|

市場調查報告書

商品編碼

1692562

泰國公路貨運:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Thailand Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

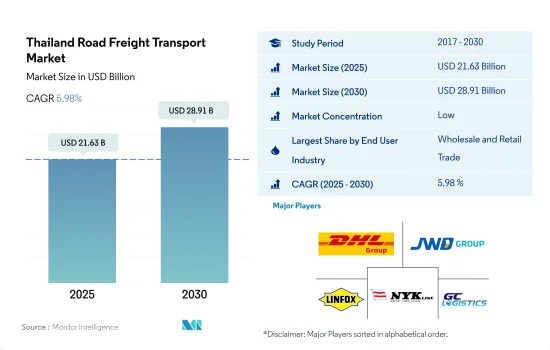

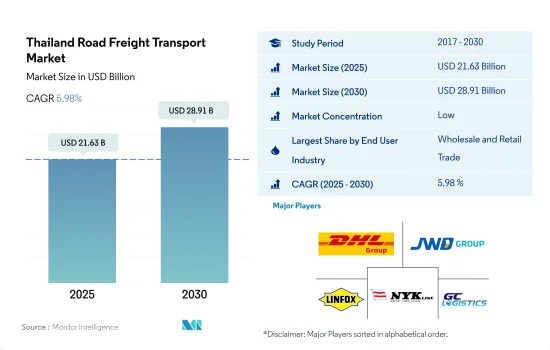

泰國公路貨運市場規模預計在 2025 年為 216.3 億美元,預計到 2030 年將達到 289.1 億美元,預測期內(2025-2030 年)的複合年成長率為 5.98%。

透過線上分銷管道增加零售商品的銷售正在推動對公路貨運服務的需求。

- 泰國是東南亞經濟最繁榮的國家之一。預計消費品零售額在 2023 年將成長 5%,2024 年預計將成長 3%,主要受外國遊客消費的推動。此外,2023年泰國將從中國進口價值4,700億泰銖(135.7億美元)的消費品,與前一年同期比較增2.8%,佔進口消費品總額的41%。進口和消費品銷售的成長推動了公路貨運市場的成長。此外,近年來透過線上分銷管道銷售的零售產品數量大幅增加。

- 泰國計劃於 2026 年開始在其西南部的一個礦山生產鋰,以實現其成為區域電動車生產中心的雄心壯志。 Reung Kiet 工廠預計將生產約 164,500 噸碳酸鋰,用於電動車的磷酸鋰鐵鋰電池。在採礦業中,將材料、樣品、設備、機械等運送到基地位置和從基地位置運送出去對於完成工作至關重要。因此,預計採礦活動的增加將刺激市場需求。

泰國公路貨運市場趨勢

受國際貿易和電子商務的推動,泰國的運輸和倉儲業將在 2022 年實現成長

- 儘管2023年經濟成長放緩,但政府已採取獎勵策略推動外國直接投資和旅遊業發展,幫助泰國成為製造地,尤其是電動卡車製造業中心。此外,2023 年最終確定的 EV 3.5 一攬子計劃將使每輛車的購買補貼減少 2,889.23 美元,從而進一步提高該行業對 GDP 的貢獻。

- 2024年2月,運輸部宣布計劃在2025年底投資188.3億美元用於約150個交通計劃,以加強該國的基礎設施。 2024 年將有 64 個計劃開工,另有 31 個計劃(價值 112.3 億美元)正在籌備中。 2025年計畫新計畫,總投資額達75.9億美元。這些舉措包括18個公路計劃、9個鐵路計劃和一項區域港口發展計劃,旨在加強運輸和倉儲行業未來對GDP的貢獻。

內閣已批准為2023年國家燃料補貼基金撥款23.5億美元。

- 泰國政府為減輕全球原油價格上漲的影響,決定自2022年2月起免除柴油消費稅,但這將導致政府損失45.6億美元的收入。透過該基金提供的關稅減免和柴油價格補貼在2022年2月至2024年3月期間將國內柴油價格維持在每公升1.01美元左右發揮了關鍵作用。隨著全球原油價格下跌,柴油價格自2023年2月起逐步下降至每公升0.92美元。泰國政府為因應高通膨,已在內閣會議上決定在 2023 年借入 23.5 億美元的新資金來補貼燃料成本。

- 儘管預計經濟成長將放緩,但預計 2024 年泰國對精製油(尤其是噴射機燃料)的需求將會成長。預計 2020 年噴射機燃料消費量平均為每天 1,680 萬公升,比 2023 年的 1,350 萬公升成長 24.2%。柴油、汽油和酒精汽油目前均享有國家價格補貼計畫。此外,預計2024年液化天然氣價格將下降,這將鼓勵發電廠業者減少對重質燃料油的依賴。

泰國公路貨運業概況

泰國公路貨運市場較為分散,前五大參與者分別為 DHL 集團、JWD 集團、Linfox Pty Ltd.、日本郵船和 WHA GC 物流公司(按字母順序排列)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 按經濟活動分類的GDP分佈

- 按經濟活動分類的GDP成長

- 經濟表現及概況

- 電子商務產業趨勢

- 製造業趨勢

- 交通運輸倉儲業GDP

- 物流績效

- 道路長度

- 出口趨勢

- 進口趨勢

- 燃油價格趨勢

- 卡車運輸成本

- 卡車持有量(按類型)

- 主要卡車供應商

- 公路貨運噸位趨勢

- 公路貨運價格趨勢

- 模態共享

- 通貨膨脹率

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 農業、漁業和林業

- 建設業

- 製造業

- 石油和天然氣、採礦和採石

- 批發和零售

- 其他

- 匯出目的地

- 國內貨運

- 國際貨運

- 卡車負載容量

- 整車裝載 (FTL)

- 零擔運輸 (LTL)

- 貨櫃運輸

- 貨櫃運輸

- 沒有容器

- 距離

- 遠距

- 短途運輸

- 產品成分

- 流體產品

- 固體貨物

- 溫度控制

- 非溫控

- 溫度控制

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- CTI Logistics Company Ltd.

- DHL Group

- GEODIS

- JWD Group

- Kiattana Transport Public Company Limited

- Leo Global Logistics Public Company Limited

- Linfox Pty Ltd.

- NYK(Nippon Yusen Kaisha)Line

- Profreight Group

- WHA GC Logistics Company Ltd.

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 全球物流市場概覽

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(市場促進因素、限制因素、機會)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

- 外匯

簡介目錄

Product Code: 92379

The Thailand Road Freight Transport Market size is estimated at 21.63 billion USD in 2025, and is expected to reach 28.91 billion USD by 2030, growing at a CAGR of 5.98% during the forecast period (2025-2030).

Growing sales of retail products through the online distribution channel are driving the demand for road freight services

- Thailand is one of the most economically thriving countries in Southeast Asia. Consumer product retail sales grew by 5% in 2023 and grew by an estimated 3% in 2024, driven largely by foreign tourist spending. In addition, Thailand imported consumer goods worth THB 470 billion (USD 13.57 billion) from China, up 2.8% YoY in 2023, accounting for 41% of total imported consumer goods. The rise in imports and sales of consumer goods drove the growth of the road freight market. Moreover, the number of retail products sold through the online distribution channel has grown substantially in recent times.

- Thailand expects to start producing lithium from a mine in its southwest in 2026, boosting its ambitions to become a regional electric vehicle production hub. It is forecasted that the Reung Kiet site could produce about 164,500 metric tons of lithium carbonate, used in lithium iron phosphate batteries for EVs. In the mining industry, the courier of materials, samples, equipment, and machinery to and from a base location is essential for getting the job done. As a result, the increase in mining activities is expected to boost the market demand.

Thailand Road Freight Transport Market Trends

Thailand's transport and storage sector experienced growth in 2022 driven by international trade and e-commerce

- Despite a decline in economic growth in 2023, the government boosted FDI and tourism to act as economic stimulus and contribute towards Thailand becoming a manufacturing hub especially for electric trucks. Furthermore, the recently finalized "EV 3.5 package" in 2023 offers a reduced purchase subsidy of USD 2,889.23 per vehicle, further supporting GDP contribution from the sector.

- In February 2024, the Transport Ministry announced plans to invest USD 18.83 billion in around 150 transport projects by the end of 2025 to enhance the country's infrastructure. In 2024, 64 projects will commence, with an additional 31 projects valued at USD 11.23 billion in the pipeline. For 2025, there are 57 new projects planned, totaling USD 7.59 billion. These initiatives include 18 motorway projects, 9 railway projects, and plans for regional port development, all aimed at bolstering the transport and storage sector's contribution to GDP in the future.

USD 2.35 billion was approved by Thailand's cabinet for the 2023 state fund to subsidize fuel costs

- The Thai government decided to waive the diesel excise tax from February 2022 to relieve the impact of the global oil price surge, but this led the government to lose USD 4.56 billion in revenue. The tax exemption and the diesel price subsidy under the fund played a key role in keeping the domestic diesel price at around USD 1.01 a liter since Feb 2022 till March 2024. The diesel price has gradually fallen since February 2023 to USD 0.92 a liter in response to declining global oil prices. Thailand's cabinet approved another USD 2.35 billion of new borrowing in 2023 for a state fund to subsidize fuel costs as the government battles high inflation.

- Despite an anticipated sluggish economic growth, demand for refined oil in Thailand, particularly jet fuel, is predicted to rise in 2024. Jet fuel consumption is forecasted to grow by 24.2% to an average of 16.8 million litres per day (MLD), up from 13.5 MLD in 2023. Diesel, gasoline, and gasohol are currently part of a state price subsidy program. Additionally, LNG prices are expected to decrease in 2024, leading power plant operators to rely less on fuel oil.

Thailand Road Freight Transport Industry Overview

The Thailand Road Freight Transport Market is fragmented, with the major five players in this market being DHL Group, JWD Group, Linfox Pty Ltd., NYK (Nippon Yusen Kaisha) Line and WHA GC Logistics Company Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 GDP Distribution By Economic Activity

- 4.2 GDP Growth By Economic Activity

- 4.3 Economic Performance And Profile

- 4.3.1 Trends in E-Commerce Industry

- 4.3.2 Trends in Manufacturing Industry

- 4.4 Transport And Storage Sector GDP

- 4.5 Logistics Performance

- 4.6 Length Of Roads

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Pricing Trends

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Major Truck Suppliers

- 4.13 Road Freight Tonnage Trends

- 4.14 Road Freight Pricing Trends

- 4.15 Modal Share

- 4.16 Inflation

- 4.17 Regulatory Framework

- 4.18 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 Truckload Specification

- 5.3.1 Full-Truck-Load (FTL)

- 5.3.2 Less than-Truck-Load (LTL)

- 5.4 Containerization

- 5.4.1 Containerized

- 5.4.2 Non-Containerized

- 5.5 Distance

- 5.5.1 Long Haul

- 5.5.2 Short Haul

- 5.6 Goods Configuration

- 5.6.1 Fluid Goods

- 5.6.2 Solid Goods

- 5.7 Temperature Control

- 5.7.1 Non-Temperature Controlled

- 5.7.2 Temperature Controlled

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 CTI Logistics Company Ltd.

- 6.4.2 DHL Group

- 6.4.3 GEODIS

- 6.4.4 JWD Group

- 6.4.5 Kiattana Transport Public Company Limited

- 6.4.6 Leo Global Logistics Public Company Limited

- 6.4.7 Linfox Pty Ltd.

- 6.4.8 NYK (Nippon Yusen Kaisha) Line

- 6.4.9 Profreight Group

- 6.4.10 WHA GC Logistics Company Ltd.

7 KEY STRATEGIC QUESTIONS FOR ROAD FREIGHT CEOS

8 APPENDIX

- 8.1 Global Logistics Market Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

02-2729-4219

+886-2-2729-4219