|

市場調查報告書

商品編碼

1773252

絕育市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Spay and Neuter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

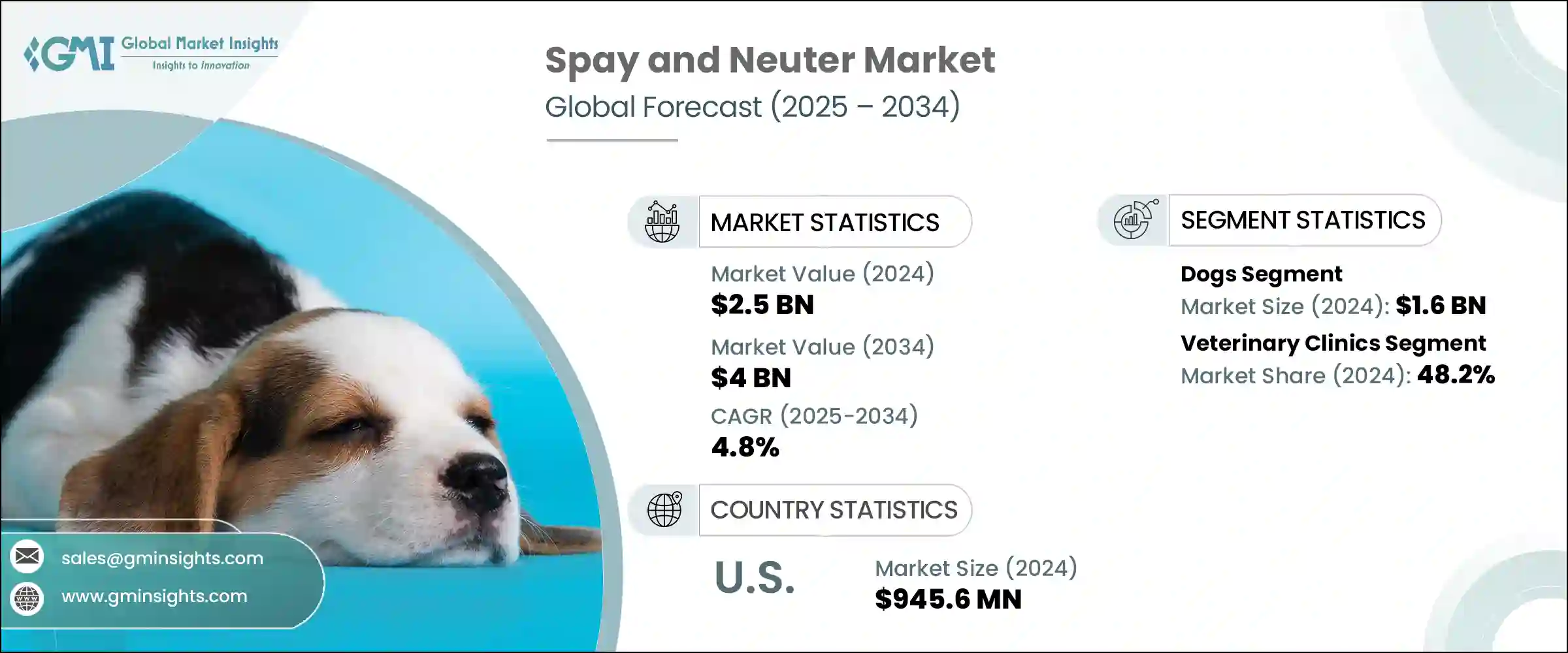

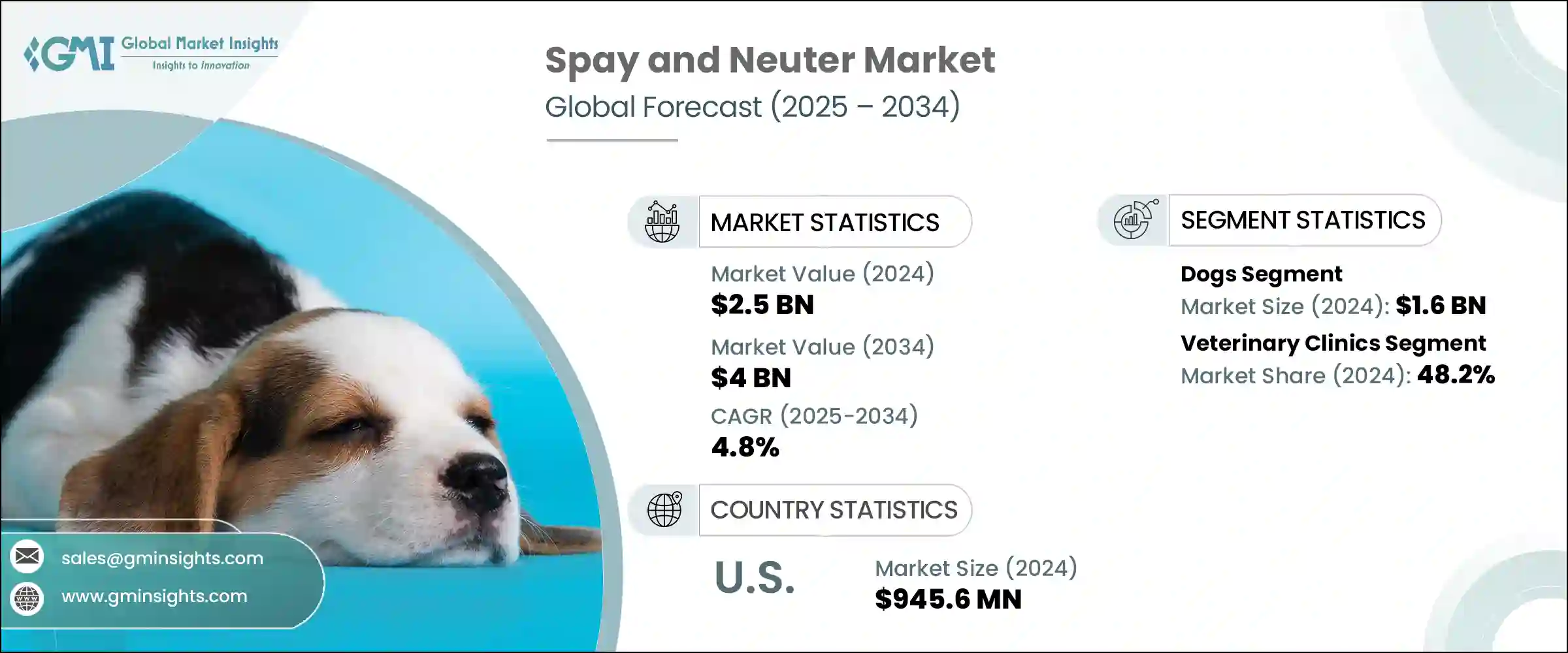

2024年,全球絕育市場規模達25億美元,預計2034年將以4.8%的複合年成長率成長,達到40億美元。人們對寵物數量過剩以及絕育手術帶來的健康益處的認知不斷提高,是推動這一成長的主要動力。由獸醫協會、政府和動物福利組織領導的公共宣傳活動持續鼓勵人們養育負責任的寵物。教育和社區推廣活動也正在轉變人們對寵物絕育的觀念,導致城鄉絕育率顯著上升。這種觀念的轉變,加上機構的努力,在推動市場發展方面發揮了至關重要的作用。

推動市場擴張的另一個關鍵因素是全球伴侶動物擁有量的穩定成長。隨著越來越多的家庭開始接納寵物,對獸醫服務的需求,尤其是絕育服務的需求也日益成長。全球各地家庭飼養數億隻貓狗,對絕育服務的需求激增。在許多情況下,救助中心和領養機構要求絕育作為領養的條件,這進一步加速了絕育服務的普及。動物領養比商業繁殖越來越受歡迎——這通常是由針對流浪動物種群的宣傳活動所推動的——這強化了絕育作為一項必要的健康和種群控制措施的地位,也加劇了對價格合理且易於獲取的絕育程序的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 25億美元 |

| 預測值 | 40億美元 |

| 複合年成長率 | 4.8% |

2024年,寵物狗佔了最大的市場佔有率,產值達16億美元。這種主導地位主要源自於寵物狗被廣泛飼養,以及消費者在寵物照護方面的支出不斷成長。歐洲各國報告稱,寵物狗數量眾多,導致絕育需求增加。狗主人更有可能選擇絕育作為整體健康和行為管理的一部分。此外,新興市場可支配收入的不斷成長以及寵物保險覆蓋率的不斷提高,使得絕育服務在經濟上更加可行。這些趨勢預計將在未來幾年推動該領域的成長。

2024年,獸醫診所佔了最高佔有率,達到48.2%。強勁的患者數量和極具競爭力的價格支撐著其領先地位,使其成為寵物主人的熱門選擇。診所配備先進的手術設備,提供專業的護理,確保安全和品質。從全面的術前評估到術後護理,診所為這些手術提供了可靠的環境。許多診所還推出了促銷套餐、分期付款計劃和社區合作夥伴關係,以幫助擴大基本服務的覆蓋範圍。獸醫診所憑藉其專業知識、經濟實惠的價格以及積極的推廣策略,已成為全球絕育手術的主要管道。

2024年,美國絕育市場規模達9.456億美元。美國廣泛的獸醫基礎設施和發達的專業人才網路支撐著持續的絕育服務需求。僅憑家庭寵物的數量就推動了對常規動物醫療保健的需求,尤其是絕育手術。腹腔鏡和內視鏡等微創手術的技術進步,因其縮短了恢復時間並降低了併發症發生率,正在逐漸普及。此外,隨著消費者在寵物健康和預防性醫療保健方面的支出不斷增加,對絕育服務的需求預計將保持在高位,這將鞏固美國在全球市場的主導地位。

絕育市場的主要參與者包括 Auburn Valley Humane Society、Alley Cat Allies、CVS Group Plc、Banfield Pet Hospital、The PAWS Clinic、Companions Spay & Neuter、Fix Long Beach、Indian Street Animal Clinic、VetPartners Group Limited、Houston Humane Society、Petco Aanimal Clinic、VetPartners Group Limited、Houston Veterinary Health 和 S/Nipped Clinic。為了鞏固其在競爭激烈的絕育市場中的地位,公司正在採取一系列有針對性的策略。許多公司專注於將診所網路擴展到服務不足或農村地區,以吸引更廣泛的客戶群。提供捆綁服務,包括疫苗接種和健康檢查以及絕育,可以提高便利性並促進普及。各組織也正在投資教育活動並與收容所密切合作,以簡化與收養相關的絕育流程。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 人們對絕育益處的認知不斷提高

- 擴大流動絕育診所

- 絕育手術的進步

- 公共/私人組織的支持舉措

- 產業陷阱與挑戰

- 絕育手術相關風險

- 一些國家反對絕育手術的規定/文化信仰

- 市場機會

- 政府和非政府組織的人口控制舉措

- 強制絕育法律和寵物許可規定

- 成長動力

- 成長潛力分析

- 監管格局

- 2024年各國寵物擁有量統計數據

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新服務推出

- 擴張計劃

第5章:市場估計與預測:依動物類型,2021 年至 2034 年

- 主要趨勢

- 狗

- 絕育

- 絕育

- 貓

- 絕育

- 絕育

- 其他動物類型

- 絕育

- 絕育

第6章:市場估計與預測:按服務供應商,2021 年至 2034 年

- 主要趨勢

- 獸醫診所

- 獸醫院

- 其他服務提供者

第7章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- Alley Cat Allies

- Auburn Valley Humane Society

- Animal Spay-Neuter Clinic

- Banfield Pet Hospital

- CVS Group Plc

- Companions Spay & Neuter

- Ethos Veterinary Health

- Fix Long Beach

- Holt Road Pet Hospital

- Houston Humane Society

- Indian Street Animal Clinic

- Naoi Animal Hospital

- Petco Animal Supplies

- S/Nipped Clinic

- The PAWS Clinic

- VetPartners Group Limited

The Global Spay and Neuter Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 4 billion by 2034. Rising awareness about pet overpopulation and the health benefits associated with sterilization procedures are major drivers behind this growth. Public campaigns led by veterinary associations, governments, and animal welfare organizations continue to encourage responsible pet ownership. Educational and community outreach initiatives are also transforming perceptions around pet sterilization, leading to a significant rise in procedure rates across both urban and rural areas. This evolving mindset, supported by institutional efforts, has played a crucial role in fueling market momentum.

Another key contributor to the market's expansion is the steady increase in global companion animal ownership. As more families welcome pets into their homes, the demand for veterinary services, especially sterilization, is growing. With hundreds of millions of dogs and cats living in households across regions, demand for spay and neuter services has surged. In many cases, rescue centers and adoption agencies require sterilization as a condition for adoption, further accelerating the uptake. The growing popularity of animal adoption over commercial breeding-often driven by awareness campaigns against stray populations-has reinforced sterilization as a necessary health and population control measure, amplifying the need for affordable and accessible procedures.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $4 Billion |

| CAGR | 4.8% |

In 2024, dogs held the largest segment share of the market, generating USD 1.6 billion. This dominance is largely due to the widespread adoption of dogs as pets, coupled with rising consumer spending on their care. Countries in Europe report high populations of pet dogs, which contributes to increased demand for sterilization. Dog owners are more likely to opt for spaying or neutering as part of general health and behavioral management. Additionally, expanding disposable incomes in emerging markets and the rising uptake of pet insurance coverage continue to make sterilization services more financially feasible. These combined trends are expected to fuel segment growth in the coming years.

The veterinary clinics segment commanded the highest share in 2024, accounting for 48.2%. Their leadership position is backed by strong patient volumes and competitive pricing, making them a popular choice among pet owners. Clinics offer expert care with advanced surgical equipment, ensuring safety and quality. From comprehensive pre-surgery evaluations to follow-up care, clinics provide a reliable environment for these procedures. Many of them are also introducing promotional packages, installment payment plans, and community partnerships that help expand access to essential services. Their expertise, affordability, and proactive outreach strategies have made veterinary clinics the primary channel for spay and neuter operations globally.

U.S. Spay and Neuter Market generated USD 945.6 million in 2024. The country's extensive veterinary infrastructure and a well-developed network of professionals support consistent demand for sterilization services. The sheer number of household pets alone boosts the requirement for regular animal healthcare, particularly spay and neuter operations. Technological advancements in minimally invasive surgeries like laparoscopy and endoscopy are gaining ground due to their reduced recovery times and lower complication rates. Moreover, with rising consumer expenditure on pet wellness and preventive healthcare, the demand for sterilization services is expected to remain high, reinforcing the U.S. as a dominant force in the global market.

Leading participants in the Spay and Neuter Market include Auburn Valley Humane Society, Alley Cat Allies, CVS Group Plc, Banfield Pet Hospital, The PAWS Clinic, Companions Spay & Neuter, Fix Long Beach, Indian Street Animal Clinic, VetPartners Group Limited, Houston Humane Society, Petco Animal Supplies, Naoi Animal Hospital, Animal Spay-Neuter Clinic, Holt Road Pet Hospital, Ethos Veterinary Health, S/Nipped Clinic. To reinforce their position in the competitive spay and neuter market, companies are adopting a range of targeted strategies. Many focus on expanding clinic networks into underserved or rural areas to capture a broader clientele. Offering bundled services, including vaccinations and wellness check-ups with sterilization, improves convenience and boosts uptake. Organizations are also investing in educational campaigns and working closely with shelters to streamline adoption-linked sterilization processes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Animal type

- 2.2.3 Service provider

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing awareness about the benefits of spaying and neutering

- 3.2.1.2 Expansion of mobile spay and neuter clinics

- 3.2.1.3 Advancement in the spay and neuter surgical procedures

- 3.2.1.4 Supportive initiatives by public/ private organizations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk associated with spay and neuter surgeries

- 3.2.2.2 Regulations/ cultural beliefs against spay and neuter surgeries in some countries

- 3.2.3 Market opportunities

- 3.2.3.1 Government and NGO initiatives for population control

- 3.2.3.2 Mandatory sterilization laws and pet licensing regulations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Pet ownership statistics by country, 2024

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Key developments

- 4.5.1 Merger and acquisition

- 4.5.2 Partnership and collaboration

- 4.5.3 New service launches

- 4.5.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Animal Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Dogs

- 5.2.1 Spaying

- 5.2.2 Neutering

- 5.3 Cats

- 5.3.1 Spaying

- 5.3.2 Neutering

- 5.4 Other animal types

- 5.4.1 Spaying

- 5.4.2 Neutering

Chapter 6 Market Estimates and Forecast, By Service Provider, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Veterinary clinics

- 6.3 Veterinary hospitals

- 6.4 Other service providers

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Alley Cat Allies

- 8.2 Auburn Valley Humane Society

- 8.3 Animal Spay-Neuter Clinic

- 8.4 Banfield Pet Hospital

- 8.5 CVS Group Plc

- 8.6 Companions Spay & Neuter

- 8.7 Ethos Veterinary Health

- 8.8 Fix Long Beach

- 8.9 Holt Road Pet Hospital

- 8.10 Houston Humane Society

- 8.11 Indian Street Animal Clinic

- 8.12 Naoi Animal Hospital

- 8.13 Petco Animal Supplies

- 8.14 S/Nipped Clinic

- 8.15 The PAWS Clinic

- 8.16 VetPartners Group Limited