|

市場調查報告書

商品編碼

1629785

北美接近感測器:市場佔有率分析、行業趨勢和成長預測(2025-2030)North America Proximity Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

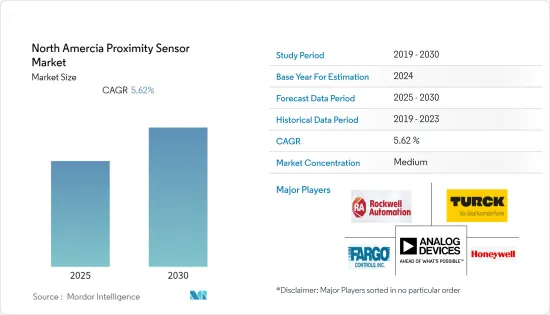

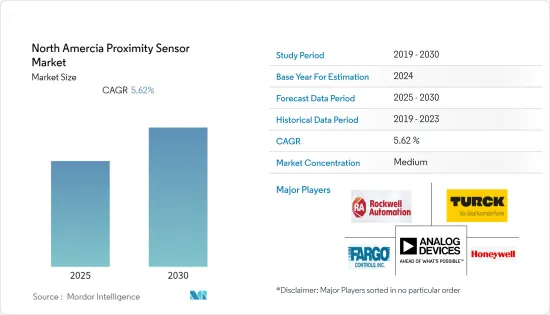

北美接近感測器市場預計在預測期內複合年成長率為 5.62%

主要亮點

- 工業控制器機構中對機器人的依賴現已成為一種既定趨勢,為工業控制和工業自動化設備的大規模和廣泛實施鋪平了道路。物料輸送是該地區接近感測器成長最快的應用市場之一。接近感測器通常安裝在堆高機等物料輸送設備 (MHE) 上,並在檢測到實體(人或其他 MHE)時啟動訊號,從而促進物料輸送設備的成長,特別是自動化設備正在推動市場成長。

- 連網汽車和自動駕駛汽車是北美汽車產業的重大發展。經濟發展增加了消費者的人均收入,從而提高了他們的生活水準。人均收入的成長推動了對豪華舒適汽車的需求不斷成長,這也刺激了對自動駕駛汽車的需求。

- 支持自動駕駛技術的政府措施和政策正在推動聯網汽車和自動駕駛汽車的採用。該地區還有許多合作和夥伴關係來測試和採用這項技術。

- 此外,現有製造商擴大與新興企業合作以獲得自動駕駛技術。此外,該公司還與各種服務供應商合作,測試自動駕駛汽車的可行性。 2018 年,福特馬達公司與沃爾瑪公司合作,測試用於運送消費品和雜貨的自動駕駛汽車。配備 AEB、ADAS、FCW 和 PAS 系統的車輛正在推動汽車接近感測器市場的發展。

- 隨著全部區域汽車使用量的增加,對智慧停車的需求也增加。因此,北美停車行業正在迅速轉向智慧技術,導致高階自動化和停車預訂解決方案的採用,這些解決方案正在整合到許多行動解決方案中,從而促進市場成長。

- 2020 年 4 月,藍牙定位信標新興企業Estimote Inc. 開發了一款專門用於遏制 COVID-19 傳播的新產品。該設備被稱為「健康證明」穿戴式設備,旨在在當地職場設施層級提供接觸者追蹤。該硬體包括被動 GPS 位置追蹤、藍牙和超寬頻無線連接、可充電電池以及內建 LTE 的接近感測器。

北美接近感測器市場趨勢

北美消費性電子產品滲透率的擴大預計將推動市場發展

- 智慧型手機和穿戴式裝置(例如智慧型手錶和健身追蹤器)在北美地區正在經歷強勁成長。預計這將在預測期內推動對接近感測器的需求。

- 據消費者科技協會稱,加拿大約 22% 的家庭擁有活動健身追蹤器(一種穿戴式電子設備),這些設備用於健身相關環境,包括心率監測、GPS 追蹤和卡路里記錄它具有標準功能,例如:這些設備是加拿大最受歡迎的穿戴式產品之一,尤其是在亞伯達和薩斯喀徹爾/曼尼托巴省等地區。

- 由於 Fitbit Inc. 和 Apple Inc. 等公司在美國創造了大量收益,預計北美地區將在預測期內佔據較高的市場佔有率。 2020年,蘋果公司的45.37%即1,245.56億美元來自美國地區,而Fitbit公司2019年的總收入僅來自美國,佔其市場大本營的55.7%。

- 智慧型手機和行動裝置已成為現代生活的設備,消費者不僅可以更有效地溝通,還可以支付申請、購物,甚至遠端控制家中和汽車中的裝置。根據 AARP 的報告,截至 2019 年中期,超過四分之三 (77%) 的 50 歲及以上美國成年人擁有智慧型手機,比幾年前的 70% 增加了 10%。在這些智慧型手機用戶中,十分之九的人每天都使用他們的設備,其中大多數 (83%) 使用它來發送和接收簡訊和電子郵件等訊息。

- 智慧型手機業務的成長和資本支出的強勁成長可能是美國接近感測器市場獲利的主要因素。

航太和國防預計將推動市場

- 由於需要安全關鍵、安全相關且高可靠性的解決方案,航太和國防領域是接近感測器採用最多的領域之一。

- Honeywell國際公司表示,接近感測器可以檢測大多數內部故障,並向飛行員和維護技術人員顯示故障輸出,從而減少停機時間和維護成本。例如,飛機起落架系統中的接近感測器在著陸過程中向飛行員提供故障警報,以便在起落架未完全展開時發出警告。

- 接近感測器廣泛部署在各種飛機系統中,包括反推力驅動系統、飛行控制設備、飛機門、貨物裝載系統、疏散滑鎖和起落架。

- 電感式接近感測器因其非機械接觸、可靠性、環境相容性強、安全等特點,在航空領域廣泛應用。隨著自動化和飛機尺寸的增加,對傳輸部件目標位置監控的需求也增加。飛機外部的監控點環境惡劣,包括灰塵、冰凍環境和聲光干擾。因此,該領域對感測器的環境適應性有很高的要求。

- 接近感測器因其感測能力而被美國、美國、海軍陸戰隊和各盟國使用。

- 2020 年 2 月,Kellstrom Defense Aerospace (KDA) 與 AMETEK Aerospace & Defense 的感測器和流體管理系統 (SFMS) 部門簽署了一項新的多年擴展現有分銷協議。該合約意味著 KDA 將繼續作為 AMETEK SFMS 產品的獨家經銷商為全球軍事和政府售後市場提供服務,同時提供OEM維修管理支援並開發用於維護軍用飛機的新售後解決方案。來建立在我們現有的夥伴關係的基礎上。

- 為了滿足日益成長的需求,Honeywell推出了兩款新型接近感測器,例如通用航太接近感測器(GAPS) 和惡劣航太接近感測器(HAPS)(以前稱為 IHM 系列)。這兩個平台融合了Honeywell的取得專利的整合健康監測功能。然而,這些產品之間存在一些技術差異,使它們能夠用於各種航太應用。

北美接近感測器產業概況

由於初始投資較高,北美接近感測器市場較為集中。它由幾家大公司主導,包括羅克韋爾自動化公司、霍尼韋爾國際公司、圖爾克公司、模擬設備公司和安華高科技公司。這些擁有大量市場佔有率的大公司正致力於擴大海外基本客群。這些公司利用策略合作措施來擴大市場佔有率並提高盈利。然而,隨著技術進步和產品創新,中小企業正在透過獲得新契約和開發新市場來增加其市場佔有率。

- 2020 年 7 月 - 海斯特公司推出了 Litum,這是一種近距離標籤,旨在促進遵守社交距離要求。該系統使用穿戴式標籤,每當員工彼此距離太近時,該標籤就會根據接近感測器的輸入和預定的距離設定而振動。

- 2020 年 6 月 - Zebra Technologies Corporation 宣布推出一款接近感測系統,該系統可偵測每位員工與其他員工的接近程度,並提供用戶級警報和接觸者追蹤。這些功能可協助企業滿足政府透過社交距離、接觸者追蹤和消毒等政策來防止 COVID-19 傳播的指導方針。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 產業價值鏈分析

- COVID-19 對市場的影響

- 市場促進因素

- 工業自動化的成長

- 非接觸式感測技術的需求增加

- 市場限制因素

- 感測能力的限制

第5章技術概況

第6章 市場細分

- 依技術

- 感應式

- 電容式

- 光電式

- 磁力型

- 按最終用戶

- 工業的

- 車

- 電子/半導體製造

- 航太/國防

- 包裝

- 其他最終用戶

- 按國家/地區

- 美國

- 加拿大

第7章 競爭格局

- 公司簡介

- Rockwell Automation Inc.

- Ifm electronic gmbh

- Pepperl+Fuchs SE

- OMRON Corporation

- Hans Turck GmbH & Co. KG

- Banner Engineering Corp

- SICK AG

- Carlo Gavazzi Holding

- Baumer Holding AG

第8章投資分析

第9章 市場未來展望

The North America Proximity Sensor Market is expected to register a CAGR of 5.62% during the forecast period.

Key Highlights

- Dependence on robots in industrial controller mechanisms is currently an established trend, paving the way for larger and wider adoption of industrial control and industrial automation equipment. Material handling is one of the fastest-growing application markets for proximity sensors in the region. As proximity sensors are typically attached to material handling equipment (MHE), such as forklifts, and activate a signal when an entity (a person or other MHE) is detected, the growth of material handling equipment, especially the automated ones, is boosting the growth of the market

- Connected vehicles and autonomous vehicles are key developments in the automotive industry in North America. Economic developments increase per capita income of consumers, thereby, increasing their standard of living. An increase in demand for luxury and comfort vehicles can be attributed to the rise in per capita income, which is another factor fueling the demand for autonomous vehicles.

- The supportive government initiatives and policies for the self-driving technology have enabled the adoption of connected and autonomous vehicles. The region is also witnessing numerous collaborations and partnerships for the testing and adoption of the technology.

- In addition to that, established manufacturers are increasingly collaborating with start-ups to acquire the autonomous technology. Furthermore, companies are also collaborating with various service providers to test the viability of autonomous cars. In 2018, Ford Motor Company partnered with Walmart Inc. to test self-driving cars for consumer goods and grocery delivery. Vehicles incorporating AEB, ADAS, FCW, and PAS systems are driving the market for automotive proximity sensors.

- With the increasing usage of cars across the region, the demand for smart parking is also growing. Thus, parking industry in North America is rapidly moving toward smart technologies and leading to adoption of high-end automation and parking reservation solutions which are getting integrated into the many mobility solutions and hence contributing to the growth of the market.

- In April 2020, Bluetooth location beacon startup Estimote Inc developed a new product designed specifically for curbing the spread of COVID-19. The devices, called the 'Proof of Health' wearables, aim to provide contact tracing at the level of a local workplace facility. The hardware includes passive GPS location tracking, as well as proximity sensors powered by Bluetooth and ultra-wide-band radio connectivity, a rechargeable battery and built-in LTE.

North America Proximity Sensors Market Trends

Growing Adoption of Consumer Electronics Devices is North America is Expected to Drive the Market

- Smartphones and wearables, such as smartwatches and fitness trackers, are experiencing high growth across North America. This is expected to drive the demand for proximity sensors over the forecast period.

- According to Consumer Technology Association, activity fitness trackers, a type of wearable electronic device, can be found in around 22% of households in Canada, and these devices are used in a fitness-related context, with standard features including heart rate monitoring, GPS tracking, and calorie tracking. These devices rank among Canada's most popular wearables, particularly in regions like Alberta and Saskatchewan/Manitoba.

- With companies, such as Fitbit Inc. and Apple Inc., making significant revenues from the United States, the North American region is expected to have a high market share during the forecast period. In 2020, Apple Inc. generated 45.37% or USD 124,556 million from the American region and Fitbit Inc. generated 55.7% of the total revenue only from the United States in 2019 which represents a stronghold on the market.

- Smartphones and mobile devices are now the fixture of modern life which is enabling consumers to not only communicate more effectively, but pay bills, shop, and even remotely control devices in their homes and cars. According to the AARP report, more than three-quarters (77%) of US adults ages 50 and up and owned a smartphone as of mid of 2019, which represents a 10% rise from 70% a couple of years earlier. Among these smartphone owners, 9 in 10 use their devices daily, with the majority (83%) using them to send or receive messages such as texts and emails.

- The ever-increasing smartphone business, and strong growth in the capital investments are going to be key drivers for the profitable development of the proximity sensors market in the United States.

Aerospace and Defense is Expected to Drive the Market

- The aerospace and defense sector is one of the largest adopters of proximity sensors, owing to the need for safety-critical, safety-related, or high-reliability solutions.

- According to Honeywell International Inc., proximity sensors can detect most internal failures and display a fault output to a pilot or maintenance technician, thereby reducing downtime and maintenance costs. For instance, proximity sensors in aircraft landing gear systems offer the pilot with a fault alert on landing approach to warn if the landing gear is not completely deployed.

- Proximity sensors are widely deployed in a wide range of aircraft systems, such as thrust reverser actuation systems, flight controls, aircraft doors, cargo loading systems, evacuation slide locks, and landing gear.

- Inductive proximity sensors are widely used in the aviation sector because of their non-mechanical contact, reliability, strong environmental suitability, and safety. The demand for target location monitoring of transmission parts is increasing with the development of automation and aircraft of larger sizes. Monitoring points at the external side of an aircraft are in harsh environments, like dusty or freezing environments, acoustic optical disturbances, etc. Thus, there are high requirements on the environmental adaptation of these sensors in this sector.

- Due to its sensing capabilities, proximity sensors have been used by the US Navy, US Air Force and Marine Corps, and various allied nations.

- In February 2020, Kellstrom Defense Aerospace (KDA) signed a new multi-year extension to an existing distribution agreement with the Sensors and Fluid Management Systems (SFMS) business unit of AMETEK Aerospace & Defense. The deal builds on a legacy of partnership, with KDA continuing to serve as the exclusive distributor of AMETEK SFMS products for the global military and government aftermarket, while also providing OEM repair management support and expanded cooperation for new aftermarket solutions for military aircraft sustainment.

- With growing demand, Honeywell introduced two new proximity sensors, such as General Aerospace Proximity Sensors (GAPS) and Harsh Aerospace Proximity Sensors (HAPS), formerly known as the IHM Series. These two platforms incorporate Honeywell's patented Integrated Health Monitoring functionality. However, the products have some technical differences that allow them to be used in various aerospace applications.

North America Proximity Sensors Industry Overview

The North America proximity sensor market is concentrated due to higher initial investments. It is dominated by a few major players like Rockwell Automation Inc., Honeywell International Inc., Turck, Inc., Analog Devices, Inc., and Avago Technologies Inc. These significant players, with a prominent share in the market, are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability. However, with technological advancements and product innovations, mid-size to smaller companies are growing their market presence by securing new contracts and tapping new markets.

- July 2020 - Hyster Company has introduced a proximity tag, Litum, to help promote compliance with social distancing requirements. The system uses wearable tags that vibrate whenever personnel gets too close to each other, based on input from proximity sensors and predetermined distance settings.

- June 2020 - Zebra Technologies Corporation launched a proximity sensing system that will detect each employee's proximity to other workers and provide user-level alerting and contact tracing. Those features will help companies to meet government guidelines around preventing the spread of Covid-19 through policies like social distancing, contact tracing, and disinfection.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

- 4.5 Market Drivers

- 4.5.1 Growth in Industrial Automation

- 4.5.2 Increase in Demand for Non-contact Sensing Technology

- 4.6 Market Restraints

- 4.6.1 Limitations in Sensing Capabilities

5 TECHNOLOGY SNAPSHOT

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Inductive

- 6.1.2 Capacitive

- 6.1.3 Photoelectric

- 6.1.4 Magnetic

- 6.2 By End-User

- 6.2.1 Industrial

- 6.2.2 Automotive

- 6.2.3 Electronics and Semiconductor Manufacturing

- 6.2.4 Aerospace and Defense

- 6.2.5 Packaging

- 6.2.6 Other End-use Applications

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rockwell Automation Inc.

- 7.1.2 Ifm electronic gmbh

- 7.1.3 Pepperl+Fuchs SE

- 7.1.4 OMRON Corporation

- 7.1.5 Hans Turck GmbH & Co. KG

- 7.1.6 Banner Engineering Corp

- 7.1.7 SICK AG

- 7.1.8 Carlo Gavazzi Holding

- 7.1.9 Baumer Holding AG