|

市場調查報告書

商品編碼

1911452

紙和紙板包裝:市場佔有率分析、行業趨勢和統計數據、成長預測(2026-2031)Paper And Paperboard Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

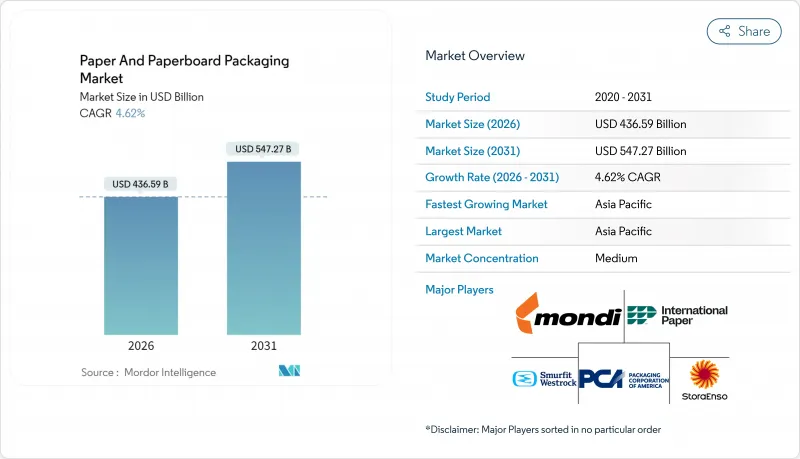

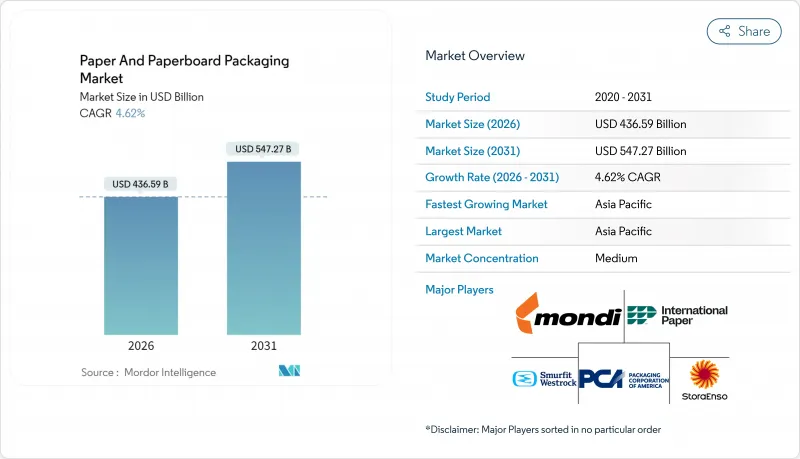

預計到2026年,紙和紙板包裝市場規模將達到4,365.9億美元,高於2025年的4,173.1億美元。預計到2031年,該市場規模將達到5,472.7億美元,2026年至2031年的複合年成長率為4.62%。

需求成長主要得益於三大結構性利多因素:歐盟加強了回收規定、電子商務對保護性運輸的需求以及亞太地區產能的快速擴張。瓦楞紙箱憑藉其強度重量比和與自動化包裝線的兼容性,仍然是主流包裝形式。同時,液體紙盒在飲料和乳製品行業中越來越受歡迎。監管期限,例如歐盟在2030年實現70%回收率的目標以及美國到2040年逐步淘汰問題塑膠的計劃,正在推動向替代材料的轉變。以Smurfit Kappa和Westrock合併為例的產業整合,正在擴大規模,並協助企業應對舊瓦楞紙箱(OCC)和原生紙漿等原料價格的波動。同時,纖維混紡技術的創新正在實現更輕的重量,減少運輸排放,並支持品牌實現永續性目標。

全球紙和紙板包裝市場趨勢與洞察

電子商務主導的SKU 爆炸性成長

線上市場擁有成千上萬種產品,必須確保產品完好無損地送達消費者手中。這促使加工商轉向小批量印刷和客製化瓦楞紙板設計。美國包裝公司 (PCA) 報告稱,由於零售商升級了二級包裝、減少了填充物並降低了體積重量溢價,2024 年瓦楞紙板出貨量將增加 9.2%。無需額外包裝即可展示品牌圖案的貨架包裝形式正以 5.81% 的複合年成長率成長,而數位印刷速度的提升使加工商能夠經濟高效地批量處理小批量訂單。國際紙業公司 2024 年 186 億美元的淨銷售額凸顯了紙製品市場的巨大成長潛力,前提是紙廠能夠轉換生產箱板紙和特種瓦楞紙板的產能。回收政策鼓勵使用紙質包裝而非塑膠郵寄包裝,這確保了紙質包裝市場能夠繼續佔據小包裹市場成長的佔有率。

塑膠禁令和課稅

世界各國政府正紛紛推出全面禁令或對一次性塑膠課稅,即時生效。新南威爾斯已於2025年1月起限制使用塑膠塗層咖啡杯和刀叉餐具。在歐洲,產品安全標籤法規也引導品牌轉向使用單一材料紙板,並貼上清晰的再生紙標誌。 Billerud 的高性能棕色阻隔紙袋取代了工業包裝袋中的聚乙烯塗層,由於其經認證的生物基成分,因此獲得了更高的價格。隨著美國環保署計劃在2040年前實現零塑膠廢棄物,品牌所有者正在簽署多年供應協議,以支持增加牛皮紙襯紙的產能。

回收紙(OCC)和原生紙漿價格波動

紙漿和再生紙指數上漲7.2%(至2024年),對未採取避險策略的加工商構成壓力。儘管銷售額達90億歐元(97億美元),斯道拉恩索仍指出木纖維價格上漲是面臨的一大不利因素。依賴現貨OCC(廢棄紙箱)的小規模紙廠難以將季度合約中的附加費轉嫁給消費者,導致其利潤率相對於樹脂成本更為穩定的塑膠替代品有所下降。

細分市場分析

2025年,瓦楞紙板將佔紙包裝市場42.85%的佔有率,這得益於嚴格的電商物流標準和可回收性要求。國際紙業的工業包裝業務展現出顯著的營運槓桿效應,儘管宏觀需求疲軟,公司仍保持了穩定的利潤率。液體紙盒雖然銷量較小,但隨著乳製品和飲料品牌從多層塑膠袋轉向PEFC認證的可再生材料紙盒,其複合年成長率(CAGR)正以5.54%的速度成長。折疊紙盒在化妝品和製藥行業繼續佔據一席之地,高解析度膠印圖案提升了產品在商店的吸引力。技術創新主要集中在水性阻隔材料上,這種材料能夠抵禦油污和潮濕,同時還能在造紙廠的製漿過程中實現纖維回收。

輕量化仍然是控制成本的關鍵策略。主要的瓦楞紙板生產商正在採用高澱粉雙層瓦楞紙板,這種紙板在纖維含量較低的情況下即可達到所需的邊緣抗壓強度。 Billerud公司投資14億瑞典克朗(約1.3億美元)的等級轉換計畫旨在生產紙張重量減少10%的食品級紙板。歐盟的回收法規迫使供應商轉向單一材料設計,確保瓦楞紙板和紙盒在紙包裝市場的長期主導地位。

預計到2025年,食品飲料業將佔總銷售額的41.10%,這得益於嚴格的衛生標準和消費者對可回收外帶容器的需求。 Graphic Packaging最新發布的10-K報告指出,冷凍食品紙板托盤的成長高於市場平均。個人護理品牌正以壓花牛皮紙套取代層壓板,以營造自然質感,推動該細分市場的複合年成長率達到6.30%。藥品包裝則受惠於防篡改撕條和條碼插頁,這些設計完美契合序列化法規。

品牌所有者在選擇供應商時也優先考慮可再生能源,並將範圍 3 的排放與採購決策結合。 Mondi 報告稱,其 87% 的銷售額目前符合可重複使用或可回收標準。這種偏好支撐了紙質包裝市場規模的預期,使得塑膠在高曝光度的消費品應用領域幾乎沒有生存空間。

區域分析

到2025年,亞太地區將佔據全球紙包裝市場46.80%的最大佔有率,這主要得益於中國創紀錄的1.2965億噸紙張產量以及到2031年該地區4.95%的複合年成長率。低成本勞動力、一體化的紙漿供應鏈以及快速成長的電子商務交易量都為投資提供了支撐。光是九龍紙業就新增了200萬噸漂白紙板產能,以滿足速食連鎖店的需求。日本和韓國完善的回收體係也為該地區提供了有力支持,兩國回收率超過80%,能夠生產高再生紙含量的箱板紙,供應出口市場。

北美擁有豐富的森林資源和先進的加工生產線,在高階瓦楞紙板和模塑紙漿緩衝材料領域佔據主導地位。美國包裝公司(Packaging Corporation of America)2024年的銷售額達到84億美元,顯示國內需求穩定。歐洲則走在更嚴格的監管道路上。 《包裝和包裝廢棄物法規》將強制回收率提高到2030年的70%,從而推動了輕質紙板的創新。斯道拉恩索在芬蘭新建的紙板生產線,標誌著該公司將資金重新配置到符合循環經濟標準的優質塗佈紙產品上。

拉丁美洲和中東及非洲是新興的都市化市場,推動包裝消費。克拉賓的森林整合模式使其能夠以具有競爭力的成本向南方共同市場成員國交付,而巴西正在探索雙邊綠色燃料貿易,以降低其出口箱板紙的碳排放強度。儘管基礎設施不足和匯率波動會在短期內抑製成長,但品牌所有者預期長期銷售將持續成長,並正在推動紙包裝市場的地理擴張。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電子商務主導的SKU激增

- 塑膠禁令和課稅

- 區域城市的速食發展

- 工業堆肥標準的興起

- 消費者藥品履約

- 以永續性為核心,革新包裝。

- 市場限制

- 回收紙漿(OCC)和原生紙漿價格波動

- 非政府組織因森林砍伐而施加壓力

- 為一家大型線上零售商提供內部瓦楞紙板加工服務

- 碳邊境調節費

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭強度

- 貿易場景(HS編碼-4819)

- 主要國家的進出口資料(按數量計,2021-2024 年)

- 主要國家的進出口資料(以金額為準,2021-2024 年)

第5章 市場規模與成長預測

- 依產品類型

- 折疊紙箱

- 紙板包裝

- 液體紙盒

- 其他產品類型

- 按最終用戶行業分類

- 食品/飲料

- 醫療/製藥

- 個人護理和化妝品

- 電氣和電子設備

- 工業和汽車

- 按包裝類型

- 主要零售包裝

- 二級運輸包

- 貨架/展示包裝

- 保護性襯墊和緩衝墊

- 按材質等級

- 原生光纖

- 再生纖維

- 混紡/混合纖維

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地區

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 馬來西亞

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- International Paper Company

- Smurfit Westrock plc

- Mondi plc

- DS Smith plc

- Packaging Corporation of America

- Stora Enso Oyj

- Nippon Paper Industries Co., Ltd.

- Oji Holdings Corporation

- Billerud AB

- Sonoco Products Company

- Nine Dragons Paper(Holdings)Ltd.

- Svenska Cellulosa AB(SCA)

- Rengo Co., Ltd.

- Lee & Man Paper Manufacturing Ltd.

- Mayr-Melnhof Karton AG

- Pratt Industries Inc.

- Klabin SA

- Georgia-Pacific LLC

第7章 市場機會與未來展望

Paper and paperboard packaging market size in 2026 is estimated at USD 436.59 billion, growing from 2025 value of USD 417.31 billion with 2031 projections showing USD 547.27 billion, growing at 4.62% CAGR over 2026-2031.

Demand builds on three structural tailwinds: tougher recycling mandates in the European Union, e-commerce's need for protective shipping formats, and rapid capacity additions in the Asia Pacific. Corrugated cases remain the anchor format because of strength-to-weight advantages and compatibility with automated packing lines, while liquid cartons gain traction in beverages and dairy. Regulatory deadlines that push recycling rates to 70% by 2030 in Europe and the United States' roadmap to phase out problematic plastics by 2040 reinforce substitution momentum. Consolidation typified by the Smurfit Kappa-WestRock merger brings scale that helps players manage volatile old-corrugated-container (OCC) and virgin-pulp input prices. At the same time, fiber-blend innovation enables lighter boards that cut freight emissions and support brand sustainability goals.

Global Paper And Paperboard Packaging Market Trends and Insights

E-commerce-led SKU explosion

Online marketplaces list thousands of product variants that must reach consumers undamaged, pushing converters toward shorter print runs and made-to-fit corrugated designs. Packaging Corporation of America posted a 9.2% jump in corrugated shipments in 2024 as merchants upgraded secondary packs to minimize void fill and cut dimensional-weight surcharges. Shelf-ready formats that reveal brand graphics without extra unpacking are expanding at 5.81% CAGR, and digital printing speeds let converters batch small orders economically. International Paper's USD 18.6 billion net sales in 2024 underline the volume upside when mills can pivot capacity between linerboard and specialty flute grades. Recycling mandates favor paper solutions over plastic mailers, ensuring the paper packaging market continues capturing parcel growth

Plastic-use bans and taxes

Governments target single-use plastics with outright bans or levies that take immediate effect. New South Wales began restricting plastic-lined coffee cups and cutlery in January 2025. In Europe, product-safety labeling rules also steer brands toward mono-material boards that carry clear recycling logos. Billerud's Performance Brown Barrier sack paper now replaces polyethylene coatings in industrial bags, securing premium pricing for verified bio-based content. With the U.S. Environmental Protection Agency mapping a plastic-waste exit by 2040, brand owners lock in multi-year supply contracts that underpin additional kraft-liner capacity.

Volatile OCC and virgin pulp prices

Pulp and recovered-paper indices rose 7.2% in 2024, squeezing converters that lack hedging programs. Stora Enso cited wood-fiber inflation as a headwind despite EUR 9 billion (USD 9.7 billion) of sales. Small mills dependent on spot OCC struggle to pass surcharges through quarterly contracts, narrowing margins against plastic substitutes with steadier resin costs.

Other drivers and restraints analyzed in the detailed report include:

- Quick-service food expansion in tier-2 cities

- Rise of industrial composting standards

- Deforestation-driven NGO pressure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Corrugated boards represented 42.85% of the paper packaging market in 2025, benefiting from rigorous e-commerce handling standards and recyclability requirements. The segment's operating leverage shows in International Paper's steady industrial-packaging margins amid sluggish macro demand. Liquid cartons, though just a fraction of volume, expand at a 5.54% CAGR as dairy and beverage brands swap multi-layer plastic pouches for renewable cartons certified under the PEFC chain-of-custody. Folding cartons maintain relevance in cosmetics and pharmaceuticals, where high-definition offset graphics add shelf appeal. Innovation focuses on water-based barriers that resist oil and moisture yet allow fiber recovery at mill pulpers.

Lightweighting remains the dominant cost-containment tactic. Leading corrugators deploy high-starch dual-wall flutes that achieve the required edge-crush strength with less fiber. Billerud's SEK 1.4 billion (USD 0.13 billion) grade-conversion program aims to produce food-grade cartonboard with 10% lower basis weight. EU recycling mandates push suppliers toward mono-material designs, ensuring long-term dominance for corrugated and carton grades within the paper packaging market.

Food and beverage accounted for 41.10% of 2025 revenue, underscoring strict hygiene norms and consumers' wish for recyclable takeaway formats. Graphic Packaging's latest 10-K cites above-market growth in paperboard trays for frozen meals. Personal-care brands lift the segment CAGR to 6.30% by substituting laminates with embossed kraft sleeves that convey natural positioning. Pharmaceutical packs benefit from tamper-evident tear strips and barcoded inserts that seamlessly integrate with serialization regulations.

Brand owners also prioritize renewable energy in supplier selection, linking scope-3 emissions to purchasing decisions. Mondi reports 87% of sales now meet reusable or recyclable criteria. This preference underpins the paper packaging market size outlook, leaving little room for plastics in high-visibility consumer applications.

The Paper and Paperboard Packaging Market Report is Segmented by Product Type (Folding Cartons, Corrugated Packaging, Liquid Cartons, and More), End-User Vertical (Food and Beverage, Healthcare and Pharma, and More), Packaging Format (Primary Retail Packs, Secondary Transit Packs, and More), Material Grade (Virgin Fiber, Recycled Fiber, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific held the largest 46.80% slice of the paper packaging market in 2025, powered by China's record 129.65 million-ton paper production run and a 4.95% regional CAGR through 2031. Cost-effective labor, integrated pulp supply, and explosive e-commerce volumes sustain investment pipelines; Nine Dragons alone is adding two million tons of bleached boxboard capacity to serve quick-service restaurant chains. Japan and South Korea complement the region with recycling systems that push collection rates above 80%, enabling high-recycled-content linerboards for export markets.

North America combines abundant forest resources with advanced converting lines that favor high-graphic corrugated and molded-pulp cushioning. Packaging Corporation of America booked USD 8.4 billion in sales in 2024, testimony to stable domestic demand. Europe follows a stricter regulatory route: the Packaging and Packaging Waste Regulation raises mandatory recycling to 70% by 2030, spurring lightweight board innovation. Stora Enso's new Finnish board line exemplifies capital re-allocation toward premium coated grades that can satisfy circular-economy scorecards.

Latin America and the Middle East/Africa represent emerging corridors where urbanization raises packaged-goods consumption. Klabin's forest-integrated model generates competitive delivered costs into Mercosur neighbors, and Brazil explores bilateral green-fuel trade that could lower the carbon intensity of export linerboard. Infrastructure gaps and currency volatility temper immediate growth, yet brand owners eye these regions for long-run volume upside, adding geographic spread to the paper packaging market.

- International Paper Company

- Smurfit Westrock plc

- Mondi plc

- DS Smith plc

- Packaging Corporation of America

- Stora Enso Oyj

- Nippon Paper Industries Co., Ltd.

- Oji Holdings Corporation

- Billerud AB

- Sonoco Products Company

- Nine Dragons Paper (Holdings) Ltd.

- Svenska Cellulosa AB (SCA)

- Rengo Co., Ltd.

- Lee & Man Paper Manufacturing Ltd.

- Mayr-Melnhof Karton AG

- Pratt Industries Inc.

- Klabin S.A.

- Georgia-Pacific LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce-led SKU explosion

- 4.2.2 Plastic use bans and taxes

- 4.2.3 Quick-service food expansion in tier-2 cities

- 4.2.4 Rise of industrial composting standards

- 4.2.5 Direct-to-consumer pharma fulfilment

- 4.2.6 Sustainability driven Packaging Shift

- 4.3 Market Restraints

- 4.3.1 Volatile OCC and virgin pulp prices

- 4.3.2 Deforestation-driven NGO pressure

- 4.3.3 In-house corrugation by mega-etailers

- 4.3.4 Carbon-border adjustment costs

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

- 4.8 Trade Scenario (HS Codes - 4819)

- 4.8.1 Import-Export Data for the Major Countries, Volume, 2021-2024

- 4.8.2 Import-Export Data for the Major Countries, Value, 2021-2024

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Folding Cartons

- 5.1.2 Corrugated Packaging

- 5.1.3 Liquid Cartons

- 5.1.4 Other Product Types

- 5.2 By End-User Vertical

- 5.2.1 Food and Beverage

- 5.2.2 Healthcare and Pharma

- 5.2.3 Personal Care and Cosmetics

- 5.2.4 Electrical and Electronics

- 5.2.5 Industrial and Automotive

- 5.3 By Packaging Format

- 5.3.1 Primary Retail Packs

- 5.3.2 Secondary Transit Packs

- 5.3.3 Shelf-ready / Display Packs

- 5.3.4 Protective Inserts and Cushioning

- 5.4 By Material Grade

- 5.4.1 Virgin Fiber

- 5.4.2 Recycled Fiber

- 5.4.3 Hybrid/Mixed Fiber

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Malaysia

- 5.5.4.7 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 International Paper Company

- 6.4.2 Smurfit Westrock plc

- 6.4.3 Mondi plc

- 6.4.4 DS Smith plc

- 6.4.5 Packaging Corporation of America

- 6.4.6 Stora Enso Oyj

- 6.4.7 Nippon Paper Industries Co., Ltd.

- 6.4.8 Oji Holdings Corporation

- 6.4.9 Billerud AB

- 6.4.10 Sonoco Products Company

- 6.4.11 Nine Dragons Paper (Holdings) Ltd.

- 6.4.12 Svenska Cellulosa AB (SCA)

- 6.4.13 Rengo Co., Ltd.

- 6.4.14 Lee & Man Paper Manufacturing Ltd.

- 6.4.15 Mayr-Melnhof Karton AG

- 6.4.16 Pratt Industries Inc.

- 6.4.17 Klabin S.A.

- 6.4.18 Georgia-Pacific LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment