|

市場調查報告書

商品編碼

1911476

日本網路安全市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Japan Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

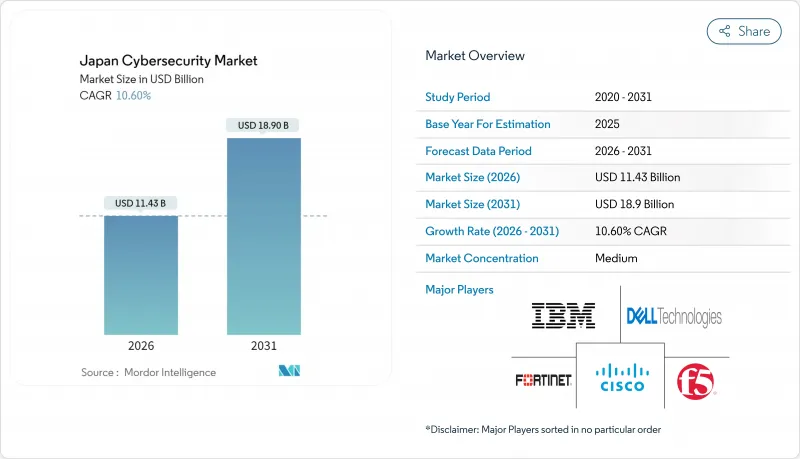

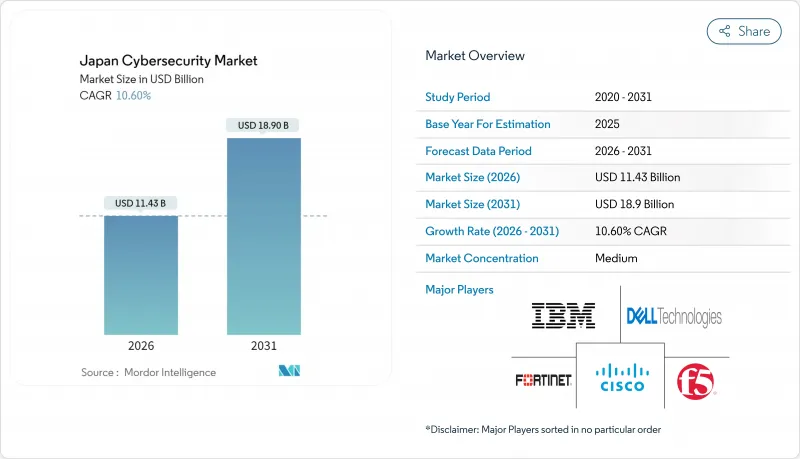

預計到 2025 年,日本網路安全市場規模將達到 103.4 億美元,到 2026 年將成長至 114.3 億美元,到 2031 年將成長至 189 億美元,預測期(2026-2031 年)的複合年成長率為 10.60%。

這一成長得益於公共和私人部門的支出,這些支出優先用於加強主權安全能力、推進零信任實施時間表以及加速雲端遷移。其他促進因素包括東京證券交易所強制要求揭露網路風險、人工智慧驅動的威脅升級以及5G智慧工廠的推廣。政府透過數位機構增加資本支出,以及諸如2025年大阪-關西世博會等區域性計劃,將擴大高階威脅偵測平台和託管服務的需求基礎。由於主要企業將合規專業知識與整合平台結合,以抵禦全球供應商的競爭,市場競爭仍然溫和。

日本網路安全市場趨勢與洞察

日本政府在數位機構成立後資本支出激增

2021年數位機構的成立標誌著一個轉捩點。 2025年,國防費用將增加至8.5兆日元,網路安全基礎設施的專案預算撥款也將從軍事計劃擴展到雲端平台、電子簽章系統和供應鏈安全標準等領域。採購法規將強制要求遵守嚴格的加密和事件回應標準,這將刺激企業對即將推出的政府雲端上運作的自主解決方案的需求。

關鍵基礎設施零信任強制指南(將於2026年實施)

2024年10月,日本金融廳(FSA)發布了177項規定,要求銀行、保險公司和支付服務提供者加強身分驗證管理,建立第三方風險監控系統和持續監控系統。日本經濟產業省(METI)的平行評級架構將這些義務擴展至供應鏈合作夥伴,加速了製造業和能源領域的零信任試點計畫。早期採用者報告稱,風險控制速度更快,審核成本更低,從而加快了其引進週期。

網路安全人才嚴重短缺推高了安全營運中心(SOC)服務成本。

經濟產業省估計,目前約有11萬名從業人員缺口,迫使服務供應商提高安全營運中心(SOC)的工時費並延長部署等待時間。語言障礙和基於工作年限的招募做法阻礙了海外人才的快速引進。計畫中的培訓計畫旨在2030年將認證專業人員的數量增加到5萬人,但預計未來十年薪資上漲的壓力將持續存在。

細分市場分析

截至2025年,解決方案領域佔據了日本網路安全市場佔有率的59.27%,這主要得益於整合了端點、雲端和身分保護功能的套件。大規模買家傾向於選擇整合式主機,以減輕人員配置壓力並簡化合規性審核。雖然網路防火牆和入侵防禦系統仍然佔據較大佔有率,但成長重心正轉向軟體定義控制和人工智慧驅動的分析。隨著零信任目標的逐步實現,身分和存取管理工具正迅速普及。日本本土廠商FFRI報告稱,由於國內軟體需求旺盛,其營業利潤成長了64.1%。

預計到2031年,資安管理服務,尤其是MDR(威脅偵測與回應)和SOC即服務(安全營運中心即服務),將以13.62%的複合年成長率快速成長。買家指出,人才短缺和全天候監控的需求是推動成長的主要因素。專業服務、風險評估、穿透測試和合規性映射也正經歷類似的成長。日本系統整合商正與超大規模資料中心業者服務供應商合作,簽訂包含雲端取證的事件回應服務包。整體趨勢是從一次性授權轉向經常性業務收益,從而提高客戶黏著度和深化資料共用。

由於採用訂閱模式和彈性擴展的優勢,到2025年,雲端解決方案將佔據日本網路安全市場54.90%的佔有率。聯合身分識別服務和持續補丁管線能夠跟上人工智慧增強型威脅帶來的快速變化。政府的雲端政策,包括一項725億日圓的國內設施計劃,進一步凸顯了雲端遷移的迫切性。金融機構正根據金融廳的指南,將保險箱應用程式遷移到強化型虛擬私有雲端,這些方針允許在基於風險的管理下使用雲端服務。

在資料居住和超低延遲要求至關重要的領域,尤其是在國防和關鍵基礎設施領域,本地部署仍將繼續。混合環境將作為一種可行的橋樑而擴展,敏感資料隔離在私有叢集集中,而分析工作負載則位於公共雲端中。供應商正在透過提供涵蓋 Kubernetes、虛擬機器和傳統伺服器的單一策略引擎來應對這一需求。在跨環境實施統一資產清單後,客戶回饋駐留時間縮短,回滾速度加快。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 日本政府在數位機構成立後資本投資激增

- 關鍵基礎設施強制零信任準則(到2026年)

- 生成式人工智慧擴大了企業範圍內的攻擊面

- 智慧工廠(尤其是中部地區)5G專用網路採用現狀

- 東京證券交易所網路風險揭露規則推動支出成長

- 為2025年大阪關西世博會實現傳統營運技術現代化

- 市場限制

- 網路安全人才嚴重短缺推高了安全營運中心(SOC)服務成本。

- 多層流通結構正在推高中小型企業解決方案的價格。

- 保守的企業文化阻礙了零信任理念的普及。

- 儘管有經濟產業省的補貼,小型企業基礎仍分散。

- 關鍵法規結構評估

- 產業價值鏈分析

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 主要用例和案例研究

- 宏觀經濟因素對市場的影響

- 投資分析

第5章 市場區隔

- 報價

- 解決方案

- 應用程式安全

- 雲端安全

- 資料安全

- 身分和存取管理

- 基礎設施保護

- 綜合風險管理

- 網路安全設備

- 端點安全

- 其他解決方案

- 服務

- 專業服務

- 託管服務

- 解決方案

- 透過部署模式

- 本地部署

- 雲

- 按最終用戶行業分類

- BFSI

- 衛生保健

- 資訊科技和電信

- 工業與國防

- 製造業

- 零售與電子商務

- 能源與公共產業

- 製造業

- 其他終端用戶產業

- 按最終用戶公司規模分類

- 中小企業

- 主要企業

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Trend Micro Inc.

- NEC Corporation

- NTT Security Holdings

- Fujitsu Ltd.

- Cisco Systems Inc.

- IBM Corporation

- Dell Technologies Inc.

- Fortinet Inc.

- Palo Alto Networks

- Check Point Software Tech.

- CrowdStrike Holdings

- Rapid7 Inc.

- Secure Brain Corporation

- Macnica Networks Corp

- LAC Co., Ltd.

- FFRI Security, Inc

- Cyberreason Inc.(JP)

- SoftBank Technology Corp.

- NS Solutions Corp.

- Hitachi Systems Ltd.

第7章 市場機會與未來展望

The Japan cybersecurity market was valued at USD 10.34 billion in 2025 and estimated to grow from USD 11.43 billion in 2026 to reach USD 18.9 billion by 2031, at a CAGR of 10.60% during the forecast period (2026-2031).

The uplift rests on public-private spending that prioritizes sovereign security capabilities, zero-trust adoption timelines, and rapid cloud migration. Mandatory cyber-risk disclosures on the Tokyo Stock Exchange, AI-driven threat escalation, and 5G-enabled smart-factory rollouts add further momentum. Heightened government capital expenditure channeled through the Digital Agency, coupled with region-specific projects such as the Osaka-Kansai Expo 2025, enlarges the demand pool for advanced threat-detection platforms and managed services. Competitive intensity remains moderate as domestic champions defend share against global suppliers by bundling compliance knowledge with integrated platforms.

Japan Cybersecurity Market Trends and Insights

Japanese Government CAPEX Surge Post-Digital Agency Formation

The 2021 launch of the Digital Agency signalled an inflection point. National defence outlays climbed to 8.5 trillion yen in 2025, and explicit earmarks for cybersecurity infrastructure moved well beyond military projects into cloud platforms, electronic signature systems, and supply-chain security criteria.Procurement rules now require compliance with stringent encryption and incident-response benchmarks, stimulating enterprise demand for sovereign solutions that can reside on forthcoming government clouds.

Mandatory Zero-Trust Guidelines for Critical Infrastructure by 2026

The Financial Services Agency issued a 177-point rule set in October 2024 that forces banks, insurers, and payment operators to harden identity controls, third-party risk oversight, and continuous monitoring regimes. Parallel grading frameworks from METI extend the obligation to supply-chain partners, accelerating zero-trust pilots in manufacturing and energy corridors. Early adopters report shorter containment times and audit cost reductions, reinforcing the adoption cycle.

Acute Cyber-Talent Shortage Inflating SOC Service Costs

METI estimates a gap of roughly 110,000 practitioners, forcing providers to raise hourly SOC tariffs and elongate onboarding queues. Language barriers and seniority-based hiring norms hinder quick relief from overseas recruitment. Planned training programs aim to lift the pool of certified experts to 50,000 by 2030, yet wage inflation is likely to persist into the next decade.

Other drivers and restraints analyzed in the detailed report include:

- Generative-AI-Driven Attack Surface Expansion Across Enterprises

- 5G Private-Network Roll-outs in Smart Factories, Especially Chubu

- Conservative Corporate Culture Slows Zero-Trust Adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions retained 59.27% of Japan cybersecurity market share in 2025 thanks to integrated suites that bundle endpoint, cloud, and identity safeguards. Large buyers gravitate to unified consoles that alleviate head-count constraints and simplify compliance audits. Network firewalls and intrusion-prevention systems still occupy sizeable allocations, yet growth tilts toward software-defined controls and AI-powered analytics. Identity and access management tools saw a sharp uptake as zero-trust milestones came into view, with domestic vendor FFRI reporting 64.1% operating-profit growth on sovereign software demand.

Managed security lines, particularly MDR and SOC-as-a-service, post the fastest 13.62% CAGR through 2031. Buyers cite the talent deficit and round-the-clock monitoring needs as catalysts. Professional services, risk assessments, penetration testing, and compliance mapping-ride the same wave. Domestic system integrators partner with hyperscalers for incident-response retainers that embed cloud forensics. The overarching shift pivots from one-off licences to recurring service revenue, deepening stickiness and data-sharing depth.

Cloud options captured 54.90% of the Japan cybersecurity market size in 2025 on the strength of subscription economics and elastic scaling. Federated ID services and continual patch pipelines answer the speed-of-change demanded by AI-enhanced threats. Government cloud directives, including a 72.5 billion-yen domestic facility programme, reinforce migration urgency. Financial operators align with FSA guidance that permits cloud use under risk-based controls, prompting institutions to shift vault applications to hardened virtual private clouds.

On-premise installations persist where data-residency or ultra-low-latency requirements prevail, notably in defence and critical infrastructure. Hybrid estates grow as a pragmatic bridge, with sensitive data fenced in private clusters while analytic workloads sit in public clouds. Vendors respond by offering single policy engines that span Kubernetes, virtual machines, and legacy servers. Customers report lower dwell times and quicker rollback after adopting unified asset inventories across environments.

The Japan Cybersecurity Market Report is Segmented by Offering (Solutions, and Services), Deployment Mode (On-Premise, and Cloud), End-User Vertical (BFSI, Healthcare, IT and Telecom, Industrial and Defense, Manufacturing, Retail and E-Commerce, Energy and Utilities, Manufacturing, and Others), and End-User Enterprise Size (SMEs, and Large Enterprises). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Trend Micro Inc.

- NEC Corporation

- NTT Security Holdings

- Fujitsu Ltd.

- Cisco Systems Inc.

- IBM Corporation

- Dell Technologies Inc.

- Fortinet Inc.

- Palo Alto Networks

- Check Point Software Tech.

- CrowdStrike Holdings

- Rapid7 Inc.

- Secure Brain Corporation

- Macnica Networks Corp

- LAC Co., Ltd.

- FFRI Security, Inc

- Cyberreason Inc. (JP)

- SoftBank Technology Corp.

- NS Solutions Corp.

- Hitachi Systems Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Japanese Government CAPEX Surge Post-Digital Agency Formation

- 4.2.2 Mandatory Zero-Trust Guidelines for Critical Infrastructure by 2026

- 4.2.3 Generative-AI-Driven Attack-Surface Expansion Across Enterprises

- 4.2.4 5G Private-Network Roll-outs in Smart-Factories, Especially Chubu

- 4.2.5 Tokyo Stock Exchange Cyber-Risk Disclosure Rules Boost Spending

- 4.2.6 Legacy OT Modernisation Ahead of Osaka-Kansai Expo 2025

- 4.3 Market Restraints

- 4.3.1 Acute cyber-talent shortage inflating SOC service costs

- 4.3.2 Multi-tier Channel Structure Inflating SME Solution Pricing

- 4.3.3 Conservative Corporate Culture Slows Zero-Trust Adoption

- 4.3.4 Fragmented SME Base Despite METI Subsidies

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Industry Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Key Use Cases and Case Studies

- 4.9 Impact on Macroeconomic Factors of the Market

- 4.10 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Offering

- 5.1.1 Solutions

- 5.1.1.1 Application Security

- 5.1.1.2 Cloud Security

- 5.1.1.3 Data Security

- 5.1.1.4 Identity and Access Management

- 5.1.1.5 Infrastructure Protection

- 5.1.1.6 Integrated Risk Management

- 5.1.1.7 Network Security Equipment

- 5.1.1.8 Endpoint Security

- 5.1.1.9 Other Solutions

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By End-User Vertical

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 IT and Telecom

- 5.3.4 Industrial and Defense

- 5.3.5 Manufacturing

- 5.3.6 Retail and E-commerce

- 5.3.7 Energy and Utilities

- 5.3.8 Manufacturing

- 5.3.9 Other End-User Vertical

- 5.4 By End-User Enterprise Size

- 5.4.1 Small and Medium Enterprises (SMEs)

- 5.4.2 Large Enterprises

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Trend Micro Inc.

- 6.4.2 NEC Corporation

- 6.4.3 NTT Security Holdings

- 6.4.4 Fujitsu Ltd.

- 6.4.5 Cisco Systems Inc.

- 6.4.6 IBM Corporation

- 6.4.7 Dell Technologies Inc.

- 6.4.8 Fortinet Inc.

- 6.4.9 Palo Alto Networks

- 6.4.10 Check Point Software Tech.

- 6.4.11 CrowdStrike Holdings

- 6.4.12 Rapid7 Inc.

- 6.4.13 Secure Brain Corporation

- 6.4.14 Macnica Networks Corp

- 6.4.15 LAC Co., Ltd.

- 6.4.16 FFRI Security, Inc

- 6.4.17 Cyberreason Inc. (JP)

- 6.4.18 SoftBank Technology Corp.

- 6.4.19 NS Solutions Corp.

- 6.4.20 Hitachi Systems Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment