|

市場調查報告書

商品編碼

1689844

印度低溫運輸物流-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)India Cold Chain Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

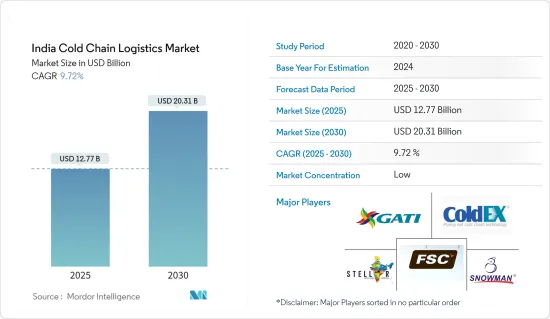

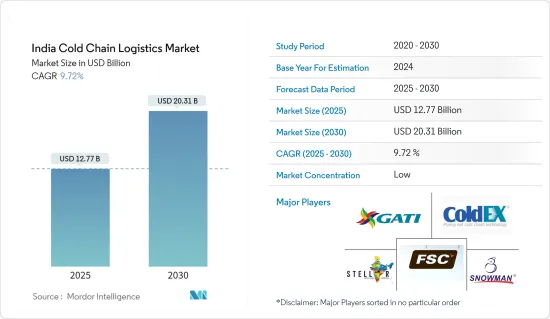

印度低溫運輸物流市場規模預計在2025年為127.7億美元,預計到2030年將達到203.1億美元,預測期內(2025-2030年)的複合年成長率為9.72%。

關鍵亮點

- 對生鮮產品的需求不斷成長,推動著市場成長。消費行為的改變導致電子商務和網路購物推動市場發展。

- 印度低溫運輸產業尚處於起步階段,是低溫運輸倉儲物流產業中最有前景的細分領域之一。印度預計在 2027 年成為世界第五大經濟體。作為在全球市場上佔有重要地位的重要參與企業,印度對供應鏈基礎設施的投資預計將逐年增加。幸運的是,印度政府一直是低溫運輸產業發展的推動力量,透過各種補貼計畫和津貼鼓勵私營部門參與。食品加工工業部(MoFPI)已推出以低溫運輸、增值和保鮮基礎設施為重點的計畫。

- 印度是世界上最大的牛奶生產國和第二大水果和蔬菜生產國,同時也生產大量的魚貝類、肉類和家禽。然而,低溫運輸供應不成熟導致食品和農產品大量損失。根據聯合國糧食及農業組織統計,全球每年約有13億噸糧食損失,佔糧食產量的三分之一。據估計,這些損失每年高達80億美元至150億美元。為了避免這些問題,開發低溫運輸環節是必要的。除了生鮮食品外,製藥業是另一個依賴可靠冷鏈供應鏈網路的重要領域。疫苗、救命藥物和其他藥物成分的儲存和運輸與強大且管理良好的冷鏈供應鏈網路相連。

- 2023年12月,印度政府將實施多項計劃,為易腐爛的園藝產品建立冷藏設施,並將在全國範圍內提供財政援助。由於該國的低溫運輸基礎設施,農業部門正在經歷模式轉移。為了實現這一目標,印度政府實施了多項計劃,為新鮮園藝作物建立冷藏庫,並在全國範圍內提供財政援助。

- 這些計劃由需求和企業家主導,並由政府透過各自的國家園藝部門(SHM)以信貸掛鉤補貼的形式提供支持,一般地區計劃成本為 35%,山區和專業地區項目成本為 50%。該措施旨在避免對農業和園藝作物造成損害。綜合園藝發展計畫(MIDH)還將提供財政援助,用於建立冷藏庫以及預冷、冷藏室、包裝廠、綜合包裝廠、儲存、冷凍運輸和成熟商店。

- 根據聯合國糧食及農業組織統計,每年生產的糧食有三分之一(約13億噸)被損失。這些損失估計每年在80億美元至150億美元之間。為了防止這些問題,印度的低溫運輸產業必須發展。

印度低溫運輸物流市場趨勢

冷藏產業未來將獲得顯著發展勢頭

- 對低溫運輸儲存設施的需求不斷成長以及冰淇淋、肉類、魚貝類等冷凍產品類型的增加正在推動低溫運輸市場向前發展。

- 預計低溫運輸物流市場的冷凍部分將在預測期內快速成長,因為冷凍可以使食物變得更加惰性,從而延長保存期限。

- 出於安全或品質原因,冷藏食品需要在整個保存期限內儲存在冷藏溫度下(低於 80°C,目標是 50°C)。

- 這種冷凍方法有助於減緩導致食物變質並限制其保存期限的生物和化學過程。冷凍食品比冷藏食品更有營養、更美味。對便利性的需求推動了消費者對冷凍食品的需求。

- 根據聯合國糧食及農業組織 (FAO) 的數據,超過 40% 的食物浪費發生在收穫後和加工過程中,尤其是在較貧窮的國家。這需要建立長期、節能的低溫運輸,可以使這些國家的糧食供應增加約 15%(超過 2.5 億噸)。

預計亞太地區將佔據主要市場佔有率

- 印度是世界第二大水果和蔬菜生產國,分別佔全球產量的11.38%和11.78%。印度是芒果、香蕉、番石榴、木瓜、檸檬、酸橙和秋葵的最大生產國,也是馬鈴薯、番茄、洋蔥、高麗菜、花椰菜和茄子的第二大生產國。印度農業研究理事會中央收穫後技術實驗室 (CIPHET) 進行的一項研究指出,印度水果和蔬菜的收穫後損失佔該國園藝產量的 4.58% 至 15.88%。印度政府透過園藝綜合發展計畫(MIDH)擴大了種植面積,發展了苗圃,並建造了魚塘。

- 資訊來源透露,過去十年來,糧食產量持續成長,從2012-13年的2.571億噸增加到2021-22年的3.156億噸。 2022-23年糧食產量將比過去五年的平均產量高出3,080萬噸。預計 2022-23 年水果產量為 1.0834 億噸,而 2021-22 年為 1.0751 億噸。 2022-23 年蔬菜產量預計為 2.1291 億噸,而 2021-22 年為 2.0914 億噸。

- 印度是世界最大的香蕉、木瓜、芒果、番石榴、生薑和秋葵生產國。 2021-22 年期間,印度出口了價值 15.276 億美元的新鮮水果和蔬菜,其中水果價值 7.507 億美元,蔬菜價值 7.6701 億美元。印度主要向鄰國出口,分別是阿拉伯聯合大公國、孟加拉、巴基斯坦、沙烏地阿拉伯、斯里蘭卡和尼泊爾。

印度低溫運輸物流產業概況

印度的低溫運輸物流市場比較分散,有大量的本地參與者來滿足日益成長的需求。市場上的一些主要參與者包括 Gati Kausar India Pvt。有限公司、雪人物流私人有限公司有限公司、ColdEx Logistics Pvt. Ltd 和 Stellar Value Chain Solutions Pvt.有限公司。投資於簡化供應鏈並擁有先進技術的公司將佔據有利地位,從而佔領更大的市場佔有率。此外,全球公司可以與當地企業合作投資市場並獲取收益。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

- 分析方法

- 研究階段

第3章執行摘要

第4章 市場動態

- 當前市場狀況

- 市場動態

- 驅動程式

- 都市化和生活方式的改變

- 零售商店中組織化食品的興起

- 製藥業需求不斷成長

- 限制因素

- 缺乏足夠的基礎設施

- 機會

- 政府優惠政策

- 新鮮農產品貿易增加

- 驅動程式

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 技術趨勢和自動化

- 政府法規和舉措

- 專注於環境和溫度控制存儲

- 排放標準和法規對低溫運輸產業的影響

- COVID-19 市場影響

第5章市場區隔

- 按服務

- 貯存

- 運輸

- 附加價值服務(速凍、貼標、庫存管理等)

- 按溫度類型

- 冷藏

- 《冷凍》

- 按應用

- 園藝(新鮮水果和蔬菜)

- 乳製品(牛奶、冰淇淋、奶油等)

- 肉類、魚類、家禽

- 加工食品

- 製藥、生命科學、化學

- 其他

第6章 競爭格局

- 市場集中度概覽

- 公司簡介

- Gati Kausar India Pvt Ltd

- Snowman Logistics Pvt Ltd

- ColdEx Logistics Pvt Ltd

- Stellar Value Chain Solutions Pvt Ltd

- TCI Express

- Future Supply Chain Solutions

- MJ Logistics Services Ltd

- Fresh and Healthy Services Ltd

- RK Foodland Private Ltd

- Gubba Cold Storages Ltd

- Cold Star Logistics Pvt Ltd*

- 其他公司

第7章 市場機會與未來趨勢

第 8 章 附錄

The India Cold Chain Logistics Market size is estimated at USD 12.77 billion in 2025, and is expected to reach USD 20.31 billion by 2030, at a CAGR of 9.72% during the forecast period (2025-2030).

Key Highlights

- The rising demand for perishable goods has been propelling market growth. Due to a shift in consumer behavior, e-commerce and online pharmaceutical shopping are driving the market.

- The Indian cold chain industry is still in its infancy, making it one of the most promising fields in the cold chain warehousing and logistics industry. India is on track to become the world's fifth-largest economy by 2027. As a well-established key player in the global market, investment in India's supply chain infrastructure is expected to rise year on year. Fortunately, the Indian government is a driving force in developing the cold chain industry, and it encourages private participation through various subsidy schemes and grants. The Ministry of Food Processing Industries (MoFPI) launched a program dedicated to cold chain, value addition, and preservation infrastructure.

- India is the world's largest producer of milk and the second-largest producer of fruits and vegetables, and it produces a significant amount of seafood, meat, and poultry. However, due to the inexperienced cold chain supply, food and agricultural products are significantly lost. According to the Food and Agriculture Organization, approximately 1.3 billion tonnes of food are lost yearly, accounting for one-third of total food production. These losses are estimated to be between USD 8 and USD 15 billion annually. To avoid these issues, the cold chain sector must be developed. Aside from perishable food, the pharmaceutical industry is another critical sector that relies on a reliable cold supply chain network. Vaccine storage and transportation, life-saving drugs, and other pharma raw materials led to a robust and well-managed cold supply chain network.

- In December 2023, the Indian government is implementing various schemes for setting up cold storage for perishable horticultural produce, under which financial assistance will be available throughout the country. The agricultural sector is witnessing a paradigm shift with its cold chain infrastructure in the country. Aiming in the same direction, the Indian government is implementing various schemes for setting up cold storage for perishable horticultural produce, for which financial assistance is available throughout the country.

- The components are demand/entrepreneur driven, for which the government assists in the form of credit-linked subsidy, providing 35% of the project cost in general areas and 50% in hilly and scheduled areas through respective State Horticulture Missions (SHMs). The initiative is aimed at avoiding damage to agriculture and horticultural produce. Besides cold storage, financial assistance is also provided for setting up a pre-cooling unit, cold room, pack houses, integrated pack house, preservation unit, reefer transport, and ripening chamber under the Mission for Integrated Development of Horticulture (MIDH).

- According to the Food and Agriculture Organization, one-third, or around 1.3 billion tonnes, of all food produced annually is lost. These losses cost USD 8 to 15 billion annually, according to estimates. To prevent these issues, the cold chain industry must grow in India.

India Cold Chain Logistics Market Trends

Chilled Segment is Gaining Huge Momentum in the Coming Years

- The expanding need for cold chain storage facilities and the increasing varieties of frozen commodities such as ice cream, meat, and seafood are moving the cold chain market ahead.

- Because frozen food products lengthen the storage time of foods by rendering them more inert, the frozen sector of the cold chain logistics market is expected to grow quickly during the projected period.

- Chilled foods, for safety or quality reasons, are designed to be stored at refrigeration temperatures (at or below 80C, targeting 50C) throughout their life.

- This method of freezing aids in slowing biological and chemical processes that cause food to decay and limit its shelf life. Frozen food has more nutrients than chilled food, which makes it more appetizing. The need for convenience is driving up consumer demand for frozen foods.

- According to the United Nations Food and Agricultural Organization (FAO), more than 40% of food losses occur during post-harvesting and processing, particularly in poor nations. This necessitates the establishment of long-term, energy-efficient cold chains capable of increasing food supply in these nations by about 15%, or over 250 million tons.

Asia-Pacific is Expected to Hold Significant Market Share

- India is the second-largest producer of fruits and vegetables, with its share in world production at 11.38% and 11.78%, respectively. India is the largest producer of mango, banana, guava, papaya, lemon, lime, and okra and the second-largest producer of potato, tomato, onion, cabbage, cauliflower, and brinjal. A study conducted by the ICAR-Central Institute of Post-Harvest Engineering & Technology (CIPHET) points out that in India, for fruits and vegetables, the post-harvest losses range from 4.58 to 15.88% of the country's horticulture production. The Government of India, through the Mission for Integrated Development of Horticulture (MIDH), has enabled area expansion, the development of nurseries, and the construction of farm ponds.

- According to the sources, food grain output has consistently grown over the last decade from 257.1 million tons in 2012-13 to 315.6 million tons in 2021-22. Food grain production in 2022-23 is 30.8 million tons higher than the previous five years' average. Fruit production is estimated to be 108.34 million tonnes in the year 2022-23 as compared to 107.51 million tonnes in the year 2021-22. The production of vegetables is estimated to be 212.91 million tonnes in the year 2022-23 compared to 209.14 million tonnes in the year 2021-22.

- India leads the world in the production of banana, papaya, mango, and guava, along with ginger and okra. During 2021-2022, India exported fresh fruits and vegetables worth USD 1.527.60 million, which comprised fruits worth USD 750.7 million and vegetables worth USD 767.01 million. India mostly exports to its neighbors, namely the UAE, Bangladesh, Pakistan, Saudi Arabia, Sri Lanka, and Nepal.

India Cold Chain Logistics Industry Overview

The Indian cold chain logistics market is fragmented in nature, with the presence of a large number of local players attending to the growing demand. Some of the major players in the market include Gati Kausar India Pvt. Ltd, Snowman Logistics Pvt. Ltd, ColdEx Logistics Pvt. Ltd, and Stellar Value Chain Solutions Pvt. Ltd, among others. Companies investing in streamlining the supply chain and having advanced technology have an edge in getting a good share of the market. Furthermore, global players can partner with local companies to invest in the market and gain profits.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Method

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Urbanization and Changes in Lifestyles

- 4.2.1.2 Increased Organized Food in Retail Stores

- 4.2.1.3 Increasing Demand from the Pharmaceutical Industry

- 4.2.2 Restraints

- 4.2.2.1 Lack of Sufficient Infrastructure

- 4.2.3 Opportunities

- 4.2.3.1 Favourable Government Policies

- 4.2.3.2 Increasing Perishable Trade

- 4.2.1 Drivers

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Technological Trends and Automation

- 4.6 Government Regulations and Initiatives

- 4.7 Spotlight on Ambient/Temperature-controlled Storage

- 4.8 Impact of Emission Standards and Regulations on Cold Chain Industry

- 4.9 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Storage

- 5.1.2 Transportation

- 5.1.3 Value-added Services (Blast Freezing, Labeling, Inventory Management, etc.)

- 5.2 By Temperature Type

- 5.2.1 Chilled

- 5.2.2 Frozen

- 5.3 By Application

- 5.3.1 Horticulture (Fresh Fruits & Vegetables)

- 5.3.2 Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3 Meats, Fish, Poultry

- 5.3.4 Processed Food Products

- 5.3.5 Pharma, Life Sciences, and Chemicals

- 5.3.6 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Gati Kausar India Pvt Ltd

- 6.2.2 Snowman Logistics Pvt Ltd

- 6.2.3 ColdEx Logistics Pvt Ltd

- 6.2.4 Stellar Value Chain Solutions Pvt Ltd

- 6.2.5 TCI Express

- 6.2.6 Future Supply Chain Solutions

- 6.2.7 M.J. Logistics Services Ltd

- 6.2.8 Fresh and Healthy Services Ltd

- 6.2.9 R.K. Foodland Private Ltd

- 6.2.10 Gubba Cold Storages Ltd

- 6.2.11 Cold Star Logistics Pvt Ltd*

- 6.3 Other Companies