|

市場調查報告書

商品編碼

1683090

電子產品中的聚氨酯 (PU) 黏合劑:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Polyurethane (PU) Adhesives in Electronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

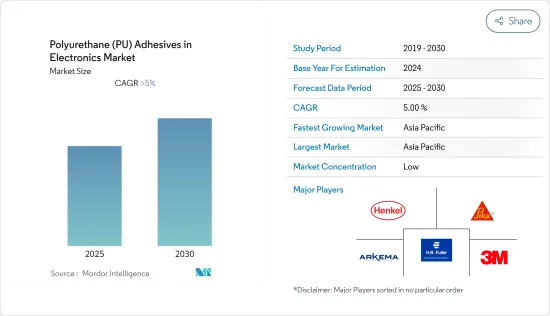

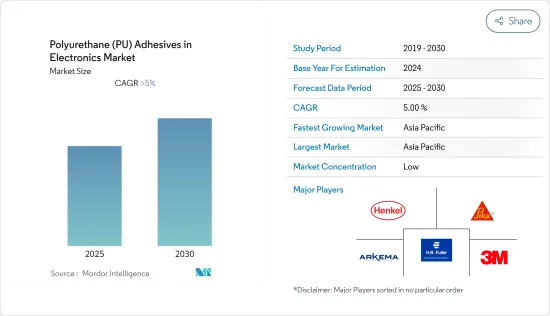

預測期內,電子產品聚氨酯 (PU) 黏合劑市場預計將以超過 5% 的複合年成長率成長

主要亮點

- 在產品類型中,導電膠預計將佔據市場主導地位。這是因為它們優異的固有特性(例如散熱能力)使其適用於許多應用。

- 全球範圍內不斷創新和發展先進技術可能會為電子市場的聚氨酯膠粘劑提供機會。

- 由於電子產品的生產、需求和出口,亞太地區是所研究市場中規模最大且成長最快的地區,這對電子應用領域中 PU 膠合劑的消費產生了重大影響。

聚氨酯 (PU) 膠合劑在電子產品的市場趨勢

導電膠黏劑佔市場主導地位

- 導電膠合劑用於電子工業,需要將各個零件固定在一起,以便電流在它們之間流動。

- PUR 雙組分黏合劑廣泛用於此目的,必須像快速固化環氧樹脂一樣混合或預先混合並冷凍。

- PUR 黏合劑還具有高剝離強度和柔韌性,使其適用於廣泛的電子應用。這些特性使其在全球電子市場上廣泛應用。

- 電子產業不斷對現有產品進行先進功能的革新,同時新電子設備和技術的發展推動了電子產業的生產和成長。

- 例如,目前推動電子產業生產的技術創新包括支援 5G 的智慧型手機、Chromecast 和智慧型揚聲器。

- 因此,預計上述因素將在預測期內推動全球電子應用領域 PUR 膠合劑的消費。

亞太地區佔市場主導地位

- 由於中國、日本、韓國等主要國家從事電子產品的生產和出口,亞太地區在電子市場的 PU 膠合劑消費中佔據主導地位。

- 無論從生產、出口或消費來看,中國都是該地區(甚至全球整體)最大的家電市場。中國是世界上最大的行動電話、電視機和電腦生產國。

- 此外,越南、韓國等國家受惠於相對較低的生產成本,推動了這些國家國內電子產品生產大幅成長。

- 因此,此類終端用戶產業擁有強大的生產基礎,且建設投資不斷增加,正在推動該國電子產品對聚氨酯(PU)膠合劑的消費。

電子產業聚氨酯 (PU) 膠黏劑概述

全球電子聚氨酯(PU)黏合劑市場本質上是分散的。市場的一些主要企業包括 3M、阿科瑪集團、HB Fuller、Sika AG 和 Henkel AG &Co.KGaA。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 汽車工業的應用日益增多

- 提高技術優勢

- 限制因素

- 有關 VOC排放的環境法規

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 依產品類型

- 導電膠

- 導熱膠

- 紫外線固化膠合劑

- 其他產品類型

- 按應用

- 表面黏著技術

- 三防膠

- 電線定位

- 盆栽

- 封裝

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 世界其他地區

- 南美洲

- 中東和非洲

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率分析

- 主要企業策略

- 公司簡介

- 3M

- Arkema Group

- Ashland

- Avery Dennison Corporation

- Beardow Adams

- Dow

- Dymax Corporation

- Franklin International

- HB Fuller

- Henkel AG & Co. KGaA

- Huntsman International LLC

- ITW Performance Polymers(Illinois Tool Works Inc.)

- Jowat AG

- Mapei Inc.

- Pidilite Industries Ltd.

- Sika AG

- Wacker Chemie AG

第7章 市場機會與未來趨勢

- 不斷創新和開發前沿技術

簡介目錄

Product Code: 46752

The Polyurethane Adhesives in Electronics Market is expected to register a CAGR of greater than 5% during the forecast period.

Key Highlights

- Among product types, the electrically conductive adhesives are expected to dominate the market, owing to their superior intrinsic properties, like thermal dissipation functionality, making them suitable for numerous applications.

- The continuous innovation and development of advanced technologies across the globe is likely to offer opportunities for the PU adhesives in electronics market.

- Asia-Pacific stands to be the largest and fastest growing region in the studied market, where electronics production, demand and exports have been significantly influencing the consumption of PU adhesives for electronic applications.

Polyurethane Adhesive in Electronics Market Trends

Electrically Conductive Adhesives Segment Dominating the Market

- Electrically conductive adhesives are used in the electronics industry on components which are required to be held in place to pass electrical current between them.

- PUR two-part adhesives is widely used for this purpose, which either needs to be mixed or supplied pre-mixed and frozen like the snap-cure epoxies.

- PUR adhesives also offer high peel strength and flexibility which makes it widely suitable for electronic applications. Such properties make it widely popular for use in global electronics market.

- The electronics industry has been continuously innovating existing products with advanced features, along with development of new electronic devices and technologies which has been driving production and growth in electronics industry.

- For instance, some of the current innovation which have been driving the production in electronics industry includes 5G supporting smartphones, chromecast, smart speakers, etc.

- Thus, the aforementioned factors are projected to drive the global consumption of PUR adhesives for electronic applications over the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific dominates the consumption of PU adhesives in electronics market, owing to the presence of some major countries, such as China, Japan and South Korea, which are engaged in the production and export of electronic products.

- In terms of production, exports and consumption, China stands to be the largest market for consumer electronics in the region (as well as globally). China's production of mobile phones, televisions and computers is the largest in the world.

- Besides, countries such as Vietnam, South Korea, etc., have been benefited due to comparatively lower cost of production, which is considerably driving the domestic electronic production in such countries.

- Hence, presence of the strong production base of such end-user industries and growing construction investments have been driving the consumption of polyurethane (PU) adhesives in electronics in the country.

Polyurethane Adhesive in Electronics Industry Overview

The global polyurethane (PU) adhesives in electronics market is fragmented in nature. Some of the keyplayers in the market includes 3M, Arkema Group, H.B. Fuller, Sika AG, and Henkel AG & Co. KGaA, amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increased Application in Automotive Industry

- 4.1.2 Growing Technological Dominance

- 4.2 Restraints

- 4.2.1 Environmental Regulations Regarding VOC Emissions

- 4.2.2 Other Restraints

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Electrically Conductive Adhesive

- 5.1.2 Thermally Conductive Adhesive

- 5.1.3 UV Curing Adhesive

- 5.1.4 Other Product Types

- 5.2 Application

- 5.2.1 Surface Mounting

- 5.2.2 Conformal Coatings

- 5.2.3 Wire Tacking

- 5.2.4 Potting

- 5.2.5 Encapsulation

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Ashland

- 6.4.4 Avery Dennison Corporation

- 6.4.5 Beardow Adams

- 6.4.6 Dow

- 6.4.7 Dymax Corporation

- 6.4.8 Franklin International

- 6.4.9 H.B. Fuller

- 6.4.10 Henkel AG & Co. KGaA

- 6.4.11 Huntsman International LLC

- 6.4.12 ITW Performance Polymers (Illinois Tool Works Inc.)

- 6.4.13 Jowat AG

- 6.4.14 Mapei Inc.

- 6.4.15 Pidilite Industries Ltd.

- 6.4.16 Sika AG

- 6.4.17 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Continuous Innovation and Development of Advanced Technologies

02-2729-4219

+886-2-2729-4219