|

市場調查報告書

商品編碼

1910507

聊天機器人:市佔率分析、產業趨勢與統計、成長預測(2026-2031)Chatbot - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

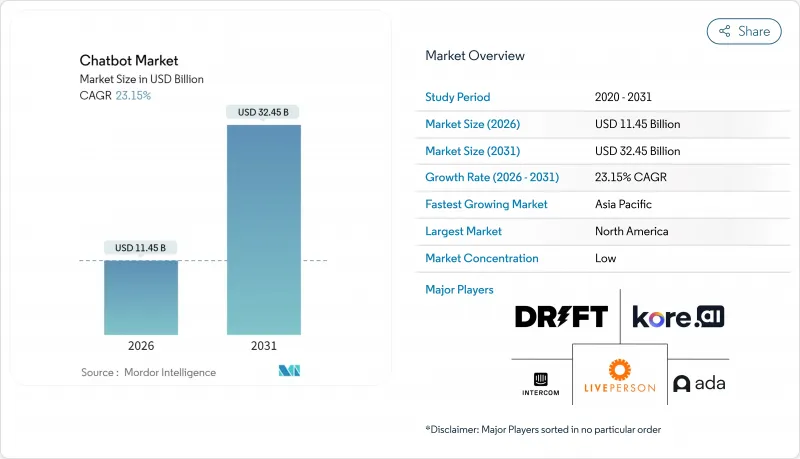

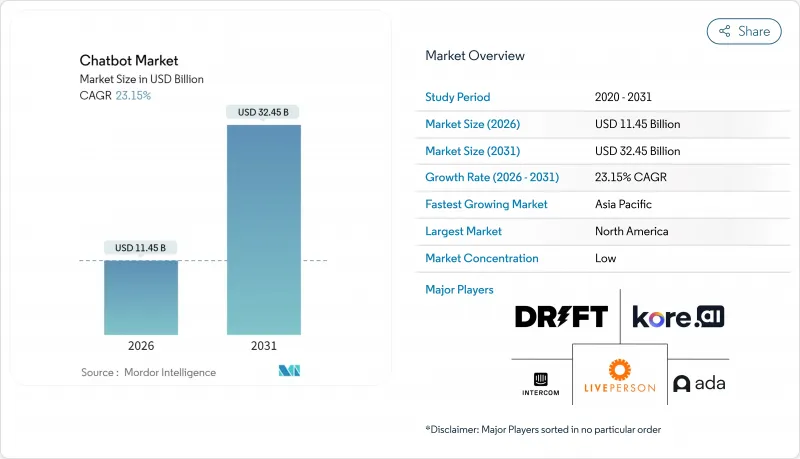

預計聊天機器人市場將從 2025 年的 93 億美元成長到 2026 年的 114.5 億美元,到 2031 年達到 324.5 億美元,2026 年至 2031 年的複合年成長率為 23.15%。

這種持續擴張是由即時通訊應用的普及、大規模語言模型性能的快速提升以及傳統客服中心運營成本壓力不斷增加所驅動的。客戶體驗領導者現在優先考慮自主、始終線上管道,這些管道能夠降低服務成本,同時透過語音、文字和多模態介面保持類人互動。平台供應商正在積極回應,整合搜尋增強型生成技術、多語言模型和特定領域代理,以縮短開發週期並普及部署。隨著企業對可衡量投資回報率的需求日益成長,供應商正專注於基於運作的定價、主動合規工具以及垂直整合的知識包,以加快受監管行業實現價值的速度。日益激烈的競爭正促使全球超大規模資料中心業者、獨立專家和客戶體驗外包商透過收購、夥伴關係和策略性資本注入來整合自身能力。

全球聊天機器人市場趨勢與洞察

通訊應用用戶群快速成長

WhatsApp 目前擁有 30 億用戶,每天支援 1.75 億次商務對話,為聊天機器人市場提供了一個龐大且現成的發行管道。企業已開設 7.64 億個 WhatsApp Business 帳戶,其開啟率高達 98%,遠高於電子郵件的 20%,並顯著降低了獲客成本。這個龐大的通訊生態系統涵蓋全球超過 2 億家企業,形成了強大的網路效應,提高了零售、銀行和醫療保健等產業聊天機器人的投資報酬率。企業正在利用富媒體模板,將互動從行銷提示轉化為完整的交易流程,而無需用戶下載應用程式。隨著用戶熟悉程度的提高,基於訊息的互動方式正逐漸成為服務諮詢、訂單追蹤和通路內支付的預設介面。

大規模語言建模(NLP)取得突破

GPT-4.5 和即將推出的 GPT-5 模型的出現,使得聊天機器人能夠以接近人類的流暢度處理複雜的多輪對話。摩根士丹利等公司正在部署 GPT-4 進行內部知識搜尋,從而縮短顧問的搜尋時間並提高合規信心。供應商正在整合搜尋擴展生成功能,使機器人能夠在保持對話流暢性的同時檢索即時數據,從而解決傳統知識缺口帶來的挑戰。 Yellow.ai 建立了一個多語言學習模型 (LLM) 管道,每年可處理超過 160 億次對話,並透過為每個查詢選擇專門的模型來最佳化成本和準確性。這些創新降低了對訓練資料的需求,使沒有大規模標註資料集的中小型企業也能使用先進的互動式人工智慧。

整合複雜性和遺留資料孤島

擁有數十年歷史系統的公司在將聊天機器人連接到大型主機、CRM 和 ERP 系統時,會面臨數月的進度延誤。 47% 的公司正在建立內部生成式人工智慧來管理資料管道,這反映出他們對整合方面的擔憂。中介軟體編配、即時同步和嚴格的安全審查會增加計劃預算並延遲全面部署,尤其是在資料碎片化嚴重的通訊業。因此,數位原民獲得了上市時間優勢,迫使現有企業投資於 API 現代化改造。

細分市場分析

到2025年,平台軟體產品將佔據聊天機器人市場64.12%的佔有率,凸顯其作為底層基礎設施的重要地位。同時,服務領域到2031年將以24.12%的複合年成長率成長,超過整體市場成長率。隨著互動式人工智慧日趨複雜,企業對諮詢、整合和最佳化方面的專業知識的需求也日益成長。 Yellow.ai透過提供涵蓋策略制定、客製化模型調優和持續管治的全生命週期支持,推動了對服務的需求。對於客戶而言,專業的合作夥伴可以解決整合難題並確保合規性,將供應商的專業知識轉化為切實可見的業務成果,從而證明其高價的合理性。

實施諮詢通常與包含運作保證、再培訓和季度績效評估的託管服務等級協定 (SLA) 捆綁在一起。這種轉變正在將收入結構轉向持續服務契約,從而穩定供應商的現金流。隨著人工智慧工具的成熟,差異化因素將從底層技術轉向以結果為導向的合作,這將使擁有深厚垂直行業專業知識和強大合作夥伴生態系統的供應商更受青睞。聊天機器人市場將持續進行平台整合,同時服務細分市場也將持續成長,佔據越來越大的市場佔有率。

到2025年,客戶支援將佔據聊天機器人市場佔有率的41.82%,反映出其諮詢量龐大且投資報酬率顯著。同時,人力資源和招募領域的應用將以24.86%的複合年成長率(CAGR)實現最快成長,直至2031年。借助聊天機器人處理候選人初步篩檢、面試安排和政策諮詢等工作,人力資源部門可以將精力集中在更高價值的活動上。企業報告稱,他們已實現了90%重複性諮詢的自動化,並縮短了招募時間,從而顯著提高了生產力。

銷售和行銷機器人透過持續的個人化對話來培養潛在客戶,IT 服務台人員可以重設密碼或診斷硬體問題,而新興的內部知識助理則可以聚合結構化和非結構化內容,從而縮短搜尋週期。這些不斷擴展的功能展現了互動式人工智慧的多功能性,並鞏固了其作為核心自動化基礎而非小眾輔助工具的地位。

區域分析

到2025年,北美將佔據聊天機器人市場38.72%的佔有率,這主要得益於低層級管理(LLM)技術的早期應用以及高昂的人事費用推動了自動化投資回報率的提升。美國金融機構和零售商正在部署先進的語音和視覺代理,而加拿大企業則利用GPT-4進行內部知識搜尋。成熟的數位基礎設施和活躍的創業投資資金支持著持續的實驗,並透過近岸服務中心將技術推廣到拉丁美洲。

亞太地區將呈現最快的成長速度,到2031年複合年成長率將達到24.71%,這主要得益於政府對人工智慧投資的支持以及行動商務的興起。中國正在人工智慧計劃上投資21億美元,印度的聊天機器人市場正以每年25%的速度成長,而新加坡則被定位為人工智慧管治的試驗場。智慧型手機的高普及率和超級應用生態系統正在產生大量的對話流量,加速人工智慧在銀行、旅遊和公共服務領域的應用。本地供應商正在開發針對不同地區方言客製化的多語言聊天機器人,以促進包容性的數位存取。

在歐洲,歐盟人工智慧立法的框架下,創新與嚴格合規之間正取得平衡。德國、法國和英國正將聊天機器人融入製造業、醫療保健和公共管理領域,並將年度合規預算納入總體擁有成本 (TCO) 的計算中。標準化的管治框架加強了跨國合作,並確立了事實上的全球標準。在南美、中東和非洲等新興地區,雲端運算成本的下降和寬頻的普及正在推動電信、能源和交通運輸等產業的應用。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 通訊應用用戶群快速成長

- 大規模語言模型(LLM):自然語言處理(NLP)領域的技術進步

- 全天候客戶支援成本壓力

- 數位顧客體驗策略中對自助服務的呼聲日益高漲

- 語音優先與多模態機器人

- 利用LLM實現內部知識自動化

- 市場限制

- 整合複雜性和遺留資料孤島

- 隱私/監管合規問題

- 幻覺帶來的品牌風險

- 缺乏垂直訓練資料集

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟因素如何影響市場

第5章 市場規模與成長預測

- 按組件

- 平台/軟體

- 服務

- 透過使用

- 客戶支援

- 銷售與行銷

- 人力資源/招聘

- IT服務管理

- 其他

- 透過部署模式

- 雲

- 本地部署

- 按組織規模

- 小型企業

- 主要企業

- 按最終用戶行業分類

- 零售與電子商務

- BFSI

- 衛生保健

- 旅遊與飯店

- 電訊和資訊技術

- 政府和公共部門

- 其他終端用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 新加坡

- 澳洲

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- LivePerson, Inc.

- Kore.ai, Inc.

- Ada Support Inc.

- Intercom, Inc.

- Drift.com, Inc.

- Yellow.ai Pvt. Ltd.

- Cognigy GmbH

- Freshworks Inc.

- Gupshup Technology India Pvt. Ltd.

- Boost.ai AS

- Rasa Technologies GmbH

- SnatchBot SA

- Tidio Poland Sp. z oo

- Chatfuel, Inc.

- Aivo Technologies, Inc.

- Inbenta Holdings, Inc.

- Senseforth.ai Labs Pvt. Ltd.

- BotsCrew, Inc.

- Quiq, Inc.

- LiveChat Software SA

- Zendesk, Inc.

- Artificial Solutions International AB

第7章 市場機會與未來展望

The Chatbot market is expected to grow from USD 9.30 billion in 2025 to USD 11.45 billion in 2026 and is forecast to reach USD 32.45 billion by 2031 at 23.15% CAGR over 2026-2031.

This sustained expansion is propelled by ubiquitous messaging-app reach, rapid advances in large-language-model performance, and mounting cost pressures on traditional contact-center operations. Customer experience leaders now prioritize autonomous, always-on channels that lower service costs while sustaining human-like interactions across voice, text, and multimodal interfaces. Platform vendors respond by embedding retrieval-augmented generation, multilingual models, and fine-tuned domain agents that reduce development cycles and democratize deployment. As enterprises seek measurable ROI, vendors emphasize outcome-linked pricing, proactive compliance tooling, and verticalized knowledge packs that accelerate time-to-value in regulated industries. Competitive intensity is rising as global hyperscalers, independent specialists, and CX outsourcers consolidate capabilities through acquisitions, partnerships, and strategic capital infusions.

Global Chatbot Market Trends and Insights

Explosion of Messaging-App User Base

WhatsApp now serves 3 billion users and supports 175 million daily business conversations, giving the Chatbot market an immense, ready-made distribution channel. Businesses have opened 764 million WhatsApp Business accounts that achieve 98% open rates versus 20% for email, dramatically lowering acquisition costs. The broader messaging ecosystem engages more than 200 million businesses worldwide, creating strong network effects that improve bot ROI across retail, banking, and healthcare. Firms leverage rich-media templates that shift interactions from marketing prompts to full-funnel transactions without requiring app downloads. As user familiarity rises, message-based journeys become the default interface for service queries, order tracking, and in-channel payments.

Breakthroughs in Large-Language-Model NLP

The launch of GPT-4.5 and expected GPT-5 models enabled chatbots to manage complex multi-turn dialogues with near-human fluency. Enterprises such as Morgan Stanley showcased GPT-4 for internal knowledge retrieval, reducing advisor search time and boosting compliance confidence. Vendors embed retrieval-augmented generation so bots pull real-time data yet maintain conversation flow, addressing historical knowledge-cutoff limits. Yellow.ai orchestrates multi-LLM pipelines over 16 billion annual conversations, selecting specialized models per query to optimize cost and accuracy. These innovations cut training-data demands and open advanced conversational AI to SMEs lacking large labeled datasets.

Integration Complexity and Legacy Data Silos

Enterprises with decades-old systems face month-long timeline overruns when wiring chatbots into mainframes, CRMs, and ERPs. Forty-seven percent of firms build generative AI in-house to control data pipelines, reflecting integration anxiety. Middleware orchestration, real-time synchronization, and stringent security vetting inflate project budgets and delay full rollout, especially in banking and telecom, where data fragmentation is acute. As a result, greenfield digital-native firms gain time-to-market advantage, pressing incumbents to invest in API modernization.

Other drivers and restraints analyzed in the detailed report include:

- 24/7 Customer-Support Cost Pressure

- Self-Service Mandates in Digital CX Strategies

- Privacy/Regulatory Compliance Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Platform and software offerings retained a 64.12% share of the Chatbot market in 2025, underscoring their role as foundational infrastructure. Services, however, outpace overall growth at a 24.12% CAGR through 2031. Enterprises increasingly seek advisory, integration, and optimization expertise as conversational AI complexity rises. Yellow.ai packages full-lifecycle support covering strategy, custom model tuning, and ongoing governance, driving services demand. For clients, expert partners mitigate integration pain points and ensure compliance, turning vendor know-how into tangible business outcomes that justify premium fees.

Implementation consulting is often bundled with managed-service SLAs that guarantee uptime, retraining, and quarterly performance reviews. This shift nudges revenue mix toward recurring service contracts, smoothing vendor cash flows. As AI tooling matures, differentiation hinges less on base technology and more on outcome-driven engagement, favoring providers with deep vertical playbooks and robust partner ecosystems. The Chatbot market expects continued platform consolidation alongside a flourishing services layer that captures expanding wallet share.

Customer support commanded 41.82% of the Chatbot market share in 2025, reflecting high ticket volumes and proven ROI. HR and recruiting use cases, however, register the quickest rise with a 24.86% CAGR through 2031. Bots prescreen candidates, schedule interviews, and answer policy questions, freeing HR teams for high-touch activities. Enterprises report 90% automation of repetitive inquiries and accelerated time-to-hire, translating into measurable productivity gains.

Sales and marketing bots nurture leads via personalized drip conversations, while IT service-desk agents reset passwords and diagnose hardware issues. Emerging internal knowledge assistants aggregate structured and unstructured content, cutting search cycles. This functional diversification underscores conversational AI's versatility and cements its status as a core automation pillar rather than a niche support add-on.

The Chatbot Market Report is Segmented by Component (Platform/Software and Services), Application (Customer Support, Sales and Marketing, and More), Deployment Mode (Cloud and On-Premise), Organization Size (Small and Medium Enterprises and Large Enterprises), End-User Industry (Retail and ECommerce, BFSI, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 38.72% to the Chatbot market size in 2025, anchored by early LLM adoption and high labor costs that sharpen automation payback. U.S. financial institutions and retailers implement advanced voice-plus-vision agents, and Canadian enterprises tap GPT-4 for internal knowledge retrieval. Mature digital infrastructure and vibrant venture funding support continuous experimentation that spills over into Latin America through nearshore service hubs.

Asia-Pacific posts the fastest 24.71% CAGR through 2031 as governments back AI investments and mobile commerce proliferates. China poured USD 2.1 billion into AI projects, India's chatbot segment grows 25% annually, and Singapore positions itself as an AI governance testbed. High smartphone penetration and super-app ecosystems generate massive conversational traffic, accelerating adoption in banking, travel, and public services. Local vendors tailor multilingual bots to regional dialects, fostering inclusive digital access.

Europe advances under the shadow of the EU AI Act, balancing innovation with rigorous compliance. Germany, France, and the U.K. integrate chatbots into manufacturing, healthcare, and public administration, with annual compliance budgets absorbed into total cost of ownership calculations. Standardized governance frameworks enhance cross-border collaborations and set de-facto global norms. Emerging regions, South America, the Middle East, and Africa benefit from falling cloud costs and expanding broadband, unlocking greenfield deployments across telecom, energy, and transport.

- LivePerson, Inc.

- Kore.ai, Inc.

- Ada Support Inc.

- Intercom, Inc.

- Drift.com, Inc.

- Yellow.ai Pvt. Ltd.

- Cognigy GmbH

- Freshworks Inc.

- Gupshup Technology India Pvt. Ltd.

- Boost.ai AS

- Rasa Technologies GmbH

- SnatchBot SA

- Tidio Poland Sp. z o.o.

- Chatfuel, Inc.

- Aivo Technologies, Inc.

- Inbenta Holdings, Inc.

- Senseforth.ai Labs Pvt. Ltd.

- BotsCrew, Inc.

- Quiq, Inc.

- LiveChat Software S.A.

- Zendesk, Inc.

- Artificial Solutions International AB

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosion of messaging-app user base

- 4.2.2 Breakthroughs in large-language-model (LLM) NLP

- 4.2.3 24/7 customer-support cost pressure

- 4.2.4 Self-service mandates in digital CX strategies

- 4.2.5 Voice-first and multimodal bot convergence

- 4.2.6 LLM-powered internal knowledge automation

- 4.3 Market Restraints

- 4.3.1 Integration complexity and legacy data silos

- 4.3.2 Privacy/regulatory compliance concerns

- 4.3.3 Hallucination-driven brand-risk

- 4.3.4 Scarcity of vertical-grade training datasets

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Platform/Software

- 5.1.2 Services

- 5.2 By Application

- 5.2.1 Customer Support

- 5.2.2 Sales and Marketing

- 5.2.3 HR and Recruiting

- 5.2.4 IT Service Management

- 5.2.5 Others

- 5.3 By Deployment Mode

- 5.3.1 Cloud

- 5.3.2 On-premise

- 5.4 By Organization Size

- 5.4.1 Small and Medium Enterprises (SMEs)

- 5.4.2 Large Enterprises

- 5.5 By End-user Industry

- 5.5.1 Retail and eCommerce

- 5.5.2 BFSI

- 5.5.3 Healthcare

- 5.5.4 Travel and Hospitality

- 5.5.5 Telecom and IT

- 5.5.6 Government and Public Sector

- 5.5.7 Other End-user Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Malaysia

- 5.6.4.6 Singapore

- 5.6.4.7 Australia

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.5.1 Middle East

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 LivePerson, Inc.

- 6.4.2 Kore.ai, Inc.

- 6.4.3 Ada Support Inc.

- 6.4.4 Intercom, Inc.

- 6.4.5 Drift.com, Inc.

- 6.4.6 Yellow.ai Pvt. Ltd.

- 6.4.7 Cognigy GmbH

- 6.4.8 Freshworks Inc.

- 6.4.9 Gupshup Technology India Pvt. Ltd.

- 6.4.10 Boost.ai AS

- 6.4.11 Rasa Technologies GmbH

- 6.4.12 SnatchBot SA

- 6.4.13 Tidio Poland Sp. z o.o.

- 6.4.14 Chatfuel, Inc.

- 6.4.15 Aivo Technologies, Inc.

- 6.4.16 Inbenta Holdings, Inc.

- 6.4.17 Senseforth.ai Labs Pvt. Ltd.

- 6.4.18 BotsCrew, Inc.

- 6.4.19 Quiq, Inc.

- 6.4.20 LiveChat Software S.A.

- 6.4.21 Zendesk, Inc.

- 6.4.22 Artificial Solutions International AB

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment