|

市場調查報告書

商品編碼

1692579

亞太建築膠合劑和密封劑:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Asia-Pacific Construction Adhesives & Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

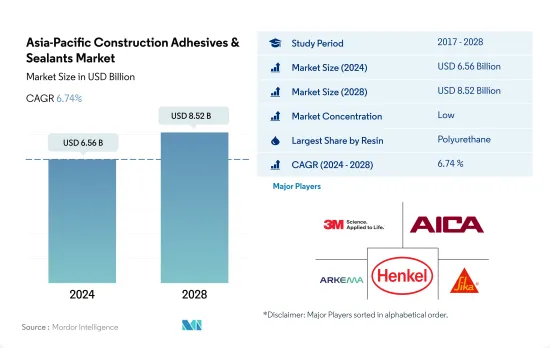

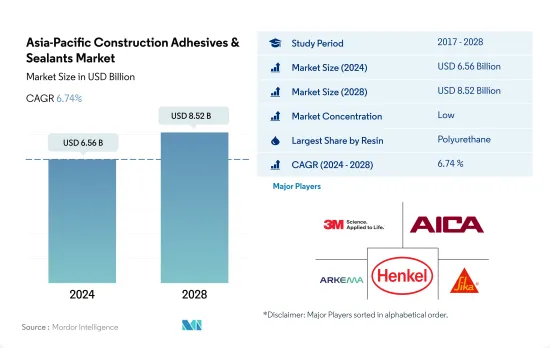

亞太地區建築膠合劑和密封劑市場規模預計在 2024 年為 65.6 億美元,預計到 2028 年將達到 85.2 億美元,預測期內(2024-2028 年)的複合年成長率為 6.74%。

基礎設施計劃支持中國和日本建築膠粘劑和密封膠的成長

- 在歷史時期(2017-2021 年)和基準年(2021 年)中,聚氨酯和丙烯酸樹脂基黏合劑和密封劑是其他樹脂類型中使用最多的。由於這些樹脂具有很強的黏合強度和可用作結構性黏著劑,預計它們將成為預測期內使用最廣泛的樹脂類型。在亞太地區,2021年約有49%的丙烯酸基建築膠黏劑採用水性技術生產,而聚氨酯基建築膠黏劑主要採用密封膠技術生產。

- 根據地區分類,2019-20 年期間建築膠合劑和密封劑的需求增加了約 13%,預計預測期(2022-2028 年)將增加約 4.6%。在所有樹脂類型中,預計預測期內(2022-2028 年)矽膠樹脂基黏合劑和密封劑的複合年成長率最高,約為 5%。

- 中國佔全球建築膠黏劑和密封劑需求的最大佔有率。 2021年,中國的需求量為12億公斤,預計到2028年將達到18億公斤,複合年成長率為6.9%。聚氨酯、丙烯酸和矽樹脂基膠黏劑和密封劑產品預計將佔中國建設產業總需求的50%以上。日本是建築膠合劑的第二大消費國,2021 年的佔有率約為 12%,預計在預測期內(2022-2028 年)的複合年成長率約為 2.7%。日本的高層建築和高層建築建築建設計劃數量正在增加,這是黏合劑需求的主要驅動力。

建築投資的增加可能會在未來推動對黏合劑和密封劑的需求。

- 亞太地區是建築膠黏劑蓬勃發展的市場。儘管由於新冠疫情影響亞太國家,2020 年上半年建築和房地產活動有所放緩,但預計 2021 年將迅速復甦,並在整個 2022-2028 年預測期內保持強勁成長。預計2030年亞太地區將成為最重要的建築和房地產市場,佔全球產量的約40%。

- 在2022年至2028年的預測期內,中國預計將引領全球建築和房地產產業,刺激該地區的成長。幾十年來,中國對基礎設施建設的大量投資、城市人口的激增以及對中國工業設施的大規模外國直接投資(FDI)極大地促進了中國建築業的崛起。受新冠疫情影響,2020年上半年中國住宅和非住宅建築業出現下滑,但隨著消費者和企業信心的恢復,建築業迅速復甦。隨著金屬、木材等建築材料全球價格飆升,中國建築企業的生產成本大幅上升,但他們仍能將這些成本轉嫁給最終客戶。

- 政府對基礎設施的投資對於新冠疫情后建築業和房地產業的復甦至關重要。預計中國、印度、日本和其他地區領先國家的大規模投資將在短期至中期推動亞太市場的成長。預計所有這些因素將在預測期內增加全部區域對建築黏合劑和密封劑的需求。

亞太地區建築膠合劑和密封劑市場趨勢

增加對擴大基礎設施活動的投資將擴大產業規模

- 亞太地區由世界主要經濟體推動:中國、日本和印度。中國正處於持續都市化進程中,目標是2030年都市化率達到70%。都市化的加速將增加都市區居住空間的需求,鼓勵中等收入都市區尋求改善的居住條件,這將影響住宅市場,進而增加中國的住宅建設。

- 非住宅基礎設施可能會大幅擴張。 2019年,中國政府核准了26個基礎建設計劃,總價值約1420億美元,預計2023年完工。中國擁有全球最大的建築市場,佔全球建築投資的20%。到2030年,政府計劃在建設方面投資超過13兆美元。因此,預計預測期內(2022-2028 年)建築市場的複合年成長率為 4.48%。

- 建築業是亞太地區最大的產業之一,2019 年取得了可喜的成長。由於該地區包含越南、馬來西亞、印尼、泰國和其他南亞國家等許多新興國家,該產業持續成長。然而,受新冠疫情影響,全部區域政府實施封鎖,建築業大幅下滑,嚴重影響了包括印度、中國、日本和東南亞國協在內的開發中國家。

- 亞太地區的建築業也越來越受到外國投資者的興趣。由於發展中國家為投資者提供更好的利益和機會,建築開發領域的外國直接投資(FDI)正在增加。

亞太地區建築膠合劑及密封劑產業概況

亞太建築膠黏劑和密封劑市場分散,前五大公司佔17.60%。該市場的主要企業有:3M、Aica Kogyo、阿科瑪集團、漢高股份公司和西卡股份公司(按字母順序排列)

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 建造

- 法律規範

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 馬來西亞

- 新加坡

- 韓國

- 泰國

- 價值鍊和通路分析

第5章市場區隔

- 樹脂

- 丙烯酸纖維

- 氰基丙烯酸酯

- 環氧樹脂

- 聚氨酯

- 矽膠

- VAE,EVA

- 其他樹脂

- 科技

- 熱熔膠

- 反應性

- 密封劑

- 溶劑型

- 水性

- 國家

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 馬來西亞

- 新加坡

- 韓國

- 泰國

- 其他亞太地區

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- 3M

- Aica Kogyo Co..Ltd.

- Arkema Group

- HB Fuller Company

- Henkel AG & Co. KGaA

- Momentive

- Shin-Etsu Chemical Co., Ltd.

- Sika AG

- Soudal Holding NV

- THE YOKOHAMA RUBBER CO., LTD.

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 全球黏合劑和密封劑產業概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 促進因素、限制因素和機會

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 92416

The Asia-Pacific Construction Adhesives & Sealants Market size is estimated at 6.56 billion USD in 2024, and is expected to reach 8.52 billion USD by 2028, growing at a CAGR of 6.74% during the forecast period (2024-2028).

Infrastructure projects to support the growth of construction adhesives and sealants in China and Japan

- Polyurethane and Acrylic resin-based adhesives and sealants are the most used among other reins types during the historical period, 2017-2021, and base year, 2021. They are expected to be the most used resin types during the forecast period because of the strong bonds and their applicability as structural adhesives. In Asia-Pacific, about 49% of the acrylic-based construction adhesives were manufactured in water-borne technology in 2021 and polyurethane based products were manufactured majorly in sealant technology.

- Regionally, during 2019-20, the demand for construction adhesives and sealants grew by about 13% and is expected to grow by about 4.6% during the forecast period (2022 - 2028). Among all the resin types, silicone resin-based adhesives and sealants are expected to register the largest CAGR of around 5% during the forecast period (2022 - 2028).

- China occupied the largest share of the demand for construction adhesives and sealants globally. In 2021, the demand generated from China was 1.2 billion kilograms and the demand is expected to reach 1.8 billion kilograms with a CAGR of 6.9% by 2028. Polyurethane, acrylic, and silicon resin-based adhesives and sealants products are expected to occupy more than 50% of the total demand generated by China's construction industry. Japan is the second-largest consumer of construction adhesives, and it had about 12% of shares in 2021, is expected to register a CAGR of about 2.7% during the forecast period (2022 - 2028). Japan is seeing an increased number of skyscraper and high-rise building projects, which has been the major source of the demand for adhesives.

Rising construction investments likely to propel the demand for adhesives & sealants in the future

- Asia-Pacific is a booming market for construction adhesives. Despite a slowdown in construction and real estate activities during the first half of 2020 as the COVID-19 pandemic affected Asia-Pacific countries, the area rebounded fast in 2021 and is expected to maintain solid growth throughout the forecast period 2022-2028. The Asia-Pacific region is expected to be the most important construction and real estate market, accounting for roughly 40% of global production value by 2030.

- Over the forecast period 2022-2028, China is expected to be the leading global construction and real estate industry, fueling regional growth. Decades of substantial Chinese investments in infrastructure expansions, a fast-rising urban population, and extensive foreign direct investment (FDI) into industrial facilities in the nation have contributed significantly to the rise of the Chinese construction sector. Due to the COVID-19 outbreak, China suffered a drop in residential and non-residential buildings in the first half of 2020 but recovered quickly as consumers' and corporate confidence returned. With the global surge in building material prices, including metals and wood, Chinese construction businesses are seeing a significant increase in manufacturing costs but are still able to pass these costs on to final customers.

- Government infrastructure investment is critical to the building and real estate industries' revival following the COVID-19 pandemic. Major investments planned in China, India, Japan, and other regional leaders are expected to boost the Asia-Pacific market's growth in the short to medium term. All such factors are expected to increase the demand for construction adhesives and sealants across the region over the forecast period.

Asia-Pacific Construction Adhesives & Sealants Market Trends

Raising investment to expand infrastructural activities will augment the industry size

- Asia-Pacific is driven by the world's major economies, such as China, Japan, and India. China is promoting and undergoing a process of continuous urbanization, with a target rate of 70% for 2030. The increased living spaces required in the urban areas resulting from increasing urbanization and the desire of middle-income urban residents to improve their living conditions may impact the housing market and, thereby, increase the residential constructions in the country.

- Non-residential infrastructure is likely to expand significantly. The Chinese government approved 26 infrastructure projects worth approximately USD 142 billion in 2019, with completion due in 2023. The country has the largest construction market globally, accounting for 20% of all worldwide construction investments. By 2030, the government plans to spend over USD 13 trillion on construction. Thus, the construction market is expected to register a 4.48% CAGR during the forecast period (2022-2028).

- The construction industry is one of the largest industries in Asia-Pacific and recorded promising growth in 2019. The industry continues to grow as the region constitutes many developing countries such as Vietnam, Malaysia, Indonesia, Thailand, and other South Asian countries. However, due to the COVID-19 pandemic, the construction sector witnessed a significant decline owing to lockdowns by governments across the region, which severely affected developing countries, including India, China, Japan, and ASEAN countries.

- The Asia-Pacific region is also witnessing significant interest from international investors in the construction space. Foreign Direct Investment (FDI) in the construction development sector is increasing as developing countries provide better returns and opportunities for investors.

Asia-Pacific Construction Adhesives & Sealants Industry Overview

The Asia-Pacific Construction Adhesives & Sealants Market is fragmented, with the top five companies occupying 17.60%. The major players in this market are 3M, Aica Kogyo Co..Ltd., Arkema Group, Henkel AG & Co. KGaA and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Building and Construction

- 4.2 Regulatory Framework

- 4.2.1 Australia

- 4.2.2 China

- 4.2.3 India

- 4.2.4 Indonesia

- 4.2.5 Japan

- 4.2.6 Malaysia

- 4.2.7 Singapore

- 4.2.8 South Korea

- 4.2.9 Thailand

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 Resin

- 5.1.1 Acrylic

- 5.1.2 Cyanoacrylate

- 5.1.3 Epoxy

- 5.1.4 Polyurethane

- 5.1.5 Silicone

- 5.1.6 VAE/EVA

- 5.1.7 Other Resins

- 5.2 Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Sealants

- 5.2.4 Solvent-borne

- 5.2.5 Water-borne

- 5.3 Country

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Indonesia

- 5.3.5 Japan

- 5.3.6 Malaysia

- 5.3.7 Singapore

- 5.3.8 South Korea

- 5.3.9 Thailand

- 5.3.10 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Aica Kogyo Co..Ltd.

- 6.4.3 Arkema Group

- 6.4.4 H.B. Fuller Company

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Momentive

- 6.4.7 Shin-Etsu Chemical Co., Ltd.

- 6.4.8 Sika AG

- 6.4.9 Soudal Holding N.V.

- 6.4.10 THE YOKOHAMA RUBBER CO., LTD.

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219