|

市場調查報告書

商品編碼

1693658

摩托車 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Two-Wheeler - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

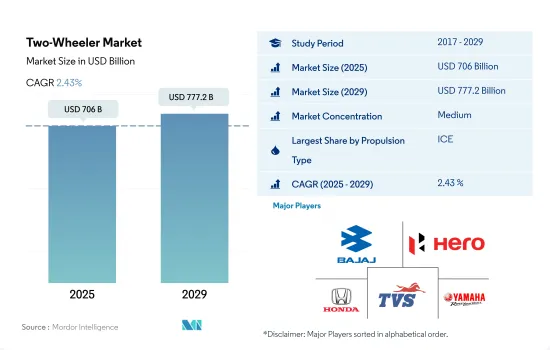

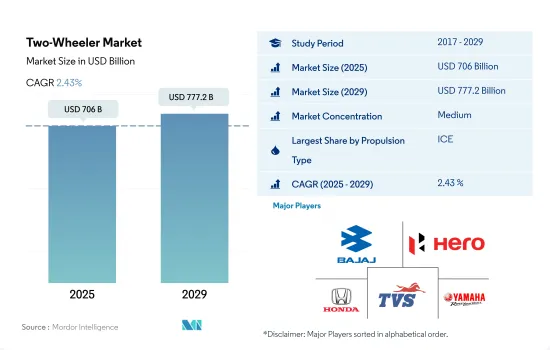

預計 2025 年摩托車市場規模將達到 7,060 億美元,到 2029 年將達到 7,772 億美元,預測期內(2025-2029 年)的複合年成長率為 2.43%。

開發中國家GDP 和人均收入的成長將推動全球摩托車需求

- 電子商務和共用微型行動服務的快速成長,尤其是在中國和印度等新興經濟體,正在刺激都市區採用二輪車。憑藉實惠的價格和基於應用程式的便利性,二輪車吸引了越來越多的客戶群。

- 此外,開發中國家GDP 和人均收入的提高也推動了全球對摩托車的需求。收入的激增催生了龐大的消費階層,並推動了整體消費。尤其是印度、泰國、印尼等國家的農村人均可支配所得預計將快速成長。

- 人們對汽車排放的擔憂日益加劇,促使世界各國政府加強監管。汽車製造商越來越重視減輕重量以提高燃油效率。作為一種減少排放氣體的方式,電動車(EV)在許多新興經濟體中越來越受歡迎。世界各國政府都在透過補貼和免稅政策來獎勵人們採用電動車。例如,在印度,混合動力汽車和電動車快速採用和製造 (FAME) 計劃為電動二輪車購買者提供每千瓦時電池容量 10,000 印度盧比(約 200 萬美元)的補貼。 FAME舉措已撥款 200 億印度盧比,用於支持 2022 年 3 月銷售約 100 萬輛電動二輪車。

世界各地的摩托車趨勢差異很大。亞洲銷售領先,歐美追求奢華,新興地區成長參差不齊

- 亞太摩托車市場非常活躍。它是世界上最大的,特別是印度、中國和東南亞等國家,由於人口密度高。摩托車和Scooter因其價格便宜、燃油效率高以及在擁擠的都市區行駛的便利性而廣受歡迎。該地區擁有強大的本地製造業基礎、強大的供應鏈以及鼓勵使用二輪車的政府支持政策。此外,人們對環境問題的認知不斷提高、政府對電動車的激勵措施以及電池技術的進步,正在幫助電動二輪車在這個市場上獲得發展動力。

- 相較之下,在北美和歐洲,摩托車市場通常被視為愛好者市場,而不是必需品市場。在這些地區,人們更傾向於選擇高功率的二輪車,而不是Scooter和輕型機踏車。該市場的特點是消費者對高階運動型摩托車的需求,哈雷戴維森、寶馬和杜卡迪等公司擁有較高的品牌忠誠度。環境問題和城市交通解決方案正在重塑市場,推動向電動和混合模式的轉變。歐洲城市尤其透過嚴格的排放法規和購買電動車的獎勵來鼓勵這種轉變。

- 在南美洲、非洲和中東等其他地區,則呈現出不同的模式。在南美,市場規模較小,但與亞太地區一樣,摩托車對於都市區和農村的交通至關重要。隨著都市化加快和道路基礎設施改善,對經濟實惠的交通工具的需求推動了非洲摩托車市場的成長。

全球摩托車市場趨勢

全球需求成長和政府支持將推動電動車市場成長

- 電動車(EV)因其具有提高能源效率、減少溫室氣體和污染排放的潛力,已成為汽車產業的重要組成部分。這種快速成長背後的主要因素是日益成長的環境問題和政府的支持政策。其中,電動車全球銷售呈現強勁成長勢頭,2022年較2021年成長10.82%。據預測,2025年底,電動乘用車年銷量將超過500萬輛,約佔汽車總銷量的15%。

- 領先的製造商和組織(例如倫敦警察廳和消防隊)正在積極推行電動車策略。例如,該公司設定了在 2025 年實現零排放汽車、在 2030 年實現 40% 貨車電氣化、到 2040 年實現全電動化的目標。預計全球也將出現類似的趨勢,2024 年至 2030 年間電動車的需求和銷售量將急劇成長。

- 在電池技術和汽車電氣化進步的推動下,亞太地區和歐洲有望主導電動車生產。 2020年5月,起亞汽車歐洲公司公佈“S計劃”,宣布轉向電動化策略。這項決定是在起亞電動車在歐洲創下銷售紀錄之際做出的。起亞雄心勃勃地計劃在 2025 年之前在全球推出 11 款電動車,涵蓋轎車、SUV 和 MPV 等各個領域。該公司的目標是到 2026 年實現全球電動車年銷量達到 50 萬輛。

機車業概況

摩托車市場適度整合,前五大企業佔52.50%的市場。該市場的主要企業有 Bajaj Auto Ltd.、Hero MotoCorp Ltd.、本田汽車、TVS Motor Company Limited、雅馬哈摩托車公司等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- 非洲

- 亞太地區

- 歐洲

- 中東

- 北美洲

- 南美洲

- 人均GDP

- 非洲

- 亞太地區

- 歐洲

- 中東

- 北美洲

- 南美洲

- 消費者汽車購買支出(cvp)

- 非洲

- 亞太地區

- 歐洲

- 中東

- 北美洲

- 南美洲

- 通貨膨脹率

- 非洲

- 亞太地區

- 歐洲

- 中東

- 北美洲

- 南美洲

- 汽車貸款利率

- 電氣化的影響

- 電動車充電站

- 電池組價格

- 非洲

- 亞太地區

- 歐洲

- 中東

- 北美洲

- 南美洲

- 新款 Xev 車型發布

- 燃油價格

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 推進類型

- 電動車

- 混合動力汽車和電動車

- ICE

- 地區

- 非洲

- 南非

- 非洲以外

- 亞太地區

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 馬來西亞

- 韓國

- 泰國

- 其他亞太地區

- 歐洲

- 奧地利

- 比利時

- 捷克共和國

- 丹麥

- 愛沙尼亞

- 法國

- 德國

- 愛爾蘭

- 義大利

- 拉脫維亞

- 立陶宛

- 挪威

- 波蘭

- 俄羅斯

- 西班牙

- 瑞典

- 英國

- 其他歐洲國家

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 北美洲

- 加拿大

- 墨西哥

- 美國

- 南美洲

- 阿根廷

- 巴西

- 南美洲其他地區

- 非洲

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Aima Technology Group Co. Ltd.

- Ather Energy Pvt. Ltd.

- Bajaj Auto Ltd.

- Harley-Davidson

- Hero MotoCorp Ltd.

- Honda Motor Co. Ltd.

- KTM Motorcycles

- Piaggio & C. SpA

- TVS Motor Company Limited

- Yadea Technology Group Co. Ltd.

- Yamaha Motor Company Limited

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

簡介目錄

Product Code: 93051

The Two-Wheeler Market size is estimated at 706 billion USD in 2025, and is expected to reach 777.2 billion USD by 2029, growing at a CAGR of 2.43% during the forecast period (2025-2029).

The rising GDP and per capita income in developing nations bolsters the global demand for two-wheelers

- The surge in e-commerce and shared micro-mobility services, particularly in emerging economies like China and India, is fueling the adoption of two-wheelers in urban areas. With their pocket-friendly prices and app-based convenience, two-wheelers are attracting a growing customer base.

- Moreover, the rising GDP and per capita income in developing nations are bolstering the global demand for two-wheelers. This surge in income has created a substantial consumer class, driving overall consumption. Notably, the per capita disposable income in rural areas of countries like India, Thailand, and Indonesia is expected to witness rapid growth.

- The mounting concerns over vehicular emissions have prompted governments worldwide to tighten regulations. Automotive manufacturers are increasingly prioritizing weight reduction to enhance fuel efficiency. Electric vehicles (EVs) are gaining traction in many developing economies as a means to curb emissions. Governments are incentivizing EV adoption through subsidies and tax exemptions. For instance, in India, the Faster Adoption and Manufacturing of (Hybrid and) Electric Vehicles (FAME) program offers subsidies of INR 10,000 per kWh of battery capacity for electric two-wheeler buyers. The FAME initiative allocated INR 2,000 crore to support the sale of nearly 1 million electric two-wheelers by March 2022.

Global two-wheeler trends vary: Asia leads in volume, the West prefers luxury, and emerging regions show mixed growth

- In Asia-Pacific, the two-wheeler market is highly dynamic. It is the largest in the world due to the high population density, particularly in countries like India, China, and Southeast Asia. Motorcycles and scooters are popular due to their affordability, fuel efficiency, and convenience in navigating congested urban areas. This region has a robust local manufacturing base, strong supply chains, and supportive government policies encouraging two-wheeler use. Additionally, electric two-wheelers are gaining traction in this market, driven by increasing awareness of environmental issues, government incentives for electric vehicles, and advancements in battery technology.

- Contrastingly, in North America and Europe, the two-wheeler market is often seen as a segment for enthusiasts rather than a necessity. These regions exhibit a strong preference for higher-powered motorcycles over scooters or mopeds. The market is characterized by a demand for luxury and sports motorcycles, with companies like Harley-Davidson, BMW, and Ducati enjoying significant brand loyalty. Environmental considerations and urban mobility solutions are reshaping the market, with an increasing shift toward electric and hybrid models. European cities, particularly, are fostering this shift with stringent emission regulations and incentives for electric vehicle purchases.

- The Rest of the World, encompassing South America, Africa, and the Middle East, shows a mixed pattern. In South America, motorcycles are essential for urban and rural transportation, similar to Asia-Pacific, though the market is smaller. Africa's two-wheeler market is growing, driven by the need for affordable transportation amid expanding urbanization and improving road infrastructure.

Global Two-Wheeler Market Trends

The rising global demand and government support propel electric vehicle market growth

- Electric vehicles (EVs) have become indispensable in the automotive industry, driven by their potential to enhance energy efficiency and reduce greenhouse gas and pollution emissions. This surge is primarily attributed to growing environmental concerns and supportive government initiatives. Notably, global EV sales witnessed a robust 10.82% growth in 2022 compared to 2021. Projections indicate that annual sales of electric passenger cars will surpass 5 million by the end of 2025, accounting for approximately 15% of total vehicle sales.

- Leading manufacturers and organizations, like the London Metropolitan Police & Fire Service, have been actively pursuing their electric mobility strategies. For instance, they have set a target of a zero-emission fleet by 2025, with a goal of electrifying 40% of their vans by 2030 and achieving full electrification by 2040. Similar trends are expected globally, with the period from 2024 to 2030 witnessing a surge in demand and sales of electric vehicles.

- Asia-Pacific and Europe are poised to dominate electric vehicle production, driven by their advancements in battery technology and vehicle electrification. In May 2020, Kia Motors Europe unveiled its "Plan S," signaling a strategic shift toward electrification. This decision came on the heels of record-breaking sales of Kia's EVs in Europe. Kia has ambitious plans to introduce 11 EV models globally by 2025, spanning various segments like passenger vehicles, SUVs, and MPVs. The company aims to achieve annual global EV sales of 500,000 by 2026.

Two-Wheeler Industry Overview

The Two-Wheeler Market is moderately consolidated, with the top five companies occupying 52.50%. The major players in this market are Bajaj Auto Ltd., Hero MotoCorp Ltd., Honda Motor Co. Ltd., TVS Motor Company Limited and Yamaha Motor Company Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.1.1 Africa

- 4.1.2 Asia-Pacific

- 4.1.3 Europe

- 4.1.4 Middle East

- 4.1.5 North America

- 4.1.6 South America

- 4.2 GDP Per Capita

- 4.2.1 Africa

- 4.2.2 Asia-Pacific

- 4.2.3 Europe

- 4.2.4 Middle East

- 4.2.5 North America

- 4.2.6 South America

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.3.1 Africa

- 4.3.2 Asia-Pacific

- 4.3.3 Europe

- 4.3.4 Middle East

- 4.3.5 North America

- 4.3.6 South America

- 4.4 Inflation

- 4.4.1 Africa

- 4.4.2 Asia-Pacific

- 4.4.3 Europe

- 4.4.4 Middle East

- 4.4.5 North America

- 4.4.6 South America

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.8.1 Africa

- 4.8.2 Asia-Pacific

- 4.8.3 Europe

- 4.8.4 Middle East

- 4.8.5 North America

- 4.8.6 South America

- 4.9 New Xev Models Announced

- 4.10 Fuel Price

- 4.11 Regulatory Framework

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Electric

- 5.1.2 Hybrid and Electric Vehicles

- 5.1.3 ICE

- 5.2 Region

- 5.2.1 Africa

- 5.2.1.1 South Africa

- 5.2.1.2 Rest-of-Africa

- 5.2.2 Asia-Pacific

- 5.2.2.1 Australia

- 5.2.2.2 China

- 5.2.2.3 India

- 5.2.2.4 Indonesia

- 5.2.2.5 Japan

- 5.2.2.6 Malaysia

- 5.2.2.7 South Korea

- 5.2.2.8 Thailand

- 5.2.2.9 Rest-of-APAC

- 5.2.3 Europe

- 5.2.3.1 Austria

- 5.2.3.2 Belgium

- 5.2.3.3 Czech Republic

- 5.2.3.4 Denmark

- 5.2.3.5 Estonia

- 5.2.3.6 France

- 5.2.3.7 Germany

- 5.2.3.8 Ireland

- 5.2.3.9 Italy

- 5.2.3.10 Latvia

- 5.2.3.11 Lithuania

- 5.2.3.12 Norway

- 5.2.3.13 Poland

- 5.2.3.14 Russia

- 5.2.3.15 Spain

- 5.2.3.16 Sweden

- 5.2.3.17 UK

- 5.2.3.18 Rest-of-Europe

- 5.2.4 Middle East

- 5.2.4.1 Saudi Arabia

- 5.2.4.2 UAE

- 5.2.4.3 Rest-of-Middle East

- 5.2.5 North America

- 5.2.5.1 Canada

- 5.2.5.2 Mexico

- 5.2.5.3 US

- 5.2.6 South America

- 5.2.6.1 Argentina

- 5.2.6.2 Brazil

- 5.2.6.3 Rest-of-South America

- 5.2.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Aima Technology Group Co. Ltd.

- 6.4.2 Ather Energy Pvt. Ltd.

- 6.4.3 Bajaj Auto Ltd.

- 6.4.4 Harley-Davidson

- 6.4.5 Hero MotoCorp Ltd.

- 6.4.6 Honda Motor Co. Ltd.

- 6.4.7 KTM Motorcycles

- 6.4.8 Piaggio & C. SpA

- 6.4.9 TVS Motor Company Limited

- 6.4.10 Yadea Technology Group Co. Ltd.

- 6.4.11 Yamaha Motor Company Limited

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219