|

市場調查報告書

商品編碼

1766212

益生菌食品市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Probiotic Food Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

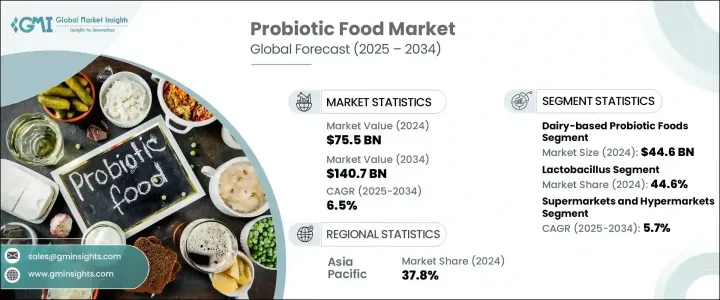

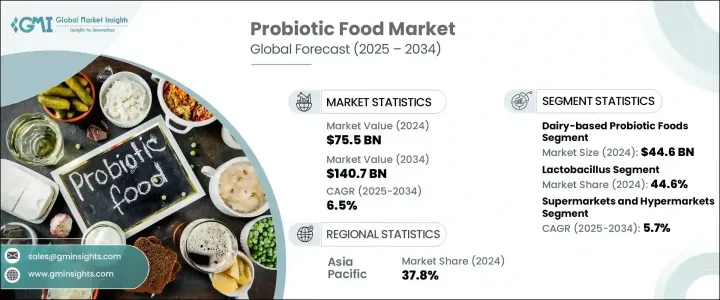

2024年,全球益生菌食品市場價值達755億美元,預計到2034年將以6.5%的複合年成長率成長至1,407億美元。這一強勁成長反映了消費者越來越重視預防性保健和功能性營養。大眾對消化健康、心理健康和免疫系統支持的意識不斷增強,推動了富含益生菌食品的日常消費。消費者也擴大尋求符合現代生活方式和健康價值觀的功能性食品。植物性和非乳製品配方正吸引著純素食者和乳糖不耐症人群的關注,而諸如耐儲存膠囊和益生菌零食棒等創新產品也正在提高益生菌的可及性。益生菌也正從食品領域擴展到護膚和美容領域,拓展健康和保健運動的版圖。

科學研究的進步和有利的監管支持持續為益生菌食品市場帶來新的機遇,促進創新並加速產品開發。正在進行的臨床研究正在加深人們對特定益生菌菌株如何影響腸道健康、免疫力、心理健康、皮膚健康和代謝功能的理解。越來越多的證據鼓勵製造商探索新的應用,並針對特定健康目標定製配方,從而為不同年齡和生活方式需求開闢專門的產品類別。各地區的監管機構也發揮關鍵作用,透過制定更清晰的指導方針、品質標準和安全規程,增強消費者信任,簡化新產品的市場准入流程。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 755億美元 |

| 預測值 | 1407億美元 |

| 複合年成長率 | 6.5% |

在菌株細分方面,乳酸桿菌在2024年佔據44.6%的市場佔有率,預計在2025-2034年期間的複合年成長率為5.3%。該菌株的吸引力在於其對各種產品類型的高度適應性,以及在多個食品加工階段的耐受性。雙歧桿菌因其對結腸健康的益處以及與兒科和老年營養的相關性而持續廣泛應用。嗜熱鏈球菌在益生菌生產中也發揮著至關重要的作用,尤其是在乳製品發酵過程中具有增味作用。同時,乾型芽孢桿菌由於其較長的保存期限和耐受極端條件的能力而使用量正在上升。

2024年,液體飲料市場佔據了53.8%的市場佔有率,市場規模達到407億美元。這一主導地位主要歸功於功能性飲料的日益普及,它們提供了一種便捷高效的益生菌攝取方式。由於其吸收迅速、便於攜帶且易於融入日常生活,消費者對這類飲品趨之若鶓,尤其是那些生活方式積極且健康意識增強的消費者。便利營養的興起進一步推動了即飲益生菌產品的需求,這與年輕都市族群尋求即時健康解決方案的偏好相契合。

2024年,亞太地區益生菌食品市場佔37.8%的市佔率。市場動態因地區而異,受飲食習慣、醫療保健系統和消費者意識差異的影響。受城鎮化進程加快、可支配收入增加以及長期以來對發酵益生菌食品的文化認同的推動,亞太地區正經歷著最快的擴張。隨著日本、中國和印度等國中產階級人口的持續成長,人們的健康意識顯著增強,這些國家已成為重要的新興市場。相較之下,儘管拉丁美洲面臨負擔能力的挑戰,但醫療保健通路和零售基礎設施的改善正在為市場發展創造有利條件。

全球益生菌食品市場的競爭者正採取多管齊下的策略來鞏固其市場地位。 Probi AB、通用磨坊公司、雀巢公司、達能公司和養樂多本社等領先公司正大力投資產品創新,推出多樣化的產品形式以適應不斷變化的消費者生活方式。他們也透過策略合作、併購等方式擴大全球影響力。許多公司專注於清潔標籤配方和天然發酵成分,以滿足日益成長的透明度和最低限度加工的需求。此外,研發投入正在幫助解鎖新的菌株和應用,將益生菌從食品擴展到個人護理和補充劑領域。全球參與者也正在調整其行銷和分銷方式,以進軍高成長區域市場。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 乳製品益生菌食品

- 優格

- 克菲爾

- 起司

- 酪乳

- 其他

- 非乳製品益生菌食品

- 植物優格替代品

- 大豆基

- 杏仁基

- 椰子基

- 燕麥基

- 其他植物替代品

- 酸菜

- 泡菜

- 酸菜

- 泡菜

- 其他發酵蔬菜

- 發酵豆製品

- 豆豉

- 味噌

- 納豆

- 康普茶

- 其他非乳製品

- 植物優格替代品

- 益生菌強化食品

- 穀物和零食

- 麵包店

- 糖果

- 營養棒

- 其他

第6章:市場估計與預測:按益生菌菌株,2021 年至 2034 年

- 主要趨勢

- 乳酸桿菌

- 嗜酸乳桿菌

- 鼠李糖乳桿菌

- 乾酪乳桿菌

- 植物乳酸桿菌

- 其他

- 雙歧桿菌

- 雙歧桿菌

- 長雙歧桿菌

- 乳酸雙歧桿菌

- 短雙歧桿菌

- 其他

- 鏈球菌

- 嗜熱鏈球菌

- 其他

- 芽孢桿菌

- 凝結芽孢桿菌

- 枯草桿菌

- 其他

- 酵母菌

- 布拉氏酵母菌

- 其他

- 多菌株配方

- 其他益生菌菌株

第7章:市場估計與預測:依形式,2021 年至 2034 年

- 主要趨勢

- 液體

- 堅硬的

- 半固體

第8章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 超市和大賣場

- 便利商店

- 專賣店

- 網路零售

- 其他

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Danone SA

- Yakult Honsha Co., Ltd.

- Nestle SA

- General Mills, Inc.

- Probi AB

- Lifeway Foods, Inc.

- BioGaia AB

- Chr. Hansen Holding A/S

- Lallemand Inc.

- Arla Foods amba

- Chobani, LLC

- Fonterra Co-operative Group Limited

- Kerry Group plc

- Kellogg Company

- PepsiCo, Inc.

The Global Probiotic Food Market was valued at USD 75.5 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 140.7 billion by 2034. This robust growth reflects a broader shift among consumers toward preventive healthcare and functional nutrition. Growing public awareness around digestive health, mental well-being, and immune system support is fueling daily consumption of probiotic-rich food products. Consumers are increasingly seeking functional options that align with modern lifestyles and health values. Plant-based and dairy-free formulations are attracting attention from vegan and lactose-intolerant demographics, while innovations such as shelf-stable capsules and probiotic-infused snack bars are enhancing accessibility. Probiotics are also branching out beyond food into skincare and beauty, expanding the health and wellness movement.

Advancements in scientific research and favorable regulatory support continue to unlock new opportunities across the probiotic food market, fostering innovation and accelerating product development. Ongoing clinical studies are expanding the understanding of how specific probiotic strains impact not only gut health but also immunity, mental wellness, skin health, and metabolic function. This growing body of evidence is encouraging manufacturers to explore new applications and tailor formulations for targeted health outcomes, opening specialized product categories for different age groups and lifestyle needs. Regulatory bodies across various regions are also playing a critical role by establishing clearer guidelines, quality standards, and safety protocols, which are boosting consumer trust and streamlining market entry for new products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $75.5 Billion |

| Forecast Value | $140.7 Billion |

| CAGR | 6.5% |

In terms of strain segmentation, the lactobacillus segment held a 44.6% share in 2024 and is forecasted to grow at a CAGR of 5.3% during 2025-2034. This strain's appeal lies in its high adaptability across various product types and its ability to survive numerous food processing stages. Bifidobacterium continues to see consistent use due to its benefits for colon health and its relevance in both pediatric and elderly nutrition. Streptococcus thermophilus also plays a vital role in probiotic production, particularly for its flavor-enhancing attributes in dairy fermentation. Meanwhile, the use of dry-form Bacillus species is rising due to their superior shelf life and ability to withstand extreme conditions.

The liquid segment captured a 53.8% share and generated USD 40.7 billion in 2024. This dominance is largely attributed to the growing popularity of functional beverages, which offer a convenient and efficient method of probiotic intake. Consumers are gravitating toward these options due to their quick absorption, portability, and ease of integration into daily routines, especially for those with active lifestyles and heightened health awareness. The rise of on-the-go nutrition has further propelled the demand for ready-to-drink probiotic products, aligning with the preferences of younger, urban populations seeking instant wellness solutions.

Asia Pacific Probiotic Food Market held a 37.8% share in 2024. Market dynamics vary by region, influenced by differences in dietary habits, healthcare systems, and consumer awareness. The Asia-Pacific region is witnessing the fastest expansion, driven by growing urbanization, rising disposable incomes, and a long-standing cultural familiarity with fermented probiotic foods. As the middle-class population continues to grow across countries like Japan, China, and India, there is a noticeable increase in health consciousness, positioning these nations as key emerging markets. In contrast, while Latin America faces affordability challenges, improvements in healthcare access and retail infrastructure are creating favorable conditions for market development.

Companies competing in the Global Probiotic Food Market are adopting multi-faceted strategies to strengthen their market presence. Leading firms such as Probi AB, General Mills, Inc., Nestle S.A., Danone S.A., and Yakult Honsha Co., Ltd. are investing significantly in product innovation, introducing diverse formats to suit changing consumer lifestyles. They are also expanding their global reach through strategic partnerships, mergers, and acquisitions. Many are focused on clean-label formulations and naturally fermented ingredients to align with the rising demand for transparency and minimal processing. Further, R&D investments are helping to unlock new strains and applications, extending probiotics beyond food into personal care and supplements. Global players are also tailoring their marketing and distribution approaches to tap into high-growth regional markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Dairy-based probiotic foods

- 5.2.1 Yogurt

- 5.2.2 Kefir

- 5.2.3 Cheese

- 5.2.4 Buttermilk

- 5.2.5 Others

- 5.3 Non-dairy probiotic foods

- 5.3.1 Plant-based yogurt alternatives

- 5.3.1.1 Soy-based

- 5.3.1.2 Almond-based

- 5.3.1.3 Coconut-based

- 5.3.1.4 Oat-based

- 5.3.1.5 Other plant-based alternatives

- 5.3.2 Fermented vegetables

- 5.3.2.1 Kimchi

- 5.3.2.2 Sauerkraut

- 5.3.2.3 Pickles

- 5.3.2.4 Other fermented vegetables

- 5.3.3 Fermented soy products

- 5.3.3.1 Tempeh

- 5.3.3.2 Miso

- 5.3.3.3 Natto

- 5.3.4 Kombucha

- 5.3.5 Other non-dairy products

- 5.3.1 Plant-based yogurt alternatives

- 5.4 Probiotic-fortified foods

- 5.4.1 Cereals & snacks

- 5.4.2 Bakery

- 5.4.3 Confectionery

- 5.4.4 Nutrition bars

- 5.4.5 Others

Chapter 6 Market Estimates and Forecast, By Probiotic Strain, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.1.1 Lactobacillus

- 6.1.2 L. acidophilus

- 6.1.3 L. rhamnosus

- 6.1.4 L. casei

- 6.1.5 L. plantarum

- 6.1.6 Others

- 6.2 Bifidobacterium

- 6.2.1 B. bifidum

- 6.2.2 B. longum

- 6.2.3 B. lactis

- 6.2.4 B. breve

- 6.2.5 Others

- 6.3 Streptococcus

- 6.3.1 S. thermophilus

- 6.3.2 Others

- 6.4 Bacillus

- 6.4.1 B. coagulans

- 6.4.2 B. subtilis

- 6.4.3 Others

- 6.5 Saccharomyces

- 6.5.1 S. boulardii

- 6.5.2 Others

- 6.6 Multi-strain formulations

- 6.7 Other probiotic strains

Chapter 7 Market Estimates and Forecast, By Form, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Liquid

- 7.3 Solid

- 7.4 Semi-solid

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Supermarkets & Hypermarkets

- 8.3 Convenience stores

- 8.4 Specialty stores

- 8.5 Online retail

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Danone S.A.

- 10.2 Yakult Honsha Co., Ltd.

- 10.3 Nestle S.A.

- 10.4 General Mills, Inc.

- 10.5 Probi AB

- 10.6 Lifeway Foods, Inc.

- 10.7 BioGaia AB

- 10.8 Chr. Hansen Holding A/S

- 10.9 Lallemand Inc.

- 10.10 Arla Foods amba

- 10.11 Chobani, LLC

- 10.12 Fonterra Co-operative Group Limited

- 10.13 Kerry Group plc

- 10.14 Kellogg Company

- 10.15 PepsiCo, Inc.