|

市場調查報告書

商品編碼

1692578

建築膠合劑和密封劑:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Construction Adhesives & Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

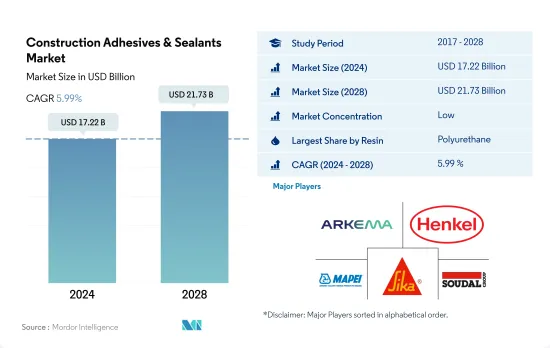

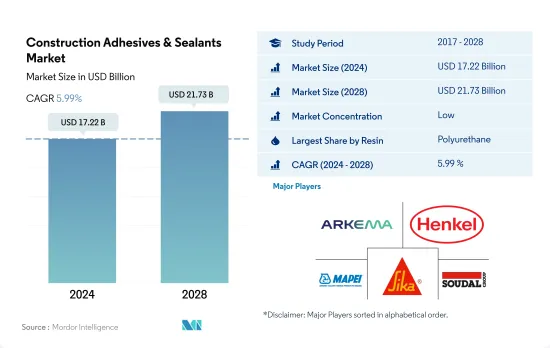

預計 2024 年建築膠合劑和密封劑市場規模將達到 172.2 億美元,到 2028 年將達到 217.3 億美元,預測期內(2024-2028 年)的複合年成長率為 5.99%。

基礎設施計劃支持建築膠粘劑和密封膠的成長

- 從全球來看,以聚氨酯樹脂、丙烯酸樹脂、矽膠樹脂和聚硫樹脂為基礎的膠合劑和密封劑最為突出。由於亞太地區和歐洲的建設活動減少,2017 年至 2019 年期間全球對這些產品的需求成長放緩。在此期間,這兩個地區的需求複合年成長率分別為-1.82%和0.73%。 2020 年,所有地區對建築黏合劑和密封劑的需求均下降,部分原因是新冠疫情導致原料和勞動力短缺。在所有樹脂中,氰基丙烯酸酯樹脂基膠黏劑的需求受到的打擊最嚴重,與2019年相比下降了6.19%。

- 隨著 2021 年限制措施的放寬,建築膠合劑和密封劑的需求迅速恢復到疫情前的水平。澳洲的HomeBuilder計劃等支援計劃在刺激需求方面發揮了關鍵作用。預計這一成長趨勢將在整個預測期內持續下去,預計 2022-2028 年預測期內建築膠合劑和密封劑的需求複合年成長率將達到 4.13%。

- 丙烯酸樹脂基建築膠合劑和密封劑因其強大的黏合力而佔據所有樹脂中最大的需求佔有率。預計預測期內丙烯酸樹脂的需求佔有率將保持最高水準。預測期內,矽膠樹脂基建築膠合劑和密封劑的需求成長預計將超過丙烯酸樹脂基建築膠合劑和密封劑的需求成長。

亞太地區建築業需求不斷成長預計將推動全球黏合劑和密封劑的銷售

- 由於中國、日本、韓國、印度、澳洲和其他國家進行了大量建設活動,因此在整個研究期間,亞太地區在建築膠合劑和密封劑需求中佔據最大佔有率。中國是世界上最大的建築市場,由於人口眾多和都市化速度快,滿足了亞太地區高達71%的建築需求。

- 2017年至2019年,由於金融市場波動加劇以及阿根廷等國央行提高利率,導致歐洲和拉丁美洲一些國家的建設活動減少,建築膠合劑和密封劑的需求疲軟。

- 2020年,一些國家對建築膠合劑和密封劑的需求下降了高達27%,但由於南非和巴西等一些國家認為建設活動必不可少,因此全球影響較小。俄羅斯等一些國家是疫情後建築工地最早重新開放的國家之一。這些因素有助於減輕新冠疫情對全球市場的影響,將跌幅限制在7.6%。

- 2021年,在美國、澳洲、歐盟國家等國的紓困計畫和支持計畫的推動下,建設活動迅速恢復到疫情前的水平,推動了對建築膠合劑和密封劑的需求。由於歐洲、南美和亞太國家投資和預算分配的增加,基礎設施建設黏合劑和密封劑預計將在預測期內在其他建築黏合劑和密封劑類型中呈現最大的成長。

全球建築膠合劑和密封劑市場趨勢

隨著住宅和基礎設施建設的擴大,建築業蓬勃發展

- 建築業呈現穩定成長,2017 年至 2019 年的複合年成長率為 2.6%。這一成長受到全球經濟活動好轉和獨棟住宅需求成長的推動。 2020年,新冠疫情對全球建築業產生了重大影響。勞動力供應限制、建築融資和供應鏈中斷以及經濟不確定性對全球 AEC 產業產生了負面影響。

- 雖然2021年呈現正成長,但疫情對供應鏈的衝擊導致原物料價格上漲,仍在困擾產業。不過,由於建築業對一個國家的經濟影響重大,北美和亞太國家都透過提供支持計畫來重新啟動經濟週期。支持計劃包括澳大利亞的HomeBuilder計劃和歐盟國家的經濟復甦計劃。

- 亞太地區的建設活動最為活躍,預計到 2028 年仍將是最大的建築市場,這得益於其龐大的人口、不斷加快的都市化以及中國、印度、日本、印尼和韓國等國家對基礎設施建設的投資不斷增加。

- 預計在預測期內,對綠色建築的日益重視和減少全球建設活動排放的努力將帶來更永續的營運程序。例如,法國在向低碳能源經濟轉型的過程中,已為建築業累計75 億歐元。

建築膠合劑和密封劑產業概況

建築膠合劑和密封劑市場分散,前五大公司佔據27.89%的市場佔有率。該市場的主要企業包括阿科瑪集團、漢高股份公司、馬貝集團、西卡股份公司和 Soudal Holding NV。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用戶趨勢

- 建築與施工

- 法律規範

- 阿根廷

- 澳洲

- 巴西

- 加拿大

- 中國

- EU

- 印度

- 印尼

- 日本

- 馬來西亞

- 墨西哥

- 俄羅斯

- 沙烏地阿拉伯

- 新加坡

- 南非

- 韓國

- 泰國

- 美國

- 價值鍊和通路分析

第5章市場區隔

- 樹脂

- 丙烯酸纖維

- 氰基丙烯酸酯

- 環氧樹脂

- 聚氨酯

- 矽膠

- VAE,EVA

- 其他

- 科技

- 熱熔膠

- 反應性

- 密封膠

- 溶劑型

- 水性

- 地區

- 亞太地區

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 馬來西亞

- 新加坡

- 韓國

- 泰國

- 其他亞太地區

- 歐洲

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 英國

- 其他歐洲國家

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

- 加拿大

- 墨西哥

- 美國

- 北美其他地區

- 南美洲

- 阿根廷

- 巴西

- 南美洲其他地區

- 亞太地區

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- 3M

- Aica Kogyo Co..Ltd.

- Arkema Group

- Dow

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Illinois Tool Works Inc.

- MAPEI SpA

- Momentive

- RPM International Inc.

- Shin-Etsu Chemical Co., Ltd.

- Sika AG

- Soudal Holding NV

- Wacker Chemie AG

第7章 CEO 的關鍵策略問題

第 8 章 附錄

- 全球黏合劑和密封劑產業概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 促進因素、限制因素和機會

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 92415

The Construction Adhesives & Sealants Market size is estimated at 17.22 billion USD in 2024, and is expected to reach 21.73 billion USD by 2028, growing at a CAGR of 5.99% during the forecast period (2024-2028).

Infrastructure projects to support the growth of construction adhesives and sealants

- Globally, the most prominent are adhesives and sealants based on polyurethane, acrylic, silicone, and polysulphide resins. Global demand for these products witnessed slow growth during 2017-2019 due to a decline in construction activities in the Asia-Pacific and European regions. The demand from these two regions recorded CAGRs of -1.82% and 0.73%, respectively, in this period. The demand for construction adhesives and sealants declined in 2020 from all regions due to a shortage of raw materials, workers, and other factors due to the COVID-19 pandemic. Among all resins, the demand for adhesives based on cyanoacrylate resins took the worst hit and declined by 6.19% compared to 2019.

- In 2021, as restrictions eased, the demand for construction adhesives and sealants quickly rebounded to the pre-pandemic levels. Support schemes like the Homebuilder program in Australia played a crucial role in the demand growth. This growth trend is expected to continue throughout the forecast period, and the demand for construction adhesives and sealants is expected to record a CAGR of 4.13% during the forecast period 2022-2028.

- Construction adhesives and sealants based on acrylic resin occupied the largest share of the demand among all resins because of their strong bonds. The demand share for acrylic resins is expected to remain the highest during the forecast period. The demand growth for silicone resin-based construction adhesives and sealants is expected to outpace the demand growth for acrylic resin-based construction adhesives and sealants over the forecast period.

Inflating demand from Asia-Pacific's construction sector likely to drive the global sales of adhesive and sealants

- Asia-Pacific accounted for the largest share of the demand for construction adhesives and sealants throughout the study period because of the large number of construction activities in China, Japan, South Korea, India, Australia, and other countries in the region. China has the largest construction market globally and generates up to 71% of the demand from Asia-Pacific due to the country's large population and increasing urbanization.

- In 2017-2019, the demand for construction adhesives and sealants was sluggish due to a decline in construction activities in a few countries in Europe and South America because of the increased volatility of financial markets and increased interest rates by central banks of countries like Argentina.

- In 2020, the demand for construction adhesives and sealants declined by up to 27% in a few countries, but the global impact was not severe as construction activities were deemed essential in a few countries like South Africa and Brazil, among others. In a few countries, like Russia, construction sites were the first to reopen after the pandemic. These factors cushioned the COVID-19 pandemic's impact on the global market, restricting the decline to 7.6%.

- In 2021, due to relief packages and support schemes in countries like the United States, Australia, and EU countries, construction activities quickly reached their pre-pandemic levels, thus boosting the demand for construction adhesives and sealants. Infrastructure construction adhesives and sealants are expected to witness the largest growth among other construction adhesives and sealants types during the forecast period because of increased investments and budget allotments in European, South American, and Asia-Pacific countries.

Global Construction Adhesives & Sealants Market Trends

Growing residential and infrastructural development to thrive the construction sector

- The building and construction industry witnessed steady growth, with a CAGR of 2.6% from 2017 to 2019. This growth was driven by the upswing in global economic activity and increasing demand for single-family homes. In 2020, the COVID-19 pandemic had a major impact on the global building and construction industry. Constraints in labor supply, disruptions in construction finances and the supply chain, and economic uncertainty negatively impacted the global building and construction industry.

- Though the industry showed positive growth in 2021, the pandemic's effect on supply chains, which resulted in a hike in raw material prices, is still plaguing the industry. However, as the construction industry heavily influences a nation's economy, countries in Europe, North America, and Asia-Pacific have used the construction industry to restart their economic cycles by offering support schemes. Some support schemes include the Homebuilder Programme in Australia and the economic recovery plan of EU countries.

- The Asia-Pacific region experiences the highest volume of construction activities, and it is expected to remain the largest construction market till 2028 due to its huge population, increasing urbanization, and increasing investments in infrastructural development in countries like China, India, Japan, Indonesia, and South Korea.

- Increasing emphasis on green buildings and efforts to reduce emissions from global construction activities are expected to result in more sustainable operational procedures during the forecast period. For example, France has sanctioned EUR 7.5 billion for the construction industry to transform itself into a low-carbon energy economy.

Construction Adhesives & Sealants Industry Overview

The Construction Adhesives & Sealants Market is fragmented, with the top five companies occupying 27.89%. The major players in this market are Arkema Group, Henkel AG & Co. KGaA, MAPEI S.p.A., Sika AG and Soudal Holding N.V. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Building and Construction

- 4.2 Regulatory Framework

- 4.2.1 Argentina

- 4.2.2 Australia

- 4.2.3 Brazil

- 4.2.4 Canada

- 4.2.5 China

- 4.2.6 EU

- 4.2.7 India

- 4.2.8 Indonesia

- 4.2.9 Japan

- 4.2.10 Malaysia

- 4.2.11 Mexico

- 4.2.12 Russia

- 4.2.13 Saudi Arabia

- 4.2.14 Singapore

- 4.2.15 South Africa

- 4.2.16 South Korea

- 4.2.17 Thailand

- 4.2.18 United States

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 Resin

- 5.1.1 Acrylic

- 5.1.2 Cyanoacrylate

- 5.1.3 Epoxy

- 5.1.4 Polyurethane

- 5.1.5 Silicone

- 5.1.6 VAE/EVA

- 5.1.7 Other Resins

- 5.2 Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Sealants

- 5.2.4 Solvent-borne

- 5.2.5 Water-borne

- 5.3 Region

- 5.3.1 Asia-Pacific

- 5.3.1.1 Australia

- 5.3.1.2 China

- 5.3.1.3 India

- 5.3.1.4 Indonesia

- 5.3.1.5 Japan

- 5.3.1.6 Malaysia

- 5.3.1.7 Singapore

- 5.3.1.8 South Korea

- 5.3.1.9 Thailand

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 Europe

- 5.3.2.1 France

- 5.3.2.2 Germany

- 5.3.2.3 Italy

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 United Kingdom

- 5.3.2.7 Rest of Europe

- 5.3.3 Middle East & Africa

- 5.3.3.1 Saudi Arabia

- 5.3.3.2 South Africa

- 5.3.3.3 Rest of Middle East & Africa

- 5.3.4 North America

- 5.3.4.1 Canada

- 5.3.4.2 Mexico

- 5.3.4.3 United States

- 5.3.4.4 Rest of North America

- 5.3.5 South America

- 5.3.5.1 Argentina

- 5.3.5.2 Brazil

- 5.3.5.3 Rest of South America

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Aica Kogyo Co..Ltd.

- 6.4.3 Arkema Group

- 6.4.4 Dow

- 6.4.5 H.B. Fuller Company

- 6.4.6 Henkel AG & Co. KGaA

- 6.4.7 Huntsman International LLC

- 6.4.8 Illinois Tool Works Inc.

- 6.4.9 MAPEI S.p.A.

- 6.4.10 Momentive

- 6.4.11 RPM International Inc.

- 6.4.12 Shin-Etsu Chemical Co., Ltd.

- 6.4.13 Sika AG

- 6.4.14 Soudal Holding N.V.

- 6.4.15 Wacker Chemie AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219