|

市場調查報告書

商品編碼

1910842

印尼軟包裝市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Indonesia Flexible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

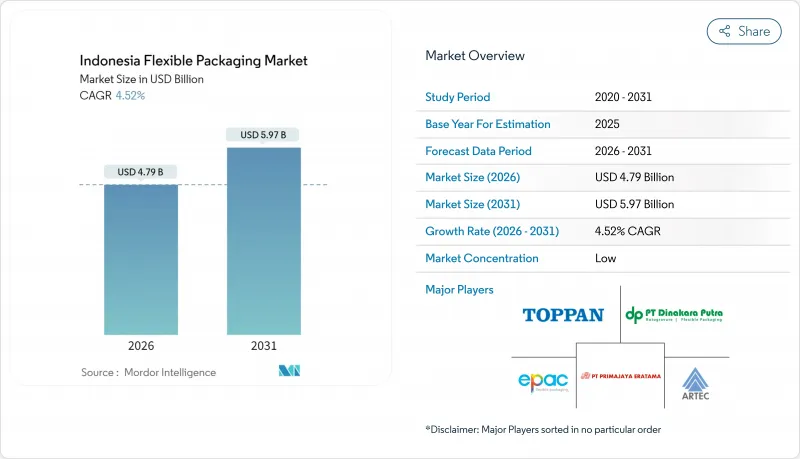

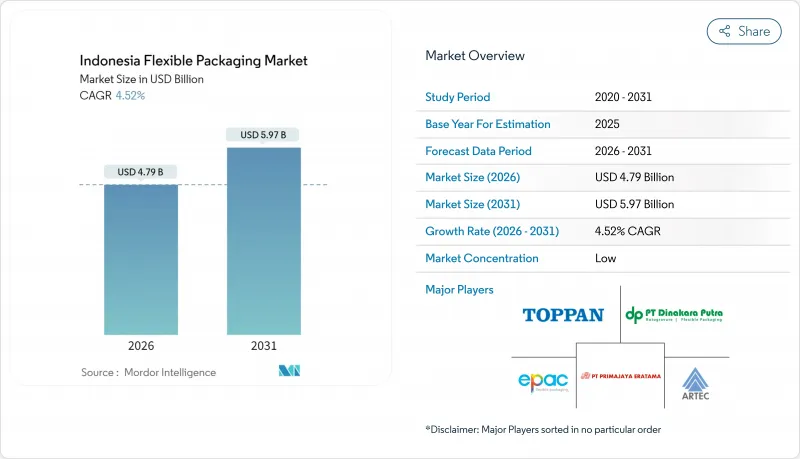

2025年印尼軟包裝市場價值為45.8億美元,預計從2026年的47.9億美元成長到2031年的59.7億美元,在預測期(2026-2031年)內複合年成長率為4.52%。

這一成長軌跡反映了印尼作為東南亞最大經濟體的地位,並受到日益都市化的人口的推動,他們正穩步轉向包裝食品和線上零售,這兩個行業都高度依賴軟包裝形式。分裝包裝的需求不斷成長、電子商務的持續活躍以及企業永續性舉措,都在推動有利於印尼軟包裝市場的材料、產品和技術變革。進口成品(主要來自中國)仍然是國內加工商面臨的成本挑戰。然而,計劃於2025年實施的生產者延伸責任制(EPR)法規預計將加速對本地回收原料的需求。目前,競爭應對措施主要集中在垂直整合、阻隔膜創新和數位印刷能力方面,這將使印尼2,550萬家具備數位化能力的中小型企業能夠進行小批量生產。

印尼軟包裝市場趨勢與洞察

包裝食品和飲料消費量的快速成長

預計到2024年,包裝食品將佔國內生產總值(GDP)的6.47%。印尼食品飲料企業家協會預測,由於都市區家庭對已調理食品和高階零食的偏好,這一比例還將進一步上升。 2024年10月起實施的強制性清真標籤要求使用清晰耐用的印刷材料,這將推動對高阻隔阻隔性多層薄膜的需求,以在印尼潮濕的群島式供應鏈中保持產品品質。進口特色食品和不斷成長的可支配收入也推動了對高階防護結構的需求。在此背景下,提供先進氧氣和水分阻隔薄膜的加工商收到了更多來自乳製品、肉品和糖果甜點加工商的訂單。印尼的軟包裝市場正直接受益於銷售的穩定成長以及向現代化分銷管道的轉變,後者更傾向於便於展示的立式袋。

對永續包裝解決方案的需求日益成長

將於2025年生效的生產者責任延伸制度(EPR)要求生產商到2029年將消費後塑膠廢棄物減少30%,這將刺激對可回收單一材料薄膜和經認證的可堆肥材料的投資。本土Start-UpsGreenhope和Biopac正在大規模生產聚聚羥基烷酯酯(PHA)和澱粉基薄膜,而像達能印尼這樣的跨國公司已經在寶特瓶使用25%的再生材料,從而推動了對食品級再生聚酯(rPET)的需求。希望展現環保形象的品牌擴大指定使用替代基材,這些基材既能簡化廢棄物處理,又能保持阻隔性能。因此,印尼的軟包裝市場對符合亞洲和出口市場回收標準的薄膜訂單強勁。

聚烯原料價格波動

2024年初,由於進口原物料價格低廉,國內原物料競爭力下降,導致國內上游產能運轉率跌破55%。現貨樹脂價格月月波動超過15%,加工商無法可靠地進行成本避險,這給固定價格包裝合約的利潤率帶來壓力。儘管提案的反傾銷稅可能有助於穩定國內供應,但在國內裂解裝置產量增加或進口配額收緊之前,不確定性仍然存在。因此,儘管終端用戶需求強勁,印尼軟包裝市場仍持續謹慎擴張產能。

細分市場分析

塑膠將支撐印尼的軟包裝市場,憑藉其成本效益和優異的防潮性能,預計到2025年將保持67.61%的市場佔有率。聚乙烯(PE)和聚丙烯(PP)薄膜仍然是零嘴零食、冷凍食品和農業應用領域的重要材料。然而,印尼對PE和PP分別依賴進口60.5萬噸和59.9萬噸,限制了價格的穩定性。生質塑膠和可堆肥材料雖然基數較小,但隨著生產者延伸責任制(EPR)期限的臨近,預計將以7.45%的複合年成長率實現最快成長。

具競爭力的解決方案包括Green Hope的PHA基薄膜和Biopack的可堆肥澱粉混合薄膜。品牌商也正在測試單一材料PE複合材料,這種材料既能簡化回收流程,又能維持機械強度。由於政府對可生物分解聚合物工廠的支持,儘管目前存在成本溢價,但預計到2031年,印尼替代基材的軟包裝市場仍將持續成長。

截至2025年,由於包裝袋和軟包裝袋在食品、個人護理和農業化學品等產品線中的廣泛應用,它們佔印尼軟包裝市場規模的46.88%。自立式包裝、拉鍊和吸嘴設計在現代零售環境中兼具便利性和商店吸引力。薄膜和包裝紙則廣泛應用於肉類加工和園藝行業,而標籤則吸引了高階品牌預算。

小袋和條狀包裝正以6.35%的複合年成長率快速成長,滿足了群島市場對價格實惠和試用裝的需求。數位印刷機無需更換模具即可實現區域語言和節日圖案的設計,將產品上市前置作業時間縮短至短短幾天。日益嚴格的一次性塑膠製品監管促使加工商提案填充用的包裝袋和可回收的複合包裝結構,在小包裝的便利性和環保性之間取得平衡。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 包裝食品和飲料消費量的快速成長

- 對永續包裝解決方案的需求日益成長

- 電子商務和線上雜貨配送的成長

- 都市區中產階級的壯大推動了對小包裝尺寸產品的需求

- 利用數位印刷和柔版印刷進行小批量印刷的迅速普及

- 創業投資擴大了快速消費品新創Start-Ups的靈活投資模式

- 市場限制

- 聚烯原料價格波動

- 回收基礎設施和收集系統不足

- 加強對一次性塑膠的環境監管

- 島際物流成本高昂限制了阻隔膜的廣泛應用。

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟因素如何影響市場

- 印尼的監管狀況和回收政策

- 技術展望

第5章 市場規模與成長預測

- 材料

- 紙

- 塑膠

- 金屬箔

- 生質塑膠和可堆肥材料

- 依產品類型

- 袋子和小袋

- 薄膜和包裝

- 小袋裝和條狀包裝

- 標籤和封套

- 按最終用戶行業分類

- 食物

- 烘焙產品

- 小吃

- 肉類、家禽和魚貝類

- 糖果甜點

- 寵物食品

- 其他食品

- 飲料

- 醫療和藥品

- 個人護理及化妝品

- 農業和園藝

- 其他終端用戶產業

- 食物

- 透過印刷技術

- 柔版印刷

- 凹版印刷

- 數位印刷

- 其他印刷技術

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amcor plc

- Mondi plc

- PT Trias Sentosa Tbk

- PT Indopoly Swakarsa Industry Tbk

- PT Argha Prima Industry Tbk

- Sealed Air Corporation

- Huhtamaki Oyj

- PT Primajaya Eratama

- PT ePac Flexibles Indonesia

- PT Indonesia Toppan Printing

- PT Dinakara Putra

- PT Artec Package Indonesia

- PT Lotte Packaging

- PT Karuniatama Polypack

- PT Masplast Poly Film

- PT Polidayaguna Perkasa

- Constantia Flexibles Group GmbH

- UFlex Limited

- Sonoco Products Company

第7章 市場機會與未來展望

The Indonesia flexible packaging market was valued at USD 4.58 billion in 2025 and estimated to grow from USD 4.79 billion in 2026 to reach USD 5.97 billion by 2031, at a CAGR of 4.52% during the forecast period (2026-2031).

This trajectory reflects Indonesia's position as Southeast Asia's largest economy, with an urbanizing population that is steadily shifting toward packaged foods and online retail, both of which rely heavily on flexible formats. Growing demand for small-portion packs, sustained e-commerce activity, and corporate moves toward sustainability are reinforcing material, product, and technology shifts that favor the Indonesia flexible packaging market. Imported finished goods, primarily from China, remain a cost challenge for domestic converters; however, mandatory Extended Producer Responsibility (EPR) regulations, set to take effect in 2025, are expected to accelerate demand for locally recycled feedstock. Competitive responses now center on vertical integration, barrier-film innovation, and digital printing capabilities that enable low minimum-order runs for Indonesia's 25.5 million digitally enabled SMEs.

Indonesia Flexible Packaging Market Trends and Insights

Surging Packaged Food and Beverage Consumption

Packaged foods contributed 6.47% to national GDP in 2024, a share the Indonesian Association of Food and Beverage Entrepreneurs expects to rise as urban households favor ready-to-eat meals and premium snacks. Mandatory halal labels introduced in October 2024 require clear, durable printing, pushing brands toward high-barrier multi-layer films that preserve product integrity across Indonesia's humid, multi-island supply chain. Imported specialty foods and rising disposable incomes further drive demand for premium protective structures. Against this backdrop, converters offering advanced oxygen- and moisture-barrier films are gaining orders from dairy, meat, and confectionery processors. The Indonesia flexible packaging market benefits directly from this steady volume growth and the shift to modern trade channels that prefer merchandisable stand-up pouches.

Accelerating Demand for Sustainable Packaging Solutions

EPR regulations effective 2025 require producers to cut post-consumer plastic waste by 30% by 2029, spurring investments in recyclable mono-material films and certified compostables. Local start-ups Greenhope and Biopac are scaling PHA- and starch-based films, while multinationals such as Danone Indonesia already use 25% recycled content in water bottles, creating pull-through for food-grade rPET. Brands seeking to signal their environmental credentials now specify drop-in substrates that maintain barrier performance while simplifying end-of-life handling. The Indonesian flexible packaging market, therefore, records strong order inflows for films that meet Asian and export-market recyclability standards.

Volatility in Polyolefin Raw Material Prices

Domestic upstream utilization fell below 55% in early 2024 after cheaper imports cut local feedstock competitiveness. Converters cannot reliably hedge costs because spot resin price swings exceed 15% month-on-month, compressing margins on fixed-price packaging contracts. Proposed anti-dumping duties may stabilize the domestic supply; however, uncertainty persists until local crackers increase output or import quotas are tightened. The Indonesia flexible packaging market therefore experiences cautious capacity expansions despite solid end-use demand.

Other drivers and restraints analyzed in the detailed report include:

- Growth of E-Commerce and Online Grocery Fulfilment

- Rising Urban Middle Class Driving Smaller Pack Sizes

- Inadequate Recycling Infrastructure and Collection Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastics retained 67.61% revenue share in 2025 owing to cost efficiency and robust moisture-barrier properties, anchoring the Indonesia flexible packaging market. Polyethylene and polypropylene films remain integral to snacks, frozen food, and agricultural applications; however, import dependence for 605,000 t of PE and 599,000 t of PP limits price stability. Bioplastics and compostables, though starting from a smaller base, log the fastest 7.45% CAGR as EPR deadlines loom.

Competitive responses include PHA-based films by Greenhope and starch blends from Biopac that comply with compostability norms. Brand owners are trialing mono-material PE laminates that simplify recycling while maintaining mechanical strength. Government incentives for biodegradable polymer plants should keep the Indonesian flexible packaging market size for alternative substrates expanding through 2031 despite current cost premiums.

Bags and pouches commanded 46.88% of Indonesia flexible packaging market size in 2025, thanks to versatility across food, personal care, and agrochemical lines. Stand-up formats, zippers, and spouts enhance convenience and shelf appeal in modern retail. Films and wraps serve the meat processing and horticulture industries, whereas labels capture premium branding budgets.

Sachets and stick packs, advancing at 6.35% CAGR, address affordability and sampling needs across archipelagic markets. Digital presses enable region-specific languages and holiday designs without altering tooling, trimming launch cycles to days. Regulatory scrutiny of single-use plastics prompts converters to propose refill pouches and recyclable laminate structures, striking a balance between small-format convenience and environmental compliance.

The Indonesia Flexible Packaging Market Report is Segmented by Material (Paper, Plastic, Metal Foil, Bioplastics and Compostable Materials), Product Type (Bags and Pouches, Films and Wraps, and More), End-User Industry (Food, Beverage, Healthcare and Pharmaceutical, and More), Printing Technology (Flexography, Rotogravure, Digital Printing, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amcor plc

- Mondi plc

- PT Trias Sentosa Tbk

- PT Indopoly Swakarsa Industry Tbk

- PT Argha Prima Industry Tbk

- Sealed Air Corporation

- Huhtamaki Oyj

- PT Primajaya Eratama

- PT ePac Flexibles Indonesia

- PT Indonesia Toppan Printing

- PT Dinakara Putra

- PT Artec Package Indonesia

- PT Lotte Packaging

- PT Karuniatama Polypack

- PT Masplast Poly Film

- PT Polidayaguna Perkasa

- Constantia Flexibles Group GmbH

- UFlex Limited

- Sonoco Products Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Packaged Food and Beverage Consumption

- 4.2.2 Accelerating Demand for Sustainable Packaging Solutions

- 4.2.3 Growth of E-Commerce and Online Grocery Fulfilment

- 4.2.4 Rising Urban Middle Class Driving Smaller Pack Sizes

- 4.2.5 Rapid Adoption of Digital and Flexographic Short-Run Printing

- 4.2.6 Venture-Backed FMCG Startups Scaling Flexible Formats

- 4.3 Market Restraints

- 4.3.1 Volatility in Polyolefin Raw Material Prices

- 4.3.2 Inadequate Recycling Infrastructure AND Collection Systems

- 4.3.3 Escalating Environmental Regulations on Single-Use Plastics

- 4.3.4 High Inter-Island Logistics Costs Limiting Barrier Film Uptake

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of Macroeconomic Factors on the Market

- 4.7 Regulatory Landscape and Recycling Policies in Indonesia

- 4.8 Technological Outlook

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Paper

- 5.1.2 Plastic

- 5.1.3 Metal Foil

- 5.1.4 Bioplastics and Compostable Materials

- 5.2 By Product Type

- 5.2.1 Bags and Pouches

- 5.2.2 Films and Wraps

- 5.2.3 Sachets and Stick Packs

- 5.2.4 Labels and Sleeves

- 5.3 BY End-user Industry

- 5.3.1 Food

- 5.3.1.1 Baked Goods

- 5.3.1.2 Snacks

- 5.3.1.3 Meat, Poultry and Seafood

- 5.3.1.4 Confectionery

- 5.3.1.5 Pet Food

- 5.3.1.6 Other Food Products

- 5.3.2 Beverage

- 5.3.3 Healthcare and Pharmaceutical

- 5.3.4 Personal Care and Cosmetics

- 5.3.5 Agriculture and Horticulture

- 5.3.6 Other End-Use Industries

- 5.3.1 Food

- 5.4 By Printing Technology

- 5.4.1 Flexography

- 5.4.2 Rotogravure

- 5.4.3 Digital Printing

- 5.4.4 Other Printing Technologies

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products AND Services, AND Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Mondi plc

- 6.4.3 PT Trias Sentosa Tbk

- 6.4.4 PT Indopoly Swakarsa Industry Tbk

- 6.4.5 PT Argha Prima Industry Tbk

- 6.4.6 Sealed Air Corporation

- 6.4.7 Huhtamaki Oyj

- 6.4.8 PT Primajaya Eratama

- 6.4.9 PT ePac Flexibles Indonesia

- 6.4.10 PT Indonesia Toppan Printing

- 6.4.11 PT Dinakara Putra

- 6.4.12 PT Artec Package Indonesia

- 6.4.13 PT Lotte Packaging

- 6.4.14 PT Karuniatama Polypack

- 6.4.15 PT Masplast Poly Film

- 6.4.16 PT Polidayaguna Perkasa

- 6.4.17 Constantia Flexibles Group GmbH

- 6.4.18 UFlex Limited

- 6.4.19 Sonoco Products Company

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment