|

市場調查報告書

商品編碼

1750318

營養化妝品成分市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Nutricosmetic Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

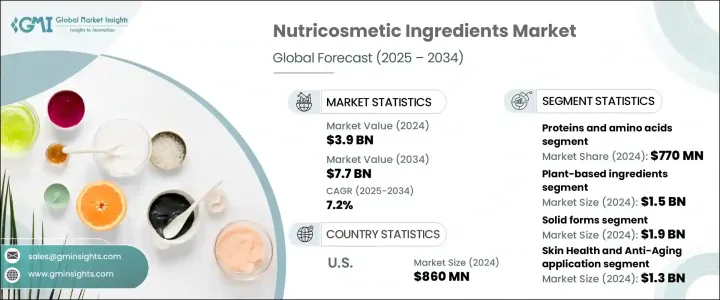

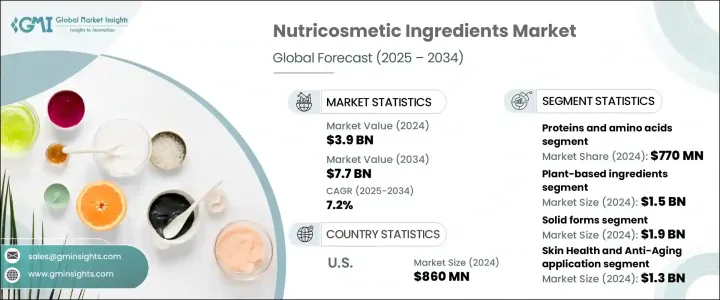

2024年,全球營養美容成分市場規模達39億美元,預計2034年將以7.2%的複合年成長率成長,達到77億美元。這得歸功於消費者對整體健康日益成長的興趣,即美麗與健康密不可分。隨著全球消費者健康意識的增強,可攝取護膚品和護髮產品的使用量正在穩步成長。營養與化妝品之間的界限日漸模糊,促進了產品的快速開發,並增加了經臨床驗證的生物活性化合物的使用。隨著可支配收入的增加、電子商務的蓬勃發展以及對天然、植物性和GRAS認證成分的有利監管框架,這種對「由內而外的美麗」的日益成長的偏好正在得到強化。

新興市場(尤其是亞太地區)在市場擴張中發揮關鍵作用,城市化進程加快,生活方式轉變,大量中產階級開始養成日常美容保健習慣。同時,全球人口老化也推動了對促進皮膚彈性、頭髮強韌度和指甲健康的產品的需求。臨床研究的進步和消費者轉向預防性醫療保健也是關鍵的加速因素,經科學驗證的成分因其功效和安全性而日益受到青睞。數位零售、個人化美容趨勢以及對清潔標籤的期望進一步增強了成長機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 39億美元 |

| 預測值 | 77億美元 |

| 複合年成長率 | 7.2% |

在成分類別中,蛋白質和胺基酸佔據市場主導地位,2024 年估值達 7.7 億美元,預計到 2034 年複合年成長率將達到 6.7%。這些化合物具有結構性和煥活肌膚的功效,尤其適用於改善皮膚彈性、頭髮強度和指甲密度的應用。利用海洋膠原蛋白、L-胱氨酸和富含歐米伽脂肪酸的萃取物的創新技術,鞏固了該領域以臨床資料支持的實際效果而聞名。

2024年,固體劑型市場以19億美元的規模佔據主導地位。膠囊、片劑和粉末憑藉其便攜性、劑量精準性和更長的保存期限,依然是首選。由於生產便利、全球分銷成本低廉,這些劑型在各個年齡層和不同用途人群中廣受歡迎。超過一半的消費者始終將固體劑型作為日常保健的一部分。同時,由於液體劑型吸收速度更快、生物利用度更高,其需求也不斷成長,尤其對於那些追求快速美容效果的用戶而言。

美國營養美容成分市場規模在2024年達到8.6億美元,並將繼續以6.9%的複合年成長率成長。美國對整體美容和健康的需求強勁,得益於成熟的補充劑行業和支持性的監管環境,這些因素鼓勵創新和快速的產品發布。消費者擴大選擇可攝取的美容解決方案,這些方案旨在從內部改善皮膚、頭髮和指甲的健康,這反映出人們越來越傾向於預防性和功能性自我護理。經臨床驗證的成分的可用性以及標籤的透明度正在建立消費者的信任和忠誠度。

奇華頓、龍沙集團、巴斯夫、安麗和杜邦等領先公司正在採取多種策略來鞏固其市場地位。他們正在投資研發以提高產品功效,與皮膚科醫生和健康專家建立合作夥伴關係以驗證其功效,並透過針對特定地區的配方拓展新興市場。此外,他們注重永續性和透明度,以滿足日益成長的對符合消費者價值觀的清潔標籤、植物源成分的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 前景

- 製造商

- 經銷商

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 主要出口國

- 主要進口國

註:以上貿易統計僅針對重點國家。

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 人口老化推動抗衰老成分需求

- 消費者對口服美容補充劑的偏好日益增加

- 生物活性溴化合物配方的創新

- 韓國美容和日本美容潮流在全球的擴張

- 產業陷阱與挑戰

- 經臨床驗證的成分成本高,限制了大眾市場產品的可負擔性。

- 跨地區監管的複雜性減緩了產品核准和市場進入。

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 競爭格局

- 公司概況

- 產品組合和規格

- SWOT分析

- 公司市佔率分析

- 各公司全球市場佔有率

- 區域市佔率分析

- 產品組合佔有率分析

- 策略舉措

- 併購

- 夥伴關係和合作

- 產品發布和創新

- 擴張計劃和投資

- 公司標竿分析

- 產品創新標竿分析

- 定價策略比較

- 配電網路比較

- 客戶服務和支援比較

第5章:市場估計與預測:依成分分類,2021-2034

- 主要趨勢

- 類胡蘿蔔素

- BETA-胡蘿蔔素

- 番茄紅素

- 葉黃素和玉米黃質

- 蝦紅素

- 其他類胡蘿蔔素

- 維生素

- 維生素A和類視黃醇

- 維生素C(抗壞血酸)

- 維生素E(生育酚)

- 維生素D

- B群維生素(生物素、菸鹼酸、核黃素)

- 其他維生素

- 礦物質

- 鋅

- 碳粉匣

- 銅

- 矽

- 其他礦物質

- 蛋白質和胺基酸

- 膠原蛋白胜肽

- 角蛋白

- 彈性蛋白

- 必需胺基酸

- 其他蛋白質和胜肽

- 歐米茄脂肪酸

- Omega-3脂肪酸

- Omega-6脂肪酸

- Omega-9脂肪酸

- 其他脂肪酸

- 多酚和黃酮類化合物

- 白藜蘆醇

- 綠茶兒茶素

- 葡萄籽萃取物

- 薑黃素

- 其他多酚

- 益生元、益生菌和後生元

- 益生元纖維

- 益生菌菌株對皮膚健康有益

- 後生元化合物

- 合生元配方

- 神經醯胺和脂質

- 植物源性神經醯胺

- 植物鞘氨醇

- 磷脂

- 其他脂質化合物

- 酵素和輔酶

- 輔酶Q10

- 超氧化物歧化酶

- 其他酵素

- 其他成分

- 玻尿酸

- 甲基磺醯甲烷 (MSM)

- 碧蘿芷

- 硫酸軟骨素

- 新興的新型成分

第6章:市場估計與預測:依來源,2021-2034

- 主要趨勢

- 植物成分

- 水果和蔬菜

- 草藥和植物藥

- 藻類和海藻

- 植物油和萃取物

- 其他植物來源

- 動物性成分

- 海洋資源

- 牛源

- 禽類來源

- 其他動物來源

- 合成和半合成成分

- 實驗室合成的維生素

- 生物工程化合物

- 其他合成成分

- 生物技術衍生成分

- 發酵衍生成分

- 重組蛋白

- 其他生物技術成分

第7章:市場估計與預測:依形式,2021-2034

- 主要趨勢

- 固體形式

- 平板電腦

- 膠囊

- 軟膠囊

- 粉末

- 軟糖和咀嚼片

- 液體形式

- 飲料和飲品

- 射擊和集中

- 糖漿和混懸液

- 其他液體形式

- 半固體形式

- 凝膠

- 果凍

- 其他半固體形式

- 新型輸送系統

- 脂質體和奈米顆粒

- 微膠囊化

- 乳液和膠束

- 其他先進的輸送系統

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 皮膚健康和抗衰老

- 減少皺紋

- 皮膚彈性和緊緻度

- 皮膚保濕

- 防紫外線及預防光老化

- 亮膚、均勻膚色

- 痤瘡和問題皮膚

- 頭髮護理

- 生髮防脫髮

- 頭髮強度和厚度

- 頭皮健康

- 秀髮閃亮活力

- 指甲健康

- 指甲強度和生長

- 指甲的外觀和紋理

- 體重管理與塑身

- 減少脂肪團

- 脂肪代謝

- 身體塑形

- 防曬和曬黑

- 內部防曬

- 曬後恢復

- 曬黑增強

- 口腔護理

- 牙齦健康

- 牙齒美白

- 口氣清新

- 其他應用

- 眼睛健康

- 關節健康

- 睡眠和壓力管理

第9章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 膳食補充劑

- 維生素和礦物質

- 草藥補充劑

- 蛋白質和胺基酸補充劑

- 特殊補充劑

- 功能性食品

- 強化穀物和穀類

- 功能性乳製品

- 營養美容零食和能量棒

- 其他功能性食品

- 功能性飲料

- 美妝飲品及飲品

- 強化果汁和冰沙

- 膠原蛋白飲料

- 草本茶和沖泡茶

- 其他功能性飲料

- 外用產品組合

- 補充劑-乳霜組合

- 飲料-精華液組合

- 其他組合產品

- 其他

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 11 章:公司簡介

- BASF SE

- Lonza Group

- Koninklijke DSM NV

- Glanbia plc

- Givaudan

- Lycored

- Ashland Global Holdings Inc.

- Evonik Industries AG

- Croda International Plc

- Sabinsa Corporation

- Seppic (Air Liquide)

- Solabia Group

- Vitablend Nederland BV

- BioCell Technology LLC

- Frutarom (IFF)

- Ingredion Incorporated

- ADM (Archer Daniels Midland)

- Naturex (a Givaudan brand)

- NutriScience Innovations LLC

- Nexira

The Global Nutricosmetic Ingredients Market was valued at USD 3.9 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 7.7 billion by 2034, driven by the growing consumer interest in holistic wellness, where beauty and health are approached as interconnected. As consumers worldwide become more health-conscious, the use of ingestible skincare and haircare solutions is rising steadily. The blurring line between nutrition and cosmetics has led to rapid product development and increasing use of clinically backed bioactive compounds. This evolving preference for "beauty from within" is being reinforced by rising disposable income, expanding e-commerce, and favorable regulatory frameworks for natural, plant-based, and GRAS-approved ingredients.

Emerging markets-particularly in Asia Pacific-are playing a pivotal role in market expansion, with increasing urbanization, changing lifestyles, and a large middle-class population adopting daily beauty and wellness routines. Simultaneously, an aging global population is fueling demand for products that promote skin elasticity, hair strength, and nail health. Advances in clinical research and a consumer shift toward preventative healthcare are also key accelerators, with science-backed ingredients gaining favor for their proven efficacy and safety. Digital retailing, personalized beauty trends, and clean-label expectations further enhance growth opportunities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $7.7 Billion |

| CAGR | 7.2% |

Among ingredient categories, proteins and amino acids led the market with a valuation of USD 770 million in 2024 and are forecast to grow at a CAGR of 6.7% through 2034. These compounds offer structural and rejuvenating benefits, especially in applications aimed at improving skin resilience, hair strength, and nail density. Innovations leveraging marine-sourced collagen, L-cystine, and omega-rich extracts have strengthened this segment's reputation for tangible results backed by clinical data.

Solid dosage formats segment dominated the market in 2024 with USD 1.9 billion. Capsules, tablets, and powders remain the top choice due to their portability, dosage accuracy, and extended shelf stability. Their popularity spans diverse age groups and usage categories, supported by ease of production and cost-efficient global distribution. Over half of the consumer base consistently prefers solid formats as part of their wellness routines. Meanwhile, the demand for liquid alternatives is gaining pace due to faster absorption and improved bioavailability, especially for users targeting rapid beauty enhancements.

U.S. Nutricosmetic Ingredients Market reached USD 860 million in 2024 and continues to grow at a 6.9% CAGR. With strong demand for holistic beauty and wellness, the country benefits from a mature supplements industry and supportive regulatory environment, encouraging innovation and rapid product launches. Consumers are increasingly turning to ingestible beauty solutions that target skin, hair, and nail health from within, reflecting a broader shift toward preventive and functional self-care. The availability of clinically-backed ingredients and transparency in labeling are building consumer trust and loyalty.

Leading companies like Givaudan, Lonza Group, BASF SE, Amway Corporation, and DuPont de Nemours, Inc. are employing several strategies to reinforce their market presence. They are investing in R&D to enhance product efficacy, forming partnerships with dermatologists and health experts to validate claims, and expanding into emerging markets with region-specific formulations. Additionally, they focus on sustainability and transparency to meet rising demand for clean-label, plant-derived ingredients that align with consumer values.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

Note: the above trade statistics will be provided for key countries only.

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Aging populations boosting anti-aging ingredient demand

- 3.7.1.2 Rising consumer preference for oral beauty supplements

- 3.7.1.3 Innovation in bioactive brominated compound formulations

- 3.7.1.4 Expansion of k-beauty and j-beauty trends globally

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High cost of clinically proven ingredients limiting mass-market product affordability.

- 3.7.2.2 Regulatory complexities across regions slowing product approvals and market entries.

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Competitive landscape

- 4.1.1 Company overview

- 4.1.2 Product portfolio and specifications

- 4.1.3 Swot analysis

- 4.2 Company market share analysis, 2024

- 4.2.1 Global market share by company

- 4.2.2 Regional market share analysis

- 4.2.3 Product portfolio share analysis

- 4.3 Strategic initiative

- 4.3.1 Mergers and acquisitions

- 4.3.2 Partnerships and collaborations

- 4.3.3 Product launches and innovations

- 4.3.4 Expansion plans and investments

- 4.4 Company benchmarking

- 4.4.1 Product innovation benchmarking

- 4.4.2 Pricing strategy comparison

- 4.4.3 Distribution network comparison

- 4.4.4 Customer service and support comparison

Chapter 5 Market Estimates & Forecast, By Ingredients Classification, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Carotenoids

- 5.2.1 Beta-carotene

- 5.2.2 Lycopene

- 5.2.3 Lutein and zeaxanthin

- 5.2.4 Astaxanthin

- 5.2.5 Other carotenoids

- 5.3 Vitamins

- 5.3.1 Vitamin A and retinoids

- 5.3.2 Vitamin C (ascorbic acid)

- 5.3.3 Vitamin E (tocopherols)

- 5.3.4 Vitamin D

- 5.3.5 B Vitamins (biotin, niacin, riboflavin)

- 5.3.6 Other vitamins

- 5.4 Minerals

- 5.4.1 Zinc

- 5.4.2 Selenium

- 5.4.3 Copper

- 5.4.4 Silicon

- 5.4.5 Other Minerals

- 5.5 Proteins and Amino Acids

- 5.5.1 Collagen peptides

- 5.5.2 Keratin

- 5.5.3 Elastin

- 5.5.4 Essential amino acids

- 5.5.5 Other proteins and peptides

- 5.6 Omega Fatty Acids

- 5.6.1 Omega-3 fatty acids

- 5.6.2 Omega-6 fatty acids

- 5.6.3 Omega-9 fatty acids

- 5.6.4 Other fatty acids

- 5.7 Polyphenols and Flavonoids

- 5.7.1 Resveratrol

- 5.7.2 Green tea catechins

- 5.7.3 Grape seed extract

- 5.7.4 Curcumin

- 5.7.5 Other polyphenols

- 5.8 Prebiotics, Probiotics, and Postbiotics

- 5.8.1 Prebiotic fibers

- 5.8.2 Probiotic strains for skin health

- 5.8.3 Postbiotic compounds

- 5.8.4 Synbiotic formulations

- 5.9 Ceramides and Lipids

- 5.9.1 Plant-derived ceramides

- 5.9.2 Phytosphingosine

- 5.9.3 Phospholipids

- 5.9.4 Other lipid compounds

- 5.10 Enzymes and Coenzymes

- 5.10.1 Coenzyme Q10

- 5.10.2 Superoxide dismutase

- 5.10.3 Other enzymes

- 5.11 Other Ingredients

- 5.11.1 Hyaluronic acid

- 5.11.2 Methylsulfonylmethane (MSM)

- 5.11.3 Pycnogenol

- 5.11.4 Chondroitin sulfate

- 5.11.5 Emerging novel ingredients

Chapter 6 Market Estimates & Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Plant-Based Ingredients

- 6.2.1 Fruits and vegetables

- 6.2.2 Herbs and botanicals

- 6.2.3 Algae and seaweed

- 6.2.4 Plant oils and extracts

- 6.2.5 Other plant sources

- 6.3 Animal-Based Ingredients

- 6.3.1 Marine sources

- 6.3.2 Bovine sources

- 6.3.3 Avian sources

- 6.3.4 Other animal sources

- 6.4 Synthetic and Semi-Synthetic Ingredients

- 6.4.1 Lab-synthesized vitamins

- 6.4.2 Bioengineered compounds

- 6.4.3 Other synthetic ingredients

- 6.5 Biotechnology-Derived Ingredients

- 6.5.1 Fermentation-derived ingredients

- 6.5.2 Recombinant proteins

- 6.5.3 Other biotech ingredients

Chapter 7 Market Estimates & Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Solid Forms

- 7.2.1 Tablets

- 7.2.2 Capsules

- 7.2.3 Softgels

- 7.2.4 Powders

- 7.2.5 Gummies and Chewables

- 7.3 Liquid Forms

- 7.3.1 Beverages and drinks

- 7.3.2 Shots and concentrate

- 7.3.3 Syrups and suspensions

- 7.3.4 Other liquid forms

- 7.4 Semi-Solid Forms

- 7.4.1 Gels

- 7.4.2 Jellies

- 7.4.3 Other semi-solid forms

- 7.5 Novel Delivery Systems

- 7.5.1 Liposomes and nanoparticles

- 7.5.2 Microencapsulation

- 7.5.3 Emulsions and micelles

- 7.5.4 Other advanced delivery systems

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Skin Health and Anti-Aging

- 8.2.1 Wrinkle reduction

- 8.2.2 Skin elasticity and firmness

- 8.2.3 Skin hydration

- 8.2.4 Uv protection and photoaging prevention

- 8.2.5 Skin brightening and even tone

- 8.2.6 Acne and problem skin

- 8.3 Hair care

- 8.3.1 Hair growth and anti-hair loss

- 8.3.2 Hair strength and thickness

- 8.3.3 Scalp health

- 8.3.4 Hair shine and vitality

- 8.4 Nail health

- 8.4.1 Nail strength and growth

- 8.4.2 Nail appearance and texture

- 8.5 Weight management and body sculpting

- 8.5.1 Cellulite reduction

- 8.5.2 Fat metabolism

- 8.5.3 Body contouring

- 8.6 Sun protection and tanning

- 8.6.1 Internal sun protection

- 8.6.2 After-sun recovery

- 8.6.3 Tanning enhancement

- 8.7 Oral care

- 8.7.1 Gum health

- 8.7.2 Teeth whitening

- 8.7.3 Breath freshening

- 8.8 Other applications

- 8.8.1 Eye health

- 8.8.2 Joint health

- 8.8.3 Sleep and stress management

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Dietary supplements

- 9.2.1 Vitamins and minerals

- 9.2.2 Herbal supplements

- 9.2.3 Protein and amino acid supplements

- 9.2.4 Specialty supplements

- 9.2.5 Functional foods

- 9.2.6 Fortified cereals and grains

- 9.2.7 Functional dairy products

- 9.2.8 Nutricosmetic snacks and bars

- 9.2.9 Other functional foods

- 9.3 Functional beverages

- 9.3.1 Beauty drinks and shots

- 9.3.2 Fortified juices and smoothies

- 9.3.3 Collagen drinks

- 9.3.4 Herbal teas and infusions

- 9.3.5 Other functional beverages

- 9.4 Topical product combinations

- 9.4.1 Supplement-cream combinations

- 9.4.2 Drink-serum combinations

- 9.4.3 Other combination products

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 BASF SE

- 11.2 Lonza Group

- 11.3 Koninklijke DSM N.V.

- 11.4 Glanbia plc

- 11.5 Givaudan

- 11.6 Lycored

- 11.7 Ashland Global Holdings Inc.

- 11.8 Evonik Industries AG

- 11.9 Croda International Plc

- 11.10 Sabinsa Corporation

- 11.11 Seppic (Air Liquide)

- 11.12 Solabia Group

- 11.13 Vitablend Nederland B.V.

- 11.14 BioCell Technology LLC

- 11.15 Frutarom (IFF)

- 11.16 Ingredion Incorporated

- 11.17 ADM (Archer Daniels Midland)

- 11.18 Naturex (a Givaudan brand)

- 11.19 NutriScience Innovations LLC

- 11.20 Nexira