|

市場調查報告書

商品編碼

1907289

紙板包裝:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Paperboard Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

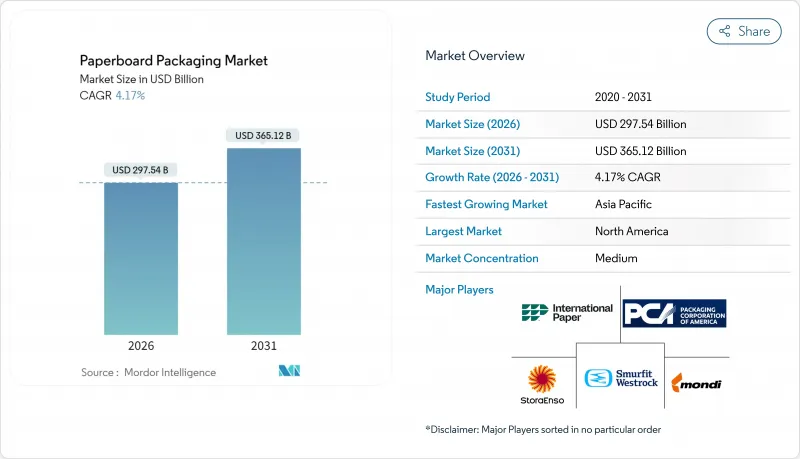

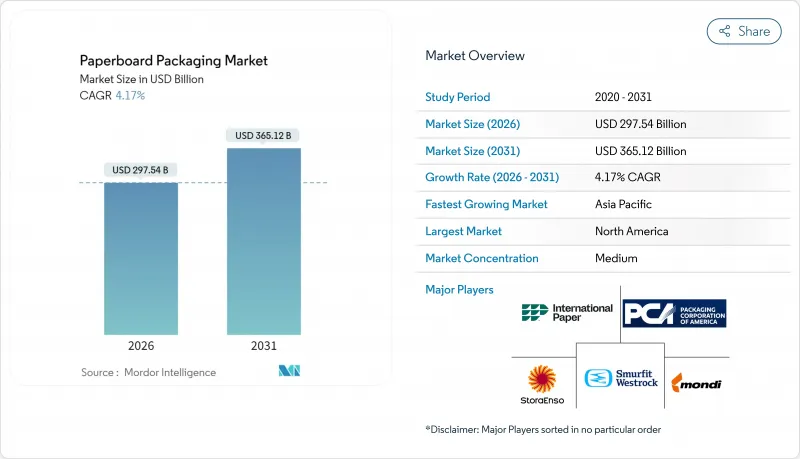

預計紙板包裝市場將從 2025 年的 2,856.3 億美元成長到 2026 年的 2,975.4 億美元,並預計在 2031 年達到 3,651.2 億美元,2026 年至 2031 年的複合年成長率為 4.17%。

電子商務交易量的成長、監管政策對纖維而非塑膠的偏好,以及輕量化和數位加工技術的不斷進步,都在推動市場擴張。再生纖維優異的成本績效特性,與零售商建構循環供應鏈的努力相輔相成,即使在原料成本波動的情況下,也能維持市場需求。瓦楞紙包裝仍然是物流網路的支柱,而高階消費品行業則擴大採用折疊紙盒。為了因應不斷上漲的能源成本和再生紙價格的波動,市場參與企業正在低成本林業地區投資垂直整合和紙漿生產能力。

全球紙板包裝市場趨勢與洞察

電子商務的快速發展推動了對瓦楞紙箱運輸的需求。

線上零售的興起推動了對堅固耐用、尺寸最佳化且能承受多次搬運的運輸包裝箱的需求。紙箱製造商透過將高性能瓦楞型材與即時設計工具相結合,實現了訂單的激增,這些工具能夠根據 SKU 的形狀客製化包裝設計。美國包裝公司 (PCA) 計劃在 2025 年初將每噸價格上調 70 美元,這凸顯了供需平衡的緊張。直接面對消費者的銷售模式進一步強化了外包裝品牌展示空間的需求,促使加工商整合高解析度數位印刷模組。智慧標籤技術(包括位置和衝擊監測)正被整合到瓦楞紙襯紙中,創造的價值遠不止於保護功能。

塑膠替代品法規促進紡織包裝業發展

歐盟的《包裝及包裝廢棄物法規》規定,到2030年,包裝材料的可回收率必須達到90%,加速從多層塑膠到可回收纖維材料的過渡。北美各州已實施生產者延伸責任制,亞太地區的多個市場也正在製定類似的法規。生產商正積極回應,採用分散阻隔塗層和不含PFAS的耐油化學處理技術,將食品保護與再生紙漿生產相結合。品牌所有者正利用這些解決方案來實現其永續永續性目標,並避免即將徵收的塑膠稅。

加強對森林砍伐和纖維來源的審查

歐盟反毀林法規的實施要求造紙廠在2020年12月後追溯木材來源,直到獲得無毀林認證為止。這增加了審核成本,並使不合規的供應鏈面臨進口禁令。跨國公司正在全球推廣類似的通訊協定,實際上實現了合規的全球化。規模較小的加工商面臨不成比例的行政負擔,因此轉向認證池和與人工林主的垂直聯盟。為認證原木支付的溢價推高了某些等級原木的損益平衡點,在監管鏈體系成熟之前,利潤空間將被壓縮。

細分市場分析

得益於完善的家庭垃圾收集網路和成熟的脫墨技術,預計到2025年,再生纖維將佔據紙板包裝市場72.10%的佔有率。受與循環經濟目標相關的監管獎勵的推動,該細分市場預計將比原生紙板實現6.65%的複合年成長率。隨著品牌商強制要求高需求產品達到最低再生材料含量,再生紙板包裝市場規模預計將進一步擴大。然而,在對視覺品質和濕強度要求極高的應用領域,例如化妝品禮盒和藥品泡殼包裝,原生纖維仍將保持其重要性。

對低成本人工林業的持續投資鞏固了再生紙的優勢。蘇扎諾新建的巴西桉樹綜合設施每年將供應255萬噸高白度紙漿,這些紙漿可與回收材料無縫混合,從而降低全球造紙廠的平均原料成本。 FSC和PEFC認證進一步提升了再生紙板的競爭力,使加工商能夠添加碳中和聲明,從而引起具有環保意識的消費者的共鳴。這種供應保障和品牌優勢使再生纖維在紙板包裝市場中佔據了領先地位。

受全通路零售帶來的出貨頻率激增的推動,到2025年,瓦楞紙箱將佔42.10%的收入佔有率。內建的防潮層和抗壓微瓦楞結構使這些紙箱能夠以最小的損壞通過自動化分類系統,進一步凸顯了其不可或缺性。折疊紙盒儘管產量較低,但由於其高解析度印刷能力與高階食品和個人保健產品的陳列方式相契合,預計將以5.55%的複合年成長率快速成長。此外,由於市場對「貨架易取包裝」(兼具鮮豔的印刷效果和更高的可回收性)的需求不斷成長,折疊紙盒的紙質包裝市場預計也將擴大。

在創新方面,Greif 的 EnviroRAP™ 提供了一種單材料包裝方案,可取代貼合加工信封,同時保持家庭可回收性。同時,數位瓦楞紙板製造設備的進步使加工商能夠以印刷速度列印可變數據,從而支持區域性節日主題和網紅合作。這種柔軟性使瓦楞紙板解決方案在紙板包裝市場中脫穎而出,並保持其作為分銷主力產品的領先地位。

區域分析

預計到2025年,北美將佔據38.55%的收入佔有率,這主要得益於一體化的再生纖維網路以及各州層面的塑膠減量政策,這些政策促使加工商轉向利用生活垃圾進行回收的解決方案。美國包裝公司(Packaging Corporation of America)以18億美元收購Containerboard,增強了區域產能,並標誌著產業整合的趨勢,旨在利用規模經濟。零售商的當日配送服務進一步刺激了對合適尺寸瓦楞紙箱的需求,幫助紙板包裝市場在能源成本上漲的不利影響下保持了個位數的溫和成長。

亞太地區是成長最快的市場,預計到2031年將以6.78%的複合年成長率成長,這主要得益於都市區家庭對包裝日用品和快餐的需求增加。中國在出口訂單中擴大指定使用紡織基運輸包裝,而越南國內包裝產業預計到2026年將創造35億美元的收入。區域各國政府正在將循環經濟條款納入新的廢棄物指令,並為再生紙板進口商提供關稅優惠。這些政策措施,加上低成本勞動力和不斷擴張的線上零售,使亞太地區成為紙板包裝市場的成長引擎。

在歐洲,諸如《包裝廢棄物指令》(PPWR) 和《歐洲廢棄物指令》(EUDR) 等法規正推動材料持續創新,以提高可回收性和採購標準。 Sappi 公司斥資 5 億歐元(約 5.8773 億美元)升級設備,提升了其輕質塗佈紙的產能;而 Mondi 公司的收購熱潮則擴大了其在消費品叢集的折疊紙盒業務版圖。高回收率和消費者對環保標籤的認可維持了穩固的基礎,但疲軟的宏觀需求抑制了銷售成長。儘管如此,嚴格的合規要求仍然構成了一定的障礙,有利於紙板包裝市場的現有企業。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電子商務的快速成長帶動了對瓦楞紙箱運輸的需求。

- 塑膠替代品法規有利於紡織包裝

- 透過輕量化技術降低物流成本

- 亞太地區包裝食品和飲料產業快速成長

- 人工智慧驅動的按需客製化印刷

- 拉丁美洲桉樹紙漿的繁榮降低了原生纖維的成本。

- 市場限制

- 加強對森林砍伐和纖維來源的審查

- 再生紙價格波動與能源成本

- 品牌所有者背棄永續性承諾

- 柔軟性塑膠袋的剪切侵蝕。

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭對手之間的競爭

- 宏觀經濟因素如何影響市場

- 技術展望

- 監管環境

第5章 市場規模與成長預測

- 按原料

- 原生光纖

- 再生纖維

- 依產品類型

- 折疊紙箱

- 瓦楞紙箱

- 硬盒

- 其他產品類型

- 按包裝類型

- 初級包裝

- 二級包裝

- 運輸/電子商務配送

- 按最終用戶行業分類

- 食物

- 飲料

- 衛生保健

- 個人護理和化妝品

- 家居用品

- 電氣和電子設備

- 其他終端用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地區

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 越南

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢與發展

- 市佔率分析

- 公司簡介

- International Paper Company

- Smurfit WestRock

- Mondi plc

- Packaging Corporation of America

- Stora Enso Oyj

- Oji Holdings Corporation

- Nippon Paper Industries Co., Ltd.

- Rengo Co., Ltd.

- Metsa Board Oyj

- Graphic Packaging Holding Company

- Cascades Inc.

- Sonoco Products Company

- Nine Dragons Paper(Holdings)Ltd.

- Georgia-Pacific LLC

- Klabin SA

- Sappi Limited

- Mayr-Melnhof Karton AG

- Huhtamaki Oyj

- Visy Industries Holdings Pty Ltd.

- Seaboard Folding Box Company Inc.

- Clearwater Paper Corporation

- ITC Limited

第7章 市場機會與未來展望

The Paperboard Packaging market is expected to grow from USD 285.63 billion in 2025 to USD 297.54 billion in 2026 and is forecast to reach USD 365.12 billion by 2031 at 4.17% CAGR over 2026-2031.

Rising e-commerce volumes, regulatory momentum favoring fiber over plastic, and continuous improvements in lightweighting and digital converting technologies collectively propel expansion. Recycled fiber's strong cost-to-performance profile complements retailer commitments to circular supply chains, sustaining demand despite raw-material cost swings. Corrugated formats remain the backbone of fulfillment networks, while folding cartons gain ground in premium consumer categories. Market participants counter mounting energy and recovered-paper price volatility by investing in vertical integration and pulp capacity in low-cost forestry regions.

Global Paperboard Packaging Market Trends and Insights

E-commerce Surge Boosting Corrugated-Shipping Demand

Online retail penetration requires stronger, dimension-optimized shipping containers that withstand multiple touchpoints. Box producers captured surging orders by pairing high-performance flute profiles with real-time design tools that tailor packaging to SKU geometry. Packaging Corporation of America's USD 70-per-ton price increase in early 2025 illustrated a tight demand-supply balance. Direct-to-consumer models further reinforce the need for branding space on outer packs, incentivizing converters to integrate high-graphics digital print modules. Smart-label technologies supporting location and shock monitoring now ship on corrugated liners, creating value beyond protection.

Plastic-Substitution Regulations Favor Fiber Packaging

The European Union's Packaging and Packaging Waste Regulation mandates 90% recyclability by 2030, accelerating the shift from multilayer plastics toward recyclable fiber formats. North American states replicate extended-producer-responsibility frameworks, while several Asia-Pacific markets draft similar statutes. Producers respond with dispersion-based barrier coatings and PFAS-free grease-proof chemistries that safeguard food while maintaining repulpability. Brand owners leverage these solutions to meet public sustainability pledges and evade upcoming plastic taxes.

Deforestation and Fiber-Sourcing Scrutiny

Implementation of the European Union Deforestation Regulation compels mills to trace wood back to plots verified as deforestation-free after December 2020, adding auditing costs and exposing non-compliant supply chains to import bans. Multinationals extend the same protocols worldwide, effectively globalizing compliance. Smaller converters face disproportionate administrative burdens, nudging them toward certification pooling or vertical partnerships with plantation owners. Premiums paid for certified logs increase the break-even point for certain grades, compressing margins until chain-of-custody systems mature.

Other drivers and restraints analyzed in the detailed report include:

- Light-Weighting Innovations Lowering Logistics Cost

- Rapid Growth of Packaged F&B in Asia-Pacific

- Volatile Recovered-Paper and Energy Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Recycled fiber secured a 72.10% share of the paperboard packaging market in 2025, underpinned by extensive curbside collection networks and maturing de-inking technologies. This segment is also projected to clock a 6.65% CAGR, outpacing virgin grades due to regulatory credits linked to circularity goals. The paperboard packaging market size for recycled grades is forecast to widen as brand owners mandate minimum post-consumer content for high-volume SKUs. Virgin fiber retains relevance where impeccable visual quality or high wet-strength is mandatory, such as cosmetics gift boxes and pharmaceutical blister cards.

Continuous investments in low-cost plantation forestry bolster recycled leadership. Suzano's new Brazilian eucalyptus complex provides 2.55 million t/year of high-brightness pulp that blends seamlessly with recovered streams, lowering average furnish costs for global mills. Certification through FSC and PEFC further differentiates recycled sheets, enabling converters to add carbon-neutral claims that resonate with eco-conscious consumers. Resulting supply security and branding leverage keep recycled fiber at the forefront of the paperboard packaging market.

Corrugated boxes captured 42.10% revenue share in 2025, propelled by shipment frequency spikes tied to omnichannel retail. Embedded moisture barriers and crush-resistant micro-flutes allow these boxes to traverse automated sortation systems with minimal damage, reinforcing their indispensability. Folding cartons, though smaller in tonnage, promise the fastest 5.55% CAGR, as high-graphics capabilities align with premium food and personal-care placement. The paperboard packaging market size for folding cartons is projected to expand alongside demand for shelf-ready packs that combine vivid print with easier recyclability.

On the innovation front, Greif's EnviroRAP(TM) showcases mono-material wrap formats that replace laminated mailers while retaining curbside recyclability. Parallel progress in digital corrugators lets converters print variable data at press speed, supporting localized holiday themes or influencer collaborations. Such flexibility differentiates corrugated solutions within the paperboard packaging market and sustains their lead as the workhorse of distribution.

The Paperboard Packaging Market Report is Segmented by Raw Material Source (Virgin Fibre, and Recycled Fibre), Product Type (Folding Cartons, Corrugated Boxes, and More), Packaging Format (Primary Packaging, Secondary Packaging, and More), End-User Industry (Food, Beverage, Healthcare, and More), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 38.55% revenue share in 2025, buoyed by integrated recovered-fiber networks and state-level plastic-reduction mandates that steer converters toward curbside-recyclable solutions. Packaging Corporation of America's USD 1.8 billion containerboard acquisition bolsters regional capacity, evidencing consolidation that harnesses scale efficiencies. Retailers' same-day delivery services further stimulate demand for right-sized corrugated shippers, helping the paperboard packaging market sustain mid-single-digit growth despite energy-cost headwinds.

Asia-Pacific represents the fastest-expanding arena, clocking a 6.78% CAGR through 2031 as urban households buy more packaged staples and quick-service meals. China's export orders increasingly specify fiber-based transit wraps, while Vietnam's local industry eyes USD 3.5 billion in packaging revenue by 2026. Regional governments embed circular-economy clauses in new waste directives, granting tariff concessions to importers of recycled sheets. These policy levers, coupled with low-cost labor and expanding online retail, turn Asia-Pacific into the growth engine of the paperboard packaging market.

Europe sustains material innovations underpinned by regulations such as the PPWR and the EUDR, which tighten recyclability and sourcing standards. Sappi's EUR 500 million(USD 587.73 million) machine upgrade enhances lightweight coated capacity, while Mondi's acquisition spree widens folding-carton footprints across consumer-goods clusters. High recovery rates and consumer receptiveness to eco-labels maintain a robust baseline, although sluggish macro demand tempers tonnage growth. Still, stringent compliance hurdles create a moat that favors established players inside the paperboard packaging market.

- International Paper Company

- Smurfit WestRock

- Mondi plc

- Packaging Corporation of America

- Stora Enso Oyj

- Oji Holdings Corporation

- Nippon Paper Industries Co., Ltd.

- Rengo Co., Ltd.

- Metsa Board Oyj

- Graphic Packaging Holding Company

- Cascades Inc.

- Sonoco Products Company

- Nine Dragons Paper (Holdings) Ltd.

- Georgia-Pacific LLC

- Klabin S.A.

- Sappi Limited

- Mayr-Melnhof Karton AG

- Huhtamaki Oyj

- Visy Industries Holdings Pty Ltd.

- Seaboard Folding Box Company Inc.

- Clearwater Paper Corporation

- ITC Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce surge boosting corrugated-shipping demand

- 4.2.2 Plastic-substitution regulations favor fibre packaging

- 4.2.3 Light-weighting innovations lowering logistics cost

- 4.2.4 Rapid growth of packaged F&B in Asia-Pacific

- 4.2.5 AI-enabled on-demand custom printing

- 4.2.6 LatAm eucalyptus pulp boom lowering virgin-fibre cost

- 4.3 Market Restraints

- 4.3.1 Deforestation and fibre-sourcing scrutiny

- 4.3.2 Volatile recovered-paper and energy costs

- 4.3.3 Brand-owner pull-back on sustainability pledges

- 4.3.4 Flexible plastic pouches eroding share

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competitive Rivalry

- 4.6 The Impact of Macroeconomic Factors on the Market

- 4.7 Technological Outlook

- 4.8 Regulatory Landscape

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Raw Material Source

- 5.1.1 Virgin Fibre

- 5.1.2 Recycled Fibre

- 5.2 By Product Type

- 5.2.1 Folding Cartons

- 5.2.2 Corrugated Boxes

- 5.2.3 Rigid Boxes

- 5.2.4 Other Product types

- 5.3 By Packaging Format

- 5.3.1 Primary Packaging

- 5.3.2 Secondary Packaging

- 5.3.3 Transit / E-commerce Shipping

- 5.4 By End-user Industry

- 5.4.1 Food

- 5.4.2 Beverage

- 5.4.3 Healthcare

- 5.4.4 Personal Care and Cosmetics

- 5.4.5 Household Care

- 5.4.6 Electrical and Electronics

- 5.4.7 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 Vietnam

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 International Paper Company

- 6.4.2 Smurfit WestRock

- 6.4.3 Mondi plc

- 6.4.4 Packaging Corporation of America

- 6.4.5 Stora Enso Oyj

- 6.4.6 Oji Holdings Corporation

- 6.4.7 Nippon Paper Industries Co., Ltd.

- 6.4.8 Rengo Co., Ltd.

- 6.4.9 Metsa Board Oyj

- 6.4.10 Graphic Packaging Holding Company

- 6.4.11 Cascades Inc.

- 6.4.12 Sonoco Products Company

- 6.4.13 Nine Dragons Paper (Holdings) Ltd.

- 6.4.14 Georgia-Pacific LLC

- 6.4.15 Klabin S.A.

- 6.4.16 Sappi Limited

- 6.4.17 Mayr-Melnhof Karton AG

- 6.4.18 Huhtamaki Oyj

- 6.4.19 Visy Industries Holdings Pty Ltd.

- 6.4.20 Seaboard Folding Box Company Inc.

- 6.4.21 Clearwater Paper Corporation

- 6.4.22 ITC Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment