|

市場調查報告書

商品編碼

1693615

北美廂型車:市場佔有率分析、產業趨勢與統計數據、成長預測(2025-2030 年)North America Van - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

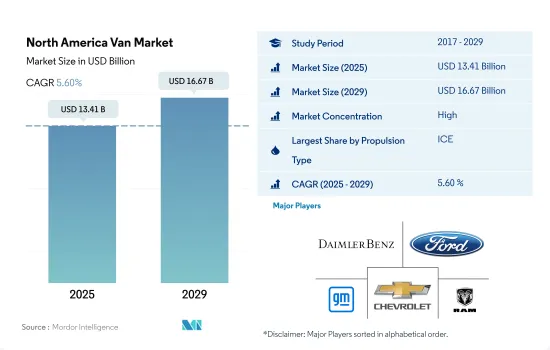

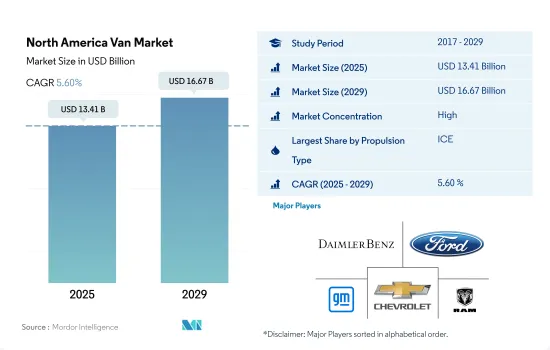

預計 2025 年北美貨車市場規模將達到 134.1 億美元,到 2029 年預計將達到 166.7 億美元,預測期內(2025-2029 年)的複合年成長率為 5.60%。

受經濟發展、新興市場物流需求以及永續交通的推動,北美輕型商用車市場預計將穩定成長

- 2023年,北美輕型商用車市場所有動力類型的銷售量都將略有成長,銷售量將從2022年的4,046,122輛增至4,055,770輛。儘管增幅不大,但這標誌著市場趨於穩定,在不斷變化的經濟和環境條件下,輕型商用車市場將繼續在支撐物流、零售和服務等各個行業方面發揮關鍵作用。預計2024年銷量將達到4,058,449輛,顯示北美對輕型商用車的需求穩定。穩定的市場表現反映了該地區經濟的韌性和商業部門的多樣化需求,凸顯了輕型商用車在促進商業和貿易方面的重要作用。

- 北美輕型商用車市場的溫和成長與更廣泛的趨勢一致,包括經濟復甦、電子商務的激增以及對永續性的日益關注。雖然人們的注意力往往集中在電動和混合動力汽車上,但對輕型商用車的需求涵蓋了多種推進類型,這標誌著向更清潔的交通方式的平衡轉變。

- 從 2024 年到 2030 年,北美輕型商用車市場預計將逐步擴大,到 2030 年底銷售量可能達到 4,473,267 輛。這一成長是由經濟擴張、都市化和電子商務需求激增所推動的,因此需要強大的物流。此外,在環境問題和汽車效率進步的推動下,電動和混合動力輕型商用車市場將經歷顯著成長,並進一步塑造北美商業運輸格局。

北美貨車市場正在經歷顯著成長,全國趨勢顯示人們越來越偏好多功能、高效的運輸解決方案。

- 由於石油供應減少和汽油價格上漲,汽車製造商正在積極探索汽車的替代燃料來源。 2022 年俄羅斯和烏克蘭之間的衝突進一步加劇了油價上漲(過去幾十年來油價已經加倍),促使全球推行電動車 (EV) 作為更經濟的日常交通方式。稅率也會影響全球燃料成本,美國的燃料稅最低,為 19%,而印度的稅率高達 69%。這些因素,加上過去二十年來不斷上漲的燃料價格,使得電動車具有吸引力,因為它們的營業成本比傳統內燃機 (ICE) 汽車低得多。

- 使其汽車產品電動化已成為汽車製造商的首要任務。沃爾沃的目標是到 2025 年,電動車將佔其全球銷量的 50%。斯巴魯計劃在 2035 年,旗下所有車型都配備混合動力汽車或電動車。福特計劃到 2025 年在電動車領域投資 290 億美元,而通用汽車計劃投資 270 億美元,實現到 2035 年所有小型車系列都實現電氣化。其他製造商也有類似的雄心,雖然時間表和目標各不相同,但都致力於電氣化。

- 2020年至2028年期間,北美計畫推出12款新型電動廂型車。值得注意的是,大多數將是全新車型,包括ELMS UD-1、Rivian R1A和BrightDrop EV600。此外,Mercedes-Benz eSprinter 和福特 Transit 等現有的貨車系列也準備在未來推出全電動貨車。

北美廂型車市場趨勢

由於政府的支持和對環境問題的日益關注,北美對電動車的需求正在成長。

- 近年來,俄羅斯共產黨經歷了顯著的起伏。從 2017 年的 2.082 億美元穩步上升至 2019 年的高峰。然而,由於新冠疫情帶來的經濟挑戰,2020 年這一數字下降至 1.939 億美元。值得注意的是,該市場預計將在 2022 年強勁復甦,達到 2.698 億美元。復甦凸顯了俄羅斯汽車產業的韌性以及獎勵策略的潛在影響。

- 政府的激勵和補貼對客戶(尤其是物流和電子商務公司)採用電動商用車具有強大的吸引力。其中一個例子是加拿大和北美,政府宣布將於 2022 年 4 月為輕型和中型電動車提供 5,000 美元的聯邦退稅。預計這些努力將推動2024年至2030年間北美對電動商用車的需求大幅成長。

- 電動車部署計劃、有吸引力的稅收優惠和外國投資津貼等政府措施將推動北美國家的電動車市場發展。引人注目的是,2022 年 3 月,福斯承諾斥資 70 億美元在北美建立電動車製造工廠。至2030年,福斯汽車計畫為美國、墨西哥和加拿大的客戶推出25款新型電動車型。因此,預計 2024 年至 2030 年間北美對電動車的需求將大幅成長。

北美廂型車產業概況

北美廂型車市場格局較為集中,前五大廠商佔93.82%的市佔率。該市場的主要企業有:戴姆勒股份公司(梅賽德斯-奔馳股份公司)、福特汽車公司、通用汽車公司、通用汽車公司(雪佛蘭)和Ram Trucking, Inc.(按字母順序排列)

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 人均GDP

- 消費者汽車支出(cvp)

- 通貨膨脹率

- 汽車貸款利率

- 共乘

- 電氣化的影響

- 電動車充電站

- 電池組價格

- 新款 Xev 車型發布

- 燃油價格

- OEM生產統計

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 推進類型

- 混合動力汽車和電動車

- 按燃料類別

- BEV

- PHEV

- ICE

- 按燃料類別

- 柴油引擎

- 汽油

- 混合動力汽車和電動車

- 國家

- 加拿大

- 墨西哥

- 美國

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Daimler AG(Mercedes-Benz AG)

- Fiat Chrysler Automobiles NV

- Ford Motor Company

- General Motors Company

- GM Motor(Chevrolet)

- Nissan Motor Co. Ltd.

- Peugeot SA

- Ram Trucking, Inc.

- Toyota Motor Corporation

- Volkswagen AG

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 92999

The North America Van Market size is estimated at 13.41 billion USD in 2025, and is expected to reach 16.67 billion USD by 2029, growing at a CAGR of 5.60% during the forecast period (2025-2029).

Steady growth is anticipated in North America's LCV market, fueled by economic development, evolving logistics needs, and a focus on sustainable transportation

- In 2023, the North American market for LCVs across all propulsion types exhibited a slight increase, with sales volumes reaching 4,055,770 units from 4,046,122 units in 2022. This growth, albeit modest, indicates a stabilizing market that continues to play a crucial role in supporting various sectors, including logistics, retail, and services, amid evolving economic and environmental landscapes. In 2024, sales are expected to reach 4,058,449 units, indicating a steady demand for LCVs in North America. This steady market performance underscores the essential role of LCVs in facilitating commerce and trade, reflecting the region's economic resilience and the diverse needs of its commercial sectors.

- The North American LCV market's modest growth aligns with broader trends, including economic recovery, a surge in e-commerce, and a heightened focus on sustainability. While the spotlight often falls on electric and hybrid vehicles, the demand for LCVs spans a spectrum of propulsion types, signaling a balanced shift toward cleaner transportation.

- From 2024 to 2030, the North American LCV market is poised for gradual expansion, with projections pointing to sales potentially reaching 4,473,267 units by the end of 2030. This growth is propelled by economic expansion, urbanization, and the surging demands of e-commerce, necessitating robust logistics. Moreover, as environmental concerns and advancements in vehicle efficiency gain traction, the market for electric and hybrid LCVs is poised for a notable increase, further shaping the commercial transportation landscape in North America.

The North American van market is witnessing significant growth, with distinct trends in each country pointing toward a rising preference for versatile and efficient transportation solutions

- Automakers are proactively exploring alternative fuel sources for their vehicles, driven by the dwindling petroleum supplies and escalating gasoline costs. The 2022 Russia-Ukraine conflict further exacerbated the already doubled petroleum prices over the past few decades, prompting a global push towards electric vehicles (EVs) for more economical everyday transportation. Tax rates also play a role in global fuel costs, with the US having the lowest fuel tax at 19% and India imposing a hefty 69% tax. These factors, combined with the rising fuel prices over the last two decades, underscore the appeal of EVs, which boast significantly lower operating costs compared to traditional internal combustion engine (ICE) vehicles.

- Electrifying their vehicle portfolios has become a paramount objective for automakers. Volvo aims for EVs to constitute 50% of its global sales by 2025. Subaru plans to introduce hybrid or electric versions for all its models by 2035. Ford is planning to invest a substantial USD 29 billion in EVs by 2025, while GM is allocating USD 27 billion, with a vision to electrify its entire light-duty vehicle lineup by 2035. Other manufacturers have set similar ambitions, albeit with varying timelines and targets, all united by their commitment to electrification.

- North America is set to witness the launch of 12 new electric vans between 2020 and 2028. Notably, the majority will be entirely new models, including the ELMS UD-1, Rivian R1A, and BrightDrop EV600. Additionally, established van lines like the Mercedes-Benz eSprinter and Ford Transit are also gearing up to introduce all-electric variants in the future.

North America Van Market Trends

Growing demand for electric vehicles in North America driven by government support and growing environmental concerns

- The CVP in Russia has experienced significant fluctuations in recent years. It climbed steadily from USD 208.2 million in 2017, peaking in 2019. However, it dipped to USD 193.9 million in 2020, largely due to the economic challenges brought on by the COVID-19 pandemic. Notably, the market rebounded sharply in 2022, reaching USD 269.8 million. This resurgence highlights both the resilience of the Russian automotive sector and the potential impact of economic stimulus measures and heightened consumer demand.

- Government incentives and subsidies are proving to be a strong draw for customers, particularly logistics and e-commerce firms, in their adoption of electric commercial vehicles. A case in point is Canada and North America, where, in April 2022, the government unveiled federal rebates of USD 5000 for electric light- and medium-duty vehicles. These initiatives are expected to significantly bolster the demand for electric commercial vehicles in North America from 2024 to 2030.

- Government initiatives, including plans for EV deployment, attractive incentives, and foreign investment allowances, are set to propel the electric vehicle market across North American nations. In a notable move, in March 2022, Volkswagen committed a staggering USD 7 billion to establish an electric car manufacturing facility in North America. By 2030, the automaker plans to roll out 25 new EV models, catering to customers in the US, Mexico, and Canada. As a result, the demand for electric vehicles is projected to witness a notable surge across various North American countries from 2024 to 2030.

North America Van Industry Overview

The North America Van Market is fairly consolidated, with the top five companies occupying 93.82%. The major players in this market are Daimler AG (Mercedes-Benz AG), Ford Motor Company, General Motors Company, GM Motor (Chevrolet) and Ram Trucking, Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.10 New Xev Models Announced

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Hybrid and Electric Vehicles

- 5.1.1.1 By Fuel Category

- 5.1.1.1.1 BEV

- 5.1.1.1.2 PHEV

- 5.1.2 ICE

- 5.1.2.1 By Fuel Category

- 5.1.2.1.1 Diesel

- 5.1.2.1.2 Gasoline

- 5.1.1 Hybrid and Electric Vehicles

- 5.2 Country

- 5.2.1 Canada

- 5.2.2 Mexico

- 5.2.3 US

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Daimler AG (Mercedes-Benz AG)

- 6.4.2 Fiat Chrysler Automobiles N.V

- 6.4.3 Ford Motor Company

- 6.4.4 General Motors Company

- 6.4.5 GM Motor (Chevrolet)

- 6.4.6 Nissan Motor Co. Ltd.

- 6.4.7 Peugeot S.A.

- 6.4.8 Ram Trucking, Inc.

- 6.4.9 Toyota Motor Corporation

- 6.4.10 Volkswagen AG

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219