|

市場調查報告書

商品編碼

1773356

寵物治療飲食市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Pet Therapeutic Diet Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

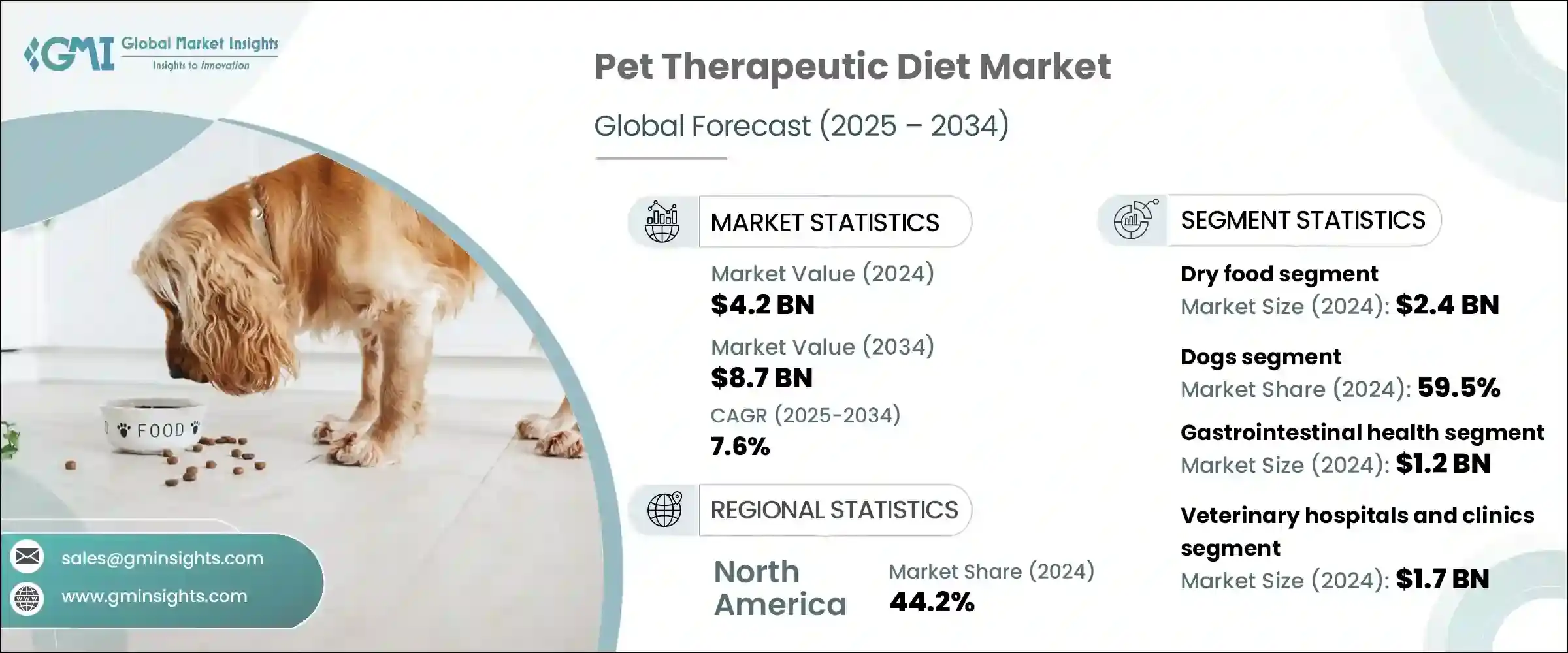

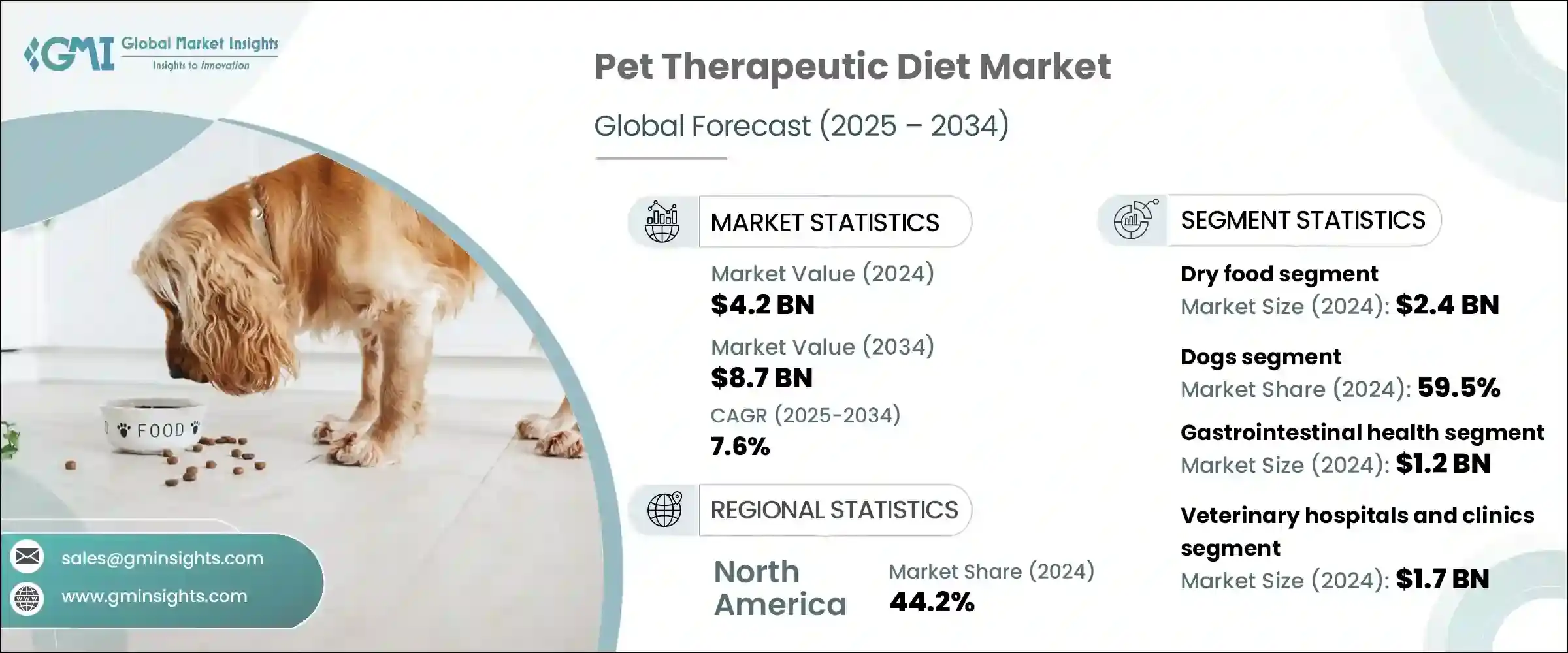

2024年,全球寵物治療性飲食市場規模達42億美元,預計到2034年將以7.6%的複合年成長率成長,達到87億美元。伴侶動物日益增多的慢性健康問題(例如肥胖、糖尿病、腎臟病和胃腸道疾病)正在推動對有針對性的營養解決方案的需求。隨著寵物主人擴大採用以家庭為中心的寵物護理方式,他們更願意投資兼具預防和治療功效的專用飲食。人們對負責任的寵物飼養意識的不斷提高以及向主動健康管理的轉變,正在強化這一趨勢。

獸醫指導的不斷成長以及對更全面護理方案的需求進一步推動了治療性營養的廣泛應用。如今,許多寵物主人將營養視為管理寵物狀況和確保長期健康的重要工具。寵物人性化趨勢提高了人們對寵物食品品質和臨床功效的期望。因此,越來越多的消費者選擇針對特定疾病的飲食來支持康復和持續健康,這使得治療性飲食成為新興市場和已開發市場伴侶動物保健策略的核心組成部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 42億美元 |

| 預測值 | 87億美元 |

| 複合年成長率 | 7.6% |

寵物治療性飲食是動物營養領域的一個專業領域,旨在幫助治療、控制或預防寵物的特定疾病。這些配方在獸醫護理中發揮關鍵作用,提供營養益處,以促進康復、減輕症狀並促進整體健康。

2024年,乾糧類別引領市場,估值達24億美元。寵物主人和獸醫青睞乾糧,因為它經濟實惠、保存期限長、易於儲存。這些產品能夠可靠地控制飲食量,是需要持續治療性營養的寵物的理想選擇,尤其是那些正在管理慢性疾病的寵物。乾糧配方旨在解決肥胖、腎臟疾病或胃腸道失衡等健康問題,使日常餵食更加輕鬆,同時確保寵物獲得持續護理所需的營養。

2024年,犬類食品佔了59.5%的市場。越來越多的犬類健康問題——尤其是肥胖——因缺乏運動的生活方式和富含人工成分的飲食而加劇——正在推動對治療性食品的需求。犬隻頻繁進食的天性使得為它們提供均衡、健康的飲食顯得尤為重要。它們的飲食習慣和營養需求正日益影響寵物食品的選擇,促使主人選擇專門的治療性食品來維持長期健康。

2024年,美國寵物治療性飲食市場規模達17億美元。寵物收養率的上升和老齡化動物數量的增加是市場擴張的主要推動因素。如今,許多寵物需要特殊飲食來控制心血管疾病、關節問題和其他慢性疾病。人們對寵物預防性保健措施的日益重視也推動了對治療性飲食的需求。美國高度發達的獸醫網路將這些飲食納入長期治療計劃,使其成為疾病管理和常規動物護理的標準組成部分。寵物保險意識的提高和普及也使更多寵物主人能夠探索更優質的飲食解決方案。

引領全球市場的公司包括獸醫營養集團 (Veterinary Nutrition Group)、JustFoodForDogs、Open Farm、Diamond Pet Foods、Mars Petcare、Hill's Pet Nutrition、EmerAid、Stella and Chewy's、United PetFood、Eden Holistic Pet、Blue Buffalo (General Mills)、Virb、Ziwi、Iden Holistic Petacy Foods、Blue Buffalo (General.wi為了加強市場影響力,寵物治療性飲食領域的公司正大力投資研發,以研發有科學根據、針對特定疾病的膳食。許多公司正在擴大產品線,以涵蓋更廣泛的健康問題,包括腎臟支持、消化系統護理、代謝健康和關節健康。與獸醫和獸醫診所的合作正在提高產品的可信度和影響力。策略性行銷工作強調臨床療效和優質成分,以建立消費者的信任。參與者還採用透明標籤和清潔配方,以滿足注重健康的寵物主人的期望。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 寵物人口老化

- 寵物擁有量和寵物人性化程度的提高

- 伴侶動物慢性病盛行率不斷上升

- 產品創新與客製化

- 產業陷阱與挑戰

- 監管挑戰和可靠性問題

- 認知和教育有限

- 市場機會

- 發展中地區寵物擁有量和都市化進程不斷成長

- 對清潔標籤、有機和植物性治療性飲食的需求不斷成長

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 技術格局

- 定價分析

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 重點發展

- 併購

- 夥伴關係與協作

- 新產品發布

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 乾糧

- 濕食/罐頭食品

- 其他產品類型

第6章:市場估計與預測:依動物類型,2021 年至 2034 年

- 主要趨勢

- 貓

- 狗

- 其他動物

第7章:市場估計與預測:依健康狀況,2021 年至 2034 年

- 主要趨勢

- 腎臟健康

- 胃腸道健康

- 心血管健康

- 體重管理

- 關節護理

- 其他健康狀況

第8章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 獸醫醫院和診所

- 電子商務

- 零售藥局

- 其他分銷管道

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Blue Buffalo (General Mills)

- Diamond Pet Foods

- Eden Holistic Pet Foods

- EmerAid

- Hill's Pet Nutrition

- iVet.com

- JustFoodForDogs

- Mars Petcare

- Nestle

- Open Farm

- Stella and Chewy's

- United PetFood

- Veterinary Nutrition Group

- Virbac

- Ziwi

The Global Pet Therapeutic Diet Market was valued at USD 4.2 billion in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 8.7 billion by 2034. Increasing chronic health issues in companion animals-such as obesity, diabetes, kidney disease, and gastrointestinal disorders-are driving the demand for targeted nutritional solutions. As pet owners increasingly adopt a family-centric approach to pet care, they're more willing to invest in specialized diets that offer both preventive and therapeutic benefits. Rising awareness about responsible pet ownership and a shift toward proactive health management are reinforcing this trend.

The broader adoption of therapeutic nutrition is further fueled by growing veterinary guidance and a demand for more holistic care options. Many pet parents now view nutrition as an essential tool for managing conditions and ensuring the long-term wellness of their animals. The trend toward pet humanization has elevated expectations for quality and clinical efficacy in pet food. As a result, more consumers are turning to condition-specific diets to support recovery and ongoing health, positioning therapeutic diets as a core component of companion animal healthcare strategies in both emerging and developed markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 7.6% |

Pet therapeutic diets represent a specialized segment within the animal nutrition sector, tailored to help treat, manage, or prevent specific medical conditions in pets. These formulations play a key role in veterinary care, delivering nutritional benefits designed to support recovery, reduce symptoms, and promote overall well-being.

The dry food category segment led the market in 2024, reaching a valuation of USD 2.4 billion. Pet owners and veterinarians prefer dry food due to its cost-effectiveness, long shelf life, and ease of storage. These products offer reliable portion control and are ideal for pets requiring consistent therapeutic nutrition, especially those managing chronic conditions. Designed to address health issues like obesity, kidney disease, or gastrointestinal imbalances, dry formulations make daily feeding routines easier while ensuring pets receive the necessary nutrients for ongoing care.

The dogs segment held a 59.5% share in 2024. A growing number of health concerns in dogs-particularly obesity, which is exacerbated by inactive lifestyles and diets high in artificial ingredients-are fueling demand for therapeutic food products. The natural tendency of dogs to consume food frequently increases the importance of feeding them balanced, health-oriented diets. Their dietary habits and nutritional needs are increasingly influencing pet food choices, encouraging owners to turn to specialized therapeutic options to maintain long-term health.

United States Pet Therapeutic Diet Market reached USD 1.7 billion in 2024. Rising pet adoption and the growing population of aging animals are major contributors to market expansion. Many pets now require specialized diets to manage cardiovascular conditions, joint problems, and other chronic illnesses. An increased focus on preventive health measures for pets is also boosting demand for therapeutic diets. The highly developed veterinary network in the U.S. incorporates these diets into long-term treatment plans, making them a standard part of disease management and routine animal care. Greater awareness and access to pet insurance are also enabling more owners to explore premium dietary solutions.

Companies leading the global market include Veterinary Nutrition Group, JustFoodForDogs, Open Farm, Diamond Pet Foods, Mars Petcare, Hill's Pet Nutrition, EmerAid, Stella and Chewy's, United PetFood, Eden Holistic Pet Foods, Blue Buffalo (General Mills), Virbac, Ziwi, Nestle, and iVet.com. To strengthen their market presence, companies in the pet therapeutic diet space are investing heavily in research and development to formulate science-backed, condition-specific diets. Many firms are expanding product lines to cover a wider range of health issues, including renal support, digestive care, metabolic health, and joint wellness. Collaborations with veterinarians and veterinary clinics are enhancing product credibility and reach. Strategic marketing efforts emphasize clinical efficacy and quality ingredients to build trust among consumers. Players are also adopting transparent labeling and clean formulations to align with the expectations of health-conscious pet owners.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Animal type

- 2.2.4 Health condition

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Aging pet population

- 3.2.1.2 Rising pet ownership and pet humanization

- 3.2.1.3 Growing prevalence of chronic disease in companion animals

- 3.2.1.4 Product innovation and customization

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory challenges and reliability concerns

- 3.2.2.2 Limited awareness and education

- 3.2.3 Market opportunities

- 3.2.3.1 Rising pet ownership and urbanization in developing regions

- 3.2.3.2 Growing demand for clean-label, organic and plant-based therapeutic diets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological landscape

- 3.6 Pricing analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key development

- 4.6.1 Mergers and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Dry food

- 5.3 Wet/ canned food

- 5.4 Other product types

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cats

- 6.3 Dogs

- 6.4 Other animals

Chapter 7 Market Estimates and Forecast, By Health Condition, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Renal health

- 7.3 Gastrointestinal health

- 7.4 Cardiovascular health

- 7.5 Weight management

- 7.6 Joint care

- 7.7 Other health conditions

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospitals and clinics

- 8.3 E-commerce

- 8.4 Retail pharmacies

- 8.5 Other distribution channels

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Blue Buffalo (General Mills)

- 10.2 Diamond Pet Foods

- 10.3 Eden Holistic Pet Foods

- 10.4 EmerAid

- 10.5 Hill's Pet Nutrition

- 10.6 iVet.com

- 10.7 JustFoodForDogs

- 10.8 Mars Petcare

- 10.9 Nestle

- 10.10 Open Farm

- 10.11 Stella and Chewy's

- 10.12 United PetFood

- 10.13 Veterinary Nutrition Group

- 10.14 Virbac

- 10.15 Ziwi