|

市場調查報告書

商品編碼

1910841

歐洲瓷磚市場:市場佔有率分析、行業趨勢、統計數據和成長預測(2026-2031 年)Europe Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

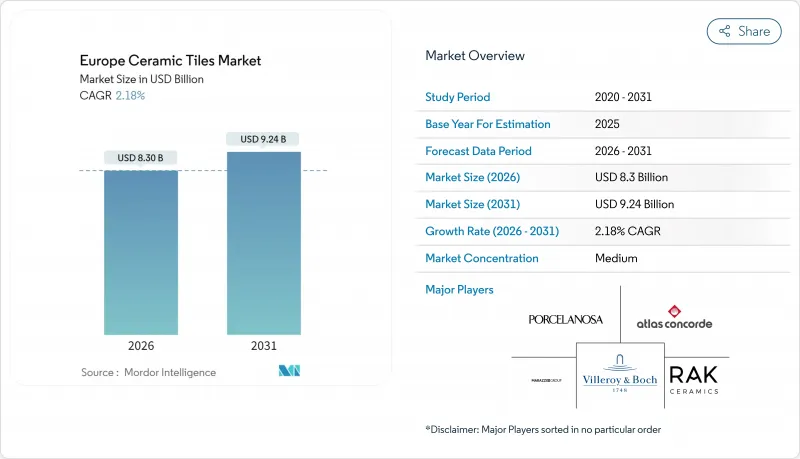

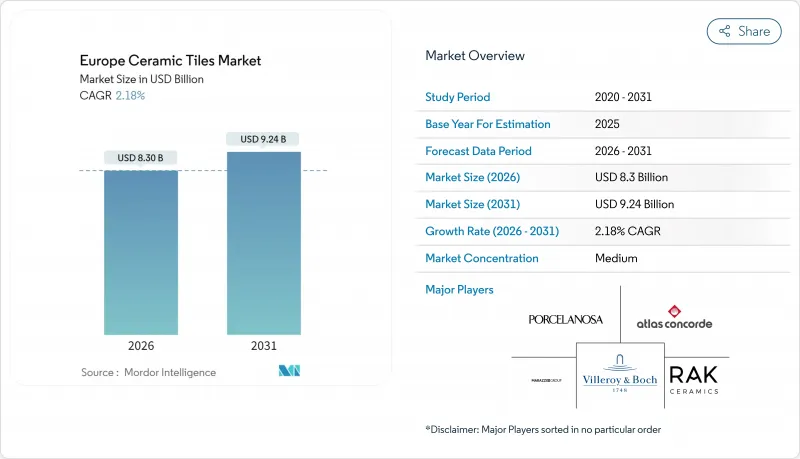

預計到 2026 年,歐洲瓷磚市場規模將達到 83 億美元,從 2025 年的 81.2 億美元成長到 2031 年的 92.4 億美元,2026 年至 2031 年的複合年成長率為 2.18%。

當前市場需求環境保持穩定,疫情後的維修支出、歐盟資助的維修補貼以及中東歐地區持續的都市化抵消了不斷上漲的能源和碳排放合規成本。大型製造商正在對其窯爐進行現代化改造,以降低天然氣價格波動的風險;同時,原始設備製造商(OEM)正優先考慮抗菌和低揮發性有機化合物(VOC)的表面處理,以符合綠色建築認證標準。數位化銷售管道正在加速發展,而專業零售商則透過提供商店設計服務和專家安裝支援來維持其市場地位。能夠迅速調整生產線以提高能源效率並符合環境、社會和治理(ESG)揭露要求的製造商,將更有可能保持利潤率並贏得公共部門的翻新合約。

歐洲瓷磚市場趨勢與洞察

新冠疫情後獎勵策略引發了一波快速的住宅翻維修。

歐洲家庭已將原本用於旅行和娛樂的預算轉向住宅維修,這一趨勢使得房屋維修需求在2025年之前保持高位。復甦與韌性基金每年向房屋維修注入約900億歐元,確保瓷磚供應商訂單穩定。高品質陶瓷瓷磚受益最大,因為住宅在廚房和浴室裝修中優先考慮瓷磚的耐用性和自然美觀。德國、法國和荷蘭的房屋維修活動尤其顯著,儘管貨幣政策緊縮,但這些國家的居民可支配所得水準依然較高。然而,從2026年起,不斷上漲的抵押房屋抵押貸款利率和消費價格可能會減緩非必需性房屋維修的步伐。

節能窯爐可降低生產成本

新一代窯爐配備高速燃燒器和餘熱回收系統,可將燃氣消費量降低高達 50%,從而提高企業在能源市場波動期間的 EBITDA 抗風險能力。義大利和西班牙的叢集正主導這一趨勢,預計到 2024 年,將有 28 家製造商投入運作熱電聯產裝置。歐洲投資銀行向 Panaria 集團提供的 5,000 萬歐元貸款表明,脫碳目標與成本競爭力之間的政策契合度很高。實現兩位數排放的生產商將有資格獲得歐盟排放權交易體系配額,並在公共競標的資格預審中獲得聲譽優勢。從長遠來看,窯爐維修可望縮小歐洲與土耳其/亞洲競爭對手之間的可變成本差距。

天然氣價格波動

天然氣約佔生產成本的30%,2024年現貨價格波動迫使多家生產商運作數週。投入成本的波動使長期供應合約變得複雜,並促使下游批發商從亞洲進口多元化。擁有避險計畫和自備可再生能源的公司表現相對較好,但價格轉嫁機制在對價格敏感的維修細分市場僅部分奏效。這次能源衝擊暴露了歐洲瓷磚市場易受地緣政治風險影響的脆弱性,並凸顯了燒製線可再生能源電氣化的迫切性。儘管隨著天然氣蘊藏量恢復正常,短期內情況有所緩解,但預計在氫氣窯得到更廣泛應用之前,波動風險仍將持續存在。

細分市場分析

瓷質磚因其耐凍性和低於1%的吸水率,適用於室內外環境,截至2025年,其在歐洲瓷磚市場佔46.75%的佔有率。馬賽克瓷磚雖然供應仍然有限,但由於高階衛浴和廚房維修中對複雜圖案和大膽配色的偏愛,預計到2031年將以2.58%的複合年成長率成長。釉藥瓷磚用於中檔翻新項目,而無釉瓷磚則因其防滑性能,在工業地面和交通樞紐等場所仍然備受歡迎。受木紋和石紋瓷磚作為木材和大理石替代品的美學吸引力推動,預計到2031年,歐洲瓷磚市場規模將超過42.8億美元。高階供應商正透過「透明著色」、「邊緣修整」和薄磚技術來降低運輸重量,同時又不犧牲耐用性,從而實現差異化競爭。

馬賽克製造仍然是資本密集型產業,玻璃網背襯和手工鋪設工序增加了工時,但單位利潤率彌補了產量小規模。設計師通常會為飯店大廳和水療中心指定使用馬賽克,客製化的幾何圖案能夠提升物業價值。自動化技術的進步,例如機器人鑲嵌,正在逐步降低每平方公尺的成本,為中端市場開闢了新的機會。永續性意識的建築師也優先考慮使用由回收玻璃和陶瓷碎片製成的馬賽克,並將循環經濟原則融入計劃提案中。總體而言,產品差異化可能會使歐洲瓷磚市場保持分散化,但對於那些擁有強大品牌知名度和專業技術的公司來說,它仍然盈利。

預計到2025年,地板材料鋪設將佔歐洲瓷磚市場規模的59.45%,主要得益於瓷磚的使用壽命長,且在高人流量區域經久耐用。商業地產業主選擇瓷磚,是因為其終身維修成本低於複合地板和地毯,從而增強了瓷磚市場的基準銷售穩定性。儘管該細分市場的複合年成長率不高,但其龐大的銷售量確保了它將繼續為瓷磚製造商帶來可觀的收入。耐冰擠壓瓷磚在北歐庭院和阿爾卑斯山滑雪勝地擁有一定的市場佔有率,並形成了季節性的需求高峰。連續噴墨數位印刷技術帶來的更高逼真度,使地板磁磚成為比採石場石材更經濟實惠的選擇。

牆面應用雖然目前規模仍較小,但預計到2031年將以2.59%的複合年成長率成長,這主要得益於抗菌釉藥和可打造無縫視覺效果的大尺寸瓷磚。醫院和住宿設施對抗菌表面的需求日益成長,例如Panaria集團的PROTECT系列,該系列可抑制99.9%的細菌滋生。 120 x 278公分的大尺寸磁磚可縮短安裝時間,並減少可能滋生病原體的接縫-這些特性符合後疫情時代的設計要求。輕薄的磁磚可以直接鋪設在現有表面上,避免拆除產生的廢棄物,並減少維修停工時間。因此,牆面應用是整個歐洲瓷磚市場的策略成長領域。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 感染疾病應對措施後,住宅維修熱潮迅速擴大

- 節能窯爐可降低生產成本

- 歐盟「翻新浪潮」政策津貼

- 綠建築認證實施情形

- 中歐和東歐的都市化推動了對多用戶住宅的需求。

- 過渡到抗菌抗病毒表面瓷磚

- 市場限制

- 天然氣價格波動

- 歐盟排放交易體系(EU ETS)導致熔爐碳成本增加

- LVT和SPC地板更換

- 西歐建設產業人手不足

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 洞察市場最新趨勢與創新

- 深入了解近期產業發展動態(新產品發布、策略性舉措、投資、合作、合資、擴張、併購等)

第5章 市場規模及成長預測(金額:美元)

- 依產品類型

- 陶瓷瓷磚

- 釉藥磁磚

- 無釉陶瓷磚

- 馬賽克瓷磚

- 其他(裝飾瓷磚、圖案瓷磚、手工瓷磚)

- 透過使用

- 地面

- 牆

- 屋頂材料

- 最終用戶

- 住宅

- 商業的

- 飯店業(飯店、度假村)

- 零售空間

- 辦公室和公共機構

- 衛生保健

- 教育設施

- 交通樞紐(機場、捷運、客運站)

- 其他商業用戶

- 依建築類型

- 新建工程

- 維修和更換

- 透過分銷管道

- 磁磚和石材專賣店

- 居家裝潢和DIY專賣店

- 線上零售

- 直接向承包商銷售

- 按地區

- 德國

- 義大利

- 西班牙

- 法國

- 英國

- 波蘭

- 比荷盧經濟聯盟(比利時、荷蘭、盧森堡)

- 北歐國家(丹麥、芬蘭、冰島、挪威、瑞典)

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Marazzi Group Srl

- Porcelanosa Grupo

- RAK Ceramics

- Ceramiche Atlas Concorde

- Villeroy & Boch

- Grupo STN

- Novoceram(Panaria)

- Tau Ceramica

- Iris Ceramica Group

- Gruppo Concorde

- ABK Group

- Emilgroup

- Florim

- Pamesa Ceramica

- Keraben Grupo

- Lasselsberger(Rako)

- Kajaria Ceramics(EU subsidiaries)

- Mohawk Industries(Dal-Tile Europe)

- Levantina

- Gigacer

第7章 市場機會與未來展望

Europe ceramic tiles market size in 2026 is estimated at USD 8.3 billion, growing from 2025 value of USD 8.12 billion with 2031 projections showing USD 9.24 billion, growing at 2.18% CAGR over 2026-2031.

The current demand environment remains stable because post-pandemic renovation spending, EU-funded retrofit grants and steady urbanization in Central and Eastern Europe counterbalance higher energy and carbon-compliance costs. Large producers mitigate volatile natural-gas prices through kiln modernizations, while OEMs emphasize antibacterial and low-VOC surfaces that align with green-building certification criteria. Digital sales channels accelerate, yet specialty retailers keep traction by offering in-store design services and professional installation support. Manufacturers that quickly adapt production lines for energy efficiency and ESG disclosure have clearer paths to preserve margins and secure public-sector renovation contracts.

Europe Ceramic Tiles Market Trends and Insights

Rapid Residential Renovation Wave Post-COVID Stimulus

European households redirected unspent travel and entertainment budgets toward home upgrades, and that behavior kept renovation volumes elevated through 2025. The Recovery and Resilience Facility channels close to EUR 90 billion per year into building upgrades, ensuring steady order inflows for tile suppliers. Premium porcelain formats benefit most as homeowners prioritize longevity and natural-look aesthetics in kitchens and bathrooms. Renovation activity is especially pronounced in Germany, France and the Netherlands, where disposable income levels remain supportive despite tighter monetary policy. Nevertheless, higher mortgage rates and consumer inflation could temper the pace of discretionary remodeling from 2026.

Energy-Efficient Kilns Lowering Production Cost

Next-generation kilns equipped with high-speed burners and waste-heat recovery reduce gas consumption by as much as 50% and improve EBITDA resilience when energy markets spike. Italian and Spanish clusters lead adoption, with 28 manufacturers operating combined-heat-and-power units by 2024. The European Investment Bank's EUR 50 million loan to Panariagroup underscores policy alignment between decarbonization goals and cost competitiveness. Producers achieving double-digit emission reductions earn EU ETS allowances and build reputational advantages that aid in public tender pre-qualification. Over the long term, kiln retrofits are expected to narrow variable-cost gaps between European and Turkish or Asian competitors.

Volatile Natural-Gas Prices

Natural-gas represents roughly 30% of production cost, and 2024 spot-price swings forced several producers to idle kilns for weeks. Input-cost volatility complicates long-term supply contracts, encouraging downstream wholesalers to diversify toward Asian imports. Firms with hedging programs or captive renewable power have fared better, yet pass-through pricing remains only partially effective in price-sensitive renovation sub-segments. The energy shock showcased Europe ceramic tiles market exposure to geopolitical risk and underlined the urgency of renewable electrification in firing lines. Short-term relief is visible as gas storage levels normalize, although volatility risks persist until hydrogen-ready kilns scale.

Other drivers and restraints analyzed in the detailed report include:

- EU "Renovation Wave" Policy Grants

- Green Building Certification Uptake

- Tightening EU ETS Carbon Costs on Kilns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Porcelain tiles retained 46.75% share of the Europe ceramic tiles market in 2025 owing to frost resistance and sub-1% water absorption that suit indoor and outdoor environments. Mosaic formats, although volume-light, are projected to clock a 2.58% CAGR through 2031 because luxury bathroom and kitchen remodels favor intricate patterns and bold colorways. Glazed ceramic serves mid-price refurbishment jobs, while unglazed tiles keep traction in factory floors and transit hubs that demand slip resistance. The Europe ceramic tiles market size for porcelain is expected to exceed USD 4.28 billion by 2031, supported by wood-look and stone-look aesthetics that displace timber and marble. Premium suppliers differentiate via through-body pigmentation, rectified edges and thin-tile technologies that reduce shipping weight without sacrificing durability.

Mosaic manufacturing remains capital-intensive because glass-mesh backing and hand-placement steps add labor hours, yet unit margins compensate for modest volumes. Designers specify mosaics for hotel lobbies and spa facilities where bespoke geometry raises perceived property value. Automation advances such as robotic tesserae placement are gradually lowering cost per square meter, opening mid-market opportunities. Sustainability-minded architects also privilege mosaics that upcycle waste glass or porcelain shards, integrating circular-economy narratives into project bids. Overall, product differentiation will keep the Europe ceramic tiles market fragmented but profitable for firms with brand equity and specialized capability.

Floor installations captured 59.45% of the Europe ceramic tiles market size in 2025, underpinned by long replacement cycles and durability in high-traffic zones. Commercial landlords choose porcelain slabs to cut lifetime maintenance costs versus laminate or carpet, reinforcing baseline volume stability. The segment's CAGR is muted, yet shear volume ensures it remains a revenue bedrock for kiln operators. Ice-resistant extruded tiles also hold niche appeal in Nordic patios and alpine ski resorts, adding seasonal peaks to demand. Continuous-inkjet digital printing enhances realism, making floor tiles an affordable alternative to quarried stone.

Wall applications, while smaller, are forecast to expand at a 2.59% CAGR through 2031 due to germ-resistant glazes and large-format panels that create seamless visuals. Hospitals and hospitality venues increasingly request antimicrobial surfaces such as Panariagroup's PROTECT line, which inhibits 99.9% of bacterial colonization. Large 120 X 278 cm tiles shorten installation times and reduce grout lines that can harbor pathogens, attractive traits in post-pandemic design briefs. Lightweight slim panels also enable direct-to-existing-surface installation, avoiding demolition waste and lowering renovation downtime. Consequently, wall applications represent a strategic growth vector within the wider Europe ceramic tiles market.

The Europe Ceramic Tiles Market Report is Segmented by Product Type (Porcelain Tiles, Glazed Ceramic Tiles, and More), Application (Floor, Wall, Roofing), End-User (Residential, Commercial), Construction Type (New Construction, Renovation and Replacement), Distribution Channel (Specialty Tile & Stone Stores, and More), and Geography (Germany, Italy, Spain, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Marazzi Group S.r.l

- Porcelanosa Grupo

- RAK Ceramics

- Ceramiche Atlas Concorde

- Villeroy & Boch

- Grupo STN

- Novoceram (Panaria)

- Tau Ceramica

- Iris Ceramica Group

- Gruppo Concorde

- ABK Group

- Emilgroup

- Florim

- Pamesa Ceramica

- Keraben Grupo

- Lasselsberger (Rako)

- Kajaria Ceramics (EU subsidiaries)

- Mohawk Industries (Dal-Tile Europe)

- Levantina

- Gigacer

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid residential renovation wave post-COVID stimulus

- 4.2.2 Energy-efficient kilns lowering production cost

- 4.2.3 EU "Renovation Wave" policy grants

- 4.2.4 Green Building certification uptake

- 4.2.5 Urbanisation in CEE boosting multi-family housing

- 4.2.6 Shift to antibacterial & antiviral surface tiles

- 4.3 Market Restraints

- 4.3.1 Volatile natural-gas prices

- 4.3.2 Tightening EU ETS carbon costs on kilns

- 4.3.3 Substitution by LVT & SPC flooring

- 4.3.4 Labour shortages in Western Europe construction

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Industry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Porcelain Tiles

- 5.1.2 Glazed Ceramic Tiles

- 5.1.3 Unglazed Ceramic Tiles

- 5.1.4 Mosaic Tiles

- 5.1.5 Others (Decorative, Patterned, Handmade)

- 5.2 By Application

- 5.2.1 Floor

- 5.2.2 Wall

- 5.2.3 Roofing

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.2.1 Hospitality (Hotels, Resorts)

- 5.3.2.2 Retail Spaces

- 5.3.2.3 Offices & Institutions

- 5.3.2.4 Healthcare

- 5.3.2.5 Educational Facilities

- 5.3.2.6 Transport Hubs (Airports, Metro, Bus Terminals)

- 5.3.2.7 Other Commercial Users

- 5.4 By Construction Type

- 5.4.1 New Construction

- 5.4.2 Renovation and Replacement

- 5.5 By Distribution Channel

- 5.5.1 Specialty Tile & Stone Stores

- 5.5.2 Home Improvement & DIY Stores

- 5.5.3 Online Retail

- 5.5.4 Direct Sales to Contractors

- 5.6 By Geography

- 5.6.1 Germany

- 5.6.2 Italy

- 5.6.3 Spain

- 5.6.4 France

- 5.6.5 United Kingdom

- 5.6.6 Poland

- 5.6.7 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.6.8 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.6.9 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Marazzi Group S.r.l

- 6.4.2 Porcelanosa Grupo

- 6.4.3 RAK Ceramics

- 6.4.4 Ceramiche Atlas Concorde

- 6.4.5 Villeroy & Boch

- 6.4.6 Grupo STN

- 6.4.7 Novoceram (Panaria)

- 6.4.8 Tau Ceramica

- 6.4.9 Iris Ceramica Group

- 6.4.10 Gruppo Concorde

- 6.4.11 ABK Group

- 6.4.12 Emilgroup

- 6.4.13 Florim

- 6.4.14 Pamesa Ceramica

- 6.4.15 Keraben Grupo

- 6.4.16 Lasselsberger (Rako)

- 6.4.17 Kajaria Ceramics (EU subsidiaries)

- 6.4.18 Mohawk Industries (Dal-Tile Europe)

- 6.4.19 Levantina

- 6.4.20 Gigacer

7 Market Opportunities & Future Outlook

- 7.1 Advances in Self-Cleaning Photocatalytic Coatings for Tiles

- 7.2 Circular Economy Initiatives: Tile Take-Back and Recycling Schemes