|

市場調查報告書

商品編碼

1910587

印尼陶瓷磚市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Indonesia Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

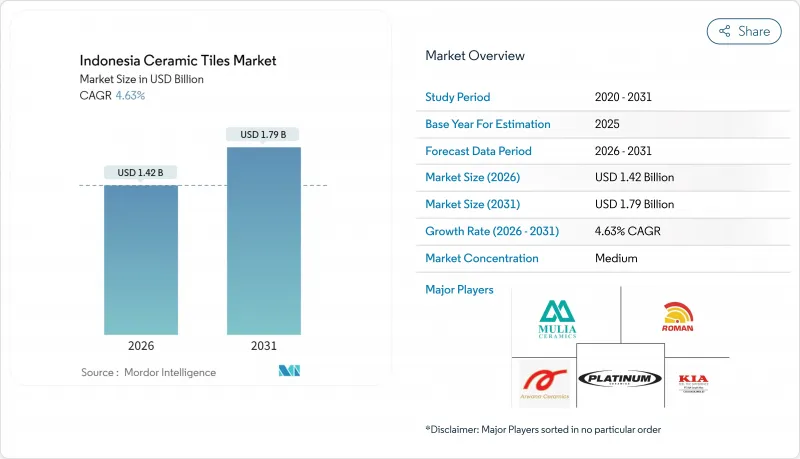

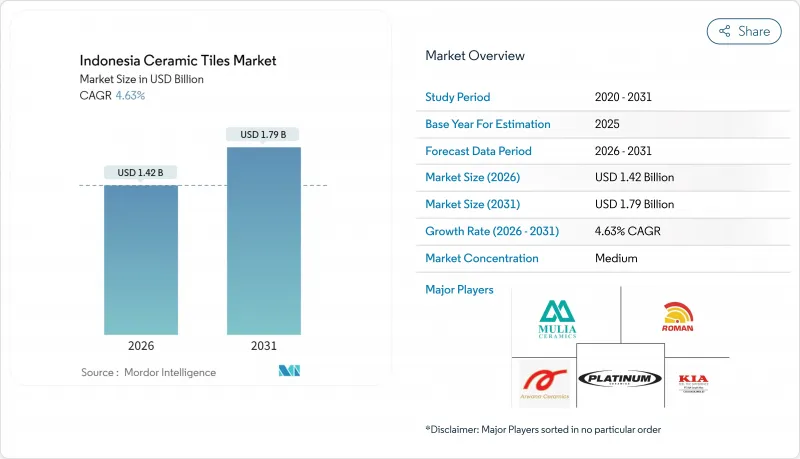

2025年印尼磁磚市場價值13.6億美元,預計從2026年的14.2億美元成長到2031年的17.9億美元,在預測期(2026-2031年)內複合年成長率為4.63%。

需求成長勢頭源於政府的天然氣補貼政策、對低成本進口商品徵收100%至200%的關稅壁壘,以及大規模的“300萬套住宅建設計畫”,這些因素共同推動了住宅、商業和公共計劃的新訂單。到2027年,印尼GDP預計將維持5.1%的強勁成長,持續的都市區進程,以及中等收入家庭不斷成長的房屋維修支出,都為建設活動增添了多重韌性。製造商正利用瓷器耐用性的優勢,而數位化銷售管道的拓展也在一定程度上抵銷了印尼高昂的島際運輸成本。此外,強制性的SNI品質標準也使本地生產商受益,該標準提高了進口商的准入門檻,並保護了高階市場的定價權。

印尼陶瓷磚市場趨勢及洞察

能源密集陶瓷產業的天然氣價格上限

根據特定天然氣價格政策,每百萬英熱單位(MMBTU)6.75美元的價格上限已使瓷磚廠窯爐運作成本降低了約30%,為國內生產商帶來了至關重要的成本優勢。由於補貼將持續到2025年,工廠能夠更好地保障原料供應並規劃設備升級,進而增強了生產力計畫的信心。受益主要集中在爪哇島和蘇門答臘島,儘管全國供不應求,但這些地區的管線基礎設施仍能支持運轉率。補貼天然氣有助於工廠緩解印尼幣疲軟對進口原料的影響。然而,天然氣供應量仍僅為合約量的65-70%,燃料供應仍是近期產能擴張的阻礙因素。政府透過能源補貼支持國內製造業的綜合策略與印尼的產業政策目標一致,將瓷磚產業定位為進口替代和出口擴張策略中的重要一環。

疫情後爪哇島和峇里島的住宅市場繁榮

由於優惠的房屋抵押貸款利率和稅收激勵措施,自出行限制放寬以來停滯的住宅計劃已經復工,新房銷售也隨之活性化。爪哇島60%的人口和58%的GDP集中在都市區,因此瓷磚需求主要集中在高密度公寓和獨立式住宅。峇里島的豪華別墅開發項目正在採用大尺寸、時尚的瓷磚,推高了平均售價。隨著在家工作習慣的普及,住宅維修廚房和浴室,翻新需求也十分強勁。預計到2027年,這些因素將支撐超過一半的總需求成長。智慧家居技術和永續建築實踐在新住宅開發中的應用,為瓷磚製造商創造了機遇,使其能夠開發出滿足不斷變化的消費者需求和節能建築監管要求的創新產品。

工業氣體供應瓶頸

管網限制迫使許多窯爐以低於設計負載70%的負載運作,從而削弱了規模經濟效益。頻繁的壓力下降擾亂了燒製週期,增加了廢品率。分配過程中的尋租行為進一步加劇了生產計畫的不確定性。不具備雙燃料能力的製造商必須承擔閒置成本或延後交貨日期。投資者推遲產能擴張,直到電網升級能夠確保穩定的電力供應。根據朝日新聞報道,外國投資者正在重新評估其在陶瓷行業的投資,這表明對供應可靠性的擔憂導致資本形成和技術升級減少,而這些本可以支持市場擴張和提高競爭力。

細分市場分析

截至2025年,陶瓷瓷磚將佔印尼陶瓷磚市場46.58%的佔有率,反映出瓷磚在購物中心、酒店和交通樞紐等場所的廣泛應用,這些場所對瓷磚的耐磨性要求很高。雅加達和泗水商業房地產的快速擴張預計將推動印尼陶瓷瓷磚市場的成長。馬賽克瓷磚雖然市場基數較小,但預計將以5.28%的複合年成長率成長,這主要得益於住宅在浴室和廚房整修中對個性化設計的偏好。當地企業正利用噴墨印刷和大型印刷技術來仿製大理石和木紋,從而搶佔了原本用於天然石材的市場佔有率。此外,對低VOC釉藥日益嚴格的監管也促使生產商採用更環保的配方,進一步提升了陶瓷瓷磚的高階形象。

更大的模組尺寸(60x120厘米、80x80厘米)的出現,推動了建築師對高效施工和現代美學的需求。釉藥防滑飾面在工業地板材料和戶外露台中越來越受歡迎,在這些場所,功能安全性比視覺偏好更為重要。手工瓷磚在峇里島的豪華度假村中佔據一席之地,銷量小規模但利潤豐厚。能夠將技術特性與時尚設計相結合的供應商繼續主導著印尼瓷磚市場,尤其是那些擁有SNI認證的供應商,SNI認證讓買家對產品的耐用性充滿信心。節能快速的窯爐進一步降低了每平方公尺的成本,即使在燃料價格波動的情況下,也能保持價格競爭力。

到2025年,地板材料將佔印尼瓷磚市場61.48%的佔有率,這主要得益於家庭對防水和易於清潔的優先考慮,尤其是在熱帶潮濕的氣候條件下。開發商擴大採用3毫米的接縫和精細的邊緣設計,以在高人流量的零售商店中創造無縫的視覺效果。屋頂瓦的複合年成長率將達到5.44%,以滿足省會城市(這些城市易受惡劣天氣影響)對耐熱和抗颶風屋頂材料日益成長的需求。牆面裝飾材料受益於醫院和教育機構日益提高的衛生標準,這些場所對易於清潔的表面要求很高。印尼瓷磚行業也看到了模組化架空地板系統(整合通風和電纜)的成長潛力,該系統可用於建造面向未來的辦公大樓。

抗菌釉藥等持續的設計創新正在推動醫院和食品加工廠對瓷磚的需求。瓷磚鋪路石因其比木材更能承受高人流量和季風雨的侵蝕,正被廣泛應用於戶外露台。地暖系統曾經僅限於溫帶地區,如今也開始應用於印尼的豪華別墅,進一步提升了瓷磚的重要性。符合經合組織(OECD)耐腐蝕性標準的瓷磚屋頂已成為公共住宅維修中鍍鋅鋼板的首選替代品。這種市場細分錶明,功能需求和不斷發展的建築標準支撐著瓷磚在各種應用領域的成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 能源密集陶瓷產業的天然氣價格上限

- 疫情後爪哇島和峇里島的住宅市場繁榮

- 提高對中國進口商品的關稅

- 政府「百萬住宅」計劃

- 區域城市的快速都市化

- 中產階級裝潢支出增加

- 市場限制

- 工業氣體供應瓶頸

- 印尼幣疲軟導致進口原料成本上升。

- 國內產能過剩加劇了價格競爭。

- 群島間高的物流成本

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 洞察市場最新趨勢與創新

- 深入了解近期產業發展動態(新產品發布、策略性舉措、投資、合作、合資、擴張、併購等)

第5章 市場規模及成長預測(金額單位:美元)

- 依產品類型

- 陶瓷瓷磚

- 釉藥磁磚

- 無釉陶瓷磚

- 馬賽克瓷磚

- 其他(裝飾瓷磚、圖案瓷磚、手工瓷磚)

- 透過使用

- 地板材料

- 牆

- 屋頂材料

- 最終用戶

- 住宅

- 商業的

- 飯店業(飯店、度假村)

- 零售店

- 辦公室和公共設施

- 衛生保健

- 教育設施

- 交通樞紐(機場、捷運、客運站)

- 其他商業用戶

- 依建築類型

- 新建工程

- 維修和更新

- 透過分銷管道

- 磁磚和石材專賣店

- 居家裝潢和DIY專賣店

- 線上零售

- 直接向建築公司銷售

- 按地區

- Java

- 蘇門答臘

- 加里曼丹

- 蘇拉威西

- 峇裡島和努沙登加拉

- 巴布亞及西巴布亞

- 馬魯古群島

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Arwana Citramulia Tbk

- Mulia Keramik Indahraya

- Roman Ceramic International

- Platinum Ceramics Industry

- KIA Keramik Tbk

- Granito(PT Citra Granito)

- Diamond Keramik Indonesia

- Indogress(PT Inti Keramik Sejahtera)

- Indopenta Sakti Teguh

- Sun Power Ceramics

- Satyaraya Keramindo Indah(SRK)

- Candra Jaya Surya

- Royalboard Ceramics

- Sandimas Intimitra

- Terracotta Indonesia

- Muliakeramik Industri Indah

- Intikeramik Alamasri Industri Tbk

- Surya Toto Indonesia Tbk(Tile division)

- Dekkson Ceramics

- Madana Tiles Surabaya

第7章 市場機會與未來展望

The Indonesia ceramic tiles market was valued at USD 1.36 billion in 2025 and estimated to grow from USD 1.42 billion in 2026 to reach USD 1.79 billion by 2031, at a CAGR of 4.63% during the forecast period (2026-2031).

Demand momentum stems from the government's subsidized-gas policy, a 100-200% duty wall against low-cost imports, and the massive 3 Million Houses program, all of which drive fresh orders across residential, commercial, and public projects. Robust GDP growth of 5.1% through 2027, steady urban migration, and higher renovation spending among middle-income households add multiple layers of resilience to construction activity. Manufacturers capitalize on porcelain's durability-driven appeal, while digital sales channels widen geographic reach and partly offset Indonesia's high inter-island freight costs. Local producers also benefit from mandatory SNI quality standards that raise compliance hurdles for importers and protect pricing power in premium product niches.

Indonesia Ceramic Tiles Market Trends and Insights

Gas-price cap for energy-intensive ceramics

The USD 6.75 per MMBTU ceiling under the Certain Natural Gas Price Policy trims roughly 30% of kiln operating costs for tile plants, granting domestic producers a decisive cost edge. Capacity-planning confidence rises because the subsidy runs through 2025, enabling factories to lock in feedstock and schedule equipment upgrades. The benefit concentrates in Java and Sumatra, where pipeline infrastructure supports high utilization despite national supply gaps. Subsidized gas helps plants counter rupiah depreciation impacts on imported raw materials. However, deliveries cover only 65-70% of contracted volumes, turning fuel availability into a gating constraint for near-term output growth. The government's broader strategy of using energy subsidies to support domestic manufacturing aligns with Indonesia's industrial policy objectives, positioning ceramic tiles as a strategic sector for import substitution and export development initiatives.

Post-pandemic residential boom in Java & Bali

Mortgage rate incentives and tax relief revived stalled housing projects and spurred new launches once mobility restrictions eased. Java's urban centers account for 60% of population and 58% of GDP, funneling a large portion of tile demand into high-density apartment and landed-housing schemes. Bali's premium villa pipeline favors large-format, design-rich tiles that lift average selling prices. The renovation wave also stays strong as remote work habits push home-owners to upgrade kitchens and bathrooms. Collectively, these drivers underpin more than half of all volume additions through 2027. The integration of smart home technologies and sustainable building practices in new residential developments creates opportunities for ceramic tile manufacturers to develop innovative products that meet evolving consumer expectations and regulatory requirements for energy-efficient construction.

Industrial gas-supply bottlenecks

Pipeline network limits force many kilns to operate below 70% of design loads, eroding economies of scale. Frequent pressure drops interrupt firing cycles and raise reject rates. Rent-seeking behavior in allocation processes adds further uncertainty to production planning. Manufacturers without dual-fuel capability must absorb idle costs or delay deliveries. Investors defer capacity expansion until transmission upgrades assure steady volume. Foreign investors' reconsideration of ceramic industry investments, as reported by Asaki, demonstrates how supply reliability concerns translate into reduced capital formation and technological upgrading that could otherwise support market expansion and competitiveness improvements.

Other drivers and restraints analyzed in the detailed report include:

- Duty hike on Chinese imports

- Government "One Million Houses" program

- Depreciating rupiah inflates imported raw-material costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Porcelain tiles held a 46.58% share of the Indonesia ceramic tiles market in 2025, reflecting widespread acceptance in malls, hotels, and transit hubs where high abrasion resistance is crucial. The Indonesia ceramic tiles market size for porcelain is projected to widen alongside rapid commercial real-estate expansion in Jakarta and Surabaya. Mosaic formats, though starting at a smaller base, exhibit the highest 5.28% CAGR as homeowners embrace design individuality in bathroom and kitchen revamps. Domestic firms leverage ink-jet printing and large-slab presses to mimic marble and wood, capturing spend that once flowed to natural stone. Regulatory emphasis on low-VOC glazes also nudges producers toward eco-friendlier formulations, reinforcing porcelain's premium tag.

Value migration toward larger modules (60X120 cm and 80X80 cm) benefits efficient installation and modern aesthetics sought by architects. Unglazed and anti-slip variants gain traction in industrial floors and outdoor patios where functional safety tops visual preference. Handmade artisanal tiles retain a niche among luxury resorts in Bali, commanding high margins despite limited scale. The Indonesia ceramic tiles market continues to reward suppliers able to mesh technical attributes with on-trend looks, especially when backed by SNI certification that reassures buyers on durability benchmarks. Energy-efficient fast-firing kilns further lower cost per square meter, allowing competitive pricing even under fuel volatility.

Flooring captured 61.48% of the Indonesia ceramic tiles market share in 2025 because households value waterproofing and ease of cleaning amid tropical humidity. Developers increasingly specify 3-mm grout lines and rectified edges to achieve seamless visuals in high-traffic retail settings. Roofing tiles, expanding at 5.44% CAGR, meet rising demand for thermally stable, cyclone-resistant coverings in secondary cities prone to severe weather. Wall cladding benefits from heightening hygiene requirements in hospitals and educational premises where washable surfaces are mandatory. The Indonesia ceramic tiles industry also finds upside in modular raised-floor systems integrating airflow and cabling for future-ready office towers.

Continuous design innovation such as antibacterial glazes widens hospital and food-processing appeal. Outdoor decks adopt porcelain pavers that tolerate heavy footfall and monsoon deluges better than timber. Underfloor-heating compatibility, once limited to temperate markets, now appears in premium Indonesian villas, boosting ceramic relevance. Compliance with OECD resilience guidelines positions tile roofing as a preferred alternative to galvanized sheets in public housing upgrades. The segmentation underscores how functional imperatives and evolving building codes sustain diversified growth paths across applications.

The Indonesia Ceramic Tiles Market Report is Segmented by Product Type (Porcelain Tiles and More), Application (Floor, Wall, Roofing), End-User (Residential, Commercial), Construction Type (New Construction, Renovation and Replacement), Distribution Channel (Specialty Tile & Stone Stores, Home Improvement & DIY Stores, and More) and Geography (Java, Sumatra and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Arwana Citramulia Tbk

- Mulia Keramik Indahraya

- Roman Ceramic International

- Platinum Ceramics Industry

- KIA Keramik Tbk

- Granito (PT Citra Granito)

- Diamond Keramik Indonesia

- Indogress (PT Inti Keramik Sejahtera)

- Indopenta Sakti Teguh

- Sun Power Ceramics

- Satyaraya Keramindo Indah (SRK)

- Candra Jaya Surya

- Royalboard Ceramics

- Sandimas Intimitra

- Terracotta Indonesia

- Muliakeramik Industri Indah

- Intikeramik Alamasri Industri Tbk

- Surya Toto Indonesia Tbk (Tile division)

- Dekkson Ceramics

- Madana Tiles Surabaya

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Gas-price cap for energy-intensive ceramics

- 4.2.2 Post-pandemic residential boom in Java & Bali

- 4.2.3 Duty hike on Chinese imports

- 4.2.4 Government "One Million Houses" program

- 4.2.5 Rapid urbanisation of secondary cities

- 4.2.6 Rising middle-class renovation spending

- 4.3 Market Restraints

- 4.3.1 Industrial gas-supply bottlenecks

- 4.3.2 Depreciating rupiah inflates imported raw-material costs

- 4.3.3 Domestic over-capacity drives price wars

- 4.3.4 High inter-island logistics costs across the archipelago

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Industry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Porcelain Tiles

- 5.1.2 Glazed Ceramic Tiles

- 5.1.3 Unglazed Ceramic Tiles

- 5.1.4 Mosaic Tiles

- 5.1.5 Others (Decorative, Patterned, Handmade)

- 5.2 By Application

- 5.2.1 Floor

- 5.2.2 Wall

- 5.2.3 Roofing

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.2.1 Hospitality (Hotels, Resorts)

- 5.3.2.2 Retail Spaces

- 5.3.2.3 Offices & Institutions

- 5.3.2.4 Healthcare

- 5.3.2.5 Educational Facilities

- 5.3.2.6 Transport Hubs (Airports, Metro, Bus Terminals)

- 5.3.2.7 Other Commercial Users

- 5.4 By Construction Type

- 5.4.1 New Construction

- 5.4.2 Renovation and Replacement

- 5.5 By Distribution Channel

- 5.5.1 Specialty Tile & Stone Stores

- 5.5.2 Home Improvement & DIY Stores

- 5.5.3 Online Retail

- 5.5.4 Direct Sales to Contractors

- 5.6 By Geography

- 5.6.1 Java

- 5.6.2 Sumatra

- 5.6.3 Kalimantan

- 5.6.4 Sulawesi

- 5.6.5 Bali & Nusa Tenggara

- 5.6.6 Papua & West Papua

- 5.6.7 Maluku Islands

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Arwana Citramulia Tbk

- 6.4.2 Mulia Keramik Indahraya

- 6.4.3 Roman Ceramic International

- 6.4.4 Platinum Ceramics Industry

- 6.4.5 KIA Keramik Tbk

- 6.4.6 Granito (PT Citra Granito)

- 6.4.7 Diamond Keramik Indonesia

- 6.4.8 Indogress (PT Inti Keramik Sejahtera)

- 6.4.9 Indopenta Sakti Teguh

- 6.4.10 Sun Power Ceramics

- 6.4.11 Satyaraya Keramindo Indah (SRK)

- 6.4.12 Candra Jaya Surya

- 6.4.13 Royalboard Ceramics

- 6.4.14 Sandimas Intimitra

- 6.4.15 Terracotta Indonesia

- 6.4.16 Muliakeramik Industri Indah

- 6.4.17 Intikeramik Alamasri Industri Tbk

- 6.4.18 Surya Toto Indonesia Tbk (Tile division)

- 6.4.19 Dekkson Ceramics

- 6.4.20 Madana Tiles Surabaya

7 Market Opportunities & Future Outlook

- 7.1 Rapid-set thin-tile technology for high-rise retrofits

- 7.2 "Smart-surface" IoT-embedded floor tiles