|

市場調查報告書

商品編碼

1906959

歐洲農業機械市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031年)Europe Agricultural Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

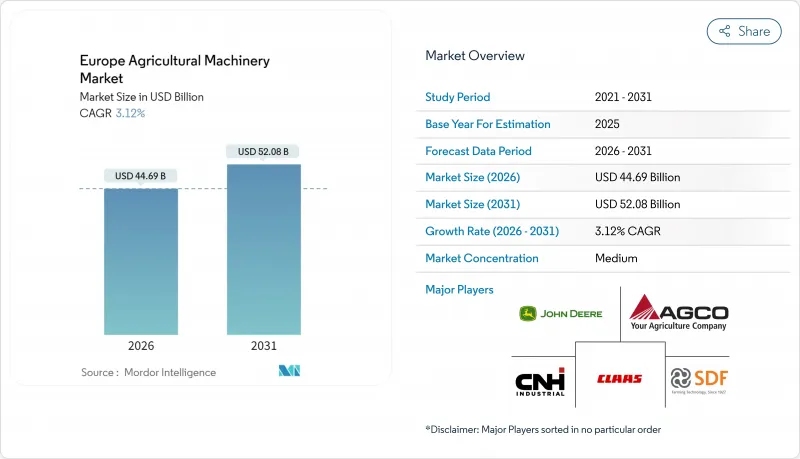

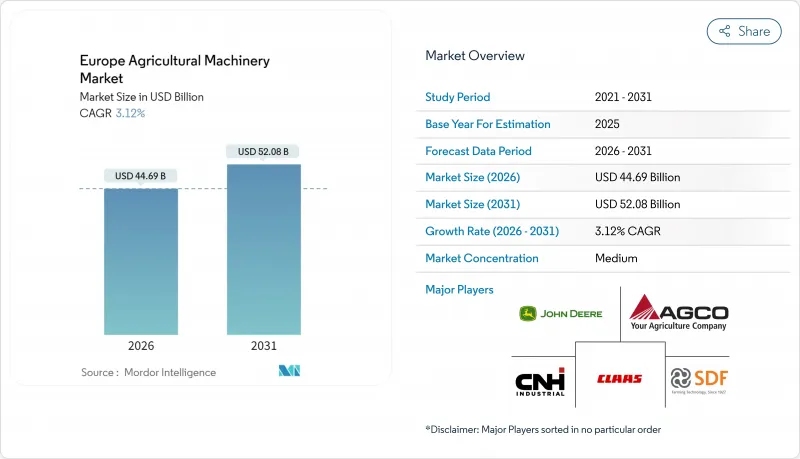

預計到 2026 年,歐洲農業機械市場規模將達到 446.9 億美元,從 2025 年的 433.4 億美元成長到 2031 年的 520.8 億美元,2026 年至 2031 年的複合年成長率為 3.12%。

農業勞動力短缺、歐盟嚴格的環境法規以及數位化普及正在重塑資本支出重點,使農業機械轉向低排放、配備豐富感測器的設備。農民不再追求更高的馬力,而是轉向能夠自動執行重複性任務、追蹤永續性並與企業軟體整合的智慧系統。為了應對這一趨勢,原始設備製造商(OEM)正在提供模組化平台,允許持續進行軟體和感測器升級,從而縮短產品生命週期並增加經常性收入來源。預計從2027年起,半導體供應量的增加和電池成本的下降將穩定交付時間並加速電氣化進程。這將縮小歐洲農業機械市場早期採用者和後期採用者之間的差距。

歐洲農業機械市場趨勢與洞察

歐盟和各國政府的補貼加速了機械化進程

歐洲投資銀行(EIB)提供的10億歐元(10.5億美元)永續發展農業技術貸款機制,可為排放的設備採購提供高達70%的標價補貼。加上德國聯邦政府提供的20%機械補貼,這使得符合第五階段排放標準的曳引機的淨購買成本與傳統的第三階段排放標準曳引機持平,從而縮短了保守型買家的投資回收期。法國和義大利也實施了類似的補貼計劃,並將補貼預算提前至2025年至2027年發放,導致預訂量激增。為了鼓勵用戶採用符合排放標準的曳引機,原始設備製造商(OEM)正在調整產品發布計劃,以配合補貼申請截止日期。租賃公司則將合約期限延長至七年,與補貼償還期一致,從而減輕年度現金流壓力,並鼓勵用戶提前續約40馬力以下的曳引機。

農業機械的快速型號升級

由於排放氣體法規的修訂和數位子系統的引入,主流曳引機產品線的平均更新周期已從六年縮短至不到兩年。迪爾公司(Deere & Company)2025年的自動駕駛曳引機配備了全新的雷射雷達陣列和無線韌體,無需更換硬體即可最佳化路徑規劃。農機設備被視為一個不斷發展的平台,47%的德國受訪者計劃每季進行軟體更新以獲得農藝優勢。這種快速的更新週期迫使經銷商投資於先進的服務工具。在歐洲農業設備市場,製造商正轉向功能解鎖的訂閱定價模式,以實現收入來源多元化,不再僅依賴產品銷售。

初始成本和維護成本不斷上漲

預計2024年至2025年間,配備豐富感測器的聯合收割機和自動噴藥機的標價將上漲18%,某些配置的單價甚至將超過100萬美元。管理200至400公頃土地的中型農場主面臨著農機和土地改良計畫之間的艱難抉擇,尤其是在東歐地區,那裡的平均淨利率徘徊在7%左右。由於專有電子設備需要經銷商介入,維修成本也不斷上升。目前,法國的平均每小時服務費用為105歐元(110美元),高於2020年的68歐元(71美元)。小規模農場可以透過組成機械聯盟來降低成本,但協調工作的成本可能會抵消效率提升所帶來的效益。

細分市場分析

到2025年,曳引機仍將維持其市場主導地位,市佔率高達48.85%,這反映了其作為歐洲大部分農業主要動力來源的根本性作用。在曳引機類別中,100-150馬力細分市場在平均耕地面積為65公頃的歐洲農場中佔最大佔有率。同時,150匹馬力以上的細分市場成長最快,這主要得益於大型農場為提高效率而對高功率設備的需求。犁地和耕作設備是第二大類別,其中耕耘機和動力耕耘機的需求特別強勁,因為保護性耕作方式在歐洲的普及程度越來越高。歐盟委員會2023年推出的4.3億歐元(約4.55億美元)農民補貼計畫(包括高成本投入品和設備的補貼)也是推動這項成長的關鍵因素。

灌溉設備正以3.74%的複合年成長率成為成長最快的細分市場,其成長主要受降雨模式日益不穩定以及用水法規要求提高效率的推動。滴灌系統是推動此成長的主要動力,與傳統噴灌系統相比,滴灌系統可節水40-60%,同時也能精準施肥,提高作物產量。收割設備的需求保持穩定,聯合收割機在該領域佔據主導地位,但隨著關鍵收割期勞動力短缺問題日益嚴重,智慧自動收割機已成為成長最快的細分市場。乾草和飼料設備為歐洲龐大的酪農行業提供支持,其中,隨著農民最佳化飼料生產效率,對打捆機的需求尤其成長。 「其他」類別(包括無人機和精準播種機)正經歷爆發式成長,該類別基數小規模,但農民們正在嘗試新興技術,這些技術有望在操作上優於傳統方法。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 長期農業勞動力短缺

- 歐盟和各成員國的補貼正在加速機械化進程。

- 農業機械的快速模型更新

- 遠端資訊處理與預測性維護技術應用廣泛

- 低排放機械的環保計畫獎勵

- OEM農業軟硬體捆綁融資

- 市場限制

- 高昂的初始成本和維修成本

- 連網裝置的網路安全風險

- 半導體供應受限

- 遵守柴油排放法規的成本不斷增加

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按類型

- 聯結機

- 不到50馬力

- 50-100馬力

- 100-150馬力

- 馬力超過150匹的車型

- 犁地和栽培設備

- 耕耘機

- 光環

- 耕耘機和中耕機

- 其他設備(起獨佔機、旋耕機等)

- 灌溉機械

- 噴灌

- 滴灌

- 其他灌溉設備(微灌、中心支軸式噴灌等)

- 收割機

- 結合

- 飼料收割機

- 智慧/自主收割機

- 乾草和飼料機械

- 死神

- 打包機

- 其他乾草收割設備(耙草機、翻曬機等)

- 其他類型(無人機、精密播種機)

- 聯結機

- 按地區

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Deere & Company

- CNH Industrial NV

- AGCO Corporation

- Kubota Corporation

- CLAAS KGaA mbH

- SDF SpA

- Kuhn SAS(Bucher Industries AG)

- Yanmar Holdings Co., Ltd.

- GRIMME Landmaschinenfabrik GmbH & Co. KG

- Horsch Maschinen GmbH(HORSCH PIRK Forestry GmbH)

- Mahindra & Mahindra Ltd.

- Pottinger Landtechnik GmbH

- Tractors and Farm Equipment Limited(TAFE)

第7章 市場機會與未來展望

The Europe agricultural machinery market size in 2026 is estimated at USD 44.69 billion, growing from 2025 value of USD 43.34 billion with 2031 projections showing USD 52.08 billion, growing at 3.12% CAGR over 2026-2031.

Tight farm-labor supply, stringent European Union environmental mandates, and widespread digitalization are reshaping capital-spending priorities toward low-emission, sensor-rich equipment. Farmers are shifting from horsepower upgrades to intelligent systems that automate repetitive tasks, document sustainability performance, and integrate with enterprise software. Original Equipment Manufacturers (OEMs) are responding with modular platforms that accept continuous software and sensor retrofits, shortening model life cycles and expanding recurring-revenue streams. Rising semiconductor availability and falling battery costs from 2027 onward are anticipated to stabilize delivery schedules and accelerate electrification, closing the gap between early-adopter and late-adopter regions of the Europe agricultural machinery market.

Europe Agricultural Machinery Market Trends and Insights

European Union and National Subsidies are Accelerating Mechanization

The European Investment Bank's EUR 1 billion (USD 1.05 billion) sustainability-linked agtech loan window covers up to 70% of equipment list prices for emissions-verified purchases. When stacked with Germany's federal 20% machinery grant, net acquisition costs for Stage V tractors drop to parity with legacy Tier III units, flattening payback curves for conservative buyers. France and Italy deploy similar top-up schemes, ensuring that subsidy budgets are front-loaded into the 2025-2027 window, which drives a spike in advance orders. OEMs are synchronizing product-launch calendars with grant-application deadlines to maximize uptake. Leasing companies are extending contracts to seven years to align with subsidy claw-back periods, lowering annual cash footprints and fostering premature retirement of sub-40-horsepower fleets.

Rapid Model Upgrades in Agricultural Machinery

Average release cycles for mainstream tractor lines have compressed from six years to fewer than two, propelled by emission revisions and the influx of digital subsystems. Deere & Company's 2025 autonomous tractors debuted new LiDAR arrays and over-the-air firmware that optimize path planning without hardware swaps. Farmers now view machinery as an evolving platform, with 47% of German survey respondents plan to upgrade software quarterly to capture agronomic gains. The speed of iteration pushes dealers to invest in advanced service tools. Manufacturers in the Europe agricultural machinery market are pivoting to subscription pricing for feature unlocks, diversifying revenue beyond unit sales.

High Upfront and Maintenance Costs

List prices for sensor-rich combines and autonomous sprayers jumped 18% between 2024 and 2025, pushing some configurations beyond USD 1 million per unit. Mid-sized growers operating 200-400 hectares face difficult trade-offs between machinery and land-improvement projects, especially in Eastern Europe where average net margins hover near 7%. Maintenance expenses have also climbed as proprietary electronics require dealer intervention. Hourly service rates in France now average EUR 105 (USD 110) compared with EUR 68 (USD 71) in 2020. Smaller farms mitigate costs by forming machinery rings, but coordination overhead can erode efficiency gains.

Other drivers and restraints analyzed in the detailed report include:

- High Adoption of Telematics and Predictive Maintenance

- Eco-Scheme Incentives for Low-Emission Machinery

- Cybersecurity Risks in Connected Equipment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tractors maintain commanding market leadership with a 48.85% share in 2025, reflecting their fundamental role as the primary power source for most European farming operations. Within the tractor category, the 100-150 HP segment captures the largest share among European farms that average 65 hectares, while the greater than 150 HP segment experiences the fastest growth as large-scale operations pursue efficiency through higher-capacity equipment. Plowing and cultivating equipment represents the second-largest category, with cultivators and tillers showing particular strength as conservation tillage practices gain adoption across the continent. The financial grant of Euro 430 million (USD 455 million) by the European Commission for the farmers opting for high-cost inputs in 2023, including agricultural equipment such as plows, is also one of the major factors increasing the adoption rates.

Irrigation machinery emerges as the fastest-growing segment at 3.74% CAGR, driven by increasingly erratic precipitation patterns and water usage regulations that mandate efficiency improvements. Drip irrigation systems lead this expansion as they deliver 40-60% water savings compared to traditional sprinkler systems while enabling precise nutrient delivery that enhances crop yields. Harvesting machinery maintains steady demand with combine harvesters dominating the category, though smart and autonomous harvesters represent the highest-growth subsegment as labor shortages intensify during critical harvest windows. Haying and forage machinery serves the substantial European dairy sector, with balers experiencing particular demand as farmers optimize feed production efficiency. The "Other Types" category, including drones and precision seeders, shows explosive growth from a small base as farmers experiment with emerging technologies that promise operational advantages over conventional approaches.

The Europe Agricultural Machinery Market Report is Segmented by Type (Tractors, Plowing and Cultivating Equipment, Irrigation Machinery, Harvesting Machinery, and More), and by Geography (Germany, France, United Kingdom, Italy, Spain, Russia, and Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Deere & Company

- CNH Industrial N.V.

- AGCO Corporation

- Kubota Corporation

- CLAAS KGaA mbH

- SDF S.p.A

- Kuhn SAS (Bucher Industries AG)

- Yanmar Holdings Co., Ltd.

- GRIMME Landmaschinenfabrik GmbH & Co. KG

- Horsch Maschinen GmbH (HORSCH PIRK Forestry GmbH)

- Mahindra & Mahindra Ltd.

- Pottinger Landtechnik GmbH

- Tractors and Farm Equipment Limited (TAFE)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Chronic farm-labor shortage

- 4.2.2 European Union and national subsidies are accelerating mechanization

- 4.2.3 Rapid model upgrades in agricultural machinery

- 4.2.4 High adoption of telematics and predictive maintenance

- 4.2.5 Eco-scheme incentives for low-emission machinery

- 4.2.6 OEM ag-software hardware-bundle financing

- 4.3 Market Restraints

- 4.3.1 High upfront and maintenance costs

- 4.3.2 Cybersecurity risks in connected equipment

- 4.3.3 Semiconductor supply constraints

- 4.3.4 Diesel-emission compliance cost escalation

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Tractor

- 5.1.1.1 Less than 50 HP

- 5.1.1.2 50 to 100 HP

- 5.1.1.3 100 to 150 HP

- 5.1.1.4 More than 150 HP

- 5.1.2 Plowing and Cultivating Equipment

- 5.1.2.1 Plows

- 5.1.2.2 Harrows

- 5.1.2.3 Cultivators and Tillers

- 5.1.2.4 Other Equipment (Ridger, Rotary tillers, etc.)

- 5.1.3 Irrigation Machinery

- 5.1.3.1 Sprinkler

- 5.1.3.2 Drip

- 5.1.3.3 Other Irrigation Machinery (Micro-irrigation, Pivot irrigation, etc.)

- 5.1.4 Harvesting Machinery

- 5.1.4.1 Combine Harvesters

- 5.1.4.2 Forage Harvesters

- 5.1.4.3 Smart/Autonomous Harvesters

- 5.1.5 Haying and Forage Machinery

- 5.1.5.1 Mowers

- 5.1.5.2 Balers

- 5.1.5.3 Other Haying Equipment (Rakes, Tedders, etc.)

- 5.1.6 Other Types (Drones, Precision Seeders)

- 5.1.1 Tractor

- 5.2 By Geography

- 5.2.1 Germany

- 5.2.2 France

- 5.2.3 United Kingdom

- 5.2.4 Italy

- 5.2.5 Spain

- 5.2.6 Russia

- 5.2.7 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Deere & Company

- 6.4.2 CNH Industrial N.V.

- 6.4.3 AGCO Corporation

- 6.4.4 Kubota Corporation

- 6.4.5 CLAAS KGaA mbH

- 6.4.6 SDF S.p.A

- 6.4.7 Kuhn SAS (Bucher Industries AG)

- 6.4.8 Yanmar Holdings Co., Ltd.

- 6.4.9 GRIMME Landmaschinenfabrik GmbH & Co. KG

- 6.4.10 Horsch Maschinen GmbH (HORSCH PIRK Forestry GmbH)

- 6.4.11 Mahindra & Mahindra Ltd.

- 6.4.12 Pottinger Landtechnik GmbH

- 6.4.13 Tractors and Farm Equipment Limited (TAFE)