|

市場調查報告書

商品編碼

1851929

聚氨酯(PU)黏合劑在電子產品中的應用:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Polyurethane (PU) Adhesives In Electronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

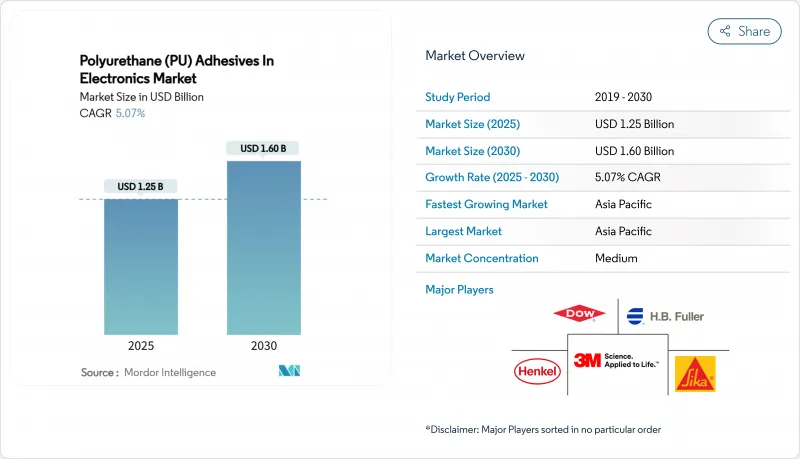

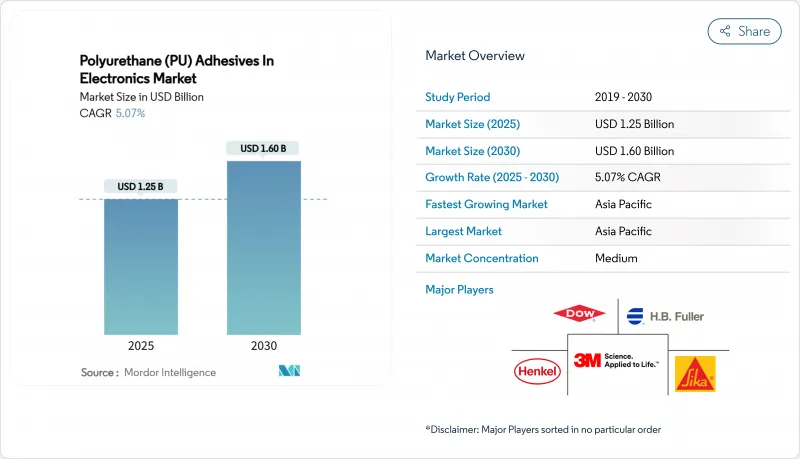

預計到 2025 年,電子產業聚氨酯接著劑市場規模將達到 12.5 億美元,到 2030 年將達到 16 億美元,預測期(2025-2030 年)複合年成長率為 5.07%。

這一穩步成長的驅動力來自高性能粘合材料在電動汽車電池組中日益成長的重要性、消費電子設備的持續小型化以及支持低排放氣體化學品的日益嚴格的安全法規。供應商優先考慮快速固化、精密點膠技術,以縮短生產節拍時間,尤其是在亞洲的大批量生產工廠。隨著設計人員面臨功率模組和汽車逆變器中不斷提高的功率密度,對導熱和紫外光固化化學品的投資正在加速。儘管多元醇和二異氰酸酯的成本波動仍然是一個不利因素,但下游強勁的需求(主要來自軟性混合電子產品)維持了整體成長動能。

全球電子產業聚氨酯(PU)黏合劑市場趨勢及洞察

消費性電子設備小型化推動了對低黏度灌封膠的需求

穿戴式裝置、耳機和物聯網感測器的尺寸不斷縮小,留給機械緊固件的空間越來越少。因此,設計人員開始採用超低黏度聚氨酯配方(<1000 cPs),這種配方可以無空隙地流入 150 μm 的縫隙中。這些材料可以封裝易碎晶片,抑制振動,並能承受 -55 度C至 100 度C 的熱循環,Protabic 的 PNU-46202 系列產品證明了這一點。元件數量的大幅減少降低了組裝成本,從而增強了電子市場對高性能灌封劑的需求,尤其是在聚氨酯接著劑領域。亞洲的組裝組裝商正在大力指定使用能夠提高一次產量比率並減少返工的新型材料。中期來看,擴增實境(AR) 頭戴裝置的日益普及預計將顯著推動複合年成長率 (CAGR) 的成長。

導熱聚氨酯基電動汽車電池熱感間隙填充劑

電池組的能量容量如今可達100千瓦時,因此防止熱失控成為設計中的重中之重。導熱聚氨酯接著劑能夠散熱並同時實現電絕緣,在一次點膠過程中即可完成兩項重要功能。陶氏化學的奈米碳管增強配方導熱係數高達5 W/m*K,收縮率低於0.5%,有效降低了電池組應力,延長了循環壽命。隨著電動車的普及,一級供應商已簽署多年供貨協議,這必將推動電子聚氨酯接著劑市場最快成長。

全球範圍內加強對揮發性有機化合物和異氰酸酯暴露的監管

美國環保署 (EPA) 和 REACH 法規目前將室內甲醛濃度限制在 0.062 mg/m³,並強制要求操作員接受二異氰酸酯處理的訓練。規模較小的電子製造服務 (EMS) 公司面臨超過 25 萬美元的合規投資,用於煙霧抽排和認證,這迫使它們轉向其他化學方法。針對不同司法管轄區的不同產品規格 (SKU) 增加了庫存成本,並延緩了新產品的上市。雖然主要供應商已經推出了低等級單體,但六到九個月的認證週期限制了電子市場聚氨酯接著劑的近期訂單訂單。

細分市場分析

預計到2024年,表面固化聚氨酯配方將佔總收入的64.26%,並在2030年之前以5.49%的複合年成長率進一步鞏固其市場地位。這一領先地位清晰地表明,隨著組裝停留時間從幾分鐘縮短到幾秒鐘,聚氨酯接著劑在電子市場中受益匪淺。許多契約製造製造商現在運作線上紫外光固化隧道,可在不到兩秒的時間內固化50微米厚的黏合層,從而將週期時間縮短近30%。快速固化能力還透過最大限度地減少固定裝置,簡化了高密度基板的自動化點膠過程。

導電和導熱型產品完善了產品組合。解決諸如LED陣列中的散熱和相機模組中的接地路徑等關鍵難題,雖然產量有所下降,但利潤率高於平均水平。結合紫外光引發和二次濕氣固化的混合雙固化化學技術可解決陰影區域接縫問題,從而擴大聚氨酯接著劑在電子市場中的佔有率。新興的熱激活產品目前仍處於小眾市場,但在無法承受高峰值照度的可折疊顯示器領域,其應用日益受到關注。

電子業聚氨酯接著劑市場報告按產品類型(導電聚氨酯黏合劑、導熱聚氨酯黏合劑及其他)、應用領域(表面黏著技術、三防膠、導線固定、灌封、封裝及其他)和地區(亞太地區、北美地區、歐洲地區、南美地區、中東和非洲)進行細分。市場預測以美元計價。

區域分析

在中國無與倫比的印刷電路板、智慧型手機和電動車電池生產能力的引領下,亞太地區將在2024年佔據主導地位,收入佔有率高達73.05%。深圳和上海的工廠正在使用高通量紫外線固化材料,這些材料可在輸送機式紫外線LED燈下於三秒內完成固化,進一步鞏固了其區域規模優勢。韓國半導體工廠則在導熱聚氨酯界面材料的消耗方面處於領先地位,這些材料能夠支援高達450W的晶片熱通量密度。

在北美,密西根州、田納西州和安大略省的電動車電池生產推動了對2W/m*K間隙填充劑的需求,而華盛頓州和德克薩斯州的航太主要企業則指定使用低密度合成聚氨酯灌封化合物,以減輕衛星控制板的重量。更嚴格的法規、美國環保署(EPA)的揮發性有機化合物(VOC)限值以及美國職業安全與健康管理局(OSHA)規定的暴露閾值,使得水性分散體越來越受歡迎,這促使當地的化合物生產商能夠及早轉型,從而在電子聚氨酯接著劑市場佔據更大的佔有率。

歐洲呈現均衡成長,這與汽車電氣化目標密切相關。德國高階汽車產業擴大採用聚氨酯結構材料來增強電池機殼的抗衝擊性,而REACH法規附件XVII對遊離單體二異氰酸酯的限制正促使汽車製造商轉向使用新型微排放化學品。由亞洲電子製造服務(EMS)製造商供應的波蘭和匈牙利新興叢集,將推動東歐地區在2030年前的消費量成長。中東/非洲和南美洲仍在發展中,但一家越南支持的非洲合資企業不斷擴大的行動電話組裝預示著該地區將迎來長期成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 消費性電子設備小型化推動了對低黏度聚氨酯灌封膠的需求

- 基於導熱聚氨酯的電動車電池熱感間隙填充材料

- 推動水性低VOC PU分散體的環保措施。

- 軟性混合電子裝置需要可拉伸、自修復的聚氨酯黏合劑。

- 需要低釋氣PU晶片貼裝的高溫SiC功率模組

- 市場限制

- 全球範圍內加強對揮發性有機化合物/異氰酸酯暴露的監管

- 多元醇和二異氰酸酯價格波動會對利潤率造成壓力。

- 矽烷封端預聚物在穿戴式裝置領域的崛起

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依產品類型

- 導電聚氨酯膠黏劑

- 導熱聚氨酯黏合劑

- UV固化聚氨酯黏合劑

- 其他產品類型

- 透過使用

- 表面黏著技術

- 三防膠

- 金屬絲釘合

- 盆栽

- 封裝

- 其他應用(顯示器貼合與光學組件、電池組件等)

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- ASEAN

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- 3M

- Arkema

- Ashland

- Avery Dennison Corporation

- BASF

- Covestro AG

- DELO Industrie

- Dow

- Dymax

- Epic Resins

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huitian New Materials

- Huntsman International LLC.

- INTERTRONICS

- ITW Performance Polymers

- Kangda New Materials(Group)Co., Ltd

- Master Bond

- Parker Hannifin Corp

- Permabond

- Sika AG

第7章 市場機會與未來展望

The Polyurethane Adhesives In Electronics Market size is estimated at USD 1.25 billion in 2025, and is expected to reach USD 1.60 billion by 2030, at a CAGR of 5.07% during the forecast period (2025-2030).

This steady expansion rests on the growing importance of high-performance bonding materials for electric-vehicle (EV) battery packs, the continuing miniaturization of consumer devices, and stricter safety regulations that favor low-emission chemistries. Vendors are prioritizing rapid-cure, precision-dispense technologies that help shrink production tact times, especially in high-volume Asian factories. Investments in thermally conductive and UV-curing chemistries are accelerating as designers confront higher power densities in power modules and automotive inverters. Cost volatility for polyols and diisocyanates remains a headwind, yet strong downstream demand, particularly from flexible-hybrid electronics, keeps overall momentum positive.

Global Polyurethane (PU) Adhesives In Electronics Market Trends and Insights

Miniaturization of Consumer Devices Boosting Demand for Low-Viscosity Potting Adhesives

Wearables, hearables, and IoT sensors continue to shrink, leaving little room for mechanical fasteners. Designers therefore rely on ultra-low-viscosity polyurethane formulations, often below 1,000 cPs, that flow into 150 µm gaps without void creation. These materials encapsulate fragile chips, mitigate vibration, and survive -55 °C to 100 °C thermal cycles, as demonstrated by Protavic's PNU-46202 series. Sharp reductions in part counts cut assembly costs, which reinforces demand for high-function potting chemistries across the polyurethane adhesives in the electronics market. Asian outsourced-assembly providers are specifying the new grades in volume because they enhance first-pass yields and reduce rework. Over the medium term, growing adoption in augmented-reality headsets will magnify the positive CAGR contribution.

EV Battery Thermal-Gap Fillers Based on Thermally Conductive Polyurethane

Battery packs now carry up to 100 kWh of energy, making thermal runaway avoidance a design priority. Thermally conductive polyurethane adhesives dissipate heat while electrically insulating cells, combining two critical functions in a single dispense step. Dow's carbon-nanotube-enhanced formulations achieve 5 W/m*K conductivity with sub-0.5% shrinkage, reducing pack stresses and extending cycle life. As EV adoption accelerates, tier-one suppliers are locking in multiyear supply contracts, ensuring that this driver delivers the highest incremental growth within the polyurethane adhesives in electronics market.

VOC and Isocyanate Exposure Regulations Tightening Globally

EPA and REACH frameworks now cap indoor formaldehyde at 0.062 mg/m3 and mandate operator training for diisocyanate handling. Smaller EMS companies face compliance investments topping USD 250,000 for fume extraction and certification, pushing them toward alternative chemistries. Separate SKUs for different jurisdictions raise inventory costs, slowing new-product introductions. Although major suppliers are unveiling low-monomer grades, qualification cycles stretch six to nine months, dampening near-term orders in the polyurethane adhesives in the electronics market.

Other drivers and restraints analyzed in the detailed report include:

- Environmental Push Toward Water-Borne, Low-VOC Polyurethane Dispersions

- Flexible-Hybrid Electronics Needing Stretchable, Self-Healing Bonds

- Polyol and Diisocyanate Price Volatility Pressuring Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Surface-flash curing polyurethane formulations commanded 64.26% revenue in 2024, a position they are set to strengthen by expanding at 5.49% CAGR to 2030. This leadership underscores how the polyurethane adhesives in the electronics market benefit when assembly lines slash dwell times from minutes to seconds. Many contract manufacturers now operate inline UV tunnels that cure 50 µm bond lines in under two seconds, delivering cycle-time savings near 30%. The rapid-cure feature also minimizes fixturing, which simplifies automated dispensing on densely populated boards.

Electrically conductive and thermally conductive variants round out the portfolio. Although they trail in volume, they capture above-average margins by solving mission-critical challenges such as thermal spreading in LED arrays or grounding paths in camera modules. Hybrid dual-cure chemistries that combine UV initiation with secondary moisture curing address shadowed joints, broadening the reachable share of the polyurethane adhesives in the electronics market. Emerging heat-activated products remain niche but draw interest in foldable displays that cannot tolerate high peak irradiance.

The Polyurethane Adhesives in Electronics Report is Segmented by Product Type (Electrically Conductive PU Adhesive, Thermally Conductive PU Adhesive, and More), Application (Surface Mounting, Conformal Coatings, Wire Tacking, Potting, Encapsulation, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated with 73.05% revenue share in 2024 on the back of China's unmatched PCB, smartphone, and EV-battery output. Factory clusters in Shenzhen and Shanghai consume high-throughput UV grades that cure under conveyor-belt UV LEDs in less than three seconds, reinforcing regional scale advantages. South Korea's semiconductor fabs drive consumption of thermally conductive polyurethane interfaces that cope with 450 W chip heat-flux densities.

North America is buoyed by EV battery production in Michigan, Tennessee, and Ontario, which is fueling orders for 2 W/m*K gap fillers, while aerospace primes in Washington and Texas specify low-density syntactic polyurethane potting compounds that shave grams from satellite control boards. Regulatory rigor, EPA VOC limits, and OSHA-dictated exposure thresholds make water-borne dispersions more popular, positioning local formulators that pivot early for share gains in the polyurethane adhesives in electronics market.

Europe shows balanced growth tied to automotive electrification targets. The German premium-car segment increasingly specifies polyurethane structurals that provide impact resistance for battery enclosures. Meanwhile, REACH Annex XVII limits on free monomer diisocyanates push OEMs to new micro-emission chemistries. Emerging clusters in Poland and Hungary, supplied by Asian EMS players, are likely to raise Eastern European consumption through 2030. Middle-East and Africa, and South America remain nascent, but rising handset assembly in Vietnam-backed African ventures hints at longer-term upside.

- 3M

- Arkema

- Ashland

- Avery Dennison Corporation

- BASF

- Covestro AG

- DELO Industrie

- Dow

- Dymax

- Epic Resins

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Huitian New Materials

- Huntsman International LLC.

- INTERTRONICS

- ITW Performance Polymers

- Kangda New Materials (Group) Co., Ltd

- Master Bond

- Parker Hannifin Corp

- Permabond

- Sika AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Miniaturization of Consumer Devices Boosting Demand for Low-Viscosity PU Potting Adhesives

- 4.2.2 EV Battery Thermal-Gap Fillers Based on Thermally Conductive PU

- 4.2.3 Environmental Push toward Water-Borne, Low-VOC PU Dispersions

- 4.2.4 Flexible Hybrid Electronics Needing Stretchable, Self-Healing PU Bonds

- 4.2.5 High-Temperature SiC Power Modules Requiring Low-Outgassing PU Die-Attach

- 4.3 Market Restraints

- 4.3.1 VOC/Isocyanate Exposure Regulations Tightening Globally

- 4.3.2 Polyol and Diisocyanate Price Volatility Pressuring Margins

- 4.3.3 Rise of Silane-Terminated Prepolymer Alternatives in Wearables

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Electrically Conductive PU Adhesive

- 5.1.2 Thermally Conductive PU Adhesive

- 5.1.3 UV Curing PU Adhesive

- 5.1.4 Other Product Types

- 5.2 By Application

- 5.2.1 Surface Mounting

- 5.2.2 Conformal Coatings

- 5.2.3 Wire Tacking

- 5.2.4 Potting

- 5.2.5 Encapsulation

- 5.2.6 Other Applications (Display Bonding and Optical Assemblies, Battery Assembly, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 Ashland

- 6.4.4 Avery Dennison Corporation

- 6.4.5 BASF

- 6.4.6 Covestro AG

- 6.4.7 DELO Industrie

- 6.4.8 Dow

- 6.4.9 Dymax

- 6.4.10 Epic Resins

- 6.4.11 H.B. Fuller Company

- 6.4.12 Henkel AG & Co. KGaA

- 6.4.13 Huitian New Materials

- 6.4.14 Huntsman International LLC.

- 6.4.15 INTERTRONICS

- 6.4.16 ITW Performance Polymers

- 6.4.17 Kangda New Materials (Group) Co., Ltd

- 6.4.18 Master Bond

- 6.4.19 Parker Hannifin Corp

- 6.4.20 Permabond

- 6.4.21 Sika AG

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment