|

市場調查報告書

商品編碼

1905992

德國農業機械市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031年)Germany Agricultural Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

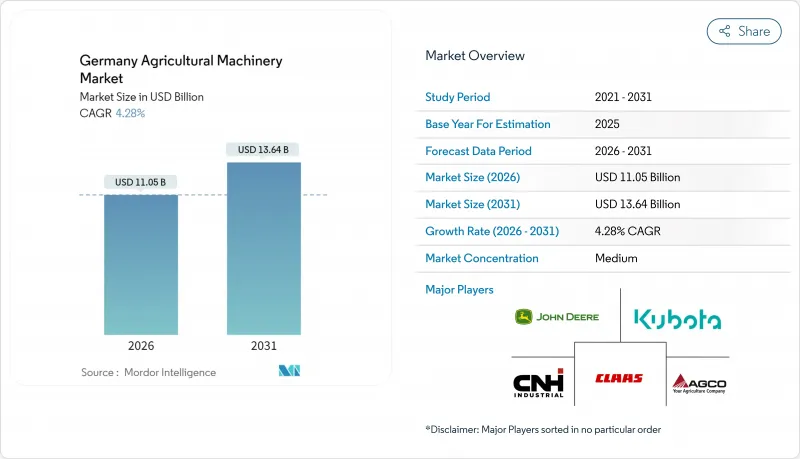

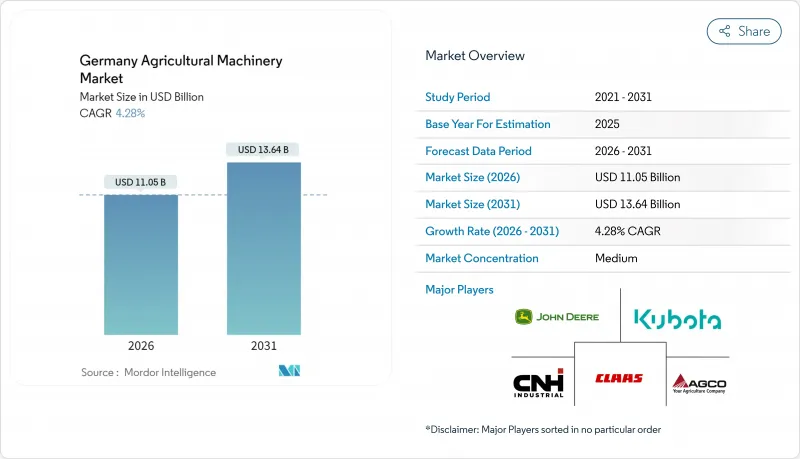

德國農業機械市場預計到 2026 年將達到 110.5 億美元,高於 2025 年的 106 億美元。

預計到 2031 年,該市場規模將達到 136.4 億美元,2026 年至 2031 年的複合年成長率為 4.28%。

強勁的曳引機需求、灌溉系統的快速普及以及持續不斷的補貼抵消了註冊量和農場收入的下降。農民正轉向精密農業和自動化技術,以應對勞動力短缺、排放目標以及氣候變遷造成的水資源壓力。製造商正在增加符合ISOBUS標準並具備智慧連網功能的改裝套件的供應,從而降低了老舊農機設備的升級門檻。原始設備製造商(OEM)也在實施創造性的融資模式,以平滑季節性現金流量並降低高昂的前期成本。同時,儘管大宗商品價格波動,但諸如每年62億歐元(68億美元)的通用農業政策(CAP)轉移支付等政策獎勵,正在支持德國農業機械市場的強勁資本投資。

德國農業機械市場趨勢與洞察

老化導致的勞動力短缺

由於勞動力老化和年輕一代缺乏興趣,德國農業部門正面臨嚴重的勞動力短缺。隨著老農退休,就業缺口不斷擴大,促使農業機械化和自動化程度大幅提升。政府政策支持引入小型機器人執行特定農活,從而減少對人工的依賴。即插即用的介面和改造套件使得老舊機械的升級改造更加便捷,能夠與智慧農具無縫整合。這項變革正在重塑農業機械市場,推動對自主解決方案和自適應技術的需求,以確保不同規模農場和不同作物類型的生產力。

歐盟和聯邦政府對購買精密農業機械的補貼

歐盟和聯邦層級的政策改革正在推動德國對精密農業技術的投資增加。通用農業政策(CAP)改革將綠色補貼提高到基準金額的130%,鼓勵農民改用精準噴灑器和智慧灌溉系統。為了降低高科技曳引機的營運成本,柴油稅每公升降低了0.21480歐元(0.24美元)。諸如「國際農業機械聯盟2023」(ILU 2023)等州級計畫增加了對排放機械的津貼,從而支持德國農業機械市場設備的持續更新。農業機械市場的現代化使經濟獎勵與環境目標一致,並加強了德國的農業基礎設施。

前期成本高,投資回收期長

對於德國農民,尤其是小規模農民而言,先進農業機械的高昂購買成本仍是一大挑戰。大型聯合收割機和精密設備需要大量投資,而不斷上漲的資金籌措成本延長了收回成本所需的時間。因此,許多農民推遲了設備升級,減緩了整個市場的升級速度,並影響了製造商的銷售。小規模農民受到的影響最大,因為他們往往缺乏投資新技術所需的資金。這種情況限制了德國農業機械市場的成長,成本和投資報酬率成為現代化的主要障礙。

細分市場分析

曳引機將繼續主導德國農業機械市場,預計到2025年將佔市場佔有率的62.28%。儘管註冊量有所下降,但由於燃油效率高的引擎和與智慧農具的兼容性,市場需求仍然強勁。農民們正在透過ISOBUS改造和即插即用升級來更新現有的曳引機車隊,而不是直接更換。電動曳引機在蔬菜種植和市政服務領域正得到越來越廣泛的應用,而像e100 Vario這樣的車型試驗表明,隨著電池技術的進步,農業機械正逐步向電氣化轉型。

受氣候變遷和節水農業需求的推動,預計到2031年,灌溉機械將以6.56%的複合年成長率實現最高成長。儘管灌溉技術的普及速度仍然緩慢,但日益嚴重的乾旱和不斷變化的氣候模式正在加速噴灌和滴灌系統的推廣應用。政府補貼和能源稅收優惠政策優惠政策正在降低營運成本,並提高精準灌溉系統的普及率。對氣候適應能力的需求正使灌溉從一項補充投資轉變為關鍵組成部分,從而影響德國農業機械市場的市場動態和基礎設施規劃。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 老化導致的勞動力短缺

- 歐盟和聯邦政府對精密機械採購的補貼

- 智慧型互聯機器和 ISOBUS 標準的快速普及

- 碳排放法規有利於第五階段排放標準和電動曳引機

- 自主多任務平台試驗部署進展

- 合適的OEM融資模式

- 市場限制

- 前期成本高,投資回收期長

- 日益數位化的車隊中存在的網路安全和資料所有權問題

- 大宗商品價格下跌和能源成本波動導致利潤率承壓。

- 關於減少農藥使用和氮排放上限的監管不確定性

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按類型

- 聯結機

- 按馬力

- 不到40馬力

- 40-100馬力

- 101-150馬力

- 超過150馬力

- 按曳引機類型

- 緊湊型多用途車

- 公用事業

- 大田作物

- 按馬力

- 犁地機械

- 犁

- 光環

- 耕耘機

- 其他(起壟機、旋轉耕耘機等)

- 種植機械

- 播種機

- 播種機

- 撒佈器

- 其他(移植機、精密播種機等)

- 收割機

- 結合

- 飼料收割機

- 其他(馬鈴薯收割機、馬鈴薯收割機等)

- 乾草和飼料機械

- 死神

- 打包機

- 其他(耙子、翻曬機等)

- 灌溉機械

- 噴灌

- 滴

- 其他方式(微噴灌、中心樞軸式灌溉等)

- 其他類型

- 聯結機

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- AGCO Corporation

- Deere & Company

- CLAAS KGaA mbH

- CNH Industrial NV

- Kubota Corporation

- SDF SpA

- Lemken Beteiligungs-GmbH

- Maschinenfabrik Bernard KRONE GmbH & Co.KG

- Horsch Holding SE

- GRIMME Landmaschinenfabrik GmbH & Co. KG

- AMAZONEN-Werke H. Dreyer GmbH & Co. KG

- Rauch Landmaschinenfabrik GmbH

- Kalverkamp Innovation GmbH(Nexat GmbH)

- Duport Machinery(Gustrower Maschinenbau GmbH)

第7章 市場機會與未來展望

The Germany agricultural machinery market size in 2026 is estimated at USD 11.05 billion, growing from 2025 value of USD 10.6 billion with 2031 projections showing USD 13.64 billion, growing at 4.28% CAGR over 2026-2031.

Strong demand for tractors, rapid irrigation system uptake, and sustained subsidy inflows offset reduced equipment registrations and lower farm incomes. Farmers pivot toward precision and autonomous technologies to cope with labor shortages, regulatory emission targets, and climate-driven water stress. Manufacturers scale retrofit kits that embed ISOBUS compliance and smart-connected features, lowering barriers for aging machine fleets. OEMs (Original Equipment Manufacturers) also deploy creative finance models that smooth seasonal cash flows and mitigate high upfront costs. Meanwhile, policy incentives such as EUR 6.2 billion (USD 6.8 billion) in annual CAP transfers keep equipment investment resilient in the Germany agricultural machinery market amid volatile commodity prices.

Germany Agricultural Machinery Market Trends and Insights

Ageing-workforce-driven Labor Scarcity

Germany's agricultural sector faces a significant labor shortage due to an aging workforce and limited interest among younger generations. As older farmers retire, hiring gaps widen, prompting a surge in mechanization and automation. Government initiatives support the deployment of mini-robots for targeted field tasks, reducing reliance on manual labor. Plug-and-play interfaces and retrofit kits allow older machinery to integrate with smart implements, making upgrades more accessible. This shift transforms the agricultural machinery market, with increased demand for autonomous solutions and adaptable technologies that maintain productivity across diverse farm sizes and crop types.

EU and Federal Subsidies for Precision-Machinery Purchases

Policy reforms at both the EU and federal levels are increasing investment in precision agriculture technologies across Germany. CAP reforms lift green premium payouts to 130% of the base rate, steering farmers toward precision sprayers and smart irrigation. Gas-oil tax relief of EUR 0.21480 per liter (USD 0.24) cuts running costs for high-tech tractors. State plans such as ILU 2023 add grants for emission-cutting machinery, supporting steady equipment turnover in the Germany agricultural machinery market.This modernization of the agricultural machinery market aligns economic incentives with environmental goals and strengthens Germany's farming infrastructure.

High Upfront Cost and Long Payback Period

The high capital cost of advanced agricultural machinery continues to challenge German farmers, particularly those operating smaller farms. Large combines and precision equipment require substantial investment, and rising financing costs have extended the time needed to recover these expenses. As a result, many farmers are postponing equipment upgrades, which slows overall market turnover and affects manufacturer sales. Smaller farms experience the greatest impact, as they often lack the financial resources to invest in newer technologies. This situation moderates growth in Germany's agricultural machinery market, where cost and return on investment remain significant barriers to modernization.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of Smart-connected Implements and ISOBUS Standards

- Carbon-footprint Regulations Favoring Tier-V and Electric Tractors

- Cybersecurity and Data Ownership Concerns in Digitally Enabled Fleets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tractors represent 62.28% of the Germany agricultural machinery market size in 2025, maintaining their dominant position. Despite decreased registration volumes, demand remains robust due to fuel-efficient engines and smart implement compatibility. Farmers are modernizing existing fleets through ISOBUS retrofits and plug-and-play upgrades rather than complete replacements. Electric tractors are gaining adoption in the vegetable farming and municipal services segments. The testing of models like the e100 Vario indicates a gradual transition toward electrification as battery technology advances.

Irrigation machinery demonstrates the highest growth rate at 6.56% CAGR through 2031, driven by climate variability and water-efficient farming requirements. While irrigation adoption remains moderate, increasing drought conditions and changing weather patterns accelerate the uptake of sprinkler and drip systems. Government subsidies and energy tax incentives reduce operational costs, improving access to precision irrigation systems. Climate resilience requirements are transforming irrigation from a supplementary investment to an essential component, influencing Germany's agricultural machinery market dynamics and infrastructure planning.

The Germany Agricultural Machinery Market Report is Segmented by Type (Tractors, Plowing and Cultivating Machinery, Planting Machinery, Harvesting Machinery, Haying and Forage Machinery, Irrigation Machinery, and Other Types). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- AGCO Corporation

- Deere & Company

- CLAAS KGaA mbH

- CNH Industrial N.V.

- Kubota Corporation

- SDF S.p.A.

- Lemken Beteiligungs-GmbH

- Maschinenfabrik Bernard KRONE GmbH & Co.KG

- Horsch Holding SE

- GRIMME Landmaschinenfabrik GmbH & Co. KG

- AMAZONEN-Werke H. Dreyer GmbH & Co. KG

- Rauch Landmaschinenfabrik GmbH

- Kalverkamp Innovation GmbH (Nexat GmbH)

- Duport Machinery (Gustrower Maschinenbau GmbH)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing-workforce-driven Labor Scarcity

- 4.2.2 EU and Federal Subsidies for Precision-Machinery Purchases

- 4.2.3 Rapid Adoption of Smart-connected Implements and ISOBUS Standards

- 4.2.4 Carbon-footprint Regulations Favouring Tier-V and Electric Tractors

- 4.2.5 Autonomous Multi-task Platforms Gaining Pilot Traction

- 4.2.6 Suitable OEM Finance Models

- 4.3 Market Restraints

- 4.3.1 High Upfront Cost and Long Payback Period

- 4.3.2 Cybersecurity and Data Ownership Concerns in Digitally Enabled Fleets

- 4.3.3 Margin Pressure from Falling Commodity Prices and Volatile Energy Costs

- 4.3.4 Regulatory Uncertainty over Pesticide Reduction and Nitrogen Caps

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Tractors

- 5.1.1.1 By Horse-Power

- 5.1.1.1.1 Less than 40 HP

- 5.1.1.1.2 40-100 HP

- 5.1.1.1.3 101-150 HP

- 5.1.1.1.4 Above 150 HP

- 5.1.1.2 By Tractor Type

- 5.1.1.2.1 Compact Utility

- 5.1.1.2.2 Utility

- 5.1.1.2.3 Row-Crop

- 5.1.1.1 By Horse-Power

- 5.1.2 Plowing and Cultivating Machinery

- 5.1.2.1 Plows

- 5.1.2.2 Harrows

- 5.1.2.3 Cultivators and Tillers

- 5.1.2.4 Others (Ridger, Rotary tillers, etc.)

- 5.1.3 Planting Machinery

- 5.1.3.1 Seed Drills

- 5.1.3.2 Planters

- 5.1.3.3 Spreaders

- 5.1.3.4 Others(Transplanters, Precision Seeders, etc.)

- 5.1.4 Harvesting Machinery

- 5.1.4.1 Combine Harvesters

- 5.1.4.2 Forage Harvesters

- 5.1.4.3 Others (Potato Harvesters, Potato Harvesters, etc.)

- 5.1.5 Haying and Forage Machinery

- 5.1.5.1 Mowers

- 5.1.5.2 Balers

- 5.1.5.3 Others (Rakes, Tedders, etc.)

- 5.1.6 Irrigation Machinery

- 5.1.6.1 Sprinkler

- 5.1.6.2 Drip

- 5.1.6.3 Others (Micro-Sprinklers, Center-Pivot Irrigation, etc.)

- 5.1.7 Other Types

- 5.1.1 Tractors

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 AGCO Corporation

- 6.4.2 Deere & Company

- 6.4.3 CLAAS KGaA mbH

- 6.4.4 CNH Industrial N.V.

- 6.4.5 Kubota Corporation

- 6.4.6 SDF S.p.A.

- 6.4.7 Lemken Beteiligungs-GmbH

- 6.4.8 Maschinenfabrik Bernard KRONE GmbH & Co.KG

- 6.4.9 Horsch Holding SE

- 6.4.10 GRIMME Landmaschinenfabrik GmbH & Co. KG

- 6.4.11 AMAZONEN-Werke H. Dreyer GmbH & Co. KG

- 6.4.12 Rauch Landmaschinenfabrik GmbH

- 6.4.13 Kalverkamp Innovation GmbH (Nexat GmbH)

- 6.4.14 Duport Machinery (Gustrower Maschinenbau GmbH)