|

市場調查報告書

商品編碼

1911824

歐洲摩托車市場佔有率分析、行業趨勢、統計數據和成長預測(2026-2031)Europe Two-Wheeler - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

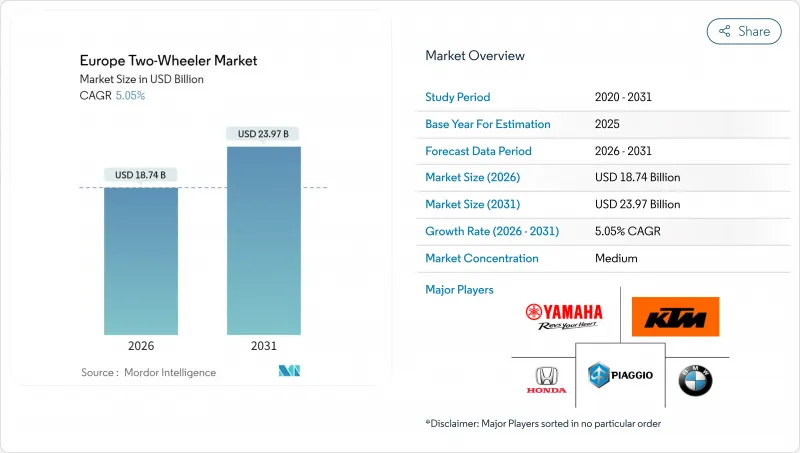

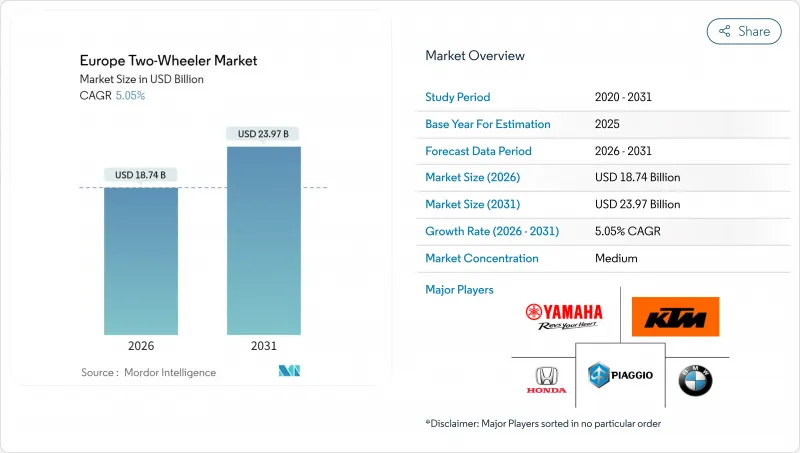

歐洲摩托車市場預計將從 2025 年的 178.4 億美元成長到 2026 年的 187.4 億美元,預計到 2031 年將達到 239.7 億美元,2026 年至 2031 年的複合年成長率為 5.05%。

這一成長勢頭得益於歐5+排放標準的實施、蓬勃發展的配送經濟以及歐盟對區域電池供應網路的資助。摩托車憑藉其在高速公路上的多功能性保持主導地位,而Scooter則在人口密集的城市中心佔據一席之地。透過電池更換網路降低前期成本,以及都市區清潔空氣區對內燃機車型的更嚴格監管,正推動電動動力系統從利基市場走向主流市場。價格兩極化日益加劇:售價低於1000美元的入門級Scooter繼續吸引著廣泛的消費群體,而售價高於3001美元的高階電動機車則經歷了最快的成長,這主要得益於追求互聯功能、安全技術和訂閱式驅動系統的騎行者對更換的需求。市場競爭較為溫和,老牌企業依賴經銷商網路和品牌資產,而專業電動摩托車製造商則利用直銷通路和模組化軟體更新來縮短車型週期。

歐洲摩托車市場趨勢與洞察

電子商務配送車隊快速擴張,需要總擁有成本(TCO)低的摩托車。

網路購物的興起使摩托車成為最後一公里物流的核心組成部分。亞馬遜在歐洲的配送合作夥伴網路規模龐大,截至2024年已超過13,000家。車隊採購商優先考慮堅固的車架、遠端資訊處理系統和可更換電池等特性,以最大限度地減少停機時間。由於總擁有成本超過購買價格,建議零售價較高的電動Scooter也受到青睞。配送公司紛紛下達包含服務合約的大額訂單,迫使原始設備製造商(OEM)提供模組化電池組和預測性維護應用程式介面(API)。這種商業性模式的轉變使需求不再局限於休閒騎乘者,有助於在經濟放緩期間增強歐洲摩托車市場的韌性。

歐盟5+排放過渡引發購車領先準備與車型更新換代

歐盟5+排放法規迫使製造商加快引擎升級和電氣化進程,導致消費者在價格上漲前搶購舊款車型,造成暫時的購買凍結。在清理舊款庫存的同時,原始設備製造商(OEM)也在推廣符合歐盟5+排放標準的高階車型,並享受暫時的利潤提升,這將有助於未來電動車型的資金籌措。該法規對主流的126-150cc等級車型影響尤為顯著,促使製造商快速更新換代,並刺激了對符合排放標準的廢氣後處理系統的需求。經銷商報告稱,在2025年新規生效前,展示室客流量有所增加,這不僅提振了短期銷量,也加速了向零排放產品的長期轉型。

鋰現貨價格的波動會影響電動車製造商建議零售價的穩定性。

2024年碳酸鋰價格的波動迫使製造商在每月調整價格和承受利潤率壓力之間做出選擇。雖然避險協議可以緩解部分價格飆升,但小規模、專注於特定領域的電動車製造商由於財務基礎薄弱,面臨生產延誤的風險。電池化學研發正在探索富錳正極材料以減少鋰的使用量,但預計實用化要到2026年或更晚才能實現。

細分市場分析

2025年,摩托車將佔歐洲二輪車市場的81.02%,這反映了其在通勤和休閒旅行方面的多功能性。引擎效率的提高和安全電子設備的進步使其在愛好者中保持了高人氣,而高階探險和運動車型則推高了平均售價。儘管基數較小,但Scooter的複合年成長率仍達到7.9%,這主要得益於大都會圈堵塞費、停車位短缺以及電子商務配送需求的成長。電動Scooter在都市區車隊競標佔據主導地位,因為簡化的動力系統減少了維修停機時間,並增強了商業性優勢。製造商正瞄準沒有車庫插座的公寓居住者,推出可拆卸電池的Scooter。隨著越來越多的城市限制高排放氣體區域,Scooter的註冊量正從傳統的南歐市場擴展到德國和北歐國家,從而縮小了與摩托車銷售的差距。

到2025年,內燃機摩托車仍將佔據歐洲摩托車市場90.86%的佔有率,這得益於現有的基礎設施和久經考驗的可靠性。符合歐盟5+排放標準的引擎在降低排放氣體的同時,並未犧牲高速公路性能,因此能夠滿足鄉村和旅行騎行者的需求。電動車將保持9.14%的市場佔有率,但由於充電網路的擴展和換電站的增加,其複合年成長率將達到6.88%。隨著都市區對符合低排放氣體標準的內燃機摩托車徵收越來越多的課稅甚至禁止其通行,電動車正逐漸成為城市通勤和配送工作的主流選擇。包含能源、保險和維護的訂閱套餐可以抵消高成本。快速充電樁的缺乏減緩了電動車在農村地區的普及速度,但計畫中的歐盟替代燃料走廊有望從2027年起縮小這一差距。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章:主要產業趨勢

- 人口和都市化

- 人均GDP(購買力平價)和可支配所得中位數

- 消費者在汽車購買和交通上的支出(CVP)

- 燃油價格

- 摩托車和汽車貸款利率及融資管道

- 摩托車普及率和車輛擁有量

- 經銷商和服務網路密度

- 摩托車貿易及收入(進口/出口)

- 電氣化現況(基礎設施和電力)

- 電池組價格和化學成分組合

- 電池更換站(網路密度和利用率)

- 新車型管線和OEM覆蓋範圍

- 價值鍊和組裝能力的在地化

- 法律規範

- 車輛標準、安全性和道路適行性

- 整車/散裝/半散的關稅、增值稅(VAT) 和在地採購含量 (LC) 法規

- 電氣化、能源與環境政策

- 摩托車計程車、送貨車輛和資金籌措的相關規定

第5章 市場情勢

- 市場概覽

- 市場促進因素

- 在過渡到歐盟5+排放標準後,領先購買和車型更新將進行。

- 電子商務配送車隊快速擴張,需要總擁有成本(TCO)低的二輪車。

- 電池更換經營模式降低了都市區用戶的電動車初始成本

- 年輕一代偏好訂閱制的旅行服務

- OEM模組化平台支援六個月的車型週期

- 根據歐盟淨零排放產業法案為區域電池供應鏈網路提供資金

- 市場限制

- 25歲以下騎士的保險費很高

- 加強對主要城市共享Scooter使用的限制

- 鋰現貨價格的波動會影響電動車製造商建議零售價的穩定性。

- 經銷商網路整合會降低本地服務取得途徑。

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 產業間競爭

第6章 市場規模及成長預測(價值及數量)

- 按車輛類型

- 摩托車

- Scooter

- 透過推廣

- 內燃機(ICE)

- 電

- 按引擎排氣量/馬達輸出功率

- 內燃機(ICE)

- 110cc或以下

- 111-125 cc

- 126-150 cc

- 151-200 cc

- 201-250 cc

- 250-350 cc

- 350-500 cc

- 500cc或以上

- 電

- 最大功率 1.0kW

- 1.1~3.0 kW

- 3.1~5.0 kW

- 5.0度或以上

- 內燃機(ICE)

- 按價格範圍

- 低於1000美元

- 1000-1500美元

- 1501-2000美元

- 2001-3000美元

- 3001-5000美元

- 超過5000美元

- 最終用戶

- B2C

- B2B

- 共乘/摩托車計程車/租賃/旅遊

- 配送/物流

- 企業和小型企業車隊

- 其他(政府/機構、非政府組織)

- 銷售管道

- 線上

- 離線

- 地區

- 德國

- 法國

- 義大利

- 西班牙

- 英國

- 荷蘭

- 瑞典

- 波蘭

- 奧地利

- 比利時

- 挪威

- 捷克共和國

- 葡萄牙

- 希臘

第7章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- BMW Motorrad

- Ducati Motor Holding SpA

- Harley-Davidson Inc.

- Honda Motor Co., Ltd.

- KTM AG

- Piaggio and C. SpA

- Royal Enfield(Eicher Motors)

- Suzuki Motor Corporation

- Triumph Motorcycles Ltd

- Yamaha Motor Co., Ltd.

- Niu Technologies

- Yadea Group Holdings Ltd

- Zero Motorcycles Inc.

- Kawasaki Motors Ltd

- Peugeot Motocycles

第8章:市場機會與未來展望

- 閒置頻段與未滿足需求評估

第9章:執行長面臨的關鍵策略挑戰

The Europe two-wheeler market is expected to grow from USD 17.84 billion in 2025 to USD 18.74 billion in 2026 and is forecast to reach USD 23.97 billion by 2031 at 5.05% CAGR over 2026-2031.

Momentum stems from Euro 5+ emission enforcement, the fast-growing delivery economy, and EU funding for local battery supply chains. Motorcycles are leading because of their highway versatility, while scooters are gaining ground in dense urban cores. Electric propulsion moves from niche to mainstream as battery-swap networks lower upfront cost and urban clean-air zones tighten rules on internal-combustion models. Price polarization grows: sub-USD 1,000 entry scooters sustain mass appeal, yet premium electric bikes above USD 3,001 post the sharpest gains as riders trade up for connectivity, safety tech, and subscription-ready drivetrains. Competition is moderate; legacy brands rely on dealer reach and brand equity, whereas electric specialists exploit direct-to-consumer channels and modular software updates to shorten model cycles.

Europe Two-Wheeler Market Trends and Insights

Rapid Expansion of E-Commerce Delivery Fleets Demanding Low-TCO 2Ws

Online shopping's rise places two-wheelers at the heart of last-mile logistics; Amazon's network of over 13,000 European delivery partners in 2024 typifies the scale. Fleet buyers favor robust frames, telematics, and battery-swap readiness to minimize downtime. Total cost of ownership now eclipses sticker price, making electric scooters preferable despite higher MSRP. Delivery operators lock in bulk orders with service contracts, pressuring OEMs to provide modular battery packs and predictive maintenance APIs. This commercial pivot diversifies demand beyond leisure riders and supports the European two-wheeler market's resilience during economic slowdowns.

Euro 5+ Emission Shift Triggering Pre-Buy and Model Refresh

Euro 5+ standards compel manufacturers to upgrade engines and accelerate electric programs, causing a short-lived pre-buy surge as riders lock in older models before price rises. OEMs clear legacy inventory while pushing premium Euro 5+ offerings, enjoying temporary margin lifts that help bankroll future electric lines. The regulation particularly influences the dominant 126-150 cc class, prompting rapid model cycles and fueling demand for compliant exhaust after-treatment systems. Dealers report elevated showroom traffic ahead of the 2025 enforcement window, reinforcing near-term volume but advancing the long-term shift toward zero-tailpipe-emission products.

Lithium-Spot-Price Volatility Hitting EV MSRP Stability

Lithium carbonate swung in 2024, forcing manufacturers either to re-price monthly or absorb margin hits. Hedging contracts mitigate some spikes, but smaller electric specialists lack balance-sheet heft, threatening production delays. Battery chemistry R&D seeks manganese-rich cathodes to reduce lithium intensity, yet commercialization lies beyond 2026.

Other drivers and restraints analyzed in the detailed report include:

- EU Net-Zero Industry Act Funding Local Battery Supply Chains

- OEM Modular Platforms Enabling 6-Month Model Cycles

- High Insurance Premiums for Below 25-Year-Old Riders

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Motorcycles controlled 81.02% of the European two-wheeler market share in 2025, reflecting their versatility for commuting and leisure touring. Continuous engine efficiency gains and safety electronics keep loyalists invested, while premium adventure and sport models lift average selling prices. Scooters, although smaller in base, deliver an 7.9% CAGR thanks to congestion charges, parking scarcity, and e-commerce courier demand in megacities. Electric scooters lead urban fleet tenders because simplified drivetrains trim service downtime, reinforcing their commercial edge. Manufacturers market detachable-battery scooters targeting apartment dwellers who lack garage outlets. As more cities restrict high-emission zones, scooter registrations broaden beyond traditional Southern European strongholds into Germany and the Nordics, closing the gap with motorcycle volumes.

Internal-combustion engines retain 90.86% of the European two-wheeler market share in 2025, buoyed by legacy infrastructure and proven reliability. Euro 5+ engines post cleaner emissions without compromising highway performance, keeping demand alive among rural and touring riders. Though with only an 9.14% share, electric variants post a 6.88% CAGR as charging grids densify and battery-swap nodes proliferate. Urban policies increasingly tax or ban low-Euro-class ICE bikes, making electric the default for city commuting and delivery jobs. Subscription bundles that wrap energy, insurance, and maintenance offset upfront battery premiums. Rural adoption lags as fast chargers remain sparse, but planned EU alternative-fuels corridors may narrow the divide after 2027.

The Europe Two-Wheeler Market Report is Segmented by Vehicle Type (Motorcycles and Scooters), Propulsion (ICE and Electric), Engine Capacity/Motor Power (Up To 110cc, and More), Price Band (Up To USD 1, 000, and More), End User (B2C and B2B), Sales Channel (Online and Offline), and by Country. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- BMW Motorrad

- Ducati Motor Holding S.p.A.

- Harley-Davidson Inc.

- Honda Motor Co., Ltd.

- KTM AG

- Piaggio and C. SpA

- Royal Enfield (Eicher Motors)

- Suzuki Motor Corporation

- Triumph Motorcycles Ltd

- Yamaha Motor Co., Ltd.

- Niu Technologies

- Yadea Group Holdings Ltd

- Zero Motorcycles Inc.

- Kawasaki Motors Ltd

- Peugeot Motocycles

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Key Industry Trend

- 4.1 Population and Urbanization Rate

- 4.2 GDP per Capita (PPP) and Median Disposable Income

- 4.3 Consumer Spend on Vehicle Purchase/Transport (CVP)

- 4.4 Fuel Prices

- 4.5 Interest Rate for 2-Wheeler/Auto Loans and Credit Access

- 4.6 2-Wheeler Penetration and Parc

- 4.7 Dealer/Service Network Density

- 4.8 Two-Wheeler Trade and Revenue (Imports/Exports)

- 4.9 Electrification Readiness (Infrastructure and Power)

- 4.10 Battery Pack Price and Chemistry Mix

- 4.11 Battery Swapping Stations (Network Density and Utilization)

- 4.12 New Model Pipeline and OEM Coverage

- 4.13 Value-Chain Localization and Assembly Capacity

- 4.14 Regulatory Framework

- 4.14.1 Vehicle Standards, Safety and Roadworthiness

- 4.14.2 CBU/CKD/SKD Duties, VAT and Local-Content Rules

- 4.14.3 Electrification, Energy and Environmental Policy

- 4.14.4 Rules for Bike-Taxi, Delivery Fleets and Financing

5 Market Landscape

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Euro 5+ Emission Shift Triggering Pre-Buy and Model Refresh

- 5.2.2 Rapid Expansion of E-Commerce Delivery Fleets Demanding Low-TCO 2Ws

- 5.2.3 Battery-Swap Business Models Lowering Up-Front EV Cost for Urban Users

- 5.2.4 Youth Preference for Subscription-Based Mobility Services

- 5.2.5 OEM Modular Platforms Enabling 6-Month Model Cycles

- 5.2.6 EU Net-Zero Industry Act Funding Local Battery Supply Chains

- 5.3 Market Restraints

- 5.3.1 High Insurance Premiums for Below 25-Year-Old Riders

- 5.3.2 Tightened Shared-Scooter Caps in Tier-1 Cities

- 5.3.3 Lithium-Spot-Price Volatility Hitting EV MSRP Stability

- 5.3.4 Dealer Network Consolidation Reducing Rural Service Access

- 5.4 Value / Supply-Chain Analysis

- 5.5 Regulatory Landscape

- 5.6 Technological Outlook

- 5.7 Porter's Five Forces

- 5.7.1 Threat of New Entrants

- 5.7.2 Bargaining Power of Suppliers

- 5.7.3 Bargaining Power of Buyers

- 5.7.4 Threat of Substitutes

- 5.7.5 Industry Rivalry

6 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 6.1 By Vehicle Type

- 6.1.1 Motorcycles

- 6.1.2 Scooters

- 6.2 By Propulsion

- 6.2.1 Internal Combustion Engine (ICE)

- 6.2.2 Electric

- 6.3 By Engine Capacity / Motor Power

- 6.3.1 Internal Combustion Engine (ICE)

- 6.3.1.1 Up to110 cc

- 6.3.1.2 111-125 cc

- 6.3.1.3 126-150 cc

- 6.3.1.4 151-200 cc

- 6.3.1.5 201-250 cc

- 6.3.1.6 250-350 cc

- 6.3.1.7 350-500 cc

- 6.3.1.8 Above 500 cc

- 6.3.2 Electric

- 6.3.2.1 Up to 1.0 kW

- 6.3.2.2 1.1-3.0 kW

- 6.3.2.3 3.1-5.0 kW

- 6.3.2.4 Above 5.0 kW

- 6.3.1 Internal Combustion Engine (ICE)

- 6.4 By Price Band

- 6.4.1 Up to USD 1,000

- 6.4.2 USD 1,000-1,500

- 6.4.3 USD 1,501-2,000

- 6.4.4 USD 2,001-3,000

- 6.4.5 USD 3,001-5,000

- 6.4.6 Above USD 5,000

- 6.5 By End User

- 6.5.1 B2C

- 6.5.2 B2B

- 6.5.2.1 Ride-Hail / Bike-Taxi / Rental / Tourism

- 6.5.2.2 Delivery and Logistics

- 6.5.2.3 Corporate and SME Fleets

- 6.5.2.4 Others (Government and Institutional, NGO)

- 6.6 Sales Channel

- 6.6.1 Online

- 6.6.2 Offline

- 6.7 Geography

- 6.7.1 Germany

- 6.7.2 France

- 6.7.3 Italy

- 6.7.4 Spain

- 6.7.5 United Kingdom

- 6.7.6 Netherlands

- 6.7.7 Sweden

- 6.7.8 Poland

- 6.7.9 Austria

- 6.7.10 Belgium

- 6.7.11 Norway

- 6.7.12 Czech Republic

- 6.7.13 Portugal

- 6.7.14 Greece

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 7.4.1 BMW Motorrad

- 7.4.2 Ducati Motor Holding S.p.A.

- 7.4.3 Harley-Davidson Inc.

- 7.4.4 Honda Motor Co., Ltd.

- 7.4.5 KTM AG

- 7.4.6 Piaggio and C. SpA

- 7.4.7 Royal Enfield (Eicher Motors)

- 7.4.8 Suzuki Motor Corporation

- 7.4.9 Triumph Motorcycles Ltd

- 7.4.10 Yamaha Motor Co., Ltd.

- 7.4.11 Niu Technologies

- 7.4.12 Yadea Group Holdings Ltd

- 7.4.13 Zero Motorcycles Inc.

- 7.4.14 Kawasaki Motors Ltd

- 7.4.15 Peugeot Motocycles

8 Market Opportunities and Future Outlook

- 8.1 White-Space and Unmet-Need Assessment