|

市場調查報告書

商品編碼

1858833

可食用包裝材料市場機會、成長促進因素、產業趨勢分析及預測Edible Packaging Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast |

||||||

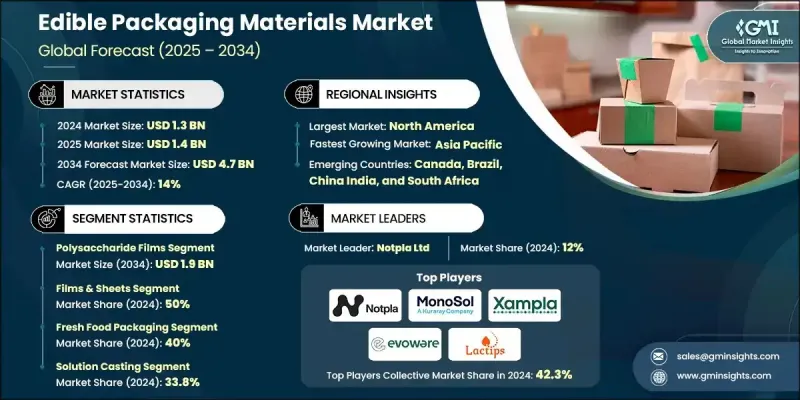

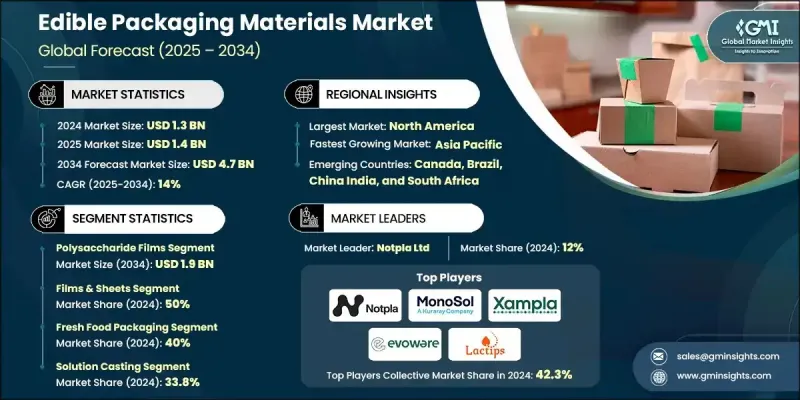

2024 年全球可食用包裝材料市場價值為 13 億美元,預計到 2034 年將以 14% 的複合年成長率成長至 47 億美元。

可食用包裝材料的廣泛應用主要得益於日益嚴格的環境法規和各行業對永續發展的日益重視。隨著各國實施更強力的政策以減少塑膠垃圾,可食用包裝材料正成為包裝策略的重要組成部分,尤其是在餐飲服務、零售和食品雜貨業。推動循環經濟模式的全球計劃也促進了這一趨勢。監管支持,例如美國的GRAS(公認安全物質)認證,簡化了創新流程,加速了可食用包裝材料的商業化。在一些地區,製造商正加大研發投入,並享有稅收優惠和補助金,從而提高成本效益和生產規模。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 13億美元 |

| 預測值 | 47億美元 |

| 複合年成長率 | 14% |

市場正迅速擴張,從糖果領域擴展到新鮮農產品、飲料和加工食品等領域。生物基材料和阻隔性能的技術進步,使得其應用範圍更加廣泛。大型消費品公司內部的永續包裝部門,如今正優先考慮符合長期環境目標的食用解決方案。萃取、配方和塗層方法的創新,使製造商能夠開發出強度更高、水分控制更佳、保存期限更長的食用產品,同時又不影響其生物分解性和安全性。

2024年,多醣薄膜市佔率達到40%,預計2034年將達到19億美元,年複合成長率(CAGR)為14.3%。這些薄膜之所以佔據領先地位,是因為它們性能可靠、監管簡便且生產成本低廉。澱粉和纖維素基薄膜具有理想的防潮性能,已被廣泛應用於食品包裝領域。奈米纖維素和化學改性多醣的最新進展正推動其在敏感食品包裝領域的應用,預計到2034年,該領域的市場規模將擴大至47億美元。

由於薄膜和片材與現有加工技術的兼容性以及其在各種包裝形式中的多功能性,預計到2024年,薄膜和片材市場佔有率將達到50%。隨著多層設計和增強阻隔性能創新技術的推出,該細分市場持續發展,這些技術有助於延長易腐產品的保存期限。模塑容器雖然市場佔有率較小,但成長迅速,這主要得益於其在即食食品和外賣食品應用領域的巨大潛力,在這些領域,堅固且可食用的包裝備受青睞。

2024年,北美可食用包裝材料市場佔據35%的佔有率,市場規模達4.396億美元。美國在該區域處於領先地位,這得益於其清晰的監管管道和政府對生物基解決方案的大力支持。來自私營和公共機構對包裝創新持續不斷的投資,進一步鞏固了北美的領先地位。各州主導的舉措,包括塑膠禁令和環保包裝強制令,在加速推廣應用方面發揮了關鍵作用。聯邦政府計畫的採購優惠政策也進一步推動了可食用、可生物分解包裝材料的使用。

全球可食用包裝材料市場的主要企業包括 MonoSol LLC(可樂麗集團)、Glanbia PLC、Xampla Ltd.、Loliware Inc.、Notpla Ltd.、Kerry Group、FlexSea Ltd.、Evoware(PT. Evogaia Karya Indonesia)、Apeel Sciences、Mori(原 CamFM Corporation、PTOk PFM、PTO)、Apeel Sciences、Mori Corporation(原 Camix Corporation)這些企業正採取多管齊下的策略來鞏固其市場地位。投資研發專有生物聚合物配方並為新型可食用薄膜技術申請專利是普遍做法,有助於提升產品性能並實現差異化。各公司正在擴建中試和大規模生產設施,以高效滿足不斷成長的市場需求。與食品製造商和零售品牌的合作有助於推動商業化應用,而聯合品牌推廣活動則有助於提高消費者認知度。此外,企業也積極與監管機構建立合作關係,以加速認證和合規進程。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 促進要素

- 陷阱與挑戰

- 機會:

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 按產品規格

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼說明:僅提供重點國家的貿易統計)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- 蛋白質基薄膜

- 酪蛋白薄膜

- 乳清蛋白膜

- 明膠膜

- 膠原蛋白膜

- 大豆蛋白膜

- 小麥臉部筋膜

- 多醣膜

- 澱粉基薄膜

- 纖維素薄膜

- 殼聚醣薄膜

- 果膠膜

- 海藻酸鹽薄膜

- 卡拉膠薄膜

- 脂質塗層

- 天然蠟塗層

- 脂肪酸膜

- 精油屏障

- 複合薄膜

- 蛋白質-多醣組合

- 多層薄膜技術

- 奈米複合材料整合

- 界面活性劑膜

- 卵磷脂基薄膜

- 特種乳化劑系統

第6章:市場估算與預測:依形式分類,2021-2034年

- 主要趨勢

- 薄膜和片材

- 軟性薄膜

- 剛性板材

- 層壓結構

- 塗層

- 噴塗塗層

- 浸塗

- 刷塗應用

- 模製容器

- 熱成型容器

- 射出成型解決方案

- 3D列印包裝

- 膠囊及封裝

- 硬膠囊

- 軟膠囊

- 微膠囊化

第7章:市場估算與預測:依屏障房產分類,2021-2034年

- 主要趨勢

- 防潮層應用

- 高防潮層

- 可控滲透性

- 濕度響應系統

- 氧氣阻隔應用

- 高氧屏障

- 選擇性滲透性

- 主動氧清除

- 抗菌特性

- 天然抗菌劑

- 基於殼聚醣的系統

- 銀奈米粒子整合

- 紫外線防護應用

- 光敏產品保護

- 光分解預防系統

- 色彩穩定性增強

第8章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 新鮮食品包裝應用

- 水果和蔬菜

- 肉類和家禽

- 海鮮及海鮮

- 乳製品

- 加工食品包裝應用

- 即食餐

- 冷凍食品

- 點心

- 烘焙食品

- 飲料應用

- 液體容器

- 飲料膠囊及單份裝

- 瓶身塗層及瓶蓋

- 糖果和烘焙應用

- 巧克力和糖果

- 蛋糕和糕點

- 冰淇淋和冷凍甜點

- 醫藥和營養保健品應用

- 藥物輸送系統

- 膳食補充劑

- 醫用食品

第9章:市場估算與預測:依製造流程分類,2021-2034年

- 主要趨勢

- 溶液鑄造工藝

- 實驗室規模生產

- 中試規模生產

- 商業規模營運

- 擠出工藝

- 吹膜擠出

- 流延薄膜擠出

- 共擠出

- 壓縮成型

- 熱壓成型

- 冷壓應用

- 真空成型

- 塗層和層壓

- 噴塗系統

- 浸塗工藝

- 層壓技術

第10章:市場估價與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 直接向製造商銷售

- 食品飲料製造商

- 製藥公司

- 合約包裝組織

- 包裝分銷商和批發商

- 區域包裝分銷商

- 專業包裝批發商

- 國際貿易公司

- 線上及數位管道

- B2B電子商務平台

- 廠商直銷

- 特用化學品分銷商

第11章:市場估計與預測:按地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第12章:公司簡介

- Notpla Ltd.

- MonoSol LLC (Kuraray Group)

- Xampla Ltd.

- Evoware (PT. Evogaia Karya Indonesia)

- Lactips

- FlexSea Ltd.

- Sway (Sway Innovation Co.)

- Apeel Sciences

- Loliware Inc.

- JRF Technology LLC

- Devro PLC

- Kerry Group

- Glanbia PLC

- FMC Corporation

- Mori (fka Cambridge Crops)

- Others

The Global Edible Packaging Materials Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 14% to reach USD 4.7 billion by 2034.

The surge in adoption is largely fueled by tightening environmental regulations and heightened emphasis on sustainability across industries. As nations implement stronger policies to reduce plastic waste, edible alternatives are becoming integral to packaging strategies, particularly in food service, retail, and grocery sectors. Global initiatives pushing circular economy models are also boosting momentum. Regulatory support, such as the GRAS classification in the US, has streamlined innovation pipelines, accelerating the commercialization of edible packaging materials. Manufacturers are ramping up R&D investments, supported by tax incentives and grants in several regions, enhancing cost efficiency and production scalability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $4.7 Billion |

| CAGR | 14% |

The market is seeing rapid expansion beyond confectionery to include segments like fresh produce, beverages, and processed foods. Technological advances in bio-based materials and barrier properties are allowing broader use cases. Sustainable packaging divisions within large CPG firms are now prioritizing edible solutions that align with long-term environmental goals. Innovations in extraction, formulation, and coating methods are enabling manufacturers to develop edible formats with superior strength, moisture control, and shelf-life extension, without compromising biodegradability or safety.

The polysaccharide films segment held a 40% share in 2024 and is expected to reach USD 1.9 billion by 2034, reflecting a CAGR of 14.3%. These films are leading due to their reliable performance, regulatory ease, and cost-effective production. Starch and cellulose-based films offer ideal moisture barrier properties and are widely adopted across food categories. New developments in nanocellulose and chemically modified polysaccharides are pushing their relevance into packaging for sensitive foods, expanding the product footprint to USD 4.7 billion by 2034.

The films and sheets segment held a 50% share in 2024, due to their compatibility with existing processing technologies and versatility across packaging formats. This segment continues to evolve with the introduction of multi-layered designs and enhanced barrier innovations that support the shelf life of perishable products. Molded containers, although smaller in share, are growing fast, driven by their potential in ready-to-eat and takeaway meal applications where rigid yet edible packaging is highly valued.

North America Edible Packaging Materials Market held 35% share and generated USD 439.6 million in 2024. The U.S. led the region, benefitting from clear regulatory channels and strong government support for biobased solutions. Ongoing investments in packaging innovation from both private and public entities are reinforcing North America's leadership. State-led initiatives, including plastic bans and eco-packaging mandates, have been instrumental in accelerating adoption. Procurement preferences through federal programs are further encouraging shifts toward edible, biodegradable options.

Key companies in the Global Edible Packaging Materials Market include MonoSol LLC (Kuraray Group), Glanbia PLC, Xampla Ltd., Loliware Inc., Notpla Ltd., Kerry Group, FlexSea Ltd., Evoware (PT. Evogaia Karya Indonesia), Apeel Sciences, Mori (formerly Cambridge Crops), JRF Technology LLC, Sway Innovation Co., Devro PLC, FMC Corporation, and Lactips. Major players in the Edible Packaging Materials Market are adopting multi-pronged strategies to establish strong market positions. Investments in proprietary biopolymer formulations and patenting new edible film technologies are common, enabling performance enhancements and differentiation. Firms are expanding pilot and full-scale production facilities to meet growing demand efficiently. Collaborations with food manufacturers and retail brands help drive commercial adoption, while co-branding initiatives support consumer awareness. Players are also engaging in regulatory partnerships to fast-track certifications and compliance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Agricultural practice trends

- 2.2.3 Application trends

- 2.2.4 Packaging format trends

- 2.2.5 Distribution channel trends

- 2.2.6 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Drivers

- 3.2.2 Pitfalls & Challenges

- 3.2.3 Opportunities:

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product format

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Protein-based films

- 5.2.1 Casein films

- 5.2.2 Whey protein films

- 5.2.3 Gelatin films

- 5.2.4 Collagen films

- 5.2.5 Soy protein films

- 5.2.6 Wheat gluten films

- 5.3 Polysaccharide films

- 5.3.1 Starch-based films

- 5.3.2 Cellulose films

- 5.3.3 Chitosan films

- 5.3.4 Pectin films

- 5.3.5 Alginate films

- 5.3.6 Carrageenan films

- 5.4 Lipid-based coatings

- 5.4.1 Natural wax coatings

- 5.4.2 Fatty acid films

- 5.4.3 Essential oil-based barriers

- 5.5 Composite films

- 5.5.1 Protein-polysaccharide combinations

- 5.5.2 Multi-layer film technologies

- 5.5.3 Nanocomposite integration

- 5.6 Surfactant films

- 5.6.1 Lecithin-based films

- 5.6.2 Specialty emulsifier systems

Chapter 6 Market Estimates and Forecast, By Form, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Films & sheets

- 6.2.1 Flexible films

- 6.2.2 Rigid sheets

- 6.2.3 Laminated structures

- 6.3 Coatings

- 6.3.1 Spray-applied coatings

- 6.3.2 Dip coatings

- 6.3.3 Brush-on applications

- 6.4 Molded containers

- 6.4.1 Thermoformed containers

- 6.4.2 Injection molded solutions

- 6.4.3 3d printed packaging

- 6.5 Capsules & encapsulation

- 6.5.1 Hard capsules

- 6.5.2 Soft capsules

- 6.5.3 Microencapsulation

Chapter 7 Market Estimates and Forecast, By Barrier Properties, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Moisture barrier applications

- 7.2.1 High moisture barrier

- 7.2.2 Controlled permeability

- 7.2.3 Humidity-responsive systems

- 7.3 Oxygen barrier applications

- 7.3.1 High oxygen barrier

- 7.3.2 Selective permeability

- 7.3.3 Active oxygen scavenging

- 7.4 Antimicrobial properties

- 7.4.1 Natural antimicrobial agents

- 7.4.2 Chitosan-based systems

- 7.4.3 Silver nanoparticle integration

- 7.5 UV protection applications

- 7.5.1 Light-sensitive product protection

- 7.5.2 Photodegradation prevention systems

- 7.5.3 Color stability enhancement

Chapter 8 Market Estimates and Forecast, By Application, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 Fresh food packaging applications

- 8.2.1 Fruits & vegetables

- 8.2.2 Meat & poultry

- 8.2.3 Seafood & marine products

- 8.2.4 Dairy products

- 8.3 Processed food packaging applications

- 8.3.1 Ready-to-eat meals

- 8.3.2 Frozen foods

- 8.3.3 Snack foods

- 8.3.4 Baked goods

- 8.4 Beverage applications

- 8.4.1 Liquid containers

- 8.4.2 Beverage pods & single-serve

- 8.4.3 Bottle coatings & closures

- 8.5 Confectionery & bakery applications

- 8.5.1 Chocolate & candy

- 8.5.2 Cake & pastry

- 8.5.3 Ice cream & frozen desserts

- 8.6 Pharmaceutical & nutraceutical applications

- 8.6.1 Drug delivery systems

- 8.6.2 Dietary supplements

- 8.6.3 Medical foods

Chapter 9 Market Estimates and Forecast, By Manufacturing Process, 2021-2034 (USD Million & Kilo Tons)

- 9.1 Key trends

- 9.2 Solution casting process

- 9.2.1 Laboratory-scale production

- 9.2.2 Pilot-scale manufacturing

- 9.2.3 Commercial-scale operations

- 9.3 Extrusion process

- 9.3.1 Blown film extrusion

- 9.3.2 Cast film extrusion

- 9.3.3 Co-extrusion

- 9.4 Compression molding

- 9.4.1 Hot press molding

- 9.4.2 Cold press applications

- 9.4.3 Vacuum forming

- 9.5 Coating & lamination

- 9.5.1 Spray coating systems

- 9.5.2 Dip coating processes

- 9.5.3 Lamination technologies

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Million & Kilo Tons)

- 10.1 Key trends

- 10.2 Direct sales to manufacturers

- 10.2.1 Food & beverage manufacturers

- 10.2.2 Pharmaceutical companies

- 10.2.3 Contract packaging organizations

- 10.3 Packaging distributors & wholesalers

- 10.3.1 Regional packaging distributors

- 10.3.2 Specialty packaging wholesalers

- 10.3.3 International trading companies

- 10.4 Online & digital channels

- 10.4.1. B2B e-commerce platforms

- 10.4.2 Manufacturer direct sales

- 10.4.3 Specialty chemical distributors

Chapter 11 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of Middle East and Africa

Chapter 12 Company Profiles

- 12.1 Notpla Ltd.

- 12.2 MonoSol LLC (Kuraray Group)

- 12.3 Xampla Ltd.

- 12.4 Evoware (PT. Evogaia Karya Indonesia)

- 12.5 Lactips

- 12.6 FlexSea Ltd.

- 12.7 Sway (Sway Innovation Co.)

- 12.8 Apeel Sciences

- 12.9 Loliware Inc.

- 12.10 JRF Technology LLC

- 12.11 Devro PLC

- 12.12 Kerry Group

- 12.13 Glanbia PLC

- 12.14 FMC Corporation

- 12.15 Mori (fka Cambridge Crops)

- 12.16 Others