|

市場調查報告書

商品編碼

1910571

陶瓷磚:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

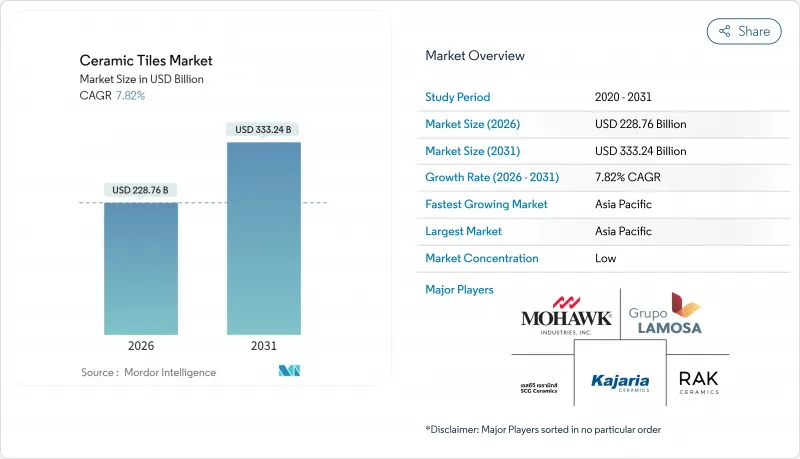

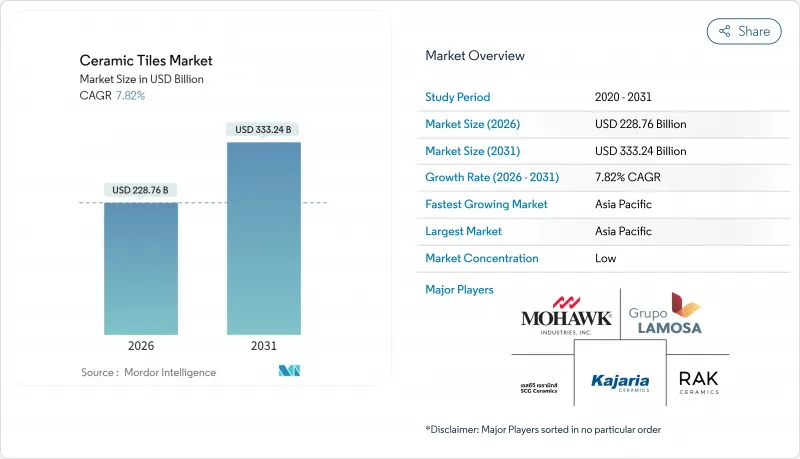

2025年陶瓷磚市場價值為2,121.7億美元,預計從2026年的2,287.6億美元成長到2031年的3,332.4億美元,在預測期(2026-2031年)內複合年成長率為7.82%。

公共部門基礎設施建設的持續投入、亞太地區快速的都市區化進程以及消費者對耐用、易清潔表面的偏好,都推動了這個市場的成長。美國新的政府支出計畫以及印度和東南亞大都會區、機場和智慧城市的持續發展,擴大了地板材料和覆材產品的潛在需求基礎。此外,將超逼真的石材、木材和金屬效果印製到瓷體上的技術也推動了需求成長,使產品能夠在不承受天然材料價格波動的情況下實現高階化。歐洲的環境法規正在加速低碳窯爐和廢棄物材料混合物的應用,而線上零售通路則提高了全球產品的供應量和價格透明度。

全球陶瓷磚市場趨勢與洞察

建築和基礎設施擴建

全球對交通走廊、能源工廠和綜合用途設施的資本支出正推動陶瓷磚市場訂單激增。在美國,聯邦政府多年計畫已撥款1.2兆美元用於道路、橋樑、半導體製造廠和清潔能源設施建設,從而持續刺激工廠和資料中心對高強度陶瓷瓷磚的需求。中國的「一帶一路」計劃正在推動經濟合作區內大量使用瓷磚的火車站和住宅,東南亞國協政府也在增加土木工程預算,優先考慮使用壽命長達30年的地板材料產品。骨材和水泥供應商的收入實現了兩位數成長,顯示陶瓷表面材料的下游消費強勁。

對美觀耐用表面的需求

設計師們越來越追求視覺衝擊力和性能之間的平衡,這推動了大尺寸瓷磚和仿大理石瓷磚的普及。噴墨印表機能夠再現天然石材的紋理和金屬光澤,同時減輕重量並實現色彩保真度。尺寸可達 1.8 公尺 x 3.6 公尺的大尺寸瓷磚減少了接縫,打造出無縫銜接的效果,這在開放式辦公室和豪華住宅中備受青睞。快速釉面釉藥縮短了生產週期,使得能夠頻繁推出反映時尚潮流的新款式。在廚房和地下室等對防潮性能要求極高的場所,瓷磚的市場佔有率正在超過實木地板。建築師正在為電子組裝車間指定防靜電飾面,使功能性不僅限於裝飾性。

高昂的建設和維修成本

許多已開發市場都面臨著熟練瓷磚工短缺的問題,這推高了人事費用並延長了計劃。大尺寸磁磚需要專用起重設備和環氧樹脂接縫劑,與標準的60公分磁磚相比,安裝預算會增加15%至25%。雖然住宅可以在週末自行安裝浮動乙烯基複合地板,但瓷磚翻新則需要專業的防水和表面處理。儘管行業協會正在加強認證項目,但合格工人的供應量仍無法滿足需求,這限制了近期的產量成長,尤其是在維修項目中。

細分市場分析

吸水率低於0.5%、耐凍、適用於戶外廣場和交通樞紐的陶瓷瓷磚,預計到2025年將佔據陶瓷磚市場50.78%的佔有率。採用噴墨裝飾技術的釉藥瓷磚,預計到2031年將以8.34%的複合年成長率成長,超過釉藥陶瓷和馬賽克瓷磚。消費者認為其天然的色彩和耐磨等級(PEI IV級及以上)是其耐用性的有力證明,因此瓷磚在酒店大廳和機場等場所被廣泛用作大理石的替代品。

該細分市場的強勁成長動能正推動著整個陶瓷磚市場的發展,製造商利用連續窯爐大規模生產大型建築幕牆牆磚,在降低結構荷載的同時,維持了抗衝擊性。馬賽克瓷磚雖然仍屬於小眾市場,但在高階水療中心等注重工藝美感的場所,其市場佔有率正在不斷擴大,價格也相應上漲。抗菌銅釉藥的創新應用正在拓展其在食品加工區和醫院等領域的應用,這很好地詮釋了產品多元化如何促進持續的收入成長。

到2025年,地板材料鋪裝將佔陶瓷磚市場規模的48.10%,這主要得益於潮濕區域和人流量大的區域的強制性規範要求。防滑瓷質磚和工業用石板磚將主導商業廚房、倉庫和交通樞紐等場所,從而確保穩定的市場銷售。

到2031年,牆面應用將以8.17%的複合年成長率成長,這主要得益於建築師對紋理和3D表面在特色牆、酒店接待區和零售背景牆等領域的應用。不斷豐富的設計選擇將推高平均售價,而易於清潔的釉藥則符合酒店業的衛生標準。屋頂和外牆應用將集中在地中海和安第斯地區,這些地區重視陶瓷的保溫性和抗冰雹性能;而檯面、泳池和一些小眾應用領域也將推動整體需求成長。

陶瓷磚市場按產品類型(例如,陶瓷瓷磚、釉藥)、應用領域(例如,地板材料、牆壁材料)、最終用戶(住宅、商業、工業)、施工階段(新建、維修/改造)、配銷通路(例如,獨立零售商、大型五金建材超市)和地區進行細分。市場預測以以金額為準。

區域分析

預計到2025年,亞太地區將佔全球營收的47.35%,並在2031年之前維持8.31%的年均成長率。這主要得益於大規模的城市住宅建設、都會區擴張以及出口導向生產群集的形成。中國內陸省份正在擴大靠近粘土礦床地區的產能,而印度則在推動智慧城市和經濟適用住宅計劃,並推薦使用地板材料。越南北部地區擁有100多家生產商,該國已從依賴進口釉藥化學品轉型,並計劃在2024年實現釉藥佔80%、陶瓷瓷磚20%的生產結構。東協貿易協定促進了免稅分銷,並推動了區域整合供應鏈的發展。

北美是一個成熟但具有重要戰略意義的地區,其本土製造商正在為未來的反傾銷關稅做好準備。儘管房屋抵押貸款利率上升導致美國瓷磚消費量在2024年降至2.645億平方公尺,但聯邦政府對半導體和電池工廠的投入支撐了長期需求。莫霍克工業公司(Mohawk Industries)正利用其在田納西州和德克薩斯州的垂直整合窯爐來縮短前置作業時間並確保公共計劃符合規範。在加拿大,大量資金正投入醫院和交通設施的維修中,並日益強制要求使用低碳材料。同時,墨西哥的拉莫薩集團(Grupo Lamosa)正在拉丁美洲各地擴建工廠,以分散其貨幣風險。儘管受能源價格上漲的影響,歐洲瓷磚機械出口量在2023年下降了18%,但仍佔全球瓷磚機械出口量的50%(assopiastrelle.it)。義大利的閉合迴路工廠可100%回收燒製前的廢料,展現了其在環保領域的領先地位。西班牙正推進氫窯試點項目,以實現歐盟的淨零排放目標;同時,波蘭的黏土短缺導致進口量增加,現貨價格波動。在中東和非洲地區,埃及正利用低成本的頁岩資源,每年生產2億平方公尺。阿拉伯聯合大公國的拉斯海馬地區擁有4萬家註冊工業企業,推動了相關表面處理流程的需求。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 擴大建築和基礎設施開發

- 市場對美觀耐用的地板材料解決方案的需求日益成長

- 消費者越來越偏好環保和永續產品。

- 製造技術的進步

- 可支配所得增加和生活方式改變

- 日益老化的建築基礎設施和不斷成長的維修需求

- 市場限制

- 安裝和維護成本高昂

- 脆性和開裂風險

- 原物料價格波動

- 製造業的環境問題

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 陶瓷瓷磚

- 釉藥磁磚

- 無釉瓷磚

- 馬賽克瓷磚

- 其他

- 透過使用

- 地面

- 牆

- 屋頂工程

- 其他

- 最終用戶

- 住宅

- 商業的

- 產業

- 依建築類型

- 新房產

- 維修和更換

- 透過分銷管道

- 獨立零售商

- 大型家居建材商店

- 線上零售

- 直接向承包商銷售

- 按地區

- 北美洲

- 加拿大

- 美國

- 墨西哥

- 南美洲

- 巴西

- 秘魯

- 智利

- 阿根廷

- 其他南美洲

- 亞太地區

- 印度

- 中國

- 日本

- 澳洲

- 韓國

- 東南亞(新加坡、馬來西亞、泰國、印尼、越南、菲律賓)

- 亞太其他地區

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 比荷盧經濟聯盟(比利時、荷蘭、盧森堡)

- 北歐國家(丹麥、芬蘭、冰島、挪威、瑞典)

- 其他歐洲地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Mohawk Industries

- Grupo Lamosa

- SCG Ceramics Public Co. Ltd.

- Kajaria Ceramics Ltd.

- RAK Ceramics

- Pamesa Grupo Empresarial

- Guangdong Newpearl Ceramics

- Johnson Tiles

- Ceramic Industries Ltd.

- Porcelanosa Grupo

- Centura Tile

- Interceramic

- Florida Tile

- Villeroy & Boch

- Crossville Inc.

- Marazzi Group

- Iris Ceramica Group

- Noritake Co., Inc.

- Somany Ceramics

- Emser Tile*

第7章 市場機會與未來展望

The ceramic tiles market was valued at USD 212.17 billion in 2025 and estimated to grow from USD 228.76 billion in 2026 to reach USD 333.24 billion by 2031, at a CAGR of 7.82% during the forecast period (2026-2031).

Steady public-sector infrastructure outlays, rapid urban migration in Asia-Pacific, and consumers' preference for durable, easy-to-clean surfaces anchor this expansion. New government spending packages in the United States and ongoing metro, airport, and smart-city developments in India and Southeast Asia are enlarging the addressable base for flooring and cladding products. Demand also benefits from technology that prints hyper-realistic stone, wood, and metallic effects on porcelain bodies, enabling premiumization without the price volatility of natural materials. Environmental regulations in Europe accelerate the rollout of low-carbon kilns and waste-based raw mixes, while online retail channels broaden product availability and price transparency worldwide.

Global Ceramic Tiles Market Trends and Insights

Construction and infrastructure expansion

Global capital spending on transport corridors, energy plants, and mixed-use complexes is stimulating large-volume orders for the ceramic tiles market. In the United States, multiyear federal programmed collectively allocate USD 1.2 trillion to roads, bridges, semiconductor fabs, and clean-energy facilities, generating sustained demand for heavy-duty porcelain specified in factories and data centers. China's Belt and Road Initiative drives tile-intensive rail stations and housing in partner economies, while ASEAN governments raise civil works budgets that favor flooring products with 30-year service lives. Suppliers of aggregates and cement report double-digit revenue growth, signaling robust downstream consumption of ceramic surfacing.

Demand for aesthetic, durable surfaces

Designers increasingly combine visual impact with performance, fuelling the uptake of large-format planks and marble-look slabs. Inkjet printers replicate veining and metallic highlights that rival quarried stone, but at lower weight and in repeatable colourways. Format growth-porcelain boards up to 1.8 m by 3.6 m-reduces grout lines and conveys seamless continuity valued in open-plan offices and luxury residences. Quick-fire glazes cut production cycles, enabling frequent style introductions that mirror fashion trends. The ceramic tiles market also gains share versus hardwood in kitchens and basements where moisture resistance is critical. Architects specify anti-static finishes for electronics assembly floors, widening functional appeal beyond decor.

High installation and maintenance costs

Skilled tile setters remain scarce in many developed markets, lifting labour rates and extending project timelines. Large-format porcelain slabs need specialised lifting rigs and epoxy grouts, adding 15-25% to installation budgets versus standard 60 cm products. Where homeowners can install floating vinyl planks themselves over a weekend, ceramic renovations require professional waterproofing and sub-floor preparation. Industry associations have stepped up certification schemes, yet supply of certified crews lags demand, tempering short-run volume growth, especially in refurbishments.

Other drivers and restraints analyzed in the detailed report include:

- Preference for eco-friendly products

- Manufacturing technology advances

- Raw material price volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Porcelain tiles secured 50.78% of the ceramic tiles market share in 2025 owing to water-absorption rates below 0.5% and frost resistance that suits outdoor plazas and transit hubs. Glazed porcelain, aided by inkjet decoration, is projected to register an 8.34% CAGR through 2031, outpacing glazed ceramic and mosaic formats. Consumers perceive its colour-through body and abrasion class >= PEI IV as proof of longevity, encouraging substitution for marble in hotel lobbies and airports.

The segment's momentum lifts the overall ceramic tiles market as manufacturers leverage continuous kilns to mass-produce large thin slabs for facades, reducing structural load yet retaining impact strength. Mosaic tiles, though niche, capture share in luxury spas were artisanal aesthetics command price premiums. Copper-glaze innovations offering antimicrobial action broaden use in food-handling zones and hospitals, illustrating how product diversification underpins sustained revenue growth.

Floor installations represented 48.10% of the ceramic tiles market size in 2025 driven by mandatory specification in wet areas and heavy-traffic corridors. Slip-resistant porcelain and industrial-grade quarry tiles dominate commercial kitchens, warehouses, and transit stations, ensuring baseline volume stability.

Wall applications, posting an 8.17% CAGR to 2031, flourish as architects deploy textured and 3D surfaces for feature walls, hotel receptions, and retail backdrops. Expanded design palettes increase average selling prices, and easy-clean glazes meet hospitality hygiene codes. Roof and facade uses remain concentrated in Mediterranean and Andean regions where ceramic's thermal mass and hail resistance are valued, while countertop, pool, and niche applications collectively extend total addressable demand.

The Ceramic Tiles Market Segments Into by Product Type (Porcelain Tiles, Glazed Ceramic Tiles, and More), by Application (Floor, Wall, and More), by End-User (Residential, Commercial, Industrial), by Construction (New Construction, Replacement and Renovation), by Distribution Channel (Independent Retailers, Large Home Centers and More), by Geography. The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

Asia-Pacific accounted for 47.35% of global revenue in 2025 and is forecast to compound to 8.31% annually through 2031, anchored by mass urban housing, metro extensions, and export-oriented production clusters. China's inland provinces add capacity close to clay deposits, while India scales smart-city and affordable-housing schemes that stipulate vitrified flooring. Vietnam's 100-plus manufacturers, concentrated in the north, rely on imported chemicals for glazes but still achieved a combined output mix of 80% glazed and 20% porcelain tiles in 2024. ASEAN trade agreements allow duty-free flows, favouring regionally integrated supply chains.

North America presents a mature but strategically important arena where domestic producers hedge against future antidumping duties. US tile consumption eased to 264.5 million m2 in 2024 amid high mortgage rates, yet federal outlays on semiconductor and battery plants underpin long-term volume. Mohawk Industries leverages vertically integrated Tennessee and Texas kilns to shorten lead times and secure public-project specifications. Canada funds hospital and transit refurbishments that increasingly stipulate low-carbon materials, while Mexico's Grupo Lamosa operates plants across Latin America to diversify currency exposure. Europe, while posting an 18% output drop in 2023 due to energy spikes, still accounts for 50% of global tile-machinery exports assopiastrelle.it. Italy's closed-loop plants recycle 100% of unfired scrap, showcasing environmental leadership. Spain advances hydrogen-kiln pilots to meet EU Net-Zero targets, while Poland's clay shortages force higher imports and spot-price volatility. In the Middle East and Africa, Egypt produces 200 million m2 annually using low-cost shale resources, and the UAE's Ras Al Khaimah cluster hosts 40,000 industrial registrants, fuelling related surface-finishing demand.

- Mohawk Industries

- Grupo Lamosa

- SCG Ceramics Public Co. Ltd.

- Kajaria Ceramics Ltd.

- RAK Ceramics

- Pamesa Grupo Empresarial

- Guangdong Newpearl Ceramics

- Johnson Tiles

- Ceramic Industries Ltd.

- Porcelanosa Grupo

- Centura Tile

- Interceramic

- Florida Tile

- Villeroy & Boch

- Crossville Inc.

- Marazzi Group

- Iris Ceramica Group

- Noritake Co., Inc.

- Somany Ceramics

- Emser Tile*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Construction and Infrastructure Development

- 4.2.2 Increasing Demand for Aesthetic and Durable Flooring Solutions

- 4.2.3 Growing Preference for Eco-Friendly and Sustainable Products

- 4.2.4 Advancements in Manufacturing Technology

- 4.2.5 Rising Disposable Income and Changing Lifestyle

- 4.2.6 Increasing Ageing Building Infrastructure and Demand for Renovation Activities

- 4.3 Market Restraints

- 4.3.1 High Installation and Maintenance Costs

- 4.3.2 Fragility and Risk of Cracking

- 4.3.3 Raw Material Price Volatility

- 4.3.4 Environmental Concerns in Manufacturing

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size and Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Porcelain Tiles

- 5.1.2 Glazed Ceramic Tiles

- 5.1.3 Unglazed Ceramic Tiles

- 5.1.4 Mosaic Tiles

- 5.1.5 Others

- 5.2 By Application

- 5.2.1 Floor

- 5.2.2 Wall

- 5.2.3 Roofing

- 5.2.4 Others

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.4 By Construction Type

- 5.4.1 New Construction

- 5.4.2 Renovation and Replacement

- 5.5 By Distribution Channel

- 5.5.1 Independent Retailers

- 5.5.2 Large Home Centers

- 5.5.3 Online Retail

- 5.5.4 Direct Sales to Contractors

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 Canada

- 5.6.1.2 United States

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Peru

- 5.6.2.3 Chile

- 5.6.2.4 Argentina

- 5.6.2.5 Rest of South America

- 5.6.3 Asia-Pacific

- 5.6.3.1 India

- 5.6.3.2 China

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.6.3.7 Rest of Asia Pacific

- 5.6.4 Europe

- 5.6.4.1 United Kingdom

- 5.6.4.2 Germany

- 5.6.4.3 France

- 5.6.4.4 Spain

- 5.6.4.5 Italy

- 5.6.4.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.6.4.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.6.4.8 Rest of Europe

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Nigeria

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 Mohawk Industries

- 6.4.2 Grupo Lamosa

- 6.4.3 SCG Ceramics Public Co. Ltd.

- 6.4.4 Kajaria Ceramics Ltd.

- 6.4.5 RAK Ceramics

- 6.4.6 Pamesa Grupo Empresarial

- 6.4.7 Guangdong Newpearl Ceramics

- 6.4.8 Johnson Tiles

- 6.4.9 Ceramic Industries Ltd.

- 6.4.10 Porcelanosa Grupo

- 6.4.11 Centura Tile

- 6.4.12 Interceramic

- 6.4.13 Florida Tile

- 6.4.14 Villeroy & Boch

- 6.4.15 Crossville Inc.

- 6.4.16 Marazzi Group

- 6.4.17 Iris Ceramica Group

- 6.4.18 Noritake Co., Inc.

- 6.4.19 Somany Ceramics

- 6.4.20 Emser Tile*

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment