|

市場調查報告書

商品編碼

1693639

印度二輪車市場:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)India Two Wheeler - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

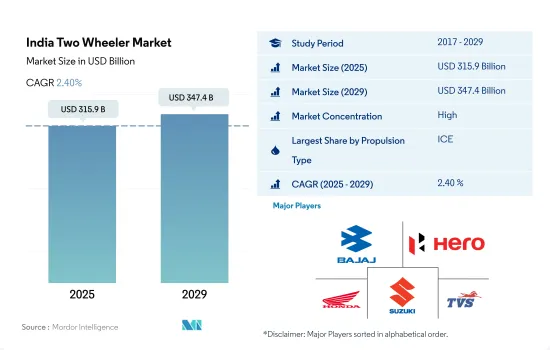

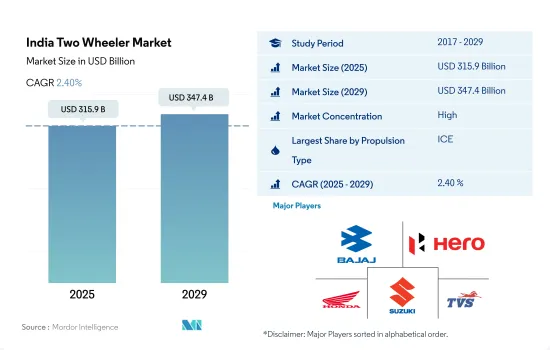

印度二輪車市場規模預計在 2025 年為 3,159 億美元,預計到 2029 年將達到 3,474 億美元,預測期內(2025-2029 年)的複合年成長率為 2.40%。

2024 年至 2030 年間,印度二輪車市場的成長將反映出電動車的普及率不斷提高,這得益於技術、政策和消費者偏好的變化。

- 2023年,印度二輪車總銷售量預計將呈現正成長,達到16,999,920輛,高於2022年的15,862,087輛。這一成長標誌著摩托車市場的復甦,反映出經濟好轉和消費者對個人行動解決方案的需求不斷成長。 2024 年的趨勢顯示該數量將進一步增加至 17,843,445 台,顯示呈現持續上升趨勢。這一積極勢頭可以歸因於多種因素,包括都市化、對廉價交通的需求以及年輕人口的成長。

- 印度政府對永續交通的支持,尤其是透過激勵購買電動車 (EV) 和基礎設施建設,對二輪車市場產生了重大影響。這些舉措加上不斷上漲的燃油價格,正在加速向電動和混合動力二輪車的轉變,使其成為消費者有吸引力的選擇。具有先進功能的新車型的推出也支持了市場的成長,以滿足廣泛消費者的偏好和需求。

- 預計印度二輪車市場將在 2024 年至 2030 年間持續成長,2030 年銷售量將達到 22,764,730 輛。該預測凸顯了持續的經濟成長、都市化和技術進步對市場的綜合影響。由於混合動力汽車和電動車因其環保特性、成本效益和政府優惠政策而備受關注,電動二輪車的普及預計將成為關鍵的驅動力。

印度摩托車市場的趨勢

政府措施和嚴格規範推動印度電動車市場快速成長

- 印度的電動車 (EV) 市場正處於成長階段,政府正在積極制定應對污染的策略。 2015年啟動的Fame India計畫在推動汽車電氣化方面發揮了關鍵作用。基於其成功經驗,Fame 第二階段計劃將持續到 2022 年 4 月,預計將進一步推動電動車的銷量,尤其是在 2021 年,政府將為電池容量高達 15kWh 的電動車提供 10,000 印度盧比(約 1,000 萬美元)的補貼。

- 印度各邦政府正大力引進電動公車,以擺脫內燃機(ICE)公車的束縛。此舉不僅可以降低營運成本,還可以抑制碳排放並改善空氣品質。引人注目的是,德里政府已於 2021 年 3 月批准採購 300 輛新型低地板電動(AC)公車,其中 100 輛將於 2022 年 1 月上路。這些舉措導致印度對電動商用車的需求大幅成長,2022 年與 2021 年相比成長了 62.58%。

- 受政府嚴格標準的推動,近年來電動車的需求激增。 2021年8月,印度政府宣布了一項汽車報廢計劃,目標是逐步淘汰污染嚴重且不合規的汽車,無論其使用年限為何。該計劃將於 2024 年實施,旨在鼓勵消費者轉向電動車。此外,政府還設定了一個雄心勃勃的目標,即到 2030 年使印度 30% 的汽車實現電動化。這些努力預計將在 2024 年至 2030 年期間促進印度的電動車銷售。

印度摩托車產業概況

印度二輪車市場相當集中,前五名廠商佔87.94%的市佔率。該市場的主要企業是 Bajaj Auto Ltd.、Hero MotoCorp Ltd.、Honda Motorcycle & Scooter India Pvt。有限公司、鈴木摩托車印度私人有限公司有限公司、TVS 汽車有限公司等

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 人均GDP

- 消費者汽車支出(cvp)

- 通貨膨脹率

- 汽車貸款利率

- 電氣化的影響

- 電動車充電站

- 電池組價格

- 新款 Xev 車型發布

- 燃油價格

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 推進類型

- 混合動力汽車和電動車

- ICE

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- AMPERE VEHICLES PRIVATE LIMITED

- Ather Energy Pvt. Ltd.

- Bajaj Auto Ltd.

- Hero Electric Vehicles Pvt. Ltd.

- Hero MotoCorp Ltd.

- Honda Motorcycle & Scooter India Pvt. Ltd.

- India Kawasaki Motors Pvt. Ltd.

- Mahindra Two Wheelers Ltd.

- Okinawa Autotech Pvt. Ltd.

- Ola Electric Mobility Pvt. Ltd.

- Piaggio Vehicles Pvt. Ltd.

- REVOLT Intellicorp Pvt. Ltd.

- Royal Enfield

- Suzuki Motorcycle India Pvt. Ltd.

- TVS Motor Company Limited

- Yamaha Motor India Pvt. Ltd.

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

The India Two Wheeler Market size is estimated at 315.9 billion USD in 2025, and is expected to reach 347.4 billion USD by 2029, growing at a CAGR of 2.40% during the forecast period (2025-2029).

India's two-wheeler market growth from 2024 to 2030 reflects rising EV adoption, driven by tech, policy, and a shift in consumer preferences

- In 2023, the total sales for two-wheelers in India showed positive growth, reaching 16,999,920 units, an increase from 15,862,087 units in 2022. This growth demonstrates a rebound in the two-wheeler market, reflecting a recovering economy and an increasing consumer demand for personal mobility solutions. The projections for 2024 indicate a further increase to 17,843,445 units, hinting at a continued upward trend. This positive momentum is likely driven by a combination of factors, including urbanization, the need for affordable transportation, and a growing young population.

- The Indian government's support for sustainable transportation, particularly through incentives for electric vehicle (EV) purchases and infrastructure development, has significantly impacted the two-wheeler market. These initiatives, alongside the rising fuel prices, have accelerated the shift toward electric and hybrid two-wheelers, making them a more appealing option for consumers. The market's growth is also supported by the introduction of new models with advanced features, catering to a wide range of consumer preferences and needs.

- From 2024 to 2030, the Indian two-wheeler market is projected to witness consistent growth, with sales hitting 22,764,730 units by 2030. This forecast underscores the compounding impact of sustained economic growth, urbanization, and technological advancements in the market. The surge in electric two-wheelers will be a pivotal driver as hybrid and electric variants gain prominence due to their eco-friendly attributes, cost efficiency, and favorable government policies.

India Two Wheeler Market Trends

Government initiatives and stringent norms drive rapid growth in the electric vehicle market in India

- India's electric vehicle (EV) market is in a growth phase, with the government actively formulating strategies to combat pollution. The Fame India scheme, launched in 2015, has played a pivotal role in driving vehicle electrification. Building on its success, Fame Phase 2, active till April 2022, further bolstered EV sales, especially in 2021, with the government offering subsidies like INR 10,000 grants for electric cars with battery capacities up to 15 kWh.

- State governments across India are increasingly incorporating electric buses into their fleets, aiming to transition from internal combustion engine (ICE) buses. This move not only cuts operational costs but also curbs carbon emissions and improves air quality. In a notable move, the Delhi government greenlit the procurement of 300 new low-floor electric (AC) buses in March 2021, with 100 of them hitting the roads in January 2022. These initiatives contributed to a significant 62.58% surge in demand for electric commercial vehicles in India in 2022 over 2021.

- The demand for electric cars has surged in recent times, driven by the government's introduction of stringent norms. In August 2021, the Indian government unveiled the Vehicle Scrappage Policy, targeting the phasing out of polluting and unfit vehicles, irrespective of their age. This policy, set to be implemented by 2024, is steering consumers toward electric cars. Additionally, the government has set an ambitious target of having 30% of all cars in India electrified by 2030. These initiatives are poised to propel electric car sales during the 2024-2030 period in India.

India Two Wheeler Industry Overview

The India Two Wheeler Market is fairly consolidated, with the top five companies occupying 87.94%. The major players in this market are Bajaj Auto Ltd., Hero MotoCorp Ltd., Honda Motorcycle & Scooter India Pvt. Ltd., Suzuki Motorcycle India Pvt. Ltd. and TVS Motor Company Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Fuel Price

- 4.11 Regulatory Framework

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Hybrid and Electric Vehicles

- 5.1.2 ICE

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 AMPERE VEHICLES PRIVATE LIMITED

- 6.4.2 Ather Energy Pvt. Ltd.

- 6.4.3 Bajaj Auto Ltd.

- 6.4.4 Hero Electric Vehicles Pvt. Ltd.

- 6.4.5 Hero MotoCorp Ltd.

- 6.4.6 Honda Motorcycle & Scooter India Pvt. Ltd.

- 6.4.7 India Kawasaki Motors Pvt. Ltd.

- 6.4.8 Mahindra Two Wheelers Ltd.

- 6.4.9 Okinawa Autotech Pvt. Ltd.

- 6.4.10 Ola Electric Mobility Pvt. Ltd.

- 6.4.11 Piaggio Vehicles Pvt. Ltd.

- 6.4.12 REVOLT Intellicorp Pvt. Ltd.

- 6.4.13 Royal Enfield

- 6.4.14 Suzuki Motorcycle India Pvt. Ltd.

- 6.4.15 TVS Motor Company Limited

- 6.4.16 Yamaha Motor India Pvt. Ltd.

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms