|

市場調查報告書

商品編碼

1750346

益生菌飲料市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Probiotic Drinks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

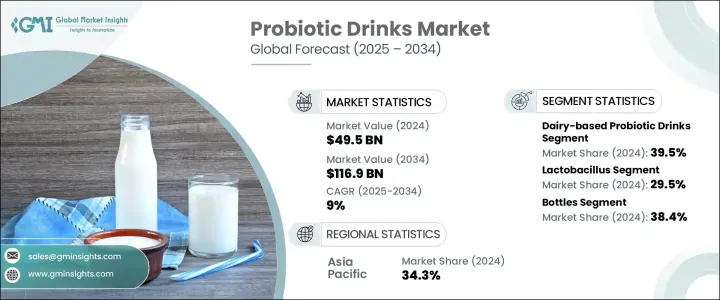

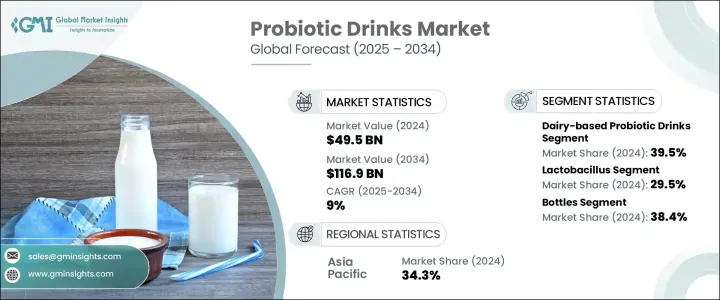

2024年,全球益生菌飲料市場規模達495億美元,預計到2034年將以9%的複合年成長率成長,達到1169億美元,這得益於消費者對腸道健康、免疫力和整體健康日益成長的興趣。益生菌產品最初僅限於優格和補充劑,如今已發展到涵蓋功能性飲料、嬰兒配方奶粉,甚至動物飼料。益生菌市場的成長得益於科學研究證實了益生菌的健康益處,以及消費者認知度的不斷提升。

無論是已開發市場或新興市場,益生菌飲料的需求都在不斷成長,其中北美、歐洲和亞太地區的成長尤為顯著。由於人口基數大、可支配收入不斷成長以及飲食偏好的轉變,亞太市場預計將實現最高成長率。此外,人口老化以及代謝和胃腸道疾病的增加也推動了益生菌產品的需求。研究表明,在食品和飲料(尤其是乳製品)中添加益生菌,顯著提高了消費者的接受度和產品穩定性,從而擴大了市場。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 495億美元 |

| 預測值 | 1169億美元 |

| 複合年成長率 | 9% |

2024年,乳製品益生菌飲料市場佔有39.5%的佔有率。這類飲料因其營養價值而依然受歡迎,優格飲料和克菲爾在某些地區仍然佔據主導地位。然而,市場正見證著向植物性益生菌飲料的轉變。這項變化主要源自於人們對純素、無乳糖和無過敏原替代品日益成長的需求。由大豆、杏仁、椰子和燕麥等原料製成的飲料因其口味和健康益處而越來越受歡迎。

益生菌飲料市場按益生菌菌株分類,其中乳酸桿菌佔據主導地位,2024 年的市佔率為 29.5%。鼠李糖乳桿菌和嗜酸乳桿菌等乳酸桿菌菌株以促進消化系統健康和增強免疫力而聞名。其他菌株,如雙歧桿菌和長雙歧桿菌,有助於維持健康的腸道平衡,特別對老年人和兒童有益。隨著消費者對益生菌益處的認知不斷加深,這些菌株預計將推動市場擴張。

2024年,亞太地區益生菌飲料市場佔了34.3%的市佔率。該地區正經歷快速成長,日本等國家專注於以科學為支撐的益生菌產品,而中國和印度則日益青睞優格和康普茶等注重健康的飲料。北美的健康趨勢也日益興起,對飲用優格和康普茶等功能性飲料的需求日益成長。

在全球益生菌飲料市場,養樂多本社株式會社、達能集團、恆天然合作集團、嘉里集團和拉克塔利斯集團等公司正在採取關鍵策略來增強其市場影響力。這些策略包括:拓展產品組合,涵蓋更廣泛的功能性飲料和植物性飲料;利用先進的生產技術提升產品品質;以及透過環保包裝和採購實踐緊跟永續發展趨勢。此外,這些公司還在研發方面投入資金,打造符合消費者不斷變化的偏好的創新產品,並專注於提高產品穩定性和增強健康益處。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 製造商

- 經銷商

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 供給側影響(原料)

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 北美洲

- FDA 法規(美國)

- 加拿大衛生部法規

- 歐洲

- 歐洲食品安全局(EFSA)指南

- 歐盟健康聲明法規

- 亞太地區

- FOSHU 法規(日本)

- CFDA法規(中國)

- FSSAI法規(印度)

- 世界其他地區

- 衝擊力

- 成長動力

- 個性化的健康和保健需求

- 永續性和道德採購

- 轉向植物性和非乳製品替代品

- 產業陷阱與挑戰

- 生產成本高

- 維持益生菌活力的挑戰

- 市場機會

- 新興市場的擴張

- 產品配方創新

- 電子商務和直接面對消費者的管道的成長

- 植物性替代品的需求不斷成長

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

- 製造程序和技術

- 製造流程概述

- 原料採購與準備

- 益生菌培養物製備

- 發酵和加工

- 配方和混合

- 包裝和儲存策略

- 生產成本分析

- 原料成本

- 加工成本

- 勞動成本

- 包裝成本

- 製造費用

- 成本最佳化策略

- 製造設施分析

- 設施擴建計劃

- 供應鏈挑戰與解決方案

- 原物料採購

- 整個供應鏈的品質控制

- 冷鏈管理

- 庫存管理

- 品質保證和控制

- 微生物檢測

- 穩定性和保存期限測試

- 感官評價

- 製造流程概述

- 消費者行為與市場趨勢分析

- 消費者偏好與購買模式

- 消費者人口統計分析

- 消費者意識和教育

- 新興消費趨勢

- 數位轉型對消費者參與度的影響

- 消費者回饋分析及啟示

- 價格趨勢分析

- 影響定價的因素

- 原料成本

- 生產加工成本

- 跨產品細分市場的定價策略

- 高階市場定位與大眾市場定位

- 基於價值的定價方法

- 影響定價的因素

- 區域價格差異和因素

- 價格價值關係分析

- 影響市場的經濟指標

- 益生菌飲料的當前科技趨勢

- 新興技術及其潛在影響

- 微膠囊技術

- 合生元配方

- 產品創新趨勢

- 功能性成分組合

- 耐儲存的益生菌解決方案

- 包裝創新

- 永續包裝材料

- 主動智慧包裝

- 生產和發行中的數位技術

- 物聯網和智慧製造

- 區塊鏈用於可追溯性

- 研發活動與創新中心

- 各地區技術採用趨勢

- 亞太地區在功能性飲料技術應用方面處於領先地位

- 歐洲強調生產技術的永續性

- 未來技術路線圖(2025-2033)

- 個性化益生菌解決方案的開發

- 品質控制系統中的自動化和人工智慧

- 新興技術及其潛在影響

- 行銷策略和品牌分析

- 當前的行銷格局

- 數位行銷策略

- 傳統行銷方法

- 健康傳播策略

- 主要參與者的品牌分析

- 包裝作為行銷工具

- 未來行銷趨勢和策略

- 市場機會和策略建議

- 尚未開發的市場機會

- 給市場參與者的策略建議

- 產品開發策略

- 市場進入和擴張策略

- 競爭優勢建構策略

- 未來的成長路徑

- 風險評估和緩解策略

- 市場風險

- 需求波動

- 競爭壓力

- 營運風險

- 供應鏈中斷

- 生產挑戰

- 監理與合規風險

- 食品安全法規的變化

- 標籤和聲明法規

- 聲譽風險

- 環境和永續性風險

- 風險緩解策略和框架

- 市場風險

- 未來展望與市場演變

- 長期市場預測(2025-2035年)

- 未來市場情景

- 樂觀情境

- 現實場景

- 悲觀情景

- 新興產品類別和創新

- 不斷變化的消費者偏好和行為

- 技術演變及其影響

- 永續性和循環經濟發展

- 未來競爭格局

- 長期成功的策略要務

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 乳製品益生菌飲料

- 益生菌優格飲料

- 克菲爾

- 益生菌乳飲料

- 其他

- 植物益生菌飲料

- 豆奶飲料

- 杏仁飲料

- 椰子飲料

- 其他

- 水果和蔬菜益生菌飲料

- 益生菌果汁

- 益生菌蔬菜汁

- 混合蔬果飲料

- 水性益生菌飲料

- 益生菌水

- 益生菌氣泡飲料

- 發酵益生菌飲料

- 康普茶

- 格瓦斯

- 其他

- 益生菌功能飲料

- 益生菌能量飲料

- 益生菌運動飲料

- 益生菌健康飲品

第6章:市場估計與預測:按益生菌菌株,2021 - 2034 年

- 主要趨勢

- 乳酸桿菌

- 雙歧桿菌

- 鏈球菌

- 芽孢桿菌

- 酵母菌

- 多菌株配方

第7章:市場估計與預測:依包裝類型,2021 - 2034 年

- 主要趨勢

- 瓶子

- 紙箱

- 罐頭

- 袋裝

- 其他

第8章:市場估計與預測:按目標消費群體,2021 - 2034 年

- 主要趨勢

- 一般成年人口

- 兒童和青少年

- 老年人口

- 運動員和健身愛好者

- 注重健康的消費者

第9章:市場估計與預測:按消費場合,2021 - 2034 年

- 主要趨勢

- 每日消費

- 代餐

- 隨時隨地消費

- 運動後恢復

第10章:市場估計與預測:按價格細分,2021 - 2034 年

- 主要趨勢

- 經濟/大眾市場

- 中檔

- 高級/豪華

第 11 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 超市和大賣場

- 便利商店

- 特色保健食品商店

- 藥局和藥局

- 網路零售

- 餐飲業

第 12 章:市場估計與預測:按銷售管道,2021 年至 2034 年

- 主要趨勢

- B2B

- B2C

第 13 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 14 章:公司簡介

- Yakult Honsha Co., Ltd.

- Danone SA

- Nestle SA

- PepsiCo, Inc.

- Coca-Cola Company

- Lifeway Foods, Inc.

- Harmless Harvest

- KeVita (PepsiCo)

- GoodBelly (NextFoods)

- Chobani, LLC

- Groupe Lactalis

- Bio-K Plus International Inc.

- Fonterra Co-operative Group Juicery

The Global Probiotic Drinks Market was valued at USD 49.5 billion in 2024 and is estimated to grow at a CAGR of 9% to reach USD 116.9 billion by 2034, driven by a surge in consumer interest in gut health, immunity, and overall wellness. Initially limited to yogurt and supplements, probiotic products have since evolved to include functional beverages, infant formulas, and even animal feed. The market's growth is supported by scientific research confirming the health benefits of probiotics, as well as increasing consumer awareness.

Demand for probiotic drinks is rising across both developed and emerging markets, with particularly high growth in North America, Europe, and the Asia-Pacific region. The Asia-Pacific market is expected to experience the highest growth rates due to its large population, increasing disposable income, and changing dietary preferences. Additionally, an aging population and a rise in metabolic and gastrointestinal disorders are driving the demand for probiotic-based products. Research has shown that incorporating probiotics into food and beverages, especially in dairy products, has significantly increased consumer acceptance and product stability, expanding the market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $49.5 Billion |

| Forecast Value | $116.9 Billion |

| CAGR | 9% |

Dairy-based probiotic drinks segment held a 39.5% share in 2024. These drinks remain popular for their nutritional value, with yogurt drinks and kefir continuing to dominate in certain regions. However, the market is witnessing a shift toward plant-based probiotic drinks. This change is largely driven by growing demand for vegan, lactose-free, and allergen-free alternatives. Drinks made from ingredients like soy, almond, coconut, and oat are gaining popularity for their taste and health benefits.

The probiotic drinks market is categorized by probiotic strains, with Lactobacillus taking the lead, representing a 29.5% share in 2024. Lactobacillus strains such as L. rhamnosus and L. acidophilus are well-known for promoting digestive health and boosting immunity. Other strains like B. bifidum and B. longum help maintain a healthy gut balance, especially in the elderly and children. As consumer awareness of the benefits of probiotics grows, these strains are expected to drive market expansion.

Asia-Pacific Probiotic Drinks Market held a 34.3% share in 2024. The region is experiencing rapid growth, with countries like Japan focusing on science-backed probiotic products, while China and India are increasingly embracing health-conscious beverages like yogurt and kombucha. North America is also seeing a rise in wellness trends, with a growing demand for functional beverages such as drinkable yogurts and kombucha.

In the Global Probiotic Drinks Market, companies like Yakult Honsha Co. Ltd., Groupe Danone SA, The Fonterra Co-op Group Ltd., Kerry Group PLC, and Groupe Lactalis are adopting key strategies to strengthen their market presence. These strategies include expanding product portfolios to include a wider range of functional and plant-based drinks, leveraging advanced production technologies to enhance product quality, and aligning with sustainability trends through eco-friendly packaging and sourcing practices. Additionally, these companies are investing in research and development to create innovative products that meet changing consumer preferences, focusing on improving product stability and enhancing health benefits.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Manufacturers

- 3.1.5 Distributors

- 3.1.6 Impact on trade

- 3.1.7 Trade volume disruptions

- 3.2 Retaliatory measures

- 3.3 Impact on the industry

- 3.3.1 Supply-side impact (raw materials)

- 3.3.1.1 Price volatility in key materials

- 3.3.1.2 Supply chain restructuring

- 3.3.1.3 Production cost implications

- 3.3.1 Supply-side impact (raw materials)

- 3.4 Demand-side impact (selling price)

- 3.4.1 Price transmission to end markets

- 3.4.2 Market share dynamics

- 3.4.3 Consumer response patterns

- 3.5 Key companies impacted

- 3.6 Strategic industry responses

- 3.6.1 Supply chain reconfiguration

- 3.6.2 Pricing and product strategies

- 3.6.3 Policy engagement

- 3.7 Outlook and future considerations

- 3.8 Supplier landscape

- 3.9 Profit margin analysis

- 3.10 Key news & initiatives

- 3.11 Regulatory landscape

- 3.12 North America

- 3.12.1 FDA regulations (United States)

- 3.12.2 Health Canada regulations

- 3.13 Europe

- 3.13.1 European Food Safety Authority (EFSA) Guidelines

- 3.13.2 EU health claims regulation

- 3.14 Asia Pacific

- 3.14.1 FOSHU regulations (Japan)

- 3.14.2 CFDA regulations (China)

- 3.14.3 FSSAI regulations (India)

- 3.15 Rest of the world

- 3.16 Impact forces

- 3.16.1 Growth drivers

- 3.16.1.1 Personalized health and wellness needs

- 3.16.1.2 Sustainability and ethical sourcing

- 3.16.1.3 Shift toward plant-based and non-dairy alternatives

- 3.16.2 Industry pitfalls & challenges

- 3.16.2.1 High production costs

- 3.16.2.2 Challenges in maintaining probiotic viability

- 3.16.3 Market Opportunities

- 3.16.3.1 Expansion in emerging markets

- 3.16.3.2 Innovation in product formulations

- 3.16.3.3 Growth of E-commerce and direct-to-consumer channels

- 3.16.3.4 Rising demand for plant-based alternatives

- 3.16.1 Growth drivers

- 3.17 Growth potential analysis

- 3.18 Porter's analysis

- 3.19 PESTEL analysis

- 3.20 Manufacturing process and technology

- 3.20.1 Manufacturing process overview

- 3.20.1.1 Raw material procurement and preparation

- 3.20.1.2 Probiotic culture preparation

- 3.20.1.3 Fermentation and processing

- 3.20.1.4 Formulation and blending

- 3.20.1.5 Packaging and storage strategies

- 3.20.2 Production cost analysis

- 3.20.2.1 Raw material costs

- 3.20.2.2 Processing costs

- 3.20.2.3 Labor costs

- 3.20.2.4 Packaging costs

- 3.20.2.5 Manufacturing overheads

- 3.20.2.6 Cost optimization strategies

- 3.20.3 Manufacturing facilities analysis

- 3.20.3.1 Facility expansion plans

- 3.20.4 Supply chain challenges and solutions

- 3.20.4.1 Raw material sourcing

- 3.20.4.2 Quality control throughout supply chain

- 3.20.4.3 Cold chain management

- 3.20.4.4 Inventory management

- 3.20.5 Quality assurance and control

- 3.20.5.1 Microbial testing

- 3.20.5.2 Stability and shelf-life testing

- 3.20.5.3 Sensory evaluation

- 3.20.1 Manufacturing process overview

- 3.21 Consumer behavior and market trends analysis

- 3.21.1 Consumer preferences and purchasing patterns

- 3.21.2 Demographic analysis of consumers

- 3.21.3 Consumer awareness and education

- 3.21.4 Emerging consumer trends

- 3.21.5 Impact of digital transformation on consumer engagement

- 3.21.6 Consumer feedback analysis and implications

- 3.22 Pricing trends analysis

- 3.22.1 Factors affecting pricing

- 3.22.1.1 Raw material costs

- 3.22.1.2 Production and processing costs

- 3.22.2 Pricing strategies across product segments

- 3.22.2.1 Premium vs. mass market positionings

- 3.22.2.2 Value-based pricing approaches

- 3.22.1 Factors affecting pricing

- 3.23 Regional price variations and factors

- 3.24 Price-value relationship analysis

- 3.25 Economic indicators impacting the market

- 3.26 Current technological trends in probiotic drinks

- 3.26.1 Emerging technologies and their potential impact

- 3.26.1.1 Microencapsulation technologies

- 3.26.1.2 Synbiotic formulations

- 3.26.2 Product innovation trends

- 3.26.2.1 Functional ingredient combinations

- 3.26.2.2 Shelf-stable probiotic solutions

- 3.26.3 Packaging innovations

- 3.26.3.1 Sustainable packaging materials

- 3.26.3.2 Active and intelligent packaging

- 3.26.4 Digital technologies in production and distribution

- 3.26.4.1 IoT and smart manufacturing

- 3.26.4.2 Blockchain for traceability

- 3.26.5 R&D activities and innovation hubs

- 3.26.6 Technology adoption trends across regions

- 3.26.6.1 Asia-pacific leading in functional drink tech adoption

- 3.26.6.2 Europe emphasizing sustainability in production tech

- 3.26.7 Future technology roadmap 2025-2033

- 3.26.7.1 Development of personalized probiotic solutions

- 3.26.7.2 Automation and ai in quality control systems

- 3.26.1 Emerging technologies and their potential impact

- 3.27 Marketing strategies and brand analysis

- 3.27.1 Current marketing landscape

- 3.27.2 Digital marketing strategies

- 3.27.3 Traditional marketing approaches

- 3.27.4 Health communication strategies

- 3.27.5 Brand analysis of key players

- 3.27.6 Packaging as a marketing tool

- 3.27.7 Future marketing trends and strategies

- 3.28 Market opportunities and strategic recommendations

- 3.28.1 Untapped market opportunities

- 3.28.2 Strategic recommendations for market participants

- 3.28.3 Product development strategies

- 3.28.4 Market entry and expansion strategies

- 3.28.5 Competitive advantage building strategies

- 3.28.6 Future growth pathways

- 3.29 Risk assessment and mitigation strategies

- 3.29.1 Market risks

- 3.29.1.1 Demand fluctuations

- 3.29.1.2 Competitive pressures

- 3.29.2 Operational risks

- 3.29.2.1 Supply chain disruptions

- 3.29.2.2 Production challenges

- 3.29.3 Regulatory and compliance risks

- 3.29.3.1 Changing food safety regulations

- 3.29.3.2 Labeling and claims regulations

- 3.29.4 Reputational risks

- 3.29.5 Environmental and sustainability risks

- 3.29.6 Risk mitigation strategies and frameworks

- 3.29.1 Market risks

- 3.30 Future outlook and market evolution

- 3.30.1 Long-term market forecast 2025-2035

- 3.30.2 Future market scenarios

- 3.30.2.1 Optimistic scenario

- 3.30.2.2 Realistic scenario

- 3.30.2.3 Pessimistic scenario

- 3.30.3 Emerging product categories and innovations

- 3.30.4 Evolving consumer preferences and behaviors

- 3.30.5 Technological evolution and its impact

- 3.30.6 Sustainability and circular economy developments

- 3.30.7 Future competitive landscape

- 3.30.8 Strategic imperatives for long-term success

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Liters)

- 5.1 Key trends

- 5.2 Dairy-based probiotic drinks

- 5.2.1 Probiotic yogurt drinks

- 5.2.2 Kefir

- 5.2.3 Probiotic milk drinks

- 5.2.4 Others

- 5.3 Plant-based probiotic drinks

- 5.3.1 Soy-based drinks

- 5.3.2 Almond-based drinks

- 5.3.3 Coconut-based drinks

- 5.3.4 Others

- 5.4 Fruit and vegetable-based probiotic drinks

- 5.4.1 Probiotic fruit juices

- 5.4.2 Probiotic vegetable juices

- 5.4.3 Mixed fruit and vegetable drinks

- 5.5 Water-based probiotic drinks

- 5.5.1 Probiotic water

- 5.5.2 Probiotic sparkling beverages

- 5.6 Fermented probiotic beverages

- 5.6.1 Kombucha

- 5.6.2 Kvass

- 5.6.3 Others

- 5.7 Probiotic functional beverages

- 5.7.1 Probiotic energy drinks

- 5.7.2 Probiotic sports drinks

- 5.7.3 Probiotic wellness shots

Chapter 6 Market Estimates and Forecast, By Probiotic Strain, 2021 - 2034 (USD Billion) (Kilo Liters)

- 6.1 Key trends

- 6.2 Lactobacillus

- 6.3 Bifidobacterium

- 6.4 Streptococcus

- 6.5 Bacillus

- 6.6 Saccharomyces

- 6.7 Multi-strain formulations

Chapter 7 Market Estimates and Forecast, By Packaging Type, 2021 - 2034 (USD Billion) (Kilo Liters)

- 7.1 Key trends

- 7.2 Bottles

- 7.3 Cartons

- 7.4 Cans

- 7.5 Pouches

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Target Consumer Group, 2021 - 2034 (USD Billion) (Kilo Liters)

- 8.1 Key trends

- 8.2 General adult population

- 8.3 Children and Adolescents

- 8.4 Elderly population

- 8.5 Athletes and fitness enthusiasts

- 8.6 Health-conscious consumers

Chapter 9 Market Estimates and Forecast, By Consumption Occasion, 2021 - 2034 (USD Billion) (Kilo Liters)

- 9.1 Key trends

- 9.2 Daily consumption

- 9.3 Meal replacement

- 9.4 On-the-Go consumption

- 9.5 Post-exercise recovery

Chapter 10 Market Estimates and Forecast, By Price Segment, 2021 - 2034 (USD Billion) (Kilo Liters)

- 10.1 Key trends

- 10.2 Economy / mass market

- 10.3 Mid-range

- 10.4 Premium / luxury

Chapter 11 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Kilo Liters)

- 11.1 Key trends

- 11.2 Supermarkets and hypermarkets

- 11.3 Convenience stores

- 11.4 Specialty health food stores

- 11.5 Pharmacy and drug stores

- 11.6 Online retail

- 11.7 Foodservice sector

Chapter 12 Market Estimates and Forecast, By Sales Channel, 2021 - 2034 (USD Billion) (Kilo Liters)

- 12.1 Key trends

- 12.2 B2B

- 12.3 B2C

Chapter 13 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Liters)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 Germany

- 13.3.2 UK

- 13.3.3 France

- 13.3.4 Spain

- 13.3.5 Italy

- 13.3.6 Netherlands

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 Australia

- 13.4.5 South Korea

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.6 Middle East and Africa

- 13.6.1 Saudi Arabia

- 13.6.2 South Africa

- 13.6.3 UAE

Chapter 14 Company Profiles

- 14.1 Yakult Honsha Co., Ltd.

- 14.2 Danone S.A.

- 14.3 Nestle S.A.

- 14.4 PepsiCo, Inc.

- 14.5 Coca-Cola Company

- 14.6 Lifeway Foods, Inc.

- 14.7 Harmless Harvest

- 14.8 KeVita (PepsiCo)

- 14.9 GoodBelly (NextFoods)

- 14.10 Chobani, LLC

- 14.11 Groupe Lactalis

- 14.12 Bio-K Plus International Inc.

- 14.13 Fonterra Co-operative Group Juicery