|

市場調查報告書

商品編碼

1910801

菲律賓瓷磚市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Philippines Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

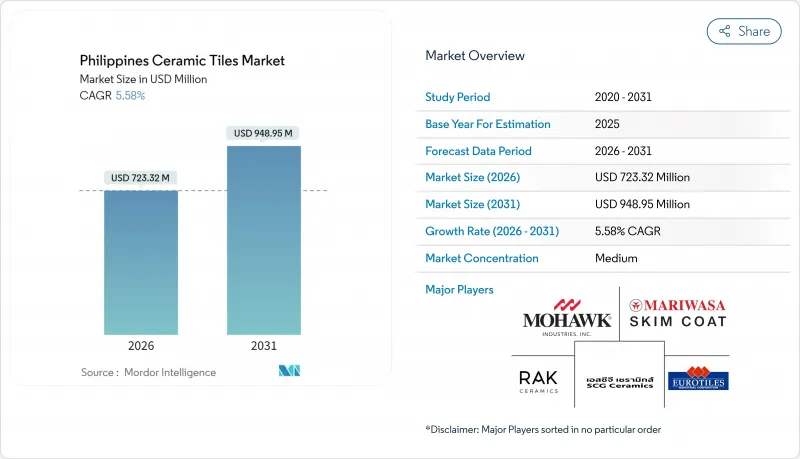

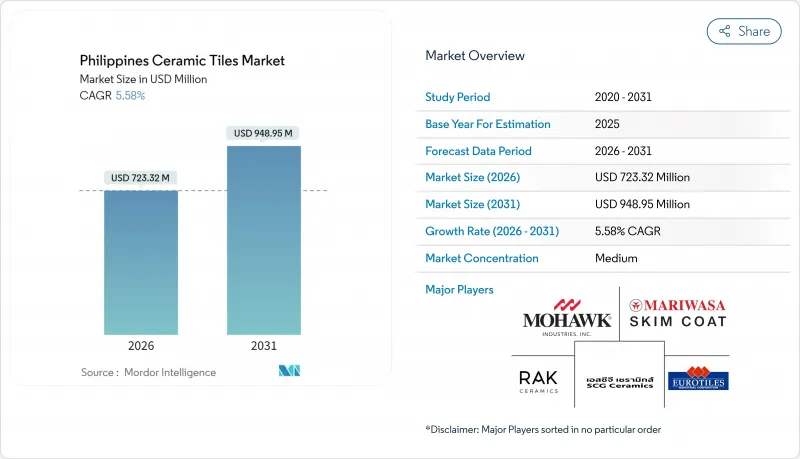

預計菲律賓瓷磚市場將從 2025 年的 6.851 億美元成長到 2026 年的 7.2332 億美元,並預計到 2031 年將達到 9.4895 億美元,2026 年至 2031 年的複合年成長率為 5.58%。

公共基礎設施的擴建、持續的住宅維修以及消費者對耐用型地面鋪裝材料偏好,共同支撐了這一成長趨勢。然而,生產商也面臨能源成本波動和進口壓力等挑戰。本地企業正透過節能窯爐、噴墨列印技術和拓展分銷網路等措施應對這些不利因素,並透過「建設更美好、更多」計畫來保障利潤並維持市場需求。中維薩亞斯和棉蘭老島地區的消費溢出效應正在擴大馬尼拉大都會區以外的潛在需求,顯示計劃儲備正朝著健康多元化的方向發展。同時,疫情期間的衛生問題也加速了大尺寸瓷磚的普及,這種瓷磚更易於清潔且縫隙更少,進一步強化了菲律賓瓷磚市場的優質化趨勢。

菲律賓瓷磚市場趨勢與洞察

疫情後住宅建設復甦

政府的住宅政策(55個計劃,17萬套住房)刺激了菲律賓瓷磚市場的勞動力需求和材料採購。宿霧的住宅市場正經歷銷售成長,這主要得益於海外勞工匯款,這些匯款推動了中檔公寓的銷售,並增加了浴室和起居空間中瓷磚的使用。像宿霧地產(Cebu Landmasters)這樣的開發商約佔中維薩亞斯地區新建公寓供應量的三分之一,計劃開發21個新計畫,總價值達披索,這些項目將需要大量的瓷磚。在東維薩亞斯地區,建築許可證的價值年增5.4%,推動住宅的平均成本達到每平方公尺披索,維持了陶瓷裝飾材料的基本消耗。預計全國將出現1000萬套住宅的供不應求,這為菲律賓瓷磚市場未來多年的住宅需求前景提供了支撐。

擴大商業和非住宅建築

商業和非住宅建設活動的成長是瓷磚市場的主要驅動力。越來越多的專業設計師和建築師指定瓷磚作為非住宅地板材料,也印證了這一點。菲律賓各類公共、工業及商業設施的開發與建設,顯著提升了對磁磚的需求。瓷磚因其耐用性而備受青睞,尤其是在人流量大的區域,即使在高強度使用下也能保持美觀。農業設施、教育機構和工業園區的擴建,進一步擴大了瓷磚的應用範圍。

商業領域的成長與現代商業環境中日益成長的設計需求相輔相成。不斷擴張的瓷磚市場和特色瓷磚品牌細分市場創造了巨大的商機,這主要得益於瓷磚品牌專賣店的興起,這些專賣店在一個展示室內提供豐富的產品系列。線上比價工具和擴增實境(AR)應用等技術的進步進一步推動了這一趨勢,客戶可以使用智慧型手機直接在施工現場預覽設計方案,從而做出明智的決策,簡化商業計劃的選材和安裝流程。

電力價格上漲給國內生產商帶來壓力

能源成本約佔生產成本的三分之一,而窯爐製造的成本會隨著馬尼拉電力公司 (MERALCO) 調整發電價格而每月重新計算。與泰國和越南的同行相比,菲律賓工廠每千瓦時電費更高,這阻礙了規模經濟,也抑制了出口。隨著菲律賓的液化天然氣 (LNG) 產能擴大 200%,對 LNG 的依賴程度將加深,將長期成本波動納入陶瓷燒製預算。小規模工廠在安裝現代化窯爐和汽電共生設備方面面臨資金籌措挑戰,其較低的利潤率也增加了電價上漲和貨幣貶值時破產的風險。持續的成本壓力可能導致產能整合,從而降低菲律賓瓷磚市場的供應多樣性。

細分市場分析

到2025年,陶瓷瓷磚將佔菲律賓瓷磚市場收入佔有率的54.85%,這反映了全球瓷磚耐用性標準以及菲律賓消費者對高階飾面的長期信賴。噴墨技術持續推動這一細分市場的發展,該技術無需維護即可複製大理石和木材的視覺效果,從而鞏固了中高收入住宅對品牌的忠誠度。馬賽克瓷磚雖然仍屬於小眾市場,但預計將以5.74%的複合年成長率成長,這主要得益於特色牆的安裝以及將當地工藝融入現代室內設計的傳統工藝復興計劃。由於防滑性能,無釉和釉藥陶瓷在實用區域將繼續保持其受歡迎程度,而其他裝飾系列,例如手繪和圖案表面,將滿足旅遊業主導的紀念品需求。生產商正在將窯爐運作重新分配給瓷器生產,隨著注重設計的買家願意支付溢價,預計在進口壓力不斷增加的情況下,大眾市場SKU的利潤率將有所提高。

瓷磚的強勢地位也得益於其經濟實惠的擁有成本。其超過25年的使用壽命和低吸水率意味著更少的更換頻率,滿足了在區域城市建造出租物業的投資者的需求。雖然進口產品曾經主導高階市場,但如今國產產品已能提供媲美歐洲美學的品質,縮短了交貨時間,並降低了計劃業主面臨的外匯風險。馬賽克瓷磚的流行反映了酒店整修中對客製化浴室日益成長的需求,這些浴室注重打造適合拍照的背景。市場細分錶明,即使馬賽克瓷磚正在探索新的收入來源,瓷磚在菲律賓瓷磚市場也不太可能失去市場佔有率。生產重點表明,資本正集中於大尺寸瓷磚生產線,這些生產線可以輕鬆切換亮面、啞光和紋理飾面。

到2025年,地板材料鋪設將佔總需求的51.62%,這主要得益於馬尼拉大都會老舊公寓的翻新以及地方政府預算資助的新學校建設。由於耐用性要求,陶瓷表面成為購物中心、交通樞紐和醫療機構走廊的主要飾面材料,這些場所每天可承受超過5000人次的客流量。屋頂應用雖然正在興起,但預計將以5.63%的複合年成長率成為成長最快的領域,這主要得益於氣候智慧型建築標準下對防水和太陽能反射瓷磚的需求不斷成長。牆壁材料應用將保持個位數的溫和成長,因為開發商在備餐廚房和衛生間等場所尋求衛生、易於消毒的表面,以取代容易滋生黴菌的油漆。應用領域的多元化將使收入來源多樣化,並保護生產商免受菲律賓整體瓷磚市場特定行業週期性低迷的影響。

住宅裝修商在廚房維修傾向於選擇防滑瓷磚,而商業地產業主則優先考慮防污瓷磚,以降低多年合約期間的清潔成本。防水屋頂瓦吸水率低,並配有機械錨固件,因此適用於比科爾和東維薩亞斯等颱風多發地區。教育機構正在推廣使用防接觸表面以應對新冠疫情,並將乙烯基地板材料更換為能夠耐受強效消毒劑的瓷磚。交通樞紐(如克拉克機場、MRT-7、宿霧BRT)在其候車大廳鋪設了耐磨等級為PEI IV和V的瓷質磚,訂單量龐大。這些趨勢表明,地板材料將繼續佔據菲律賓瓷質磚市場的大部分佔有率,而新興的屋頂規範將創造一個前景廣闊的相鄰市場。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 疫情後住宅建設復甦

- 政府的「建設更好、建設更多」基礎建設計劃

- 對大尺寸瓷磚的需求不斷成長

- 零售連鎖店在區域城市的擴張

- 節能型窯爐可降低單位成本

- 馬尼拉大都會區地面裝飾材料綠建築強制規定

- 市場限制

- 電力價格上漲給國內生產商帶來壓力

- 液化天然氣價格波動推高燃料成本

- 來自中國和越南的進口滲透率不斷提高

- 農村地區技術純熟勞工短缺

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 洞察市場最新趨勢與創新

- 深入了解近期產業發展動態(新產品發布、策略性舉措、投資、合作、合資、擴張、併購等)

第5章 市場規模及成長預測(金額:美元)

- 依產品類型

- 陶瓷瓷磚

- 釉藥磁磚

- 無釉陶瓷磚

- 馬賽克瓷磚

- 其他(裝飾瓷磚、圖案瓷磚、手工瓷磚)

- 透過使用

- 地板材料

- 牆

- 屋頂材料

- 最終用戶

- 住宅

- 商業的

- 飯店業(飯店、度假村)

- 零售店

- 辦公室和機構

- 衛生保健

- 教育設施

- 交通樞紐(機場、捷運、客運站)

- 其他商業用戶

- 依建築類型

- 新建工程

- 維修和更換

- 透過分銷管道

- 磁磚和石材專賣店

- 居家裝潢和DIY專賣店

- 線上零售

- 直接向承包商銷售

- 按地區

- 呂宋島

- 維薩揚群島

- 棉蘭老島

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Mariwasa Siam Ceramics Inc.

- Eurotiles Industrial Corporation

- SCG Ceramics(COTTO)

- RAK Ceramics PJSC

- PORCELANOSA Grupo

- Mohawk Industries Inc.(Daltile)

- Kajaria Ceramics Ltd.

- China Ceramics Co. Ltd.

- Guangdong Dongpeng Ceramic Co., Ltd.

- Pamesa Ceramica

- Grupo Lamosa

- HRD Singapore Pte Ltd(Niro Granite)

- Italgraniti Group

- Atlas Concorde SpA

- FC Tile Depot

- ABC Tile Center

- Wilcon Depot Inc.

- Cebu Home and Builders Centre

- Tile Express Shop

- Royal Tern Ceramics

第7章 市場機會與未來展望

The Philippines ceramic tiles market is expected to grow from USD 685.1 million in 2025 to USD 723.32 million in 2026 and is forecast to reach USD 948.95 million by 2031 at 5.58% CAGR over 2026-2031.

Expansion of public infrastructure, steady residential upgrades, and rising preference for durable floor finishes underpin this trajectory, even as producers grapple with volatile energy costs and import pressure. Domestic players are countering headwinds through energy-efficient kilns, ink-jet printing, and wider distribution footprints that help protect margins and sustain demand pull from the Build Better More program. Regional spending spillovers in Central Visayas and Mindanao are broadening addressable demand beyond Metro Manila, signaling healthy diversification in project pipelines. Simultaneously, pandemic-era hygiene concerns have accelerated the adoption of large-format porcelain slabs that promise easier cleaning and fewer grout lines, reinforcing premiumization trends in the Philippines' ceramic tiles market.

Philippines Ceramic Tiles Market Trends and Insights

Post-pandemic Residential Construction Rebound

Government-backed housing initiatives targeting 170,000 units across 55 projects are reviving labor demand and material procurement in the Philippines ceramic tiles market. Cebu's residential sector shows rising turnover as overseas Filipino workers channel remittances into mid-priced condominiums that typically specify ceramic tiles for wet areas and living spaces. Developers such as Cebu Landmasters hold roughly one-third share of condominium launches in Central Visayas and have scheduled 21 new projects collectively worth PHP 31.5 billion that will require extensive tile packages. Across Eastern Visayas, the value of building permits rose 5.4% year-on-year, and average residential construction costs hit PHP 9,151 per square meter, sustaining baseline consumption of ceramic finishes. A projected 10 million-unit national housing backlog underpins multi-year visibility for residential demand in the Philippines ceramic tiles market.

Expanding Commercial and Non-residential Construction

The growth in commercial and non-residential construction activities has become a significant driver for the ceramic tiles market, supported by the increasing presence of professional designers and architects who specify porcelain ceramic tiles for non-residential flooring applications. The development of various institutional, industrial, and commercial facilities has created substantial demand for ceramic floor tiles Philippines, with these materials being particularly valued for their ability to withstand heavy foot traffic and maintain their appearance in high-use areas. The expansion of agricultural facilities, educational institutions, and industrial complexes has further diversified the application base for ceramic tiles.

The commercial sector's growth is complemented by the rising sophistication of design requirements in modern business environments. The expanding ceramic tile market and dedicated tiles brand sector have created significant opportunities, with an increasing number of tiles brand name stores offering diverse product portfolios in single showrooms. This trend has been further enhanced by technological advancements such as online price comparison tools and augmented reality applications, allowing customers to make informed decisions and visualize designs directly at construction sites using smartphones, thereby streamlining the selection and installation process for commercial projects.

High Electricity Tariffs Squeezing Domestic Producers

Energy costs account for roughly one-third of production spending, exposing kiln-based manufacturing to price recalculations each month that MERALCO revises generation charges. Compared with peers in Thailand or Vietnam, Philippine factories pay premium kilowatt-hour rates, which curtail economies of scale and hamper export ambitions. LNG dependence will deepen as the county expands regasification capacity by 200%, baking long-term cost volatility into ceramic firing budgets. Smaller plants struggle to finance modern kilns or cogeneration units, and their thinner margins heighten liquidation risk when tariff spikes coincide with currency depreciation. Persistent cost stress may consolidate capacity, lowering supply diversity within the Philippines ceramic tiles market.

Other drivers and restraints analyzed in the detailed report include:

- Growing Interior Design Trends and Aesthetic Preferences

- Government "Build Better More" Infrastructure Pipeline

- Rising Import Penetration from China and Vietnam

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Porcelain commanded 54.85% revenue share in 2025, mirroring global durability standards and longstanding consumer trust in the Philippines ceramic tiles market size for premium finishes. The segment continues to reap benefits from ink-jet technology that replicates marble or timber visuals without the maintenance burden, entrenching brand loyalty among mid- to high-income homeowners. Mosaic tiles, though niche, are projected to record a 5.74% CAGR-fueled by accent-wall installations and artisanal revival programs that foothold local crafts into contemporary interiors. Unglazed and glazed ceramic formats retain loyalty in utility areas to slip resistance, while "other" decorative lines showcase hand-painted or patterned surfaces that support tourism-driven souvenir demand. Producers reallocating kiln cycles toward porcelain anticipate wider margin spreads, given the willingness among design-centric buyers to pay premiums while import pressure remains heavier in mass-market SKUs.

Porcelain's entrenched position also reflects cost-of-ownership economics: life cycles exceed 25 years, and low water absorption means fewer replacements, which resonates with investors building rental inventories in provincial cities. Imports once cornered top-end styles, but domestic imitations now match European aesthetics, tightening delivery timelines and lessening foreign exchange exposure for project owners. Mosaic uptake mirrors push toward bespoke bathrooms in hospitality refurbishments that prioritize Instagram-ready backdrops. Segment dynamics indicate that Philippines ceramic tiles market share held by porcelain is unlikely to cede ground, even as mosaics open incremental revenue pockets. Manufacturing priorities are thus skewing capital toward large-format porcelain lines that can toggle between glossy, matte, and textured finishes on demand.

Floor installations accounted for 51.62% of total demand in 2025, anchored by renovation cycles in Metro Manila's aging condominium stock and new-build schools funded by LGU budgets. Durability mandates make ceramic surfaces the baseline finish for malls, transport terminals, and healthcare corridors that face pedestrian loads exceeding 5,000 footfalls daily. Roofing applications, albeit just emerging, are set to clock the highest 5.63% CAGR as flood-resistant and solar-reflective tiles gain traction under climate-resilience building codes. Wall cladding sustains mid-single-digit growth as developers pivot toward hygienic, easy-to-sanitize surfaces in prep kitchens and restrooms, supplanting paints susceptible to mold. Application dispersion ensures diversified revenue streams, cushioning producers from cyclical dips in any single vertical within the broader Philippines ceramic tiles market.

Residential remodelers gravitate to anti-slip textures for kitchen refurbishments, while commercial landlords prefer stain-resistant variants that reduce janitorial expense over multi-year lease cycles. Flood-resistant rooftop tiles feature low water absorption and mechanical anchors suited for typhoon-exposed geographies such as Bicol and Eastern Visayas. Educational campuses adopting contact-safe surfaces after COVID-19 have swapped vinyl flooring for ceramic alternatives that withstand aggressive disinfectant regimens. Transport nodes-Clark Airport, MRT-7, Cebu BRT-embed porcelain in concourses due to abrasion grades PEI IV and V, reinforcing high-volume orders. Collectively, these patterns confirm floors will sustain the lion's share of Philippines ceramic tiles market size while emerging roofing specifications create promising adjacencies.

The Philippines Ceramic Tiles Market Report is Segmented by Product Type (Porcelain Tiles, Glazed Ceramic Tiles, and More), Application (Floor, Wall, Roofing), End-User (Residential, Commercial), Construction Type (New Construction, Renovation and Replacement), Distribution Channel (Specialty Stores, Home Improvement Stores, Online Retail, Direct Sales), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Mariwasa Siam Ceramics Inc.

- Eurotiles Industrial Corporation

- SCG Ceramics (COTTO)

- RAK Ceramics PJSC

- PORCELANOSA Grupo

- Mohawk Industries Inc. (Daltile)

- Kajaria Ceramics Ltd.

- China Ceramics Co. Ltd.

- Guangdong Dongpeng Ceramic Co., Ltd.

- Pamesa Ceramica

- Grupo Lamosa

- HRD Singapore Pte Ltd (Niro Granite)

- Italgraniti Group

- Atlas Concorde S.p.A.

- FC Tile Depot

- ABC Tile Center

- Wilcon Depot Inc.

- Cebu Home and Builders Centre

- Tile Express Shop

- Royal Tern Ceramics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Post-Pandemic Residential Construction Rebound

- 4.2.2 Government "Build Better More" Infrastructure Pipeline

- 4.2.3 Growing Preference For Large-Format Porcelain Slabs

- 4.2.4 Retail-Chain Expansion In Tier-2 Cities

- 4.2.5 Energy-Efficient Kilns Lowering Unit Costs

- 4.2.6 Metro Manila Green-Building Mandate For Floor Finishes

- 4.3 Market Restraints

- 4.3.1 High Electricity Tariffs Squeezing Domestic Producers

- 4.3.2 Volatile LNG Prices Inflating Firing Costs

- 4.3.3 Rising Import Penetration From China And Vietnam

- 4.3.4 Skilled-Labor Shortages In Provincial Regions

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Industry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Porcelain Tiles

- 5.1.2 Glazed Ceramic Tiles

- 5.1.3 Unglazed Ceramic Tiles

- 5.1.4 Mosaic Tiles

- 5.1.5 Others (Decorative, Patterned, Handmade)

- 5.2 By Application

- 5.2.1 Floor

- 5.2.2 Wall

- 5.2.3 Roofing

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.2.1 Hospitality (Hotels, Resorts)

- 5.3.2.2 Retail Spaces

- 5.3.2.3 Offices & Institutions

- 5.3.2.4 Healthcare

- 5.3.2.5 Educational Facilities

- 5.3.2.6 Transport Hubs (Airports, Metro, Bus Terminals)

- 5.3.2.7 Other Commercial Users

- 5.4 By Construction Type

- 5.4.1 New Construction

- 5.4.2 Renovation and Replacement

- 5.5 By Distribution Channel

- 5.5.1 Specialty Tile & Stone Stores

- 5.5.2 Home Improvement & DIY Stores

- 5.5.3 Online Retail

- 5.5.4 Direct Sales to Contractors

- 5.6 By Geography

- 5.6.1 Luzon

- 5.6.2 Visayas

- 5.6.3 Mindanao

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Mariwasa Siam Ceramics Inc.

- 6.4.2 Eurotiles Industrial Corporation

- 6.4.3 SCG Ceramics (COTTO)

- 6.4.4 RAK Ceramics PJSC

- 6.4.5 PORCELANOSA Grupo

- 6.4.6 Mohawk Industries Inc. (Daltile)

- 6.4.7 Kajaria Ceramics Ltd.

- 6.4.8 China Ceramics Co. Ltd.

- 6.4.9 Guangdong Dongpeng Ceramic Co., Ltd.

- 6.4.10 Pamesa Ceramica

- 6.4.11 Grupo Lamosa

- 6.4.12 HRD Singapore Pte Ltd (Niro Granite)

- 6.4.13 Italgraniti Group

- 6.4.14 Atlas Concorde S.p.A.

- 6.4.15 FC Tile Depot

- 6.4.16 ABC Tile Center

- 6.4.17 Wilcon Depot Inc.

- 6.4.18 Cebu Home and Builders Centre

- 6.4.19 Tile Express Shop

- 6.4.20 Royal Tern Ceramics

7 Market Opportunities & Future Outlook

- 7.1 Adoption of flood-resistant outdoor ceramic paving tiles

- 7.2 Local producers adopting inkjet printing for custom designs