|

市場調查報告書

商品編碼

1801930

冷凍熟食市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Frozen Cooked Ready Meals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

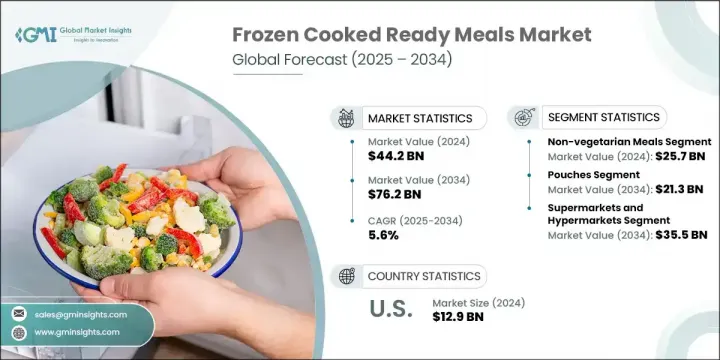

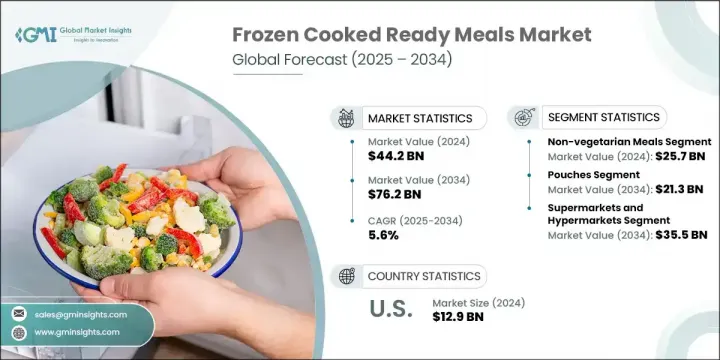

2024年,全球冷凍熟食即食食品市場規模達442億美元,預計到2034年將以5.6%的複合年成長率成長,達到762億美元。消費者對便利快速餐飲解決方案的日益偏好,並持續推動市場發展動能。城鎮化、雙收入家庭的增加以及日常生活節奏的加快,都在推動人們對符合日益提升的健康標準的速食食品的需求。改良的包裝形式和先進的保鮮方法,使品牌能夠提供口味更新鮮、營養更豐富的冷凍食品。同時,電子商務正在重塑消費者的購物方式,使這些食品更容易取得。

預計到2034年,全球市場規模將成長近一倍,這得益於飲食偏好的轉變、產品供應的擴大以及消費者越來越願意在更健康、更省時的食品上花費更多。植物性飲食習慣正在進一步推動成長,越來越多的消費者尋求永續的無肉選擇。各大品牌正在將肉類食品轉變為植物蛋白替代品,並加入扁豆、大豆和豌豆等成分,吸引注重道德和健康的消費者。隨著對清潔標籤、即食和多樣化全球美食的需求不斷成長,冷凍熟食即食食品類別正成為現代膳食計劃和食品消費模式的重要組成部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 442億美元 |

| 預測值 | 762億美元 |

| 複合年成長率 | 5.6% |

2024年,非素食冷凍食品市場規模達257億美元,佔58.1%。由於市場對富含蛋白質且風味濃郁的膳食選擇的需求普遍存在,該市場仍佔據主導地位。儘管素食選擇日益受到青睞,這主要得益於人們對植物性飲食和健康意識的提升,但非素食仍然受益於其穩定的消費者群體以及對便捷性與多樣性兼顧的日益成長的需求。消費者青睞既能滿足飲食需求又能節省時間的膳食,尤其是在注重便利性的城市環境中。健康意識的提升正推動各大品牌推出更乾淨、更均衡的非素食食品,從而進一步促進其成長。

2034年,包裝創新領域將達到213億美元。包裝袋易於使用、方便攜帶,並能提高儲存效率。這些輕巧的包裝選擇不僅迎合了快節奏的生活方式,也順應了市場向永續發展的轉變。新型包裝袋具有更佳的隔熱性、可回收性和智慧包裝功能,正在影響產品的展示和保存方式。

美國冷凍熟食市場佔80.1%的市場佔有率,2024年市場規模達129億美元。得益於成熟的零售基礎設施和消費者對產品種類創新的持續需求,該地區呈現強勁成長動能。雙收入家庭的成長和時間緊迫的消費者等生活方式的改變,創造了一種追求便利的文化,並持續推動市場擴張。儘管線上食品配送平台顯著提升了冷凍食品的曝光度和可及性,但傳統雜貨店和大型零售商仍然是重要的銷售管道。隨著消費者飲食越來越注重健康,美國品牌正在穩步增加植物性產品,以補充其核心的肉類產品線。

影響全球冷凍熟食即食食品市場的關鍵參與者包括 Dr. Oetker、通用磨坊、Frosta、嘉里集團和康尼格拉品牌。為了在冷凍熟食即食食品市場中佔據競爭優勢,領先品牌正致力於持續的產品創新,以滿足多樣化的消費者需求。各公司正在擴大其植物性和清潔標籤產品組合,以吸引注重健康的消費者和彈性素食消費者。投資研發有助於改善口味並延長保存期限,無需添加人工防腐劑。與本地供應商建立策略合作夥伴關係可以加快產品上市速度並更好地控制成分。增強型包裝解決方案(包括可回收包裝袋和微波爐安全容器)也是優先事項。各品牌正透過全通路零售策略進一步加強其市場影響力,強調線上雜貨平台和直接面對消費者的通路。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 消費者對快速、方便、省時的餐飲解決方案的需求日益成長

- 都市化進程加快,雙收入家庭烹調時間減少

- 冷凍技術的進步保留了風味、質地和營養

- 有組織的零售和電子商務雜貨平台的滲透率不斷提高

- 產業陷阱與挑戰

- 消費者認為冷凍食品不如新鮮食品健康

- 新鮮餐點和餐廳外送服務的激烈競爭

- 市場機會

- 對植物性和清潔標籤冷凍食品的需求不斷成長

- 向中產階級人口不斷成長的新興市場擴張

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 素食

- 非素食餐

第6章:市場估計與預測:依包裝類型,2021 - 2034 年

- 主要趨勢

- 袋裝

- 托盤

- 包包

- 盒子

第7章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 超市/大賣場

- 便利商店

- 網路零售

- 專賣店

- 餐飲服務/餐廳

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

8.3.1 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 埃及

- MEA 其餘地區

第9章:公司簡介

- Ajinomoto Co., Inc.

- Bellisio Foods

- Conagra Brands

- Dr. Oetker

- Frosta AG

- General Mills

- Iceland Foods

- Kerry Group

- Kraft Heinz

- McCain Foods

- MTR Foods

- Nestle

- Nomad Foods

- Seara Foods (JBS)

- Tyson Foods

The Global Frozen Cooked Ready Meals Market was valued at USD 44.2 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 76.2 billion by 2034. Rising consumer preference for convenient and fast meal solutions continues to drive market momentum. Urbanization, increasing dual-income households, and the growing pace of everyday life are fueling the demand for quick-prep meals that also meet evolving health standards. Enhanced packaging formats and advanced preservation methods are enabling brands to deliver fresher-tasting, nutrient-retaining frozen meals. Simultaneously, e-commerce is reshaping how consumers shop, making these meals more accessible.

Across global regions, market volumes are expected to nearly double by 2034, supported by changing dietary preferences, expanded product offerings, and growing consumer willingness to spend more on healthier, time-saving food options. Plant-based eating habits are further propelling growth, with more consumers seeking sustainable, meat-free choices. Brands are evolving meat-based meals into plant protein alternatives, incorporating ingredients like lentils, soy, and peas to appeal to ethical and health-conscious shoppers. With demand rising for clean-label, ready-to-serve, and varied global cuisines, the frozen cooked ready meals category is becoming a central part of modern meal planning and food consumption patterns.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $44.2 Billion |

| Forecast Value | $76.2 Billion |

| CAGR | 5.6% |

The non-vegetarian frozen meals segment accounted for USD 25.7 billion in 2024, capturing 58.1% share. This segment remains dominant due to the widespread demand for protein-rich and flavorful meal options. While vegetarian options are gaining traction, largely because of increased awareness around plant-based diets and health, non-vegetarian meals continue to benefit from an established consumer base and growing appetite for convenience without compromising variety. Consumers are drawn to meals that meet dietary needs while saving time, and this is especially true in urban environments where convenience is a priority. The rise in health consciousness is pushing brands to offer cleaner, better-balanced non-veg meals, further boosting growth.

Packaging innovation segment will reach USD 21.3 billion by 2034, pouches offer ease of use, portability, and better storage efficiency. These lightweight options cater to fast-paced lifestyles and align with the market's shift toward sustainability. New pouch formats with improved insulation, recyclability, and smart-packaging features are influencing how products are presented and preserved.

U.S. Frozen Cooked Ready Meals Market held 80.1% share and generated USD 12.9 billion in 2024. The region shows strong growth thanks to mature retail infrastructure and consistent consumer demand for innovation in product variety. Lifestyle changes such as the growth of dual-income homes and time-constrained consumers have created a culture of convenience that continues to expand the market. Traditional grocery stores and large-format retailers remain essential channels, though online grocery delivery platforms have significantly boosted visibility and accessibility of frozen meals. As consumer diets shift toward health and wellness, brands in the U.S. are steadily adding plant-based options to complement their core meat-based lines.

The key players shaping the Global Frozen Cooked Ready Meals Market include Dr. Oetker, General Mills, Frosta, Kerry Group, and Conagra Brands. To secure a competitive position in the frozen cooked ready meals market, leading brands are focusing on continuous product innovation, targeting diverse consumer needs. Companies are expanding their plant-based and clean-label portfolios to appeal to health-conscious and flexitarian consumers. Investing in R&D helps improve taste profiles and extend shelf life without artificial preservatives. Strategic partnerships with local suppliers allow faster product launches and better control over ingredients. Enhanced packaging solutions, including recyclable pouches and microwave-safe containers, are also a priority. Brands are further strengthening their market footprint through omnichannel retail strategies, emphasizing online grocery platforms and direct-to-consumer channels.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Packaging type

- 2.2.3 Distribution channel

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing consumer demand for quick, convenient, and time-saving meal solutions

- 3.2.1.2 Rising urbanization and dual-income households with less cooking time

- 3.2.1.3 Advancements in freezing technology preserving taste, texture, and nutrition

- 3.2.1.4 Increasing penetration of organized retail and e-commerce grocery platforms

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Consumer perception of frozen meals as less healthy than fresh alternatives

- 3.2.2.2 Intense competition from fresh meal kits and restaurant delivery services

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for plant-based and clean-label frozen meal options

- 3.2.3.2 Expansion into emerging markets with growing middle-class population

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product type

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Bn, Tons)

- 5.1 Key trends

- 5.2 Vegetarian meals

- 5.3 Non-vegetarian meals

Chapter 6 Market Estimates & Forecast, By Packaging Type, 2021 - 2034 (USD Bn, Tons)

- 6.1 Key trends

- 6.2 Pouches

- 6.3 Trays

- 6.4 Bags

- 6.5 Boxes

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Bn, Tons)

- 7.1 Key trends

- 7.2 Supermarkets/hypermarkets

- 7.3 Convenience stores

- 7.4 Online retail

- 7.5 Specialty stores

- 7.6 Foodservice/restaurants

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn, Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest Of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Egypt

- 8.6.5 Rest of MEA

Chapter 9 Company Profiles

- 9.1 Ajinomoto Co., Inc.

- 9.2 Bellisio Foods

- 9.3 Conagra Brands

- 9.4 Dr. Oetker

- 9.5 Frosta AG

- 9.6 General Mills

- 9.7 Iceland Foods

- 9.8 Kerry Group

- 9.9 Kraft Heinz

- 9.10 McCain Foods

- 9.11 MTR Foods

- 9.12 Nestle

- 9.13 Nomad Foods

- 9.14 Seara Foods (JBS)

- 9.15 Tyson Foods