|

市場調查報告書

商品編碼

1627136

美國接近感測器:市場佔有率分析、產業趨勢、成長預測(2025-2030)United States Proximity Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

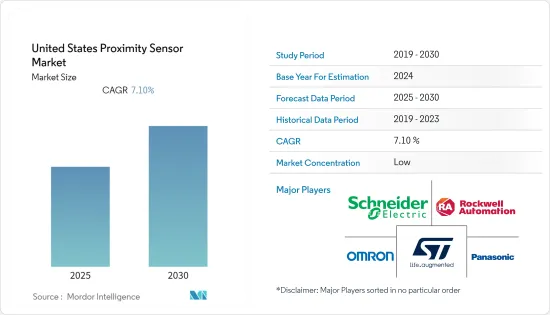

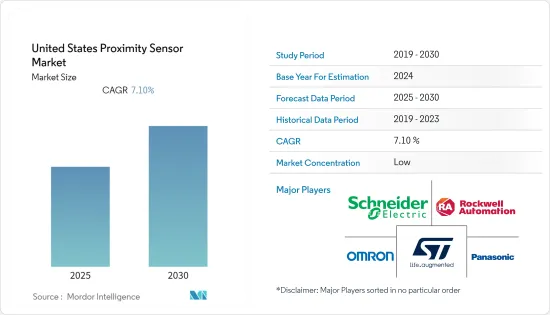

美國接近感測器市場預計在預測期內複合年成長率為 7.1%

主要亮點

- 在美國,由於都市化和人口成長,現代化設施變得更加複雜和多樣化。例如,世界銀行進行的世界發展指標調查發現,2020年美國都市化程度為82.66%。

- 來自感測器的資訊資料預計將有助於管理各種城市設施,並透過共用資訊有效應對緊急情況和事故。智慧城市車輛需要多個感測器來監測各種現象。這些各種類型的接近感測器不斷監控車輛的位置和控制,增加了它們對城市基礎設施的需求並推動了接近感測器市場的發展。

- 此外,在科技進步的時代,新型創新的接近感測器飛行時間(ToF)感測器可以在保持社交距離的同時以多種方式保護您的健康。例如,意法半導體於2020年7月推出了基於FlightSense飛行時間技術的高性能接近和測距感測器。這些飛行時間 (ToF) 感測器可協助客戶為其日常使用的各種產品開發 3D 感測功能。

- 此外,隨著 COVID-19 對各行業的影響越來越大,企業正在透過先進技術追求社交距離。由於大流行,對接近感測器的需求增加了,以提高職場安全性,透過接近檢測標籤確保接觸者追蹤,並確保業務連續性。

- 然而,在不影響品質的情況下設計微型感測器一直是接近感測器市場成長的挑戰。

美國接近感測器市場趨勢

汽車領域預計將推動市場成長

- 接近感測器廣泛應用於汽車應用中,用於檢測汽車附近的物體。這些感測器向駕駛員發出警報並提供有關車輛狀況的資訊。接近感測器在汽車中的主要應用包括引擎溫度、電池充電檢查、速度控制、燃油油位等。在某些情況下,這些感測器安裝在門和把手上,以便在發生碰撞或警告時偵測物體。

- 此外,停車輔助系統和 ADAS 等自動駕駛技術使用各種感測器,包括溫度感測器、動作感測器和光子感測器。這些感測器對於自動駕駛系統至關重要,因為它們產生高效、準確操作所需的資料。

- 由於監管機構和消費者對保護乘員和減少事故死亡人數的安全應用的興趣,自動監控、警告和控制車輛制動和轉向的高級駕駛員輔助系統 (ADAS) 市場正在不斷成長。

- 例如,美國要求汽車到2020年必須配備自動緊急煞車(AEB)和前方碰撞警報(FCW)系統。這正在推動汽車接近感測器市場的發展。

- 聯網汽車和自動駕駛汽車是汽車產業的重要發展。經濟發展,消費者人均所得增加,生活水準提高。由於對豪華舒適車的需求不斷增加,對自動駕駛汽車的需求也在增加。配備 AEB、ADAS、FCW 和 PAS 系統的車輛正在推動汽車接近感測器市場的發展。

電感式接近感測器預計將佔據主要市場佔有率

- 電感式接近感測器是一種經濟高效且可靠的解決方案,適用於自動化設備和機械中的大多數應用。不受振動、水、油和灰塵的影響,適合惡劣環境。這些感測器的主要應用包括工具機、農業和物料輸送系統。

- 電感式感測器在提高自動化流程的品質和生產率方面發揮關鍵作用。這些感測器沒有移動部件,因此它們的使用壽命不取決於操作週期數。

- 工業和汽車應用中物料輸送的增加推動了對電感式接近感測器的需求。接近感測器通常安裝在堆高機等物料輸送設備 (MHE) 上,並在偵測到實體(人或其他 MHE)時啟動訊號。

- 日益成長的工業進步迫使製造業、石油和天然氣等行業利用電感式接近感測器實現自動化。例如,在石油和天然氣行業,電感式接近感測器為測量海上石油鑽井平台的變數提供了耐用且可靠的解決方案。這些感測器可以承受海水等惡劣的海洋條件,海水可能會腐蝕和損壞設備。因此,可以部署感應式接近感測器來安全地測量鑽機上管道搬運機和其他移動部件的最終位置,而不會影響性能。

- 然而,這些感測器只能檢測金屬物體,這限制了它們在不使用金屬的其他行業中的功能,這可能會影響美國接近感測器市場的成長。

美國接近感測器產業概況

美國接近感測器市場是一個競爭激烈且分散的市場。著名公司包括意法半導體、歐姆龍公司、霍尼韋爾國際公司和松下公司。這些公司正在利用策略合作計劃來提高市場佔有率和盈利。在預測期內,競爭和快速的技術進步預計將威脅市場中公司的成長。

- 2020 年 9 月 - 理科光電科技推出 JM-N3/P3 矩形電感式接近感測器,擴大了其產品範圍。此感測器的檢測距離為2mm+_10%。

- 2020 年 5 月—意法半導體推出了 VL53L3CX,擴展了其 FlightSense ToF 測距感測器的功能,該感測器採用取得專利的直方圖演算法,可以更準確地測量到多個物體的距離。與傳統紅外線感測器不同,VL53L3CX 可測量 2.5cm 至 3m 範圍內的物體,且不受目標顏色或反射率的影響。這使得設計人員能夠將強大的新功能融入他們的產品中。例如,它可以忽略不需要的背景或前景物體以提供無錯誤感測,或者它可以報告到感測器視場內的多個目標的準確距離。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 工業自動化的成長

- 對感應感測技術的需求不斷成長

- 汽車感測應用的擴展

- 市場挑戰

- 感測能力的限制

第6章 市場細分

- 依技術

- 感應式

- 電容式

- 光電式

- 磁力型

- 超音波

- 其他技術

- 按頻道類型

- 單通道

- 多通道

- 按最終用戶

- 航太/國防

- 車

- 工業自動化

- 家用電子產品

- 飲食

- 製藥

- 建造

- 能源

- 其他最終用戶

第7章 競爭格局

- 公司簡介

- STMicroelectronics

- OMRON Corporation

- Rockwell Automation

- Schneider Electric

- Panasonic Corporation

- Honeywell International Inc.

- SICK AG

- NXP Semiconductors NV

- General Electric

第8章投資分析

第9章 未來展望

The United States Proximity Sensor Market is expected to register a CAGR of 7.1% during the forecast period.

Key Highlights

- In the United States, modern facilities are becoming more complex and diverse with urbanization and population growth. For instance, according to a world development indicators survey conducted by the World Bank, it was found that the degree of urbanization in the United States was 82.66% in 2020.

- The sensor information data would aid in managing various urban facilities and the effective response to emergencies and accidents through information sharing. Intelligent urban vehicles would require multiple sensors to monitor a variety of phenomena. These various types of proximity sensors constantly monitor the position and control of the vehicle, increasing their demand in urban infrastructures and propelling the proximity sensor market forward.

- Moreover, in the era of technological advancement, new innovative proximity sensors - Time of Flight (ToF) sensors - can protect health in various ways while maintaining social distance. For instance, STMicroelectronics introduced high-performance proximity and ranging sensors based on FlightSense Time of Flight technology in July 2020. These Time of Flight (ToF) sensors aid in developing 3D sensing capabilities for a wide range of products used by customers daily.

- Further, with the growing impact of COVID-19 on various industries, businesses are following social distance through advanced technologies. As a result of the pandemic, the demand for proximity sensors has increased as they improve workplace safety and ensure contact tracing through proximity detection tags to ensure business continuity.

- However, designing miniaturized sensors without affecting their quality poses a challenge for the proximity sensor market growth.

US Proximity Sensor Market Trends

The Automotive Segment is Expected to Drive the Market's Growth

- Proximity sensors are widely used in automotive applications to detect objects close to vehicles. These sensors alert the driver and provide information about the vehicle's status. Engine temperature, battery charging check, speed control, fuel level, and other prominent applications of proximity sensors in automobiles include the following. In some cases, these sensors are installed on doors and handle to detect objects in the event of a collision or warning.

- Further, autonomous technologies, such as parking assist systems and ADAS, use a variety of sensors, such as temperature sensors, motion detectors, photon sensors, and so on. These sensors are critical to autonomous systems because they generate the data required for efficient and accurate operation.

- The market for advanced driver-assistance systems (ADAS) that automatically monitor, warn, and control braking and vehicle steering is expected to increase as a result of regulatory and consumer interest in safety applications that protect passengers and reduce accident fatalities.

- For instance, the United States has mandated that vehicles be equipped with autonomous emergency braking (AEB) and forward-collision warning (FCW) systems by 2020. This is propelling the market for automotive proximity sensors.

- Connected and autonomous vehicles are significant developments in the automotive industry. An increase in the per capita income of the consumers as a result of economic developments is elevating their standard of living. The rise, which is also fueling demand for autonomous vehicles, can be attributed to the increase in demand for luxury and comfort vehicles. Vehicles with AEB, ADAS, FCW, and PAS systems are driving the automotive proximity sensor market.

Inductive Proximity Sensor is Expected to Hold a Major Market Share

- The inductive proximity sensors are cost-effective and reliable solutions for most applications in automation equipment and machinery. They are not influenced by vibrations, water, oil, and dust, making them suitable for harsh environments. Some of the prominent applications of these sensors include machine tools, agriculture, and material handling systems.

- Inductive sensors play a crucial role in securing quality and higher productivity from the automated process. As these sensors have no moving parts, their service life is independent of the number of operation cycles.

- The demand for inductive proximity sensors is being driven by increased material handling in industrial and automotive applications. Proximity sensors are typically attached to material handling equipment (MHE) such as forklifts; when an entity (a person or other MHE) is detected, they activate a signal.

- The growing industrial advancement is compelling industries like manufacturing, oil, and gas to utilize inductive proximity sensors for automation. For instance, in the oil and gas industry, inductive proximity sensors provide a durable and dependable solution for measuring variables on offshore oil rigs. These sensors can withstand harsh sea conditions, such as saltwater, which could be corrosive and damaging to equipment. Consequently, deploying inductive proximity sensors can safely measure the ultimate positions of pipe handlers and other moveable components on the rig without performance being influenced by the elements.

- However, these sensors can only detect metal objects, limiting their functionality in other industries that do not use metal, which can affect the growth of the US proximity sensor market.

US Proximity Sensor Industry Overview

The United States Proximity Sensor Market is a fragmented market with intense competition. Some prominent players include STMicroelectronics, OMRON Corporation, Honeywell International Inc., Panasonic Corporation, etc. These companies are leveraging strategic collaborative initiatives to increase their market share and profitability. The competition and rapid technological advancements are expected to threaten the growth of the companies in the said market during the forecast period.

- September 2020 - Riko Optoelectronics Technology Co. Ltd expanded its product range by introducing JM - N3/P3 Rectangular Inductive Proximity Sensor. The sensors have a sensing distance of 2mm+_ 10%.

- May 2020 - STMicroelectronics expanded the capabilities of its FlightSense ToF ranging sensors with the introduction of the VL53L3CX, which features patented histogram algorithms that allow measuring distances to multiple objects while increasing accuracy. Unlike conventional infrared sensors, the VL53L3CX measures objects ranging from 2.5cm to 3m and is unaffected by target color or reflectance. This enables designers to incorporate powerful new features into their products, such as allowing occupancy detectors to provide error-free sensing by ignoring unwanted background or foreground objects or reporting exact distances to multiple targets within the sensor's field of view.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Industrial Automation

- 5.1.2 Increase in the Demand for Inductive Sensing Technology

- 5.1.3 Expansion of Automotive Sensing Applications

- 5.2 Market Challenges

- 5.2.1 Limitations in Sensing Capabilities

6 MARKET SEGMENTATION

- 6.1 Technology

- 6.1.1 Inductive

- 6.1.2 Capacitive

- 6.1.3 Photoelectric

- 6.1.4 Magnetic

- 6.1.5 Ultrasonic

- 6.1.6 Other Technology

- 6.2 Channel Type

- 6.2.1 Single Channel

- 6.2.2 Multi-Channel

- 6.3 End-User

- 6.3.1 Aerospace and Defense

- 6.3.2 Automotive

- 6.3.3 Industrial Automation

- 6.3.4 Consumer Electronics

- 6.3.5 Food & Beverage

- 6.3.6 Pharmaceutical

- 6.3.7 Construction

- 6.3.8 Energy

- 6.3.9 Other End-users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 STMicroelectronics

- 7.1.2 OMRON Corporation

- 7.1.3 Rockwell Automation

- 7.1.4 Schneider Electric

- 7.1.5 Panasonic Corporation

- 7.1.6 Honeywell International Inc.

- 7.1.7 SICK AG

- 7.1.8 NXP Semiconductors N.V.

- 7.1.9 General Electric