|

市場調查報告書

商品編碼

1692551

法國公路貨運:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)France Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

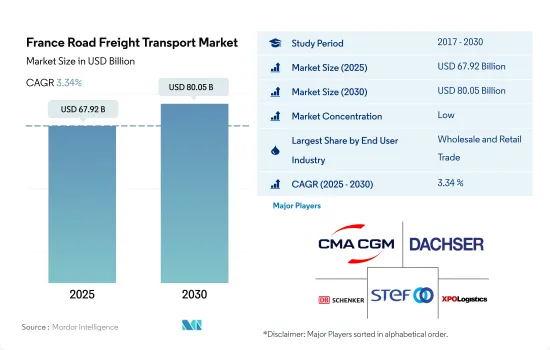

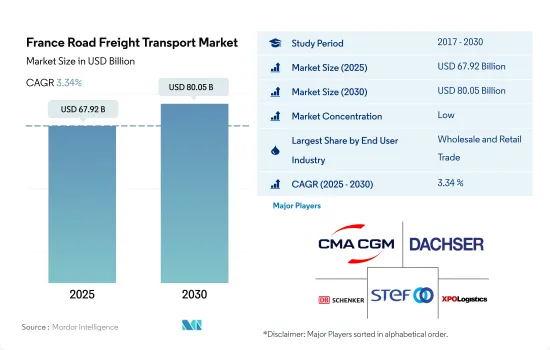

預計 2025 年法國公路貨運市場規模為 679.2 億美元,到 2030 年將達到 800.5 億美元,預測期間(2025-2030 年)的複合年成長率為 3.34%。

法國電子商務市場激增推動市場成長

- 2023年,法國電子商務產業預計將實現與前一年同期比較增7%以上,到2024年底將成長11%以上。蓬勃發展的電子商務格局正在刺激對公路貨運服務的需求成長。這一成長證實了法國充滿活力的數位市場在經濟挑戰面前具有韌性。法國數位基礎設施的不斷加強正在簡化線上交易並改善用戶體驗。值得注意的是,到2023年,將有近4,000萬法國消費者進行網路購物,平均每月下單約5次。

- 未來幾年,法國計畫每年招募2萬名年輕人進入農業領域,較目前的1.2萬至1.4萬人大幅增加。此外,作為雄心勃勃的「法國2030」計畫的一部分,法國政府正在向農業領域投入超過20億美元。這些投資大部分流向了法國農業技術公司和新興企業。這些努力有望推動最終用戶市場向前發展。

法國公路貨運市場趨勢

法國正在投資 10.6 億美元用於道路現代化建設,投資 1,060 億美元用於鐵路基礎建設,以促進其物流業的發展。

- 2023年,法國宣布了一項1,067.4億美元的投資策略,預計將於2040年完成。這項由政府主導的計劃重點是加強和現代化該國的鐵路基礎設施。該計畫的核心是引進通往各大城市的高速通勤列車,以巴黎著名的 RER 系統為藍本。該項目涉及法國國家鐵路公司 SNCF、歐盟和地方當局的合作。

- 2024 年 7 月,Solaris訂單。這些公車預計將於 2025 年初交付,並將加強 Artois Mobility 減少二氧化碳排放的努力,特別是在蘭斯和貝蘇納地區。 Solaris Urbino 12 氫氣公車的車頂配備了 70 kW 燃料電池,並配有 Solaris 高功率牽引電池,可在電力需求高峰時提供額外支援。

俄羅斯將增加對法國的液化天然氣供應,以因應俄烏戰爭造成的燃料短缺

- 截至 2024 年 7 月 12 日的一周,法國柴油和超級無鉛燃料的價格略有上漲。柴油價格為每公升 1.84 美元(含稅)。 2024年前三個月,俄羅斯向法國供應的液化天然氣比2023年同期成長超過歐盟其他國家。 2024年迄今,巴黎已向俄羅斯支付了超過6.4049億美元的天然氣供應,並敦促法國減少購買量。俄羅斯入侵烏克蘭兩年後,烏克蘭與俄羅斯的天然氣貿易不斷成長,而馬克宏也試圖採取更強硬的立場來支持基輔。

- 2027年,歐盟將引進新的碳定價體系-排放交易體系2(ETS2)。歐盟立法者最初同意在 2023 年將二氧化碳排放量限制在每噸 48.03 美元,並對每公升柴油和汽油附加稅。

法國公路貨運業概況

法國公路貨運市場較為分散,其中最大的五家公司(按字母順序排列)分別是法國達飛集團(CMA CGM Group,包括 CEVA Logistics)、德莎集團(Dachser)、德國鐵路股份公司(Deutsche Bahn AG,包括 DB Schenker)、STEF 集團和 XPO, Inc.

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 按經濟活動分類的GDP分佈

- 經濟活動GDP成長

- 經濟表現及概況

- 電子商務產業趨勢

- 製造業趨勢

- 交通運輸倉儲業GDP

- 物流績效

- 道路長度

- 出口趨勢

- 進口趨勢

- 燃油價格趨勢

- 卡車運輸成本

- 卡車持有量(按類型)

- 主要卡車供應商

- 公路貨運噸位趨勢

- 公路貨運價格趨勢

- 模態共享

- 通貨膨脹率

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 最終用戶產業

- 農業、漁業和林業

- 建設業

- 製造業

- 石油和天然氣、採礦和採石

- 批發和零售

- 其他

- 匯出目的地

- 國內的

- 國際貨運

- 卡車負載容量

- 整車裝載 (FTL)

- 零擔運輸 (LTL)

- 貨櫃運輸

- 貨櫃運輸

- 沒有容器

- 運輸距離

- 遠距

- 短途運輸

- 產品成分

- 流體產品

- 固體貨物

- 溫度控制

- 非溫控

- 溫度控制

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- CMA CGM Group(including CEVA Logistics)

- Dachser

- Deutsche Bahn AG(including DB Schenker)

- DHL Group

- DSV A/S(De Sammensluttede Vognmaend af Air and Sea)

- Expeditors International of Washington, Inc.

- FM Logistics

- Lactalis Group(including Lactalis Logistique & Transports)

- Reyes Holdings(including Martin Brower)

- STEF Group

- XPO, Inc.

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 全球物流市場概覽

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(市場促進因素、限制因素、機會)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

- 外匯

簡介目錄

Product Code: 92368

The France Road Freight Transport Market size is estimated at 67.92 billion USD in 2025, and is expected to reach 80.05 billion USD by 2030, growing at a CAGR of 3.34% during the forecast period (2025-2030).

Surge in French e-commerce market propels the growth of the market

- In 2023, France's e-commerce sector witnessed a YoY growth exceeding 7%, with projections suggesting an uptick of over 11% by the end of 2024. This burgeoning e-commerce landscape is fueling an increased demand for road freight services. Such growth underscores a dynamic digital marketplace in France, resilient even amidst economic challenges. Continuous enhancements to France's digital infrastructure are streamlining online transactions and elevating user experiences. Notably, in 2023, close to 40 million French consumers engaged in online shopping, averaging about five orders each month.

- In the coming years, France aims to recruit 20,000 young individuals annually into its agricultural sector, marking a notable rise from the current intake of 12,000-14,000, all in a bid to enhance the industry's output. Furthermore, as part of its ambitious France 2030 program, the French government is channeling over USD 2 billion into the agricultural sector. A significant chunk of this investment is directed towards French agritech firms and startups. Such initiatives are poised to propel the end-user market forward.

France Road Freight Transport Market Trends

France is boosting its logistics industry with USD 1.06 billion investments toward road modernization and USD 106 billion towards rail infrastructure

- In 2023, France unveiled a USD 106.74 billion investment strategy slated for completion by 2040, aligning with its commitment to slash carbon emissions. The initiative, spearheaded by the government, focuses on bolstering and modernizing the nation's rail infrastructure. Central to the plan is the introduction of high-speed commuter trains, mirroring Paris's renowned RER system, in key urban centers. Collaborating on this endeavor are France's national rail entity, SNCF, alongside the European Union and regional administrations.

- In July 2024, Solaris secured an order from Artois Mobilites, part of the TADAO transport network in northern France, for four 12-meter Urbino hydrogen buses. These buses, slated for delivery in early 2025, will bolster Artois Mobilites' efforts to reduce carbon emissions, particularly in the Lens and Bethune regions. The Solaris Urbino 12 hydrogen buses will boast 70 kW fuel cells on their roofs and will be complemented by Solaris High Power traction batteries, providing additional support during peak electricity demand.

Increase in Russian LNG deliveries to France catering to fuel shortages caused by Russia-Ukraine war

- For the week ending July 12, 2024, diesel and super unleaded motor fuel prices in France saw a modest uptick. Diesel was priced at USD 1.84 per liter, inclusive of all taxes. In the first three months of 2024, Russian LNG deliveries to France increased more than to any other EU country compared to 2023. Paris has paid over USD 640.49 million to Russia for gas supplies since the start of 2024, prompting calls for France to reduce its purchases. This growing gas trade with Russia occurs as Macron aims to take a tougher stance in support of Kyiv, two years after Russia's full-scale invasion of Ukraine.

- In 2027, the EU is set to implement a new carbon pricing scheme, the Emissions Trading System 2 (ETS2), targeting CO2 emissions from buildings and road transport. Initially agreed upon in 2023, EU legislators assured that the pricing would cap at USD 48.03 per tonne of CO2, translating to an estimated 10-cent surcharge on each liter of diesel or petrol.

France Road Freight Transport Industry Overview

The France Road Freight Transport Market is fragmented, with the major five players in this market being CMA CGM Group (including CEVA Logistics), Dachser, Deutsche Bahn AG (including DB Schenker), STEF Group and XPO, Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 GDP Distribution By Economic Activity

- 4.2 GDP Growth By Economic Activity

- 4.3 Economic Performance And Profile

- 4.3.1 Trends in E-Commerce Industry

- 4.3.2 Trends in Manufacturing Industry

- 4.4 Transport And Storage Sector GDP

- 4.5 Logistics Performance

- 4.6 Length Of Roads

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Pricing Trends

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Major Truck Suppliers

- 4.13 Road Freight Tonnage Trends

- 4.14 Road Freight Pricing Trends

- 4.15 Modal Share

- 4.16 Inflation

- 4.17 Regulatory Framework

- 4.18 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 Truckload Specification

- 5.3.1 Full-Truck-Load (FTL)

- 5.3.2 Less than-Truck-Load (LTL)

- 5.4 Containerization

- 5.4.1 Containerized

- 5.4.2 Non-Containerized

- 5.5 Distance

- 5.5.1 Long Haul

- 5.5.2 Short Haul

- 5.6 Goods Configuration

- 5.6.1 Fluid Goods

- 5.6.2 Solid Goods

- 5.7 Temperature Control

- 5.7.1 Non-Temperature Controlled

- 5.7.2 Temperature Controlled

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 CMA CGM Group (including CEVA Logistics)

- 6.4.2 Dachser

- 6.4.3 Deutsche Bahn AG (including DB Schenker)

- 6.4.4 DHL Group

- 6.4.5 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.6 Expeditors International of Washington, Inc.

- 6.4.7 FM Logistics

- 6.4.8 Lactalis Group (including Lactalis Logistique & Transports)

- 6.4.9 Reyes Holdings (including Martin Brower)

- 6.4.10 STEF Group

- 6.4.11 XPO, Inc.

7 KEY STRATEGIC QUESTIONS FOR ROAD FREIGHT CEOS

8 APPENDIX

- 8.1 Global Logistics Market Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

02-2729-4219

+886-2-2729-4219