|

市場調查報告書

商品編碼

1871093

冷鏈物流設備市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Cold Chain Logistics Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

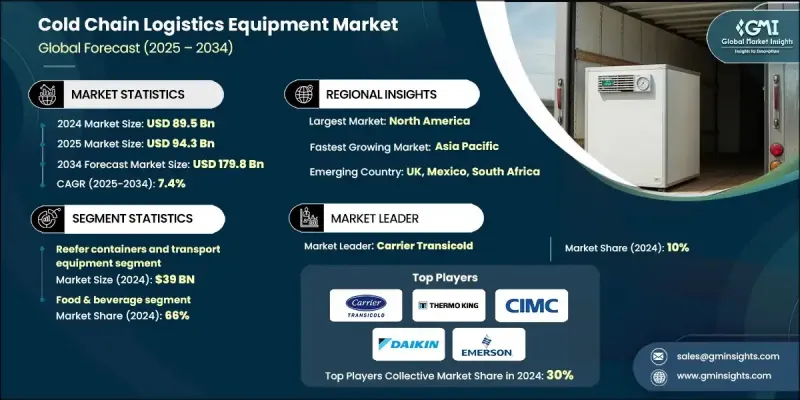

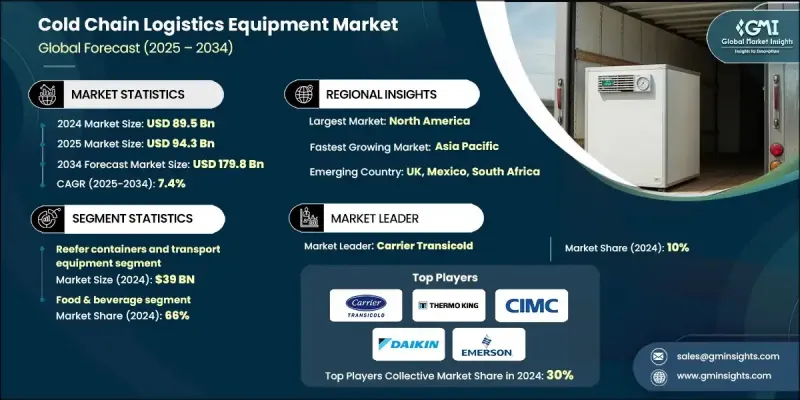

2024年全球冷鏈物流設備市場價值為895億美元,預計2034年將以7.4%的複合年成長率成長至1,798億美元。

全球對溫度敏感型產品(例如藥品、生物製劑、疫苗、新鮮農產品、海鮮、乳製品和冷凍食品)的需求不斷成長,推動了市場成長。製藥業高度依賴超低溫儲存和運輸系統來保存生物製劑和mRNA療法,對先進的冷藏物流設備產生了強勁的需求。同樣,新鮮和有機食品消費量的成長也促使企業投資冷藏儲存和運輸系統,以確保整個供應鏈的產品安全和品質。隨著全球化將易腐貨物的流通範圍擴展到各大洲,物流供應商擴大採用溫控解決方案來保持產品完整性並減少變質。人們對食品安全和永續性的日益關注也加速了向先進冷鏈系統的轉型,這些系統旨在從生產到最終交付始終保持穩定的溫度條件。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 895億美元 |

| 預測值 | 1798億美元 |

| 複合年成長率 | 7.4% |

2024年,冷藏貨櫃及運輸設備市場規模達390億美元。這些冷藏貨櫃對國際物流至關重要,可在海運、鐵路和公路等多模式過程中提供高效的溫度控制,確保易腐貨物在長途運輸中保持品質。其適應性和可靠性使其成為全球冷鏈營運不可或缺的一部分。

2024年,食品飲料產業佔了66%的市場佔有率,這主要得益於消費者對新鮮、天然和即食產品的偏好日益成長。為了防止產品變質和污染,精準的溫度控制至關重要,這促使生產商、零售商和分銷商大力投資先進的製冷基礎設施,包括冷庫、溫度感測系統和冷藏運輸車輛。這些投資有助於產品從農場到零售店的無縫流通,同時確保產品的高安全性和新鮮度。

2024年,美國冷鏈物流設備市場佔78.2%的市場佔有率,市場規模達249億美元。美國完善的基礎設施、嚴格的監管環境以及對溫控貨物的強勁需求,使其成為全球冷鏈營運的重要樞紐。對智慧監控技術、冷庫擴建和高效運輸系統的持續投資,進一步鞏固了美國在該領域的領先地位。蓬勃發展的電子商務、食品配送和製藥業也為此成長提供了支撐,這些產業高度依賴可靠的冷鏈系統。

全球冷鏈物流設備市場的主要參與者包括開利運輸冷凍(聯合技術公司)、艾默生電氣(科普蘭)、江森自控、瑞科德、丹佛斯、ORBCOMM、德納鋼鐵、大金工業、冷王(特靈科技)、博瑞達貿易製冷、TSSC、熱力動力、中國國際海運冷王(特靈科技)、博瑞達貿易製冷、TSSC、熱力動力、中國國際海運貨櫃運輸有限公司(Canotti)。這些企業正採取多種策略來加強其全球影響力並保持競爭優勢。領先的製造商正在投資先進的冷凍技術,例如節能壓縮機、智慧感測器和即時監控系統,以改善溫度控制並降低能耗。與物流供應商和食品生產商的策略合作與夥伴關係正在拓展分銷網路並最佳化供應鏈。持續的研發投入專注於開發環保冷媒和永續設計,以滿足全球環境標準。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 對溫度敏感產品的需求不斷成長

- 生鮮電商和線上食品配送業務成長

- 永續性和綠色物流

- 產業陷阱與挑戰

- 溫度控制故障

- 高昂的營運和能源成本

- 機會

- 技術創新

- 模組化和移動式冷藏解決方案

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依設備類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依設備類型分類,2021-2034年

- 主要趨勢

- 冷藏貨櫃和運輸設備

- 標準冷藏貨櫃(10英尺、20英尺、40英尺)

- 冷藏卡車和拖車

- 專業海上貨櫃(DNV認證)

- 移動式製冷機組

- 冷庫基礎設施

- 模組化冷藏室

- 溫控倉庫

- 速凍設備

- 步入式冷藏室和冷凍室

- 監控系統

- 支援物聯網的感測器

- 數據記錄器和記錄儀

- SCADA監控系統

- 區塊鏈溯源平台

- 冷凍設備

- 中央冷凍系統

- 冷凝機組

- 壓縮機和蒸發器

- 熱交換器

第6章:市場估算與預測:依溫度範圍分類,2021-2034年

- 主要趨勢

- 冷凍儲存(-25°C 至 -18°C)

- 冷藏(0°C 至 +8°C)

- 冷藏(+8°C 至 +15°C)

- 環境溫度加(+15°C 至 +25°C)

- 超低溫(-70°C 至 -40°C)

第7章:市場估算與預測:依服務類型分類,2021-2034年

- 主要趨勢

- 儲存服務

- 交通運輸服務

- 加值服務

- 速凍

- 標籤和包裝

- 庫存管理

- 品質管制

第8章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 餐飲

- 新鮮農產品(水果、蔬菜)

- 乳製品

- 肉類和海鮮

- 冷凍食品

- 加工食品

- 醫藥與醫療保健

- 疫苗和生物製劑

- 對溫度敏感的藥物

- 血液製品

- 醫療器材

- 化學品和工業

- 特種化學品

- 工業材料

- 電子元件

第9章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 物流和第三方物流供應商

- 食品製造商

- 製藥公司

- 零售連鎖店

- 電子商務平台

- 政府和醫療機構

第10章:市場估價與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 直接的

- 間接

第11章:市場估計與預測:按地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- Bureida Trading & Refrigeration

- Carrier Transicold (United Technologies)

- China International Marine Containers

- Coldstores Group of Saudi Arabia (CGS)

- Daikin Industries

- DANA Steel

- Danfoss

- Emerson Electric (Copeland)

- Johnson Controls

- ORBCOMM

- Rivacold

- Thermo King (Trane Technologies)

- Thermodynamics

- TSSC

- Zanotti spa

- Zhengzhou Kaixue Cold Chain

The Global Cold Chain Logistics Equipment Market was valued at USD 89.5 Billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 179.8 Billion by 2034.

Market growth is fueled by the increasing global demand for temperature-sensitive products such as pharmaceuticals, biologics, vaccines, fresh produce, seafood, dairy, and frozen foods. The pharmaceutical industry relies heavily on ultra-low-temperature storage and transport systems to preserve biologics and mRNA-based therapies, creating strong demand for advanced refrigerated logistics equipment. Similarly, the rising consumption of fresh and organic food products has prompted investments in refrigerated storage and transportation systems to ensure product safety and quality throughout the supply chain. With globalization extending the reach of perishable goods across continents, logistics providers are increasingly adopting temperature-controlled solutions to preserve product integrity and reduce spoilage. Growing awareness about food safety and sustainability is also accelerating the transition toward advanced cold chain systems designed to maintain consistent temperature conditions from production to final delivery.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $89.5 Billion |

| Forecast Value | $179.8 Billion |

| CAGR | 7.4% |

In 2024, the reefer containers and transport equipment segment generated USD 39 Billion. These refrigerated containers are vital for international logistics, offering efficient temperature control during multimodal transportation spanning sea, rail, and road, ensuring perishable goods maintain quality during long-distance shipment. Their adaptability and reliability make them indispensable for global cold chain operations.

The food & beverage sector held a 66% share in 2024, driven by rising consumer preference for fresh, natural, and ready-to-eat products. The need for precise temperature regulation to prevent spoilage and contamination has led producers, retailers, and distributors to invest heavily in advanced refrigeration infrastructure, including cold storage units, temperature-sensing systems, and refrigerated transport vehicles. These investments support seamless product movement from farms to retail outlets while maintaining high safety and freshness standards.

U.S. Cold Chain Logistics Equipment Market held 78.2% share and generated USD 24.9 Billion in 2024. The country's well-established infrastructure, strict regulatory environment, and strong demand for temperature-sensitive goods make it a major global hub for cold chain operations. Continuous investments in smart monitoring technologies, cold storage expansion, and efficient transportation systems are further strengthening the country's dominance. The growth is also supported by the thriving e-commerce, food delivery, and pharmaceutical industries, which rely heavily on reliable cold chain systems.

Key players in the Global Cold Chain Logistics Equipment Market include Carrier Transicold (United Technologies), Emerson Electric (Copeland), Johnson Controls, Rivacold, Danfoss, ORBCOMM, DANA Steel, Daikin Industries, Thermo King (Trane Technologies), Bureida Trading & Refrigeration, TSSC, Thermodynamics, China International Marine Containers, Zanotti Spa, Zhengzhou Kaixue Cold Chain, and Coldstores Group of Saudi Arabia (CGS). Companies in the Cold Chain Logistics Equipment Market are adopting multiple strategies to strengthen their global presence and maintain a competitive advantage. Leading manufacturers are investing in advanced refrigeration technologies, such as energy-efficient compressors, smart sensors, and real-time monitoring systems, to improve temperature control and reduce energy consumption. Strategic collaborations and partnerships with logistics providers and food producers are expanding distribution networks and optimizing supply chains. Continuous R&D efforts are focused on developing eco-friendly refrigerants and sustainable designs to meet global environmental standards.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Temperature range

- 2.2.4 Service type

- 2.2.5 Application

- 2.2.6 End use industry

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for temperature-sensitive products

- 3.2.1.2 Growth in e-grocery and online food delivery

- 3.2.1.3 Sustainability and green logistics

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Temperature control failures

- 3.2.2.2 High operational and energy costs

- 3.2.3 Opportunities

- 3.2.3.1 Technological innovation

- 3.2.3.2 Modular and mobile cold storage solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By equipment type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Reefer containers and transport equipment

- 5.2.1 Standard reefer containers (10ft, 20ft, 40ft)

- 5.2.2 Refrigerated trucks and trailers

- 5.2.3 Specialized offshore containers (DNV certified)

- 5.2.4 Mobile refrigeration units

- 5.3 Cold storage infrastructure

- 5.3.1 Modular cold rooms

- 5.3.2 Temperature-controlled warehouses

- 5.3.3 Blast freezing equipment

- 5.3.4 Walk-in coolers and freezers

- 5.4 Monitoring and control systems

- 5.4.1 IoT-enabled sensors

- 5.4.2 Data loggers and recorders

- 5.4.3 SCADA monitoring systems

- 5.4.4 Blockchain traceability platforms

- 5.5 Refrigeration equipment

- 5.5.1 Centralized refrigeration systems

- 5.5.2 Condensing units

- 5.5.3 Compressors and evaporators

- 5.5.4 Heat exchangers

Chapter 6 Market Estimates and Forecast, By Temperature Range, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Frozen storage (-25°C to -18°C)

- 6.3 Chilled storage (0°C to +8°C)

- 6.4 Cool storage (+8°C to +15°C)

- 6.5 Ambient plus (+15°C to +25°C)

- 6.6 Ultra-low temperature (-70°C to -40°C)

Chapter 7 Market Estimates and Forecast, By Service Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Storage services

- 7.3 Transportation services

- 7.4 Value-added services

- 7.4.1 Blast freezing

- 7.4.2 Labeling and packaging

- 7.4.3 Inventory management

- 7.4.4 Quality control

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.2.1 Fresh produce (fruits, vegetables)

- 8.2.2 Dairy products

- 8.2.3 Meat and seafood

- 8.2.4 Frozen foods

- 8.2.5 Processed foods

- 8.3 Pharmaceuticals & healthcare

- 8.3.1 Vaccines and biologics

- 8.3.2 Temperature-sensitive medicines

- 8.3.3 Blood products

- 8.3.4 Medical devices

- 8.4 Chemicals & industrial

- 8.4.1 Specialty chemicals

- 8.4.2 Industrial materials

- 8.4.3 Electronics components

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Logistics & 3PL providers

- 9.3 Food manufacturers

- 9.4 Pharmaceutical companies

- 9.5 Retail chains

- 9.6 E-commerce platforms

- 9.7 Government & healthcare institutions

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Bureida Trading & Refrigeration

- 12.2 Carrier Transicold (United Technologies)

- 12.3 China International Marine Containers

- 12.4 Coldstores Group of Saudi Arabia (CGS)

- 12.5 Daikin Industries

- 12.6 DANA Steel

- 12.7 Danfoss

- 12.8 Emerson Electric (Copeland)

- 12.9 Johnson Controls

- 12.10 ORBCOMM

- 12.11 Rivacold

- 12.12 Thermo King (Trane Technologies)

- 12.13 Thermodynamics

- 12.14 TSSC

- 12.15 Zanotti spa

- 12.16 Zhengzhou Kaixue Cold Chain