|

市場調查報告書

商品編碼

1692580

歐洲建築膠合劑和密封劑:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Europe Construction Adhesives & Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

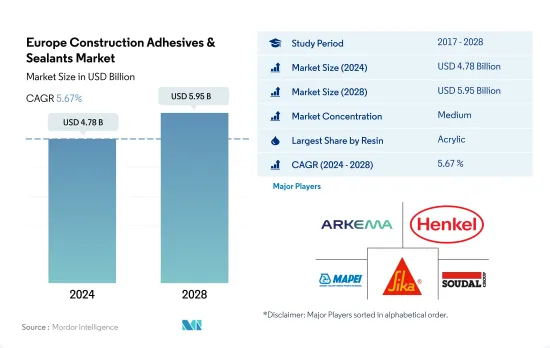

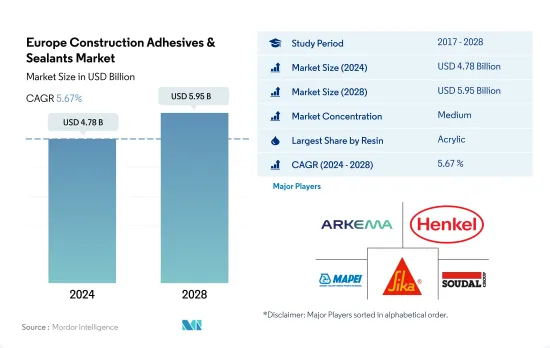

預計 2024 年歐洲建築膠合劑和密封劑市場規模將達到 47.8 億美元,預計到 2028 年將達到 59.5 億美元,預測期內(2024-2028 年)的複合年成長率為 5.67%。

支持歐洲建築膠黏劑和密封劑成長的政府政策和舉措

- 建設產業需要黏合劑和密封劑來安裝地毯、地板材料、木材和預製板黏合、牆面覆層、密封條、屋頂等。根據 EURO CONSTRUCT 的報告,預計 2022 年至 2024 年西歐建設產業的複合年成長率為 6.1%,中歐和東歐建築業的複合年成長率為 6.4%。預計這將在預測期內增加對建築黏合劑和密封劑的需求。

- 透過《能源效率指令》和《建築能源性能》等框架,歐盟委員會正在製定政策,推動住宅基礎設施轉向節能和數位資源性能。這些措施將需要對現有建築維修,從而導致 2022-2028 年預測期內建築業對黏合劑和密封劑的需求增加。

- 建築業用於各種應用(包括屋頂、地板材料和窗戶安裝)的緊固件容易出現故障,但可以使用具有優異強度的建築膠合劑和密封劑來防止故障。由於建築領域高效資源規劃的發展,預計 2022-2028 年建築膠合劑和密封劑的需求將會增加。

- 截至 2021 年,丙烯酸樹脂佔歐洲建築膠合劑和密封劑市場的最大佔有率,因為它們廣泛用作機械接頭、不同基材之間的黏合劑以及易收縮材料的密封劑。由於這些應用,黏合劑和密封劑被廣泛應用於建設產業,預計在預測期內需求將會增加。

愛爾蘭、西班牙和斯洛伐克建築產量的上升推動了對建築黏合劑和密封劑的需求

- 由於新冠疫情在歐洲蔓延,導致全國關閉、供應鏈中斷和強制實施社交隔離規定,2020 年整體建築業產出下降了 4.4%。這些因素減少了2020年建築所需的黏合劑和密封劑的需求。其他歐洲國家地區的降幅最大,原因是斯洛伐克等國家的景氣衰退,建築業產出與前一年同期比較減16.8%。

- 由於歐盟委員會針對2020年新冠疫情造成的整體經濟放緩制定了復甦計劃,例如“下一代歐盟”,2021年建築膠粘劑和密封劑的需求大幅增加。 2021年,其他歐洲國家地區建築膠合劑和密封劑需求整體增幅最高,其中丹麥等北歐國家較去年與前一年同期比較成長17.8%。

- 其他歐洲國家地區在歐洲建築膠合劑和密封劑市場中佔有最高的價值佔有率,佔了近一半的市場。同時,愛爾蘭等國家的整體建築業產量預計將在 2021 年成長 15.1%,其次是西班牙(14.3%)和斯洛伐克(13.5%)。

歐洲建築膠合劑和密封劑市場趨勢

該行業受到新建築激增以及維修需求上升的推動

- 受新冠疫情影響,2020年建設業整體收益大幅下降,導致整體復甦放緩,且工作場所採取了社交隔離措施。

- 歐洲建築業的銷售額呈現驚人的成長勢頭,2021與前一年同期比較率與 2020 年相比最高。這得歸功於歐盟委員會的舉措和措施的成功,例如在名為「下一代歐盟」的新冠疫情復甦計劃下向所有行業注資 7500 億歐元。在下一代歐盟計畫下,建築業獲得了最大的投資,因為歐洲的綠色建築數位化建築目標導致現有建築和結構的年度維修增加。

- 根據 EUROCONSTRUCT 報告,在基於歐盟政治區域的細分市場中,中歐和東歐預計將以 6.4% 的複合年成長率成長,其次是西歐,複合年成長率為 6.1%。

- 歐盟和國家層級的政策制定者正在透過各種政策(包括《建築能源性能指令》)優先提高新建設和現有建築的能源效率。預計這些政策將在預測期內提高整體建築收益。

歐洲建築膠黏劑和密封劑產業概況

歐洲建築膠合劑和密封劑市場適度整合,前五大公司佔51.69%的市場。該市場的主要企業有:阿科瑪集團、漢高股份公司、馬貝集團、西卡股份公司和Soudal Holding NV(按字母順序排列)

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 建造

- 法律規範

- EU

- 俄羅斯

- 價值鍊和通路分析

第5章市場區隔

- 樹脂

- 丙烯酸纖維

- 氰基丙烯酸酯

- 環氧樹脂

- 聚氨酯

- 矽膠

- VAE,EVA

- 其他樹脂

- 科技

- 熱熔膠

- 反應性

- 密封劑

- 溶劑型

- 水性

- 國家

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 英國

- 其他歐洲國家

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- 3M

- Arkema Group

- HB Fuller Company

- Henkel AG & Co. KGaA

- Illinois Tool Works Inc.

- MAPEI SpA

- RPM International Inc.

- Sika AG

- Soudal Holding NV

- Wacker Chemie AG

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 全球黏合劑和密封劑產業概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 促進因素、限制因素和機會

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 92417

The Europe Construction Adhesives & Sealants Market size is estimated at 4.78 billion USD in 2024, and is expected to reach 5.95 billion USD by 2028, growing at a CAGR of 5.67% during the forecast period (2024-2028).

Government policies and initiatives to support the growth of construction adhesives and sealants in Europe

- The construction industry requires adhesives and sealants for purposes such as carpet layering, flooring, timber, prefabricated panels joining, wall covering, weather-sealing, and roofing. The construction industry is expected to record a 6.1% CAGR in 2022-2024 in Western Europe and a 6.4% CAGR in 2022-2024 in Central and Eastern Europe, per the EURO CONSTRUCT report. This is expected to increase demand for construction adhesives and sealants in the forecast period.

- The European Commission has framed policies to transit the residential infrastructure to energy-efficient and digital resource performance with frameworks such as the Energy Efficiency Directive and Energy Performance of Buildings. These initiatives will require the renovation of existing buildings, leading to an increase in demand for adhesives and sealants required for construction in the forecast period 2022-2028.

- The fasteners used in the construction industry for different applications, such as roofing, flooring, and window fitting, are prone to failures that can be prevented with good strength holding construction adhesives and sealants. With the development of efficient resource planning in construction, the demand for construction adhesives and sealants is expected to increase in the period 2022-2028.

- Acrylic resin accounted for the maximum share of the European construction adhesives and sealants market value share as of 2021 because of its wide usage as an adhesive for mechanical joining and with different substrates and as a sealant for materials prone to shrinkage. These applications make them widely used in the construction industry, and their demand is expected to grow over the forecast period.

Rising construction output from Ireland, Spain, and Slovakia to raise the demand for construction adhesives and sealants

- In 2020, the overall decline in construction output by 4.4% was due to the COVID-19 pandemic spreading across Europe, which led to nationwide lockdowns, supply chain disruptions, mandatory social distancing regulations, etc. These factors led to declining demand for adhesives and sealants required for construction in 2020. The decline was maximum for the Rest of Europe regional segment because of the huge recessions in countries such as Slovakia, which recorded a 16.8% Y-o-Y decline in its construction output.

- The demand for construction adhesives and sealants increased tremendously in 2021 because of the EU Commission's recovery plan for an overall economic slowdown due to COVID-19 in 2020 such as Next Generation EU, in which the maximum fund allocation was done for the construction sector to make European buildings environmentally benign with decreased wastage of resources. The overall growth in demand for construction adhesives and sealants was highest in 2021 for the Rest of Europe segment because of Nordic countries, such as Denmark, which registered a growth of 17.8% Y-o-Y in construction output.

- The value share in the European construction adhesives and sealants market is highest for the Rest of Europe segment, which accounts for nearly half of the share because the overall construction output from countries such as Ireland is expected to grow by 15.1%, followed by Spain with 14.3%, and Slovakia with 13.5%, as published in a report by EURO CONSTRUCT in 2021.

Europe Construction Adhesives & Sealants Market Trends

Rapid growth of new construction along with rising need for renovation activities will drive the industry

- The overall revenue of construction showed a steep decrement in 2020 because of the impact of the pandemic situation due to COVID-19, which led to an overall recovery slowdown and social distancing measures on work sites.

- The overall revenue of the construction sector in Europe grew tremendously, with the highest year-on-year growth in 2021 compared to that of 2020 because of the initiatives and measures taken by the EU Commission, such as the infusion of EUR 750 billion for all sectors under the COVID recovery plan named Next Generation EU. Under the Next Generation EU plan, the construction sector received the maximum investment because of the European objective of green and digital transition in buildings which led to growth in the annual renovation rate of existing buildings and structures.

- As per the EUROCONSTRUCT report, among the segments of the European Union based on political geography, Central and Eastern Europe are expected to register a CAGR of 6.4%, followed by Western Europe at a CAGR of 6.1% in 2022-2024.

- The policymakers at European Union and national level are prioritizing the construction of new buildings and conversion of existing buildings to be energy efficient through various policies including Energy Performance of Buildings Directive and others. These policies will lead to an increase in overall revenue for construction in the forecast period.

Europe Construction Adhesives & Sealants Industry Overview

The Europe Construction Adhesives & Sealants Market is moderately consolidated, with the top five companies occupying 51.69%. The major players in this market are Arkema Group, Henkel AG & Co. KGaA, MAPEI S.p.A., Sika AG and Soudal Holding N.V. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Building and Construction

- 4.2 Regulatory Framework

- 4.2.1 EU

- 4.2.2 Russia

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 Resin

- 5.1.1 Acrylic

- 5.1.2 Cyanoacrylate

- 5.1.3 Epoxy

- 5.1.4 Polyurethane

- 5.1.5 Silicone

- 5.1.6 VAE/EVA

- 5.1.7 Other Resins

- 5.2 Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Sealants

- 5.2.4 Solvent-borne

- 5.2.5 Water-borne

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Russia

- 5.3.5 Spain

- 5.3.6 United Kingdom

- 5.3.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 H.B. Fuller Company

- 6.4.4 Henkel AG & Co. KGaA

- 6.4.5 Illinois Tool Works Inc.

- 6.4.6 MAPEI S.p.A.

- 6.4.7 RPM International Inc.

- 6.4.8 Sika AG

- 6.4.9 Soudal Holding N.V.

- 6.4.10 Wacker Chemie AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219