|

市場調查報告書

商品編碼

1801861

冷凍食品可食用包裝市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Edible Packaging for Frozen Foods Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

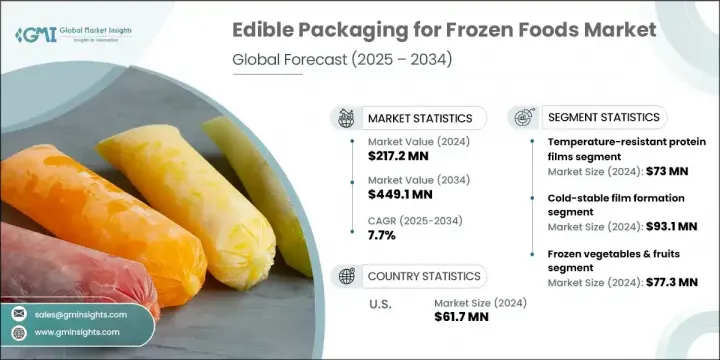

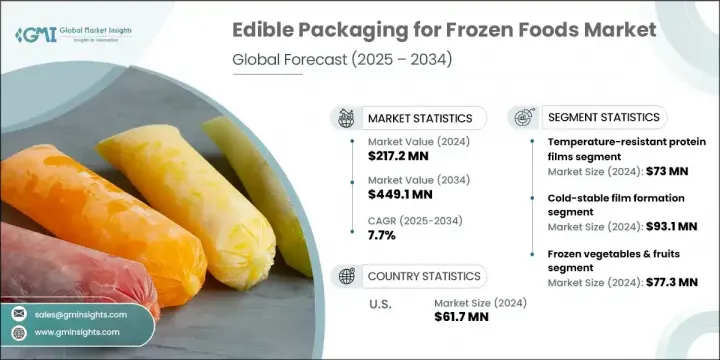

2024 年全球冷凍食品可食用包裝市場價值為 2.172 億美元,預計到 2034 年將以 7.7% 的複合年成長率成長,達到 4.491 億美元。這個不斷成長的市場是由對耐寒、可生物分解包裝日益成長的需求所驅動的,尤其是對單獨速凍 (IQF) 水果、蔬菜、微波冷凍食品和即熱食品的需求。這種需求在北美、歐洲以及亞太部分地區(如日本、韓國和澳洲)尤其明顯。可食用包裝的需求主要受到北美和歐洲冷凍水果和植物性食品銷售的推動,以及亞太部分地區殼聚醣和澱粉基包裝等更實惠的替代品的推動。

多醣薄膜因其價格實惠且冷凍穩定性高,預計將成為市場成長最快的產品。此外,對冷鏈最佳化的需求以及將風味融入可食用塗層的需求預計將推動高階產品類別的成長。北美和西歐自有品牌冷凍食品的興起是可食用包裝日益普及的另一個重要因素。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.172億美元 |

| 預測值 | 4.491億美元 |

| 複合年成長率 | 7.7% |

到2034年,多醣薄膜市場的佔有率將達到34.9%。這些薄膜由澱粉、藻酸鹽和纖維素等材料製成,因其成本低、過敏風險低以及在冷凍環境下性能優異而備受青睞。它們還具有良好的柔韌性,適用於各種冷凍食品,例如蔬菜、海鮮和即食食品。

2024年,冷凍蔬菜和水果市場佔比35.6%,這得益於其高出口量和早期採用可食用塗層的推動,可食用塗層有助於保持水分並增強環保品牌形象。由於歐洲和亞洲部分地區等多個地區對有機標籤法規的嚴格要求以及對冷凍農產品使用塑膠包裝的禁令,可食用包裝的使用獲得了進一步發展。

2024年,北美冷凍食品可食用包裝市場佔據33%的市場佔有率,這得益於零售商的採用、可食用包裝領域的創新新創公司以及消費者日益增強的永續性意識。光是美國就佔據了6,170萬美元的市場。此外,以可食用薄膜為特色的自有品牌冷凍食品的興起,使其成為永續的差異化賣點,也進一步推動了市場的成長。然而,原料成本高昂和監管合規等挑戰可能會減緩市場的擴張。

全球冷凍食品可食用包裝市場的主要參與者包括 Ingredion Incorporated、Tate & Lyle PLC、BASF SE、WikiCell Designs Inc. 和 Amcor Plc。為了維持和擴大市場地位,可食用包裝行業的公司採用了各種策略。這些策略包括不斷創新材料以提升產品性能,例如提高冷凍穩定性和改善冷凍食品的保濕性。公司也注重永續性,確保其產品可生物分解,並符合消費者對環保解決方案的需求。與冷凍食品製造商建立策略合作夥伴關係和合作關係,使該公司能夠將其可食用包裝融入更廣泛的產品系列,尤其是在日益成長的植物性和有機食品領域。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 供應鏈複雜性

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按材料類型,2025 - 2034 年

- 主要趨勢

- 耐高溫蛋白膜

- 多醣膜

- 脂質塗層

- 複合材料和混合材料

第6章:市場估計與預測:按技術類型,2025 - 2034 年

- 主要趨勢

- 冷穩定成膜

- 屏障增強

- 冷鏈一體化

第7章:市場估計與預測:按應用類型,2025 - 2034 年

- 主要趨勢

- 冷凍蔬菜和水果

- 冷凍肉類和海鮮

- 冷凍即食食品

- 冷凍乳製品和甜點

第8章:市場估計與預測:按地區,2025 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Tate & Lyle PLC

- Kerry Group plc

- Ingredion Incorporated

- Cargill, Incorporated

- Archer-Daniels-Midland Company

- DuPont de Nemours, Inc.

- BASF SE

- Corbion NV

- Roquette Freres

- CP Kelco (JM Huber Corporation)

- FMC Corporation

- Ashland Global Holdings Inc.

- Novamont SpA

- WikiCell Designs Inc.

- MonoSol LLC

The Global Edible Packaging for Frozen Foods Market was valued at USD 217.2 million in 2024 and is estimated to grow at a CAGR of 7.7% to reach USD 449.1 million by 2034. This growing market is driven by an increasing demand for cold-stable, biodegradable packaging, particularly for individually quick frozen (IQF) fruits, vegetables, microwaveable frozen meals, and ready-to-heat meals. This demand is particularly evident in North America, Europe, and select parts of Asia-Pacific, such as Japan, South Korea, and Australia. The demand for edible packaging has been primarily fueled by the sales of frozen fruits and plant-based meals in North America and Europe, alongside more affordable alternatives like chitosan and starch-based packaging in parts of Asia-Pacific.

Polysaccharide films, due to their affordability and freeze stability, are expected to see the highest growth within the market. Additionally, the need for cold-chain optimization and the integration of flavors into edible coatings is expected to drive growth in premium product categories. The rise of private-label frozen foods in North America and Western Europe is another significant contributor to the increasing adoption of edible packaging.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $217.2 Million |

| Forecast Value | $449.1 Million |

| CAGR | 7.7% |

The polysaccharide films segment will reach 34.9% share by 2034. These films, derived from materials like starch, alginate, and cellulose, are preferred for their low cost, minimal allergen risk, and strong performance in frozen environments. They also offer flexibility, making them suitable for various frozen foods, such as vegetables, seafood, and ready-to-eat meals.

In 2024, the frozen vegetables and fruits segment accounted for 35.6% share driven by their high export volumes and early adoption of edible coatings, which help preserve moisture and enhance eco-friendly branding. The use of edible packaging has gained further momentum due to stricter organic labeling regulations and bans on plastic wraps for frozen produce in various regions, including Europe and parts of Asia.

North America Edible Packaging for Frozen Foods Market held 33% share in 2024, driven by retailer adoption, innovative start-ups in edible packaging, and growing consumer awareness of sustainability. The U.S. alone represented USD 61.7 million. Additionally, the rise of private-label frozen food products featuring edible films as a sustainable differentiation point has fueled further market growth. However, challenges such as the high cost of raw materials and regulatory compliance may slow the market's expansion.

Key players in the Global Edible Packaging for Frozen Foods Market include Ingredion Incorporated, Tate & Lyle PLC, BASF SE, WikiCell Designs Inc., and Amcor Plc. To maintain and expand their market position, companies in the edible packaging sector have employed a variety of strategies. These include ongoing innovation in materials to enhance product performance, such as increasing freeze stability and improving moisture retention for frozen foods. Companies have also focused on sustainability, ensuring their products are biodegradable and aligned with consumer demand for eco-friendly solutions. Strategic partnerships and collaborations with frozen food manufacturers have allowed companies to integrate their edible packaging into a broader range of products, especially in the growing plant-based and organic food sectors.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material

- 2.2.3 Technology

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain complexity

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2025 - 2034 (USD Million, Units)

- 5.1 Key trends

- 5.2 Temperature-resistant protein films

- 5.3 Polysaccharide films

- 5.4 Lipid-based coatings

- 5.5 Composite & hybrid materials

Chapter 6 Market Estimates and Forecast, By Technology Type, 2025 - 2034 (USD Million, Units)

- 6.1 Key trends

- 6.2 Cold-stable film formation

- 6.3 Barrier enhancements

- 6.4 Cold chain integration

Chapter 7 Market Estimates and Forecast, By Application type, 2025 - 2034 (USD Million, Units)

- 7.1 Key trends

- 7.2 Frozen vegetables & fruits

- 7.3 Frozen meat & seafood

- 7.4 Frozen ready meals

- 7.5 Frozen dairy & desserts

Chapter 8 Market Estimates and Forecast, By Region, 2025 - 2034 (USD Million, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Tate & Lyle PLC

- 9.2 Kerry Group plc

- 9.3 Ingredion Incorporated

- 9.4 Cargill, Incorporated

- 9.5 Archer-Daniels-Midland Company

- 9.6 DuPont de Nemours, Inc.

- 9.7 BASF SE

- 9.8 Corbion N.V.

- 9.9 Roquette Freres

- 9.10 CP Kelco (J.M. Huber Corporation)

- 9.11 FMC Corporation

- 9.12 Ashland Global Holdings Inc.

- 9.13 Novamont S.p.A.

- 9.14 WikiCell Designs Inc.

- 9.15 MonoSol LLC