margin Pressure from Intense Price Wars

- 4.16.2 Rural Addressing Gaps in East Malaysia Causing Delivery Retries

- 4.16.3 Double-Digit Fuel-Surcharge Volatility

- 4.16.4 Customs-Clearance Bottlenecks for Low-Value B2C Imports Despite De-Minimis Reforms

- 4.17 Technology Innovations in the Market

- 4.18 Porter's Five Forces Analysis

- 4.18.1 Threat of New Entrants

- 4.18.2 Bargaining Power of Buyers

- 4.18.3 Bargaining Power of Suppliers

- 4.18.4 Threat of Substitutes

- 4.18.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 City-Link Express

- 6.4.2 DHL Group

- 6.4.3 FedEx

- 6.4.4 GDEX Group

- 6.4.5 J&T Express

- 6.4.6 Ninja Van

- 6.4.7 POS Malaysia Bhd

- 6.4.8 SF Express (KEX-SF)

- 6.4.9 SkyNet Worldwide Express

- 6.4.10 United Parcel Service (UPS)

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment