|

市場調查報告書

商品編碼

1745943

用於長期儲能的氧化還原液流電池 (RFB):電網、微電網、市場和技術(2025-2045)Long Duration Energy Storage with Redox Flow Batteries: Grid, Microgrid, Markets, Technology 2025-2045 |

||||||

氧化還原液流電池 (RFB) 正日益成為電網和微電網的長期儲能 (LDES)。預計 2025 年至 2045 年期間,該業務的累計規模將超過 1,700 億美元,全球需求將呈現多元化和分散化趨勢。

2024 年,RFB 的銷售額約 10 億美元,主要用於短期應用。到 2045 年,該銷售額可能達到約 220 億美元,其中大部分用於 LDES(長期儲能)。這是由於市場需求和 RFB 技術的發展。由於微電網的 RFB 應用與即將推出的 RFB 技術的特性高度契合,因此在 2045 年左右,RFB 的銷售也可能成為主流。

由於本報告提供RFB (氧化還原液流電池) 的LDES (長時間能源儲存) 的市場調查,彙整RFB技術的概要與藍圖,市場規模的預測,RFB製造商的簡介等資訊。

目錄

第1章 摘要整理·總論

- 目標、LDES、RFB、混合RFB

- 研究方法

- 定義、延遲電源需求、替代技術

- 8個關鍵結論:RFB市場和產業,包含10個資訊圖

- 資訊圖表:RFB按公司和技術劃分的業績和展望

- 資訊圖表:LDES技術持續時間和2025年的電力供應

- RFB 2025-2045目標:併網LDES與需求截然不同的離網LDES

- 資訊圖表:RFB未來超網應用範例:6G基地台

- RFB的成功與市場空白

- RFB背景:併網和離網應用的完整LDES工具包資訊圖

- LDES RFB技術2025-2045 年領導企業

- 關於再生能源流出物 (RFB) 技術的 19 個關鍵結論

- RFB 路線圖:依市場和技術分類

- 長時儲能 (LDES) 路線圖

- 市場預測:2025-2045

第2章 到LDES的需求,設計原則,2025年狀況

- 能源基礎

- 再生能源進入成本快速下降:2025 年統計與趨勢

- 太陽能的勝利與間歇性課題

- LDES 的替代路線

- LDES 的定義及方案比較

- 併網與離網 LDES 的主要需求

- 2025 年主要項目

- LDES 的障礙、替代方案與投資環境

- LDES 工具包

- 最新的獨立績效評估:技術

- LDES的RFB參數對照表

第3章 從RFB (氧化還原液流電池) LDES的轉變:需求,成本,化學,薄膜

- 概要

- 概述:用於電網和微電網的RFB

- 針對2030年6G通訊等微電網優化的RFB

- 陽極電解液和陰極電解液化學性質

- 尋求更低的LCOS、不可燃性、混合泡棉和更佳膜(資訊圖)

- 有機和水基RFB設計

- 大規模RFB變得可行

- 充滿活力的創新管道

- 資訊圖表:RFB商業化成果與展望

- RFB研究轉向LDES

- LDES 區域燃料流出物 (RFB) 的 SWOT 評估

第4章 RFB技術和趨勢

- RFB 技術

- 常規和混合方案的 SWOT 評估

- 依材料劃分的具體設計:釩、鐵及其變體、鹵素基、有機、錳、鹽水

第5章 RFB製造商的簡介·分析

- 按化學成分劃分的製造商數量和市場規模

- 45 家 RFB 公司在 8 個類別中的比較:名稱、品牌、技術、技術就緒程度、離網重點、LDES 重點、評論

- RFB 製造商概況

Summary

Redox Flow Batteries RFB increasingly supply Long Duration Energy Storage LDES for grids and microgrids. From 2025-2045, that may total over $170 billion dollars of business cumulatively but fragmenting to serve increasingly varied needs and locations worldwide. It is time for an independent report on that large business opportunity, so we now have the Zhar Research 252-page report, "Long Duration Energy Storage with Redox Flow Batteries: Grid, microgrid, markets, technologies 2025-2045" . This is your detailed guidebook, whether you offer added value materials or complete devices.

Advances in 2025 are very important

Importantly, this new report includes PhD level analysis of the remarkable research and company advances in 2025. See 23 forecast lines 2025-2045, new roadmaps 2025-2045, SWOT reports, comparison tables, infograms and 45 manufacturer profiles with appraisals. Learn how the number of RFB manufacturers will grow up-to and after a future shakeout. Which formats, chemistries, materials and membranes win? What are your potential acquisitions, partners, competitors? What optimum strategies assist you to attain up to $5 billion in yearly RFB LDES sales?

Chapters and their findings

The "Executive summary and conclusions" (50 pages) is sufficient if your time is limited, for here are the basics, eight key conclusions on markets and companies and 19 on technologies. 45 RFB companies are compared in eight columns for each. Many pie charts, three SWOT appraisals and those 23 forecast lines and graphs with explanations make sense of it all. For example, RFB sales were around $1 billion in 2024, mainly for short duration, but sales could be around $22 billion in 2045, mostly as LDES, due to the needs and RFB technologies changing as explained here. RFB LDES value sales for microgrids could dominate by then, because these different requirements are an even better match for emerging RFB capabilities.

Chapter 2. "LDES needs, design principles, situation through 2025" takes 30 pages giving a balanced, independent view embracing the microgrid opportunity as well. You do not suffer figures from manufacturers and trade associations exaggerating the opportunity and concentrating only on grid applications. See why RFB has less competition for microgrid LDES and RFB may even lead that storage market. See escape routes from LDES such as grids widening over time and weather zones and new green generation modes each giving less intermittency. That reduces the need for grid LDES though it will still be substantial.

Chapter 3. "Redox flow batteries RFB pivoting to LDES: needs, costs, chemistries and membranes" (20 pages) gives the big picture on the costs, formats, liquid chemistries and membrane science involved. 2025 advances and potential for improvement are prioritised. The different grid and microgrid solutions are examined.

Chapter 4. "RFB technologies and trends" (37 pages) examines those all-important electrolytes and their matched formats in detail. It compares and interprets the flood of advances, particularly in 2025. The general picture is of most effort, and progress, being with vanadium, iron and zinc-based anolytes and catholytes, variants including combinations with several other metals but there is more. Eliminating flammability is now a given with the aqueous electrolytes and some organic ones. Progress is patchy in eliminating toxigens and toxigen intermediaries and zinc chemistries have considerable research but struggle with commercialisation. Such problems may be your opportunities.

The report closes with the longest chapter. Chapter 5. "RFB manufacturer profiles and analysis" (106 pages) appraises manufacturers and putative manufacturers of RFB including their profiles, technology focus and readiness, strategies, successes and failures. Conclusions are presented in tables, pie charts and forecasts.

Expert opinion

Primary author Dr Peter Harrop, CEO of Zhar Research, says, "As LDES becomes a very large market, pumped hydro and its variants and compressed air underground may serve most grid needs but special situations will favour RFB creating a lesser - but still large - grid opportunity. Green generation off-grid and capable-of-being-off-grid is an even bigger opportunity for RFB because it reads more strongly onto its strengths such as no major earthworks, small footprint when stacked and fast permitting and installation, even safely in cities. Overall, RFB can follow the demand as it moves to longer time of storage and longer duration of subsequent power delivery. It will provide ever larger capacity still with minimal fade and self-leakage, even offering repair and upgrading after deployment. Most alternatives cannot keep up with this, so we strongly urge you to assess these opportunities for both your added-value materials and your capability with structures and product integration".

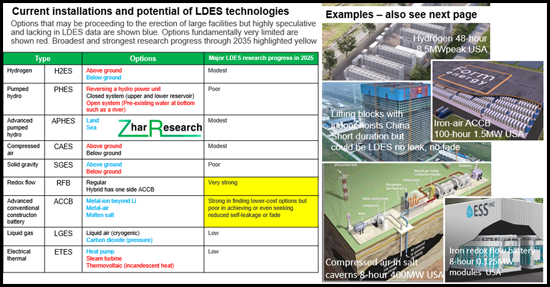

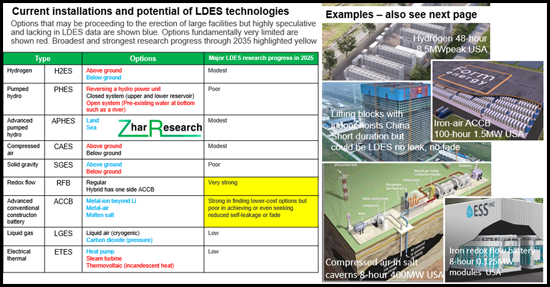

CAPTION: Current installations and potential of LDES technologies showing strong position of RFB. Source, Zhar Research report, "Long Duration Energy Storage with Redox Flow Batteries: Grid, microgrid, markets, technologies 2025-2045".

Table of Contents

1. Executive summary and conclusions

- 1.1. Purpose of this report, LDES, RFB and hybrid RFB

- 1.2. Methodology of this analysis

- 1.3. Definitions, need for delayed electricity, escape routes

- 1.4. Eight primary conclusions: RFB markets and industry with ten infograms

- 1.5. Infogram: RFB achievements and aspirations by company and technology 2025-2045

- 1.6. Infogram: Duration hours vs power delivered for LDES technologies in 2025

- 1.7. The very different needs for grid vs beyond-grid LDES targetted by RFB 2025-2045

- 1.8. Infogram: Example of future beyond-grid application of RFB: 6G base stations

- 1.9. RFB success and gaps in its markets

- 1.10. RFB in context: Infogram of complete LDES toolkit for grid and beyond-grid applications

- 1.11. RFB technology leaders for LDES 2025-2045

- 1.11.1. Vanadium RFB gets busy - examples

- 1.11.2. RFB projects without vanadium coming up fast - examples

- 1.11.3. Analysis of number of manufacturers by chemistry: vanadium lead reducing

- 1.11.4. Research pipeline analysis: 61 papers from 2024-2025: primary emphasis strongly beyond vanadium

- 1.12. 19 primary conclusions concerning RFB technologies

- 1.12.1. The 19 conclusions

- 1.12.2. Seven RFB key parameters driving volume sales, vanadium vs other 2025-2045

- 1.12.3. 45 RFB companies compared in 8 columns: name, brand, technology, tech. readiness, beyond grid focus, LDES focus, comment

- 1.12.4. SWOT appraisal of regular RFB

- 1.12.5. SWOT appraisal of hybrid RFB

- 1.12.6. SWOT appraisals of vanadium and all-iron RFB against alternatives

- 1.13. RFB roadmap by market and by technology 2025-2045

- 1.14. Long Duration Energy Storage LDES roadmap 2025-2045

- 1.15. Market forecasts 2025-2045 in 23 lines

- 1.15.1. RFB global value market grid vs beyond-grid 2025-2045 table, graph, explanation

- 1.15.2. RFB global value market short term and LDES $ billion 2025-2045 table, graph, explanation

- 1.15.3. Vanadium vs iron vs other RFB value market % 2025-2045 table, graph, explanation

- 1.15.4. Regional share of RFB value market % in four regions and manufacturer numbers 2025-2045

- 1.15.5. LDES total value market showing beyond-grid gaining share 2025-2045

- 1.15.6. LDES value market $ billion in 9 technology categories with explanation 2025-2045

2. LDES needs, design principles, situation through 2025

- 2.1. Energy fundamentals

- 2.2. Racing into renewables with rapid cost reduction: 2025 statistics and trends

- 2.3. Solar winning and the intermittency challenge

- 2.4. Escape routes from LDES

- 2.4.1. General situation

- 2.4.2. Reduction of LDES need by unrelated actions

- 2.4.3. Many options to deliberately reduce the need for LDES

- 2.5. LDES definitions and choices compared

- 2.6. The very different needs for grid vs beyond-grid LDES 2025-2045

- 2.7. Leading projects in 2025 showing leading technology subsets

- 2.7.1. Current LDES situation and trend in need: simplified version

- 2.7.2. Leading projects in 2025 showing detail and leading technology subsets, trend

- 2.8. LDES impediments, alternatives, and investment climate

- 2.9. LDES toolkit

- 2.9.1. Overview

- 2.9.2. LDES choices compared

- 2.9.3. Electrochemical LDES options explained

- 2.10. Latest independent assessments of performance by technology

- 2.11. Parameter comparison table of RFB for LDES

3. Redox flow batteries RFB pivoting to LDES: needs, costs, chemistries, and membranes

- 3.1. Overview

- 3.1.1. General: RFB for grids and microgrids

- 3.1.2. RFB optimised for microgrids including 6G Communications in 2030

- 3.1.3. Chemistries of anolyte and catholyte

- 3.1.4. Quest for lower LCOS, non-flammable, hybrid forms and better membranes (with infogram)

- 3.1.5. Organic and aqueous RFB design

- 3.1.6. Large RFB becoming viable

- 3.1.7. Vibrant pipeline of innovation

- 3.2. Infogram: RFB commercial achievements and aspirations 2025-2045

- 3.3. RFB research pivoting to LDES

- 3.3.1. Overview of RFB and its potential for LDES

- 3.3.2. Lessons from review papers

- 3.3. SWOT appraisal of RFB for LDES

4. RFB technologies and trends

- 4.1. RFB technologies

- 4.1.1. Regular or hybrid, their chemistries and the main ones being commercialised

- 4.1.2. Types of RFB and their design

- 4.1.3. Leading alternative chemistries compared for redox flow batteries RFB including hybrids

- 4.2. SWOT appraisals of regular vs hybrid options

- 4.2.1. SWOT appraisal of regular RFB geometry

- 4.2.2. SWOT appraisal of hybrid RFB

- 4.3. Specific designs by material: vanadium, iron and variants, halogen-based, organic, manganese, salt water 2025, research, 3 SWOT

- 4.3.1. Metal ligand RFB

- 4.3.2. Vanadium RFB design with 15 research advances in 2025 and SWOT

- 4.3.3. All-iron RFB design with research advances in 2025

- 4.3.4. Iron combinations for RFB with research advances in 2025

- 4.3.6. Salt-water to acid-plus-base and back

5. RFB manufacturer profiles and analysis

- 5.1. Number of manufacturers and value market by chemistry 2025-2045

- 5.2. 45 RFB companies compared in 8 columns: name, brand, technology, tech. readiness, beyond-grid focus, LDES focus, comment

- 5.3. Profiles of RFB manufacturers and putative manufacturers in 97 pages