|

市場調查報告書

商品編碼

1863603

軟質包裝市場按材料、包裝類型、印刷技術、應用和地區分類-預測至2030年Flexible Packaging Market By Material, Packaging Type, Printing Technology, Application, Region - Global Forecast to 2030 |

||||||

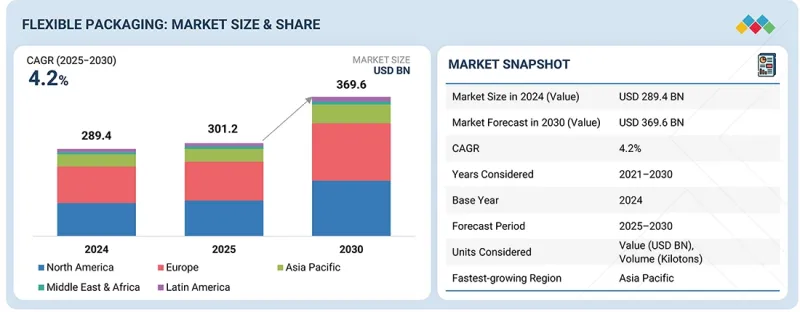

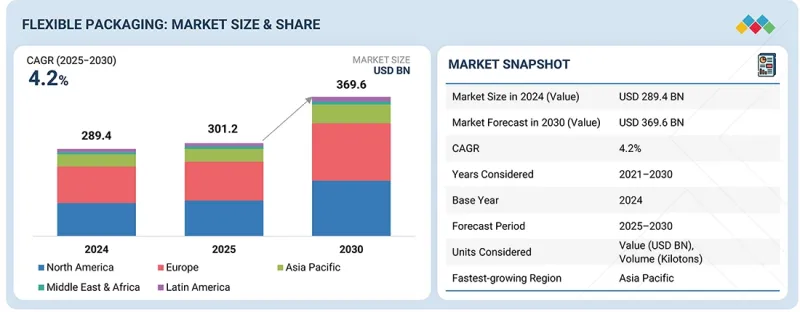

預計到 2025 年,軟質包裝市場規模將達到 3,012 億美元,到 2030 年將達到 3,696 億美元,預測期內複合年成長率為 4.2%。

對提高產品保護、延長保存期限和降低運輸成本的需求正在推動對軟質包裝的需求。

| 調查範圍 | |

|---|---|

| 調查期 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 目標單元 | 金額(百萬美元),數量(千噸) |

| 部分 | 按材料、包裝類型、印刷技術、應用和地區分類 |

| 目標區域 | 北美洲、亞太地區、歐洲、中東和非洲、南美洲 |

製造商和品牌商紛紛採用軟性包裝形式,因為這種包裝形式能夠提高營運效率、縮短生產週期,並能打造吸引消費者眼球的創新且美觀的設計。此外,日益嚴格的減少包裝廢棄物的法規以及向循環經濟的轉型,也推動了食品飲料、醫療保健和個人護理等行業對軟性、高阻隔阻隔性和環保材料的使用。

在預測期內,紙質包裝預計將繼續保持其在軟質包裝市場的第二大地位。其成長主要得益於品牌和監管機構日益重視減少塑膠廢棄物,從而推動了對永續、可回收和環保包裝解決方案的需求成長。塗佈紙、複合紙和高阻隔紙技術的進步提高了紙質包裝的耐用性、防潮性和產品保護性能,使其適用於食品、飲料、個人護理和醫藥等行業。消費者對環保包裝日益成長的偏好也進一步推動了該細分市場在全球範圍內的擴張。

在預測期內,包裝袋預計將成為軟質包裝市場第二大細分市場。其成長主要得益於包裝袋在食品、飲料、個人護理和工業領域的多功能性、耐用性和成本效益。包裝袋具有便於儲存、便於攜帶和保存期限長的優點,使其成為零售和散裝包裝的理想選擇。此外,消費者對可客製化、輕量和永續材料的需求不斷成長,以及現代零售和電子商務的蓬勃發展,也進一步推動了該細分市場在全球範圍內的擴張。

在預測期內,凹版印刷預計將在軟質包裝市場佔據第二大市場。其成長主要得益於市場對高品質、一致性和精細印刷的軟質包裝需求,尤其是在高階食品、飲料和個人保健產品領域。凹版印刷具有色彩還原度高、設計表現力強、大量生產效率高等優點。品牌對視覺吸引力的日益重視、新興市場對凹版印刷的接受度不斷提高,以及客製化和視覺吸引力強的包裝解決方案的興起,都推動了該細分市場的穩定成長。

在預測期內,個人護理和化妝品領域預計將繼續保持其在軟質包裝市場中的第二大地位。推動該領域成長的主要因素是消費者對便攜、輕巧且外觀吸引人的包裝的需求不斷成長,這些包裝有助於提升品牌差異化。消費者對永續、可回收和可重複填充包裝的偏好日益增強,也進一步推動了此類包裝的普及。軟包裝袋、小袋和軟管包裝具有便利性,能夠保護產品並延長保存期限。此外,產品快速創新、電子商務的蓬勃發展以及新興市場護膚和美容產品消費的成長,也共同推動了該領域的強勁成長。

亞太地區是全球最大的軟質包裝,這主要得益於快速的都市化、不斷成長的可支配收入以及對包裝食品、飲料和個人保健產品日益成長的需求。中國、印度和東南亞國家強勁的工業和製造業成長,以及電子商務的擴張和現代零售的普及,都在推動該地區的需求。此外,人們對永續和可回收包裝的日益關注,以及全球和本地製造商對擴大產能的投資,進一步鞏固了亞太地區作為全球軟質包裝關鍵成長中心的地位。

本研究對軟質包裝市場的主要企業進行了深入的競爭分析,包括公司簡介、近期發展和關鍵市場策略。

調查範圍

本研究報告按材料、包裝類型、印刷技術、應用和地區對軟質包裝市場進行了細分。報告涵蓋了影響軟質包裝市場成長的促進因素、限制因素、挑戰和成長機會的詳細資訊。該報告對主要行業參與企業進行了全面分析,深入剖析了他們的業務概況、產品組合以及與軟質包裝市場相關的關鍵策略,例如聯盟、併購、產品發布、業務擴張和收購。此外,報告也對軟質包裝生態系統中新興的Start-Ups進行了競爭分析。

購買本報告的好處

本報告為市場領導和新參與企業提供整體軟質包裝市場及其細分市場的收入預測。它將幫助相關人員了解競爭格局,深入了解自身定位,並制定有效的打入市場策略。此外,報告還提供有關關鍵市場促進因素、限制、挑戰和機會的資訊,幫助企業了解市場趨勢。

目錄

第1章 引言

第2章執行摘要

第3章重要考察

第4章 市場概覽

- 介紹

- 市場動態

- 未滿足的需求和差距

- 相互關聯的市場與跨產業機遇

- 1/2/3級參與企業的策略舉措

第5章 產業趨勢

- 波特五力分析

- 主要相關人員和採購標準

- 招募障礙和內部挑戰

- 來自各個終端使用者產業的未滿足需求

- 市場盈利

- 宏觀經濟分析

- 價值鏈分析

- 生態系分析

- 定價分析

- 貿易分析

- 2025-2026 年主要會議和活動

- 影響客戶業務的趨勢/干擾因素

- 投資和資金籌措方案

- 案例研究分析/實際應用

- 2025年美國關稅對軟質包裝市場的影響

第6章:科技、專利、數位化和人工智慧應用帶來的策略顛覆

- 主要技術

- 互補技術

- 鄰近技術

- 技術/產品藍圖

- 專利分析

- 未來應用

- 人工智慧/生成式人工智慧對軟質包裝市場的影響

- 成功案例和實際應用

第7章永續性和監管環境

- 地方法規和合規性

- 對永續性的承諾

- 永續性影響和監管政策舉措

- 認證、標籤和環境標準

第8章:顧客狀況與購買行為

- 決策流程

第9章軟質包裝市場(依材料分類)

- 介紹

- 紙

- 塑膠

- 金屬

第10章軟質包裝市場(依包裝類型分類)

- 介紹

- 小袋

- 包包

- 卷材

- 薄膜包裝

- 其他

第11章軟質包裝市場(依印刷技術分類)

- 介紹

- 柔版印刷

- 凹版印刷

- 數位印刷

- 其他

第12章軟質包裝市場(依應用領域分類)

- 介紹

- 食物

- 飲料

- 製藥和醫療保健

- 個人護理及化妝品

- 其他

第13章軟質包裝市場(按地區分類)

- 介紹

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 義大利

- 其他

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他

- 中東和非洲

- 海灣合作理事會國家

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他海灣合作理事會國家

- 南非

- 其他

第14章 競爭格局

- 概述

- 主要參與企業的策略/優勢

- 收入分析

- 市佔率分析

- 估值和財務指標

- 品牌/產品對比

- 公司估值矩陣:主要參與企業,2024 年

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 競爭基準化分析:Start-Ups/中小企業,2024 年

- 競爭場景

第15章:公司簡介

- 主要參與企業

- AMCOR PLC

- SMURFIT WESTROCK

- MONDI

- TOPPAN HOLDINGS INC.

- SEALED AIR

- HUHTAMAKI

- CONSTANTIA FLEXIBLES

- TRANSCONTINENTAL INC.

- UFLEX LIMITED

- BISCHOF+KLEIN SE & CO. KG

- 其他公司

- PROAMPAC

- NOVOLEX

- SILAFRICA

- PPC FLEX COMPANY, INC.

- PRINTPACK

- NOVUS HOLDINGS LTD.

- AHLSTROM

- WIHURI GROUP

- CP FLEXIBLE PACKAGING

- COSMO FILMS

- GUALA PACK SPA

- EPAC HOLDINGS, LLC.

第16章調查方法

第17章:鄰近及相關市場

第18章附錄

The flexible packaging market is expected to grow from USD 301.2 billion in 2025 to USD 369.6 billion by 2030, at a CAGR of 4.2% during the forecast period. The demand for flexible packaging is rising due to the need for better product protection, longer shelf life, and lower transportation costs.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Segments | Material, Packaging Type, Printing Technology, Application, and Region |

| Regions covered | North America, Asia Pacific, Europe, Middle East & Africa, and South America |

Manufacturers and brands are adopting flexible formats because they can improve operational efficiency, allow for smaller batch production, and support innovative, eye-catching designs that attract consumers. Increasing regulatory focus on reducing packaging waste and the shift toward circular economy practices are also promoting the use of flexible, high-barrier, and eco-friendly materials across industries like food, beverages, healthcare, and personal care.

"Paper segment predicted to be the second-largest market during the forecast period"

The paper segment is expected to be the second-largest in the flexible packaging market during the forecast period. Its growth is driven by rising demand for sustainable, recyclable, and eco-friendly packaging solutions as brands and regulators focus on reducing plastic waste. Advances in coated, laminated, and high-barrier paper technologies improve durability, moisture resistance, and product protection, making paper suitable for food, beverages, personal care, and pharmaceutical uses. Growing consumer preference for environmentally responsible packaging further supports the segment's global expansion.

"The bags segment is projected to be the second-largest segment during the forecast period"

The bags segment is expected to be the second-largest in the flexible packaging market during the forecast period. Growth is fueled by their versatility, durability, and cost-effectiveness across food, beverage, personal care, and industrial sectors. Bags provide convenient storage, portability, and extended shelf life, making them perfect for retail and bulk packaging. The rising demand for customizable, lightweight, and sustainable materials, along with the growth of modern retail and e-commerce, further drives the segment's global expansion.

"Rotogravure segment predicted to be the second largest market during forecast period"

The rotogravure segment is expected to be the second-largest in the flexible packaging market during the forecast period. Its growth is driven by the demand for high-quality, consistent, and detailed printing on flexible packaging, especially for premium food, beverage, and personal care products. Rotogravure offers superior color reproduction, complex designs, and efficient large-scale production. Increasing brand focus on visual appeal, along with growing adoption in emerging markets, supports the segment's steady growth alongside the rise of customized and visually attractive packaging solutions.

"The personal care & cosmetics segment market is projected to be the second largest market during the forecast period."

The personal care & cosmetics segment is expected to be the second-largest in the flexible packaging market during the forecast period. Growth is fueled by increasing demand for travel-friendly, lightweight, and visually appealing packaging that enhances brand differentiation. Growing consumer preference for sustainable, recyclable, and refillable packaging further encourages adoption. Flexible pouches, sachets, and tubes provide convenience, protect products, and extend shelf life. Rapid product innovation, expansion of e-commerce, and rising skincare and beauty consumption in emerging markets also drive the segment's strong growth.

"In terms of value, the Asia Pacific flexible packaging market is projected to grow at the highest CAGR during the forecast period."

Asia Pacific is the largest market for flexible packaging, driven by rapid urbanization, rising disposable incomes, and growing demand for packaged food, beverages, and personal care products. Strong industrial and manufacturing growth in countries like China, India, and Southeast Asia, along with expanding e-commerce and modern retail penetration, boosts regional demand. An increasing focus on sustainable and recyclable packaging, along with investments by global and local manufacturers to expand production capacities, further strengthens Asia Pacific's dominance, making it the key growth hub for flexible packaging worldwide.

By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

By Designation: C-level Executives: 20%, Directors: 30%, and Other Designations: 50%

By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and Middle East & Africa 20%

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million-1 Billion; and Tier 3: <USD 500 million

Companies Covered: Amcor plc (Switzerland), Smurfit Westrock (Ireland), Mondi (UK), TOPPAN Holdings Inc. (Japan), Sealed Air (US), Huhtamaki (Finland), Constantia Flexibles (Austria), Transcontinental Inc. (Canada), Bischof+Klein SE & CO. KG (Germany), and UFlex Limited (India), among others are covered in the report.

The study includes an in-depth competitive analysis of these key players in the flexible packaging market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the flexible packaging market based on material (plastic, paper, metal), packaging type (pouches, bags, rollstock, films & wraps, other packaging types), printing technologies (flexography, rotogravure, digital), application (food, beverages, pharmaceutical & healthcare, personal care & cosmetics), and region (Asia Pacific, North America, Europe, South America, and Middle East & Africa). The report's scope includes detailed information on the drivers, restraints, challenges, and opportunities affecting the growth of the flexible packaging market. A comprehensive analysis of the key industry players has been conducted to provide insights into their business overview, products offered, and key strategies such as partnerships, mergers, product launches, expansions, and acquisitions related to the flexible packaging market. This report also features a competitive analysis of emerging startups in the flexible packaging ecosystem.

Reasons to Buy the Report

The report will provide market leaders and new entrants with estimates of the revenue figures for the overall flexible packaging market and its subsegments. This report will assist stakeholders in understanding the competitive landscape, gaining better insights into positioning their businesses, and developing effective go-to-market strategies. Additionally, it will help stakeholders grasp the market's pulse by offering information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (growth of e-commerce platform, and rising demand for disposable packaging from end-use industries), restraints (non-availability of efficient recycling infrastructure, and surge in raw material price), opportunities (commercialization of mono-material high-barrier films, expansion of refill, reuse, and concentrate-compatible formats), and challenges (high dependence on petrochemical-based resins, rapidly evolving sustainability standards and certification requirements)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the flexible packaging market

- Market Development: Comprehensive information about profitable markets - the report analyzes the flexible packaging market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the flexible packaging market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and service offerings of leading players such as Amcor plc (Switzerland), Smurfit Westrock (Ireland), Mondi (UK), TOPPAN Holdings Inc. (Japan), Sealed Air (US), Huhtamaki (Finland), Constantia Flexibles (Austria), Transcontinental Inc. (Canada), Bischof+Klein SE & CO. KG (Germany), UFlex Limited (India)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FLEXIBLE PACKAGING MARKET

- 3.2 FLEXIBLE PACKAGING MARKET, BY MATERIAL AND REGION

- 3.3 FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE

- 3.4 FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY

- 3.5 FLEXIBLE PACKAGING MARKET, BY APPLICATION

- 3.6 FLEXIBLE PACKAGING MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Growth of E-commerce platform

- 4.2.1.2 Cost-effectiveness and enhanced product shelf life

- 4.2.1.3 Rising demand for disposable packaging from end-use industries

- 4.2.1.4 Growing concerns toward sustainability

- 4.2.2 RESTRAINTS

- 4.2.2.1 Non-availability of efficient recycling infrastructure

- 4.2.2.2 Surge in raw material prices

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Commercialization of mono-material high-barrier films

- 4.2.3.2 Expansion of refill, reuse, and concentrate-compatible formats

- 4.2.3.3 Integration of recycled content via advanced mechanical & chemical recycling

- 4.2.4 CHALLENGES

- 4.2.4.1 High dependence on petrochemical-based resins

- 4.2.4.2 Rapidly evolving sustainability standards and certification requirements

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 SHELF-LIFE TRANSPARENCY

- 4.3.2 MATERIAL LIMITATIONS VS. CONSUMER EXPECTATIONS

- 4.3.3 PORTIONING AND USABILITY

- 4.3.4 PREMIUMIZATION WITHOUT PLASTIC WASTE

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.4.2.1 Food ↔ Beverages

- 4.4.2.2 Food & Beverages ↔ Pharmaceutical & Healthcare

- 4.4.2.3 Personal Care & Cosmetics ↔ Food & Beverages

- 4.4.2.4 Pharmaceutical & Healthcare ↔ Personal Care & Cosmetics

- 4.4.2.5 Other Sectors (Automotive, Agriculture, Sports) ↔ Food & Beverages/Healthcare/Cosmetics

- 4.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

- 4.5.1 TIER 1 PLAYERS: GLOBAL LEADERS DRIVING CONSOLIDATION AND INNOVATION

- 4.5.1.1 Amcor and Berry Global Merger

- 4.5.1.2 Sonoco's acquisition of Eviosys

- 4.5.2 TIER 2 PLAYERS: REGIONAL INNOVATORS AND NICHE LEADERS

- 4.5.2.1 Jindal Poly Films' expansion in Nashik

- 4.5.2.2 Coveris' commitment to sustainability

- 4.5.3 TIER 3 PLAYERS: AGILE INNOVATORS AND SPECIALIZED PROVIDERS

- 4.5.3.1 ProAmpac's innovations in sustainable packaging

- 4.5.3.2 Huhtamaki's focus on sustainable packaging

- 4.5.1 TIER 1 PLAYERS: GLOBAL LEADERS DRIVING CONSOLIDATION AND INNOVATION

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES' ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 KEY STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 5.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.2.2 BUYING CRITERIA

- 5.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 5.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 5.5 MARKET PROFITABILITY

- 5.5.1 REVENUE POTENTIAL

- 5.5.2 COST DYNAMICS

- 5.5.3 MARGIN OPPORTUNITIES BY APPLICATION

- 5.6 MACROECONOMIC ANALYSIS

- 5.6.1 INTRODUCTION

- 5.6.2 GDP TRENDS AND FORECASTS

- 5.6.3 URBANIZATION AND DEMOGRAPHIC SHIFTS

- 5.6.4 TRADE AND GLOBAL SUPPLY CHAIN DYNAMICS

- 5.7 VALUE CHAIN ANALYSIS

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY MATERIAL

- 5.9.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT DATA RELATED TO HS CODE 3920, BY COUNTRY, 2020-2024 (USD THOUSAND)

- 5.10.2 EXPORT DATA RELATED TO HS CODE 3920, BY COUNTRY, 2020-2024 (USD THOUSAND)

- 5.10.3 IMPORT DATA RELATED TO HS CODE 48, BY COUNTRY, 2020-2024 (USD THOUSAND)

- 5.10.4 EXPORT DATA RELATED TO HS CODE 48, BY COUNTRY, 2020-2024 (USD THOUSAND)

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.13 INVESTMENT AND FUNDING SCENARIO

- 5.14 CASE STUDY ANALYSIS/REAL WORLD APPLICATIONS

- 5.14.1 PAPERPAK PARTNERS WITH KATHMANDU FOR BIODEGRADABLE AND COMPOSTABLE SOLUTIONS

- 5.14.2 PAPERPAK'S REFINED BAG FOR HARPER, INC. TO MEET SUSTAINABILITY DEMAND

- 5.14.3 AMCOR'S 30% RECYCLED CONTENT PACKAGING REDUCES VIRGIN PLASTIC USAGE

- 5.15 IMPACT OF 2025 US TARIFF ON FLEXIBLE PACKAGING MARKET

- 5.15.1 INTRODUCTION

- 5.15.2 KEY TARIFF RATES

- 5.15.3 PRICE IMPACT ANALYSIS

- 5.15.4 KEY IMPACT ON VARIOUS REGIONS

- 5.15.4.1 US

- 5.15.4.2 Europe

- 5.15.4.3 Asia Pacific

- 5.15.5 END-USE INDUSTRY IMPACT

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 COEXTRUSION TECHNOLOGY

- 6.1.2 MODIFIED ATMOSPHERE PACKAGING (MAP)

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 ACTIVE PACKAGING

- 6.2.2 ADVANCED RECYCLING

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 PACKAGING AUTOMATION

- 6.3.2 SMART PACKAGING (RFID, NFC, SENSORS)

- 6.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.4.1 SHORT-TERM (2025-2027) | TRANSITION AND DIGITAL INTEGRATION PHASE

- 6.4.2 MID-TERM (2027-2030): CIRCULAR ECONOMY AND SMART PACKAGING CONSOLIDATION

- 6.4.3 LONG-TERM (2030-2035+): FULLY CIRCULAR, INTELLIGENT, AND ADAPTIVE PACKAGING SYSTEMS

- 6.5 PATENT ANALYSIS

- 6.5.1 INTRODUCTION

- 6.5.2 APPROACH

- 6.5.3 TOP APPLICANTS

- 6.6 FUTURE APPLICATIONS

- 6.6.1 BIO-DERIVED SELF-DECONTAMINATING FILMS (PHOTOCATALYTIC/ENZYMATIC SURFACES)

- 6.6.2 FULLY EDIBLE FLEXIBLE PACKAGING FILMS

- 6.6.3 SHAPE-ADAPTIVE FILMS USING EMBEDDED SOFT ACTUATORS

- 6.6.4 BIOLUMINESCENT INDICATOR FILMS

- 6.7 IMPACT OF AI/GEN AI ON FLEXIBLE PACKAGING MARKET

- 6.7.1 TOP USE CASES AND MARKET POTENTIAL

- 6.7.2 BEST PRACTICES IN FLEXIBLE PACKAGING

- 6.7.3 CASE STUDIES OF AI IMPLEMENTATION IN FLEXIBLE PACKAGING MARKET

- 6.7.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.7.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN FLEXIBLE PACKAGING MARKET

- 6.8 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.8.1 DOW AND LIBY DEPLOY RECYCLABLE BOPE RESIN IN CHINA

- 6.8.2 HUHTAMAKI'S MONO-MATERIAL FLEXIBLE INNOVATIONS REDEFINE RECYCLABILITY

- 6.8.3 AMCOR'S AMPRIMA PE PLUS POUCH REDUCES NON-RECYCLABLE LAMINATE USE

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF FLEXIBLE PACKAGING

- 7.2.1.1 Carbon Impact Reduction

- 7.2.1.2 Eco-Applications

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF FLEXIBLE PACKAGING

- 7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, ECO-STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

9 FLEXIBLE PACKAGING MARKET, BY MATERIAL

- 9.1 INTRODUCTION

- 9.2 PAPER

- 9.2.1 EXPANDING PULP SUPPLY AND RECYCLING EFFICIENCY REINFORCE PAPER'S ROLE IN FLEXIBLE PACKAGING

- 9.3 PLASTIC

- 9.3.1 MONO-MATERIAL INNOVATION AND RECYCLING TO DRIVE DEMAND FOR PLASTICS IN FLEXIBLE PACKAGING

- 9.4 METAL

- 9.4.1 LIGHTWEIGHT FOIL INNOVATION AND HIGH RECYCLING RATES SUSTAIN METAL'S RELEVANCE IN FLEXIBLE PACKAGING

10 FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE

- 10.1 INTRODUCTION

- 10.2 POUCHES

- 10.2.1 MONO-MATERIAL AND HYBRID POUCH DESIGNS TO DRIVE GROWTH

- 10.3 BAGS

- 10.3.1 HIGH-BARRIER AND RECYCLABLE FLEXIBLE BAGS TO DRIVE EFFICIENCY AND CIRCULARITY IN PACKAGING

- 10.4 ROLLSTOCK

- 10.4.1 MODULAR ROLLSTOCK SOLUTIONS DRIVE CUSTOMIZATION, EFFICIENCY, AND HIGH-BARRIER PACKAGING

- 10.5 FILMS & WRAPS

- 10.5.1 ADVANCED FILMS AND WRAPS DRIVE PERFORMANCE, FLEXIBILITY, AND SUSTAINABLE PACKAGING SOLUTIONS

- 10.6 OTHER PACKAGING TYPES

11 FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY

- 11.1 INTRODUCTION

- 11.2 FLEXOGRAPHY

- 11.2.1 FLEXOGRAPHY DRIVES SUSTAINABLE, HIGH-PRECISION PRINTING EVOLUTION IN FLEXIBLE PACKAGING INDUSTRY

- 11.3 ROTOGRAVURE

- 11.3.1 ROTOGRAVURE RETAINS ITS STRONGHOLD IN PREMIUM, LONG-RUN FLEXIBLE PACKAGING PRODUCTION

- 11.4 DIGITAL PRINTING

- 11.4.1 DIGITAL PRINTING REDEFINES FLEXIBLE PACKAGING THROUGH CUSTOMIZATION, AGILITY, AND SUSTAINABILITY

- 11.5 OTHER PRINTING TECHNOLOGIES

12 FLEXIBLE PACKAGING MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 FOOD

- 12.2.1 FLEXIBLE PACKAGING DRIVES INNOVATION, SUSTAINABILITY, AND SHELF-LIFE OPTIMIZATION IN FOOD PRODUCTS

- 12.3 BEVERAGES

- 12.3.1 FLEXIBLE PACKAGING REDEFINES BEVERAGE CONSUMPTION THROUGH CONVENIENCE AND PRODUCT PROTECTION

- 12.4 PHARMACEUTICAL & HEALTHCARE

- 12.4.1 FLEXIBLE PACKAGING ENSURES SAFETY, COMPLIANCE, AND EFFICIENCY IN PHARMACEUTICALS

- 12.5 PERSONAL CARE & COSMETICS

- 12.5.1 POLYOLS ENABLE HIGH-PERFORMANCE, INSULATED, AND SUSTAINABLE SOLUTIONS IN ADVANCED PACKAGING APPLICATIONS

- 12.6 OTHER APPLICATIONS

13 FLEXIBLE PACKAGING MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 US

- 13.2.1.1 Evolving consumer and industry trends to accelerate shift toward flexible packaging

- 13.2.2 CANADA

- 13.2.2.1 Expanding manufacturing and export sectors to propel growth

- 13.2.3 MEXICO

- 13.2.3.1 Expanding agri-food, pharma, and beauty exports strengthen shift toward flexible packaging

- 13.2.1 US

- 13.3 ASIA PACIFIC

- 13.3.1 CHINA

- 13.3.1.1 Growing food, beverage, healthcare, and beauty sectors to fuel demand

- 13.3.2 INDIA

- 13.3.2.1 Rapid industrial and consumer growth to drive demand

- 13.3.3 JAPAN

- 13.3.3.1 Expanding food, beverage, pharma, and beauty exports to drive market

- 13.3.4 SOUTH KOREA

- 13.3.4.1 Expanding agri-food, pharma, and cosmetics exports to propel market

- 13.3.5 REST OF ASIA PACIFIC

- 13.3.1 CHINA

- 13.4 EUROPE

- 13.4.1 GERMANY

- 13.4.1.1 Strong economy and sectoral growth to drive demand

- 13.4.2 UK

- 13.4.2.1 Expanding exports and evolving lifestyles to drive growth

- 13.4.3 FRANCE

- 13.4.3.1 Export strength and eco-innovation to propel market

- 13.4.4 RUSSIA

- 13.4.4.1 Policy support and evolving consumer lifestyles to accelerate demand

- 13.4.5 SPAIN

- 13.4.5.1 Expanding agri-food and biotech sectors to support market growth

- 13.4.6 ITALY

- 13.4.6.1 Strong food, pharma, and beauty sectors to drive demand

- 13.4.7 REST OF EUROPE

- 13.4.1 GERMANY

- 13.5 SOUTH AMERICA

- 13.5.1 BRAZIL

- 13.5.1.1 Expanding manufacturing scale and export integration to drive market

- 13.5.2 ARGENTINA

- 13.5.2.1 Expanding export-oriented and consumer-driven demand to drive market

- 13.5.3 CHILE

- 13.5.3.1 Rising exports and urban consumption to drive demand

- 13.5.4 REST OF SOUTH AMERICA

- 13.5.1 BRAZIL

- 13.6 MIDDLE EAST & AFRICA

- 13.6.1 GCC COUNTRIES

- 13.6.2 SAUDI ARABIA

- 13.6.2.1 Expanding economy and sectoral growth to increase demand

- 13.6.3 UAE

- 13.6.3.1 Emerging as strategic hub for flexible packaging across key sectors

- 13.6.4 REST OF GCC COUNTRIES

- 13.6.5 SOUTH AFRICA

- 13.6.5.1 Food, healthcare, and beauty markets to drive economic growth

- 13.6.6 REST OF MIDDLE EAST & AFRICA

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYERS STRATEGIES/RIGHT TO WIN

- 14.3 REVENUE ANALYSIS

- 14.4 MARKET SHARE ANALYSIS

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.5.1 COMPANY VALUATION

- 14.5.2 FINANCIAL METRICS

- 14.6 BRAND/PRODUCT COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 Packaging type footprint

- 14.7.5.4 Application footprint

- 14.7.5.5 Material footprint

- 14.7.5.6 Printing technology footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.9 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.9.1 DETAILED LIST OF KEY STARTUPS/SMES

- 14.9.2 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 14.10 COMPETITIVE SCENARIO

- 14.10.1 PRODUCT LAUNCHES

- 14.10.2 DEALS

- 14.10.3 EXPANSIONS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 AMCOR PLC

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches

- 15.1.1.3.2 Deals

- 15.1.1.3.3 Expansions

- 15.1.1.4 MnM view

- 15.1.1.4.1 Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses & competitive threats

- 15.1.2 SMURFIT WESTROCK

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.3.2 Deals

- 15.1.2.3.3 Expansions

- 15.1.2.4 MnM view

- 15.1.2.4.1 Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 MONDI

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches

- 15.1.3.3.2 Deals

- 15.1.3.3.3 Expansions

- 15.1.3.4 MnM view

- 15.1.3.4.1 Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 TOPPAN HOLDINGS INC.

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches

- 15.1.4.3.2 Deals

- 15.1.4.3.3 Expansions

- 15.1.4.4 MnM view

- 15.1.4.4.1 Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 SEALED AIR

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches

- 15.1.5.3.2 Deals

- 15.1.5.3.3 Expansions

- 15.1.5.4 MnM view

- 15.1.5.4.1 Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 HUHTAMAKI

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Product launches

- 15.1.6.3.2 Deals

- 15.1.6.3.3 Expansions

- 15.1.6.4 MnM view

- 15.1.7 CONSTANTIA FLEXIBLES

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches

- 15.1.7.3.2 Deals

- 15.1.7.3.3 Expansions

- 15.1.7.4 MnM view

- 15.1.8 TRANSCONTINENTAL INC.

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Deals

- 15.1.8.3.2 Expansions

- 15.1.8.4 MnM view

- 15.1.9 UFLEX LIMITED

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Product launches

- 15.1.9.3.2 Deals

- 15.1.9.4 MnM view

- 15.1.10 BISCHOF+KLEIN SE & CO. KG

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Deals

- 15.1.10.3.2 Expansions

- 15.1.10.4 MnM view

- 15.1.1 AMCOR PLC

- 15.2 OTHER PLAYERS

- 15.2.1 PROAMPAC

- 15.2.2 NOVOLEX

- 15.2.3 SILAFRICA

- 15.2.4 PPC FLEX COMPANY, INC.

- 15.2.5 PRINTPACK

- 15.2.6 NOVUS HOLDINGS LTD.

- 15.2.7 AHLSTROM

- 15.2.8 WIHURI GROUP

- 15.2.9 C-P FLEXIBLE PACKAGING

- 15.2.10 COSMO FILMS

- 15.2.11 GUALA PACK S.P.A.

- 15.2.12 EPAC HOLDINGS, LLC.

16 RESEARCH METHODOLOGY

- 16.1 RESEARCH DATA

- 16.2 SECONDARY DATA

- 16.2.1 KEY DATA FROM SECONDARY SOURCES

- 16.3 PRIMARY DATA

- 16.3.1 KEY DATA FROM PRIMARY SOURCES

- 16.4 MARKET SIZE ESTIMATION

- 16.5 DATA TRIANGULATION

- 16.6 RESEARCH ASSUMPTIONS

- 16.7 RISK ASSESSMENT

- 16.8 GROWTH RATE ASSUMPTIONS

17 ADJACENT & RELATED MARKET

- 17.1 INTRODUCTION

- 17.2 LIMITATIONS

- 17.2.1 FLEXIBLE PLASTIC PACKAGING MARKET

- 17.2.1.1 Market definition

- 17.2.1.2 Market overview

- 17.2.1.3 Flexible plastic packaging market, by material

- 17.2.1.4 Flexible plastic packaging market, by packaging type

- 17.2.1.5 Flexible plastic packaging market, by printing technology

- 17.2.1.6 Flexible plastic packaging market, by application

- 17.2.1.7 Flexible plastic packaging market, by region

- 17.2.2 POLYPLEX CORPORATION LTD.

- 17.2.3 GLENROY, INC.

- 17.2.4 ATHAR PACKAGING SOLUTIONS PVT. LTD.

- 17.2.1 FLEXIBLE PLASTIC PACKAGING MARKET

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS

List of Tables

- TABLE 1 PACKAGE COMPARISON

- TABLE 2 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS IN FLEXIBLE PACKAGING

- TABLE 4 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS IN FLEXIBLE PACKAGING

- TABLE 5 UNMET NEEDS IN FLEXIBLE PACKAGING MARKET BY END-USE INDUSTRY

- TABLE 6 GLOBAL GDP GROWTH PROJECTION, 2021-2028 (USD TRILLION)

- TABLE 7 ROLE OF COMPANIES IN FLEXIBLE PACKAGING MARKET ECOSYSTEM

- TABLE 8 AVERAGE SELLING PRICE TREND OF FLEXIBLE PACKAGING OFFERED BY KEY PLAYERS, BY TYPE, 2024 (USD/KG)

- TABLE 9 AVERAGE SELLING PRICE TREND OF FLEXIBLE PACKAGING, BY REGION, 2024-2030 (USD/KG)

- TABLE 10 IMPORT DATA RELATED TO HS CODE 3920, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 EXPORT DATA RELATED TO HS CODE 3920, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 IMPORT DATA RELATED TO HS CODE 48, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 13 EXPORT DATA RELATED TO HS CODE 48, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 14 FLEXIBLE PACKAGING MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 FLEXIBLE PACKAGING MARKET: LIST OF MAJOR PATENTS: 2024

- TABLE 16 TOP USE CASES AND MARKET POTENTIAL

- TABLE 17 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 18 FLEXIBLE PACKAGING MARKET: CASE STUDIES RELATED TO GEN AI IMPLEMENTATION

- TABLE 19 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 GLOBAL INDUSTRY STANDARDS IN FLEXIBLE PACKAGING MARKET

- TABLE 25 CERTIFICATIONS, LABELING, ECO-STANDARDS IN THE FLEXIBLE PACKAGING MARKET

- TABLE 26 FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 27 FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 28 FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 29 FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 30 FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 31 FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 32 FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 33 FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 35 FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 36 FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 37 FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 38 FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 39 FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 40 FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 41 FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 42 FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 43 FLEXIBLE PACKAGING MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 44 FLEXIBLE PACKAGING MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 45 FLEXIBLE PACKAGING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 46 FLEXIBLE PACKAGING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 47 NORTH AMERICA: FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 48 NORTH AMERICA: FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 49 NORTH AMERICA: FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 50 NORTH AMERICA: FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 51 NORTH AMERICA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 52 NORTH AMERICA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 53 NORTH AMERICA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 54 NORTH AMERICA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 55 NORTH AMERICA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 56 NORTH AMERICA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 57 NORTH AMERICA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 58 NORTH AMERICA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 59 NORTH AMERICA: FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 60 NORTH AMERICA: FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 61 NORTH AMERICA: FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 62 NORTH AMERICA: FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 64 NORTH AMERICA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 65 NORTH AMERICA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 66 NORTH AMERICA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 67 US: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 68 US: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 69 US: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 70 US: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 71 US: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 72 US: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 73 US: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 74 US: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 75 US: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 76 US: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 77 US: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 78 US: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 79 CANADA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 80 CANADA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 81 CANADA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 82 CANADA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 83 CANADA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 84 CANADA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 85 CANADA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 86 CANADA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 87 CANADA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 88 CANADA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 89 CANADA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 90 CANADA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 91 MEXICO: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 92 MEXICO: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 93 MEXICO: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 94 MEXICO: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 95 MEXICO: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 96 MEXICO: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 97 MEXICO: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 98 MEXICO: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 99 MEXICO: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 100 MEXICO: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 101 MEXICO: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 102 MEXICO: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 103 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 104 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 105 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 106 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 107 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 108 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 109 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 110 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 111 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 112 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 113 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 114 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 115 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 116 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 117 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 118 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 120 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 121 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 122 ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 123 CHINA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 124 CHINA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 125 CHINA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 126 CHINA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 127 CHINA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 128 CHINA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 129 CHINA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 130 CHINA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 131 CHINA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 132 CHINA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 133 CHINA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 134 CHINA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 135 INDIA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 136 INDIA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 137 INDIA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 138 INDIA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 139 INDIA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 140 INDIA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 141 INDIA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 142 INDIA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 143 INDIA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 144 INDIA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 145 INDIA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 146 INDIA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 147 JAPAN: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 148 JAPAN: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 149 JAPAN: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 150 JAPAN: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 151 JAPAN: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 152 JAPAN: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 153 JAPAN: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 154 JAPAN: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 155 JAPAN: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 156 JAPAN: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 157 JAPAN: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 158 JAPAN: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 159 SOUTH KOREA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 160 SOUTH KOREA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 161 SOUTH KOREA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 162 SOUTH KOREA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 163 SOUTH KOREA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 164 SOUTH KOREA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 165 SOUTH KOREA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 166 SOUTH KOREA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 167 SOUTH KOREA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 168 SOUTH KOREA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 169 SOUTH KOREA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 170 SOUTH KOREA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 172 REST OF ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 173 REST OF ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 174 REST OF ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 175 REST OF ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 176 REST OF ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 177 REST OF ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 178 REST OF ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 179 REST OF ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 180 REST OF ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 181 REST OF ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 182 REST OF ASIA PACIFIC: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 183 EUROPE: FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 184 EUROPE: FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 185 EUROPE: FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 186 EUROPE: FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 187 EUROPE: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 188 EUROPE: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 189 EUROPE: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 190 EUROPE: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 191 EUROPE: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 192 EUROPE: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 193 EUROPE: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 194 EUROPE: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 195 EUROPE: FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 196 EUROPE: FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 197 EUROPE: FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 198 EUROPE: FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 199 EUROPE: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 200 EUROPE: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 201 EUROPE: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 202 EUROPE: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 203 GERMANY: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 204 GERMANY: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 205 GERMANY: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 206 GERMANY: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 207 GERMANY: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 208 GERMANY: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 209 GERMANY: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 210 GERMANY: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 211 GERMANY: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 212 GERMANY: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 213 GERMANY: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 214 GERMANY: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 215 UK: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 216 UK: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 217 UK: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 218 UK: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 219 UK: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 220 UK: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 221 UK: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 222 UK: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 223 UK: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 224 UK: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 225 UK: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 226 UK: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 227 FRANCE: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 228 FRANCE: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 229 FRANCE: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 230 FRANCE: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 231 FRANCE: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 232 FRANCE: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 233 FRANCE: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 234 FRANCE: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 235 FRANCE: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 236 FRANCE: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 237 FRANCE: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 238 FRANCE: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 239 RUSSIA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 240 RUSSIA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 241 RUSSIA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 242 RUSSIA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 243 RUSSIA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 244 RUSSIA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 245 RUSSIA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 246 RUSSIA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 247 RUSSIA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 248 RUSSIA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 249 RUSSIA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 250 RUSSIA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 251 SPAIN: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 252 SPAIN: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 253 SPAIN: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 254 SPAIN: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 255 SPAIN: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 256 SPAIN: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 257 SPAIN: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 258 SPAIN: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 259 SPAIN: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 260 SPAIN: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 261 SPAIN: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 262 SPAIN: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 263 ITALY: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 264 ITALY: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 265 ITALY: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 266 ITALY: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 267 ITALY: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 268 ITALY: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 269 ITALY: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 270 ITALY: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 271 ITALY: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 272 ITALY: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 273 ITALY: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 274 ITALY: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 275 REST OF EUROPE: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 276 REST OF EUROPE: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 277 REST OF EUROPE: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 278 REST OF EUROPE: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 279 REST OF EUROPE: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 280 REST OF EUROPE: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 281 REST OF EUROPE: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 282 REST OF EUROPE: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 283 REST OF EUROPE: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 284 REST OF EUROPE: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 285 REST OF EUROPE: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 286 REST OF EUROPE: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 287 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 288 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 289 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 290 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 291 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 292 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 293 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 294 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 295 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 296 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 297 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 298 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 299 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 300 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 301 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 302 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 303 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 304 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 305 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 306 SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 307 BRAZIL: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 308 BRAZIL: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 309 BRAZIL: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 310 BRAZIL: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 311 BRAZIL: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 312 BRAZIL: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 313 BRAZIL: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 314 BRAZIL: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 315 BRAZIL: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 316 BRAZIL: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 317 BRAZIL: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 318 BRAZIL: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 319 ARGENTINA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 320 ARGENTINA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 321 ARGENTINA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 322 ARGENTINA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 323 ARGENTINA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 324 ARGENTINA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 325 ARGENTINA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 326 ARGENTINA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 327 ARGENTINA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 328 ARGENTINA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 329 ARGENTINA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 330 ARGENTINA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 331 CHILE: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 332 CHILE: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 333 CHILE: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 334 CHILE: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 335 CHILE: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 336 CHILE: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 337 CHILE: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 338 CHILE: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 339 CHILE: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 340 CHILE: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 341 CHILE: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 342 CHILE: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 343 REST OF SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 344 REST OF SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 345 REST OF SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 346 REST OF SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 347 REST OF SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 348 REST OF SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 349 REST OF SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 350 REST OF SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 351 REST OF SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 352 REST OF SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 353 REST OF SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 354 REST OF SOUTH AMERICA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 355 MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 356 MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 357 MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 358 MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 359 MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 360 MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 361 MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 362 MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 363 MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 364 MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 365 MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 366 MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 367 MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 368 MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 369 MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 370 MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 371 MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 372 MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 373 MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 374 MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 375 GCC COUNTRIES: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 376 GCC COUNTRIES: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 377 GCC COUNTRIES: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 378 GCC COUNTRIES: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 379 GCC COUNTRIES: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 380 GCC COUNTRIES: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 381 GCC COUNTRIES: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 382 GCC COUNTRIES: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 383 GCC COUNTRIES: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 384 GCC COUNTRIES: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 385 GCC COUNTRIES: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 386 GCC COUNTRIES: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 387 SAUDI ARABIA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 388 SAUDI ARABIA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 389 SAUDI ARABIA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 390 SAUDI ARABIA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 391 SAUDI ARABIA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 392 SAUDI ARABIA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 393 SAUDI ARABIA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 394 SAUDI ARABIA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 395 SAUDI ARABIA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 396 SAUDI ARABIA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 397 SAUDI ARABIA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 398 SAUDI ARABIA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 399 UAE: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 400 UAE: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 401 UAE: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 402 UAE: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 403 UAE: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 404 UAE: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 405 UAE: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 406 UAE: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 407 UAE: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 408 UAE: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 409 UAE: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 410 UAE: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 411 REST OF GCC COUNTRIES: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 412 REST OF GCC COUNTRIES: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 413 REST OF GCC COUNTRIES: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 414 REST OF GCC COUNTRIES: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 415 REST OF GCC COUNTRIES: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 416 REST OF GCC COUNTRIES: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 417 REST OF GCC COUNTRIES: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 418 REST OF GCC COUNTRIES: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 419 REST OF GCC COUNTRIES: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 420 REST OF GCC COUNTRIES: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 421 REST OF GCC COUNTRIES: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 422 REST OF GCC COUNTRIES: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 423 SOUTH AFRICA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 424 SOUTH AFRICA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 425 SOUTH AFRICA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 426 SOUTH AFRICA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 427 SOUTH AFRICA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 428 SOUTH AFRICA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 429 SOUTH AFRICA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 430 SOUTH AFRICA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 431 SOUTH AFRICA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 432 SOUTH AFRICA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 433 SOUTH AFRICA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 434 SOUTH AFRICA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 435 REST OF MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 436 REST OF MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (KILOTON)

- TABLE 437 REST OF MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 438 REST OF MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 439 REST OF MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 440 REST OF MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 441 REST OF MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 442 REST OF MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 443 REST OF MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 444 REST OF MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 445 REST OF MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 446 REST OF MIDDLE EAST & AFRICA: FLEXIBLE PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 447 FLEXIBLE PACKAGING MARKET: OVERVIEW OF STRATEGIES ADOPTED BY MARKET PLAYERS BETWEEN JANUARY 2021 AND SEPTEMBER 2025

- TABLE 448 FLEXIBLE PACKAGING MARKET: DEGREE OF COMPETITION

- TABLE 449 FLEXIBLE PACKAGING MARKET: REGION FOOTPRINT

- TABLE 450 FLEXIBLE PACKAGING MARKET: PACKAGING TYPE FOOTPRINT

- TABLE 451 FLEXIBLE PACKAGING MARKET: APPLICATION FOOTPRINT

- TABLE 452 FLEXIBLE PACKAGING MARKET: MATERIAL FOOTPRINT

- TABLE 453 FLEXIBLE PACKAGING MARKET: PRINTING TECHNOLOGY FOOTPRINT

- TABLE 454 FLEXIBLE PACKAGING MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 455 FLEXIBLE PACKAGING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 456 FLEXIBLE PACKAGING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 457 FLEXIBLE PACKAGING MARKET: PRODUCT LAUNCHES, JANUARY 2021- AUGUST 2025

- TABLE 458 FLEXIBLE PACKAGING MARKET: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 459 FLEXIBLE PACKAGING MARKET: EXPANSIONS, JANUARY 2021-AUGUST 2025

- TABLE 460 AMCOR PLC: COMPANY OVERVIEW

- TABLE 461 AMCOR PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 462 AMCOR PLC: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 463 AMCOR PLC: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 464 AMCOR PLC: EXPANSIONS, JANUARY 2021-AUGUST 2025

- TABLE 465 SMURFIT WESTROCK: BUSINESS OVERVIEW

- TABLE 466 SMURFIT WESTROCK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 467 SMURFIT WESTROCK: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 468 SMURFIT WESTROCK: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 469 SMURFIT WESTROCK: EXPANSIONS, JANUARY 2021-AUGUST 2025

- TABLE 470 MONDI: COMPANY OVERVIEW

- TABLE 471 MONDI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 472 MONDI: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 473 MONDI GROUP: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 474 MONDI: EXPANSIONS, JANUARY 2021-AUGUST 2025

- TABLE 475 TOPPAN HOLDINGS INC.: COMPANY OVERVIEW

- TABLE 476 TOPPAN HOLDINGS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 477 TOPPAN HOLDINGS INC.: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 478 TOPPAN HOLDINGS INC.: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 479 TOPPAN HOLDINGS INC.: EXPANSIONS, JANUARY 2021-AUGUST 2025

- TABLE 480 SEALED AIR: COMPANY OVERVIEW

- TABLE 481 SEALED AIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 482 SEALED AIR: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 483 SEALED AIR: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 484 SEALED AIR: EXPANSIONS, JANUARY 2021-AUGUST 2025

- TABLE 485 HUHTAMAKI: COMPANY OVERVIEW

- TABLE 486 HUHTAMAKI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 487 HUHTAMAKI: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 488 HUHTAMAKI: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 489 HUHTAMAKI: EXPANSIONS, JANUARY 2021-AUGUST 2025

- TABLE 490 CONSTANTIA FLEXIBLES: COMPANY OVERVIEW

- TABLE 491 CONSTANTIA FLEXIBLES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 492 CONSTANTIA FLEXIBLES: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 493 CONSTANTIA FLEXIBLES: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 494 CONSTANTIA FLEXIBLES: EXPANSIONS, JANUARY 2021-AUGUST 2025

- TABLE 495 TRANSCONTINENTAL INC.: COMPANY OVERVIEW

- TABLE 496 TRANSCONTINENTAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 497 TRANSCONTINENTAL INC.: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 498 TRANSCONTINENTAL INC.: EXPANSIONS, JANUARY 2021-AUGUST 2025

- TABLE 499 UFLEX LIMITED: COMPANY OVERVIEW

- TABLE 500 UFLEX LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 501 UFLEX LIMITED: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 502 UFLEX LIMITED: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 503 BISCHOF+KLEIN SE & CO. KG: COMPANY OVERVIEW

- TABLE 504 BISCHOF+KLEIN SE & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 505 BISCHOF+KLEIN SE & CO. KG: PRODUCT LAUNCHES, JANUARY 2021- AUGUST 2025

- TABLE 506 BISCHOF+KLEIN SE & CO. KG: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 507 BISCHOF + KLEIN SE & CO. KG: EXPANSIONS, JANUARY 2021-AUGUST 2025

- TABLE 508 PROAMPAC: COMPANY OVERVIEW

- TABLE 509 NOVOLEX: COMPANY OVERVIEW

- TABLE 510 SILAFRICA: COMPANY OVERVIEW

- TABLE 511 PPC FLEX COMPANY, INC.: COMPANY OVERVIEW

- TABLE 512 PRINTPACK: COMPANY OVERVIEW

- TABLE 513 NOVUS HOLDINGS LTD.: COMPANY OVERVIEW

- TABLE 514 AHLSTROM: COMPANY OVERVIEW

- TABLE 515 WIHURI GROUP: COMPANY OVERVIEW

- TABLE 516 C-P FLEXIBLE PACKAGING: COMPANY OVERVIEW

- TABLE 517 COSMO FILMS: COMPANY OVERVIEW

- TABLE 518 GUALA PACK S.P.A.: COMPANY OVERVIEW

- TABLE 519 EPAC HOLDINGS, LLC.: COMPANY OVERVIEW

- TABLE 520 FLEXIBLE PLASTIC PACKAGING MARKET, BY MATERIAL, 2020-2022 (USD MILLION)

- TABLE 521 FLEXIBLE PLASTIC PACKAGING MARKET, BY MATERIAL, 2023-2029 (USD MILLION)

- TABLE 522 FLEXIBLE PLASTIC PACKAGING MARKET, BY MATERIAL, 2020-2022 (KILOTON)

- TABLE 523 FLEXIBLE PLASTIC PACKAGING MARKET, BY MATERIAL, 2023-2029 (KILOTON)

- TABLE 524 FLEXIBLE PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2022 (USD MILLION)

- TABLE 525 FLEXIBLE PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2023-2029 (USD MILLION)

- TABLE 526 FLEXIBLE PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2022 (KILOTON)

- TABLE 527 FLEXIBLE PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2023-2029 (KILOTON)