|

市場調查報告書

商品編碼

1906141

馬來西亞瓷磚:市場佔有率分析、行業趨勢與統計、成長預測(2026-2031)Malaysia Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

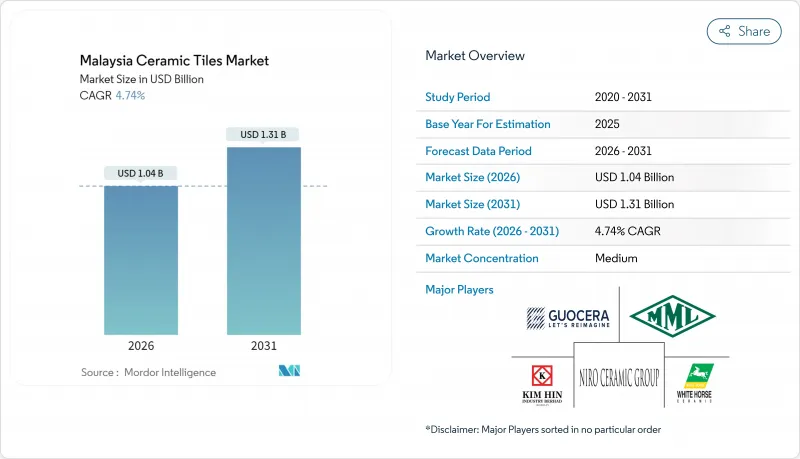

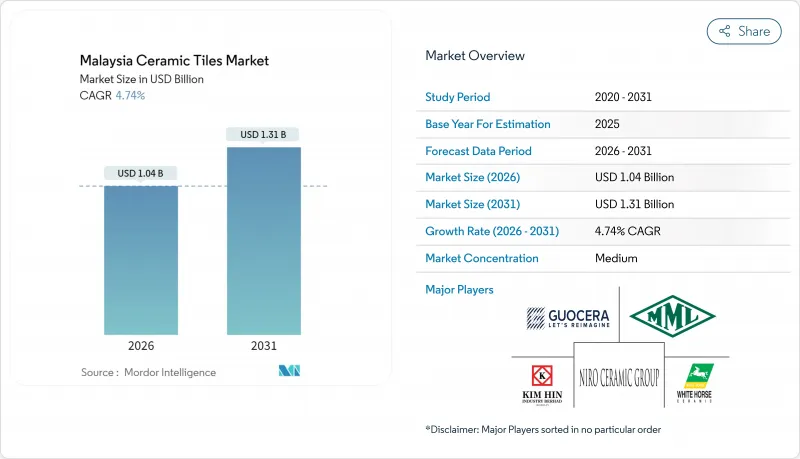

2025年馬來西亞瓷磚市場價值9.9億美元,預計到2031年將達到13.1億美元,高於2026年的10.4億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 4.74%。

這些數據表明,馬來西亞瓷磚市場是一個穩定、中等成長的建材領域,其前景日益受到巴生谷大型企劃、沙巴和砂拉越基礎設施建設以及零售通路快速數位化的影響。預計2024年將簽署價值馬幣億令吉的建築契約,創歷史新高,這將推動住宅和商業應用領域對瓷磚的下游需求。技術的快速應用,尤其是在配備噴墨列印技術的大型瓷磚生產線上的應用,正在推動瓷磚的優質化,而政府的經濟適用住宅配額制度則確保了基準需求。來自中國和越南進口產品的競爭壓力迫使本地製造商透過永續性、先進的釉藥技術和全通路分銷策略來實現差異化。

馬來西亞瓷磚市場趨勢與分析

都市區中產階級的需求日益成長

吉隆坡、雪蘭莪和檳城居民可支配收入的成長持續推動人均地板材料支出,馬來西亞瓷磚市場從中受益匪淺。家庭裝飾性地面支出預計將從2018年的5.306億馬幣成長至2022年的馬幣,並在2026年達到7.6億馬幣,年複合成長率達4.4%。預計2024年住宅房地產交易量將成長6.2%,交易金額將成長14.4%,顯示強勁的翻新需求將使高階陶瓷瓷磚成為市場青睞的對象。中產階級買家更專注於開放式佈局中瓷磚的耐用性和美觀性,從而推高了每個計劃的平均購買面積。人口結構的變化也促使零售商擴展其線上產品目錄,因為都市區消費者在選擇瓷磚圖案之前越來越傾向於使用數位視覺化工具。

政府主導的經濟適用住宅計劃

聯邦政府的「我的家園」(My Home)、「一人一馬」(PR1MA)和「雪蘭莪房屋」(Rumah Selangork)等項目指定廚房、浴室和公共區域使用瓷磚,從而確保製造商獲得穩定的訂單量。 「我的家園」計畫為開發商提供每套房屋高達馬幣的補貼,直接為瓷磚採購開闢了建築管道。森那美地產的「種子家園」(Seed Homes)計劃展示了私人建設公司如何響應國家目標,為經濟適用房提供耐用的瓷磚地面。標準化的設計和單元尺寸使供應商能夠透過批量採購協議降低成本,從而在價格壓縮的情況下保持利潤率。經濟適用住宅法規也強制要求在地採購,保護國內企業免受馬來西亞瓷磚市場進口價格競爭的影響。這些項目通常指定潮濕區域和人流量大的區域使用瓷磚,從而確保在經濟週期中保持穩定的基準需求。經濟適用住宅計劃的標準化特性帶來了批量採購的優勢,在保持價格競爭力的同時,有望提高瓷磚供應商的利潤率。

天然氣和電力成本波動

瓷磚窯爐在超過攝氏1150度的高溫下消耗大量天然氣,這使得生產商極易受到現貨價格突然飆升的影響。對於通體磁磚生產線而言,公用事業成本已佔出廠價的30%以上,而數位印刷機的電價上漲也進一步推高了成本。預計到2035年,東南亞將佔全球能源需求成長的25%,馬來西亞的瓷磚工廠將面臨持續的成本不確定性。由於缺乏避險工具,中小企業被迫在利潤率下降和因價格傳導而導致馬來西亞瓷磚市場銷售量下滑之間做出選擇。石化燃料約佔該地區能源需求的80%,這種持續依賴使其面臨全球大宗商品價格波動的風險。僅靠提高營運效率無法完全應對這項挑戰。高能耗的磁磚生產在用電高峰期面臨特別嚴峻的挑戰,因為此時公用事業公司會實施基於需求的收費系統。這迫使製造商最佳化生產計劃,以適應能源成本週期。

細分市場分析

預計到2025年,陶瓷瓷磚將佔馬來西亞陶瓷磚市場收入的41.62%,並在2031年之前以5.15%的複合年成長率成長。因此,陶瓷瓷磚仍然是馬來西亞陶瓷磚市場健康狀況的關鍵指標。這一成長主要得益於陶瓷瓷磚低於0.5%的吸水率,使其即使在馬來西亞潮濕的氣候下也具有很高的耐用性。乾壓成型和數位釉藥技術的進步使得瓷磚能夠呈現出與天然石材直接競爭的大理石紋理效果,從而刺激了高階住宅的升級需求。

釉藥瓷磚仍然是住宅浴室牆面的重要選擇,而無釉藥工業瓷磚則廣泛應用於工業設施和交通樞紐的地板材料,這些場所對防滑性能要求極高。小批量燒製、可客製化顏色的馬賽克瓷磚在酒店業中佔據了一席之地,常用於裝飾牆面和泳池區域。其他裝飾性產品,例如手繪娘惹風格瓷磚,因其將傳統圖案與現代幾何紋樣相結合,在精品開發商中保持著較高的利潤率。隨著暹羅水泥運作產能擴張項目的投產,預計大尺寸陶瓷瓷磚的供應將有所緩解,從而支撐馬來西亞瓷磚市場長期的優質化趨勢。

到2025年,地磚將佔馬來西亞瓷磚市場58.72%的佔有率,這主要得益於零售商場和獨棟住宅對耐用性的需求。吉隆坡新建公寓的平均占地面積預計將在2023年至2025年間成長6%,從而推動絕對需求的成長。同時,牆磚預計將以4.84%的複合年成長率成長,在所有應用領域中增速最高,這主要得益於浴室翻新中對衛生易清潔表面的優先考慮。屋頂瓦將保持其獨特的市場地位,這主要得益於一項研究表明,淺色陶瓷屋頂瓦在馬來西亞的熱帶氣候下可將最高溫度降低高達16攝氏度,從而降低13.14%的年度能源成本。

馬來西亞的牆壁材料瓷磚市場正受益於噴墨紋理技術,該技術能夠模仿壁紙,同時避免熱帶浴室常見的潮濕問題。在屋頂領域,研究表明,淺色瓷磚可使閣樓溫度降低攝氏16度,從而減少13.14%的年度冷卻成本。商業建築重視低維護的填縫系統,並追求從牆面到地面連續統一的圖案設計,以創造更協調的外觀。因此,供應商將產品以多種規格包裝,方便設計師在垂直和水平表面上應用相同的圖案。這種模式在馬來西亞瓷磚行業正日益普及。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 都市區中產階級的需求日益成長

- 政府主導的低收入住宅計劃

- 大尺寸磁磚板材的應用日益廣泛

- 向環保、低碳瓷磚生產轉型

- 利用數位噴墨印刷實現大規模客製化

- 加速大型政府資助的計劃

- 市場限制

- 天然氣和電力成本波動

- 來自低成本進口商品(中國、越南)的競爭

- 先進製造業技術純熟勞工短缺

- 馬來西亞中層建築從業人員對建築資訊模型(BIM)要求的採納率低

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 洞察市場最新趨勢與創新

- 深入了解近期產業發展動態(新產品發布、策略性舉措、投資、合作、合資、擴張、併購等)

第5章 市場規模與成長預測

- 依產品類型

- 瓷質磚

- 釉藥陶瓷磚

- 無釉陶瓷磚

- 馬賽克瓷磚

- 其他(裝飾瓷磚、圖案瓷磚、手工瓷磚)

- 透過使用

- 地面

- 牆

- 屋頂材料

- 最終用戶

- 住宅

- 商業

- 飯店業(飯店、度假村)

- 零售店

- 辦公室和公共設施

- 衛生保健

- 教育設施

- 交通樞紐(機場、捷運、客運站)

- 其他商業用戶

- 依建築類型

- 新建工程

- 維修和更換

- 透過分銷管道

- 磁磚和石材專賣店

- 居家裝潢和DIY專賣店

- 線上零售

- 直接向承包商銷售

- 按地區

- 北馬來西亞

- 馬來西亞中部(巴生谷)

- 南馬來西亞

- 馬來西亞東海岸

- 東馬(沙巴和砂勞越)

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Guocera Holdings Sdn Bhd

- White Horse Ceramic Industries Sdn Bhd

- Niro Ceramic Group

- Kim Hin Industry Berhad

- Yi-Lai Industry Berhad(Alpha Tiles)

- Seacera Group Berhad

- Malaysia Mosaic Sdn Bhd(MML)

- Claytan Group

- Venus Ceramic Industry Sdn Bhd

- Perfect Ceramic Tiles Sdn Bhd

- RAK Ceramics PJSC

- Kajaria Ceramics Ltd

- Siam Cement Group(SCG Tiles)

- Mohawk Industries Inc.

- Roca Tile Group

- Dongpeng Ceramic Co., Ltd.

- Johnson Tiles(Norcos plc)

- Somany Ceramics Ltd

- Monalisa Group Co., Ltd.

- Panaria Group Industrie Ceramiche SpA

第7章 市場機會與未來展望

The Malaysia ceramic tiles market was valued at USD 0.99 billion in 2025 and estimated to grow from USD 1.04 billion in 2026 to reach USD 1.31 billion by 2031, at a CAGR of 4.74% during the forecast period (2026-2031).

These figures position the Malaysia ceramic tiles market as a stable, mid-growth building-materials arena whose outlook is increasingly influenced by Klang Valley megaprojects, Sabah-Sarawak infrastructure upgrades, and rapid digitalization in retail channels. A record RM 183.7 billion worth of construction contracts was awarded in 2024, reinforcing downstream demand for tiles in both residential and commercial settings. Rapid technology adoption, especially large-format porcelain slab lines equipped with ink-jet printing, supports premiumization, while state-led affordable-housing quotas safeguard baseline volume. Competitive pressures from Chinese and Vietnamese imports are forcing local manufacturers to differentiate through sustainability credentials, advanced glazing, and omnichannel distribution strategies.

Malaysia Ceramic Tiles Market Trends and Insights

Rising Urban Middle-Class Demand

Rising disposable incomes in Kuala Lumpur, Selangor, and Penang continue to lift per-capita floor-covering expenditures, making the Malaysia ceramic tiles market a prime beneficiary. Household spending on decorative surfaces climbed from RM 530.6 million in 2018 to RM 640.2 million in 2022, and is projected to reach RM 760.0 million by 2026, a 4.4% CAGR. Transaction volumes for residential property grew 6.2%, with values up 14.4% in 2024, signaling robust renovation activity that favors premium porcelain formats. Middle-class buyers place higher value on durability and aesthetic coherence across open-plan layouts, driving up average square-meter purchases per project. The demographic trend also pushes retailers to widen online catalogs as urban consumers increasingly prefer digital visualization tools before selecting tile patterns.

Government-Led Affordable Housing Projects

Federal schemes such as MyHome, PR1MA, and Rumah Selangorku specify ceramic tiles for kitchens, bathrooms, and common areas, ensuring predictable order volumes for manufacturers. MyHome offers developers up to RM 30,000 per unit, unlocking a construction pipeline that directly feeds tile procurement. Sime Darby Property's Seed Homes initiative shows private builders aligning with state goals to supply budget apartments furnished with durable tile surfaces. Because designs and unit sizes are standardized, suppliers capture cost efficiencies through bulk purchase agreements, protecting margins despite compressed price points. Affordable-housing rules also compel local sourcing, shielding domestic players from import price warfare in this segment of the Malaysia ceramic tiles market. These programs typically specify ceramic tiles for wet areas and high-traffic zones, ensuring consistent baseline demand regardless of economic cycles. The standardized nature of affordable housing projects enables bulk procurement advantages, potentially improving profit margins for ceramic tile suppliers while maintaining competitive pricing structures.

Volatile Natural-Gas & Electricity Costs

Tile kilns consume large volumes of natural gas at temperatures exceeding 1,150 °C, leaving producers highly exposed to spot-price spikes. Utility bills already account for more than 30% of ex-factory cost on full-body porcelain lines, and electricity charges for digital printers add upward pressure. With Southeast Asia expected to represent 25% of global energy-demand growth by 2035, Malaysian plants face continued cost unpredictability. Smaller companies lack hedging instruments, forcing them either to absorb margin erosion or pass on price increases that risk volume loss in the Malaysia ceramic tiles market. The region's continued reliance on fossil fuels, which meet nearly 80% of energy demand, creates ongoing exposure to global commodity price volatility that manufacturers cannot fully control through operational efficiency improvements. Energy-intensive ceramic tile production faces particular challenges during peak demand periods when utility companies implement demand-based pricing structures, forcing manufacturers to optimize production scheduling around energy cost cycles.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Adoption of Large-Format Porcelain Slabs

- Shift Toward Eco-Friendly Low-Carbon Tile Production

- Competition from Low-Cost Imports

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Porcelain accounted for 41.62% of 2025 revenue in the Malaysia ceramic tiles market, while the segment is projected to accelerate at a 5.15% CAGR through 2031. The Malaysia ceramic tiles market size for porcelain therefore, remains the primary barometer of industry health. These gains rest on porcelain's sub-0.5% water-absorption rate, making it more durable in Malaysia's high-humidity climate. Advancements in dry-pressing and digital glazing now permit marble-look finishes that compete directly with natural stone, persuading upscale homeowners to upgrade.

Glazed ceramic tiles retain importance in mass-housing bathroom walls, whereas unglazed technical porcelain targets industrial and transit flooring where slip resistance is critical. Mosaic tiles secure niche value in hospitality accent walls and pools, capitalizing on bespoke color blends enabled by small-batch firing. Decorative "others," including hand-painted Nyonya-style tiles, command high margins among boutique developers who marry heritage motifs with modern geometry. As capacity expansions by Siam Cement Group come online, the supply of large-format porcelain is expected to ease, supporting the Malaysia ceramic tiles market's long-term premiumization trend.

Floor installations held a 58.72% share of the Malaysia ceramic tiles market in 2025, anchored by durability needs in retail malls and landed houses. Average floor areas per new condominium in Kuala Lumpur rose 6% between 2023 and 2025, lifting absolute volume demand. Wall applications, however, are penciled in for a 4.84% CAGR, the fastest within overall applications, as bathroom remodels prioritize hygienic, easy-wipe surfaces. Roofing applications maintain a specialized market position, particularly benefiting from research demonstrating that lighter-colored ceramic roof tiles can reduce peak temperatures by up to 16°C and achieve 13.14% annual energy cost savings in Malaysia's tropical climate.

The Malaysia ceramic tiles market size for wall coverings is benefiting from ink-jet textures that mimic wallpaper without the moisture issues common in tropical bathrooms. On the roofing side, research shows lighter-colored ceramic tiles can reduce attic temperatures by 16 °C and cut annual cooling bills by 13.14%. Commercial sectors appreciate low-maintenance grout systems, prompting wall-to-floor continuity to improve design coherence. Consequently, suppliers package multi-format SKUs that allow designers to run identical graphics across vertical and horizontal planes, an approach gaining traction in the Malaysia ceramic tiles industry.

The Malaysia Ceramic Tiles Market Report is Segmented by Product Type (Porcelain Tiles, Glazed Ceramic Tiles, and More), Application (Floor, Wall, Roofing), End-User (Residential, Commercial), Construction Type (New Construction, Renovation and Replacement), Distribution Channel (Specialty Stores, DIY Stores, Online Retail, Direct Sales), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Guocera Holdings Sdn Bhd

- White Horse Ceramic Industries Sdn Bhd

- Niro Ceramic Group

- Kim Hin Industry Berhad

- Yi-Lai Industry Berhad (Alpha Tiles)

- Seacera Group Berhad

- Malaysia Mosaic Sdn Bhd (MML)

- Claytan Group

- Venus Ceramic Industry Sdn Bhd

- Perfect Ceramic Tiles Sdn Bhd

- RAK Ceramics PJSC

- Kajaria Ceramics Ltd

- Siam Cement Group (SCG Tiles)

- Mohawk Industries Inc.

- Roca Tile Group

- Dongpeng Ceramic Co., Ltd.

- Johnson Tiles (Norcos plc)

- Somany Ceramics Ltd

- Monalisa Group Co., Ltd.

- Panaria Group Industrie Ceramiche S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Urban Middle-Class Demand

- 4.2.2 Government-Led Affordable Housing Projects

- 4.2.3 Increasing Adoption of Large-Format Porcelain Slabs

- 4.2.4 Shift Toward Eco-Friendly Low-Carbon Tile Production

- 4.2.5 Digital Ink-Jet Printing Enabling Mass Customization

- 4.2.6 Acceleration of Government-Funded Infrastructure Megaprojects

- 4.3 Market Restraints

- 4.3.1 Volatile Natural-Gas & Electricity Costs

- 4.3.2 Competition From Low-Cost Imports (China, Vietnam)

- 4.3.3 Skilled-Labour Shortages In Advanced Manufacturing

- 4.3.4 Slow Diffusion of Building-Information-Modelling (Bim) Requirements In Malaysia's Mid-Tier Architectural Community

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Industry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Porcelain Tiles

- 5.1.2 Glazed Ceramic Tiles

- 5.1.3 Unglazed Ceramic Tiles

- 5.1.4 Mosaic Tiles

- 5.1.5 Others (Decorative, Patterned, Handmade)

- 5.2 By Application

- 5.2.1 Floor

- 5.2.2 Wall

- 5.2.3 Roofing

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.2.1 Hospitality (Hotels, Resorts)

- 5.3.2.2 Retail Spaces

- 5.3.2.3 Offices & Institutions

- 5.3.2.4 Healthcare

- 5.3.2.5 Educational Facilities

- 5.3.2.6 Transport Hubs (Airports, Metro, Bus Terminals)

- 5.3.2.7 Other Commercial Users

- 5.4 By Construction Type

- 5.4.1 New Construction

- 5.4.2 Renovation and Replacement

- 5.5 By Distribution Channel

- 5.5.1 Specialty Tile & Stone Stores

- 5.5.2 Home Improvement & DIY Stores

- 5.5.3 Online Retail

- 5.5.4 Direct Sales to Contractors

- 5.6 By Geography

- 5.6.1 Northern Malaysia

- 5.6.2 Central Malaysia (Klang Valley)

- 5.6.3 Southern Malaysia

- 5.6.4 East Coast Malaysia

- 5.6.5 East Malaysia (Sabah & Sarawak)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Guocera Holdings Sdn Bhd

- 6.4.2 White Horse Ceramic Industries Sdn Bhd

- 6.4.3 Niro Ceramic Group

- 6.4.4 Kim Hin Industry Berhad

- 6.4.5 Yi-Lai Industry Berhad (Alpha Tiles)

- 6.4.6 Seacera Group Berhad

- 6.4.7 Malaysia Mosaic Sdn Bhd (MML)

- 6.4.8 Claytan Group

- 6.4.9 Venus Ceramic Industry Sdn Bhd

- 6.4.10 Perfect Ceramic Tiles Sdn Bhd

- 6.4.11 RAK Ceramics PJSC

- 6.4.12 Kajaria Ceramics Ltd

- 6.4.13 Siam Cement Group (SCG Tiles)

- 6.4.14 Mohawk Industries Inc.

- 6.4.15 Roca Tile Group

- 6.4.16 Dongpeng Ceramic Co., Ltd.

- 6.4.17 Johnson Tiles (Norcos plc)

- 6.4.18 Somany Ceramics Ltd

- 6.4.19 Monalisa Group Co., Ltd.

- 6.4.20 Panaria Group Industrie Ceramiche S.p.A.

7 Market Opportunities & Future Outlook

- 7.1 Smart Anti-Microbial Glazed Tiles With Iot Sensors

- 7.2 Carbon-Neutral Kiln Technologies Leveraging Hydrogen Fuel