|

市場調查報告書

商品編碼

1637746

磁性接近感測器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Magnetic Proximity Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

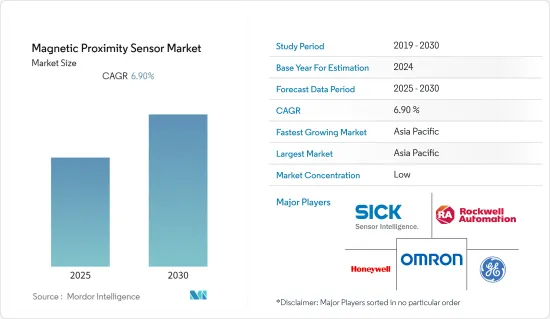

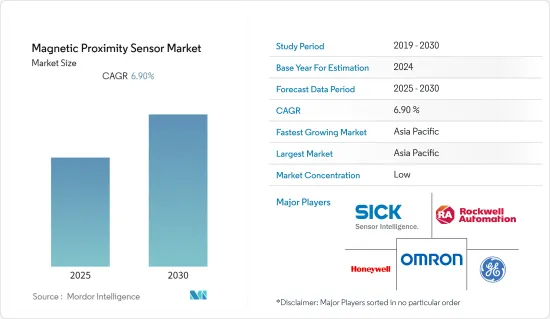

預計預測期內磁性接近感測器市場複合年成長率為 6.9%。

主要亮點

- 工業自動化產業已成為全球企業相對有吸引力的投資目標。工業控制器機制對機器人的依賴是一種既定的趨勢,為更廣泛地採用工業控制和自動化設備鋪平了道路。

- 世界各國政府都在要求所有終端用戶產業安全使用感測器,並要求制定詳細的法規以確保終端用戶的安全,尤其是免受電氣、化學、生物和物理威脅。 。

- 由於對非接觸式感測技術的需求不斷成長,接近磁性感測器預計將在不久的將來在市場上發揮關鍵作用,因為它們將用於包括航太、軍事和汽車在內的各種應用。

- 新冠肺炎疫情對市場產生了重大影響。隨著市場從疫情中復甦或進入後疫情時代,預計不同地區的成長軌跡將有所不同,有些國家具有巨大的成長潛力,而有些國家的利潤率較低。此外,對於高度整合磁感測器的電動和自動駕駛汽車的需求也日益增加。因此,磁接近感測器製造商在市場上面臨更多的機會。

- 然而,這個市場的主要挑戰可能是感測技術的局限性,因為它需要專業人員來分析測量結果,而這些測量結果可能成本高昂,而且非常複雜,難以理解。

磁接近感測器的市場趨勢

汽車應用推動需求

- 汽車生產中使用各種接近感測器:位置感測器、磁性感測器、液位感測器、電感感測器、霍爾感測器和數位感測器。電動車的發展趨勢也推動了這些感測器的採用。預計這一趨勢將在預測期內推動磁性接近感測器市場的擴張。

- 汽車的磁性接近感測器發射電磁束來掃描磁場的變化。它非常耐用且靈敏度範圍很廣。它們還透過磁性組合提供高穩定性、可靠性和一致性。客戶可以更改外殼顏色、出口方向、電線、接線端子等。

- 汽車馬達採用永久磁鐵,具有效率高、高功率、體積小、重量輕等特性。磁性接近感測器用於監視這些功能的性能並尋找缺陷。

- 此外,隨著對輕型商用車的需求不斷增加,製造商現在更加重視乘客的舒適度和自動控制。因此,接近磁感測器已成為現代汽車基礎設施的關鍵。輕型車的銷售仍然受到公共事業車和高檔車的推動,這可能有助於在預測期內推動磁性接近感測器的需求。

- 此外,速度和位置感測應用需要霍爾效應技術的寬頻頻寬、線性度和高精度。對於角度感應應用,這些感測器還提供非接觸式測量和預編程功能。由於霍爾磁感測器。

- 例如,2021年5月,Allegro Microsystems宣布推出基於「垂直霍爾效應」技術的新型磁性感測IC。此款新感光元件針對汽車和工業應用,佔地面積小,具有 3D 位置感應功能。無芯霍爾效應感測器技術的持續發展可能會在預測期內推動產業成長。

亞太地區佔較大市場佔有率

- 由於日本、中國、韓國和印度等國家快速採用智慧工廠,亞太地區磁性感測器市場預計將佔據大部分收益。該地區領先的智慧工廠是上汽大眾MEB,專注於電動車的量產。此外,該地區政府宣布,到 2023 年將在該地區新建 100 家智慧工廠。

- 同樣,韓國政府在 2020 年 11 月宣布,到 2025 年將在全國推出 1,000 家配備 5G 和 AI 功能的智慧工廠。這些智慧工廠高度整合了自動化機器、生產線、輸送機和工業機器人,需要磁感測器來進行位置、速度和距離感應應用。新智慧工廠的推出可能會為該地區的感測器供應商提供新的機會。

- 政府也採取舉措保障機動車乘客安全。因此,磁性接近感測器已成為汽車必不可少的零件。預計該因素將在預測期內推動接近磁感測器市場的發展。汽車現在配備了各種類型的感測裝置,可以在危險時採取行動。

- AK8781由旭化成公司於2020年6月發行。這是一款超小型封裝的鎖存型霍爾 IC,適用於小型直流無刷 (BL)馬達。小尺寸和快速響應時間使該封裝成為高溫應用的理想選擇。此次發布將促進 DCBL 馬達的更高效率和小型化。

- 該地區的工廠自動化正在經歷強勁成長。這些感測器用於創建更快、更有效率的生產線,以及用於具有高精度、可重複性和精確度的安全開關和接近檢測。

磁接近感測器產業概況

市場高度分散,有多個大大小小的參與者提供解決方案。主要公司包括通用電氣、伊頓公司、羅克韋爾自動化、OMRON、Panasonic、恩智浦半導體、Honeywell國際和 Talc。

- 2022 年 6 月 - 運動控制和節能系統感測和電源解決方案的先驅 Allegro Microsystems 推出了磁性位置感測器 A33110 和 A33115。根據 Allegro 介紹,該感測器專為需要高精度和不同訊號冗餘的 ADAS 應用而設計。

- 2022 年 3 月-Standex International 宣布將以約 970 萬美元現金收購 Sensor Solutions。感測器解決方案可生產專業和標準霍爾效應和磁性接近感測器產品,包括線性和旋轉式感測器、專業感測器、霍爾開關和鎖存感測器。這些產品用於消費性電子、航太、汽車、工業、醫療和保健產業。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 非接觸式感測技術的需求不斷增加

- 市場限制

- 感測能力的局限性

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 技術簡介

第6章 市場細分

- 按應用

- 航太和國防

- 車

- 家電

- 建築自動化

- 其他用途

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Sick AG

- Omron Corporation

- Honeywell International Inc.

- Rockwell Automation

- General Electric

- Panasonic Corporation

- Eaton Corporation

- Pepperl+Fuchs GmbH

- Turck Inc.

- IFM Electronic GmbH

第8章投資分析

第9章 市場機會與未來趨勢

簡介目錄

Product Code: 46658

The Magnetic Proximity Sensor Market is expected to register a CAGR of 6.9% during the forecast period.

Key Highlights

- The industrial automation segment emerged as a relatively more attractive space for investment by organizations worldwide. The dependence on robots in industrial controller mechanisms is an established trend that is paving the way for more extensive and broader adoption of industrial control and automation equipment.

- Governments are enforcing the safe use of sensors in every end-user industry, especially in healthcare devices that require detailed regulations to ensure safety for the end users from electrical, chemical, biological, and physical threats.

- Due to the growing demand for non-contact sensing technology, proximity magnetic sensors are projected to play a significant role in the market in the near future as they are used in a variety of applications, including aerospace and military, and automotive.

- The COVID-19 pandemic significantly impacted the market. It is anticipated that as the market recovers from the pandemic or in post pandemic situation, the growth trajectory will differ across regions, with some nations having enormous growth potential and others having low profit margins. Also, there is growing demand for electric and self-driving vehicles that are highly integrated with magnetic sensors. Thus, magnetic proximity sensor manufacturers are experiencing more opportunities in the market.

- However, the major challenge for this market may be the limitations in sensing technology, as it is expensive and needs expert personnel to analyze the readings that can be very complex to understand.

Magnetic Proximity Sensors Market Trends

Application in Automotive to Drive the Demand

- All varieties of proximity sensors, including position, magnetic, level, inductance, hall, digital, and others, are used in the production of automobiles. The increasing trend toward adopting electric mobility is also propelling the adoption of these sensors. During the forecast period, this trend is anticipated to fuel market expansion for magnetic proximity sensors.

- Magnetic proximity sensors in automobiles emit electromagnetic beams to scan for changes in the field. They are highly durable and have a wide sensitivity range. They also possess high stability, dependability, and consistency with a combination of magnets triggers. The customers can change the shell color, outlet direction, wire, terminal blocks, etc.

- Automobile motors are made of permanent magnets, contributing to their high efficiency, high power output, small size, and lightweight nature. A magnetic proximity sensor is used to monitor the performance of these functions and look for any defects.

- Additionally, the manufacturers now place a greater emphasis on passenger comfort and autonomous control due to the rising demand for light commercial vehicles. As a result, proximity magnetic sensors are crucial to the infrastructure of modern automobiles. The sales of light vehicles are still being driven by utilities and premium cars, which may help raise the demand for magnetic proximity sensors during the forecast period.

- Moreover, for speed and position sensing applications, hall-effect technology's wide frequency bandwidth, linearity, and high accuracy are essential. For angle-sensing applications, these sensors also offer contactless measurements and pre-programmability features. The market for automobiles may adopt Hall-based magnetic sensors more widely due to their capacity to maintain wide temperature stability in challenging environments.

- For instance, in May 2021, Allegro MicroSystems Inc. introduced a new magnetic sensing IC based on the 'Vertical Hall-effect' technology. For the automotive and industrial sectors, the new sensor has a small footprint and 3D position sensing capabilities. The ongoing technological developments in coreless Hall-effect sensors may drive the industry's growth over the forecast period.

Asia-Pacific to Account for a Significant Market Share

- Asia-Pacific's magnetic sensor market captured the majority of revenue share because of the rapid proliferation of smart factories in the countries, including Japan, China, South Korea, and India. The major smart factory in the region was SAIC Volkswagen MEB, which focuses on the mass production of electric vehicles. Besides, the regional government announced an additional 100 new smart factories in the region by 2023.

- Similarly, in November 2020, the government of South Korea announced the deployment of 1,000 smart factories with 5G and AI capabilities in the country by 2025. These smart factories are highly integrated with automated machinery, production lines, conveyors, and industrial robots requiring magnetic sensors for position, speed, and distance sensing applications. Launching new smart factories may offer new opportunities for regional sensor vendors.

- The government has also taken initiatives for the safety of passengers in automobiles. As a result, magnetic proximity sensors have become essential parts of automobiles. This factor is expected to drive the proximity magnet sensor market during the forecast period. The vehicles are now equipped with different kinds of sensing devices that can take measures in case of danger.

- The AK8781 was introduced by Asahi Kasei Corporation in June 2020. It is a latch-type Hall IC with ultra-compact packaging that is appropriate for small DC brushless (BL) motors. It is the ideal packaging for high-temperature applications as it is compact and has a short response time. Through this launch, the company aims to advance the high efficacy and micro-miniaturization of DCBL motors.

- Factory automation is witnessing substantial growth in the region. These sensors are used for faster and more efficient production lines, as well as for sensing safety switches and proximity detection with high precision, repeatability, and accuracy.

Magnetic Proximity Sensors Industry Overview

The market is significantly fragmented as there are several large and small players offering solutions. Some of the major players include General Electric, Eaton Corporation PLC, Rockwell Automation Inc., Omron Corporation, Panasonic Corporation, NXP Semiconductors NV, Honeywell International Inc., and Turck Inc.

- June 2022 - The A33110 and A33115 magnetic position sensors from Allegro MicroSystems Inc., a pioneer in sensing and power solutions for motion control and energy-efficient systems, went on sale. According to Allegro, the sensors are made for ADAS applications requiring high precision levels and heterogeneous signal redundancy.

- March 2022 - Standex International Corporation announced the acquisition of Sensor Solutions for roughly USD 9.7 million in cash. Sensor Solutions creates and manufactures specialized and standard Hall effect and magnetic proximity sensor products, including linear and rotating sensors, specialty sensors, and Hall switch and latching sensors. The consumer electronics, aerospace, automotive, industrial, medical, and healthcare industries use these products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in the Demand for Non-contact Sensing Technology

- 4.3 Market Restraints

- 4.3.1 Limitations in Sensing Capabilities

- 4.4 Value Chain/Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 TECHNOLOGY SNAPSHOT

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Aerospace and Defense

- 6.1.2 Automotive

- 6.1.3 Consumer Electronics

- 6.1.4 Building Automation

- 6.1.5 Other Applications

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Sick AG

- 7.1.2 Omron Corporation

- 7.1.3 Honeywell International Inc.

- 7.1.4 Rockwell Automation

- 7.1.5 General Electric

- 7.1.6 Panasonic Corporation

- 7.1.7 Eaton Corporation

- 7.1.8 Pepperl + Fuchs GmbH

- 7.1.9 Turck Inc.

- 7.1.10 IFM Electronic GmbH

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219