|

市場調查報告書

商品編碼

1906969

北美軟包裝市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)North America Flexible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

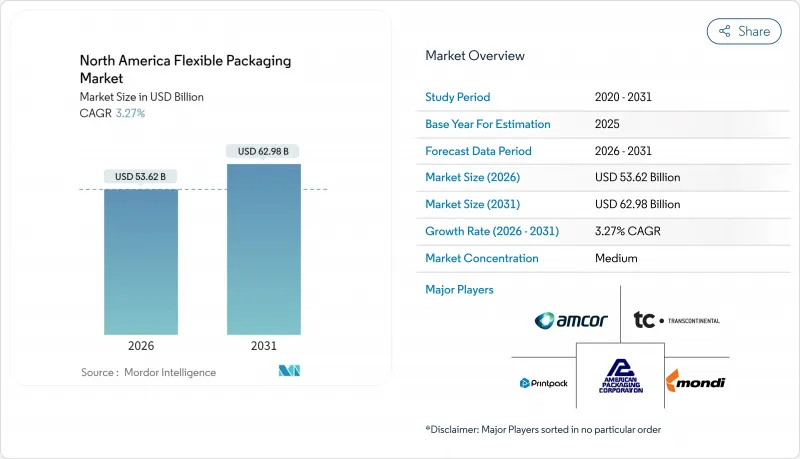

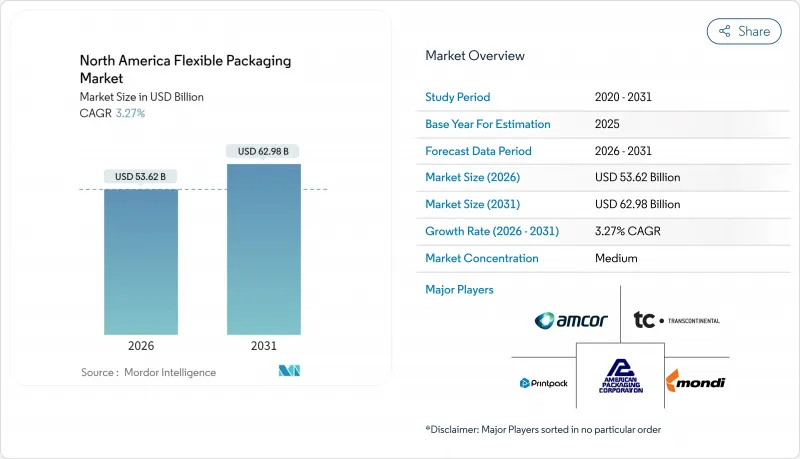

預計到 2026 年,北美軟包裝市場規模將達到 536.2 億美元,高於 2025 年的 519.2 億美元。預計到 2031 年,該市場規模將達到 629.8 億美元,2026 年至 2031 年的複合年成長率為 3.27%。

終端用戶需求的成熟、日益嚴格的永續性法規以及技術的逐步升級支撐著這一穩步成長的趨勢。可回收的單一材料設計、電商履約的自動化以及醫療包裝需求的激增是推動成長的主要因素。然而,聚合物價格的波動以及多層薄膜回收的不足限制了短期內的成長空間。品牌所有者目前已將消費後回收樹脂的目標直接納入長期採購契約,而加工商則正在擴展其纖維基產品線,以滿足零售商的塑膠減量承諾。儘管競爭格局仍然分散,但大型企業正在透過整合來獲取循環經濟方面的專業知識並確保成本優勢。

北美軟包裝市場趨勢與洞察

攜帶式零食包裝需求激增

隨著行動消費習慣的日益普及,對單件包裝的投資持續成長。瑪氏和百事可樂2024年的產品線擴張計畫包括兼顧保存期限和份量控制的軟性包裝,這促使加工商擴大其高速填充封口設備的規模。預計2023年包裝器材出貨收益將達到109億美元,主要得益於每分鐘可處理70-100個包裝袋的包裝袋生產線。食品接觸應用中再生聚乙烯使用需求的明確,使得在維持產品完整性的前提下,可以預先混合消費後回收材料(PCR)。這項監管政策的明確推動了採用符合How2Recycle「退貨至商店」標準的單一材料聚乙烯立式袋包裝的休閒食品的上市,進一步增強了銷售量勢頭。

品牌所有者正轉向可回收的單一材料結構

多層薄膜歷來有助於解決阻隔難題,但北美地區的回收率仍低於10%。品牌商目前正圍繞單一聚合物結構重新設計產品系列。 Mondi為Skanemeierri開發了一種聚丙烯優格包裝袋,該包裝袋在保持60天保存期限的同時,還能整合到現有的回收系統中。據報導,與層壓結構相比,Amco的AmPrima Plus平台可將其生產過程的碳足跡降低高達68%。功能性阻隔樹脂是此轉變的關鍵,其基於取向聚丙烯和原子層塗層的EVOH替代化學技術,無需共擠出黏合層即可實現0.1 cc/m²/天或更低的氧氣透過率。持續改善通訊協定會根據APR的關鍵指導原則評估設計,以確保其符合可回收性聲明和零售商清單的要求。

家庭收藏的多層薄膜數量有限

多層複合材料佔軟包裝總重量的26%,但由於混合聚合物阻礙了機械分離,路邊回收率仍低於10%。BASF和Tomra的化學剝離先導工廠可提取高達69%的純淨組分,但商業化仍處於早期階段。市政項目優先回收高價值的寶特瓶,導致薄膜回收資金不足,這將阻礙北美軟包裝市場的發展,直到可擴展的分類解決方案出現。

細分市場分析

到2025年,塑膠基材將維持北美軟包裝市場86.72%的佔有率,這主要得益於LDPE、HDPE和BOPP薄膜的強勁表現,這些薄膜在密封性、剛性和成本效益方面實現了良好的平衡。然而,隨著零售商從不可可再生複合材料轉向纖維基包裝袋和郵寄袋,紙板的市佔率正以4.41%的複合年成長率成長。 Sappi北美公司斥資5億美元升級其2號造紙廠,將使其固態硫酸鹽漿的年產能提升至47萬噸,這表明該公司對阻隔性塗佈紙充滿信心。鋁箔仍用於保護對濕度敏感的藥品,但其高消費量限制了其市場佔有率,使其僅佔小規模部分。

循環經濟的迫切需求正在加速消費後回收材料(PCR)的普及應用。美國 )2022年發布的食品藥物管理局明確了食品級再生聚乙烯(PE)的化學成分要求,允許PCR含量高達30%,且不會影響其阻隔性能。預計到2031年,北美紙基軟包裝市場規模將成長21.8億美元。同時,多層薄膜製造商正轉向無溶劑複合製程和相容劑添加劑,以保持產品的可回收性。品牌商正在評估纖維-聚合物混合材料,以功能性水性塗層取代金屬化層,從而建立一條過渡路徑,降低對現有塑膠供應商造成衝擊的風險。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 方便攜帶的零食需求激增

- 品牌所有者正轉向可回收的單一材料結構

- 寵物食品軟包裝的優質化

- 州級PCR強制令推動了長期樹脂回收合約的簽訂。

- 微型倉配中心的自動化推動了超薄郵寄薄膜的發展

- 零售商向自動化微型倉配中心的轉變正在推動對超薄膜的需求。

- 市場限制

- 多層薄膜的有限路邊回收

- 地緣政治衝擊引發聚合物價格波動

- 符合FDA標準的再生聚乙烯原料短缺

- 生產者延伸責任制(EPR)立法帶來了新的成本和報告義務。

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依材料類型

- 塑膠

- 聚乙烯(PE)

- 雙軸延伸聚丙烯(BOPP)

- 流延聚丙烯(CPP)

- 聚氯乙烯(PVC)

- 乙烯-乙烯醇共聚物(EVOH)

- 紙

- 鋁箔

- 塑膠

- 依產品類型

- 小袋

- 袋裝/小袋裝

- 薄膜和包裝

- 收縮套標和標籤

- 其他產品類型

- 按最終用戶行業分類

- 食物

- 冷凍食品

- 乳製品

- 水果和蔬菜

- 肉類、家禽、魚貝類

- 烘焙點心和零食

- 糖果甜點

- 其他食物

- 飲料

- 藥品和醫療用品

- 居家及個人護理

- 工業和化學產品

- 食物

- 按國家/地區

- 美國

- 加拿大

- 墨西哥

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amcor plc

- Sealed Air Corp.

- Mondi plc

- ProAmpac LLC

- Transcontinental Inc.

- American Packaging Corp.

- Sonoco Products Co.

- Printpack Inc.

- Sigma Plastics Group

- Novolex Holdings Inc.

- Constantia Flexibles

- PPC Flexible Packaging

- Charter Next Generation

- Glenroy Inc.

- CCL Industries

- Smurfit Westrock plc

- Coveris Holdings SA

- Emmerson Packaging

第7章 市場機會與未來展望

North America flexible packaging market size in 2026 is estimated at USD 53.62 billion, growing from 2025 value of USD 51.92 billion with 2031 projections showing USD 62.98 billion, growing at 3.27% CAGR over 2026-2031.

Mature end-user demand, tightening sustainability regulations and incremental technology upgrades underpin this steady trajectory. Growth centers on recyclable mono-material designs, automation in e-commerce fulfillment, and surging health-care packaging volumes, even as polymer-price volatility and multilayer film recycling gaps temper near-term upside. Brand owners now embed post-consumer resin targets directly into long-term procurement contracts, while converters expand fiber-based offerings to serve retailers' plastic-reduction pledges. The competitive field remains fragmented; scale players consolidate to access circular-economy know-how and lock in cost advantages.

North America Flexible Packaging Market Trends and Insights

Surge in Demand for Convenient On-the-Go Snacking Formats

Portable consumption habits continue to expand single-serve packaging investments. Mars and PepsiCo's 2024 portfolio additions relied on flexibles that balance shelf life with portion control, prompting converters to scale high-speed form-fill-seal capacity. packaging-machinery shipments reached USD 10.9 billion in 2023, led by pouching lanes optimized for 70-100 units per minute guidance now clarifies conditions under which recycled polyethylene can enter food-contact applications, enabling brands to pre-blend PCR while protecting product integrity. The regulatory clarity supports snack launches in mono-material PE stand-up pouches that meet How2Recycle "store-drop-off" criteria, reinforcing volume momentum.

Brand-Owner Shift Toward Recyclable Mono-Material Structures

Multilayer films historically solved barrier challenges but suffer from <10% collection rates in North America. Brand owners now redesign portfolios around single-polymer formats; Mondi's polypropylene yogurt pouch for Skanemejerier maintained 60-day shelf life while entering existing recycle streams . Amcor's AmPrima Plus platform reports up to 68% lower cradle-to-gate carbon footprint versus laminated structures. The transition depends on functional barrier resins, including EVOH replacement chemistries that rely on oriented PP plus atomic-layer coatings, enabling oxygen-transmission rates under 0.1 cc/m2/day without co-extruded tie layers. Continuous-improvement protocols now benchmark designs against APR Critical Guidance to secure recyclability claims and retailer listings.

Limited Curb-Side Collection for Multilayer Films

Multilayer laminates make up 26% of flexible-packaging tonnage yet achieve <10% curbside recovery because mixed polymers hinder mechanical separation.Chemical-delamination pilots from BASF and Tomra extract up to 69% clean fractions, but commercialization is at early stages. Municipal programs prioritize higher-value PET bottles, leaving film streams underfunded, thereby restraining the North America flexible packaging market until scalable sortation solutions emerge.

Other drivers and restraints analyzed in the detailed report include:

- Premiumisation in Pet-Food Flexibles

- State-Level PCR Mandates Triggering Long-Term Resin Off-Take Contracts

- Polymer-Price Volatility After Geopolitical Shocks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic substrates retained 86.72% share of the North America flexible packaging market in 2025, led by LDPE, HDPE and BOPP films that balance sealability, stiffness and cost efficiency. Yet paperboard grades grow at a 4.41% CAGR as retailers substitute non-recyclable laminates with fiber-based sachets and mailers. Sappi North America's USD 500 million upgrade of Paper Machine 2 boosts solid-bleached-sulfate capacity to 470,000 t/y, signaling confidence in high-barrier coated papers. Aluminum foil continues to protect moisture-sensitive pharmaceuticals but remains a small-volume niche owing to high energy intensity.

Circular-economy imperatives accelerate PCR incorporation, and FDA's 2022 guidance clarifies chemistry requirements for food-grade recycled PE, facilitating PCR rates up to 30% without barrier compromises. The North America flexible packaging market size tied to paper substrates is forecast to add USD 2.18 billion incremental revenue by 2031, while multilayer film producers pivot toward solvent-less lamination and compatibilizer additives to maintain recyclability. Brand owners evaluate fiber-poly hybrid formats where functional waterborne coatings replace metallized layers, creating a transition path that tempers disruptive risk for incumbent plastic suppliers.

The North America Flexible Packaging Market Report is Segmented by Material Type (Plastics, Paper, and Aluminum Foil), Product Type (Pouches, Bags and Sachets, Films and Wraps, Shrink Sleeves and Labels, and More), End-User Industry (Food, Beverage, Pharmaceutical and Medical, Household and Personal Care, and Industrial and Chemical), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amcor plc

- Sealed Air Corp.

- Mondi plc

- ProAmpac LLC

- Transcontinental Inc.

- American Packaging Corp.

- Sonoco Products Co.

- Printpack Inc.

- Sigma Plastics Group

- Novolex Holdings Inc.

- Constantia Flexibles

- PPC Flexible Packaging

- Charter Next Generation

- Glenroy Inc.

- CCL Industries

- Smurfit Westrock plc

- Coveris Holdings SA

- Emmerson Packaging

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in demand for convenient on-the-go snacking formats

- 4.2.2 Brand-owner shift toward recyclable mono-material structures

- 4.2.3 Premiumisation in pet-food flexibles

- 4.2.4 State-level PCR mandates triggering long-term resin off-take contracts

- 4.2.5 Automation in micro-fulfilment hubs favouring ultra-thin mailer films

- 4.2.6 Retailers' shift to automated micro-fulfilment hubs is spurring demand for ultra-thin

- 4.3 Market Restraints

- 4.3.1 Limited curb-side collection for multilayer films

- 4.3.2 Polymer-price volatility after geopolitical shocks

- 4.3.3 Scarcity of FDA-grade rPE feedstock

- 4.3.4 Extended Producer Responsibility (EPR) laws impose new fees and reporting burdens

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Plastics

- 5.1.1.1 Polyethylene (PE)

- 5.1.1.2 Biaxially-Oriented Polypropylene (BOPP)

- 5.1.1.3 Cast Polypropylene (CPP)

- 5.1.1.4 Polyvinyl Chloride (PVC)

- 5.1.1.5 Ethylene-Vinyl Alcohol (EVOH)

- 5.1.2 Paper

- 5.1.3 Aluminum Foil

- 5.1.1 Plastics

- 5.2 By Product Type

- 5.2.1 Pouches

- 5.2.2 Bags and Sachets

- 5.2.3 Films and Wraps

- 5.2.4 Shrink Sleeves and Labels

- 5.2.5 Other Product Type

- 5.3 By End-user Industry

- 5.3.1 Food

- 5.3.1.1 Frozen Food

- 5.3.1.2 Dairy Products

- 5.3.1.3 Fruits and Vegetables

- 5.3.1.4 Meat, Poultry and Seafood

- 5.3.1.5 Baked Goods and Snacks

- 5.3.1.6 Confectionery

- 5.3.1.7 Other Food

- 5.3.2 Beverage

- 5.3.3 Pharmaceutical and Medical

- 5.3.4 Household and Personal Care

- 5.3.5 Industrial and Chemical

- 5.3.1 Food

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Sealed Air Corp.

- 6.4.3 Mondi plc

- 6.4.4 ProAmpac LLC

- 6.4.5 Transcontinental Inc.

- 6.4.6 American Packaging Corp.

- 6.4.7 Sonoco Products Co.

- 6.4.8 Printpack Inc.

- 6.4.9 Sigma Plastics Group

- 6.4.10 Novolex Holdings Inc.

- 6.4.11 Constantia Flexibles

- 6.4.12 PPC Flexible Packaging

- 6.4.13 Charter Next Generation

- 6.4.14 Glenroy Inc.

- 6.4.15 CCL Industries

- 6.4.16 Smurfit Westrock plc

- 6.4.17 Coveris Holdings SA

- 6.4.18 Emmerson Packaging

7 MARKET OPPORTUNITIES and FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment