|

市場調查報告書

商品編碼

1871124

車載支付系統硬體市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)In-Vehicle Payment System Hardware Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

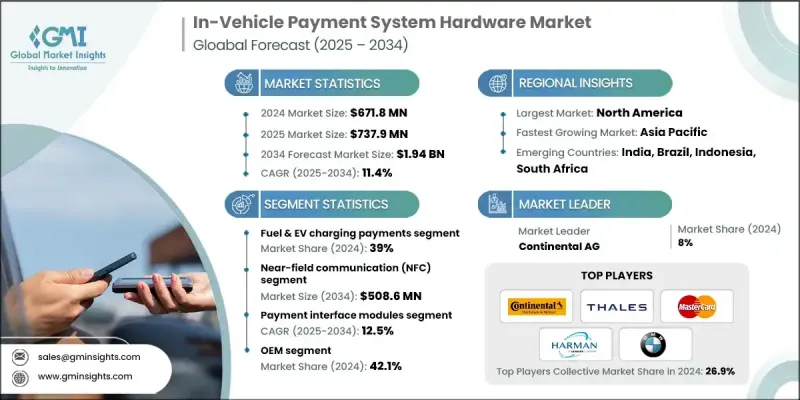

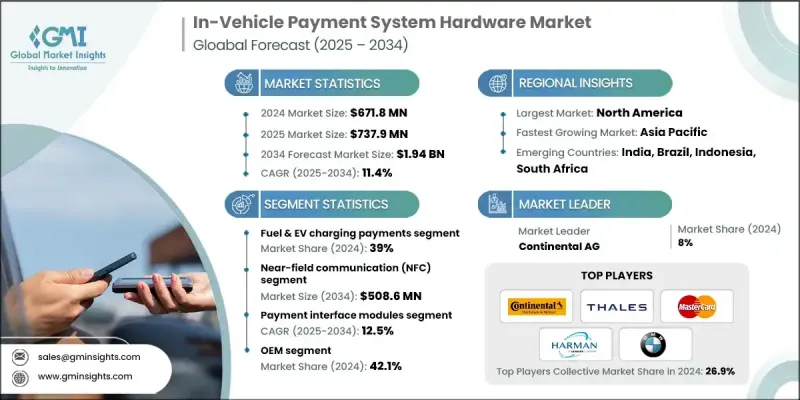

2024 年全球車載支付系統硬體市值為 6.718 億美元,預計到 2034 年將以 11.4% 的複合年成長率成長至 19.4 億美元。

全球互聯和自動駕駛汽車的普及正在加速車載支付技術的普及。先進的硬體組件,例如安全晶片、生物識別感測器和NFC模組,使得車輛能夠直接進行即時、無縫的交易。這一發展趨勢正在重塑出行格局,簡化了出行即服務(MaaS)生態系統中加油、停車和通行費等服務的自動支付流程。尤其是在疫情之後,消費者對數位化和非接觸式交易的偏好普遍增強,這進一步提升了對安全、便利、快速支付體驗的需求。汽車製造商正積極回應,增加對嵌入式車載支付系統的投資,這些系統採用藍牙、NFC和RFID等技術。這些系統可與車載資訊娛樂平台和數位錢包整合,實現與外部支付網路的安全同步。同時,城市和交通管理部門正在利用V2X和DSRC技術對收費、停車和充電基礎設施進行現代化改造,這些技術依賴車載支付硬體來實現互通性和跨境功能。汽車製造商、金融科技公司和支付提供者之間的合作正在擴大透過車載商務、訂閱和互聯數位服務實現盈利的機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 6.718億美元 |

| 預測值 | 19.4億美元 |

| 複合年成長率 | 11.4% |

預計2025年至2034年間,支付介面模組市場將以12.5%的複合年成長率成長。這些模組嵌入車載資訊娛樂系統,支援停車、加油和通行費等非現金及非接觸式交易,透過代幣化支付方式提供便利性和高安全性。汽車製造商和頂級供應商正大力投資於汽車級介面模組,這些模組的設計旨在確保可靠性、可擴展性並符合全球安全標準。這些整合模組有助於實現不同車型支付體驗的標準化,並增強用戶對安全且便利的行動支付的信心。

預計到2024年,燃油和電動車充電支付領域將佔據39%的市場。電動車的日益普及以及對高效加油和充電解決方案需求的成長,正在推動車載支付系統的應用。這些系統使駕駛員能夠直接透過車載資訊娛樂系統完成燃油或電動車充電交易,從而減少對實體卡或現金的依賴。非接觸式支付支援以及與多種支付平台的兼容性,增加了靈活性,簡化了用戶交互,提升了消費者的便利性。

2024年,美國車載支付系統硬體市佔率達86.4%。美國車主對直接整合到車輛系統中的安全、非接觸式即時支付方式的強烈偏好,持續推動市場成長。汽車製造商正優先實施先進的安全功能,包括生物辨識驗證、嵌入式錢包和符合PCI標準的令牌化技術,以保護消費者資料並確保支付安全。對隱私標準和合規要求的重視,以及汽車製造商與金融網路之間的合作,正在鞏固美國在該領域的領先地位。

全球車載支付系統硬體市場的主要參與者包括寶馬、大陸集團、戴姆勒、泰雷茲集團、萬事達卡、哈曼國際、現代汽車和本田汽車。這些關鍵企業正積極推行策略性舉措,以鞏固自身競爭力並提昇技術能力。各公司致力於開發整合支付模組,這些模組配備先進的身份驗證、加密和連接功能,以確保交易的無縫和安全。汽車製造商、金融科技公司和支付技術公司之間的策略合作正在促進創新並擴大生態系統的兼容性。對研發的大量投入正在推動符合全球安全和資料保護標準的標準化、可互通硬體解決方案的開發。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預報

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 價值鏈分析與產業結構

- 原料與晶圓製造

- BMS IC設計與開發

- 半導體製造與測試

- BMS模組組裝與整合

- 電池組整合與驗證

- OEM車輛整合與部署

- 售後市場及服務生態系統

- 報廢回收與永續性

- 價值鏈分析與產業結構

- 供應商格局

- 原物料供應商

- 零件製造商

- 系統整合商

- OEM

- 最終用途

- 產業影響因素

- 成長促進因素

- 連網智慧汽車激增

- 消費者對非接觸式支付的偏好日益增強

- 電動車和充電基礎設施的成長

- OEM金融科技合作

- 智慧城市與智慧交通發展

- 產業陷阱與挑戰

- 高昂的硬體和整合成本

- 網路安全和資料隱私問題

- 市場機遇

- 與出行即服務 (MaaS) 的整合

- 電動車充電和綠色出行的擴展

- 原始設備製造商與數位錢包提供商之間的合作關係

- 車輛生物辨識認證的興起

- 成長促進因素

- 成長潛力分析

- 監管環境

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 目前技術

- 新興技術

- 專利分析

- 價格趨勢分析

- 按組件

- 按地區

- 成本細分分析

- 生產統計

- 生產中心

- 消費中心

- 進出口

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 市場成熟度與採納分析

- 技術準備程度評估

- 區域採用成熟度比較

- 應用領域成熟度分析

- 生產準備和規模評估

- 商業部署時程

- 未來趨勢

- 主要市場趨勢和顛覆性因素

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 重要新聞和舉措

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依組件分類,2021-2034年

- 主要趨勢

- 支付介面模組

- 生物辨識認證設備

- 顯示與資訊娛樂單元

- 連接組件

- 感測器和控制器

- 嵌入式安全硬體

第6章:市場估算與預測:依支付應用類型分類,2021-2034年

- 主要趨勢

- 燃油和電動車充電付款

- 收費站

- 停車費

- 免下車支付和零售支付

- 訂閱及車載服務

第7章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- 近場通訊(NFC)

- 無線射頻識別(RFID)

- 專用短程通訊(DSRC)

- 蜂窩網路(4G/5G)

- Wi-Fi/藍牙低功耗

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- OEM

- 車隊營運商

- 行動服務提供者

- 收費和停車營運商

- 燃料和電動車基礎設施供應商

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐

- 荷蘭

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球參與者

- BMW AG

- Continental AG

- Daimler AG (Mercedes-Benz Group)

- Denso Corporation

- Harman International

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Mastercard Incorporated

- NXP Semiconductors

- Qualcomm Technologies Inc.

- Robert Bosch GmbH

- Thales Group

- 區域玩家

- Aisin Corporation

- Aptiv PLC

- Garmin Ltd.

- Hyundai Mobis

- LG Electronics

- Magna International Inc.

- Valeo SA

- ZF Friedrichshafen AG

- 新興參與者和顛覆者

- Car IQ Inc.

- Cerence Inc.

- IDEMIA

- Ingenico (Worldline)

- PayByCar Inc.

- Rambus Inc.

- Secure-IC

- Utimaco GmbH

- Verifone Systems Inc.

- Xevo Inc. (Lear Corporation)

The Global In-Vehicle Payment System Hardware Market was valued at USD 671.8 million in 2024 and is estimated to grow at a CAGR of 11.4% to reach USD 1.94 Billion by 2034.

The expansion of connected and autonomous vehicles worldwide is accelerating the adoption of integrated in-vehicle payment technologies. Advanced hardware components such as secure chips, biometric sensors, and NFC modules enable real-time and seamless transactions directly from vehicles. This evolution is reshaping the mobility landscape by streamlining automated payments for services such as fueling, parking, and tolls within mobility-as-a-service ecosystems. The widespread shift in consumer preferences toward digital and contactless transactions, particularly following the pandemic, has further increased demand for secure, frictionless, and fast payment experiences. Automakers are responding by increasing their investment in embedded vehicle payment systems using technologies like Bluetooth, NFC, and RFID. These systems integrate with infotainment platforms and digital wallets, allowing secure synchronization with external payment networks. Meanwhile, cities and transport authorities are modernizing tolling, parking, and charging infrastructure using V2X and DSRC technologies that depend on in-vehicle payment hardware to enable interoperability and cross-border functionality. Partnerships between automakers, fintech firms, and payment providers are expanding opportunities for monetization through in-car commerce, subscriptions, and connected digital services.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $671.8 Million |

| Forecast Value | $1.94 Billion |

| CAGR | 11.4% |

The payment interface module segment is expected to grow at a CAGR of 12.5% from 2025 to 2034. These modules, embedded into infotainment systems, enable cashless and contactless transactions for parking, fuel, and tolls, offering convenience and high security through tokenized payment methods. OEMs and top-tier suppliers are heavily investing in automotive-grade interface modules designed for reliability, scalability, and compliance with global safety standards. These integrated modules help standardize payment experiences across various vehicle models and enhance user confidence in secure, on-the-go transactions.

The fuel and EV charging payment segment held a 39% share in 2024. Growing adoption of electric vehicles and rising demand for efficient refueling and recharging solutions are fostering the use of in-vehicle payment systems. These systems enable drivers to complete transactions for fuel or EV charging directly from their infotainment systems, reducing reliance on physical cards or cash. The inclusion of contactless payment support and compatibility with diverse payment platforms adds flexibility and simplifies user interaction, enhancing convenience for consumers.

United States In-Vehicle Payment System Hardware Market held 86.4% share in 2024. The strong preference among U.S. drivers for secure, contactless, and instant payments integrated directly into vehicle systems continues to drive market growth. OEMs are prioritizing the implementation of advanced security features, including biometric verification, embedded wallets, and PCI-compliant tokenization to protect consumer data and ensure payment safety. The focus on privacy standards and compliance requirements, combined with collaboration between vehicle manufacturers and financial networks, is strengthening the country's leadership in this space.

Major companies operating in the Global In-Vehicle Payment System Hardware Market include BMW, Continental, Daimler, Thales Group, Mastercard Incorporated, Harman International, Hyundai Motor Company, and Honda Motor. Key players in the in-vehicle payment system hardware market are pursuing strategic initiatives to reinforce their competitive standing and expand their technological capabilities. Companies are focusing on developing integrated payment modules equipped with advanced authentication, encryption, and connectivity features to ensure seamless and secure transactions. Strategic collaborations between automakers, fintech providers, and payment technology companies are fostering innovation and expanding ecosystem compatibility. Heavy investment in R&D is driving the creation of standardized, interoperable hardware solutions that align with global security and data protection standards.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Component

- 2.2.2 Payment Application

- 2.2.3 Technology

- 2.2.4 End use

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Value Chain Analysis & Industry Structure

- 3.1.1.1 Raw Materials & Wafer Fabrication

- 3.1.1.2 BMS IC Design & Development

- 3.1.1.3 Semiconductor Manufacturing & Testing

- 3.1.1.4 BMS Module Assembly & Integration

- 3.1.1.5 Battery Pack Integration & Validation

- 3.1.1.6 OEM Vehicle Integration & Deployment

- 3.1.1.7 Aftermarket & Service Ecosystem

- 3.1.1.8 End-of-Life Recycling & Sustainability

- 3.1.1 Value Chain Analysis & Industry Structure

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 System integrators

- 3.2.4 OEM

- 3.2.5 End use

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Surge in Connected and Smart Vehicles

- 3.3.1.2 Rising Consumer Preference for Contactless Payments

- 3.3.1.3 Growth of EVs and Charging Infrastructure

- 3.3.1.4 OEM-Fintech Collaborations

- 3.3.1.5 Smart City and Intelligent Transportation Development

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High Hardware and Integration Costs

- 3.3.2.2 Cybersecurity and Data Privacy Concerns

- 3.3.3 Market opportunities

- 3.3.3.1 Integration with Mobility-as-a-Service (MaaS)

- 3.3.3.2 Expansion of EV Charging and Green Mobility

- 3.3.3.3 Partnerships Between OEMs and Digital Wallet Providers

- 3.3.3.4 Emergence of Biometric Authentication in Vehicles

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle east and Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and Innovation landscape

- 3.8.1 Current technology

- 3.8.2 Emerging technology

- 3.9 Patent analysis

- 3.10 Price Trends Analysis

- 3.10.1 By component

- 3.10.2 By region

- 3.11 Cost breakdown analysis

- 3.12 Production statistics

- 3.12.1 Production hubs

- 3.12.2 Consumption hubs

- 3.12.3 Export and import

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.13.5 Carbon footprint considerations

- 3.14 Market maturity & adoption analysis

- 3.14.1 Technology readiness level assessment

- 3.14.2 Regional adoption maturity comparison

- 3.14.3 Application domain maturity analysis

- 3.14.4 Manufacturing readiness & scale assessment

- 3.14.5 Commercial deployment timeline

- 3.15 Future trends

- 3.16 Major market trends and disruptions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Payment Interface Modules

- 5.3 Biometric Authentication Devices

- 5.4 Display & Infotainment Units

- 5.5 Connectivity Components

- 5.6 Sensors & Controllers

- 5.7 Embedded Security Hardware

Chapter 6 Market Estimates & Forecast, By Payment Application, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Fuel & EV Charging Payments

- 6.3 Toll Collection

- 6.4 Parking Fees

- 6.5 Drive-through & Retail Payments

- 6.6 Subscription & In-Car Services

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Near-Field Communication (NFC)

- 7.3 Radio Frequency Identification (RFID)

- 7.4 Dedicated Short-Range Communication (DSRC)

- 7.5 Cellular (4G/5G)

- 7.6 Wi-Fi/Bluetooth Low Energy

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Fleet Operators

- 8.4 Mobility Service Providers

- 8.5 Toll & Parking Operators

- 8.6 Fuel & EV Infrastructure Providers

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Netherlands

- 9.3.8 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 BMW AG

- 10.1.2 Continental AG

- 10.1.3 Daimler AG (Mercedes-Benz Group)

- 10.1.4 Denso Corporation

- 10.1.5 Harman International

- 10.1.6 Honda Motor Co., Ltd.

- 10.1.7 Hyundai Motor Company

- 10.1.8 Mastercard Incorporated

- 10.1.9 NXP Semiconductors

- 10.1.10 Qualcomm Technologies Inc.

- 10.1.11 Robert Bosch GmbH

- 10.1.12 Thales Group

- 10.2 Regional Players

- 10.2.1 Aisin Corporation

- 10.2.2 Aptiv PLC

- 10.2.3 Garmin Ltd.

- 10.2.4 Hyundai Mobis

- 10.2.5 LG Electronics

- 10.2.6 Magna International Inc.

- 10.2.7 Valeo SA

- 10.2.8 ZF Friedrichshafen AG

- 10.3 Emerging Players and Disruptors

- 10.3.1 Car IQ Inc.

- 10.3.2 Cerence Inc.

- 10.3.3 IDEMIA

- 10.3.4 Ingenico (Worldline)

- 10.3.5 PayByCar Inc.

- 10.3.6 Rambus Inc.

- 10.3.7 Secure-IC

- 10.3.8 Utimaco GmbH

- 10.3.9 Verifone Systems Inc.

- 10.3.10 Xevo Inc. (Lear Corporation)