|

市場調查報告書

商品編碼

1690939

歐洲貨車:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Van - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

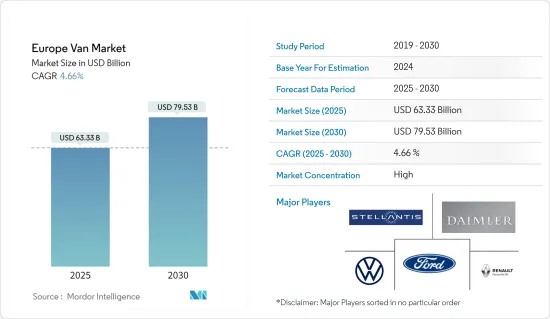

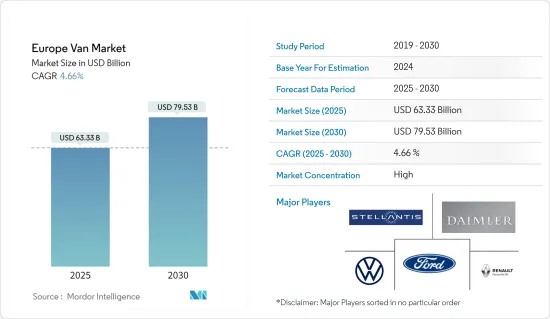

預計2025年歐洲貨車市場規模為633.3億美元,2030年將達795.3億美元,預測期間(2025-2030年)的複合年成長率為4.66%。

歐洲廂型車市場規模龐大,受都市區商用車需求不斷成長的推動,正穩步成長。貨車對物流、建築和零售等多個行業都至關重要,是運輸貨物和服務的多功能主力車輛。

科技對於改變歐洲貨車市場至關重要。將先進的遠端資訊處理、GPS 追蹤和 IoT(物聯網)整合到現代貨車中,可提高車隊管理和業務效率。這些技術提供有關車輛性能、燃油消費量和路線最佳化的即時資料,對於尋求降低營運成本和提高生產力的公司來說至關重要。

作為傳統柴油貨車的永續替代品,電動貨車越來越受歡迎。梅賽德斯-奔馳、雷諾和福特等主要製造商正在大力投資電動貨車的開發和生產,以滿足對環保運輸解決方案日益成長的需求。賓士eSprinter、雷諾Kangoo ZE等車型的推出,標誌著市場朝向電氣化的邁進。

歐洲的監管情況對貨車市場產生了重大影響。歐盟正在實施嚴格的排放氣體法規,包括歐盟 6 標準,該標準要求所有新車輛都必須具有低排放氣體。這些法規正在鼓勵製造商創新並採用更清潔的技術。此外,歐洲城市正在引入低排放氣體區,只有符合特定排放標準的汽車才能行駛。由於企業尋求遵守這些法規並避免處罰,這加速了電動和混合動力貨車的採用。

電子商務的爆炸性成長也是一個重要因素,網路購物越來越受歡迎。這增加了對高效最後一英里運送解決方案的需求,使得貨車成為首選的運輸方式。亞馬遜、DHL 和 UPS 等公司正在擴大其貨車車隊,以滿足日益成長的快速、可靠送貨服務的需求。

都市化也是一個關鍵促進因素。隨著越來越多的人遷入城市,對商品和服務的需求不斷增加,從而需要高效率的城市物流。貨車和卡車是理想的選擇,因為它們可以在狹窄的城市街道上行駛並將貨物直接送到消費者手中。

儘管歐洲貨車市場呈現出積極的成長軌跡,但仍面臨許多挑戰。其中一個關鍵挑戰是電動貨車的高成本。雖然由於節省燃料和維護成本,從長遠來看電動貨車的總擁有成本較低,但初始購買價格仍然是許多中小型企業 (SME) 面臨的障礙。

基礎設施也是一個挑戰。歐洲許多地區電動貨車的充電站數量仍然有限,這對其廣泛應用造成了障礙。此外,與電動車相關的里程焦慮(用戶擔心在到達目的地之前耗盡電量)仍然是一個問題。

在電子商務、都市化和技術進步的推動下,歐洲貨車市場預計將經歷顯著成長。隨著市場的發展,公司將能夠更好地適應不斷變化的消費者需求和監管要求,並在這種動態環境中取得更好的成功。

歐洲貨車市場的趨勢

歐洲廂型車市場電動廂型車細分市場成長迅速

在監管、經濟和技術因素的推動下,電動貨車市場在歐洲貨車市場經歷了快速成長。歐盟綠色交易和商用車嚴格的二氧化碳排放目標正在鼓勵汽車製造商投資電動車技術。此外,許多歐洲城市還引入了低排放氣體區(LEZ),限制符合特定排放氣體標準的車輛進入。這些監管支持使得電動貨車成為在都市區運作的公司的一個有吸引力的選擇。

政府的獎勵和補貼在推動電動貨車的普及方面也發揮關鍵作用。歐洲各國都為電動車提供財政獎勵,如補貼、退稅和降低註冊費。例如,英國的插電式貨車補助金為符合條件的電動貨車的購買價格提供了大幅折扣。這些財政獎勵將降低整體擁有成本,使企業,特別是中小型企業(SMEs)更能負擔得起電動貨車。

電池技術和電力傳動系統的技術進步顯著提高了電動貨車的性能和續航里程。現代電動貨車具有可與柴油車相媲美的續航里程、更快的充電時間和強勁的性能。此外,歐洲各地綜合充電基礎設施的發展也減少了里程焦慮,使公司能夠更切實地駕駛電動貨車遠距。

消費者對永續和環保交通途徑的需求不斷成長也是電動貨車成長的主要動力。日益增強的環保意識迫使企業採取更環保的做法,包括使用電動車。電子商務的激增以及對高效最後一英里交付解決方案的需求進一步推動了對電動貨車的需求。亞馬遜和 DHL 等公司正在擴大其電動貨車車隊,以實現永續性目標並遵守排放法規。

歐洲貨車市場的競爭格局正在迅速變化,各大汽車製造商紛紛推出新型電動貨車車型以搶佔市場佔有率。梅賽德斯·奔馳、雷諾和大眾等公司都推出了 eSprinter、Kangoo ZE 和 e-Crafter 等熱門廂型車車型的電動版本。這些模型適用於從都市區配送到城際運輸的廣泛商業應用,從而增加了其對更廣泛客戶群的吸引力。

歐洲貨車市場電動貨車的快速成長證明了商業運輸格局的不斷發展。透過採用電氣化,公司和汽車製造商可以獲得顯著的經濟和環境效益,為移動出行領域的永續發展鋪平道路。

法國是歐洲貨車市場的主要參與者

法國在歐洲廂型車市場佔有較大的佔有率。該國強勁的經濟、多元化的工業基礎和廣泛的商業活動導致各行業對貨車的需求很高。從物流運輸到建築和服務業,貨車對於促進法國的商業營運和城市交通至關重要。

法國擁有優良的基礎設施,支援高效率的運輸和物流業務。廣泛的道路網路,包括高速公路和城市道路,有利於使用貨車運輸貨物和服務。這種基礎設施優勢使法國成為尋求可靠運輸解決方案的貨車製造商和車隊營運商的一個有吸引力的市場。

在法國,貨車是各種規模的企業(無論大小)的必備工具。它有多種用途,包括最後一英里的交付、客運、行動服務和公用事業應用。廂型車的多功能性和適應性對於電子商務、零售分銷、建築和公共服務等領域至關重要,對經濟生產力和效率做出了重大貢獻。

法國汽車製造商和科技公司處於貨車市場創新的前沿。各公司正大力投資研發,以提高車輛的效率、安全性能、連接性和環境性能。電動動力傳動系統、自動駕駛系統和數位連接等先進技術的整合正在推動法國貨車的演變,以滿足不斷變化的客戶需求和監管要求。

法國汽車產業競爭激烈,主要的貨車製造商和供應商都在該國開展業務。雷諾、標緻、雪鐵龍(標緻雪鐵龍集團)和賓士等公司在貨車領域擁有強大的市場地位和品牌知名度。這些公司利用其技術專長、製造能力和廣泛的分銷網路來保持其市場領導地位並滿足多樣化的客戶需求。

預計法國將透過持續創新、永續的商業實踐和戰略夥伴關係關係保持其在歐洲貨車市場的領導地位。然而,消費者偏好改變、監管變化和技術顛覆等挑戰需要產業相關人員積極應對。透過擁抱數位轉型、投資永續移動解決方案和促進產業合作,法國可以保持競爭力並推動歐洲貨車市場的未來成長。

歐洲廂型車產業概況

歐洲貨車市場競爭激烈。該地區主要OEM製造商的存在正在推動市場的成長。市場的主要企業包括梅賽德斯-奔馳、大眾集團、福特汽車和沃克斯豪爾,而 Arrival 馬達 Group Limited 等新參與企業也滿足了該地區對電動貨車的需求。

- 2023 年 6 月,Punch 動力傳動系統與 Cubonik 簽署了一項戰略協議,以開發和製造永續的自動化和自動駕駛輕型商用車 (eLCV),特別是 Cubonik 的旅客運輸車和貨物運輸車 eLCV。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 電動貨車銷售上漲推動市場成長

- 市場限制

- 電動車電池高成本預計將抑制市場成長

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按貨艙

- 5立方米以上

- 少於5立方米

- 按最終用戶

- 商業的

- 政府

- 按驅動類型

- 內燃機

- 電動式的

- 替代燃料

- 按地區

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 其他歐洲國家

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Stellantis NV

- Daimler AG

- Volkswagen AG

- Ford Motor Company

- Groupe Renault

- Vauxhall Motors Limited

- Hyundai Motors

- Toyota Motor Corporation

- Nissan Motors Co. Ltd

- BYD Co. Ltd

- IVECO Group NV

- Arrival Electric Group Limited

第7章 市場機會與未來趨勢

The Europe Van Market size is estimated at USD 63.33 billion in 2025, and is expected to reach USD 79.53 billion by 2030, at a CAGR of 4.66% during the forecast period (2025-2030).

The European van market is significant, with steady growth driven by increasing demand for commercial vehicles in urban and rural areas. Vans are essential for various industries, including logistics, construction, and retail, where they serve as versatile workhorses for transporting goods and services.

Technology is pivotal in transforming the European van market. Integrating advanced telematics, GPS tracking, and IoT (Internet of Things) in modern vans enhances fleet management and operational efficiency. These technologies provide real-time data on vehicle performance, fuel consumption, and route optimization, which is crucial for businesses aiming to reduce operational costs and improve productivity.

Electric vans are gaining traction as a sustainable alternative to conventional diesel vans. Major manufacturers like Mercedes-Benz, Renault, and Ford are investing heavily in developing and producing electric vans, addressing the growing demand for eco-friendly transportation solutions. Introducing models, like the Mercedes-Benz eSprinter and Renault Kangoo ZE, signify the market's move toward electrification.

The regulatory landscape in Europe is a significant factor influencing the van market. The European Union has implemented stringent emission standards, such as the Euro 6 regulations, which mandate lower emissions for all new vehicles. These regulations are pushing manufacturers to innovate and adopt cleaner technologies. Additionally, European cities have introduced low-emission zones, where only cars meeting specific emission criteria can operate. This has accelerated the adoption of electric and hybrid vans as businesses seek to comply with these regulations and avoid penalties.

The surge in e-commerce is a primary driver, with online shopping becoming increasingly popular. This has led to a rise in demand for efficient last-mile delivery solutions, where vans are the preferred mode of transportation. Companies like Amazon, DHL, and UPS are expanding their van fleets to meet the increasing demand for quick and reliable delivery services.

Urbanization is another key driver. As more people move to cities, a higher demand for goods and services necessitates efficient urban logistics. Vans are ideal because they can navigate narrow city streets and deliver directly to consumers.

Despite the positive growth trajectory, the European van market faces several challenges. One significant challenge is the high cost associated with electric vans. Although the total cost of ownership for electric vans can be lower in the long run due to savings on fuel and maintenance, the initial purchase price remains a barrier for many small and medium-sized enterprises (SMEs).

Infrastructure is another challenge. The availability of charging stations for electric vans is still limited in many parts of Europe, posing a hurdle to widespread adoption. Additionally, the range anxiety associated with electric vehicles, where users fear running out of charge before reaching their destination, continues to be a concern.

The European van market is poised for substantial growth, driven by the surge in e-commerce, urbanization, and technological advancements. As the market evolves, businesses can adapt to changing consumer demands and regulatory requirements and are expected to be well-positioned to thrive in this dynamic environment.

Europe Van Market Trends

The Electric Van Segment is Growing at a Faster Rate in the European Van Market

The electric van segment is experiencing rapid growth in the European van market, driven by regulatory, economic, and technological factors. The European Union's Green Deal and the stringent CO2 emission targets for commercial vehicles are compelling automakers to invest in electric vehicle (EV) technology. Additionally, many European cities have implemented low-emission zones (LEZs), where access is restricted to vehicles meeting specific emission standards. This regulatory push is making electric vans an attractive option for businesses operating in urban areas.

Government incentives and subsidies are also playing a crucial role in boosting the adoption of electric vans. Various European countries offer financial incentives such as grants, tax rebates, and reduced registration fees for electric vehicles. For instance, the UK's Plug-in Van Grant significantly discounts eligible electric vans' purchase prices. These economic incentives lower the total cost of ownership, making electric vans more affordable for businesses, particularly small and medium-sized enterprises (SMEs).

Technological advancements in battery technology and electric drivetrains have significantly improved the performance and range of electric vans. Modern electric vans offer competitive driving ranges, faster charging times, and robust performance comparable to their diesel counterparts. The development of a comprehensive charging infrastructure across Europe also alleviates range anxiety, making it more feasible for businesses to operate electric vans over longer distances.

The rising consumer demand for sustainable and eco-friendly transportation options is another key driver of the growth of electric vans. As environmental awareness increases, businesses are under pressure to adopt greener practices, including the use of electric vehicles. The surge in e-commerce and the corresponding need for efficient last-mile delivery solutions have further fueled demand for electric vans. Companies like Amazon and DHL are expanding their fleets with electric vans to meet their sustainability goals and comply with emission regulations.

The competitive landscape of the European van market is evolving rapidly, with major automakers launching new electric van models to capture market share. Companies like Mercedes-Benz, Renault, and Volkswagen have introduced electric versions of their popular van models, such as the eSprinter, Kangoo ZE, and e-Crafter. These models cater to a wide range of commercial applications, from urban deliveries to intercity transport, enhancing their appeal to a broader customer base.

The rapid growth of electric vans in the European van market is a testament to the evolving landscape of commercial transportation. By embracing electrification, businesses and automakers can achieve significant economic and environmental benefits, paving the way for a sustainable future in the mobility sector.

France is the Leading Country in the European Van Market

France has a significant market size in the European van market. The country's robust economy, diverse industrial base, and extensive commercial activities contribute to a high demand for vans across various sectors. From logistics and transportation to construction and service industries, vans are crucial in facilitating business operations and urban mobility in France.

France benefits from a well-developed infrastructure network that supports efficient transportation and logistics operations. The country's extensive road network, including highways and urban roads, facilitates the movement of goods and services using vans. This infrastructure advantage makes France an attractive market for van manufacturers and fleet operators seeking reliable transportation solutions.

Vans are essential tools for businesses of all sizes in France, ranging from small enterprises to large corporations. They serve diverse purposes, including last-mile delivery, passenger transport, mobile services, and utility applications. The versatility and adaptability of vans make them indispensable in sectors such as e-commerce, retail distribution, construction, and public services, contributing significantly to economic productivity and efficiency.

French automakers and technology firms are at the forefront of innovation in the van market. Companies are investing heavily in research and development to enhance vehicle efficiency, safety features, connectivity, and environmental performance. The integration of advanced technologies such as electric powertrains, autonomous driving systems, and digital connectivity is driving the evolution of vans in France, catering to evolving customer demands and regulatory requirements.

France hosts a competitive automotive industry with leading van manufacturers and suppliers operating within its borders. Companies like Renault, Peugeot, Citroen (Groupe PSA), and Mercedes-Benz have established strong market positions and brand recognition in the van segment. These companies leverage their technological expertise, manufacturing capabilities, and extensive distribution networks to maintain market leadership and meet diverse customer needs.

France is expected to maintain its leadership in the European van market through continued innovation, sustainable practices, and strategic partnerships. However, challenges such as evolving consumer preferences, regulatory changes, and technological disruptions require proactive responses from industry stakeholders. By embracing digital transformation, investing in sustainable mobility solutions, and fostering industry collaboration, France can sustain its competitive edge and drive future growth in the European van market.

Europe Van Industry Overview

The European van market is highly competitive. The presence of major original equipment manufacturers (OEMs) across the region is likely to drive the growth of the market. Major key players in the market include Mercedes Benz, Volkswagen Group, Ford Motor Company, and Vauxhall, along with new entrants like Arrival Electric Group Limited, catering to the region's electric van needs.

- June 2023: Punch Powertrain established a strategic agreement with Cubonic to develop and manufacture sustainable automated and autonomous electric light commercial vehicles (eLCVs), specifically the PeopleMover and CargoMover eLCVs from Cubonic.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rise in Sale of Electric Vans is Driving the Market's Growth

- 4.2 Market Restraints

- 4.2.1 High Cost of Electric Vehicle Battery is Anticipated to Restrain the Market's Growth

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Cargo Space

- 5.1.1 More than 5 Cubic Meter

- 5.1.2 Less than 5 Cubic Meter

- 5.2 By End User

- 5.2.1 Commercial

- 5.2.2 Government

- 5.3 By Drive Type

- 5.3.1 IC Engine

- 5.3.2 Electric

- 5.3.3 Alternative Fuel

- 5.4 By Geography

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 Italy

- 5.4.4 France

- 5.4.5 Spain

- 5.4.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Stellantis NV

- 6.2.2 Daimler AG

- 6.2.3 Volkswagen AG

- 6.2.4 Ford Motor Company

- 6.2.5 Groupe Renault

- 6.2.6 Vauxhall Motors Limited

- 6.2.7 Hyundai Motors

- 6.2.8 Toyota Motor Corporation

- 6.2.9 Nissan Motors Co. Ltd

- 6.2.10 BYD Co. Ltd

- 6.2.11 IVECO Group NV

- 6.2.12 Arrival Electric Group Limited