|

市場調查報告書

商品編碼

1911483

德國網路安全市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Germany Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

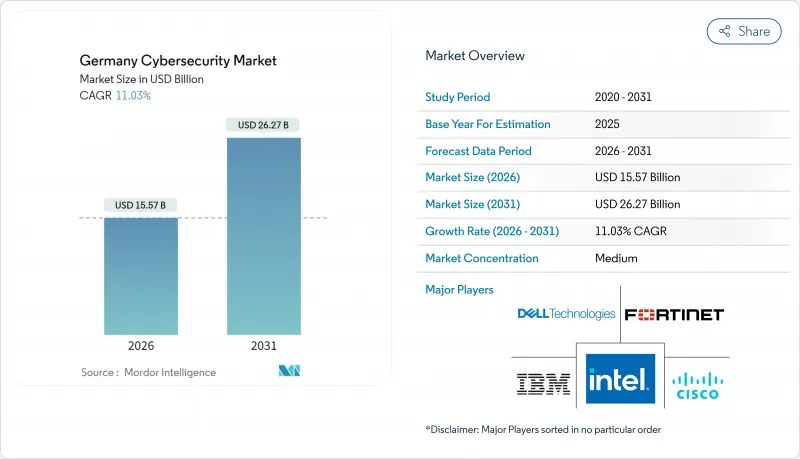

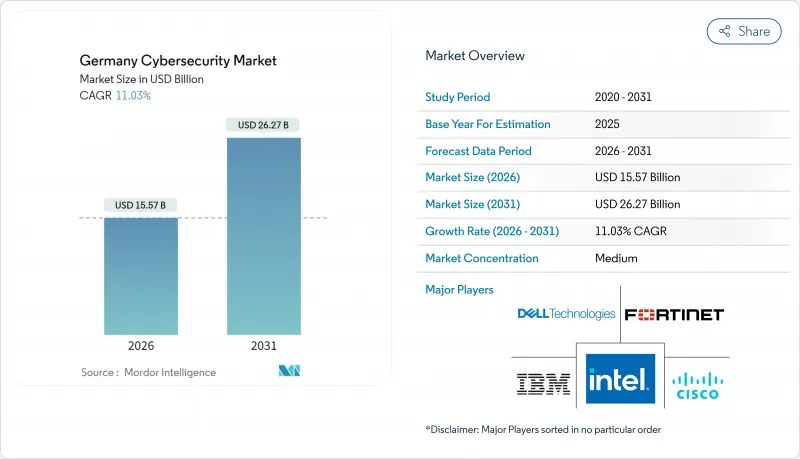

據估計,德國網路安全市場在 2026 年的價值為 155.7 億美元,從 2025 年的 140.2 億美元成長到 2031 年的 262.7 億美元,2026 年至 2031 年的年複合成長率(CAGR)為 11.03%。

2024年全年,德國聯邦資訊安全辦公室(BSI)共記錄了7.2萬起安全事件報告,比上年增加21%。同時,該機構的產品指南(Produkt-Kompass)登記了24531個公開漏洞,其中15%被評為「嚴重」漏洞。新的法規,特別是《NIS2實施和加強網路安全法案》和《數位營運彈性法案》,以及德國聯邦金融監理局(BaFin)更新的IT要求,將導致2025年至2027年間強制支出74億歐元。同時,監管力道也正在加強,2024年,68%的DAX指數成分股公司設立了董事會級別的網路安全委員會(高於2022年的42%)。這些管治措施正在加速預算核准,並鼓勵將安全防線納入德國網路安全市場的核心IT資本投資。

德國聯邦統計局報告稱,雲端使用率將從2021年的54%增加到2024年的69%。去年,隨著各部會收緊國內資料儲存規則,公共機構的自主雲端合約成長了27%。此外,各組織擴大將人工智慧和網路安全預算合併到一個指導委員會下,預計這將推動德國網路安全市場支出成長。

德國網路安全市場趨勢與洞察

雲端原生應用程式在公共部門和醫療保健領域的興起

德國《線上查詢法》要求到2026年,575項聯邦和市政服務必須數位化交付。截至2024年12月,其中41%的服務已在德國電信開放雲端運作。一家大學醫院將其混合雲端儲存容量擴展至每年Petabyte,用於歸檔影像資料集。所有新增工作負載都必須符合BSI C5安全框架,2024年獲得認證的供應商數量從23家增加到34家。更快捷的認證流程減少了採購摩擦,並鼓勵了進一步的遷移。這直接轉化為德國網路安全市場對許可證和諮詢服務需求的成長。

工業4.0時代OT/ICS安全的迫切性

根據德國機械設備製造業聯合會 (VDMA) 的報告,到 2024 年,智慧感測器在生產線上的應用率將達到 71%。科隆研究所 (IW Cologne Research Institute) 估計,汽車工廠的平均停機成本為每小時 29 萬歐元。資產發現平台目前已在全國範圍內繪製了 230 萬台關鍵工業設備的地圖,為被動監控奠定了基礎。透過將網路安全防護措施整合到整體設備效率 (OEE) 運算中,製造商正在將資金從可自由支配的 IT 預算轉移到必要的營運防護上,從而推動德國網路安全市場工業級解決方案的收入成長。

合格的網路安全專業人員短缺

德國預計到2025年將有96,300個IT安全職缺,比上一年成長25%。慕尼黑高級安全營運中心(SOC)分析師的平均年薪為96,000歐元,比2019年成長57%。雖然有28所大學提供相關專業學位,但每年只有3,400名畢業生進入勞動市場,僅能滿足7%的需求。人才短缺導致企業預算中最低工資標準提高,支出轉向自動化、SOC即服務(SOCaaS)和託管檢測服務。這雖然會擠壓利潤空間,但卻能為德國網路安全市場的服務供應商帶來收入。

細分市場分析

到2025年,解決方案領域將佔據德國網路安全市場佔有率的66.05%(92.6億美元)。同時,資安管理服務創造了37.1億美元的收入,實現了18.12%的成長。企業也採購了16.4萬台經BSI認證的新一代防火牆,出貨量成長了14%。業務收益正日益轉向按使用量付費模式:據德國電信稱,2024年42%的安全合約將採用計量型,而非固定費用模式。將服務供應商的獎勵與實際威脅情勢掛鉤,可確保德國網路安全市場持續最佳化並實現長期客戶留存。

中央政府斥資 6.8 億歐元製定的 2024 年安全營運中心 (SOC) 框架協議進一步推動了對資安管理服務(MSS) 的需求,並促使供應商擴張。對軟體定義邊界 (SDP) 和零信任試點專案的日益依賴,需要全天候策略協調,這對大多數內部團隊來說難以管理,也加速了對外包 SOC 能力的需求。

截至2025年,本地部署和私有雲端環境將佔德國網路安全市場52.85%(74.1億美元)的佔有率,而公共雲端安全市場將以16.52%的複合年成長率成長。根據歐盟統計局的一項調查,46%的德國公司在公共雲端中儲存部分數據,但只有11%的公司將核心財務記錄儲存在公有雲中。Capgemini SA顧問公司的調查顯示,本地託管服務的價格比公有雲高出18%,但58%的用戶願意接受這筆價格上漲。

Eco eV 估計,在轉型階段,72% 的公司正在運行兩個 SIEM 平台。整合本地和雲端遙測功能的供應商預計,2024 年的年度經常性收入 (ARR) 將成長 41%。這種雙棧模式加劇了複雜性,使擴充性平台比單一產品更具優勢,並強化了指導德國網路安全市場的「主權優先」理念。

德國網路安全市場報告按公共產業類型(解決方案、服務)、部署模式(雲端、本地部署)、最終用戶垂直產業(銀行、金融服務和保險、醫療保健、IT 和電信、工業和國防、製造業、零售和電子商務、能源和公用事業、其他)以及最終用戶公司規模(中小企業、大型企業)對產業進行細分。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 德國公共部門和醫療保健領域雲端原生應用的成長

- 工業4.0時代OT/ICS安全的迫切性

- 擴展5G和互聯行動基礎設施

- 網路保險需求增加推動安全支出

- 監理合規要求(NIS2、DORA、BaFin IT法規)

- 人工智慧驅動的威脅偵測和自動回應

- 市場限制

- 德語世界嚴重缺乏網路安全專家。

- 中型企業(Mittelstand)的預算限制,該地區以中小企業為主。

- 資料主權問題限制了全球SaaS安全工具的採用

- 聯邦採購體系碎片化延緩了大規模推廣應用

- 關鍵法規結構評估

- 價值鏈分析

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 主要用例和案例研究

- 宏觀經濟因素對市場的影響

- 投資分析

第5章 市場區隔

- 報價

- 解決方案

- 應用程式安全

- 雲端安全

- 資料安全

- 身分和存取管理

- 基礎設施保護

- 綜合風險管理

- 網路安全設備

- 端點安全

- 其他服務

- 服務

- 專業服務

- 託管服務

- 解決方案

- 透過部署模式

- 本地部署

- 雲

- 按最終用戶行業分類

- BFSI

- 衛生保健

- 資訊科技和電信

- 工業與國防

- 製造業

- 零售與電子商務

- 能源與公共產業

- 其他

- 按最終用戶公司規模分類

- 中小企業

- 主要企業

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Deutsche Telekom(T-Systems)

- SAP SE

- Siemens AG

- IBM Deutschland GmbH

- Cisco Systems Germany

- Fortinet Germany GmbH

- Palo Alto Networks

- Check Point Software Tech

- Trend Micro Deutschland

- Kaspersky Labs DE

- Arctic Wolf

- CrowdStrike Germany

- Sophos Ltd

- Thales DIS Germany

- Atos Eviden

- Rheinmetall Cyber Solutions

- Deutsche Bahn Cyberservice

- Signal Iduna Cyber Protect

- Airbus Defence & Space Cybersecurity

- Rohde & Schwarz Cybersecurity

- IONOS Cloud Security

- CGI Deutschland

第7章 市場機會與未來展望

The German Cybersecurity market size in 2026 is estimated at USD 15.57 billion, growing from 2025 value of USD 14.02 billion with 2031 projections showing USD 26.27 billion, growing at 11.03% CAGR over 2026-2031.

Across 2024, the Federal Office for Information Security (BSI) logged 72,000 incident reports, a 21% jump on the prior year, while its Produkt-KOMPASS registered 24,531 published vulnerabilities, 15% of which were labelled critical . Fresh statutes-most notably the NIS2 Implementation and Cyber Security Strengthening Act, the Digital Operational Resilience Act and BaFin's updated IT requirements-unlock EUR 7.4 billion of compulsory outlays between 2025 and 2027. Oversight is tightening in parallel; 68% of DAX constituents created a board-level cybersecurity committee in 2024, up from 42% in 2022. These governance moves encourage earlier budget sign-off and embed protection lines within core IT capex across the German Cybersecurity market.

The Federal Statistical Office reported cloud use by 69% of companies in 2024, compared with 54% in 2021. Sovereign-cloud contracts inside public agencies expanded 27% last year as ministries tightened domestic-data-residency rules. Organizations also fuse AI and protection budgets under single steering committees, and that integration is expected to reinforce spending momentum across the German Cybersecurity market.

Germany Cybersecurity Market Trends and Insights

Cloud-native application expansion in public sector and healthcare

Germany's Online Access Act mandates digital delivery of 575 federal and municipal services by 2026. By December 2024, 41% of those services already ran on Open Telekom Cloud. University hospitals raised hybrid-cloud storage to 94 petabytes over the year to archive imaging datasets. All new workloads must conform to the BSI C5 security framework, whose list of certified providers grew from 23 to 34 during 2024. Faster certification lowers procurement friction and fuels additional migrations, translating directly into higher license and consulting demand across the German Cybersecurity market.

OT/ICS security urgency amid Industrie 4.0 roll-outs

The VDMA reported that smart-sensor adoption reached 71% of production lines in 2024. IW Cologne pegged average downtime costs at EUR 290,000 per hour in automotive plants. Asset-discovery platforms now map 2.3 million critical industrial components nationwide, underpinning passive-monitoring adoption. By integrating cyber safeguards in overall-equipment-effectiveness calculations, manufacturers shift budgets from discretionary IT to mandatory operational protection, tilting revenue towards industrial-grade solutions inside the German Cybersecurity market.

Shortage of qualified cybersecurity professionals

Germany entered 2025 with 96,300 open IT-security positions, 25% higher than a year earlier. Senior SOC analysts in Munich command average pay of EUR 96,000, 57% above 2019 levels. Although 28 universities award specialist degrees, only 3,400 graduates enter the workforce annually, covering 7% of demand. Scarcity hardwires elevated wage floors into corporate budgets and directs spending towards automation, SOC-as-a-service and managed detection, which tempers margins yet supports service-provider revenues in the German Cybersecurity market.

Other drivers and restraints analyzed in the detailed report include:

- 5G and connected-mobility infrastructure growth

- Cyber-insurance requirements

- Budget limitations across the Mittelstand

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions accounted for 66.05% of 2025 German Cybersecurity market share, equal to USD 9.26 billion, while managed security services produced USD 3.71 billion and are pacing an 18.12% expansion curve. Companies also bought 164,000 BSI-certified next-generation firewalls, a 14% shipment gain. Service revenue is increasingly usage-based; Deutsche Telekom said that 42% of 2024 security bookings were metered rather than fixed-fee. Aligning provider incentives with live threat conditions ensures continuous optimisation and long-term stickiness across the German Cybersecurity market.

MSS engagement is further fuelled by central government placing EUR 680 million of SOC framework orders in 2024, which broadens vendor scale. The growing reliance on software-defined perimeters and zero-trust pilots requires 24/7 policy tuning unavailable in most internal teams, accelerating demand for outsourced SOC capacity.

On-premise and private-cloud instances retained 52.85% of the German Cybersecurity market size in 2025, or USD 7.41 billion, even as public-cloud security exhibits a 16.52% CAGR. Eurostat shows 46% of German firms storing some data in the public cloud, yet only 11% entrust core financial records. Capgemini measured an 18% premium for locally hosted services, but 58% of adopters accept the higher price.

Eco e.V. estimates that 72% of enterprises operate two SIEM platforms during transition phases. Vendors that unify on-premise and cloud telemetry registered 41% new ARR growth in 2024. This dual-stack reality entrenches complexity, favouring extensible platforms over point products and reinforcing the sovereign-first ethos guiding the German Cybersecurity market.

The Germany Cyber Security Market Report Segments the Industry Into by Offering (Solutions, and Services), Deployment Mode (Cloud, and On-Premise), End-User Vertical (BFSI, Healthcare, IT and Telecom, Industrial and Defense, Manufacturing, Retail and E-Commerce, Energy and Utilities, and Others), and End-User Enterprise Size (Small and Medium Enterprises (SMEs), and Large Enterprises).

List of Companies Covered in this Report:

- Deutsche Telekom (T-Systems)

- SAP SE

- Siemens AG

- IBM Deutschland GmbH

- Cisco Systems Germany

- Fortinet Germany GmbH

- Palo Alto Networks

- Check Point Software Tech

- Trend Micro Deutschland

- Kaspersky Labs DE

- Arctic Wolf

- CrowdStrike Germany

- Sophos Ltd

- Thales DIS Germany

- Atos Eviden

- Rheinmetall Cyber Solutions

- Deutsche Bahn Cyberservice

- Signal Iduna Cyber Protect

- Airbus Defence & Space Cybersecurity

- Rohde & Schwarz Cybersecurity

- IONOS Cloud Security

- CGI Deutschland

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-native Application Growth in Germany's Public Sector & Healthcare

- 4.2.2 OT/ICS Security Urgency amid Industrie 4.0 Roll-outs

- 4.2.3 Expansion of 5G and Connected Mobility Infrastructure

- 4.2.4 Rise of Cyber-Insurance Requirements Driving Security Spending

- 4.2.5 Regulatory compliance mandates (NIS2, DORA, BaFin IT rules)

- 4.2.6 AI-driven threat detection and response automation

- 4.3 Market Restraints

- 4.3.1 Severe Shortage of German-speaking Cybersecurity Professionals

- 4.3.2 Budget Limitations across SME-dominated Mittelstand

- 4.3.3 Data-Sovereignty Concerns Limiting Adoption of Global SaaS Security Tools

- 4.3.4 Federal Procurement Fragmentation Slowing Large-scale Roll-outs

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Key Use Cases and Case Studies

- 4.9 Impact on Macroeconomic Factors of the Market

- 4.10 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Offering

- 5.1.1 Solutions

- 5.1.1.1 Application Security

- 5.1.1.2 Cloud Security

- 5.1.1.3 Data Security

- 5.1.1.4 Identity and Access Management

- 5.1.1.5 Infrastructure Protection

- 5.1.1.6 Integrated Risk Management

- 5.1.1.7 Network Security Equipment

- 5.1.1.8 Endpoint Security

- 5.1.1.9 Other Services

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By End-User Vertical

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 IT and Telecom

- 5.3.4 Industrial and Defense

- 5.3.5 Manufacturing

- 5.3.6 Retail and E-commerce

- 5.3.7 Energy and Utilities

- 5.3.8 Others

- 5.4 By End-User Enterprise Size

- 5.4.1 Small and Medium Enterprises (SMEs)

- 5.4.2 Large Enterprises

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Deutsche Telekom (T-Systems)

- 6.4.2 SAP SE

- 6.4.3 Siemens AG

- 6.4.4 IBM Deutschland GmbH

- 6.4.5 Cisco Systems Germany

- 6.4.6 Fortinet Germany GmbH

- 6.4.7 Palo Alto Networks

- 6.4.8 Check Point Software Tech

- 6.4.9 Trend Micro Deutschland

- 6.4.10 Kaspersky Labs DE

- 6.4.11 Arctic Wolf

- 6.4.12 CrowdStrike Germany

- 6.4.13 Sophos Ltd

- 6.4.14 Thales DIS Germany

- 6.4.15 Atos Eviden

- 6.4.16 Rheinmetall Cyber Solutions

- 6.4.17 Deutsche Bahn Cyberservice

- 6.4.18 Signal Iduna Cyber Protect

- 6.4.19 Airbus Defence & Space Cybersecurity

- 6.4.20 Rohde & Schwarz Cybersecurity

- 6.4.21 IONOS Cloud Security

- 6.4.22 CGI Deutschland

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment