|

市場調查報告書

商品編碼

1907332

紙包裝:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Paper Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

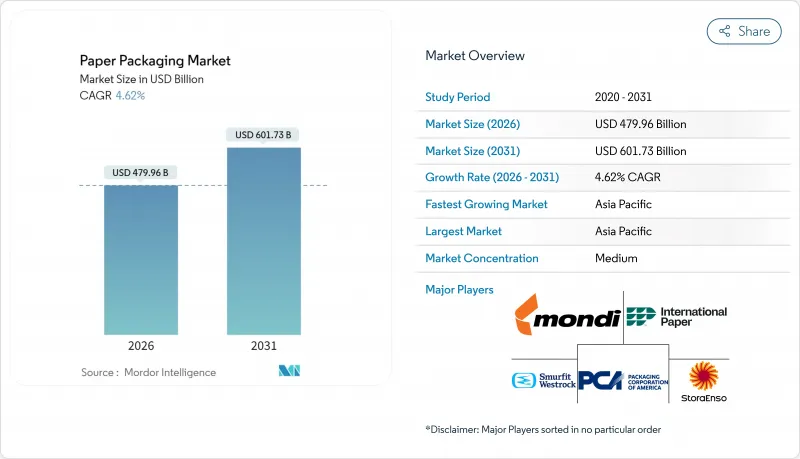

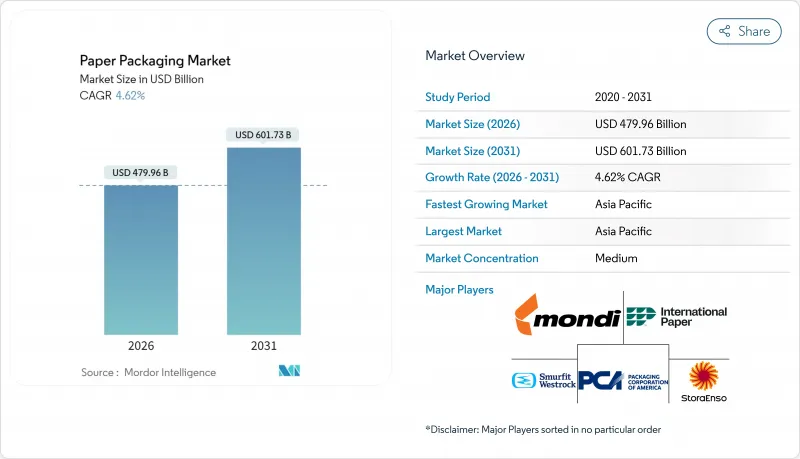

2025年紙包裝市場價值為4,588億美元,預計到2031年將達到6017.3億美元,而2026年為4799.6億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 4.62%。

這項擴張的驅動力來自鼓勵使用可再生基材的環境法規、線上零售的持續成長以及生物基阻隔塗層的快速發展,這些技術使紙張在防潮和防油性能方面能夠與塑膠相媲美。與多層塑膠相比,生產者延伸責任制 (EPR) 的收費系統降低了纖維基材料的合規成本,使生產者從中受益。同時,對奈米纖維素技術的投資有望實現不含 PFAS 的性能,這與美國和歐盟即將逐步淘汰化學物質的目標相符。數位印刷和小批量生產的經濟效益推動了供應側的柔軟性,擴大了紙包裝市場的潛在規模,使加工商能夠以可觀的利潤承接小批量、高度客製化的宣傳活動。

全球紙包裝市場趨勢與洞察

阻隔塗佈紙板解決方案的開發推動了高階應用的發展

基於生物聚合物和奈米纖維素的先進防水、防潮、防油阻隔塗層,在提升紙張性能的同時,也保持了紙張的可回收性。實驗室測試表明,纖維素奈米纖維塗層可將氧氣透過率降低90%以上,並使紙張的折疊耐久性比未塗層紙板提高一倍。美國食品藥物管理局(FDA)已確認,含全氟烷基和多氟烷基物質(PFAS)的防油添加劑已從食品接觸市場移除,市場需求轉向更安全的化學物質。在歐洲,多家加工商正在迅速提高硼酸鹽交聯聚乙烯醇塗層的工業化生產能力,這種塗層具有優異的水蒸氣阻隔性能,並符合可堆肥標準。隨著品牌商尋求在不影響保存期限的前提下替代塑膠包裝,優質阻隔塗層紙板正成為即食食品、冷凍食品和個人護理禮品包裝的標準配置,從而推動紙質包裝市場的價值成長。

電子商務對瓦楞紙包裝的強勁需求重塑了生產重點。

全球線上零售持續超越實體店面銷售,因此每個小包裹都需要能夠承受自動化處理的保護性承重外包裝。瓦楞紙箱目前估計約佔電商出貨量的80%,穩固確立了其作為末端物流支柱的地位。預計到2024年,以中國和印度為首的亞洲大型市場將新增數十億件小包裹,這將推動紙箱工廠的擴張以及為網店安裝高速數位印刷生產線。生產結構正轉向更輕的瓦楞型材,以在保持抗壓強度的同時降低運輸成本。為了滿足電商需求,綜合生產商優先提高箱板紙的產量,而非印刷用紙。這種需求支撐著成熟經濟體和新興經濟體紙包裝市場的穩定成長。

森林砍伐監測對傳統供應鏈結構構成挑戰。

歐盟《森林砍伐條例》要求進口商在2025年底前為所有木質原料提供包裹等級的可追溯性認證。佔歐盟特種紙漿進口量60%的美國牛皮紙漿,現在必須包含第三方檢驗的地理座標。引入衛星監測和監管鏈審核會增加採購成本,並可能導致運輸延誤。缺乏先進數據系統的小型造紙廠可能會被擁有認證森林的大型垂直整合企業搶佔市場佔有率,從而改變紙包裝市場的競爭格局。隨著時間的推移,更嚴格的原產地規則可能會對供應造成壓力,並限制該產業在依賴進口纖維的市場中的成長潛力。

細分市場分析

截至2025年,箱板紙將佔紙包裝市場54.12%的佔有率,這主要得益於瓦楞紙包裝產業的成熟以及其在電子商務配送中的核心地位。同時,紙板將在各種纖維等級中實現最高的複合年成長率(CAGR),達到7.05%。紙板基紙包裝的市場規模預計將會擴大,這反映出高階套筒包裝在食品和個人保健產品領域日益成長的需求。加工商正在透過改造閒置的印刷紙生產線,配備適用於固態漂白硫酸鹽漿(SBS)和折疊紙盒生產的塗佈頭,來提高產能運轉率。折疊紙盒非常適合高解析度數位印刷,能夠提升產品在商店的吸引力。其優異的阻隔阻隔性也使其能夠進入冷藏食品領域。同時,箱板紙生產商正在投資研發輕質牛皮紙襯裡,以減輕運輸重量並提高永續性。混合使用原生材料和再生材料可以最佳化強度重量比,使箱板紙保持競爭力,從而鞏固其在紙包裝市場中的領先地位。

紙板的成長潛力正推動歐洲和北美地區資本快速流入,產能迅速擴張,預計2026年運作將超過100萬噸。食品接觸認證和製藥無塵室相容性提升了紙板的噸值,尤其是固態實心紙板。歐盟多個國家對黑色塑膠的限制促使高階糖果甜點和化妝品包裝轉向白色紙板,進一步刺激了市場需求。奈米黏土等性能增強添加劑可在不影響可回收性的前提下提供防潮性能,從而減少對塑膠薄膜的依賴。隨著零售品牌尋求能夠體現品質和永續性的單一材料包裝,紙板正成為紙包裝市場最大的受益者。

到2025年,瓦楞紙箱將佔據紙包裝市場61.48%的佔有率,這得益於其無與倫比的防護強度以及在運輸、工業和食品分銷領域的廣泛應用。然而,折疊紙盒預計將以5.12%的複合年成長率成長,超過整體成長速度,這主要得益於個人化圖案、快速回應季節性宣傳活動以及小批量生產的需求。整合到模切機中的數位列印頭縮短了換模時間,並實現了無需高成本庫存的大規模客製化。高階化妝品、營養補充劑和植物性食品都青睞折疊紙盒,因為它們具有美觀的柔軟性和便於上架的特性。

瓦楞紙箱製造商正透過內印刷和高飽和度印刷技術來搶佔品牌展示空間,而折疊紙盒則憑藉觸感飾面和壓紋工藝保持著優勢。家電配件正逐漸從塑膠泡殼包裝轉向帶有模塑纖維襯墊的加固紙盒,以吸引永續性的消費者。此外,受柔軟性袋啟發而開發的創新撕拉條開口設計進一步提升了便利性。這些設計和技術的進步正推動著紙質包裝市場佔有率的穩定成長。

區域分析

預計到2025年,亞太地區將以47.62%的市佔率引領紙包裝市場,並在2031年之前以5.51%的複合年成長率持續成長。快速的都市化、不斷增強的中產階級購買力以及大規模的食品配送生態系統,都支撐著南亞和東南亞的纖維需求。區域企業正利用成本效益高的綜合工廠,將人工林與內部加工設施結合,以縮短面向出口客戶的前置作業時間。地方政府透過對節能機械設備提供關稅減免,鼓勵對永續包裝的投資,進一步加速了產能擴張。

北美是創新中心,推動了數位印刷技術的應用,並主導奈米纖維素試點計畫的商業化進程。多個州收緊掩埋法規,刺激了對可回收包裝的需求,從而支撐了國內箱板紙的需求。美國豐富的軟木資源確保了原生紙漿的穩定供應,可與進口的再生紙(OCC)混合使用。同時,歐洲嚴格的回收目標和生產者延伸責任制(EPR)計畫的實施,創造了可預測的政策環境,鼓勵設備持續更新換代。德國和斯堪的斯堪地那維亞的造紙廠正擴大從石化燃料鍋爐轉向生質能鍋爐,在高能源價格的背景下,減少了範圍1排放,並提高了成本競爭力。

拉丁美洲和中東及非洲目前僅佔市場佔有率的一小部分,但這兩個地區的成長速度都高於全球平均水平。巴西紙漿生產商正積極融入下游紙板生產環節,以減輕商品週期波動的影響;波灣合作理事會(GCC)成員國則在擴大瓦楞紙板產能,以滿足不斷成長的電子商務中心的需求。在非洲,不完善的回收網路阻礙了再生纖維的供應,但國際發展計畫正在資助試點材料回收設施,為未來的循環經濟奠定基礎。這些區域趨勢鞏固了紙包裝市場多元化的需求基礎,從而增強了其長期韌性。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 開發阻隔塗層紙板解決方案

- 電子商務對瓦楞紙包裝的需求不斷成長

- 品牌所有者向單一材料包裝的轉型

- 強制性生產者延伸責任制(EPR)

- 奈米纖維素阻隔技術取得突破

- 加工廠現場數位印刷的經濟效益。

- 市場限制

- 對森林砍伐和纖維供應的審查

- 再生纖維價格波動劇烈

- 逐步淘汰 PFAS「永久性化學物質」的代價

- 新興市場退貨流量有限

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 全球再生紙生產統計數據

- 再生紙 - 生產數量

- 再生紙-進口價值和數量

- 再生紙-出口價值和數量

- 再生紙產量 - 主要生產國

- 紙板進出口狀況

- 出口(價值和數量)

- 進口(價值和數量)

第5章 市場規模與成長預測

- 按年級

- 紙板

- 固態漂白硫酸鹽紙漿(SBS)

- 未漂白硫酸鹽紙漿(SUS)

- 折疊板(FBB)

- 塗佈再生紙板(CRB)

- 未塗佈再生紙板(URB)

- 其他等級的紙板

- 貨櫃紙板

- 白色牛皮紙襯墊

- 其他牛皮紙襯墊

- 白色頂部測試襯墊

- 其他測試襯墊

- 半化學開槽

- 回收長笛

- 紙板

- 依產品

- 折疊紙箱

- 瓦楞紙箱

- 其他產品

- 按最終用戶行業分類

- 食物

- 飲料

- 衛生保健

- 個人護理

- 家居用品

- 電氣和電子設備

- 其他終端用戶產業

- 按包裝類型

- 硬紙板(紙板、厚紙)

- 半硬質(可折疊瓦楞紙箱)

- 軟性紙(小袋、包裝紙)

- 模塑纖維和紙漿

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- International Paper Company

- Smurfit Westrock plc

- Mondi plc

- Packaging Corporation of America

- Stora Enso Oyj

- Graphic Packaging International, LLC

- Nippon Paper Industries Co. Ltd.

- Sonoco Products Company

- Oji Holdings Corporation

- Georgia-Pacific LLC

- Nine Dragons Paper Holdings

- Lee & Man Paper Manufacturing

- Sappi Limited

- Ilim Group

- Klabin SA

- Asia Pulp & Paper(APP)

第7章 市場機會與未來展望

The paper packaging market was valued at USD 458.8 billion in 2025 and estimated to grow from USD 479.96 billion in 2026 to reach USD 601.73 billion by 2031, at a CAGR of 4.62% during the forecast period (2026-2031).

This expansion is propelled by environmental regulations that reward recyclable substrates, the continued rise of online retail, and rapid progress in bio-based barrier coatings that let paper compete with plastics on moisture and grease resistance. Producers benefit from Extended Producer Responsibility fee schedules that lower compliance costs for fiber-based materials relative to multilayer plastics. At the same time, investments in nano-cellulose technology promise PFAS-free performance that aligns with looming U.S. and EU chemical phase-outs. Supply-side flexibility, powered by digital printing and smaller batch economics, is enabling converters to serve short-run, highly customized campaigns at attractive margins, expanding addressable volume for the paper packaging market.

Global Paper Packaging Market Trends and Insights

Development of Barrier-Coated Paperboard Solutions Drive Premium Applications

Advanced water-, oxygen-, and grease-barrier coatings based on bio-polymers and nano-cellulose are elevating paper's performance while preserving its recyclability. Laboratory trials show that cellulose nanofibril coatings can reduce oxygen transmission by more than 90% and double folding endurance compared with uncoated board. The U.S. Food & Drug Administration confirmed that grease-proofing agents containing PFAS have exited the food-contact market, shifting demand toward safer chemistries. In Europe, several converters are fast-tracking industrial runs of boric-acid-cross-linked poly(vinyl alcohol) coatings that deliver robust water vapor protection and meet compostability standards. As brand owners pursue plastic replacement without compromising shelf life, premium barrier-coated board is becoming the default for ready-to-eat foods, frozen meals, and personal-care gift packs, boosting value growth in the paper packaging market.

E-Commerce Corrugated Demand Surge Reshapes Production Priorities

Global online retail continues to outperform brick-and-mortar channels, and each parcel requires protective, stackable outer packaging that can withstand automated handling. Corrugated cases now account for an estimated 80% of e-commerce shipments, cementing their role as the workhorse for last-mile logistics. Asian mega-markets led by China and India added double-digit billions of parcels in 2024, prompting box-plant expansions and high-speed digital print lines dedicated to web-shop volumes. The production mix is shifting toward lightweight fluting profiles that cut freight costs yet retain compression strength, and integrated producers are prioritizing incremental containerboard tonnage over graphic paper grades to keep pace with e-commerce pull-through. This demand foundation underpins steady volume growth for the paper packaging market in both mature and emerging economies.

Deforestation Scrutiny Challenges Traditional Supply-Chain Structures

The EU Deforestation Regulation obliges importers to demonstrate plot-level traceability for all wood-based inputs by the end of 2025. U.S. Kraft pulp, representing 60% of EU specialty-grade imports, must now carry geo-coordinates verified by third parties. Implementing satellite monitoring and chain-of-custody audits raises procurement costs and risks of shipment delays. Smaller mills lacking sophisticated data systems may cede share to vertically integrated majors with certified forests, altering competitive balances within the paper packaging market. Over time, tighter provenance rules could squeeze supply and curb the sector's growth potential in markets that rely on imported fiber.

Other drivers and restraints analyzed in the detailed report include:

- Brand-Owner Migration Toward Mono-Material Packaging Architectures

- Extended Producer Responsibility Mandates Accelerate Market Transformation

- Volatile Recycled-Fiber Pricing Creates Margin Compression Pressures

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Containerboard held a 54.12% paper packaging market share in 2025, supported by deep corrugated infrastructure and its central role in e-commerce shipping. Meanwhile, cartonboard is registering a 7.05% CAGR, the fastest among fiber grades. The paper packaging market size for cartonboard applications is projected to rise, reflecting premium penetration in food and personal-care sleeves. Converters are refitting idle graphic-paper machines with coating heads suited to Solid Bleached Sulfate and Folding Boxboard production, improving asset utilization. Folding Boxboard's compatibility with high-definition digital print elevates shelf appeal, while dispersion-barrier upgrades enable chilled-food entry. At the same time, containerboard producers are investing in lightweight kraftliner to cut shipping mass, enhancing sustainability credentials. Virgin-recycled blends optimize strength-to-weight ratios and keep containerboard competitive, ensuring it remains the volume backbone of the paper packaging market.

Cartonboard's growth profile attracts capital for rapid European and North American capacity expansions, with start-ups exceeding 1 million tons by 2026. Food-contact certification and pharmaceutical clean-room compliance boost value per ton, particularly for solid-bleached grades. Regulatory bans on black plastics in several EU countries redirect premium confectionery and cosmetic packs to white cartonboard formats, lifting demand further. Performance-enhancing additives such as nano-clays deliver moisture barriers without compromising recyclability, reducing reliance on plastic films. As retail brands demand mono-material packs that convey quality and sustainability, cartonboard emerges as the prime beneficiary within the paper packaging market.

Corrugated boxes occupied 61.48% of the paper packaging market in 2025 owing to their unmatched protective strength and versatility across shipping, industrial, and grocery channels. Folding cartons, however, are forecast to outpace overall growth, expanding at a 5.12% CAGR on the back of personalized graphics, quick-response seasonal campaigns, and smaller lot sizes. Digital printheads integrated into die-cutters reduce changeover times, paving the way for mass-customization without costly inventories. Premium beauty, nutraceuticals, and plant-based foods all favor folding cartons for their aesthetic flexibility and shelf-ready formats.

Corrugated producers respond with inside-print and high-color capabilities to keep hold of branding real estate, but folding cartons maintain an edge in tactile finishes and embossing. Consumer-electronics accessories increasingly shift from plastic clamshells to reinforced cartons married with molded-fiber inserts, capturing sustainability-minded shoppers. Novel tear-strip opening features borrowed from flexible pouches further boost convenience. These design and technology advances underpin steady share migration within the broader paper packaging market.

The Paper Packaging Market Report is Segmented by Grade (Cartonboard [Solid Bleached Sulphate, and More], and Containerboard [White-Top Kraftliner, and More]), Product (Folding Cartons, Corrugated Boxes, and More), End-User Industry (Food, Beverage, Healthcare, Personal Care, Household Care, and More), Packaging Format (Rigid, Semi-Rigid, Flexible, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led the paper packaging market with a 47.62% revenue share in 2025 and is projected to record a 5.51% CAGR to 2031. Rapid urbanization, expanding middle-class purchasing power, and large-scale food-delivery ecosystems underpin fiber demand in South and Southeast Asia. Regional players leverage cost-efficient integrated mills that pair plantation forests with in-house converting, shortening lead times for export-oriented customers. Local governments incentivize sustainable-pack investments through duty rebates on energy-efficient machinery, further accelerating capacity additions.

North America remains an innovation nucleus, driving digital-print adoption and spearheading nano-cellulose pilot commercialization. Tightening landfill legislation in several states spurs demand for curbside-recyclable packs, bolstering domestic containerboard offtake. The United States also benefits from abundant softwood resources, ensuring steady virgin-fiber availability to blend with imported OCC. Meanwhile, Europe's stringent recyclability targets and EPR rollouts create a predictable policy environment that favors continuous equipment upgrades. German and Scandinavian mills transition from fossil to biomass boilers, reducing Scope 1 emissions and sharpening cost competitiveness despite high energy prices.

Latin America and the Middle East and Africa collectively hold modest shares today, yet both regions register above-global average growth. Brazilian pulp producers integrate downstream into cartonboard to mitigate commodity cycles, while Gulf Cooperation Council economies add corrugated capacity to serve expanding e-commerce hubs. Africa's underdeveloped collection network hinders recycled-fiber supply, but international development programs are funding pilot materials-recovery facilities, laying groundwork for future circularity. Collectively, these regional trajectories reinforce the diversified demand base that supports the long-term resilience of the paper packaging market.

- International Paper Company

- Smurfit Westrock plc

- Mondi plc

- Packaging Corporation of America

- Stora Enso Oyj

- Graphic Packaging International, LLC

- Nippon Paper Industries Co. Ltd.

- Sonoco Products Company

- Oji Holdings Corporation

- Georgia-Pacific LLC

- Nine Dragons Paper Holdings

- Lee & Man Paper Manufacturing

- Sappi Limited

- Ilim Group

- Klabin S.A.

- Asia Pulp & Paper (APP)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Development of barrier-coated paperboard solutions

- 4.2.2 Rise in e-commerce corrugated demand

- 4.2.3 Brand-owner shift toward mono-material packs

- 4.2.4 Extended Producer Responsibility (EPR) mandates

- 4.2.5 Nano-cellulose barrier breakthroughs

- 4.2.6 Converting-plant on-site digital printing economics

- 4.3 Market Restraints

- 4.3.1 Deforestation and fibre-supply scrutiny

- 4.3.2 Volatile recycled-fibre pricing

- 4.3.3 PFAS "forever-chemicals" phase-out costs

- 4.3.4 Limited recovery logistics in emerging markets

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Global Recovered Paper Production Statistics

- 4.8.1 Recovered Paper - Production Quantity

- 4.8.2 Recovered Paper - Import Value and Quantity

- 4.8.3 Recovered Paper - Export Value and Quantity

- 4.8.4 Recovered Paper Production - Leading Countries

- 4.9 Cartonboard EXIM Scenario

- 4.9.1 Exports (Value and Volume)

- 4.9.2 Imports (Value and Volume)

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Grade

- 5.1.1 Cartonboard

- 5.1.1.1 Solid Bleached Sulphate (SBS)

- 5.1.1.2 Solid Unbleached Sulphate (SUS)

- 5.1.1.3 Folding Boxboard (FBB)

- 5.1.1.4 Coated Recycled Board (CRB)

- 5.1.1.5 Uncoated Recycled Board (URB)

- 5.1.1.6 Other Cartonboard Grades

- 5.1.2 Containerboard

- 5.1.2.1 White-top Kraftliner

- 5.1.2.2 Other Kraftliners

- 5.1.2.3 White-top Testliner

- 5.1.2.4 Other Testliners

- 5.1.2.5 Semi-chemical Fluting

- 5.1.2.6 Recycled Fluting

- 5.1.1 Cartonboard

- 5.2 By Product

- 5.2.1 Folding Cartons

- 5.2.2 Corrugated Boxes

- 5.2.3 Other Products

- 5.3 By End-User Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Healthcare

- 5.3.4 Personal Care

- 5.3.5 Household Care

- 5.3.6 Electrical and Electronics

- 5.3.7 Other End-User Industries

- 5.4 By Packaging Format

- 5.4.1 Rigid (Corrugated, Solid Board)

- 5.4.2 Semi-rigid (Folding Cartons)

- 5.4.3 Flexible Paper (Sachets, Wraps)

- 5.4.4 Molded Fibre and Pulp

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 International Paper Company

- 6.4.2 Smurfit Westrock plc

- 6.4.3 Mondi plc

- 6.4.4 Packaging Corporation of America

- 6.4.5 Stora Enso Oyj

- 6.4.6 Graphic Packaging International, LLC

- 6.4.7 Nippon Paper Industries Co. Ltd.

- 6.4.8 Sonoco Products Company

- 6.4.9 Oji Holdings Corporation

- 6.4.10 Georgia-Pacific LLC

- 6.4.11 Nine Dragons Paper Holdings

- 6.4.12 Lee & Man Paper Manufacturing

- 6.4.13 Sappi Limited

- 6.4.14 Ilim Group

- 6.4.15 Klabin S.A.

- 6.4.16 Asia Pulp & Paper (APP)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment