|

市場調查報告書

商品編碼

1844542

接近感測器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030)Proximity Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

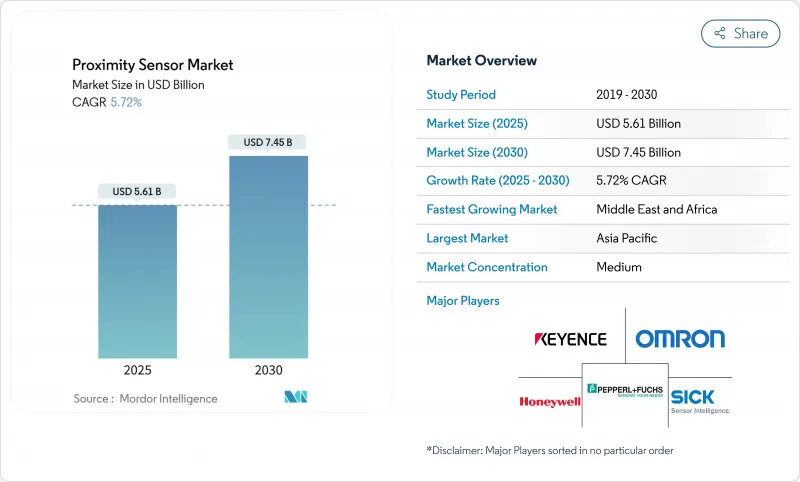

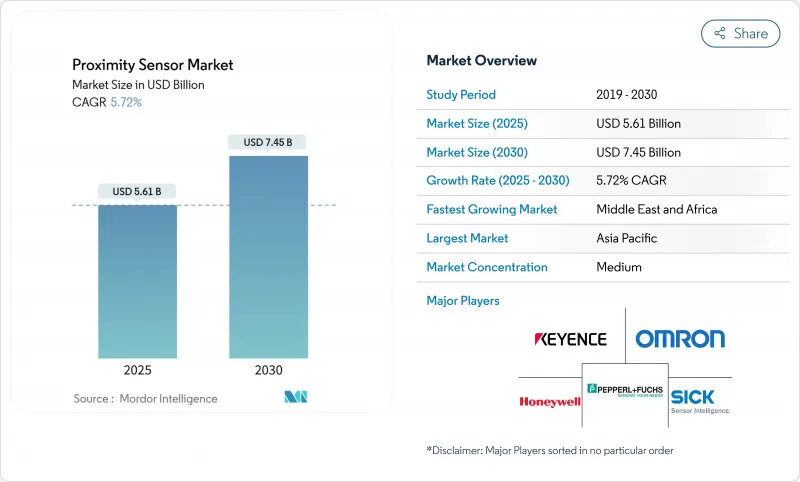

預計 2025 年接近感測器市場價值將達到 56.1 億美元,到 2030 年將達到 74.5 億美元,複合年成長率為 5.72%。

2025年,這個價值56.1億美元的市場將由電動動力傳動系統、航太安全法規以及工業4.0改裝專案的交匯驅動,這些專案需要精確、穩健且經濟高效的感測設備。支援IO-Link的感測器可為邊緣控制器提供即時診斷,從而減少工廠停機時間;而汽車原始設備製造商(OEM)則要求設備符合ISO 26262認證標準,促使供應商加快功能安全產品組合的投資。雖然銅線圈價格壓力的增加以及大功率電動車逆變器對電磁相容性(EMC)的要求限制了短期利潤,但監管轉向航空固態感測器,以及混合霍爾效應、MEMS和體聲波裝置的快速普及,將為接近感測器市場的長期前景帶來積極支撐。

全球接近感測器市場趨勢和洞察

工業4.0主導亞洲棕地工廠的改裝需求

中國、越南和印尼的製造商更傾向於使用支援 IO-Link 的接近感測器升級現有生產線,而不是新建工廠。透過 5G 監控,他們實現了 15-20% 的效率提升和 30% 的成本節省 [gsma.com]。提供嵌入式圓柱形裝置、支援 PLC 的引腳排列和雲端診斷功能的供應商在改裝競標佔據主導地位。與傳統控制設備的兼容性可避免買家長時間停機,從而確保接近感測器市場至少在 2028 年之前保持強勁成長。

汽車原始設備製造商需要獲得 ISO 26262 認證的非接觸式定位

西方汽車計畫目前正在指定符合 ASIL C/D 標準的電感線性和旋轉感測器,以取代對雜散磁場敏感的霍爾效應元件。 Melexis 推出了雙晶粒架構,可在 12 毫米行程內實現 ±0.85% 的精度,並在煞車、踏板和轉向模組中內建冗餘功能 [melexis.com]。認證成本正在層級構造供應格局,迫使規模較小的公司要么獲得 IP 許可,要么退出市場,這進一步鞏固了接近感測器市場。

線圈銅成本波動影響歐洲感應爐BOM

銅現貨價格已達到三年來的最高點,導致線圈成本上漲高達25%,這進一步擠壓了德國和義大利感測器製造商的淨利率,而這些製造商先前就已經飽受電費上漲的困擾。大型供應商正在對沖或垂直整合其銅供應,但小型企業則面臨季度價格表調整的壓力,這削弱了它們的競爭力。

細分分析

到2024年,電感式感測器將佔銷售額的35%,成為整個接近感測器市場中沖壓線和CNC工具機金屬偵測的最佳選擇。其堅固耐用的鐵氧體磁芯線圈能夠耐受油污、切屑和振動,是亞太地區工廠改造的理想選擇。電容式感測器的複合年成長率高達9.80%,目前正用於檢測製藥無塵室中的塑膠外殼和液位,而電感式感測器在這些領域往往失效。霍爾效應角度和電容式存在檢測技術的混合趨勢正在推動供應商轉向多物理場ASIC,從而簡化安裝並減少SKU數量。

電容式正日益普及,因為單一感測器無需機械接觸即可覆蓋玻璃、樹脂和穀物層,從而滿足食品安全要求。光電感測器在需要10公尺瞄準的多塵輸送機領域仍佔據一席之地,而超音波感測器則適用於光學感測器無法應用的化學品罐。磁性xMR感測器在電動車牽引馬達領域的市場佔有率正在不斷擴大,這類馬達需要毫米級精度才能實現面向現場的控制。總而言之,這些轉變使接近感測器市場充滿活力且富有彈性。

出於成本效益的考慮,到2024年,固定距離氣缸將佔出貨量的60%。汽車沖壓車間全年生產相同的門板,因此固定閾值是首選,以避免意外的重新校準。然而,在電子組裝的小批量生產中,配備IO-Link參數化的可調距離型號的複合年成長率將達到8.50%。生產工程師無需更換硬體,只需微調板載韌體,即可縮短轉換時間。在過渡到無人值守的工廠中,智慧可調設備會將EQ時間戳和循環計數發送到MES儀表板,從而深化數位雙胞胎,並提升接近感測器的市場影響力。

維修團隊表示,透過可調式感測器覆蓋多個燈具距離,可以抵消高昂的標價並減少備件需求。供應商正在競相推出LED引導式示教模式和NFC智慧型手機設置,以提高易用性。從長遠來看,韌體主導的距離調節預計將成為軟性工廠的預設。

在智慧型手機拾取平台、馬達換向和卡扣式品質檢查的推動下,0-20mm 感測器將在 2024 年佔據接近感測器市場的 45%。它們的固態穩健性優於機械限位開關,從而減少了廢品率。然而,倉庫自動化、AMR 和托盤穿梭車系統要求在 2 公尺以上的距離內保持視線安全,因此 40mm 及更大尺寸設備的複合年成長率將達到 7.20%。供應商正在推出放大收發器和波束成形光學元件,即使在霧天也能偵測到 4 公尺的距離,與LiDAR和雷達互補,實現 360° 機器人感知。

在物流,遠距接近感測器可避免盲點碰撞,且無需犧牲高解析度視覺。超音波光電混合堆疊已進入該領域,將距離和存在性資訊整合到一個SKU中,從而減少高架貨架的故障點和佈線工作量。

區域分析

受中國工廠數位化補貼、日本機器人出口領先地位以及韓國半導體投資的推動,亞太地區將在2024年保持36%的接近感測器市場佔有率。將IO-Link感測器改裝到棕地線上,可以在不建造新廠房的情況下,在符合區域資本支出限制的前提下提高產量。零件製造商正在將感測器組裝安裝在智慧型手機叢集附近,以在產品週期緊張的情況下縮短前置作業時間。各國政府正在補貼5G專用網路,支援支撐即時品質迴路的感測器數據主幹網。

歐洲仍然是高階買家群體,德國一級供應商要求線控轉向應用採用 ASIL-D 電感式編碼器,法國航太整合商則指定 ELDEC 感測器用於嚴苛的渦輪機艙。持續的銅價上漲和高昂的電費推高了歐洲的物料清單 (BOM),導致線圈繞製轉移到中歐,並使研發中心更靠近原始設備製造商。歐洲大陸大力推行淨零工廠,鼓勵採用 IO-Link 診斷技術來消除廢料和能源浪費,從而增強了接近感測器市場對先進用例的吸收。

北美市場消費穩定且成熟,主要集中在航太、能源和蓬勃發展的電動車供應鏈領域。美國電網現代化計劃將擴大用於監測斷路器位置和閥門狀態的接近感測器的市場空間。Schneider Electric7億美元的資本投資表明,北美市場對整合工廠校準感測器的數位化開關設備和配電盤的需求旺盛。加拿大採礦自動化和墨西哥汽車組裝出口正在加深該地區的需求。

中東地區的複合年成長率將達到7.50%,其中沙烏地阿拉伯的石化和公用事業工廠將部署預測性維護套件,每個站點配備數百個IO-Link接近節點。非洲和南美洲雖然仍處於自動化應用的早期階段,但透過物流和食品加工廠的發展,逐漸普及,為全球接近感測器市場帶來長尾成長。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 工業4.0主導亞洲棕地工廠的改裝需求

- ISO 26262 認證非接觸式定位技術是汽車原始設備製造商 (OEM) 的強制性要求

- 智慧型手機中安裝的Mini LED/LED背光源(亞太地區)

- FAA 和 EASA 過渡到固態起落架接近感測器

- 建築自動化和智慧基礎設施的物聯網整合

- 歐洲離散生產線採用 IO-Link

- 市場限制

- 線圈銅成本波動影響歐洲電感BOM

- 高功率電動車逆變器違反 EMC違規(美國)

- 冷凝導致食品光電感測器故障

- ATEX區域認證前置作業時間延遲中東計劃

- 價值/供應鏈分析

- 監理展望(IEC 60947-5-2、ISO 13849)

- 技術展望(晶片級孔、BAW、MEMS混合)

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 投資與資金籌措分析

第5章市場規模及成長預測

- 依技術

- 電感式

- 電容式

- 光電式

- 磁性(霍爾效應和簧片)

- 超音波

- 紅外線及其他

- 依產品類型

- 固定距離感測器

- 可變距離感測器

- 按檢測範圍

- 0-20 mm

- 20-40 mm

- 40毫米或以上

- 依外殼/外形規格

- 圓柱形

- 長方形

- 插槽/頻道

- 小型/PCB 安裝

- 環形/直通光束

- 依輸出類型

- 數字(NPN/PNP)

- 模擬(0-10 V/4-20 mA)

- IO-Link 和其他智慧介面

- 通道佈線

- 兩線交流/直流

- 3線直流

- 四線互補

- 按最終用戶產業

- 航太/國防

- 車

- 工業自動化與機器人

- 家用電器和穿戴設備

- 食品和飲料加工

- 醫療保健和醫療設備

- 建築自動化和智慧基礎設施

- 其他行業(採礦業、農業、海洋業)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 中東

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Keyence Corporation

- Omron Corporation

- Pepperl+Fuchs GmbH

- Sick AG

- Panasonic Holdings Corp.

- Honeywell International Inc.

- STMicroelectronics NV

- Schneider Electric SE

- Rockwell Automation Inc.

- IFM Electronic GmbH

- Turck Holding GmbH

- Datalogic SpA

- Delta Electronics Inc.

- Autonics Corporation

- Balluff GmbH

- Banner Engineering Corp.

- Texas Instruments Inc.

- Broadcom Inc.

- Littelfuse Inc.

- Baumer Group

- Vishay Intertechnology

- BorgWarner Inc.

- Allegro MicroSystems

- Leuze electronic GmbH

第7章 市場機會與未來展望

The proximity sensors market size is valued at USD 5.61 billion in 2025 and is forecast to grow at a 5.72% CAGR, reaching USD 7.45 billion by 2030.

The 2025 market value of USD 5.61 billion is supported by the intersection of electrified powertrains, aerospace safety directives, and Industry 4.0 retro-fit programs that demand precise, rugged, and cost-efficient detection devices. Growth momentum intensifies as IO-Link-enabled sensors feed real-time diagnostics to edge controllers, trimming factory downtime, while automotive OEM mandates for ISO 26262-certified devices accelerate supplier investments in functional-safety portfolios. Intensifying price pressure on copper coils and the need for electromagnetic compatibility (EMC) in high-power EV inverters temper near-term gains, yet regulatory shifts toward solid-state aviation sensors and the rapid uptake of hybrid Hall-effect, MEMS, and bulk-acoustic-wave devices reinforce a positive long-term outlook for the proximity sensors market.

Global Proximity Sensor Market Trends and Insights

Industry 4.0-led Retro-Fit Demand in Brownfield Asian Factories

Manufacturers across China, Vietnam, and Indonesia prefer upgrading existing lines with IO-Link-ready proximity sensors rather than building new plants, unlocking 15-20% efficiency gains and 30% cost cuts through 5G-enabled monitoring [gsma.com]. Suppliers offering drop-in cylindrical devices with PLC-friendly pinouts yet cloud-ready diagnostics dominate retro-fit tenders. Compatibility with legacy controls shields buyers from lengthy downtime, keeping the proximity sensors market buoyant until at least 2028.

Automotive OEM Mandates for ISO 26262-Certified Contactless Positioning

European and U.S. vehicle programs now specify inductive linear and rotary sensors qualified to ASIL C/D, displacing Hall-effect devices sensitive to stray fields. Dual-die architectures introduced by Melexis achieve +-0.85% accuracy over 12 mm strokes and offer built-in redundancy for brake, pedal, and steering modules [melexis.com]. Certification costs create a two-tier supply landscape, pushing smaller firms to license IP or exit, and further consolidating the proximity sensors market.

Coil-Copper Cost Volatility Impacting Inductive BOM in Europe

Three-year highs in copper spot prices raise coil costs by up to 25%, squeezing margins for German and Italian sensor producers already burdened by elevated electricity tariffs. Larger vendors hedge or vertically integrate copper supply, but smaller firms confront price-list resets quarterly, hampering competitiveness.

Other drivers and restraints analyzed in the detailed report include:

- Mini-LED/µLED Back-Light Integration in Smartphones (APAC)

- FAA & EASA Transition to Solid-State Landing-Gear Proximity Sensors

- EMC Compliance Failures in High-Power EV Inverters (US)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Inductive units delivered 35% of 2024 revenue, validating their status as the de-facto choice for metal detection on press lines and CNC machines embedded across the proximity sensors market. Rugged ferrite-core coils endure oil, chips, and vibration, ideal for retro-fits in APAC factories. Capacitive devices, advancing at 9.80% CAGR, now sense plastic housings and fluid levels in pharmaceutical clean rooms where inductive devices fail. The hybridization trend-combining Hall-effect for angle and capacitive for presence-pushes suppliers toward multi-physics ASICs that simplify installation and reduce SKU count.

Capacitive adoption accelerates because one sensor can cover glass, resin, or grain level without mechanical contact, aligning with food-safety mandates. Photoelectric SKUs retain niches requiring 10 m targeting over dusty conveyors, while ultrasonic variants serve chemical vats impervious to optical methods. Magnetic xMR sensors gain share within EV traction motors needing millidegree precision for field-oriented control. Collectively, these transitions keep the proximity sensors market varied and resilient.

Skewing to cost efficiency, fixed-distance cylinders amassed 60% of 2024 shipments. Automotive stamping plants, running identical door panels year-round, favor fixed thresholds to avoid accidental recalibration. However, short batch runs in electronics assembly spark an 8.50% CAGR for adjustable-distance models equipped with IO-Link parameterization. Production engineers tweak on-board firmware rather than swapping hardware, slashing changeover times. In plants moving toward lights-out operation, smart adjustable devices feed EQ timestamps and cycle counts to MES dashboards, deepening digital twins and elevating the proximity sensors market profile.

Maintenance teams cite reduced spares when one adjustable sensor covers multiple jig distances, offsetting its higher list price. Suppliers compete on LED-guided teach modes and NFC smartphone setup, reinforcing ease of use. Long term, firmware-driven range tuning is expected to become the default in flexible factories.

Smartphone pick-and-place stages, electric-motor commutation, and snap-fit quality checks keep 0-20 mm sensors at 45% of proximity sensors market size in 2024. Their solid-state ruggedness beats mechanical limit switches and reduces false rejects. Yet warehouse automation, AMRs, and pallet-shuttle systems require line-of-sight safety at two-meter plus distances, lifting>40 mm devices at a 7.20% CAGR. Suppliers respond with amplified transceivers and beam-forming optics capable of 4 m detection even in fog, complementing LiDAR and radar for 360° robot perception.

In intralogistics, longer-range proximity avoids blind-spot collisions without the cost of high-resolution vision. Hybrid ultrasonic-photoelectric stacks enter this space, integrating distance and presence into one SKU, reducing points of failure and wiring labor in high-bay racking.

The Proximity Sensors Market Report is Segmented by Technology (Inductive, Capacitive, and More), Product Type (Fixed-Distance, Adjustable-Distance), Sensing Range (0-20mm, 20-40m, M, Greater Than 40mm), Housing (Cylindrical, and More), Output Type (Digital, Analog, IO-Link), Channel Wiring (2-Wire, and More), End-User Industry (Automotive, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained 36% proximity sensors market share in 2024, buoyed by China's factory digitalization grants, Japan's robotics export leadership, and South Korea's semiconductor investments. Retro-fitting brownfield lines with IO-Link sensors boosts output without new buildings, aligning with local CapEx restrictions. Component makers co-locate sensor assembly near smartphone clusters, shrinking lead times amid tight product cycles. Governments subsidize 5G private networks, anchoring sensor data backbones that support real-time quality loops.

Europe remains a premium buyer base. German Tier-1s demand ASIL-D inductive encoders for steer-by-wire, while French aerospace integrators specify ELDEC sensors for harsh turbine bays. Continual copper price waves and high electricity tariffs raise European BOMs, nudging some coil-winding to Central Europe yet retaining R&D centers near OEMs. The continent's push for net-zero factories incentivizes IO-Link diagnostics that trim scrap and energy waste, reinforcing advanced use-case uptake across the proximity sensors market.

North America records steady but mature consumption, concentrated in aerospace, energy, and a burgeoning EV supply chain. U.S. energy grid modernization programs open niches for proximity sensors monitoring breaker position and valve status. Schneider Electric's USD 700 million cap-ex illustrates domestic appetite for digitized switchgear and panelboards that embed factory-calibrated sensors. Canada's mining automation and Mexico's auto assembly exports deepen regional demand.

The Middle East delivers the quickest 7.50% CAGR, with Saudi Arabia's petrochemical and utility plants installing predictive-maintenance suites featuring hundreds of IO-Link proximity nodes per site. Africa and South America, while early in automation adoption, lay groundwork through logistics and food-processing plants, offering long-tail upside to the global proximity sensors market.

- Keyence Corporation

- Omron Corporation

- Pepperl+Fuchs GmbH

- Sick AG

- Panasonic Holdings Corp.

- Honeywell International Inc.

- STMicroelectronics N.V.

- Schneider Electric SE

- Rockwell Automation Inc.

- IFM Electronic GmbH

- Turck Holding GmbH

- Datalogic SpA

- Delta Electronics Inc.

- Autonics Corporation

- Balluff GmbH

- Banner Engineering Corp.

- Texas Instruments Inc.

- Broadcom Inc.

- Littelfuse Inc.

- Baumer Group

- Vishay Intertechnology

- BorgWarner Inc.

- Allegro MicroSystems

- Leuze electronic GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Industry 4.0-led Retro-Fit Demand in Brownfield Asian Factories

- 4.2.2 Automotive OEM Mandates for ISO 26262-Certified Contactless Positioning

- 4.2.3 Mini-LED/LED Back-Light Integration in Smartphones (Asia-Pacific)

- 4.2.4 FAA and EASA Transition to Solid-State Landing-Gear Proximity Sensors

- 4.2.5 Building Automation and Smart Infrastructure IoT Integration

- 4.2.6 IO-Link Adoption in European Discrete Manufacturing Lines

- 4.3 Market Restraints

- 4.3.1 Coil-Copper Cost Volatility Impacting Inductive BOM in Europe

- 4.3.2 EMC Compliance Failures in High-Power EV Inverters (US)

- 4.3.3 Condensation-Driven False Trips in Food-Grade Photoelectric Sensors

- 4.3.4 ATEX-Zone Certification Lead-Times Delaying Middle-East Projects

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook (IEC 60947-5-2, ISO 13849)

- 4.6 Technological Outlook (Chip-level Hall, BAW, MEMS Hybrids)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Inductive

- 5.1.2 Capacitive

- 5.1.3 Photoelectric

- 5.1.4 Magnetic (Hall-Effect and Reed)

- 5.1.5 Ultrasonic

- 5.1.6 Infra-Red and Others

- 5.2 By Product Type

- 5.2.1 Fixed-Distance Sensors

- 5.2.2 Adjustable-Distance Sensors

- 5.3 By Sensing Range

- 5.3.1 0 - 20 mm

- 5.3.2 20 - 40 mm

- 5.3.3 Greater than 40 mm

- 5.4 By Housing / Form Factor

- 5.4.1 Cylindrical

- 5.4.2 Rectangular

- 5.4.3 Slot / Channel

- 5.4.4 Miniature / PCB-Mount

- 5.4.5 Ring and Through-Beam

- 5.5 By Output Type

- 5.5.1 Digital (NPN / PNP)

- 5.5.2 Analog (0-10 V / 4-20 mA)

- 5.5.3 IO-Link and Other Smart Interfaces

- 5.6 By Channel Wiring

- 5.6.1 2-Wire AC/DC

- 5.6.2 3-Wire DC

- 5.6.3 4-Wire Complementary

- 5.7 By End-user Industry

- 5.7.1 Aerospace and Defense

- 5.7.2 Automotive

- 5.7.3 Industrial Automation and Robotics

- 5.7.4 Consumer Electronics and Wearables

- 5.7.5 Food and Beverage Processing

- 5.7.6 Healthcare and Medical Devices

- 5.7.7 Building Automation and Smart Infrastructure

- 5.7.8 Other Industries (Mining, Agriculture, Marine)

- 5.8 By Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Mexico

- 5.8.2 Europe

- 5.8.2.1 United Kingdom

- 5.8.2.2 Germany

- 5.8.2.3 France

- 5.8.2.4 Italy

- 5.8.2.5 Rest of Europe

- 5.8.3 Asia-Pacific

- 5.8.3.1 China

- 5.8.3.2 Japan

- 5.8.3.3 India

- 5.8.3.4 South Korea

- 5.8.3.5 Rest of Asia-Pacific

- 5.8.4 Middle East

- 5.8.4.1 Israel

- 5.8.4.2 Saudi Arabia

- 5.8.4.3 United Arab Emirates

- 5.8.4.4 Turkey

- 5.8.4.5 Rest of Middle East

- 5.8.5 Africa

- 5.8.5.1 South Africa

- 5.8.5.2 Egypt

- 5.8.5.3 Rest of Africa

- 5.8.6 South America

- 5.8.6.1 Brazil

- 5.8.6.2 Argentina

- 5.8.6.3 Rest of South America

- 5.8.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Keyence Corporation

- 6.4.2 Omron Corporation

- 6.4.3 Pepperl+Fuchs GmbH

- 6.4.4 Sick AG

- 6.4.5 Panasonic Holdings Corp.

- 6.4.6 Honeywell International Inc.

- 6.4.7 STMicroelectronics N.V.

- 6.4.8 Schneider Electric SE

- 6.4.9 Rockwell Automation Inc.

- 6.4.10 IFM Electronic GmbH

- 6.4.11 Turck Holding GmbH

- 6.4.12 Datalogic SpA

- 6.4.13 Delta Electronics Inc.

- 6.4.14 Autonics Corporation

- 6.4.15 Balluff GmbH

- 6.4.16 Banner Engineering Corp.

- 6.4.17 Texas Instruments Inc.

- 6.4.18 Broadcom Inc.

- 6.4.19 Littelfuse Inc.

- 6.4.20 Baumer Group

- 6.4.21 Vishay Intertechnology

- 6.4.22 BorgWarner Inc.

- 6.4.23 Allegro MicroSystems

- 6.4.24 Leuze electronic GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment