|

市場調查報告書

商品編碼

1850219

數位行銷軟體:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Digital Marketing Software Market - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

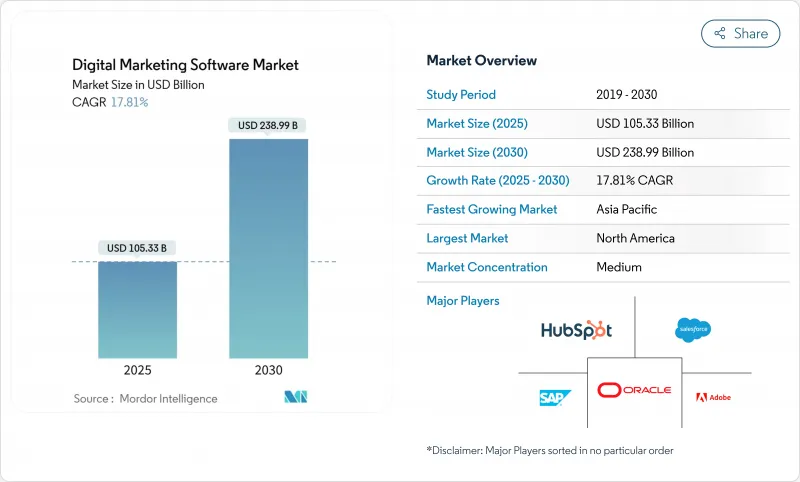

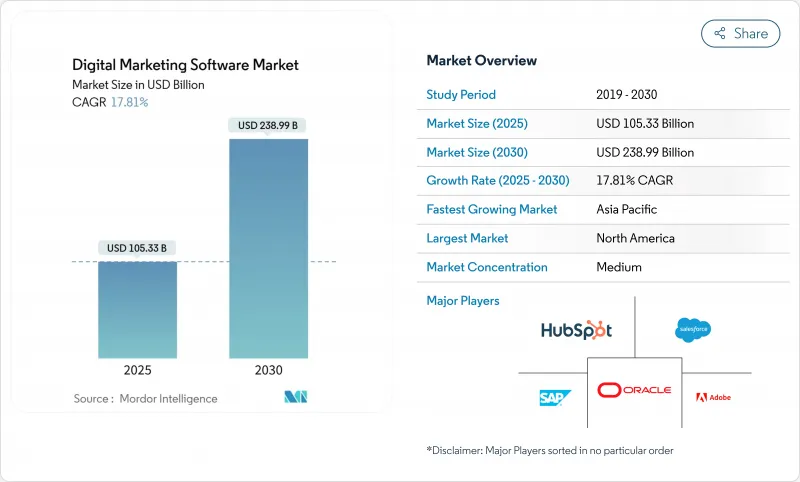

全球數位行銷軟體市場預計到 2025 年將累計1,053.3 億美元的收入,到 2030 年將達到 2,389.9 億美元,在此期間的複合年成長率為 17.81%。

朝向雲端原生架構、人工智慧主導的自動化和無 Cookie 個人化的快速轉型,使得行銷技術支出佔行銷總預算的比例維持在 25.4%。企業現在正摒棄分散的獨立解決方案(這些方案會增加整合成本),轉而採用整合資料、內容和啟動功能的整合套件。與使用量掛鉤的訂閱定價模式降低了前期投資,並推動了中型企業的採用。隨著平台供應商整合生成式人工智慧輔助工具,縮短創新週期並擴展自助式分析功能,競爭持續加劇。

全球數位行銷軟體市場趨勢與洞察

數位化優先的客戶旅程激增

70%的B2B買家透過搜尋引擎開始調查,這迫使企業重新構想內容、數據和商務方面的互動模式。製造商正將75%的行銷預算分配給數位管道,比上一周期增加了10個百分點。醫療服務提供者正在利用人工智慧編配,在入口網站和麵向患者的應用程式中提供合規且個人化的患者就醫體驗。歐洲企業將22.9%的數位轉型病人歷程分配給行銷技術,並將客戶體驗視為關鍵的競爭優勢。這種持續向數位化優先互動模式的轉變,支撐了對用於管理客戶獲取、轉換和留存的整合平台的持續需求。

人工智慧驅動的內容和宣傳活動最佳化

Adobe GenStudio 等生成式人工智慧平台能夠大規模地產生動態素材變體,在縮短 50% 製作時間的同時,也能將電子郵件轉換率提升一倍。 HubSpot 在 2024 年 9 月發布的 Breeze AI 中整合了 80 多項人工智慧功能,用於自動化宣傳活動設計。亞太地區的企業正在加速投資人工智慧,59% 的企業計劃在 2025 年增加人工智慧預算。企業採用 Salesforce Agentforce 等自主代理,證明行銷工作流程可以在極少人工干預的情況下運作。人工智慧能力正迅速成為一項基本要求,而非差異化優勢。

與傳統行銷技術堆疊整合的複雜性

企業平均擁有 130 個應用程式,但只有不到五分之一的應用程式實現了完全整合。行銷長指出,資料分散、管治不善和實施技能不足是他們面臨的最大障礙。轉型為 MACH(微服務、API 優先、雲端原生、無頭)架構需要許多中型企業所缺乏的技術專長,這不僅延長了專案週期,也推高了整體擁有成本。歐洲製造商中只有三分之二實現了數位成熟,而美國同行中這一比例接近五分之四,這一事實凸顯了二者之間的差距。

細分市場分析

預計到2024年,雲端交付將佔總營收的65.5%,並在2030年之前以18.5%的複合年成長率持續成長,佔據數位行銷軟體市場佔有率。彈性基礎設施、持續更新和更低的維護成本,在提高擴充性的同時,降低了整體擁有成本。在資料駐留和客製化整合至關重要的監管領域,本地部署仍然佔據主導地位,但隨著雲端供應商獲得更高級別的安全認證,其市場佔有率正在萎縮。

此外,人工智慧功能通常僅在雲端版本中提供,這促使企業更傾向於選擇雲端版本。雖然供應商提供混合模式以簡化過渡,但隨著企業優先考慮速度和靈活性,全面採用SaaS的趨勢似乎已不可逆轉。

2024年,軟體授權收入將佔總收入的54.9%,而隨著企業尋求專業知識以釋放平台價值,服務收入將以19.2%的複合年成長率快速成長。系統整合、資料清理和變更管理將成為初期計劃的主導,而託管服務則負責長期最佳化。人工智慧的普及應用將進一步推動數位行銷軟體服務市場規模的成長,因為人工智慧需要模型訓練、管治和迭代效能調優。

隨著技術棧日趨複雜,外部合作夥伴正在填補能力缺口,尤其是在多重雲端和可組合架構方面。供應商將諮詢和託管服務打包到訂閱計劃中,從而創造穩定的經常性收入並加深客戶忠誠度。培訓機構和認證計畫也日益普及,旨在提升客戶團隊的技能並加速平台投資報酬率的實現。

數位行銷軟體市場配置(雲端和本地部署)、組件(軟體和服務)、最終用戶公司規模(大型企業和中小企業)、最終用戶行業(IT和電信、銀行、金融服務和保險、零售和電子商務、製造業等)以及地區進行細分。市場預測以美元(USD)計價。

區域分析

2024年,北美將佔全球營收的41.9%,這主要得益於雲端運算的深度普及、高技能的勞動力以及Adobe、Salesforce和HubSpot等平台供應商的集中佈局。創業投資持續支持人工智慧主導的行銷科技Start-Ups,進一步推動了該地區的創新發展。隨著技術應用日趨成熟,產品更換週期延長,北美地區的成長將保持穩健但適度的態勢。

預計到2030年,亞太地區的複合年成長率將達到20.6%,成為全球成長最快的地區。各國政府都在積極推動數位轉型,企業正在採用尊重語言和文化差異的在地化人工智慧模型,製造業和金融服務業的現代化項目正在加速平台應用,而本土供應商也不斷湧現以應對監管方面的特殊挑戰。因此,儘管競爭日益激烈,亞太地區的數位行銷軟體市場預計仍將快速成長。

歐洲市場依然強勁,但監管也十分嚴格。歐盟僅有66%的製造商實現了端到端數位化,然而56%的高階主管計劃在2025年增加技術預算。 GDPR將推動對隱私優先平台的需求,同時也延長實施週期並增加成本。擁有合規設計架構的供應商將找到積極的買家,而隨著其他司法管轄區效仿隱私法規,歐洲累積的專業知識也日益輸出。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 數位化優先的客戶體驗的激增

- 雲端原生SaaS的成本優勢

- 人工智慧驅動的內容和宣傳活動最佳化

- 來自 B2C 和 B2B 的全通路互動需求

- 零方資料和無 Cookie 個人化

- Gen-AI 輔助駕駛系統大幅縮短創新製作時間

- 市場限制

- 與傳統行銷技術堆疊整合的複雜性

- 資料隱私和同意管理合規成本

- 第一方資料增強的單位成本不斷上升

- 人工智慧主導的宣傳活動設計領域客戶體驗人才短缺

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過部署

- 雲

- 本地部署

- 按組件

- 軟體

- 服務

- 按最終用戶公司規模分類

- 主要企業

- 小型企業

- 按最終用戶行業分類

- 資訊科技和通訊

- 媒體與娛樂

- BFSI

- 零售與電子商務

- 製造業

- 醫療保健和生命科學

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 西班牙

- 瑞士

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 新加坡

- 越南

- 印尼

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 奈及利亞

- 南非

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Adobe Inc.

- Salesforce, Inc.

- Oracle Corp.

- SAP SE

- Microsoft Corp.

- HubSpot Inc.

- IBM Corp.

- Google LLC

- SAS Institute Inc.

- Teradata Corp.

- Criteo SA

- Infor Inc.

- Marketo Engage(Adobe)

- ActiveCampaign LLC

- Klaviyo Inc.

- Intuit Mailchimp

- Sendinblue(Brevo)

- Zoho Corporation

- Constant Contact

- Sitecore

- Acoustic LP

- Insider Inc.

- Sprinklr

- Braze Inc.

第7章 市場機會與未來展望

The global digital marketing software market posted USD 105.33 billion revenue in 2025 and is forecast to touch USD 238.99 billion by 2030, advancing at a 17.81% CAGR over the period.

Rapid migration to cloud-native architectures, AI-driven automation, and cookieless personalization keeps spending on marketing technology at 25.4% of overall marketing budgets. Enterprises now favor integrated suites that unify data, content, and activation functions, replacing fragmented point solutions that raise integration costs. Subscription pricing tied to usage reduces up-front capital outlays, encouraging adoption among mid-market firms. Competitive intensity continues to rise as platform vendors embed generative AI copilots that shorten creative cycles and expand self-service analytics.

Global Digital Marketing Software Market Trends and Insights

Surge in Digital-First Customer Journeys

Seventy percent of B2B buyers now initiate research via search engines, forcing enterprises to re-engineer engagement models across content, data, and commerce. Manufacturing firms allocate 75% of marketing budgets to digital channels, up 10 percentage points versus past cycles. Healthcare providers use AI orchestration to deliver compliant, personalized journeys across web portals and patient apps. European organizations devote 22.9% of digital transformation budgets to marketing technology, recognizing customer experience as a primary competitive lever. The persistent shift toward digital-first engagement underpins sustained demand for unified platforms that manage acquisition, conversion, and retention.

AI-Powered Content and Campaign Optimization

Generative AI platforms such as Adobe GenStudio enable dynamic asset variation at scale, cutting production times by 50% while raising email conversion rates two-fold. HubSpot embedded more than 80 AI features in its Breeze AI release of September 2024, underscoring the race to automate campaign design. Asia-Pacific firms are accelerating investment, with 59% planning higher AI budgets in 2025. Enterprise deployments of autonomous agents, as seen in Salesforce Agentforce, prove marketing workflows can operate with minimal human intervention. AI capability is rapidly becoming a baseline requirement rather than a differentiator.

Integration Complexity with Legacy Martech Stacks

Enterprises average 130 applications in the stack, yet fewer than one-fifth are fully integrated, inflating operational costs and delaying ROI. CMOs cite disconnected data, poor governance, and limited implementation skills as top barriers. Moving to MACH (microservices, API-first, cloud-native, headless) architectures demands technical expertise that many mid-market firms lack, extending timelines and inflating total cost of ownership. European manufacturers illustrate the gap, with only two-thirds achieving digital maturity, compared with nearly four-fifths of US peers.

Other drivers and restraints analyzed in the detailed report include:

- Omnichannel Engagement Demand from B2C and B2B

- Gen-AI Copilots Slashing Creative Production Time

- Data-Privacy and Consent-Management Compliance Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud delivery controlled 65.5% of 2024 revenue, and its share of the digital marketing software market size is projected to expand at an 18.5% CAGR through 2030. The economics remain compelling: elastic infrastructure, continuous updates, and lower maintenance overheads drive total cost of ownership down while improving scalability. On-premise installations persist in regulated verticals where data residency and bespoke integration remain critical, but their share shrinks as cloud providers earn advanced security certifications.

Cost alignment with usage encourages mid-market entry, and AI functionality is often available first in cloud editions, reinforcing preference. Vendors offer hybrid models to ease transition, yet the momentum toward full SaaS deployment appears irreversible as enterprises prioritize speed and flexibility.

Software licenses represented 54.9% of 2024 revenue, yet services revenue is set to grow faster at 19.2% CAGR as firms seek expertise to unlock platform value. System integration, data hygiene, and change-management engagements dominate initial projects, while managed services sustain long-term optimization. The digital marketing software market size for service engagements is further buoyed by AI adoption, which requires model training, governance, and iterative performance tuning.

As stacks grow more complex, external partners fill capability gaps, particularly around multi-cloud and composable architectures. Vendors bundle advisory and managed-service offerings into subscription plans, generating sticky recurring revenue and deepening customer lock-in. Training academies and certification programs proliferate to upskill client teams and accelerate platform ROI.

Digital Marketing Software Market is Segmented by Deployment (Cloud and On-Premise), Component (Software and Services), End-User Enterprise Size (Large Enterprises and Small and Medium Enterprises (SMEs)), End-User Vertical (IT and Telecom, BFSI, Retail and E-Commerce, Manufacturing and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 41.9% revenue in 2024, driven by deep cloud penetration, a skilled workforce, and dense concentration of platform vendors such as Adobe, Salesforce, and HubSpot. Venture capital continues to favor AI-led martech startups, reinforcing the local innovation flywheel. Growth is steady but moderates as penetration approaches maturity and replacement cycles lengthen.

Asia-Pacific is projected to record a 20.6% CAGR to 2030, the fastest worldwide. Governments incentivize digital transformation, and enterprises are adopting localized AI models that respect linguistic and cultural nuances. Manufacturing and financial-services modernization programs accelerate platform uptake, and domestic vendors emerge to address regulatory specifics. The digital marketing software market size attributable to Asia-Pacific will therefore expand rapidly, even as competition intensifies.

Europe remains a solid but regulated adopter. While only 66% of EU manufacturers have achieved end-to-end digitalization, 56% of executives plan higher technology budgets in 2025. GDPR catalyzes demand for privacy-first platforms, yet also stretches implementation timelines and cost structures. Vendors with compliance-by-design architectures find receptive buyers, and expertise developed in Europe is increasingly exported as other jurisdictions replicate privacy statutes.

- Adobe Inc.

- Salesforce, Inc.

- Oracle Corp.

- SAP SE

- Microsoft Corp.

- HubSpot Inc.

- IBM Corp.

- Google LLC

- SAS Institute Inc.

- Teradata Corp.

- Criteo SA

- Infor Inc.

- Marketo Engage (Adobe)

- ActiveCampaign LLC

- Klaviyo Inc.

- Intuit Mailchimp

- Sendinblue (Brevo)

- Zoho Corporation

- Constant Contact

- Sitecore

- Acoustic L.P.

- Insider Inc.

- Sprinklr

- Braze Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in digital-first customer journeys

- 4.2.2 Cloud-native SaaS cost advantages

- 4.2.3 AI-powered content and campaign optimization

- 4.2.4 Omnichannel engagement demand from B2C and B2B

- 4.2.5 Zero-party data and cookieless personalization

- 4.2.6 Gen-AI copilots slashing creative production time

- 4.3 Market Restraints

- 4.3.1 Integration complexity with legacy martech stacks

- 4.3.2 Data-privacy and consent-management compliance costs

- 4.3.3 Rising unit prices for 1st-party data enrichment

- 4.3.4 CX talent shortage for AI-led campaign design

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 By Component

- 5.2.1 Software

- 5.2.2 Services

- 5.3 By End-user Enterprise Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Mid-sized Enterprises

- 5.4 By End-user Industry

- 5.4.1 IT and Telecom

- 5.4.2 Media and Entertainment

- 5.4.3 BFSI

- 5.4.4 Retail and E-commerce

- 5.4.5 Manufacturing

- 5.4.6 Healthcare and Life Sciences

- 5.4.7 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Spain

- 5.5.3.7 Switzerland

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Malaysia

- 5.5.4.6 Singapore

- 5.5.4.7 Vietnam

- 5.5.4.8 Indonesia

- 5.5.4.9 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 Nigeria

- 5.5.5.2.2 South Africa

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Adobe Inc.

- 6.4.2 Salesforce, Inc.

- 6.4.3 Oracle Corp.

- 6.4.4 SAP SE

- 6.4.5 Microsoft Corp.

- 6.4.6 HubSpot Inc.

- 6.4.7 IBM Corp.

- 6.4.8 Google LLC

- 6.4.9 SAS Institute Inc.

- 6.4.10 Teradata Corp.

- 6.4.11 Criteo SA

- 6.4.12 Infor Inc.

- 6.4.13 Marketo Engage (Adobe)

- 6.4.14 ActiveCampaign LLC

- 6.4.15 Klaviyo Inc.

- 6.4.16 Intuit Mailchimp

- 6.4.17 Sendinblue (Brevo)

- 6.4.18 Zoho Corporation

- 6.4.19 Constant Contact

- 6.4.20 Sitecore

- 6.4.21 Acoustic L.P.

- 6.4.22 Insider Inc.

- 6.4.23 Sprinklr

- 6.4.24 Braze Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment