|

市場調查報告書

商品編碼

1911342

日本潤滑油市場-佔有率分析、產業趨勢與統計、成長預測(2026-2031)Japan Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

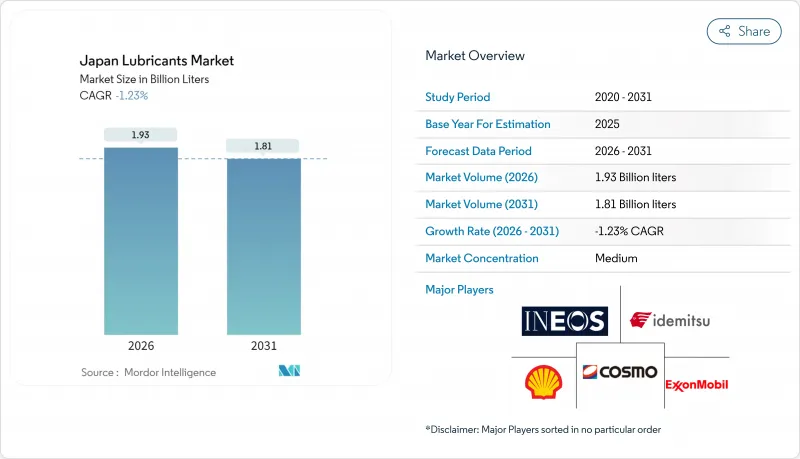

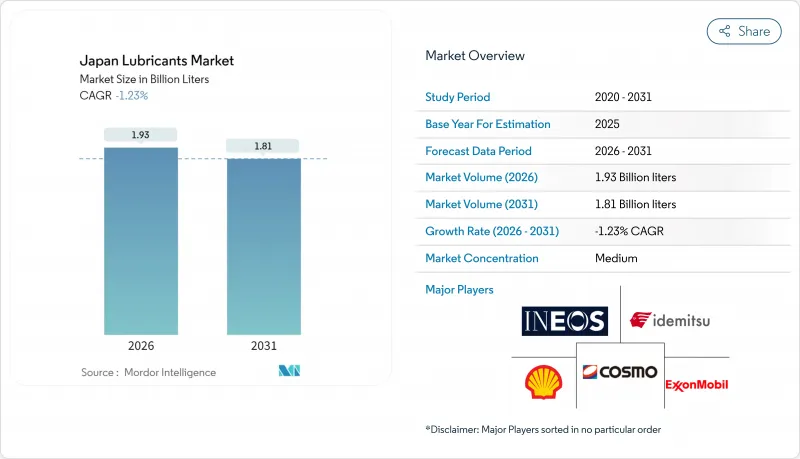

預計到2026年,日本潤滑油市場規模將達到19.3億公升,低於2025年的19.5億公升。到2031年,預計市場規模將達到18.1億升,2026年至2031年的複合年成長率為-1.23%。

這種負成長反映了汽車生產結構性變化、電動動力傳動系統總成普及以及換油週期延長等因素的綜合影響,所有這些因素都在抑製成熟經濟體的總需求。然而,由於混合動力汽車仍需要自動變速箱油(ATF)、電驅動橋潤滑油和溫度控管油,需求依然強勁;同時,工業自動化、資料中心冷卻和永續性措施也創造了成長機會。這穩定了綜合煉油企業的利潤率。日本主要企業——ENEOS、出光興產和科斯莫能源——在需求下降的情況下,透過利用其煉油能力、廣泛的銷售網路以及與原始設備製造商(OEM)的技術合作,保持了價格紀律。新的法規要求到2035年廢油回收量達到17.5千萬公升,到2040年達到35萬千升,這使得再生基礎油成為一個具有戰略競爭力的領域。現有企業正在投資建置閉合迴路供應鏈,以符合經濟產業省所訂定的循環經濟目標。

日本潤滑油市場趨勢與分析

電動車和混合動力汽車潤滑油市場成長

豐田的「混合動力優先」策略(預計到2024年,混合動力汽車將佔日本國內銷量的40%)正在降低對傳統機油的需求,但維持著對自動變速箱油、電驅動橋潤滑脂和逆變器冷卻油的需求。由於混合動力傳動系統結合了電動馬達和內燃機,每個單元仍然需要小油底殼引擎油,以及專為高扭矩、低粘度運行而設計的專用傳動系統油液。能夠配製添加銅腐蝕抑制劑的低黏度自動變速箱油的供應商正在贏得市場佔有率,以延長緊湊型變速驅動橋內部件的使用壽命。豐田公開宣布的多路徑電氣化藍圖還包括探索燃料電池和合成燃料,這將進一步延緩向純電動車的快速過渡。這使得日本潤滑油市場能夠提供差異化的化學產品,而不是傳統的單一黏度潤滑油。

資料中心採用浸沒式冷卻液

位於東京和大阪的超大規模資料中心營運商正從傳統的風冷機架轉向單相浸沒式冷卻槽,以應對人工智慧工作負載帶來的日益成長的熱負荷。 ENEOS 和 Idemitsu Kosan 提供的介電液能夠將熱量直接傳遞到晶片,使每個機架的功率密度超過 75kW,同時避免效能限制。這些專用介電液具有抗氧化性、超低揮發性和不導電性,使營運商能夠省去冷卻設備、降低風扇能耗並延長伺服器壽命。雖然絕對銷量仍然較低,但單價超過每公升 12 美元,使其成為日本潤滑油市場中附加價值最高的領域。

內燃機汽車產量下降

日本汽車製造商持續將組裝和動力傳動系統生產轉移到成本更具競爭力的海外工廠,導致日本國內內燃機產量下降。因此,日本國內工廠的引擎油和消費量油灌裝量也正在減少。電動車進一步加劇了這一下降趨勢,因為與傳統內燃機車型相比,電動車的潤滑油消耗量可減少70%。這種萎縮趨勢迫使潤滑油調配商調整其本地產能,轉向生產更高價值的電動車動力總成潤滑油,並進行大量生產以出口。

細分市場分析

截至2025年,汽車機油佔日本潤滑油市場的33.33%。然而,由於混合動力汽車和電池式電動車的日益普及,導致承油盤容量減小、換油週期延長,這一細分市場正在穩步萎縮。高里程混合動力汽車仍然需要0W-8和0W-12黏度的機油來降低摩擦,因此,專注於超低黏度合成機油的配方商仍然具有重要意義。工業機油將以0.02%的適度複合年成長率成長,但由於對備用柴油發電機的需求,以支持資料中心的可靠性和颶風應急發電,其銷量在宏觀經濟環境平穩的情況下仍在成長。

變速箱油市場呈現兩極化趨勢。由於內燃機(ICE)產量下降,傳統自動變速箱油(ATF)的需求正在減少,而混合動力變速驅動橋和電驅動橋冷卻液的需求卻在成長,供應商正加大促銷對銅友好的抗氧化劑配方。齒輪油,尤其是ISO 320和ISO 460等級的齒輪油,受益於機器人和精密機械設備的普及,這些設備需要更長的使用壽命和抗微點蝕的化學成分。受施工機械更換需求以及資料中心升降系統採用阻燃磷酸酯的推動,液壓油的需求預計將在一定程度上緩解整體市場的下滑。潤滑脂市場依然強勁,這得益於風力發電機變槳軸承和電動方向盤裝置的需求。雖然加工油油和金屬加工油的銷售量保持平穩,但由於更嚴格的環保標準,合成油和水溶性油的需求不斷成長,單價也隨之上漲。渦輪機油和變壓器油的需求與日本可再生能源擴張計劃和電網現代化計劃相關的維護週期密切相關。

日本潤滑油市場報告按產品類型(汽車引擎油、工業引擎油、變速箱油、齒輪油、煞車油、液壓油、潤滑脂等)、終端用戶產業(汽車、船舶、航太、重型機械、工業)、基礎油類型(礦物油、合成油、半合成油、生物基油)和地區(日本)對市場進行分析。市場預測以公升為單位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電動車和混合動力汽車潤滑油市場成長

- 工業自動化程度的提高推動了對油壓油和齒輪油的需求。

- 老舊車隊持續推高車輛更新需求

- 資料中心浸沒式冷卻劑的應用

- 企業淨零排放目標推動生物基潤滑油的發展

- 促進石油回收的循環經濟政策

- 市場限制

- 內燃機汽車產量下降

- 成熟的工業生產限制了產量擴張。

- 原廠延長換油週期可降低每輛車的消費量。

- 低成本進口再生油

- 價值鏈分析

- 法律規範

- 終端用戶趨勢

- 汽車產業

- 製造業

- 發電業

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依產品類型

- 汽車引擎油

- 工業機油

- 變速箱油

- 齒輪油

- 煞車油

- 油壓

- 潤滑脂

- 加工油(包括橡膠加工油和白油)

- 金屬加工油

- 渦輪機油

- 變壓器油

- 其他產品類型

- 按最終用戶行業分類

- 車

- 搭乘用車

- 商用車輛

- 摩托車

- 船

- 航太

- 重型機械

- 建造

- 礦業

- 農業

- 工業的

- 發電

- 冶金/金屬加工

- 紡織業

- 石油和天然氣

- 其他終端用戶產業

- 車

- 依基礎油類型

- 礦物油性潤滑劑

- 合成潤滑油

- 半合成潤滑油

- 生物性潤滑劑

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率**(%)/排名分析

- 公司簡介

- ENEOS Corporation

- Idemitsu Kosan Co., Ltd.

- Cosmo Energy Holdings Co., Ltd.

- ExxonMobil Corporation

- BP Plc(Castrol)

- KYODO YUSHI CO., LTD.

- FUCHS SE

- Japan Sun Oil Co. Ltd.(SUNOCO Inc.)

- Mitasu Oil Corporation

- Yushiro Chemical Industry Co., Ltd.

- TotalEnergies SE

- Shell plc

- KYODO YUSHI CO., LTD.

第7章 市場機會與未來展望

第8章:執行長面臨的關鍵策略挑戰

Japan lubricants market size in 2026 is estimated at 1.93 billion liters, growing from 2025 value of 1.95 billion liters with 2031 projections showing 1.81 billion liters, growing at -1.23% CAGR over 2026-2031.

The negative trajectory reflects structural changes in vehicle production, the advancement of electrified powertrains, and longer drain intervals, which collectively curb overall volumes in this mature economy. Demand nonetheless remains meaningful because hybrid vehicles still require automatic-transmission fluids, e-axle lubricants, and thermal-management oils, while industrial automation, data-center cooling, and sustainability mandates create pockets of growth that stabilize margins for integrated refiners. Domestic leaders ENEOS, Idemitsu, and Cosmo Energy rely on their refining footprints, extensive distributor networks, and technical relationships with original equipment manufacturers to preserve pricing discipline even as volumes slide. New regulations targeting 175,000 kL of waste-oil recycling by 2035 and 350,000 kL by 2040 have turned re-refined base stocks into a strategic battleground, with incumbents investing in closed-loop supply chains to align with circular economy objectives set by Japan's Ministry of Economy, Trade, and Industry.

Japan Lubricants Market Trends and Insights

Growth in EV and hybrid-specific lubricants

Toyota's hybrid-first strategy, exemplified by hybrids accounting for 40% of the OEM's 2024 domestic sales, preserves demand for automatic-transmission fluids, e-axle greases, and inverter-cooling oils even as conventional engine-oil volumes erode. Hybrid powertrains combine electric motors with internal-combustion engines, meaning each unit still needs small-sump engine oils plus specialized driveline fluids tuned for high-torque, low-viscosity operation. Suppliers able to formulate low-viscosity automatic-transmission fluids with copper-corrosion inhibitors gain share because they extend component life in compact transaxles. Toyota's well-publicized multi-pathway electrification roadmap, which keeps fuel-cell and synthetic-fuel research in scope, further delays an abrupt battery-electric pivot, allowing the Japan lubricants market to sell differentiated chemistries instead of conventional mono-grade oils.

Data-center immersion-cooling fluids adoption

Hyperscale operators based in Tokyo and Osaka are replacing legacy air-cooling racks with single-phase immersion tubs to accommodate rising thermal loads from artificial-intelligence workloads. Dielectric fluids supplied by ENEOS and Idemitsu enable direct-to-chip heat transfer, allowing power densities above 75 kW per rack without performance throttling. These niche fluids deliver oxidation stability, ultra-low volatility, and non-conductivity, letting operators eliminate chillers, reduce fan energy, and raise server life expectancy. Although absolute volumes remain small, unit prices exceed USD 12 per liter, positioning the segment as the highest value pool within the Japanese lubricants market.

Declining ICE vehicle production

Domestic automakers continue to shift final assembly and powertrain production to cost-competitive overseas plants, removing internal-combustion engine output from Japan and thus shrinking in-country fill volumes for factory-fill engine and gear oils. Electric vehicles require as much as 70% fewer lubricants by volume compared with typical ICE models, deepening the consumption slide. The contraction forces lubricant blenders to rationalize local capacity and pivot to higher-value electric-driveline fluids or export-oriented batches.

Other drivers and restraints analyzed in the detailed report include:

- Industrial automation is boosting hydraulic and gear oils

- Corporate net-zero targets driving bio-based lubricants

- Mature industrial output limiting volume expansion

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Automotive engine oils held a 33.33% share of the Japanese lubricants market in 2025, but the segment is contracting steadily as hybrids and battery electric vehicles reduce sump sizes and extend oil-change intervals. High-mileage hybrid vehicles still depend on 0W-8 and 0W-12 viscosities to minimize friction, so formulators geared toward ultralow-viscosity synthetics maintain relevance. Industrial engine oils, although growing at a modest 0.02% CAGR, benefit from backup diesel generators that support data center resiliency and hurricane emergency power protocols, adding incremental liters in a flat macroeconomic environment.

Transmission fluids face a bifurcation: demand for conventional automatic-transmission fluids declines in tandem with ICE output, whereas hybrid-transaxle and e-axle coolants expand, prompting suppliers to market copper-friendly, antioxidation packages. Gear oils, especially ISO 320 and ISO 460 grades, benefit from robotics and precision-machinery installations that require long-life, anti-micropitting chemistry. Hydraulic-fluid demand aligns with the renewal of construction equipment and the adoption of fire-resistant phosphate esters in data-center lift systems, slightly moderating the total market decline. Greases remain resilient, powered by wind-turbine pitch bearings and electrified power-steering units. Process oil and metalworking fluid volumes plateau, but synthetics and water-soluble versions command a higher unit value under tighter environmental standards. Turbine and transformer oil turnover follows maintenance cycles within Japan's renewable-energy build-out and grid modernization programs.

The Japan Lubricants Market Report is Segmented by Product Type (Automotive Engine Oil, Industrial Engine Oil, Transmission Fluids, Gear Oil, Brake Fluids, Hydraulic Fluids, Greases, and More), End-User Industry (Automotive, Marine, Aerospace, Heavy Equipment, Industrial), Base Stock Type (Mineral Oil-Based, Synthetic, Semi-Synthetic, Bio-Based), and Geography (Japan). The Market Forecasts are Provided in Terms of Volume (Liters).

List of Companies Covered in this Report:

- ENEOS Corporation

- Idemitsu Kosan Co., Ltd.

- Cosmo Energy Holdings Co., Ltd.

- ExxonMobil Corporation

- BP Plc (Castrol)

- KYODO YUSHI CO., LTD.

- FUCHS SE

- Japan Sun Oil Co. Ltd. (SUNOCO Inc.)

- Mitasu Oil Corporation

- Yushiro Chemical Industry Co., Ltd.

- TotalEnergies SE

- Shell plc

- KYODO YUSHI CO., LTD.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in EV / Hybrid-specific lubricants

- 4.2.2 Rising industrial automation boosting hydraulic and gear lubes

- 4.2.3 Aging vehicle fleet sustaining replacement demand

- 4.2.4 Data-center immersion-cooling fluids adoption

- 4.2.5 Corporate net-zero targets driving bio-based lubricants

- 4.2.6 Circular-economy policies promoting re-refined oils

- 4.3 Market Restraints

- 4.3.1 Declining ICE vehicle production

- 4.3.2 Mature industrial output limiting volume expansion

- 4.3.3 OEM long-drain intervals reduce consumption per vehicle

- 4.3.4 Low-cost imports of re-refined oils

- 4.4 Value Chain Analysis

- 4.5 Regulatory Framework

- 4.6 End-User Trends

- 4.6.1 Automotive Industry

- 4.6.2 Manufacturing Industry

- 4.6.3 Power Generation Industry

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Automotive Engine Oil

- 5.1.2 Industrial Engine Oil

- 5.1.3 Transmission Fluids

- 5.1.4 Gear Oil

- 5.1.5 Brake Fluids

- 5.1.6 Hydraulic Fluids

- 5.1.7 Greases

- 5.1.8 Process Oil (Including Rubber Process Oil and White Oil)

- 5.1.9 Metalworking Fluids

- 5.1.10 Turbine Oil

- 5.1.11 Transformer Oil

- 5.1.12 Other Product Types

- 5.2 By End-user Industry

- 5.2.1 Automotive

- 5.2.1.1 Passenger Vehicles

- 5.2.1.2 Commercial Vehicles

- 5.2.1.3 Two-Wheelers

- 5.2.2 Marine

- 5.2.3 Aerospace

- 5.2.4 Heavy Equipment

- 5.2.4.1 Construction

- 5.2.4.2 Mining

- 5.2.4.3 Agriculture

- 5.2.5 Industrial

- 5.2.5.1 Power Generation

- 5.2.5.2 Metallurgy and Metalworking

- 5.2.5.3 Textiles

- 5.2.5.4 Oil and Gas

- 5.2.5.5 Other End-Use Industries

- 5.2.1 Automotive

- 5.3 By Base Stock Type

- 5.3.1 Mineral Oil-Based Lubricants

- 5.3.2 Synthetic Lubricants

- 5.3.3 Semi-Synthetic Lubricants

- 5.3.4 Bio-Based Lubricants

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share**(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ENEOS Corporation

- 6.4.2 Idemitsu Kosan Co., Ltd.

- 6.4.3 Cosmo Energy Holdings Co., Ltd.

- 6.4.4 ExxonMobil Corporation

- 6.4.5 BP Plc (Castrol)

- 6.4.6 KYODO YUSHI CO., LTD.

- 6.4.7 FUCHS SE

- 6.4.8 Japan Sun Oil Co. Ltd. (SUNOCO Inc.)

- 6.4.9 Mitasu Oil Corporation

- 6.4.10 Yushiro Chemical Industry Co., Ltd.

- 6.4.11 TotalEnergies SE

- 6.4.12 Shell plc

- 6.4.13 KYODO YUSHI CO., LTD.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment