|

市場調查報告書

商品編碼

1906895

歐洲網路安全市場:市場佔有率分析、產業趨勢與統計資料、成長預測(2026-2031 年)Europe Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

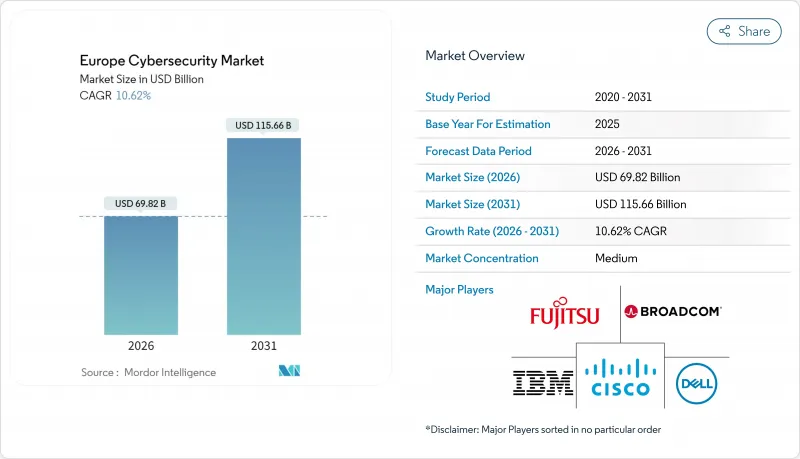

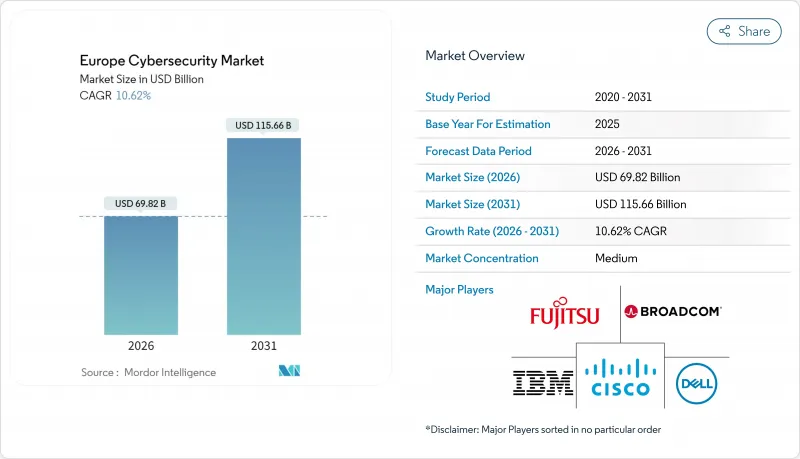

預計到 2026 年,歐洲網路安全市場規模將達到 698.2 億美元。預計該市場規模將從 2025 年的 631.2 億美元成長到 2031 年的 1,156.6 億美元,2026 年至 2031 年的複合年成長率為 10.62%。

強制法規、日益加劇的地緣政治風險以及向自主雲端平台加速轉型,正推動網路安全從可自由支配的支出躍升為全部區域的核心營運成本。網路與資訊安全指令2 (NIS2) 和數位營運彈性法案 (DORA) 的實施鞏固了支出計劃,而俄烏衝突導致勒索軟體造成的損失增加了30%,並提高了董事會層面的風險意識。雲端優先策略仍在繼續,而隨著企業在自主性和規模之間尋求平衡,混合部署正在加速發展。為了滿足合規要求,供應商紛紛收購事件回應和託管服務能力,供應商整合正在加劇。然而,日益激烈的競爭因29.9萬名專業人員的短缺而有所緩和,這加劇了內部安全團隊的壓力,並推動了託管服務的普及。

歐洲網路安全市場趨勢與洞察

隨著歐盟範圍內NIS2和DORA的實施,強制安全支出增加。

NIS2 將其適用範圍擴大至超過 16 萬家歐洲營業單位,並引入最高 1000 萬歐元或全球營業額 2% 的罰款,使網路安全預算從可自由支配支出轉變為強制性支出。 DORA 對金融機構施加了類似的 ICT 風險管理義務,迫使像 Belfius Bank 這樣的銀行重組其供應商組合以增強其韌性。法律要求已將平均安全支出推高至 IT 預算的 9%,89% 的公司表示需要招募新員工。整合平台和託管服務受益最大,因為它們簡化了多司法管轄區報告流程,確保合規性並降低處罰風險。

與俄烏衝突相關的複雜勒索軟體攻擊激增

2024年,針對歐洲組織的勒索軟體攻擊增加了30%,威脅行為者利用了地緣政治緊張局勢。 2025年第一季,製造業遭受的攻擊增加了84%,資料外洩造成的損失超過556萬美元,超過了以往危機造成的損失。 2023年,醫療保健產業的安全事件達到309起,其中一半與勒索軟體相關,促使歐盟制定行動計劃,分配更多事件回應資源。像LockBit這樣的持續性勒索軟體組織在被搗毀前發動了1700次攻擊,凸顯了行為模式的偵測和多層回應服務的必要性。

網路安全人才嚴重短缺限制了應對能力。

歐洲面臨超過29.9萬名合格網路安全專業人員的缺口,現有從業人員有76%缺乏正式資格。儘管德國的支出實現了兩位數的成長,但仍難以填補職缺;法國預計仍有1.5萬個職缺,儘管其年薪已接近9.81萬美元。技能短缺正在拖慢計劃開發進度,尤其是在雲端安全和營運技術(OT)保護領域,迫使企業轉向託管式偵測和回應服務,以取代內部自建能力。

細分市場分析

到2025年,解決方案將佔據歐洲網路安全市場佔有率的67.25%,這主要得益於將雲端、身分和網路控制整合到統一主機的整合平台。預計到2031年,包括託管偵測和回應在內的歐洲網路安全服務市場規模將以13.56%的複合年成長率成長,因為企業正尋求透過外包日常營運來填補人才缺口。推動這一高速成長要素是新納入NIS2範圍的中型企業,這些企業往往更傾向於單一訂閱服務包,而非多供應商工具包。

託管服務供應商製合規儀表板,實現歐盟不同管理體制下的證據收集自動化。同時,隨著大型銀行和製造商建構零信任參考模型和後量子密碼技術藍圖,對專業服務的需求仍然強勁。整合工作流程自動化和原生報告功能的整合解決方案供應商享有交叉銷售優勢,而專注於單一產品的供應商則面臨整合壓力。

到2025年,雲端採用將佔總收入的56.90%,因為企業將彈性和持續更新視為首要任務。混合模式目前正經歷著15.03%的最快複合年成長率,因為主權規則要求企業在歐盟境內保留敏感資料的同時,持續利用全球超大規模資料中心業者的分析能力。隨著金融機構試行部署抗量子攻擊的都會區網路,歐洲混合架構的網路安全市場規模正在擴大。這些城域網路將遙測資料路由到主權雲端中的分析引擎,同時將金鑰保留在企業內部。

對於需要完全控制硬體的國防和公共部門工作負載而言,本地部署仍然是主流。然而,這些環境也在整合基於雲端的威脅情報來源,從而建構複雜的拓撲結構。因此,供應商在 SaaS 和設備產品中提供相同的策略引擎,使管理員能夠應用統一的控制措施,而無需考慮工作負載的位置。

歐洲網路安全市場報告公共產業、其他)、最終用戶公司規模(中小企業、大型企業)和國家/地區對產業進行細分。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 在歐盟範圍內實施NIS2和DORA將增加強制安全支出。

- 與俄烏衝突相關的複雜勒索軟體激增

- 快速向歐洲主權雲端轉型推動零信任架構

- 在德國和北歐製造基地擴展5G專用網路

- 數位身分(eIDAS 2.0)的引入催生了對身分驗證的新需求。

- 保險公司主導的中型企業最低網路安全措施

- 市場限制

- 在歐盟範圍內實施NIS2和DORA將增加強制安全支出。

- 與俄烏衝突相關的複雜勒索軟體激增

- 快速向歐洲主權雲端轉型推動零信任架構

- 在德國和北歐製造基地擴展5G專用網路

- 關鍵法規結構評估

- 價值鏈分析

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 主要用例和案例研究

- 宏觀經濟因素對市場的影響

- 投資分析

第5章 市場區隔

- 報價

- 解決方案

- 應用程式安全

- 雲端安全

- 資料安全

- 身分和存取管理

- 基礎設施保護

- 綜合風險管理

- 網路安全設備

- 端點安全

- 其他服務

- 服務

- 專業服務

- 託管服務

- 解決方案

- 透過部署模式

- 本地部署

- 雲

- 按最終用戶行業分類

- BFSI

- 衛生保健

- 資訊科技/通訊

- 工業與國防

- 製造業

- 零售與電子商務

- 能源與公共產業

- 製造業

- 其他

- 按最終用戶公司規模分類

- 中小企業

- 主要企業

- 按國家/地區

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 其他歐洲國家(北歐國家、比荷盧經濟聯盟(不包括荷蘭)、中歐和東歐以及巴爾幹半島)

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Cisco Systems Inc.

- Palo Alto Networks Inc.

- IBM Corporation

- Check Point Software Technologies Ltd.

- Fortinet Inc.

- Thales Group(Thales DIS)

- Siemens AG(Siemens Digital Industries)

- Atos SE(Eviden)

- Accenture PLC(Security Services)

- Kaspersky Lab JSC

- Trend Micro Inc.

- Sophos Ltd.

- F-Secure Corp.

- Darktrace PLC

- Orange Cyberdefense(Orange SA)

- Airbus Defence and Space GmbH(CyberSecurity)

- Capgemini SE

- Deutsche Telekom Security GmbH(T-Systems)

- BAE Systems Applied Intelligence

- Rapid7 Inc.

- CrowdStrike Holdings Inc.

- Nexus Group

- Secunet Security Networks AG

- Rohde & Schwarz Cybersecurity GmbH

第7章 市場機會與未來展望

Europe cybersecurity market size in 2026 is estimated at USD 69.82 billion, growing from 2025 value of USD 63.12 billion with 2031 projections showing USD 115.66 billion, growing at 10.62% CAGR over 2026-2031.

Mandatory regulation, rising geopolitical risk, and an accelerating shift to sovereign cloud platforms elevate cybersecurity from optional spend to core operational outlay across the region. Enforcement of the Network and Information Security Directive 2 (NIS2) and the Digital Operational Resilience Act (DORA) anchors spending plans, while the Russia-Ukraine conflict fuels a 30% rise in ransomware incidents that heightens board-level risk awareness. Cloud-first strategies persist, yet hybrid deployments gain traction as enterprises balance sovereignty with scale. Vendor consolidation intensifies as suppliers acquire incident-response and managed-services capabilities to meet compliance demand. Heightened competition, however, is tempered by a 299,000-professional skills deficit that stretches internal security teams and bolsters managed service uptake.

Europe Cybersecurity Market Trends and Insights

EU-wide Enforcement of NIS2 and DORA Elevating Mandatory Security Spend

NIS2 expands coverage to more than 160,000 European entities and introduces penalties of up to EUR 10 million or 2% of global turnover, which is shifting cybersecurity budgets from discretionary to compulsory . DORA imposes parallel ICT-risk mandates on financial entities, forcing banks such as Belfius to restructure vendor portfolios for resilience. The legal scope drives average security spending to 9% of IT budgets, while 89% of firms report new hiring needs. Integration-ready platforms and managed services benefit most because they streamline multi-jurisdiction reporting, sustain compliance, and reduce penalty exposure.

Surge in Sophisticated Ransomware Linked to Russia-Ukraine Conflict

Ransomware attacks on European organizations climbed 30% in 2024 as threat actors weaponized geopolitical tensions. Manufacturing bore 84% growth in strike volume during Q1 2025 with breach costs topping USD 5.56 million, eclipsing previous crisis-era losses. Healthcare incidents reached 309 in 2023, half involving ransomware, prompting an EU action plan that allocates additional incident-response resources. Persistent groups such as LockBit executed 1,700 attacks before takedown efforts, underlining the need for behavior-based detection and layered response services.

Acute Cybersecurity Skills Shortage Limiting Implementation Capacity

Europe lacks more than 299,000 qualified cybersecurity professionals, and 76% of existing staff possess no formal credentials. Germany posts double-digit growth in spending yet struggles to fill vacancies, while France expects 15,000 open roles despite salaries approaching USD 98,100. Skills scarcity slows project rollouts, particularly in cloud security and OT protection, compelling enterprises to shift toward managed detection and response as a substitute for in-house capability.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Shift to European Sovereign Clouds Driving Zero-Trust Architectures

- Expansion of 5G Private Networks in German and Nordic Manufacturing Hubs

- Rising Compliance Costs Straining Mid-Market Enterprise Budgets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions accounted for 67.25% of the Europe cybersecurity market share in 2025, underpinned by integrated platforms that bundle cloud, identity, and network controls into unified consoles. The Europe cybersecurity market size for services, including managed detection and response, is projected to expand at a 13.56% CAGR to 2031 as enterprises offset workforce shortages by outsourcing daily operations. High-growth comes from mid-market firms newly covered under NIS2 that prefer single-subscription service bundles over multi-vendor toolkits.

Managed services providers tailor compliance dashboards that automate evidence collection across the EU's heterogeneous regulatory regimes. Concurrently, professional-services demand remains steady as large banks and manufacturers architect zero-trust reference models and post-quantum roadmaps. Integrated solution vendors that embed workflow automation and native reporting enjoy cross-sell advantage, while niche point-product suppliers face consolidation pressure.

Cloud deployments represented 56.90% of 2025 revenue as enterprises embraced elasticity and evergreen updates. Hybrid models now register the swiftest 15.03% CAGR because sovereignty rules compel companies to retain sensitive data inside EU borders while still tapping global hyperscaler analytics. The Europe cybersecurity market size for hybrid architectures grows as financial institutions pilot quantum-secure metro networks that keep keys on premises yet route telemetry to analytics engines in sovereign clouds.

On-premise installations persist in defense and public-sector workloads that require full control of hardware. Yet even these environments integrate cloud-based threat intelligence feeds, creating blended topologies. Vendors therefore package identical policy engines across SaaS and appliance form factors so administrators can enforce uniform controls regardless of workload location.

The Europe Cybersecurity Market Report Segments the Industry Into by Offering (Solutions, and Services), Deployment Mode (On-Premise, and Cloud), End-User Vertical (BFSI, Healthcare, IT and Telecom, Industrial and Defense, Manufacturing, Retail and E-Commerce, Energy and Utilities, Manufacturing, and Others), and End-User Enterprise Size (Small and Medium Enterprises (SMEs), and Large Enterprises). And Country.

List of Companies Covered in this Report:

- Cisco Systems Inc.

- Palo Alto Networks Inc.

- IBM Corporation

- Check Point Software Technologies Ltd.

- Fortinet Inc.

- Thales Group (Thales DIS)

- Siemens AG (Siemens Digital Industries)

- Atos SE (Eviden)

- Accenture PLC (Security Services)

- Kaspersky Lab JSC

- Trend Micro Inc.

- Sophos Ltd.

- F-Secure Corp.

- Darktrace PLC

- Orange Cyberdefense (Orange SA)

- Airbus Defence and Space GmbH (CyberSecurity)

- Capgemini SE

- Deutsche Telekom Security GmbH (T-Systems)

- BAE Systems Applied Intelligence

- Rapid7 Inc.

- CrowdStrike Holdings Inc.

- Nexus Group

- Secunet Security Networks AG

- Rohde & Schwarz Cybersecurity GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU-wide Enforcement of NIS2 and DORA Elevating Mandatory Security Spend

- 4.2.2 Surge in Sophisticated Ransomware Linked to Russia-Ukraine Conflict

- 4.2.3 Rapid Shift to European Sovereign Clouds Driving Zero-Trust Architectures

- 4.2.4 Expansion of 5G Private Networks in German and Nordic Manufacturing Hubs

- 4.2.5 Digital-ID Roll-out (eIDAS 2.0) Creating New Authentication Demand

- 4.2.6 Insurer-Driven Minimum Cyber-Controls for Mid-Market Firms

- 4.3 Market Restraints

- 4.3.1 EU-wide Enforcement of NIS2 and DORA Elevating Mandatory Security Spend

- 4.3.2 Surge in Sophisticated Ransomware Linked to Russia-Ukraine Conflict

- 4.3.3 Rapid Shift to European Sovereign Clouds Driving Zero-Trust Architectures

- 4.3.4 Expansion of 5G Private Networks in German and Nordic Manufacturing Hubs

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Key Use Cases and Case Studies

- 4.9 Impact on Macroeconomic Factors of the Market

- 4.10 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Offering

- 5.1.1 Solutions

- 5.1.1.1 Application Security

- 5.1.1.2 Cloud Security

- 5.1.1.3 Data Security

- 5.1.1.4 Identity and Access Management

- 5.1.1.5 Infrastructure Protection

- 5.1.1.6 Integrated Risk Management

- 5.1.1.7 Network Security Equipment

- 5.1.1.8 Endpoint Security

- 5.1.1.9 Other Services

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By End-User Vertical

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 IT and Telecom

- 5.3.4 Industrial and Defense

- 5.3.5 Manufacturing

- 5.3.6 Retail and E-commerce

- 5.3.7 Energy and Utilities

- 5.3.8 Manufacturing

- 5.3.9 Others

- 5.4 By End-User Enterprise Size

- 5.4.1 Small and Medium Enterprises (SMEs)

- 5.4.2 Large Enterprises

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Spain

- 5.5.5 Italy

- 5.5.6 Netherlands

- 5.5.7 Rest of Europe (Nordics, Benelux excl. NL, CEE, Balkans)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Cisco Systems Inc.

- 6.4.2 Palo Alto Networks Inc.

- 6.4.3 IBM Corporation

- 6.4.4 Check Point Software Technologies Ltd.

- 6.4.5 Fortinet Inc.

- 6.4.6 Thales Group (Thales DIS)

- 6.4.7 Siemens AG (Siemens Digital Industries)

- 6.4.8 Atos SE (Eviden)

- 6.4.9 Accenture PLC (Security Services)

- 6.4.10 Kaspersky Lab JSC

- 6.4.11 Trend Micro Inc.

- 6.4.12 Sophos Ltd.

- 6.4.13 F-Secure Corp.

- 6.4.14 Darktrace PLC

- 6.4.15 Orange Cyberdefense (Orange SA)

- 6.4.16 Airbus Defence and Space GmbH (CyberSecurity)

- 6.4.17 Capgemini SE

- 6.4.18 Deutsche Telekom Security GmbH (T-Systems)

- 6.4.19 BAE Systems Applied Intelligence

- 6.4.20 Rapid7 Inc.

- 6.4.21 CrowdStrike Holdings Inc.

- 6.4.22 Nexus Group

- 6.4.23 Secunet Security Networks AG

- 6.4.24 Rohde & Schwarz Cybersecurity GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment