|

市場調查報告書

商品編碼

1910859

法國網路安全市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)France Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

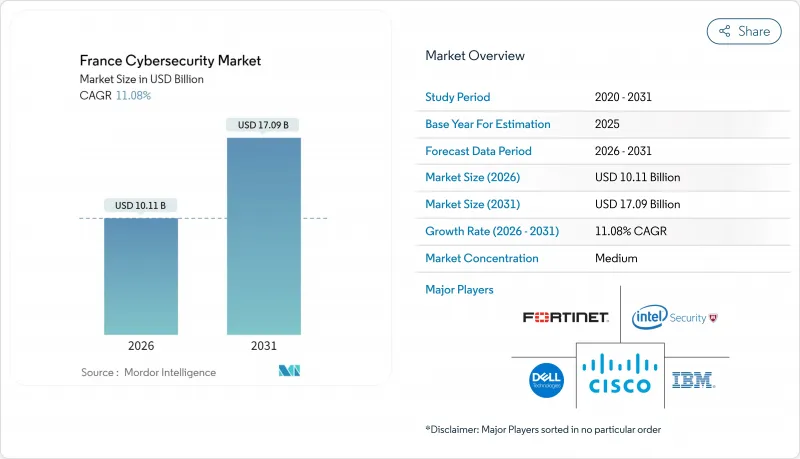

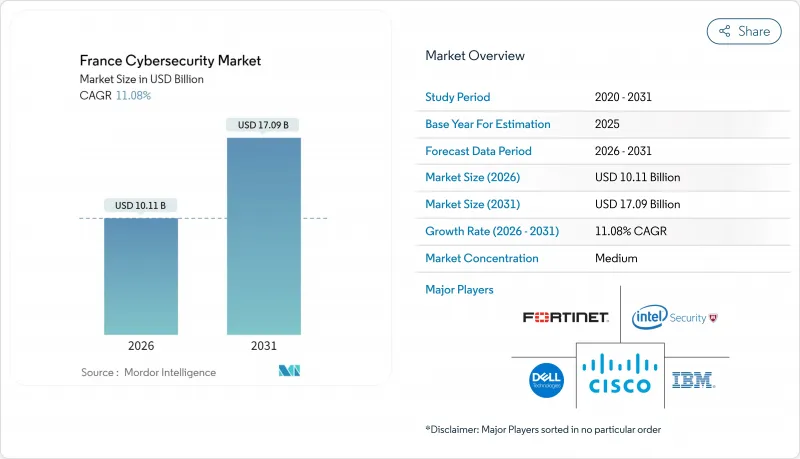

法國網路安全市場預計到 2025 年將達到 91 億美元,到 2026 年將成長到 101.1 億美元,到 2031 年將成長到 170.9 億美元,預測期(2026-2031 年)的複合年成長率為 11.08%。

NIS2法規的快速擴展、公共部門資金的增加以及雲端遷移的激增,共同為供應商帶來了更多潛在機會。企業持續整合其安全架構,增加對整合平台的投入,以減輕合規負擔並緩解人才短缺問題。為解決熟練人員長期短缺的問題,對資安管理服務的需求激增,而人工智慧驅動的分析正成為法國安全營運中心(SOC)的標配。奧運期間網路安全活動的活性化,正在永久改變法國對威脅的認知,並促使企業對醫療保健、能源和交通等關鍵領域的威脅監控基礎設施進行長期投資。

法國網路安全市場趨勢與洞察

加速NIS2實施及法國政府網路安全資金投入

NIS2 將監管範圍從 500 家法國公司擴大到約 15,000 家,受監管行業數量增加了兩倍。對管治、風險和合規 (GRC) 工具的需求正在蓬勃發展。法國政府的「法國 2030」計畫累計3,900 萬歐元(約 4,200 萬美元)用於 17 個資訊安全相關計劃,以提升國家網路安全能力。法國國家資訊安全局 (ANSSI) 的分階段實施政策強調能力建構而非製裁,這刺激了企業應對漏洞的需求,也促使企業爭相解決安全漏洞。政府計劃以 7 億歐元(約 7.48 億美元)收購 Atos 的網路安全資產,進一步凸顯了國內智慧財產權的戰略價值。這些措施共同註入了資金,擴大了基本客群,並鞏固了法國網路安全市場作為歐洲合規中心的地位。

法國關鍵基礎設施和醫療保健領域勒索軟體激增

法國國家安全資訊系統管理局 (ANSSI) 記錄顯示,2024 年共發生 4,386 起安全事件(較前一年增加 15%),其中醫療保健產業佔勒索軟體攻擊報告總數的 10%。阿爾芒蒂耶爾和科爾貝-埃鬆的醫院被迫關閉,導致對固定價格的端點檢測和事件回應服務的需求激增。盧浮宮和大皇宮等文化機構也受到影響,這顯示沒有一個產業能夠倖免。支出已轉向擴展災難復原 (XDR) 平台和危機管理諮詢,這表明法國網路安全市場作為快速服務交付中心的地位正在增強。

網路安全人才嚴重短缺推高了安全營運中心(SOC)的成本。

儘管自2020年以來網路安全人才成長了89%,但全國仍存在約15,000個職缺。高級分析師的薪資已高達90,000歐元(約96,300美元),這擠壓了服務提供者的利潤空間,並推動了自動化進程。泰雷茲公司實施了GenAI4SOC系統,並將個案分診效率提高了40%。雖然這些努力緩解了人才短缺問題,但並未徹底消除人才短缺,這仍然是法國網路安全市場全面擴張的一大障礙。

細分市場分析

到2025年,解決方案業務將佔總收入的52.10%,其中統一威脅管理套件和XDR的普及加速了企業減少工具冗餘的需求。隨著越來越多的客戶將全天候監控外包以應對人員短缺問題,託管服務正以12.85%的複合年成長率快速成長。身分識別和存取管理工具,尤其是特權存取管理,對於零信任架構的實作至關重要。例如,Wallix正利用其獲得法國國家資訊安全局(ANSSI)認證的優勢來吸引受監管的客戶。專業服務是軟體支出的補充,提供旨在實現NIS2(網路資訊安全指令)目標的評估和補救計劃。雖然硬體設備仍然至關重要,但它們與人工智慧驅動的分析功能的整合凸顯了法國網路安全市場的融合特徵。

這種整合趨勢正在推動混合消費模式的出現,即買家獲得核心平台的許可,並額外購買用於事件回應的持續服務。這種方式既延長了供應商的生命週期價值,又能在預算緊張時期提供柔軟性。隨著勒索軟體攻擊的日益增多,用於事件回應的持續服務已成為銀行、金融和保險 (BFSI) 以及醫療保健行業的基本需求,從而穩步擴大了法國保全服務市場的規模。

到2025年,雲端採用將佔支出的59.78%,這反映出SaaS的廣泛應用以及中小企業快速進入雲端領域的趨勢。法國網路安全市場中與雲端解決方案相關的規模預計將以14.25%的複合年成長率成長,超過本地部署平台,因為關鍵工作負載正在遷移到混合環境中。 SecNumCloud認證正在增強人們對國內託管的信心,使OVHcloud和Outscale等業者受益。

在國防和監管嚴格的公共產業領域,本地部署模式仍然佔據主導地位,因為在這些領域,資料居住和延遲要求比擴充性更為重要。然而,即使是這些領域也在採用基於雲端的分析來增強傳統的控制功能。能夠跨多個雲端供應商標準化策略的多重雲端編配平台正變得越來越受歡迎,這降低了企業在尋求超越單一超大規模資料中心業者服務商時被供應商鎖定的風險。因此,法國網路安全市場正在進一步模糊傳統部署的界限,並朝著以控制平面為中心的架構發展。

法國網路安全市場報告按公共產業類型(解決方案、服務)、部署模式(本地部署、雲端部署)、最終用戶垂直產業(銀行、金融服務和保險、醫療保健、IT 和電信、工業和國防、製造業、零售和電子商務、能源和公用事業、其他)以及最終用戶公司規模(中小企業、大型企業)對產業進行細分。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 加快實施NIS2標準並增加對法國政府網路安全計畫的資金投入

- 法國關鍵基礎設施和醫療保健產業遭受勒索軟體攻擊激增

- 2024年巴黎奧運推動了威脅監測投資

- 法國NUM數位代金券推動中小企業雲端遷移

- 校園網路生態系統驅動區域解決方案創新

- 向遠端辦公的轉變需要零信任和身分與存取管理 (IAM) 升級。

- 市場限制

- 網路安全人才嚴重短缺正在推高安全營運中心(SOC)服務成本。

- 法國中小企業將網路安全視為營運支出 (OPEX),並傾向於避免預算限制。

- 由於法規重疊(GDPR、NIS2、ANSSI產業法規)導致的採購延誤

- 工具分散且整合複雜,導致技術棧碎片化。

- 重要法規結構評估

- 價值鏈分析

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 主要用例和案例研究

- 宏觀經濟因素對市場的影響

- 投資分析

第5章 市場區隔

- 報價

- 解決方案

- 應用程式安全

- 雲端安全

- 資料安全

- 身分和存取管理

- 基礎設施保護

- 綜合風險管理

- 網路安全設備

- 端點安全

- 其他服務

- 服務

- 專業服務

- 託管服務

- 解決方案

- 透過部署模式

- 本地部署

- 雲

- 按最終用戶行業分類

- BFSI

- 衛生保健

- 資訊科技/通訊

- 工業與國防

- 製造業

- 零售與電子商務

- 能源與公共產業

- 製造業

- 其他

- 按最終用戶公司規模分類

- 中小企業

- 主要企業

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- IBM Corporation

- Cisco Systems Inc.

- Dell Technologies Inc.(SecureWorks)

- Fortinet Inc.

- Intel Security(McAfee LLC)

- F5 Networks Inc.

- AVG Technologies(Gen Digital)

- IDECSI Enterprise Security

- Trellix(Formerly FireEye)

- Thales Group

- Orange Cyberdefense

- Atos SE(Eviden)

- Capgemini SE

- Sopra Steria Group SA

- Airbus Defence & Space CyberSecurity

- Stormshield

- Wallix Group

- Exclusive Networks SA

- Check Point Software Technologies Ltd.

- Palo Alto Networks Inc.

- CrowdStrike Holdings Inc.

- Trend Micro Inc.

- Okta Inc.

- Darktrace plc

第7章 市場機會與未來展望

The France cybersecurity market was valued at USD 9.10 billion in 2025 and estimated to grow from USD 10.11 billion in 2026 to reach USD 17.09 billion by 2031, at a CAGR of 11.08% during the forecast period (2026-2031).

Rapid regulatory expansion under NIS2, heavier public-sector funding, and a sharp rise in cloud migration are synchronizing to widen the addressable opportunity for vendors. Enterprises continue to consolidate security stacks, channeling spending toward integrated platforms that ease compliance and talent pressures. Managed security services are surging as buyers offset a persistent shortage of skilled practitioners, while AI-driven analytics are becoming standard in French security operations centers. Heightened Olympic-period cyber activity has permanently recalibrated domestic threat awareness, prompting long-term investment in threat-monitoring infrastructure across critical sectors such as healthcare, energy, and transportation.

France Cybersecurity Market Trends and Insights

Accelerated NIS2 adoption and French Government cyber funding

NIS2 widens the compliance net from 500 to roughly 15,000 French entities, tripling the number of regulated sectors and intensifying demand for governance, risk, and compliance tooling. France 2030 earmarked EUR 39 million (USD 42 million) for 17 cybersecurity projects, anchoring sovereign capability development. ANSSI's phased roll-out stresses enablement over sanction, spurring advisory services as firms race to close gaps. Government interest in acquiring Atos' cybersecurity assets for EUR 700 million (USD 748 million) further underlines the strategic value of domestic IP. Together these moves inject capital, enlarge the client base, and reinforce the France cybersecurity market as a continental compliance hub.

Ransomware surge on French critical infrastructure and healthcare

ANSSI logged 4,386 security incidents in 2024, up 15% year on year, with healthcare representing 10% of ransomware filings. Hospitals at Armentieres and Corbeil-Essonnes endured emergency shutdowns, driving urgency around endpoint detection and incident-response retainer services. Cultural landmarks such as the Louvre and Grand Palais also faced disruptions, proving no sector is immune. Spending is pivoting toward XDR platforms and crisis-management consulting, reinforcing the France cybersecurity market as a responsive services arena.

Acute cyber-talent shortage inflating SOC costs

Roughly 15,000 cybersecurity vacancies persist nationwide, despite an 89% workforce expansion since 2020. Salary inflation reaches EUR 90,000 (USD 96,300) for senior analysts, squeezing provider margins and stimulating automation. Thales responded with GenAI4SOC to improve case triage efficiency by 40%. Such initiatives temper, but do not erase, the talent gap that restrains the France cybersecurity market's ability to scale fully.

Other drivers and restraints analyzed in the detailed report include:

- Paris 2024 Olympics-driven threat-monitoring investments

- SME cloud-migration boom under "France Num" digital vouchers

- Budget aversion among SMEs viewing cyber as OPEX

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions generated 52.10% of 2025 revenue, with unified threat-management suites and XDR gaining traction as enterprises rationalize tool sprawl. The managed-services slice is growing at 12.85% CAGR as clients contract out 24/7 monitoring to compensate for staffing gaps. Identity-and-access tools, especially privileged-access management, underpin Zero-Trust rollouts. Wallix, for example, leverages its ANSSI qualification to court regulated clients. Professional services complement software spend, delivering assessment and remediation projects tied to NIS2 milestones. Hardware appliances remain foundational but are increasingly bundled with AI-driven analytics, illustrating the convergence that defines the France cybersecurity market.

The integration trend is fostering hybrid consumption models in which buyers license core platforms and overlay retained services for incident response. This approach expands lifetime value for vendors while providing flexibility in tight budget cycles. As ransomware campaigns intensify, incident-response retainers are now a baseline requirement across BFSI and healthcare, pushing the France cybersecurity market size for services steadily upward.

Cloud deployments accounted for 59.78% of 2025 spending, reflecting widespread SaaS preference and rapid SME onboarding. The France cybersecurity market size attached to cloud solutions is forecast to rise at a 14.25% CAGR, outpacing the on-premise base as more critical workloads move to hybrid environments. SecNumCloud certification accelerates trust in domestic hosting, benefiting players such as OVHcloud and Outscale.

On-premise models persist in defense and heavily regulated utilities where data residency and latency demands outweigh elasticity. Yet even these sectors adopt cloud-based analytics to augment legacy controls. Multi-cloud orchestration platforms that normalize policy across providers are gaining lift, mitigating vendor lock-in risks for enterprises expanding beyond a single hyperscaler. As a result, the France cybersecurity market continues to blur traditional deployment lines, pivoting toward control-plane-centric architectures.

The France Cybersecurity Market Report Segments the Industry Into by Offering (Solutions, and Services), Deployment Mode (On-Premise, and Cloud), End-User Vertical (BFSI, Healthcare, IT and Telecom, Industrial and Defense, Manufacturing, Retail and E-Commerce, Energy and Utilities, Manufacturing, and Others), and End-User Enterprise Size (Small and Medium Enterprises (SMEs), and Large Enterprises)

List of Companies Covered in this Report:

- IBM Corporation

- Cisco Systems Inc.

- Dell Technologies Inc. (SecureWorks)

- Fortinet Inc.

- Intel Security (McAfee LLC)

- F5 Networks Inc.

- AVG Technologies (Gen Digital)

- IDECSI Enterprise Security

- Trellix (Formerly FireEye)

- Thales Group

- Orange Cyberdefense

- Atos SE (Eviden)

- Capgemini SE

- Sopra Steria Group SA

- Airbus Defence & Space CyberSecurity

- Stormshield

- Wallix Group

- Exclusive Networks SA

- Check Point Software Technologies Ltd.

- Palo Alto Networks Inc.

- CrowdStrike Holdings Inc.

- Trend Micro Inc.

- Okta Inc.

- Darktrace plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated NIS2 adoption and Increasing French Government Cyber Plan funding

- 4.2.2 Ransomware surge on French critical infrastructure and healthcare

- 4.2.3 Paris 2024 Olympics-driven threat-monitoring investments

- 4.2.4 SME cloud-migration boom under "France Num" digital vouchers

- 4.2.5 Campus Cyber ecosystem catalysing local solution innovation

- 4.2.6 Remote-work shift demanding Zero-Trust and IAM upgrades

- 4.3 Market Restraints

- 4.3.1 Acute cyber-talent shortage inflating SOC service costs

- 4.3.2 Budget aversion among French SMEs viewing cyber as OPEX

- 4.3.3 Regulatory overlap (GDPR, NIS2, ANSSI sector rules) delaying buys

- 4.3.4 Tool-sprawl and integration complexity across fragmented stack

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Key Use Cases and Case Studies

- 4.9 Impact on Macroeconomic Factors of the Market

- 4.10 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Offering

- 5.1.1 Solutions

- 5.1.1.1 Application Security

- 5.1.1.2 Cloud Security

- 5.1.1.3 Data Security

- 5.1.1.4 Identity and Access Management

- 5.1.1.5 Infrastructure Protection

- 5.1.1.6 Integrated Risk Management

- 5.1.1.7 Network Security Equipment

- 5.1.1.8 Endpoint Security

- 5.1.1.9 Other Services

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By End-User Vertical

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 IT and Telecom

- 5.3.4 Industrial and Defense

- 5.3.5 Manufacturing

- 5.3.6 Retail and E-commerce

- 5.3.7 Energy and Utilities

- 5.3.8 Manufacturing

- 5.3.9 Others

- 5.4 By End-User Enterprise Size

- 5.4.1 Small and Medium Enterprises (SMEs)

- 5.4.2 Large Enterprises

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 IBM Corporation

- 6.4.2 Cisco Systems Inc.

- 6.4.3 Dell Technologies Inc. (SecureWorks)

- 6.4.4 Fortinet Inc.

- 6.4.5 Intel Security (McAfee LLC)

- 6.4.6 F5 Networks Inc.

- 6.4.7 AVG Technologies (Gen Digital)

- 6.4.8 IDECSI Enterprise Security

- 6.4.9 Trellix (Formerly FireEye)

- 6.4.10 Thales Group

- 6.4.11 Orange Cyberdefense

- 6.4.12 Atos SE (Eviden)

- 6.4.13 Capgemini SE

- 6.4.14 Sopra Steria Group SA

- 6.4.15 Airbus Defence & Space CyberSecurity

- 6.4.16 Stormshield

- 6.4.17 Wallix Group

- 6.4.18 Exclusive Networks SA

- 6.4.19 Check Point Software Technologies Ltd.

- 6.4.20 Palo Alto Networks Inc.

- 6.4.21 CrowdStrike Holdings Inc.

- 6.4.22 Trend Micro Inc.

- 6.4.23 Okta Inc.

- 6.4.24 Darktrace plc

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment