|

市場調查報告書

商品編碼

1766174

培養肉生物反應器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Cultured Meat Bioreactors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

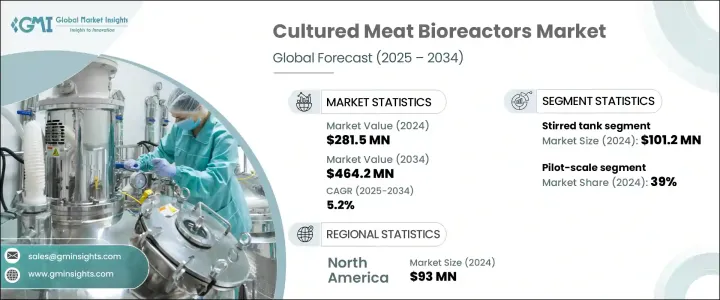

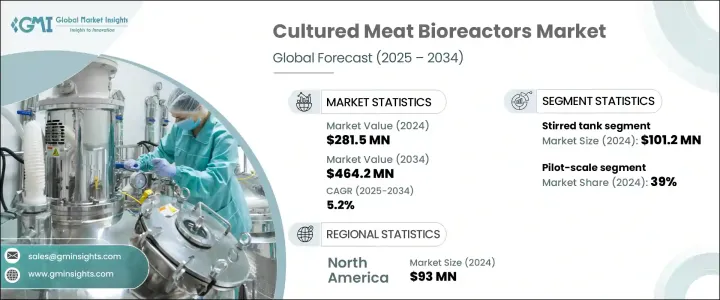

2024年,全球培養肉生物反應器市值為2.815億美元,預計2034年將以5.2%的複合年成長率成長,達到4.642億美元。該市場透過先進的生物反應器系統,實現了實驗室培養肉類的大規模生產,在培養肉類領域中發揮著至關重要的作用。這些生物反應器為動物細胞培養創造了精心控制的環境,因此無需屠宰動物即可生產肉類。各種生物反應器類型,包括攪拌槽式、灌注式、氣升式和中空纖維系統,在可擴展性、營養輸送和剪切力管理方面各有優勢。生物反應器設計、細胞培養基和規模化方法的創新提高了培養肉品生產的成本效益。

隨著技術的進步,生產成本預計將下降,使培養肉更加經濟實惠且易於取得。質地、風味和品質的提升也是提升消費者接受度並推動市場成長的關鍵因素。永續性仍然是主要驅動力,培養肉提供了一種環保且更符合道德的傳統肉類生產替代方案。消費者對肉類替代品的興趣日益濃厚,進一步刺激了對這項技術的需求,儘管高昂的初始資本和營運成本仍然是重大障礙,尤其是對於新創公司而言。建立生產需要能夠支援工業規模細胞生長的專用生物反應器。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.815億美元 |

| 預測值 | 4.642億美元 |

| 複合年成長率 | 5.2% |

攪拌槽式生物反應器細分市場在2024年引領市場,產值達1.012億美元。攪拌槽式生物反應器因其可靠性和可擴展性而備受青睞,是商業規模細胞培養的理想選擇。憑藉在生物製藥和發酵應用領域的卓越業績,它們為培養肉生產商帶來了較低的技術風險。這些系統可以從1-10公升的小型實驗室規模擴展到超過10,000公升的工業規模,為研發和大規模生產提供了至關重要的靈活性。對於致力於以具有競爭力的價格實現培養肉商業化的公司而言,這種可擴展性至關重要。

2024年,中試規模市場佔39%的佔有率。由於培養肉產業正從研究階段向商業化生產轉型,中試規模生物反應器發揮至關重要的橋樑作用。許多處於商業化前階段的公司使用中試規模系統來改進細胞系、最佳化組織工程工藝,並模擬大規模生產,而無需承擔大規模設施的高成本。這些生物反應器所需的資本投入較低,因此新創公司和正在申請法規核准或開發商業模式的公司都可以使用。

2024年,北美培養肉生物反應器市場規模達9,300萬美元。美國透過明確的法規,為從事培養肉的投資者和企業創造了有利的環境。繼2023年政府批准培養雞肉上市後,美國已成為全球培養肉商業化銷售的領導者,推動了對生物反應器技術和基礎設施的投資。該地區擁有一些最先進的生物技術和食品科技公司,這些公司專注於生物反應器的開發和製程創新,並得到了領先研究機構的支持。此外,北美消費者,尤其是千禧世代和Z世代,對符合道德規範生產的環保食品表現出強烈的偏好,這推動了對培養肉的需求,並鼓勵企業擴大生產規模並創新生物反應器系統。

全球培養肉生物反應器產業的領導公司包括默克集團 (Merck KGaA)、ABEC、阿法拉伐 (Alfa Laval)、生物工程股份公司 (Bioengineering AG)、Esco Lifesciences Group、賽多利斯股份公司 (Sartorius AG)、基伊埃 (GEA)、Infors HT、艾本德股份公司 (Sartorius AG)、基伊埃 (GEA)、Infors HT、艾本德股份公司 (EppenOVA, Biotechnc年, Biotechnd GmBH、OLLITAL Technology、頗爾集團 (Pall Corporation)、Solaris Biotech 和 Vogtlin Instruments GmbH。市場領導者採用的關鍵策略重點在於創新與協作,以提升其市場地位。

企業在研發方面投入巨資,旨在改進生物反應器設計、最佳化細胞培養基,並提高可擴展性,從而實現經濟高效的生產。與培養肉品生產商建立策略夥伴關係,有助於實現技術整合和製程改進。企業也優先考慮擴大產能並進入新興市場,以利用不斷成長的需求。在行銷活動中強調永續性和符合道德標準的食品生產有助於吸引具有環保意識的消費者。此外,企業注重法規合規性和智慧財產權保護,以保障創新成果。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 對永續蛋白質的需求不斷成長

- 生物反應器設計的技術進步

- 不斷增加對培養肉新創企業的投資

- 產業陷阱與挑戰

- 資本和營運成本高

- 擴大生產的複雜性

- 機會

- 供應鏈最佳化

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 中空纖維

- 氣升式反應器

- 攪拌槽

- 其他

第6章:市場估計與預測:依規模,2021 年至 2034 年

- 主要趨勢

- 實驗室規模

- 中試規模

- 商業規模

第7章:市場估計與預測:依營運模式,2021 年至 2034 年

- 主要趨勢

- 批次

- 補料分批

- 連續的

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 牛肉

- 家禽

- 豬肉

- 其他

第9章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 培養肉製造商

- 合約製造組織

- 研發機構/研究所

第10章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- ABEC

- Alfa Laval

- Bioengineering AG

- Eppendorf AG

- Esco Lifesciences Group

- GEA

- Infors HT

- INNOVA Bio-meditech

- KBiotech GmBH

- Merck KGaA

- OLLITAL Technology

- Pall Corporation

- Sartorius AG

- Solaris Biotech

- Vogtlin Instruments GmbH

The Global Cultured Meat Bioreactors Market was valued at USD 281.5 million in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 464.2 million by 2034. This market plays a critical role in the cultivated meat sector by enabling large-scale production of lab-grown meat through sophisticated bioreactor systems. These bioreactors create carefully controlled environments for animal cell cultures, allowing meat production without the need for animal slaughter. Various bioreactor types, including stirred-tank, perfusion, airlift, and hollow-fiber systems, each provide distinct advantages in terms of scalability, nutrient delivery, and management of shear forces. Innovations in bioreactor design, cell culture media, and scaling methods have enhanced the cost-efficiency of cultured meat production.

As technology advances, production costs are expected to decline, making cultivated meat more affordable and accessible. Improved texture, flavor, and quality are also key factors that will boost consumer acceptance and drive market growth. Sustainability remains a major motivator, with cultured meat offering an eco-friendly and more ethical alternative to traditional meat production. Rising consumer interest in meat alternatives further fuels demand for this technology, though high initial capital and operating costs remain significant barriers, especially for startups. Establishing production requires specialized bioreactors capable of supporting cell growth at industrial scales.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $281.5 Million |

| Forecast Value | $464.2 Million |

| CAGR | 5.2% |

The stirred-tank bioreactor segment led the market in 2024, generating USD 101.2 million. Stirred-tank bioreactors are highly favored for their reliability and scalability, making them ideal for commercial-scale cell cultivation. With a strong track record in biopharmaceutical and fermentation applications, they present low technical risks to cultivated meat producers. These systems can scale from small laboratory sizes of 1-10 liters to industrial capacities exceeding 10,000 liters, offering vital flexibility for research, development, and full-scale manufacturing. This scalability is essential for companies aiming to commercialize cultured meat at competitive prices.

The pilot-scale segment held a 39% share in 2024. Since the cultured meat industry is transitioning from research to commercial production, pilot-scale bioreactors serve as a critical bridge. Many companies at the pre-commercial stage use pilot-scale systems to refine cell lines, optimize tissue engineering processes, and simulate large-scale production without the high costs associated with full-scale facilities. These bioreactors require lower capital investment, making them accessible to startups and firms working on regulatory approvals or business model development.

North America Cultured Meat Bioreactors Market accounted for USD 93 million in 2024. The United States has fostered a supportive environment for investors and companies involved in cultivated meat through clear regulations. Following government approval for marketing cultured chicken in 2023, the U.S. has become a global leader in commercial cultured meat sales, boosting investments in bioreactor technology and infrastructure. The region hosts some of the most advanced biotech and food tech companies specializing in bioreactor development and process innovation, supported by leading research institutions. Moreover, North American consumers, particularly millennials and Gen Z, show strong preferences for ethically produced, environmentally friendly food products, driving demand for cultured meat and encouraging companies to scale production and innovate bioreactor systems.

Leading companies operating in the Global Cultured Meat Bioreactors Industry include Merck KGaA, ABEC, Alfa Laval, Bioengineering AG, Esco Lifesciences Group, Sartorius AG, GEA, Infors HT, Eppendorf AG, INNOVA Bio-meditech, KBiotech GmBH, OLLITAL Technology, Pall Corporation, Solaris Biotech, and Vogtlin Instruments GmbH. Key strategies adopted by market leaders focus heavily on innovation and collaboration to boost their market positioning.

Companies invest extensively in research and development to improve bioreactor designs, optimize cell culture media, and enhance scalability for cost-effective production. Forming strategic partnerships with cultivated meat producers enables technology integration and process refinement. Firms also prioritize expanding production capacities and entering emerging markets to capitalize on rising demand. Emphasizing sustainability and ethical food production in marketing campaigns helps attract eco-conscious consumers. Additionally, players focus on regulatory compliance and securing intellectual property to safeguard innovations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Scale

- 2.2.4 Mode of Operation

- 2.2.5 Application

- 2.2.6 End Use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for sustainable protein

- 3.2.1.2 Technological advancements in bioreactor design

- 3.2.1.3 Growing investments in cultured meat startups

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital and operating costs

- 3.2.2.2 Complexity in scaling up production

- 3.2.3 Opportunities

- 3.2.4 Supply chain optimization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Million) (Units)

- 5.1 Key trends

- 5.2 Hollow fiber

- 5.3 Airlift reactor

- 5.4 Stirred tank

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Scale, 2021 – 2034 (USD Million) (Units)

- 6.1 Key trends

- 6.2 Lab-scale

- 6.3 Pilot-scale

- 6.4 Commercial-scale

Chapter 7 Market Estimates and Forecast, By Mode of Operation, 2021 – 2034 (USD Million) (Units)

- 7.1 Key trends

- 7.2 Batch

- 7.3 Fed-batch

- 7.4 Continuous

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million) (Units)

- 8.1 Key trends

- 8.2 Beef

- 8.3 Poultry

- 8.4 Pork

- 8.5 Others

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Million) (Units)

- 9.1 Key trends

- 9.2 Cultured meat manufacturers

- 9.3 Contract manufacturing organizations

- 9.4 R&D organizations/Institutes

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million) (Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 ABEC

- 11.2 Alfa Laval

- 11.3 Bioengineering AG

- 11.4 Eppendorf AG

- 11.5 Esco Lifesciences Group

- 11.6 GEA

- 11.7 Infors HT

- 11.8 INNOVA Bio-meditech

- 11.9 KBiotech GmBH

- 11.10 Merck KGaA

- 11.11 OLLITAL Technology

- 11.12 Pall Corporation

- 11.13 Sartorius AG

- 11.14 Solaris Biotech

- 11.15 Vogtlin Instruments GmbH